TVL เพิ่มขึ้น 7 เท่า ตรวจสอบข้อมูลการพัฒนา DeFi ของ TON ในไตรมาสที่สอง

Original author: The Open Platform

ต้นฉบับแปล: 1912212.eth, Foresight News

The second quarter of 2024 is a turning point for TONs DeFi ecosystem, with the launch of native USDT, and its liquidity and trading volume have increased significantly. This growth has made the TON/USDT liquidity pool on DeDust and STON.fi the largest stablecoin multi-exposure liquidity pool in the public chain (source DefiLlama data). In addition, TON also launched important infrastructure this quarter. In this report, we will explore the following:

-

Data chart trends;

-

Market dynamics of TON DEX liquidity pools;

-

Small-protocol TVL performance: EVAA and Storm Trade;

-

Launched ION Finance, DEX Diamonads, and Tradoor;

-

The solution to bring EVM functionality to TON: TON Application Chain;

-

Launched decentralized development platform TonFura.

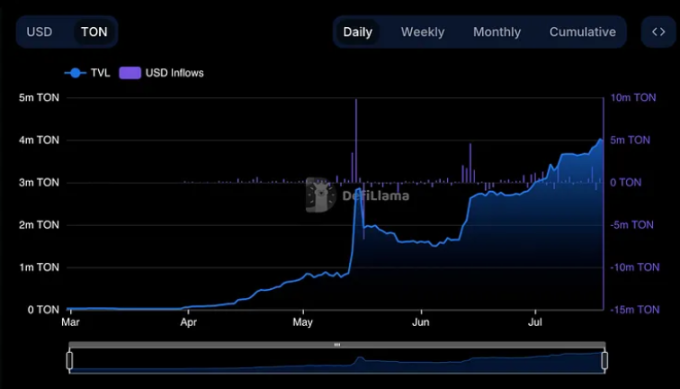

The launch of USDT-TON has increased TON’s TVL by 7 times in Q2 2024, and its average daily active address (DAA) has surpassed Ethereum

In the second quarter of 2024, TON was characterized by explosive growth in various data indicators. The launch of native USDT by TON greatly boosted the liquidity and trading volume of major DeFi protocols on it. The incentive program also played an important role in acquiring new users and enhancing the TVL of the ecosystem. The number of wallets and monthly active wallets increased by more than 200% this quarter.

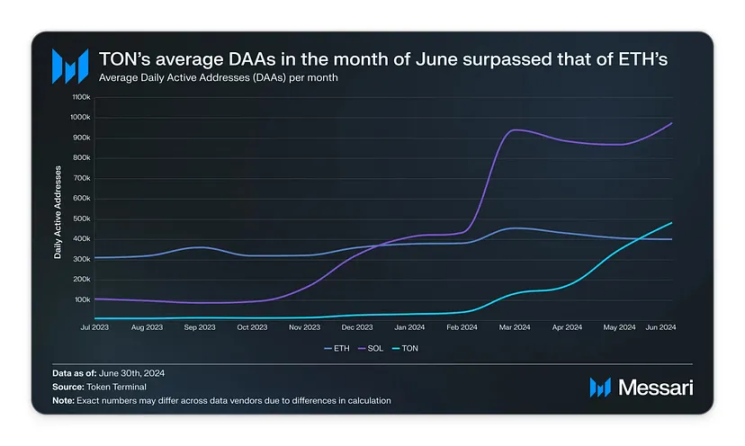

Since launching The Open League, TON’s average daily active addresses have been on a steady upward trend. After the launch of native USDT on April 19, data growth accelerated. In June, TON’s average daily active addresses surpassed Ethereum.

According to Token Terminal data, as of July 29, TON ranked 7th in daily active users and 8th in monthly active users among public chains.

DEX liquidity pool ranks first

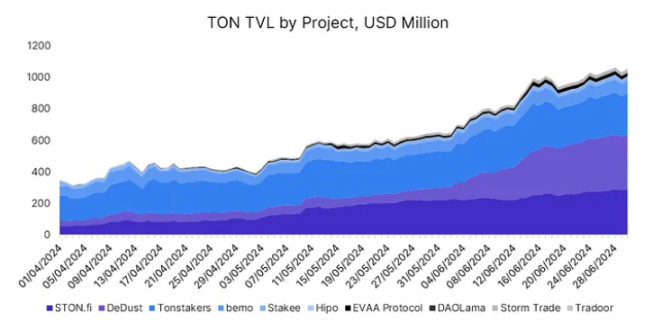

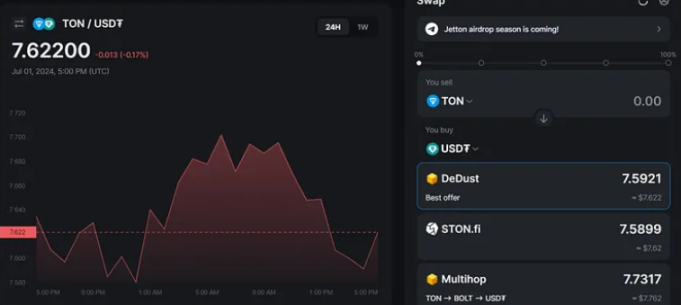

DEX protocols have once again gained TVL dominance, which was previously dominated by liquidity staking protocols. This shift stems from the surge in TVL in liquidity pools on STON.fi and DeDust, especially the USDT-TON trading pair pool.

As of the end of the quarter, DeDust and STON.fi accounted for more than 50% of TON TVL.

In Q2 2024, the TVL of DeDust and STON.fi increased by 10 times and 5 times respectively, most of which occurred in June. This trend is consistent with the trend of TON/USDT LP pools on the two DEXs.

When USDT pools are not taken into account, STON.fi maintains its lead, accounting for 61% of TVL among ecosystem DEXs by the end of the quarter.

To promote the adoption of USDT-TON, the TON Foundation allocated 10 million TON tokens to DeDust and STON. Users can now provide liquidity for TON and USDT-TON on these two DEXs to earn an annualized rate of return of about 50%. Currently, the TVL of the two mining pools has reached US$301.12 million and US$286.75 million, respectively.

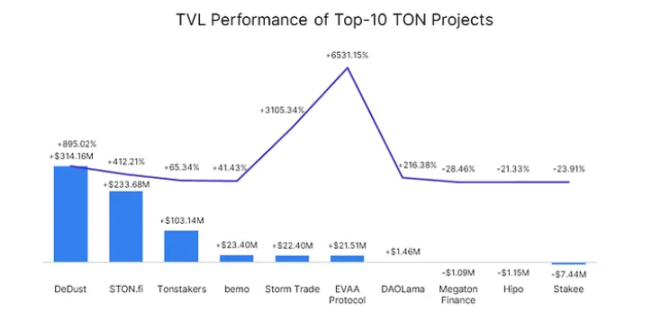

Small protocols show strong TVL growth in Q2 2024

While DEXs led the quarter in terms of TVL growth, EVAA and Storm Trade performed best in percentage growth. Their small size makes their growth percentages impressive.

EVAA’s TVL surge coincided with large inflows in mid-May and mid-June, with the first peak likely driven by EVAA’s announcement that its TON’s annualized return had risen to 100%.

Storm Trade’s TVL surge coincides with The Open League event and the introduction of the USDT Treasury, a yield optimizer that “aggregates liquidity from private markets and channels it to staking protocols to optimize yields.”

In addition, Storm Trade launched multi-currency collateral this quarter. This new feature allows users to use multiple types of cryptocurrencies, such as TON and USDT, as collateral for various currency pair futures transactions. It aims to significantly improve the user experience by increasing asset utilization and reducing the tediousness of frequent token conversions.

New DEX models are entering the ecosystem

This quarter, TON introduced two projects with alternative trade execution models and new derivatives DEXs.

ION is the first liquid DEX on TON, using an order execution model based on a bin system in its hybrid order book AMM. This system allows liquidity providers to allocate their funds into specific price segments, thereby improving liquidity efficiency and reducing slippage. Each interval represents a different price point, ensuring that liquidity is concentrated where it is most needed. This approach optimizes returns for liquidity providers by concentrating funds in high-demand areas and enhances the trading experience by providing better prices and more efficient transactions.

DEX Diamonds, a jetTON DEX aggregator, has launched its Telegram Mini APP. The platform brings together liquidity from STON.fi and DeDust. DEX aggregators like DEX Diamonds work by combining liquidity from multiple decentralized exchanges into a single platform. This approach provides users with better token prices and lower slippage due to increased aggregated liquidity compared to a single DEX. Additionally, DEX aggregators simplify the trading process by allowing users to execute trades between various DEXs without having to compare prices or manually navigate through multiple interfaces. This results in a more efficient, cost-effective, and user-friendly trading experience, making it easier for traders to find the best exchange rates and execute larger trades seamlessly.

Tradoor is a new derivatives DEX on TON that aims to provide a seamless and efficient trading experience for users who offer up to 100x leverage for its Bitcoin and Ethereum perpetual contracts. Tradoor positions itself as a NDMM (i.e. AMM based on normal distribution). NDMM is a unique pricing mechanism that uses advanced mathematical models to ensure efficient pricing and enhance trading and LP experience. The NDMM mechanism calculates the deviation rate for each trading pair based on the difference between long and short positions, and then determines the premium rate using a normal distribution function. This approach ensures that liquidity providers always act as passive counterparties and trade at consistent prices, thereby reducing risks and maintaining market stability.

TON implements EVM functions through TON Application Chain (TAC)

TON is a non-EVM public chain, which means that it does not natively support the Ethereum Virtual Machine (EVM) – the runtime environment for smart contracts on Ethereum. Examples of non-EVM blockchains include Bitcoin, Solana, and Polkadot. These blockchains may benefit from EVM functionality because integrating the EVM will enable them to tap into a broad ecosystem of Ethereum-compatible tools, DApps, and developer expertise. However, due to differences in the underlying architecture, consensus mechanisms, and programming languages, introducing EVM functionality to non-EVM chains is very complex, which requires a lot of engineering effort.

Finally, TON achieves EVM compatibility through a second-layer solution based on Polygon technology. TON Application Chain (TAC) is a new protocol that facilitates this integration by leveraging Polygons zkEVM. Polygon was chosen as the basis for EVM compatibility, allowing TON to maintain its high throughput and low latency while leveraging Polygons expertise in creating scalable and efficient second-layer solutions.

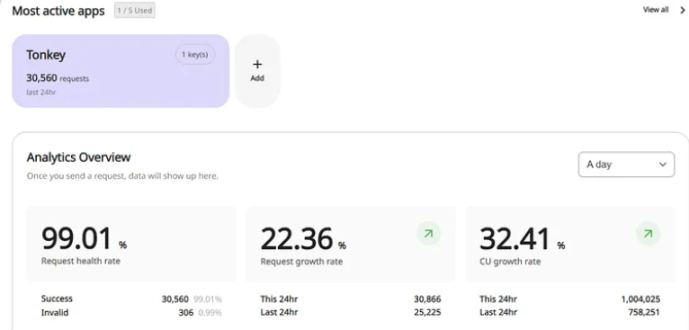

Strengthening DApp development on TON: Introduction to TonFura

TonFura aims to improve the overall performance and scalability of applications on the network, providing developers with powerful tools that allow them to effortlessly build and deploy high-performance DApps.

TonFuras core products include TonFura SDK, which provides developers with a comprehensive toolkit for building and managing DApps and provides seamless access to blockchain data and services.

TonFura is a complement to the TON API that simplifies access to TON functionality, enabling developers to manage DApps, tokens, and payments while providing advanced data analytics and seamless integration with various blockchain services. The TON API is deeply integrated into various Web3 areas of TON. Some of the DeFi integrations of the TON API include STON.fi, DeDust, TONstarter, and TON Whales.

This article is sourced from the internet: TVL increased 7 times, data review of TONs DeFi development in the second quarter

Related: Bloomberg reporters perspective: 48 hours of Bitcoin 2024 conference

Original article by Zeke Faux, Bloomberg Original translation: Luffy, Foresight News On July 17, about a week before Donald Trump took the stage in front of 8,000 Bitcoin fans in Nashville, Bitcoin Magazine CEO David Bailey gleefully explained how he and his friends had gotten the presidential candidate to attend the convention. Bailey, a 33-year-old with a baby face and a thick beard, appeared on a podcast called Galaxy Brains and told the host that the event was so crazy that he was keeping a journal to record what was going on. “I’m not going to publish this because no one is going to believe it,” Bailey said. Why is Bailey so excited? It’s easy to understand why. Trump will attend the Bailey Company conference, a convention for Bitcoin’s true…