สถาบันวิจัย Bitget: Bitcoin ฟื้นตัวถึง $57,000 และภาค AI ฟื้นตัวเร็วที่สุด

ในช่วง 24 ชั่วโมงที่ผ่านมา สกุลเงินและหัวข้อยอดนิยมใหม่ๆ มากมายปรากฏขึ้นในตลาด ซึ่งอาจเป็นโอกาสต่อไปในการสร้างรายได้ รวมทั้ง:

-

The sectors with strong wealth-creating effects are: AI sector and Solana sector;

-

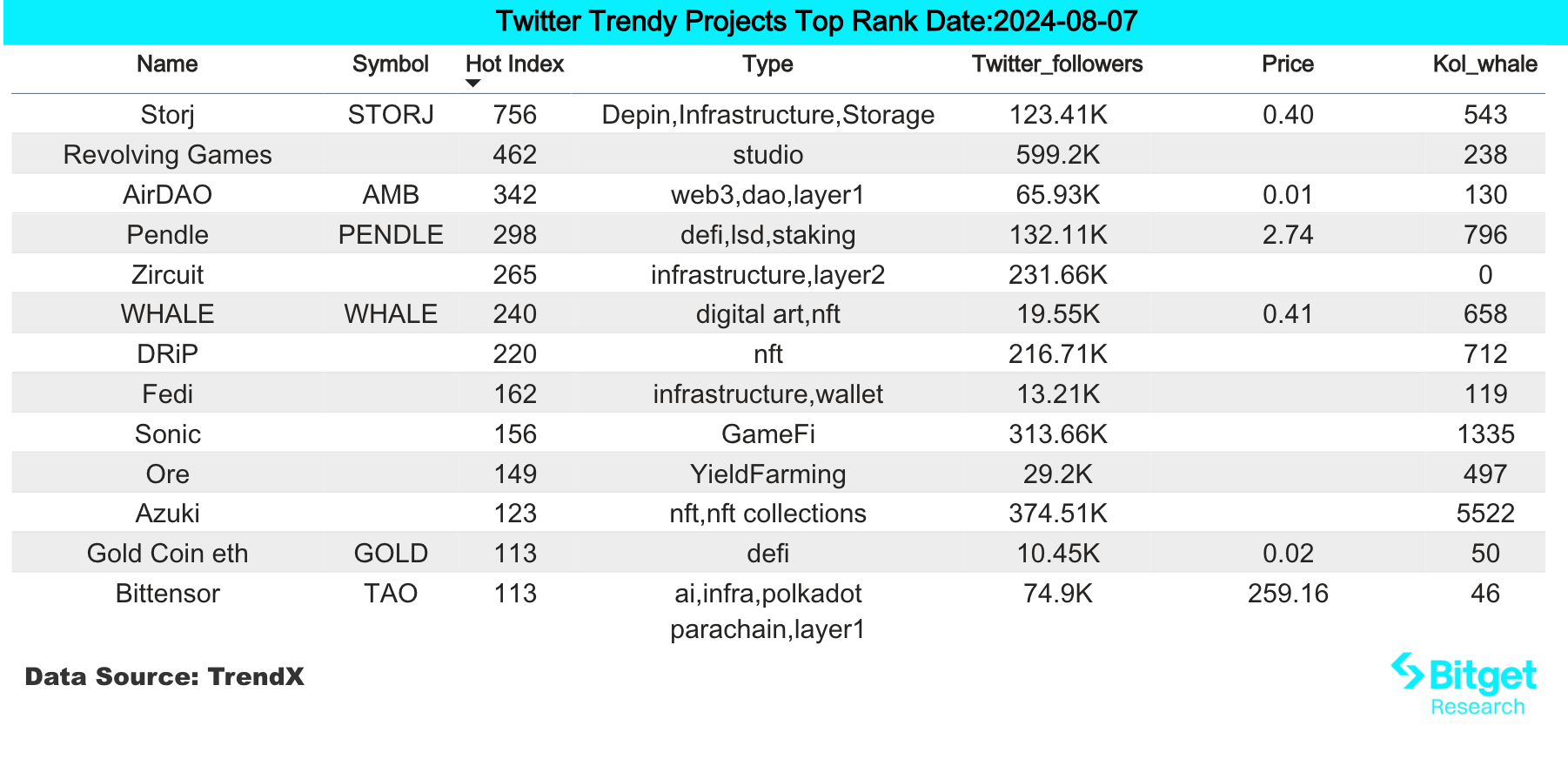

The most searched tokens and topics by users are: Kelp DAO, Zircuit, Pendle;

-

Potential airdrop opportunities include: Term Finance, Fuel;

Data statistics time: August 7, 2024 4: 00 (UTC + 0)

1. สภาพแวดล้อมของตลาด

In the past 24 hours, Bitcoin rebounded to $57,000, and the market ushered in a phased rise. Yesterday, the US Ethereum ETF had a net inflow of 8,815 ETH, and the Bitcoin ETF had a net outflow of 3,615 BTC. BlackRocks official update of the spot Ethereum ETF data showed that as of August 5, the market value of iShares Ethereum Trust ETF (ETHA) reached approximately $568,651,893.12, and the holdings rose to 237,882.8821 ETH.

In terms of macro data, following Mondays plunge, the Nikkei 225 index opened up 8% on Tuesday, recovering most of yesterdays losses. The Topix index rose 2%, and the South Korean KOSPI index opened up 3.7%. Japans Topix index futures triggered the circuit breaker mechanism upward. In the crypto market, Bitcoin rose 3.83% and Ethereum rose 5.05%. According to the latest data from Coingecko, the total market value of the crypto market has returned to above $2 trillion, with a 24-hour increase of 3.6%. According to Cointelegraph, Bitcoin trading volume hit a new high after halving, with a transaction volume of more than $1.14 billion on August 6. The decline in Bitcoin since the halving is now similar to the halving bull market cycle from 2015 to 2017. Cointelegraphs statement compared the depth of market adjustments since the halving date, pointing out that the two are very similar. Although some indicators are now showing bearish signals, there is still a possibility of continued rebound, and investors should keep an eye on it.

2. Wealth-creating sector

1) Sector changes: AI sector (TAO, NEAR, RENDER)

เหตุผลหลัก:

-

The AI sector has been falling and consolidating for a long time. In the environment of oversold market rebound, it was the first to attract the attention of funds;

-

Nvidia opened low and rebounded yesterday, and continued to rebound after the market closed, driving the overall enthusiasm for the AI sector;

-

Grayscale launched a new decentralized artificial intelligence fund, Grayscale Decentralized AI Fund LLC, which aims to strengthen the cryptocurrency industrys investment in artificial intelligence. As of today, the decentralized artificial intelligence projects already included in the funds basket include Bittensor (TAO), Filecoin (FIL), Livepeer (LPT), Near (NEAR) and Render (RNDR). Near, Filecoin and Render are the assets with the highest weights in the fund, respectively.

Rising situation: TAO, NEAR, and RENDER rose by 8% in 24 hours respectively;

ปัจจัยที่ส่งผลต่อแนวโน้มตลาด:

-

Nvidias subsequent trend: Nvidia is a bellwether of the AI track, affecting the markets overall valuation of the AI track. If Nvidia continues to rebound in the U.S. stock market tomorrow, the AI sector of the crypto market is expected to continue to rebound;

-

Impact of news: Pay attention to the product updates and partnerships recently promoted by the project party. If an AMA is held, you can consider deploying related assets in advance, because there is a high probability that good news will be released in the near future using the improved liquidity environment.

2) Sector changes: Solana sector (SOL, JUP, WIF)

เหตุผลหลัก:

-

SOL took the lead in driving the entire SOL ecosystem to rebound. After reaching $130, it rebounded to $150, driving the ecological coin to rise;

-

SOL is currently trading at $143, down more than 30% in the past two days. However, this decline mirrors the pattern that preceded the sharp price increase in 2021. The nearest resistance is at $217.15, a break above which could push SOL to $279.76.

Rising situation: SOL, JUP, and WIF rose by 10%, 10%, and 20% respectively within 24 hours;

ปัจจัยที่ส่งผลต่อแนวโน้มตลาด:

-

ข้อมูลชุมชน: การทำงานของ Meme coin ส่งผลอย่างมากต่อแนวโน้มของ Meme โปรดใส่ใจข้อมูลเนื้อหา AMA และ Twitter ของเป้าหมายการซื้อขาย หากมีข่าวใหม่ คุณสามารถซื้อขายได้ทันเวลาและคว้าโอกาสสร้างตำแหน่งในครั้งแรก

-

Increase or decrease in open interest: SOLs open interest rose yesterday, indicating an influx of hot money. Use the contract data on the tv.coinglass website to understand the movement of the main funds. First, look at the increase in net long positions on the contract; then look at whether the contract data shows a net increase in long positions, an increase in OI, and an increase in trading volume. If so, it means that the main force continues to buy up and can continue to hold;

3) Sectors that need to be focused on in the future: POW sector (KAS, ALPH, SMR)

เหตุผลหลัก:

-

Recently, governments around the world have gradually promoted the legalization of crypto mining. For example, the Russian government has withdrawn from related policies, and the United States is also actively expanding related industries. Therefore, the mining industry is gradually studying what new POW tokens can be invested in addition to mainstream mining assets. Some relatively high-quality targets have emerged in the market, with a significant increase in computing power recently and a relatively bright performance in currency prices.

ปัจจัยที่ส่งผลต่อแนวโน้มตลาด:

-

Hashrate performance: The continuous investment in hashrate indicates that there is continuous investment in mining machines, which increases the cost of token mining. This means that most market participants believe that investing in hashrate is still profitable at this cost. At the same time, the entry of large hashrate also indicates that mining groups may join the mining of this project, which is a signal of large capital entry.

-

Synchronous development of ecology: POW also has many application ecosystems. Ecology is the key to moving towards Mass Adoption. Therefore, if the ecology can attract enough developers, users, etc. to participate in its ecology, the demand for the token will increase, and there is a greater chance of continuing its market trend.

3. การค้นหายอดนิยมของผู้ใช้

1) DApps ยอดนิยม

Kelp DAO: The Ethereum restaking platform Kelp DAO announced that it will release the Gain function on August 13, which will bring multiple airdrops and reward increases to users by concentrating multiple L2s in one place. Kelp DAOs current TVL has exceeded US$800 million, and it has completed US$9 million in private financing. It is one of the leading projects in the Restaking platform concept.

2) ทวิตเตอร์

Zircuit:

Zircuit is a fully EVM-compatible ZK rollup with AI-enabled sequencer-level security. Today, the project announced that the first phase of the mainnet is now live. With over $2 billion staked on the Zircuit platform, Zircuit has also opened claims for the Season 1 airdrop. Users who staked assets in the Season 1 points event can now claim their tokens.

3) ภูมิภาคการค้นหาของ Google

จากมุมมองระดับโลก:

Pendle:

Pendle is an interest rate derivatives protocol built on multiple chains. It strips coupons on interest-bearing token assets – tokenizes the income, splits it into independently tradable interest payment parts and principal payment parts, and mints corresponding tokens. Affected and boosted by the general rise of altcoins following the market and Upbits new PENDLE Korean won and BTC market news, PENDLE briefly broke through $3 and then fell back. It is still up more than 30% in 24 hours.

จากคำค้นหาที่มาแรงในแต่ละภูมิภาค:

(1) The hot searches in Asia are very scattered. Public chains, RWA, Layer 2, and Restaking appear in the top search lists in Indonesia, the Philippines, Thailand, and Malaysia, respectively, with no universal characteristics.

(2) Hot searches in Europe, America and the English-speaking region are also relatively scattered, but public chain tokens are relatively popular. ICP and Monad appeared in the UK, while more meme tokens such as Boden, Hero, and Pepe appeared in the US.

(3) In Latin America, the hot searches in Brazil are stella, bonk, and polyx, while in Argentina they are Kelp, sand, and tron.

ศักยภาพ แอร์ดรอป โอกาส

เชื้อเพลิง

Fuel เป็นเลเยอร์การดำเนินการแบบโมดูลาร์ที่ใช้ UTXO ซึ่งทำให้ Ethereum ขยายขนาดได้ทั่วโลก ในฐานะเลเยอร์การดำเนินการแบบโมดูลาร์ Fuel สามารถบรรลุปริมาณงานทั่วโลกในลักษณะที่โซ่โมโนลิธิกไม่สามารถทำได้ ขณะเดียวกันก็สืบทอดความปลอดภัยของ Ethereum

ในเดือนกันยายน 2022 Fuel Labs ประสบความสำเร็จในการระดมทุนได้ $80 ล้านดอลลาร์สหรัฐในรอบการระดมทุนที่นำโดย Blockchain Capital และ Stratos Technologies สถาบันการลงทุนชั้นนำหลายแห่ง เช่น CoinFund, Bain Capital Crypto และ TRGC ก็ได้ลงทุนด้วย

วิธีการเข้าร่วม: คุณสามารถฝากโทเค็นที่ Fuel ยอมรับเข้าในคะแนนที่คุณได้รับได้โดยตรง ผู้เข้าร่วมสามารถรับ 1.5 คะแนนต่อวันสำหรับทุกๆ $1 ที่ฝากเข้าในสินทรัพย์ต่อไปนี้:

คะแนน: ETH, WET, eETH, rsETH, rETH, wbETH, USDT, USDC, USDe, sUSDe และ stETH ตั้งแต่วันที่ 8 ถึง 22 กรกฎาคม การฝากเงิน ezETH จะทำให้คุณได้รับ 3 คะแนนต่อวัน

Term Finance

Term Finance is a decentralized lending protocol that leverages a unique auction model to support scalable fixed-rate/term lending, the first of its kind in the DeFi space. It brings borrowers and lenders together in a fair and transparent auction process to determine a single market clearing rate for all participants, regardless of size.

Term Finance recently completed seed and strategic rounds of financing, with Electric Capital, Coinbase Ventures and other well-known institutions participating in the investment, with a financing amount of US$8 million. On July 9, the project announced the launch of

How to participate: 1. Register: Use an invitation code or referral link; 2. Link social: Link X and Discord for easy login; 3. Check bonus eligibility; 4. Participate: Borrow by participating in regular auctions; 5. Track: Get an in-depth understanding of how to maximize points through Terms tracking dashboard.

ลิงค์ต้นฉบับ: https://www.bitget.fit/zh-CN/research/articles/12560603813950

銆怐isclaimer銆慣ตลาดมีความเสี่ยง ดังนั้นควรระมัดระวังในการลงทุน บทความนี้ไม่ถือเป็นคำแนะนำในการลงทุน และผู้ใช้ควรพิจารณาว่าความคิดเห็น ความเห็น หรือข้อสรุปในบทความนี้เหมาะสมกับสถานการณ์เฉพาะของตนหรือไม่ การลงทุนตามข้อมูลนี้เป็นความเสี่ยงของคุณเอง

This article is sourced from the internet: Bitget Research Institute: Bitcoin rebounded to $57,000, and the AI sector rebounded the fastest

Original|Odaily Planet Daily ( @OdailyChina ) Author: Wenser ( @wenser 2010 ) At 2 a.m. today, perhaps affected by the news of Bidens withdrawal from the election, the price of Bitcoin once fell to $65,764.5, and then quickly rebounded, returning to around $68,000 after a month, and is currently reported at around $67,900; the price of Ethereum once fell to $3,411, and then also rebounded to above $3,500, and is currently reported at around $3,527. Odaily Planet Daily will organize and analyze the market situation and related views in this article for readers reference. Bullish: Buying is more honest than market opinion Currently, bullish views mainly come from market trading operations, political policy news and the views of market sources. Market trading operations: strong buying, institutional holdings increased According to…