ประวัติการเติบโตของ Arbitrum One ซึ่งเป็นยักษ์ใหญ่ L2: สามปีแห่งการทดลองและความยากลำบาก จาก 0 ถึง 20 พันล้าน TVL

ผู้เขียนต้นฉบับ: TechFlow

Without going through a complete bull-bear cycle, it is not enough to talk about real success in Web3.

The so-called time test is nothing more than extending the dimension, abandoning the false trend of misjudgment, and seeing the true nature of demand, which is especially applicable to the involutionary L2 track. The DeFi Summer of 2020 further exposed the performance limitations of Ethereum, and L2 emerged as a necessary expansion solution for blockchain to carry large-scale users.

In the past four years, L2 has been very competitive, and many projects have disappeared in the long bear market, but there are also projects that have withstood the test of time and built their own ecosystems step by step. Among them, การตัดสินโดยอนุญาโตตุลาการ One is definitely a highlight.

On August 31, 2024, Arbitrum One celebrates its third anniversary.

After three years of trials and tribulations and two rounds of bull and bear markets, Arbitrum One has grown into an industry giant in L2 and even Web3: its TVL has exceeded US$14.75 billion, far ahead of other L2s, with more than 36 million independent addresses and more than 2,000 ecological projects. In the eyes of many people, it is the largest and most ecologically rich L2.

On the occasion of the third anniversary, Arbitrum’s official Chinese community also launched a series of celebration activities including Twitter Giveaway and Chinese AMA on September 4th: participating in them not only allows you to win exquisite peripherals, but also allows you to look back on the past and look forward to the next milestone of Arbitrum One with many well-known industry leaders, outstanding developers and core contributors.

While actively participating in the third anniversary celebration, let us look back at Arbitrum One’s growth path and review its successful strategies.

Birth: Blockchain can’t bear the pressure, Arbitrum One is just in time

Let’s go back to 2021 when Arbitrum One was born.

Previously, DeFi continued to develop, NFTs were coming in full force, and on-chain interactions were more frequent. As the birthplace of DeFi, the Ethereum mainnet could only process about 15 transactions per second, which caused serious on-chain congestion and high Gas costs, and also helped the industry seek transformation:

On the one hand, Ethereum has embarked on the long road of upgrading to Ethereum 2.0;

On the other hand, new public chains and L2s have emerged one after another, aiming to expand blockchain performance and take over the spillover of Ethereum’s value.

Arbitrum One was born based on this situation.

As an Ethereum L2 scaling solution based on Optimistic Rollup technology, Arbitrum One mainnet was launched on August 31, 2021. It is one of the earliest Optimistic Rollups L2 to be launched on the mainnet. In fact, Offchain Labs, the technical service provider behind Arbitrum One, is also one of the earliest teams focusing on L2 research and development.

As early as 2018, former White House technical official and Princeton University computer professor Ed Felten and two Princeton computer doctoral students Steven Goldfeder and Harry Kalodner made a forward-looking assessment of the performance difficulties Ethereum will face in the future. Subsequently, the three of them founded Offchain Labs and started L2 research. Between 2019 and 2022, Offchain Labs has received a total of US$120 million in financing, with a valuation of over US$1.2 billion.

The strong technical background also enables Arbitrum One to have outstanding technical advantages in all aspects, and multi-round interactive fraud proof is one of the manifestations.

We know that L2 improves the performance of the main chain by moving a large amount of computing and storage requirements of L1 to L2. During the flow of data between L1 and L2, it is necessary to ensure that the data synchronized to L1 is valid.

Arbitrum One proposed a multi-round interactive fraud proof based on the Optimstic Rollup fraud proof . Its operation logic can be simply summarized as follows:

The L2 validator synchronizes the compressed data to L1 and pledges the digital assets used as collateral. If someone disputes the transaction data of the Rollup block, they need to initiate a challenge and also pledge the digital assets used as collateral. The validator and challenger continuously split the controversial steps through the dichotomy method under the blockchain until the scope of the dispute is reduced to a specific step, and then judge the step on the L1 chain to efficiently resolve the dispute.

All links are under the control of the contract, and no party can cheat. In this way, Arbitrum One not only ensures the security and validity of the data, but also basically inherits the security of the Ethereum mainnet and achieves extremely low transaction fees, which is very suitable for the development of DeFi and NFT.

Of course, in 2021, when the world has suffered from Ethereums performance for a long time, Arbitrum Ones birth was not only timely, but also achieved outstanding performance at the beginning of its launch, thanks to its in-depth exploration of market pain points, sufficient research and development of the L2 track in the past three years, and the first-mover advantage of Optimistic Rollups L2 as one of the first batches to be launched on the mainnet.

According to official social media, at the beginning of its launch, Arbitrum Ones ecosystem had deployed more than 100 projects, including leading DeFi protocols such as Uniswap, Sushiswap, and Curve. This is due to Arbitrum Ones almost 100% compatibility with EVM, which allows high-quality projects from the Ethereum ecosystem to be easily and efficiently transplanted.

The prosperous ecosystem also brings enviable on-chain activity:

In terms of TVL, according to L2 Beat data, when Arbitrum One was first launched on September 14, 2021, the total TVL of all Ethereum L2s was approximately US$3 billion. However, just two weeks after the mainnet launch, Arbitrum Ones TVL has reached US$2.2 billion, with a growth rate of approximately 2411% in the past seven days.

In terms of the number of addresses, according to arbiscan.io data, the number of independent addresses of Arbitrum One has exceeded 100,000 in half a month. The 267,608 on-chain transactions on September 12 further demonstrated the enthusiasm of community participation. At the same time, the average Gas fee was greatly reduced compared to Ethereum.

It can be said that since its launch, Arbitrum One has firmly established itself as the leader in L2, both in terms of ecology and on-chain activity. As the saying goes: starting a business is not easy, and maintaining a business is even harder. In the past three years, facing the more diversified demands of larger-scale users and increasingly fierce competition in the field, how to always maintain a competitive advantage has become a more difficult issue than achieving a good start.

From this perspective, reviewing Arbitrum One’s current achievements from the important node of its third anniversary seems to have become even more valuable.

Growth: Arbitrum One is on a roll, becoming the L2 giant with the highest TVL

The community has always regarded Arbitrum One as the second-layer network with the highest starting point, the earliest start, and the most mature ecosystem to date.

Such discussions are not groundless, but are supported by solid and rich data. We usually use data dimensions such as TVL, number of independent addresses, number of daily active addresses, and daily transaction volume to judge the size and prosperity of a chain. Looking back at the growth history of Arbitrum One over the past three years, it is not difficult to find that it has always maintained a leading position in the L2 track.

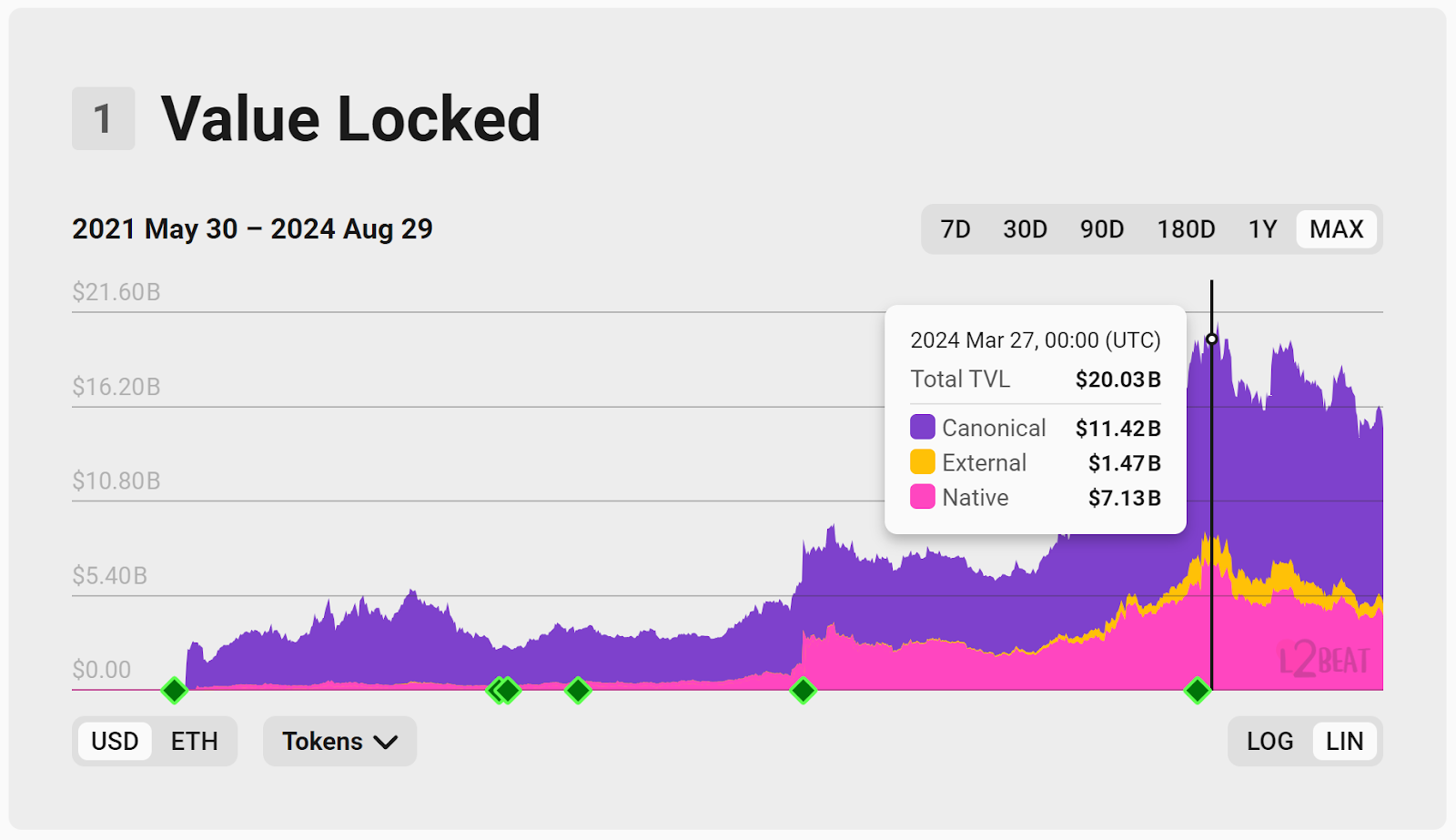

TVL usually represents the amount of funds available within the ecosystem, and since its inception, Arbitrum One TVL has long been at the top of the L2 list : According to L2 Beat data, on August 31, 2022, the TVL of the one-year-old Arbitrum One increased from almost 0 to US$3.33 billion; on August 31, 2023; the TVL of the two-year-old Arbitrum One increased to US$6.67 billion, doubling its TVL during the markets deep bear phase; and by August 31, 2024, the three-year-old Arbitrum Ones TVL increased to US$14.77 billion, with the peak TVL in April exceeding US$20 billion, accounting for about 65% of the total TVL of L2. Under the premise that the amount of funds is already very large, with the arrival of a new cycle, Arbitrum One still achieved a growth of more than 450%.

The number of addresses is an important data to measure the size of ecological users. There are only a handful of projects in L2 that have broken through the 10 million address mark, and Arbitrum One is one of them : According to arbiscan.io data, as of August 28, 2024, the number of Arbitrum One independent addresses is 37.47 million. According to Growthepie data, Arbitrum One had 1.48 million daily active addresses on May 18, 2024, which once surpassed Solana, which was the most popular in the Meme craze.

In addition, according to the L2 report data released by Coin 98 Analytics: In the second quarter of 2024, the number of Arbitrum One independent addresses increased from 19.88 million to 33.24 million, and the total number of independent addresses ranked third among all 11 mainstream L2s counted, and the quarterly increase exceeded 67%; in the past July, the number of Arbitrum One independent addresses increased to 35.77 million, with a monthly increase of more than 7%. It is not difficult to see the long-term growth momentum of Arbitrum One.

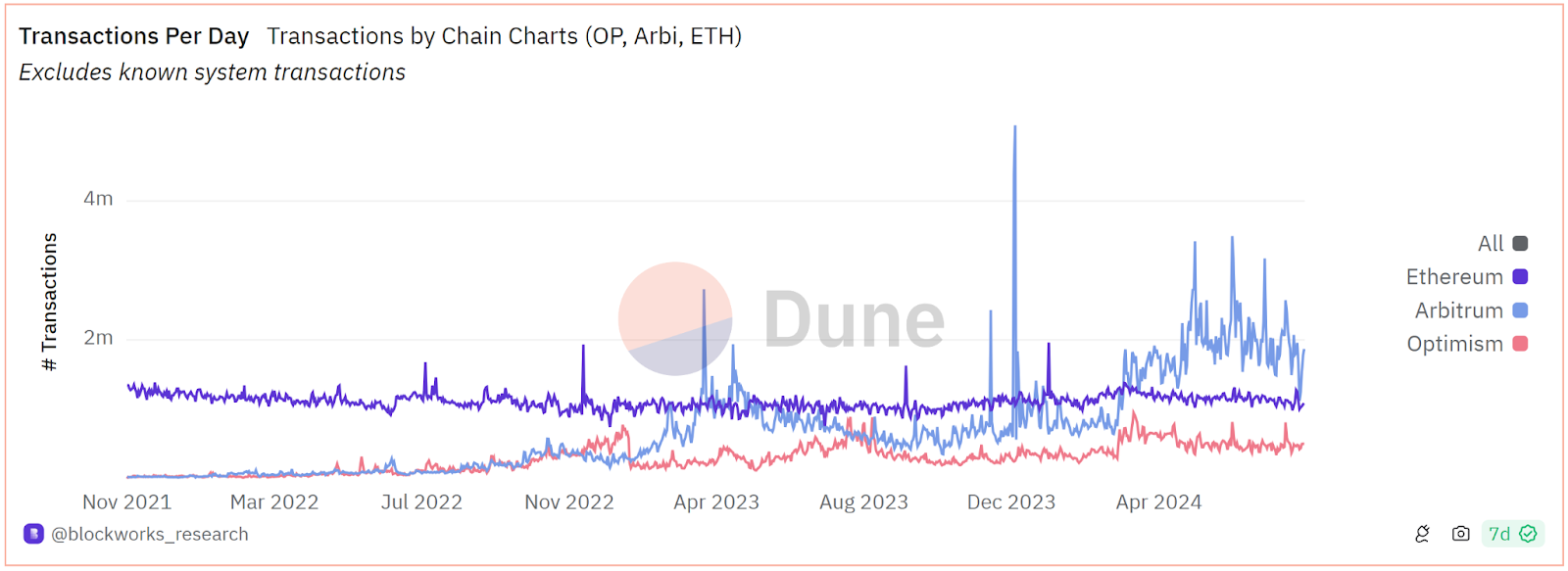

Transaction volume not only represents the level of activity of ecological users, but also a higher daily transaction volume is a strong proof that L2 performance has withstood the test. In this regard, Arbitrum One still has a good performance : Arbitrum One has currently processed more than 900 million transactions. According to Dune data, on December 16, 2023, Arbitrums daily transaction volume broke a new high of 5.08 million. Currently, Arbitrums daily transaction volume is about 2 million, second only to Base. OP, which is also one of the earliest mainnet launches, has about 500,000 transactions. At the same time, the daily transaction volume of the Ethereum mainnet has remained at around 1.1 million for most of this year.

There was a very vivid metaphor for the Arbitrum One community:

If the L2 competition in the past three years was a series of exams, Arbitrum One is like a candidate who has never fallen out of the top three in terms of single subject scores or overall strength. No one will deny its achievements in the L2 track.

It also drives more people to explore:

In an industry where we are used to seeing short-lived shows, what efforts have been made behind Arbitrum One’s longevity?

Attribution: Technology iteration + ecological incentives create an all-encompassing Arbitrum ecosystem

Funds and users will not come in for no reason. The most fundamental driving force lies in: ecology.

In the eyes of many community members, Arbitrum is Ethereum . This is partly because the Arbitrum ecosystem has attracted a number of Ethereum ecosystem leading projects to settle in, and partly because of Arbitrum’s innovative ability to produce high-quality applications.

Unlike many L2 upstarts that have focused on segmenting the market to differentiate themselves amid homogeneous competition, Arbitrum, as one of the earliest Optimistic Rollups L2s to go live on the mainnet, has a big and comprehensive ecological style. According to the Arbitrum Encyclopedia Portal page, there are currently more than 2,000 Arbitrum ecological projects, which is as rich as Ethereum.

Perfect infrastructure is a necessary condition for the stable and positive development of the ecosystem . As a fully EVM-compatible L2, Arbitrum can not only enjoy Ethereums perfect infrastructure, but also has greater flexibility. The infrastructure products within the ecosystem include wallet adaptation support, cross-chain bridges, developer tools and other sections. According to the Portal, there are 60 bridge projects, 13 centralized exchanges, 76 wallets, 33 data analysis tools, 13 oracles, and 79 developer tools within the ecosystem, which further improves the availability of the network.

DeFi is the cornerstone of the ecosystem . According to the portal, there are more than 373 DeFi projects in the Arbitrum ecosystem, including 64 Dex projects, 48 lending projects, and 26 stablecoin projects. The three elements of DeFi are complete. Other project categories include derivatives, perpetual contracts, DeFi tools, liquidity management, income aggregation, re-staking and other sectors.

Among them, we can see a number of old DeFis such as Uniswap, 1inch, AAVE, Compound, Curve, DODO, Sushiswap, etc., as well as native DeFi innovative projects that are rooted in Arbitrum and have achieved rapid growth, such as the perpetual contract product GMX and the Dex product Camelot.

As we enter 2024, we can still see Arbitrums active presence in the DeFi field. New projects include Robinhood, Renzo, coW Swap, etc., all of which have made significant contributions to Arbitrum TVL and on-chain activity.

As an L2 project launched on the mainnet in 2021, Arbitrum will certainly not miss the NFT craze : According to the Portal, there are more than 74 NFT projects in the Arbitrum ecosystem, including 15 NFT Marketplace projects, 28 NFT projects, 12 NFT tools, and 10 NFTFi projects. Users can not only buy/sell freely, but also participate in DeFi gameplay such as lending through NFT. With comprehensive support, the Arbitrum ecosystem has also attracted many well-known NFT projects, including OpenSea, NFTScan, and Azuki, which just joined this year.

When it comes to NFT, we have to mention the gaming sector that is deeply linked to NFT : According to the Portal, there are more than 76 game projects in the Arbitrum ecosystem, covering multiple sectors such as GameFi, action, adventure, RPG, and leisure. Among them, the most talked-about is the metaverse project Treasure DAO supported by Offchain labs.

As the gaming ecosystem center of Arbitrum, Treasure DAO aims to build a decentralized Nintendo. It came into the public eye at the end of 2022 due to the popularity of the game The Beacon. Less than 9 days after its launch, the number of NFT purchases of the games founding characters in The Beacon reached 34,394 times (0.031 E per founding character). Other on-chain games of Treasure DAO include Bridgeworld, Smolverse, etc. Each game is connected to each other through the native token MAGIC as a shared currency, and in-game NFTs can be traded through the trading platform Trove. Through diverse gameplay and a prosperous community, Treasure DAO is an important force in the Arbitrum ecosystem game landscape.

As an important entry point for incremental users of Web3, the Arbitrum ecosystem has always paid high attention to this sector. New projects entering the ecosystem this year include Pirate Nation – Apex Chain, InfiniGods, Avarik Saga and many other high-quality blockchain games.

The scale effect formed by Arbitrums prosperous ecosystem provides strong support for its continued leading position in L2. This prosperity is due not only to Arbitrums continuous iteration and optimization as the underlying platform to better empower developers, but also to its all-round support for projects within the ecosystem for three years.

In terms of technical support, Arbitrum continues to make efforts in two major directions: vertical and horizontal.

The vertical strategy can be simply understood as Arbitrums continued in-depth exploration of blockchain performance and developer experience. By launching multiple technological iterations and functional innovations, it aims to become the preferred platform for developers to build projects.

The Nitro upgrade is one of the strong proofs : In August 2022, Arbitrum One was successfully upgraded to the Nitro version. By supporting Nitro code compiled in WASM for Arbitrums interactive fraud proofs, Nitro enables Arbitrum to achieve higher throughput, faster finality, and more effective dispute resolution. According to data released by the official team, after running Arbitrum Nitro, L2 execution speed increased by 20-50 times, and transaction fees were further reduced.

Another much-discussed technical innovation is AnyTrust : by introducing a new security model of the Data Availability Committee (DAC), AnyTrust achieves ultra-low operating fees and faster withdrawal speeds while maintaining Ethereum mainnet-level security.

On the special time node of the third anniversary this year, Arbitrum Stylus will be launched on Arbitrum One and Nova mainnet : As an open source SDK developed by Arbitrum that supports building applications in multiple languages, Stylus allows developers to deploy applications in their favorite programming languages (including Rust, C and C++) without being limited to the traditional Solidity language, which undoubtedly opens the door for Arbitrums ecosystem to applications in the entire industry and even the Web2 industry. As the largest execution layer upgrade in Arbitrums history, Arbitrum Stylus will take developers and user experience to a higher level.

In addition, more technical support includes completing the Atlas upgrade to integrate blob transaction functions, reducing the minimum basic fee to 0.01 gwei, launching a series of practical Arbitrum SDK tools, detailed development documentation, active technical community response, etc., further lowering the threshold while giving developers more support.

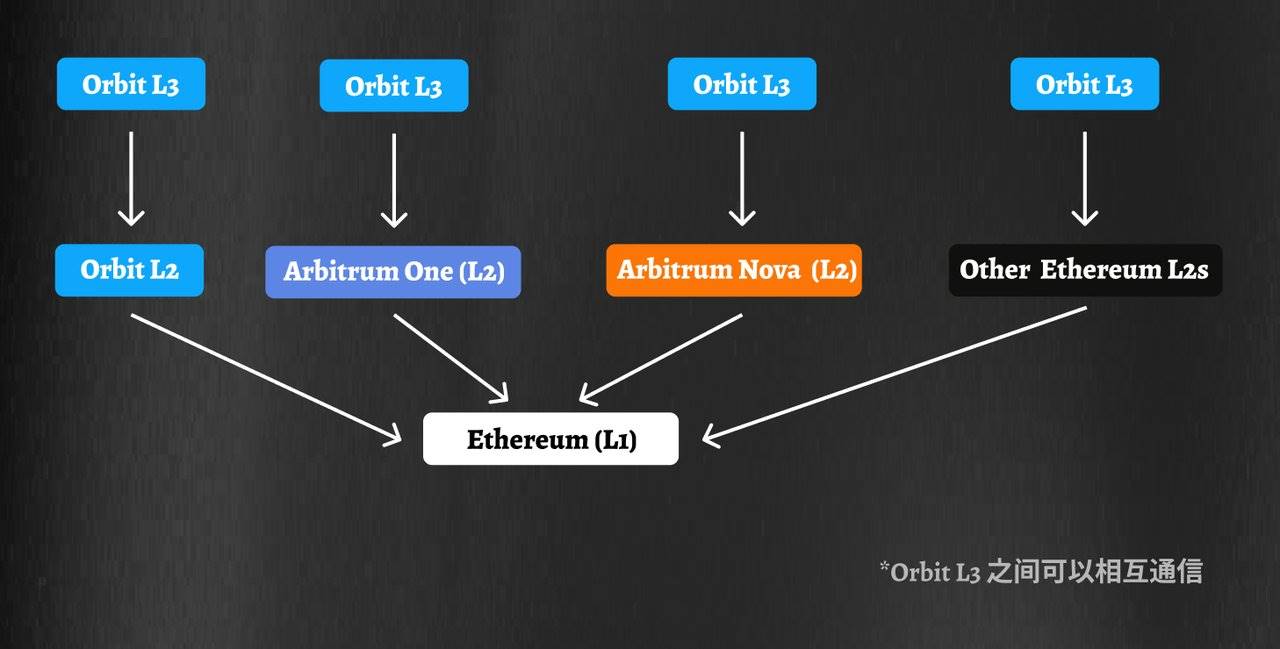

The horizontal strategy can be simply understood as covering the diverse needs of a wider ecosystem. Facing the differentiated considerations of different dApp developers in terms of speed, cost, security, etc., Arbitrum has also launched multi-chain products and RaaS services:

-

Arbitrum One: L2 based on Arb Rollup technology, which basically inherits the security of Ethereum mainnet and is more suitable for building products with high security requirements such as DeFi.

-

Arbitrum Nova: Based on AnyTrusts L2, it significantly reduces on-chain interaction costs by sacrificing some decentralization, making it more suitable for building products with high-frequency trading needs such as GameFi.

-

Arbitrum Orbit: allows you to build your own private chain without permission, and can customize settings such as throughput, privacy, gas tokens, governance, etc., which is more suitable for products with highly customized requirements.

The three major products have their own strengths and have developed a thriving ecosystem in their respective areas of expertise: Arbitrum Nova has deployed more than 120 projects, and since the beginning of the year, Orbit Chain has attracted more than 55 projects to launch 17 main networks, with a cumulative transaction volume of more than 10 million. In addition, more than 100 projects are being deployed. The full blossoming of the three major product ecosystems will further accelerate the multi-chain era based on the Ethereum ecosystem and bring more possibilities for on-chain innovation.

In addition to technical support, ecological support is an indispensable catalyst for the explosion of applications. Arbitrums strong ecological incentive measures have further promoted Arbitrum to become a fertile ground for innovation.

On the user side:

I believe everyone still remembers the Arbitrum Odyssey event that attracted thousands of people in 2022. As an ecological experience reward program, participants have the opportunity to obtain NFTs and more rewards by completing tasks. With the expected launch of the governance token, a large number of new users flocked to the event, which once led to an increase in transaction costs and even downtime. This also prompted Arbitrum to continuously seek performance optimization, and the Odyssey activities carried out at different stages thereafter also attracted a large number of users to participate.

In addition, ordinary users can also participate in the Ambassador Program to contribute to the community by hosting events, creating content, spreading education, and building tools, and receive generous rewards and wide recognition from the Arbitrum community.

On the developer side:

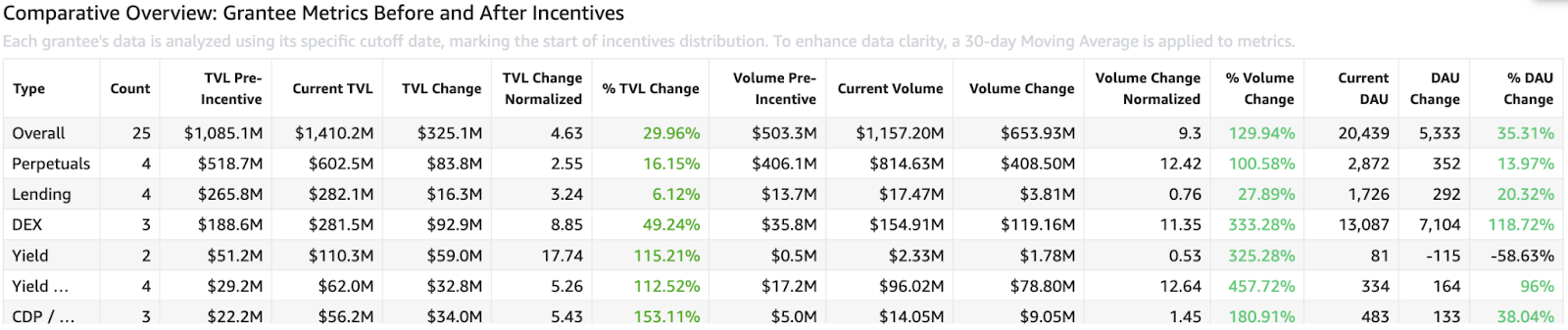

Starting from November 2023, Arbitrum launched a short-term incentive plan (STIP). Through community voting, 50 million ARB tokens were distributed to major protocols in the Arbitrum ecosystem to increase user participation. 29 of the 95 projects that participated in the vote were selected, including Camelot, GMX, Galxe, Pendle, etc., and a total of 71.4 million ARB tokens were distributed to 27 projects. Through the on-chain data, we can also see the results of the incentives: various protocols have achieved comprehensive growth in the number of daily active users (DAU), TVL, and transaction volume.

Based on the results of the Short-Term Incentive Program (STIP), ArbitrumDAO launched the Long-Term Incentive Pilot Program (LTIPP) this year, which will distribute 25 million to 45 million ARB to Arbitrum-based protocols to attract new users and Arbitrum liquidity and explore more effective incentive systems.

At the same time, Arbitrum has also launched a bug bounty program to encourage developers to participate in security audits and vulnerability discovery. Depending on the level of the vulnerability, developers will have the opportunity to receive rewards ranging from $1,000 to $2 million. This initiative continues to enhance the security and reliability of the ecosystem.

In addition, the Arbitrum Foundation will also launch more Grant programs and hackathon activities. In June of this year, with the approach of Arbitrum Stylus, Arbitrum also launched the Stylus Blitz Hackathon event on the Arbitrum Sepolia test network. Currently, the Arbitrum Foundation has completed three Grants programs. According to the Arbitrum official website, the registration channel for the fourth Grants funding program of the Arbitrum Foundation will soon be open.

The diverse incentives have attracted a large number of developers to participate. The abundant funding, resources, and technical support have also enabled developers to freely explore various innovative possibilities in a vibrant environment, from financial applications to games, social platforms, and other fields, injecting more driving force into the growth of the Arbitrum ecosystem.

Outlook: The roadmap is advancing in an orderly manner, and Arbitrum One is poised to flourish in the future

Of course, at such a memorable moment as the third anniversary, it is gratifying to review past impressive achievements, but we should also focus on future development strategies and growth potential.

On the one hand, with the announcement of the airdrop plan by zkSync in June 2024, the former four kings of L2 have all launched tokens. On the other hand, facing the competition from rising L2 players such as Base, Blast, and Mantle, as one of the four kings of L2, how can Arbitrum start the second growth curve of the ecosystem and continue to consolidate its leading position in L2 with the highest TVL?

Judging from the information released recently, Arbitrum is clearly well prepared to face an increasingly treacherous market.

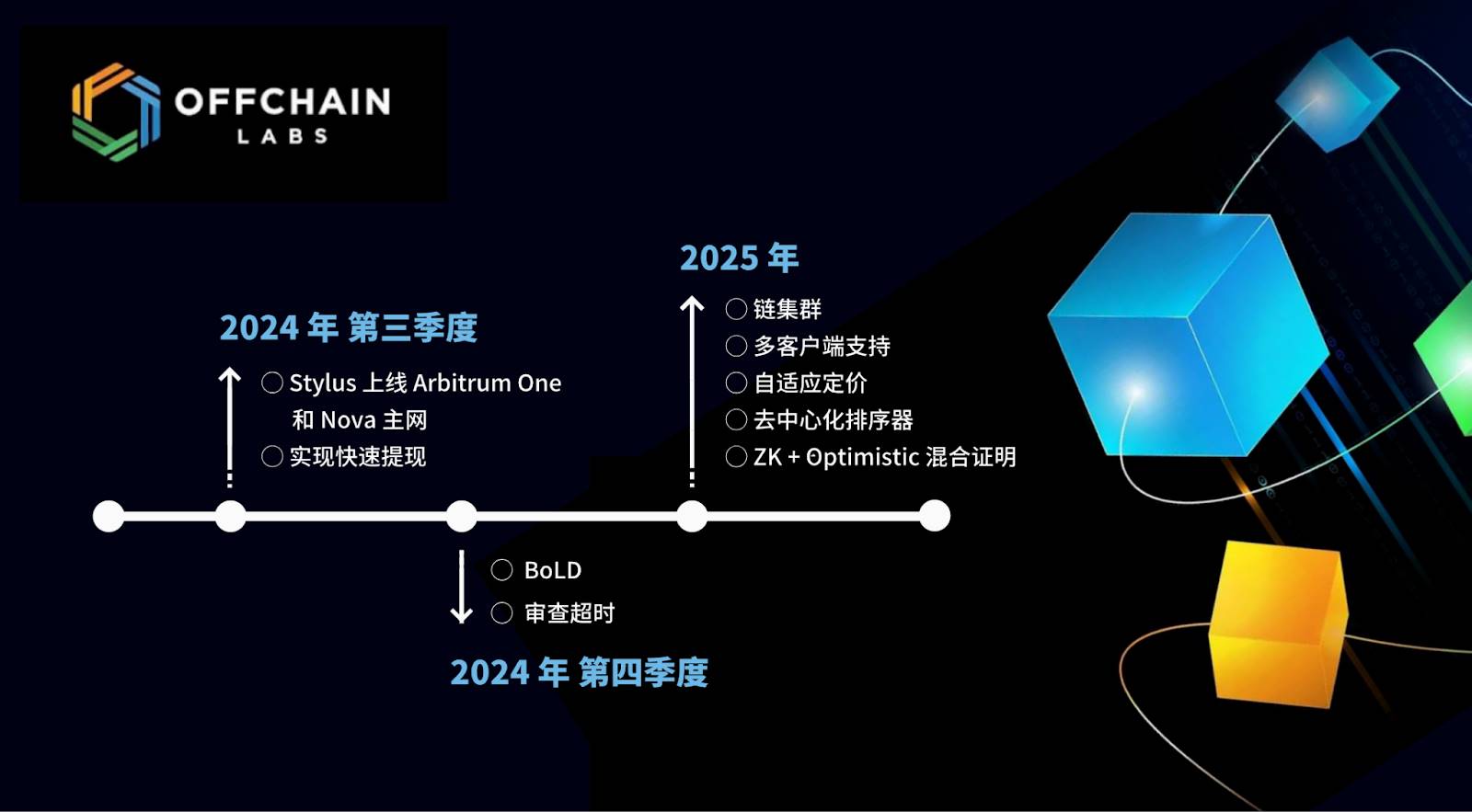

In terms of technology, last week, Offchain Labs, the technical service provider of Arbitrum, announced its latest development blueprint. In addition to the Arbitrum Stylus mentioned above that will be launched on the Arbitrum One and Nova mainnets on the Arbitrum anniversary, the article also detailed more technical proposals planned by Offchain Labs for Arbitrum, including:

In the third quarter of 2024, Offchain Labs will complete the development of Arbitrum’s fast withdrawals;

Second half of 2024: Offchain Labs will complete the development of a new verification protocol, Bounded Liquidity Delay (BoLD), to achieve permissionless verification, and will introduce review timeouts based on BoLD to limit the negative impact of repeated reviews or sorter offline on the Arbitrum chain, providing Arbitrum chain with stronger anti-censorship guarantees.

By 2025, Offchain Labs technical work focuses include multi-client support, adaptive pricing, chain clusters, and the implementation of decentralized sequencers. In addition, more explorations on ZK + Optimistic hybrid proofs are also being carried out simultaneously to further improve Arbitrums performance, efficiency, interoperability, scalability, and decentralization. The above proposals will be voted on the chain through ArbitrumDAO, and will be implemented in an orderly manner after passing.

At the ecological level, the Arbitrum ecosystem has achieved many milestone achievements in the first half of 2024: ApeCoin DAO, the decentralized autonomous organization behind ApeCoin, chose to launch ApeChain on Arbitrum; DuckChain used Arbitrum Orbit to become TONs first L2; several leading projects in the social, NFT, and DeFi fields, including Azuki, Farcaster, and Robinhood, have entered the Arbiturm ecosystem.

These achievements together demonstrate the lasting appeal of the Arbitrum ecosystem, and will also become an important driving force for the continued active and leading Arbitrum ecosystem in the future. In the future, based on the three major products of Arbitrum One, Arbitrum Nova, and Arbitrum Orbit, Arbitrum will also actively promote more cooperation and continue to work hard in improving the ecological landscape, stimulating ecological innovation, and empowering ecological users.

บทสรุป

It is undeniable that the road ahead is difficult.

Looking at the L2 track, on one hand, L2 newcomers such as Base and Mantle are eyeing the market covetously. Some of the former four kings of L2 seem to have fallen behind under the impact. On the other hand, in this cycle, anyone can launch a chain, and everyone is launching a chain. The market competition among thousands of chains and the communitys disenchantment with the infrastructure narrative have made the L2 competition more variable.

But we can still see that for a true L2 leader like Arbitrum, the leading advantage it has accumulated cannot be challenged overnight, especially since Arbitrums leading advantage is more due to the on-chain activity brought about by the rich ecology, which is even more difficult to replace in the L2 competition.

As Arbitrum continues to improve and break through its technology, users, and ecosystem, as well as achieve various milestones, we wish and expect Arbitrum to bring more innovative developments to L2 and the entire industry in the future.

This article is sourced from the internet: The growth history of L2 giant Arbitrum One: three years of trials and tribulations, from 0 to 20 billion TVL

Original author: Satou In the field of blockchain, The Open Network (TON) has gradually emerged in the payment track with its unique advantages and deep user base. In 2024, the TON ecosystem has shown strong growth momentum in many aspects. According to the latest data, as of July 21, 2024, more than 730 M USDT has been issued on the TON network, becoming an important driving force for the development of the TON payment ecosystem. In addition, TON game platforms such as Notcoin, Hamster Kombat and Catizen have also achieved remarkable achievements, attracting 35 million, 230 million and 25 million users respectively. As the TON ecosystem continues to mature and expand, its application prospects in multiple fields such as DeFi, GameFi, and SocialFi are becoming increasingly clear. The CGV research…