OpenSea ได้รับแจ้งจาก SEC Wells ว่าเส้นทาง NFT มีกำหนดจะล้มเหลวล่วงหน้าหรือไม่?

ต้นฉบับ|Odaily Planet Daily ( @โอเดลี่ไชน่า )

ผู้แต่ง : เวนเซอร์ ( @เวนเซอร์2010 )

Just yesterday, OpenSea, once the largest NFT trading platform, received a Wells Notice from the US SEC, becoming another targeted crypto project after Coinbase, Lido, Bittrex, Uniswap, and Robinhood . (Note from Odaily Planet Daily: The Wells Notice is an informal reminder issued by the US SEC before filing a civil lawsuit against a US-listed company. Companies that receive the notice can communicate and negotiate with the SEC before receiving a formal lawsuit.) In response, OpenSea พูดว่า it plans to provide $5 million to pay legal fees for NFT artists and developers who received the Wells Notice, and that it is ready to fight for the industry; Uniswap founder Hayden Adams was also speechless about this, and โพสต์แล้ว a post in support of OpenSea, saying that the US SEC is like a clown, thinking that digital art will magically become a security after being put on the blockchain.

เช่น NFT trading volumes on mainstream chains such as Ethereum, Solana, and Polygon are picking up , perhaps it’s finally time to talk about whether the NFT track’s big failure has come to an end. Odaily Planet Daily will explore representative projects, events, and reasons for the big failures in multiple sub-tracks in this cycle (2021-2024) in this article and subsequent series of articles.

NFT Milestones: OpenSea, BAYC, Blur

ในบทความก่อนหน้านี้ Evolution of Crypto Venture Capital Cycle (Part 2): The Lost Future , we mentioned the key heavyweight players in the NFT track –

-

OpenSea, which completed a $300 million Series C round in January 2022, with a valuation of $13.3 billion;

-

BAYC and its parent company Yuga Labs completed a new round of financing of US$450 million with a valuation of US$4 billion in March 2022, which was the largest financing in the NFT industry at that time.

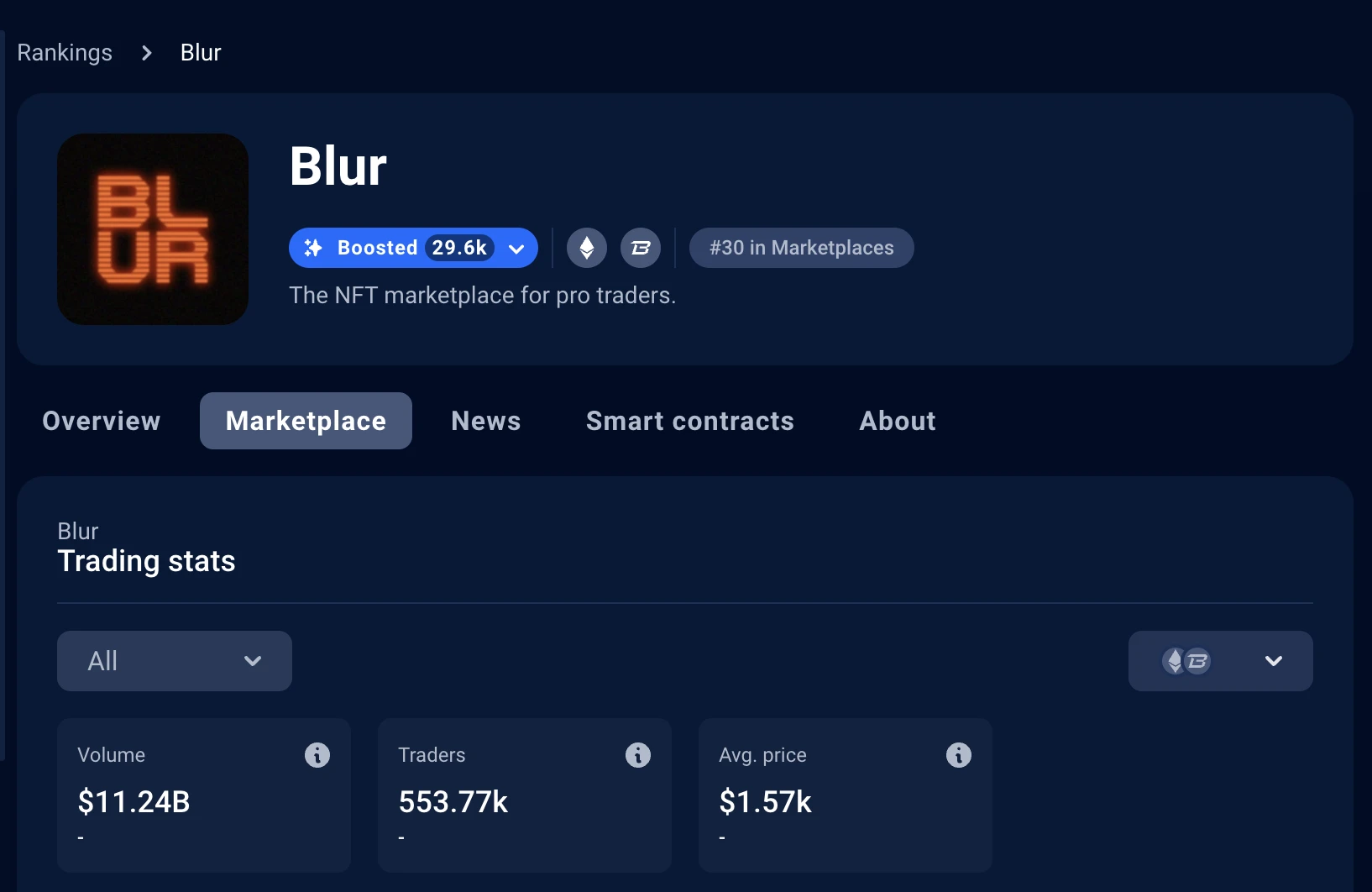

As for Blur, as a rising star in the field of NFT trading platforms, it not only pioneered the PointFi gameplay that is still used today, and positioned itself as an aggregation platform for professional NFT players, but also received investment support from well-known investment institutions Paradigm and a number of NFT KOLs including Deeze, Zeneca, and Punk 6529. It can be said that it was a popular platform. Later, Blur founder Pacman Tieshun launched L2 Blast based on Blur, setting a precedent for L2 network high-interest deposit collection – attracting TVL funds through Blur and Blast ecological airdrops.

Currently, according to data from the DappRadar website , Blurs total transaction volume exceeds US$11.24 billion, and the number of traders is as high as 553,770, but active NFT traders have long since disappeared.

Blur Platform Overall Data

Looking back, it is not difficult to find that the main driving forces of the NFT bull market at that time came from the following three aspects:

Hot money: represented by a16z and Paradigm

In 2021, Roblox, the first stock in the Metaverse, and Coinbase, the first cryptocurrency exchange, were listed on the New York Stock Exchange, triggering continued advocacy and pursuit of concepts such as the Metaverse, NFT, and Web3. The former social giant Facebook changed its name to Meta, pushing this trend to the extreme. The cryptocurrency industry at that time also continued to rise amid the influx of hot money, and reached its peak market value in November of that year, exceeding $3 trillion at one point.

In this process, venture capital firms represented by a16z and Paradigm have made indispensable contributions.

Celebrity IP: represented by Curry, Gou Ye, and Jay Chou

In addition, after the liquidity of the cryptocurrency industry gradually overflowed from the DeFi and GameFi fields to NFT, many celebrities and IPs and brands in traditional industries also joined this liquidity feast because of their envy of the hot money – basketball star Curry spent $180,000 to buy BAYC; rap superstar Dog Ye also joined the ranks of BAYC Holder; Chinese pop superstar Jay Chou also supported the Phanta Bear NFT project initiated by his good brother Liu Genghong, creating the celebrity NFT myth with the floor price of Jay Chou Bear once approaching 8 ETH (worth about $35,000 at the time).

As the focus of attention from all walks of life, celebrities in the entertainment and sports circles and brand IPs in traditional industries have found a path to quickly monetize their fame, which has also added fuel to the frenzy of celebrities launching NFT projects and endorsing NFT projects.

After the wind changed, the celebrity IPs just walked away, waving their sleeves without taking a cloud with them, but the only ones who paid for this liquidity feast were the retail investors in the market.

Crypto cycle: represented by DeFi Summer, GameFi Summer, and Fed’s easing

After experiencing the DeFi Summer in 2020, the GameFi Summer in 2021, and the Federal Reserves interest rate cuts and money releases during this period, the cryptocurrency industry has gradually recovered from the big crashes of 3·12 and 5·19. The NFT creations of crypto digital artists such as ผึ้งple and the maturity of technical standards such as ERC-721 have also laid the foundation for NFTs breaking the circle. Therefore, as the last link in the cryptocurrency liquidity closed loop , NFT became the best target for liquidity such as collection and consumption at that time. As the most popular concept in the cryptocurrency industry, the decentralized community also provides the best soil for the generation, development and takeover of NFT projects.

In a frenzy market where “you can sell and make money after getting the whitelisted Mint NFT”, the liquidity feast has completed its “last dance”.

As these conditions gradually disappeared in the cold market that was constantly collapsing, the NFT project also transformed from a crypto cultural carrier that had attracted much attention in the past to a worthless little picture.

NFT’s failure is already doomed: low threshold, weak liquidity, small market, low ceiling

When the fanatical market sentiment calms down, when the hot money that rushed in withdraws, and when the idealists who shouted NFT changes art and changes the world are hit hard, the ending of NFT can only be its own big defeat in a mess, and this is, to some extent, also affected by the genes of the track and the project.

The consequence of low threshold: a mixed bag of good and bad, countless Rugs

When hot money for speculation pours in and the market becomes in short supply, profit-seeking people will naturally set their sights on this big cake.

On the one hand, there are ordinary retail investors who have dreams of getting rich quickly, ideals of decentralization, but lack investment or even speculation experience; on the other hand, there are project parties who can change their faces anytime and anywhere, and can strike again after a little sprucing up, whose resource backgrounds are difficult to distinguish, who are anonymous and of various types. Both parties are naturally in a position of information asymmetry, so it is not surprising that there is a one-sided harvest.

Weak liquidity, small market cap: 10K PFP becomes the “NFT curse”

With Cryptopunks, BAYC, Pudgy Penguins, and Azuki as examples, countless NFT projects have rushed into the 10K PFP track, and their market share once exceeded more than half. However, compared with the supply of Tokens, which are often 1 billion, 10 billion, or even 100 billion or more, this number not only limits the entry and exit of liquidity, but also limits the size of the plate – according to Coingecko data , the current overall market value of the NFT market is about 65 billion US dollars, and the 24-hour trading volume is only 9.068 million US dollars, which is not even as liquid as a new Meme coin, let alone other mainstream tokens. This is the market status after the hype of BTC NFT last year. If BTC NFT is excluded, the market data is even bleaker. In this regard, the non-homogeneous nature gives NFT superficial uniqueness (most NFTs are not on the chain, and their IPFS-carrying media content can be replaced at any time, the only difference is that the Token ID is unique), but it has become an liquidity shackle that it cannot escape.

NFT market value and transaction volume data

Low ceiling: Animation movies, IP peripherals, and cultural brands are the upper limit

Compared with other tracks in the cryptocurrency industry, the ceiling of NFT projects is lower – they can neither master the core bottleneck to collect handling fees nor expand the ecological scope and tell a story of infrastructure construction. Most NFT projects choose only two directions: one is games, transforming to GameFi, but it takes a long time, has a long cycle, high costs, and high manpower investment costs; the other is to turn to IP and brands, but they also face problems such as high time costs, difficulty in channel construction, and expansion of traffic entrances.

As I wrote in my previous article “Acquiring Frame, Building Abstract Chain, Subverting Base, Can Pudgy Penguins Take Up the Banner of Consumer Economy?” , the reason why Pudgy Penguins chose to acquire Frame to build its own Abstract Chain and focus on the path of “consumer economy construction” is to “develop a business model with a higher ceiling to connect the Web2 and Web3 worlds.”

The reason why Azuki, which once completed a US$30 million Series A financing, gradually disappeared is similar to the mistakes made by BAYC and Yuga Labs behind it in their obsession with games – they overestimated their ability to build entertainment brands and successful products, and underestimated the ability, timing, resources and luck required to build a successful brand and a best-selling product.

Take the recently popular domestic 3A game Black Myth: Wukong as an example. The game science team behind it has been deeply involved in the game field for more than a decade, but it still took 7 years and invested tens of millions of dollars. Before the game was released, it was not certain whether the project would succeed or fail. How could Yuga Labs, which has raised more than 450 million yuan in financing, be sure that its OtherSide project would be able to break through successfully?

Or perhaps, these NFT projects have never thought about accomplishing something, but just calmly accepted the gift of the times and boarded their own ship of wealth when the wind came. As for who will pay for the ticket? Sorry, we failed.

Conclusion: NFT’s defeat is inevitable, but there may be a glimmer of hope for technological transformation and pure digital art

ตาม RootData data , approximately 239 projects declared bankruptcy or ceased operations in 2022, with a cumulative financing amount of US$4.033 billion.

After the piles of bones from the past have piled up into a mountain and turned into mud and dust, combined with the recent performance of the former blue chip NFT projects, to some extent, the NFT defeat can be concluded – in the BAYC team, former creative director Jeff Nicholas ประกาศสิ่งนั้น he would join Metas Reality Labs in September, and Yuga Labs also ประกาศแล้ว in April that it would reorganize the company and lay off some team members ; อาซึกิ ประกาศแล้ว in June ที่ it had hired Steve Chung, a senior entertainment executive who had worked at Fox and Korean entertainment giant CJ ENM Entertainment , as chief operating officer, seeking to expand its business beyond digital collectibles. As for the ambition to build an animation industry empire, it has long since given up; Moonbirds was taken over by Yuga Labs after announcing CC0, and the founder Kevin Rose eventually disappeared. The last tweet of the X platform account stopped in March of this year, and it seems that it has embraced a new life.

At the same time, after experiencing a brief hype wave such as BitFrog and Puppet Monkey, BTC NFT has gradually calmed down as the FOMO sentiment in the Bitcoin ecosystem has cooled down.

Next, perhaps NFT projects need to focus on pure digital art or technological transformation applications, expand scenarios into games, social networking, and real life, and combine them with market brand marketing, and there is still a glimmer of hope.

After all, according to recent news , the works of crypto artist XCOPY are still being sold at high prices (DEATHLESS was sold at 40 ETH, OVERLORD was sold at 35 ETH, Gobble was sold at 22.6 ETH, and Doomed was sold at 21 ETH). Although it is an isolated case, digital art will continue to shine.

This article is sourced from the internet: OpenSea received a notice from SEC Wells, is the NFT track scheduled to fail in advance?

Recently, with the influence of macro data and government agencies selling coins, the crypto market seems to be very turbulent, but the more in such a period, the more we need to calm down and find good targets and continue to pay attention. Although memes are dominant in this cycle, there are also many outstanding projects in tracks such as DeFi and games. Aerodrome Finance, the largest DEX in the Base ecosystem, and Notcoin in the Ton ecosystem are both excellent cases. After Notcoin went online and became popular, many ecosystems have Tap-to-Earn imitations, but few have achieved significant results. Aptos ecosystem game Tapos is one of the best. According to data from Artemis, an on-chain analysis agency, on May 25, Aptoss daily transaction volume reached 115.4 million, exceeding Solanas…