สงสัยขนส่งเกินจริง เซเลสเทียตกอยู่ในวิกฤตความไว้วางใจ

ผู้แต่งต้นฉบับ: Grapefruit, ChainCatcher

Recently, the highly-anticipated modular blockchain Celestia has been caught in a crisis of trust. The disclosed $100 million in financing was actually an over-the-counter (OTC) sale of coins, and was announced during the countdown to a large amount of unlocking. This series of confusing operations has put Celestia, the leading modular public chain, at the forefront of public opinion.

The community questioned Celestias behavior, and it is possible that they were colluding with VCs or institutions to take the opportunity to pull up the price of the currency and sell it. A few days before the unlocking, they announced the proceeds from OTC sales of the currency as financing news to create favorable conditions, and used information manipulation and other means to guide retail investors to take over, thereby seeking personal gain.

In the communitys view, the Celestia Foundation failed to make the necessary transparent disclosure of this OTC transaction, and instead packaged it as financing news, which misled investors and triggered a crisis of trust.

However, as of press time, Celestia has not responded to this incident.

The countdown to unlocking the $1 billion TIA, the announcement of $100 million financing is good news or may be suspected of pumping up shipments

On September 24, the Celestia Foundation publicly announced that it had completed a $100 million financing round led by Bain Capital Crypto, with participation from Syncracy Capital, 1kx, Robot Ventures, Placeholder, and others. It wrote that this brought the total amount raised for the project to $155 million.

After the good news was released, Celestias native token TIA rose accordingly. The price of the currency rose from US$5.6 to US$6.9 on the same day, an increase of more than 20%. It has now fallen back to around US$6.5.

However, just as the crypto community was celebrating Celestias huge financing, well-known crypto investor Sisyphus revealed on social media that the $100 million financing announced by Celestia was actually an over-the-counter transaction that the foundation reached directly with several institutions a few months ago. The financing valuation at the time was $3.5 billion, and these token shares may be unlocked in October.

Sisyphus added that if institutions were able to sell all unlocked assets at $7.5, they would break even.

The real identity of Sisyphus was once revealed by users to be Kevin Pawla, the former head of OpenSea Ventures.

After Sisyphuss remarks, the originally favorable financing news changed. In the communitys view, Celestias $100 million financing was actually the proceeds from OTC coin sales a few months ago, but it was packaged as new financing and made public when the unlocking expired.

This series of operations angered users in the crypto community. The community generally believes that the foundation or team should not disclose OTC trading proceeds as new financing, and should not release packaged false fundraising news on the eve of a large unlocking, which is suspected of inducing users to buy and increase shipments.

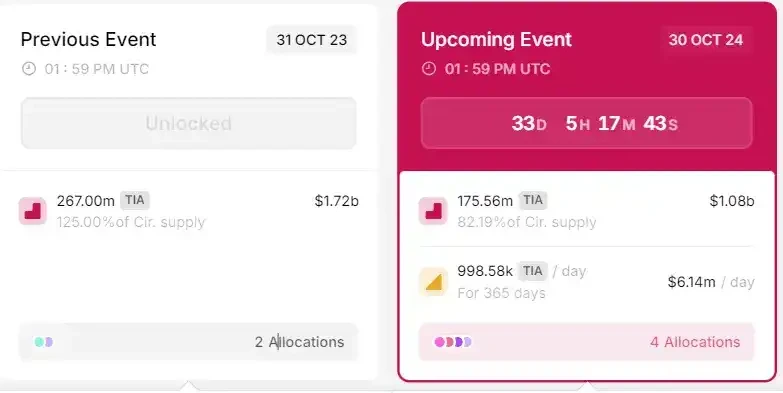

ตาม โทเค็น unlock data, Celestia will unlock more than 175 million TIA tokens on October 30, accounting for 17.68% of the total supply of TIA, with a value of approximately $1.08 billion. This is likely to lead to a sharp increase in the circulation of TIA in the market, which will in turn cause short-term price fluctuations. According to historical data, large-scale token unlocking events often put downward pressure on the price of the currency.

The over-the-counter transaction, which was originally completed several months ago, was not released until one month before the token unlocking. The motive behind this cannot help but make people suspect that the project party or institution wanted to take the opportunity to increase shipments.

In fact, as early as September 7, Sisyphus posted a message on his social media to remind that Celestia completed $100 million in over-the-counter transactions, with the coin price at about $3.5. The team and investors will unlock $1 billion in funds in the next six months.

However, the content of Sisyphus tweet did not attract the attention of the community until Celestia officially announced its financing on September 24.

Crypto KOL @Ericonomic posted on social media that if what Sisyphus said is true, Celestias $100 million financing event may be a scheme set up by the project party and VC institutions. A few months ago, the project party sold the tokens to institutions through OTC when the price was high, and only released the so-called financing news a few days before the unlocking, making users think that the financing had just happened. These institutions that bought tokens through OTC transactions are currently very optimistic about the project and thus blindly follow up.

Community user @minjung has a different view on this. He believes that Celestias trading in the secondary OTC market is not a bad thing. Direct cooperation with venture capital trading institutions can help mitigate the impact of huge token unlocking. Institutions such as SyncracyCapital, 1kx, and Robot Ventures are likely to be hedging. If it is indeed obtained in the secondary market, it is inappropriate for Celestia to announce the transaction as financing, especially before a major unlocking.

Regarding Celestias financing turmoil, the main point of contention in the community is that the project party should explain the source of the financing funds clearly.

In addition, OTC transactions are very common, and there is no problem in announcing the process before unlocking. However, the project party can fully disclose the funding information in a reasonable and transparent manner, disclose the project valuation and fund ownership, make it clear that this is OTC transaction income rather than financing, and disclose relevant information to investors, rather than taking concealment and misleading means to deceive users.

However, as of September 27, Celestia has not made any official response to the financing storm. ChainCatcher has also not received a response when asking the community to verify whether the financing disclosure was true.

Celestia valuation out of line with revenue?

Celestia is a modular infrastructure designed for the Data Availability Network (DA), which can reduce data costs by 99.9% compared to the Ethereum mainnet, the largest DA layer in the industry. The project caused a market frenzy in February this year due to the TIA token airdrop, and the price soared to more than $21, and was once called a new crypto blue chip project. As the Layer 2 narrative cooled, the price of TIA also began to fall from its high point, falling to as low as $3.7, a price reduction of 80%.

In addition to causing a crisis of confidence in Celestia, this financing turmoil also revealed the common problem of crypto projects that valuations are out of line with actual revenue.

Although Celestia is valued at $3.5 billion, its potential annual revenue is only over $5 million. The valuation is far from the actual business situation. This huge gap has caused people to re-examine the true value of crypto projects.

As early as January this year, there were reports that Celestias current data usage rate is 0.1%, and the total fee is significantly lower. Celestia generates about 5 TIAs or $65 in fees per day. If Celestia is fully loaded in the future and the TIA price is calculated at $13, the network can generate about $5.2 million in annual fee income, which will be 65 times the data currently released to Ethereum.

Blue Fox also published a statement at that time stating that although Celestias revenue was only in the hundreds of dollars, its diluted market value was very high, and was almost the same as the diluted market value of the leading L2 with a more mature ecosystem and annual revenue of tens of millions of dollars. TIAs diluted market value is currently around US$19 billion, which is not much different from Arbitrums diluted market value and exceeds Optimism.

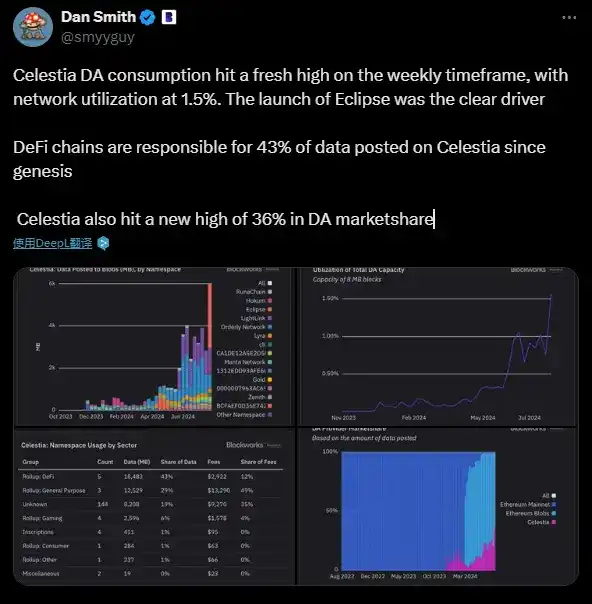

The data recently released by Blockwork on August 6 showed that Celestia DA data space consumption hit a record high during the week, with a network utilization rate of 1.5%, accounting for 36% of the DA market share. Ethereum is still the protagonist of the DA market.

A company valued at billions of dollars has a maximum annual revenue of just over $5 million, which illustrates the huge gap between valuation and actual value.

Sisyphus also added in a tweet on September 7 that it would not be a good deal to buy a product with a maximum annual revenue of only $5 million at a valuation of $3.5 billion.

Regarding the high valuation of the project, crypto investor Kiki said that currently, the valuation of crypto projects is too dependent on future imagination and ignores the current actual operation. Just like Celestia, although it has proposed a promising data availability network concept, its technology implementation and commercialization still need further verification.

The main reason for this phenomenon is that the crypto industry lacks a mature valuation system. There is no mature valuation system, and the valuation process lacks standards and logic. Compared with traditional industries, the valuation of crypto projects relies more on conceptual imagination, market hype and investor sentiment, and lacks in-depth analysis of fundamental indicators such as actual business, such as operating data and profitability.

This article is sourced from the internet: Suspected of inflating shipments, Celestia falls into a crisis of trust

Related: Tiger Research: Is South Korea still a strategic location for blockchain mainnet?

Original author: Leo Park Yoon Lee Original translation: TechFlow Summary of key points: Those global mainnets that entered the Korean market early are still very active, especially in the gaming field, and they have demonstrated strong competitiveness around entertainment IP. This year, mainnet projects such as Arbitrum, Monad, Story, and Scroll have rapidly expanded their influence in South Korea. Each project has adopted a unique strategy, focusing on community building, education, and strategic partnerships to grow its ecosystem. While the Korean market is certainly attractive, in-depth understanding of its language, culture and regulatory environment is essential. Early collaboration with local partners is key to successfully entering and adapting to the market. 1. Introduction Source: Tiger Research Since 2022, global blockchain mainnets have actively explored the Korean market by appointing local…