บทความใหม่ของ Arthur Hayes: การยุติการซื้อขายสกุลเงินเยนจะส่งผลต่อตลาดหุ้นสหรัฐและตลาดคริปโตอย่างไร?

ผู้เขียนต้นฉบับ |อาเธอร์ เฮย์ส (ผู้ร่วมก่อตั้ง BitMEX)

Compiled by Nan Zhi ( @Assassin_Malvo )

Summary of the full text:

-

No worries in the short term: Due to Harriss election needs, there is no risk of a major crash in the short term. Once the market falls sharply on Friday, Harris will instruct Treasury Secretary Yellen to work with Japan to introduce a rescue policy over the weekend (around the 11th and 12th).

-

Focus on observing the correlation in the long term : In the long term, the Japanese yen will continue to appreciate against the US dollar, and the yen carry trade may come to an end. Focus on observing the correlation between Bitcoin and the exchange rate.

-

The underlying logic behind the end of carry trade: Japan has effectively achieved the rise of stocks and real estate by suppressing the yen price through long-term ultra-low interest rates. However, the yen has depreciated excessively, and the inflation problem can no longer be ignored. Japans lifting of financial suppression on the yen will lead to rising bond interest rates; due to high debt, if it does not want to print money to pay bond interest, the Bank of Japan needs to sell bonds to other Japanese units; this will further lead to other Japanese units selling foreign assets, especially US stocks; historical laws show that the appreciation of the yen is highly correlated with the decline of US stocks, and the liquidation of the above-mentioned carry trade positions may be very large, which may lead to a rapid chain reaction.

The following is a translation of the original text

What do you do when the market is down but you need to win an election?

If you are a politician, the answer is simple: your primary goal is to secure reelection. Therefore, you print money and manipulate prices to go up.

Imagine you are Kamala Harris, the Democratic nominee for the US presidency, facing a powerful orange figure. You need everything to go right because so much has gone wrong during your vice presidency since the last election, and the last thing you need on Election Day is a global financial crisis.

George W. Bush was nearing the end of his second term as president when Lehman Brothers went bankrupt in September 2008, which really triggered the global financial crisis. One could argue that because he was a Republican president, part of Obama’s appeal as a Democrat was that he was a member of another party and therefore not responsible for the recession, and Obama subsequently won the 2008 presidential election.

Let’s focus again on Harris’ dilemma of how to deal with the global financial crisis caused by Japan’s massive yen carry trade . She can let things run their course, letting the free market destroy over-leveraged businesses and allowing financial asset holders among the wealthy baby boomers to experience some real pain. Or, she can instruct U.S. Treasury Secretary “Bad Girl” Yellen to solve the problem with printed money. (Odaily Note: See Arthur’s previous article “ Bad Gurl ” for details, mainly because Arthur believes that Yellen will use fiscal policy to meet the unreasonable demands of the Biden administration.)

Like any politician, regardless of party affiliation or economic beliefs, Harris will instruct Yellen to use the monetary tools available to her to avoid a financial crisis. Of course, that means some form of money printing will be going on in some fashion . Harris will not want Yellen to wait, she will want Yellen to act forcefully and immediately. So if you agree with me that the unwinding of the yen carry trade could collapse the entire global financial system, you must also believe that Yellen will act immediately when Asian trading opens next Monday, August 12.

To give you an impressive idea of the size and magnitude of the potential impact that could result from the unwinding of carry trades for Japanese companies, I will walk you through an excellent research report from Deutsche Bank in November 2023. Then, I will describe how I would structure a rescue package if I were appointed U.S. Treasury Secretary.

Yen arbitrage system and future trends

What is a carry trade? A carry trade is when you borrow in a low-interest currency and buy financial assets in another currency that have a higher yield or a higher chance of appreciation. Some investors hedge their currency risk, some dont. In this case, because the Bank of Japan can print an unlimited amount of yen, Japanese companies dont have to hedge their borrowed yen.

Deutsche Bank wrote a report titled “The World’s Largest Carry Trade” in 2023. The author asked the question “Why didn’t the yen carry trade collapse and bring down the Japanese economy?” The situation today is very different than it was at the end of last year.

The common wisdom is that Japan is overloaded with debt. Hedge fund manager after hedge fund manager bets that Japan is about to collapse. But those who bet on Japans collapse always lose. This trade is not called the widow maker for nothing. Many macro investors are too pessimistic about Japan because they fail to understand the combination of Japans public and private balance sheets. This is an easy psychological mistake for Western investors who believe in individual rights. But in Japan, the collective is supreme. Therefore, certain actors that are considered private in the West are just another branch of government in Japan.

Lets deal with the liabilities side first. These are the sources of funding for the carry trade, i.e. how the yen is borrowed. These funds have an associated interest cost. There are two main ones: bank reserves and bonds and treasury bills.

Bank Reserves – These are the funds that banks hold at the Bank of Japan. Since the Bank of Japan creates bank reserves when it does bond buying, the amount is very large. Remember, the Bank of Japan holds almost half of the Japanese government bond market. Therefore, the amount of bank reserves is huge, at 102% of GDP. The cost of these reserves is 0.25%, which is the interest that the Bank of Japan pays to banks. For comparison, the Federal Reserve pays 5.4% interest on excess bank reserves. This cost of money is almost zero (in Japan).

Bonds Treasury Bills – These are Japanese government bonds issued by the government. Due to the market manipulation of the Bank of Japan, Japanese government bond yields are extremely low. The current 10-year Japanese government bond yield at the time of posting is around 0.77%. This is a very cheap cost of money.

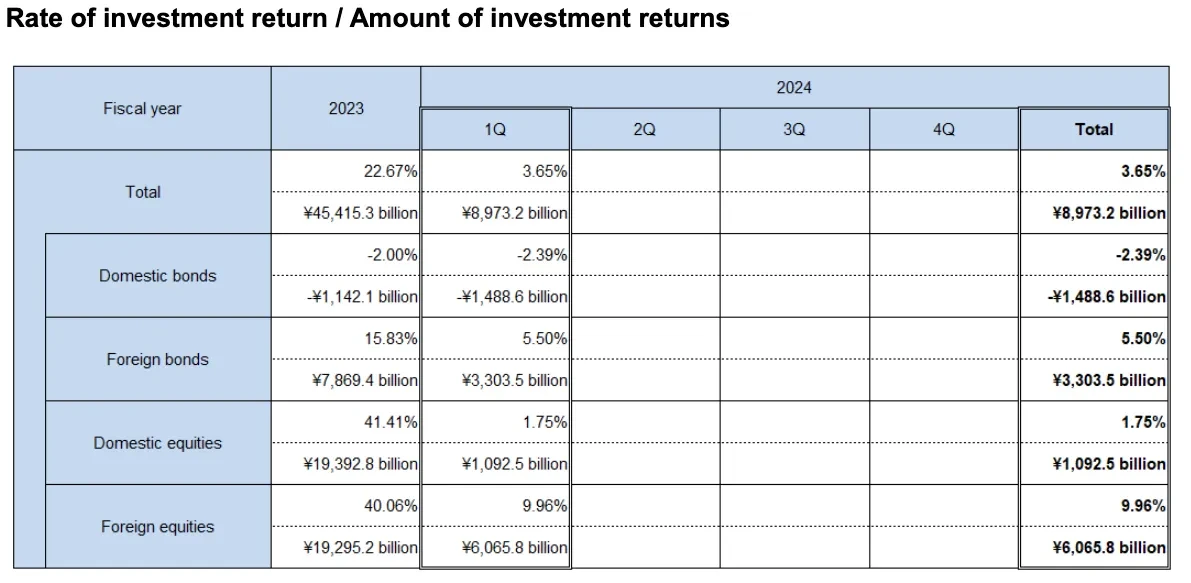

In terms of assets, the largest item is foreign securities. These are financial assets owned abroad by the public and private sectors. One large private foreign holder is the Government Pension Investment Fund (GPIF). With $1.14 trillion in assets, GPIF is one of the largest pension funds in the world and holds foreign stocks, bonds, and real estate.

Domestic loans, securities, and stocks also performed well when the BoJ fixed bond prices. Finally, domestic stock and real estate markets were boosted by the depreciation of the yen as a result of the creation of large amounts of yen liabilities.

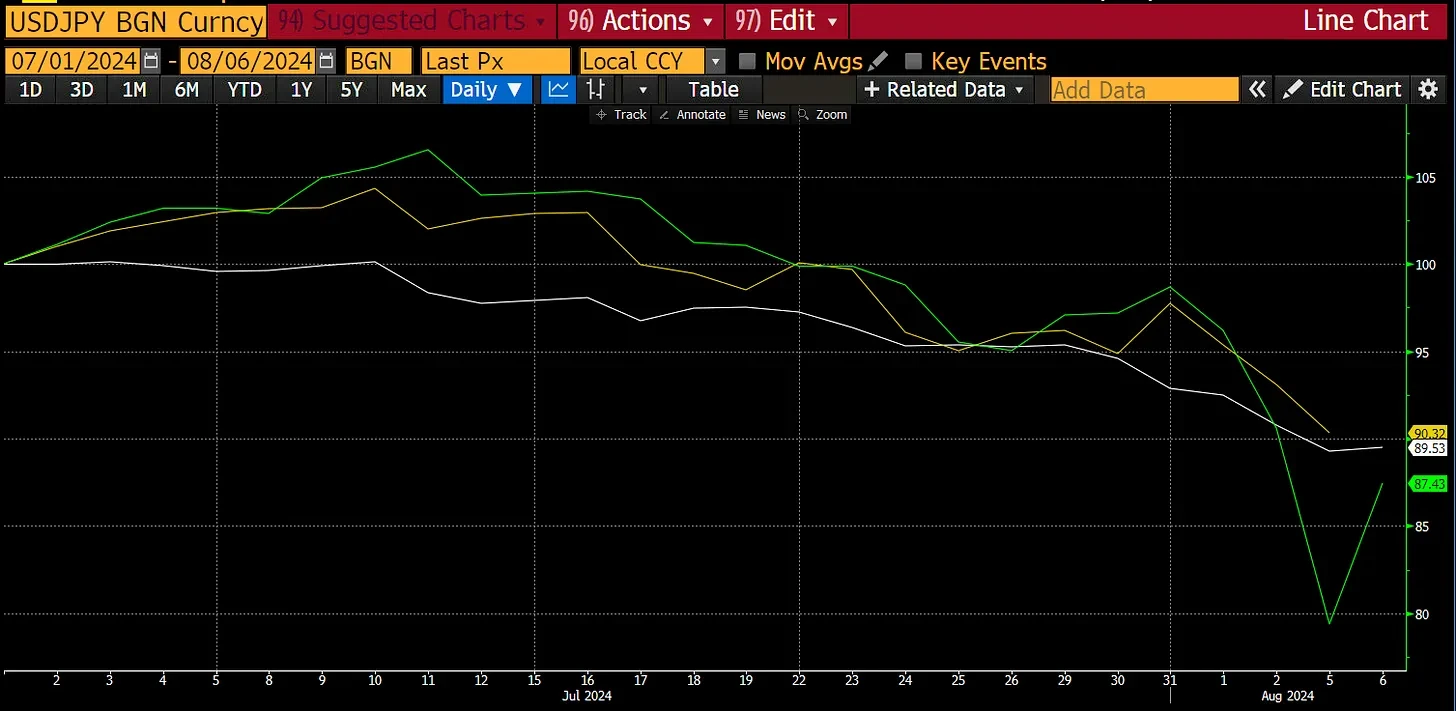

USD/JPY (white) rose, which means the yen has depreciated relative to the dollar. It also brought the Nasdaq 100 (green) and Nikkei 225 (yellow) higher.

In general, Japanese companies have taken advantage of the financial repression imposed by the Bank of Japan to finance themselves and receive high returns due to the depreciation of the yen. This is why the Bank of Japan can continue to run the worlds loosest monetary policy even as global inflation rises.

The GPIF has been very strong, especially in the last decade. What happened in the last decade is that the yen has depreciated significantly. As the yen depreciated, the returns on foreign assets soared.

If not for the excellent returns on its foreign stock and bond portfolios, GPIF would have lost money last quarter. The domestic bond losses were because the Bank of Japan exited its yield curve control (YCC), which led to higher yields and lower prices for Japanese government bonds. However, the yen continued to depreciate because the interest rate differential between the Bank of Japan and the Federal Reserve was so large.

Japanese companies traded this on a massive scale. Japans GDP is about $4 trillion, and with a total exposure of 505%, they were taking on $24 trillion worth of risk. This trade was clearly working, but the yen got too weak . The dollar hit 162 yen in early July, which was unsustainable because domestic inflation was raging .

The BoJ does not want to end this trade immediately but intends to exit it slowly over time… they always say so. Satoshi Ueda succeeds Haruhiko Kuroda as BoJ Governor in April 2023, Kuroda was the main architect of this massive trade. He exited when the going was good. Satoshi Ueda was the only candidate willing to seppuku by trying to unwind this trade. The market knew Satoshi Ueda would try to get the BoJ out of this carry trade. The question has always been the speed of normalization.

Odaily Minimalist Summary

Japan has effectively achieved the rise of stocks and real estate by suppressing the yen price through ultra-low interest rates for many years. However, the yen has depreciated excessively and the inflation problem can no longer be ignored. Now it plans to break this old pattern.

Ending the arbitrage trade

What might a disorderly termination look like? What would happen to the various assets of Japanese companies? How much would the yen appreciate?

To end this trade, the Bank of Japan would need to raise interest rates by stopping its purchases of JGBs and eventually selling them back into the market.

What happens on the liability side?

If the Bank of Japan stops pushing down JGB yields, yields will rise as the market demands, at least to a level that matches inflation. Japan’s consumer price index (CPI) rose 2.8% year-on-year in June. If JGB yields rise to 2.8%, higher than bond yields at any point on the yield curve, the cost of debt at all maturities will increase. The interest costs of bond and treasury bill liabilities will rise sharply.

The Bank of Japan would also have to raise the interest it pays banks on reserves to prevent those funds from escaping its control. Again, given the notional amounts involved, that cost would rise from virtually nothing to very high levels.

In short, allowing interest rates to rise to market-clearing levels would force the BoJ to pay hundreds of billions of yen in interest each year to maintain its position. Without the revenue from selling assets, the BoJ would have to print large amounts of yen to pay its liabilities. This would make the situation worse, inflation would rise, and the yen would weaken. Therefore, assets must be sold .

On the asset side, what happens?

The Bank of Japan’s biggest headache is how to sell its massive pile of JGBs. Over the past two decades, the Bank of Japan has destroyed the JGB market through its various quantitative easing (QE) and yield curve control (YCC) programs. In practical terms, the JGB market no longer exists. The Bank of Japan must force another member of Japanese corporate to do its job and buy JGBs at prices that won’t bankrupt the Bank of Japan. If you’re not sure who to turn to, turn to the banks.

Japanese commercial banks were forced to deleverage after the real estate and stock market bubble burst in 1989. Since then, bank lending has been stagnant. Since companies did not borrow from banks, the Bank of Japan began printing money. Given that banks are in good shape, it is time to put hundreds of trillions of yen of Japanese government bonds back on its balance sheet.

While the BoJ can ask banks to buy bonds, the banks need to get capital from somewhere. As JGB yields rise, Japanese companies seeking profits and banks holding trillions of dollars in foreign assets will sell those assets, repatriate the capital back to Japan, and deposit it in banks. Banks and these companies will buy JGBs in large quantities. As the capital inflows and the yen appreciate, JGB yields will not rise to a level that would bankrupt the BoJ, while they reduce their holdings.

The main casualties are the falling prices of foreign stocks and bonds that Japanese companies sell to repatriate capital. Given the sheer size of this carry trade, Japanese companies are the marginal price makers for stocks and bonds around the world . This is especially true for any “Pax Americana” listed securities, as their markets are the preferred destination for yen carry trade capital. Since the yen is a freely convertible currency, many traditional financial trading accounts reflect the situation of Japanese companies.

As the yen weakened, more and more global investors were encouraged to borrow in yen and buy U.S. stocks and bonds. As the yen appreciated, everyone rushed to close their positions at the same time because they were highly leveraged.

I showed you a chart earlier when the yen was weak. What happens when the yen strengthens a little bit?

Remember, it took USD/JPY 15 years to go from 90 to 160. In 4 trading days, it went from 160 to 142, with the following results:

If the USD/JPY (white line) appreciates 10%, the Nasdaq 100 (white line) falls 10%, while the Nikkei 225 (green line) falls 13%. This shows that the percentage of yen appreciation is roughly 1:1 with the decline of the stock index. If the USD/JPY reaches 100, which is a 38% appreciation, the Nasdaq will fall to about 12,600 and the Nikkei will fall to about 25,365.

USDJPY 100 is possible. A 1% reduction in the carry trade of Japanese companies corresponds to a notional amount of about $240 billion. That is a lot of capital on the margin. Different players in Japanese companies have different secondary priorities. We saw the problem with Norinchukin Bank, the fifth largest commercial bank in Japan. Some of their carry trades started to unravel and they had to start unwinding their positions. They are selling their foreign bond positions and covering their forward FX hedges in USDJPY.

Remember, everyone is unwinding the same trades at the same time. Neither we nor the elites who set global monetary policy know the full extent of the yen carry trade money lurking in the financial system. The opacity of this situation means that there will be a rapid overcorrection as markets reveal this highly leveraged part of the global financial system.

Odaily Minimalist Summary

Japans lifting of financial repression on the yen will lead to higher bond interest rates;

Due to high debt, the Bank of Japan needs to sell bonds to other Japanese entities if it does not want to print money to pay bond interest.

This will then further lead to other Japanese units selling foreign assets, especially U.S. stocks;

Historical rules show that the appreciation of the Japanese yen is highly correlated with the decline of US stocks, and the liquidation positions of the above-mentioned arbitrage transactions may be very large, which may lead to a rapid chain reaction.

Panic

Since the 2008 global financial crisis, I think China and Japan have saved American hegemony from a worse recession. China undertook one of the largest fiscal stimulus measures in human history, manifested through debt-driven infrastructure construction. China needed to buy goods and raw materials from the rest of the world to complete its projects. Japan, through the Bank of Japan, printed a lot of money to increase its carry trade. With these yen, Japanese companies bought American stocks and bonds.

The U.S. government has received a lot of capital gains tax revenue from the stock market boom. From January 2009 to early July 2024, the Nasdaq 100 Index rose 16 times and the SP 500 Index rose 6 times. Capital gains tax rates range from about 20% to 40%.

The U.S. government is running a deficit despite record capital gains tax revenues. To finance that deficit, the Treasury must issue debt. Japanese companies are among the largest marginal buyers of U.S. Treasuries, at least until the yen starts to appreciate. Japan helps keep the debt affordable for profligate U.S. politicians who need to win votes with tax cuts (Republicans) or various forms of welfare checks (Democrats).

Total U.S. debt outstanding (yellow) has been rising. However, the yield on the 10-year Treasury bond (white) has remained in a fairly tight range and has shown no correlation with the growing debt.

My point is that the structure of the U.S. economy requires that Japanese companies and those who copy them continue to engage in this carry trade. If this trade ends, the U.S. governments finances will be torn to shreds.

Rescue Operation

My assumption of a coordinated bailout of Japanese corporate carry trade positions is based on the belief that Harris will not allow her electoral chances to be diminished because some foreigners decide to exit certain trades, even though she does not understand what those trades are.

Her voters certainly don’t know what’s going on and don’t care. Either their stock portfolios are up or they aren’t. If not, they won’t go out and vote for the Democrats on Election Day. Voter turnout will determine whether Trump or Harris gets elected as the clown emperor.

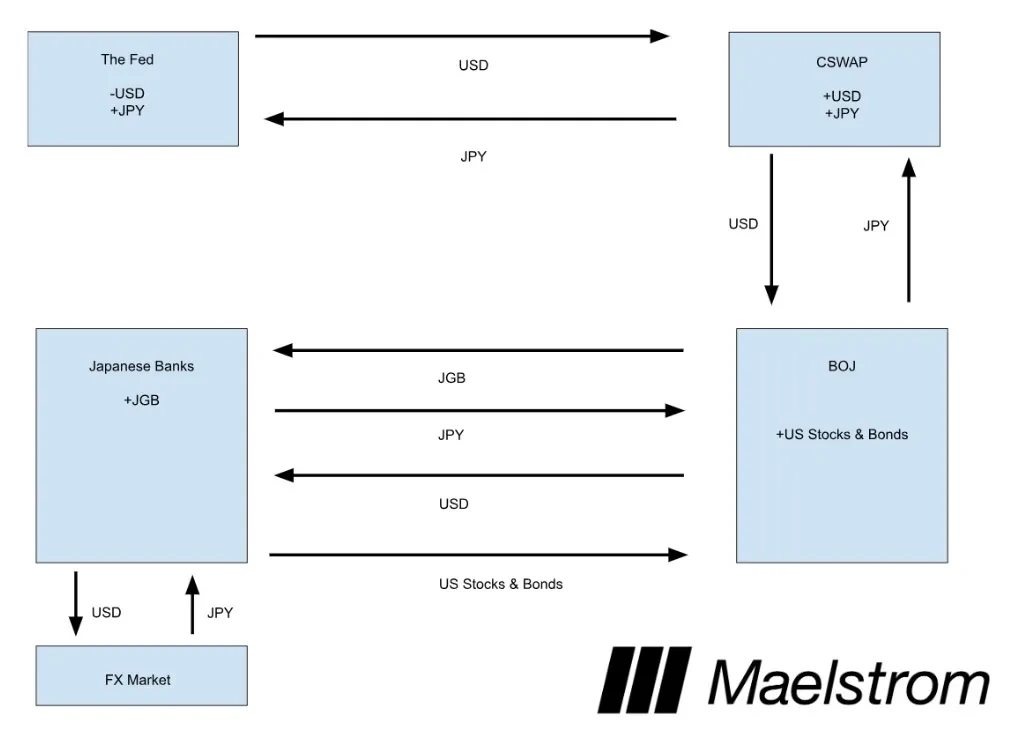

Japanese companies have to unwind their positions but cannot sell certain assets on the open market. This means that some government agency in the United States has to print money and lend it to some member of Japanese companies. Let me reintroduce myself, my name is Central Bank Swap Agreement (CSWAP).

Let me explain how I would conduct a bailout if I were Yellen.

On Sunday evening, August 11, I will make an announcement (assuming I am Yellen):

The U.S. Treasury, the Federal Reserve System, and our Japanese counterparts discussed in detail the market volatility of the past week. During this call, I reiterated our support for the use of the U.S. dollar-yen central bank swap facility.

Thats it. To the public, it seems totally harmless. Its not some kind of announcement that the Fed will cave in and cut rates and restart quantitative easing (QE). Because ordinary people know that doing so will cause inflation, which is already uncomfortably high, to accelerate again. If inflation is rampant on Election Day and it can be easily traced back to the Fed, Harris will lose.

Most American voters have no idea what CSWAP is, why it was created, or how it can be used to print unlimited amounts of money . However, the market will rightly view it as a hidden bailout because of the way the mechanism is used.

The Bank of Japan borrows billions of dollars and provides yen as collateral to the Fed. These swaps are rolled over as many times as the Bank of Japan needs.

The Bank of Japan has privately communicated with large companies and banks, telling them it is ready to pay dollars in exchange for U.S. stocks and U.S. Treasuries.

This transfers ownership of foreign assets from Japanese companies and banks to the BoJ. These private entities, flush with cash, repatriate capital to Japan by selling dollars and buying yen. They then buy JGBs from the BoJ at current high prices/low yields. The result is an inflated CSWAP outstanding, a dollar amount similar to the amount of money printed by the Fed.

I drew a diagram to illustrate the flow of money, but the net effect is what matters:

The Federal Reserve – they increase the supply of dollars, or in other words, take back the yen that was created by the growth of the carry trade.

ซีเอสวอป – The Fed has a dollar obligation to the Bank of Japan, and the Bank of Japan has a yen obligation to the Fed.

Bank of Japan – They now hold more US stocks and bonds, the prices of these assets will rise because the amount of USD rises due to the increase in CSWAP balances.

Bank of Japan – They now hold more Japanese Government Bonds (JGBs).

As you can see, this had no impact on the US stock or bond markets, and the overall carry trade exposure of Japanese companies remained the same. The yen appreciated against the dollar, and more importantly, US stock and bond prices rose due to the Fed printing money. As an added bonus, Japanese banks could issue unlimited yen loans using their newly acquired JGB collateral. This trade reinjected liquidity in both the US and Japan.

schedule

The carry trade for Japanese companies will eventually end, I am sure of that. The question is when the Fed and Treasury will start printing money to mitigate the effects on the US.

If U.S. stocks fall sharply on Friday, August 9 , leaving the SP 500 and Nasdaq 100 each 20% below their recent July all-time highs, some kind of action may be in the offing over the weekend.

If the yen starts to depreciate again, the crisis will end in the short term . The unwinding of the carry trade will continue, but at a slower pace. I think the market will see another sharp move between September and November as the USD/JPY exchange rate continues to move towards the target of 100. This time there will definitely be a response as the US presidential election will be approaching.

Interpretation of the impact on the crypto market

Two opposing forces influence my cryptocurrency positioning.

Positive force of liquidity:

After a quarter of net tightening, the US Treasury will inject USD liquidity as it issues Treasury bills and likely drains the Treasury account. This policy shift was made clear in the recent quarterly refunding announcements. In short, Harris and Yellen will inject between $301 billion and $1.05 trillion between now and the end of the year. I will explain this in a follow-up article if necessary.

Negative forces of liquidity:

This is the appreciation of the yen. The unwinding of the carry trade leads to a globally coordinated sell-off of financial assets, as yen debt becomes more expensive with each transaction that must be repaid.

Which force is stronger really depends on how quickly the carry trade unwinds. We cant know that in advance. The only observable effect is the correlation of Bitcoin to USDJPY. If Bitcoin exhibits convexity, meaning it rises whether USDJPY appreciates or depreciates, then I know the market expects a bailout if the yen is too strong and the liquidity provided by the US Treasury is sufficient.

If Bitcoin falls when the yen appreciates and rises when the yen depreciates, then Bitcoin will move in sync with traditional financial markets.

If the conclusion is convexity, I will aggressively add to my position when a local bottom is reached. If the setup is a stronger correlation, then I will sit on the sidelines and wait for the market to eventually collapse. If the Bank of Japan sticks to the plan laid out at the last meeting, the unwinding of the carry trade will continue.

That’s the most concrete advice I can offer at this point. As always, these trading days and months will define your returns in this bull market. If you must use leverage, use it wisely and constantly monitor your positions. When you hold a leveraged position, you better keep an eye on your Bitcoin or other cryptocurrencies. Otherwise, you will be liquidated.

This article is sourced from the internet: Arthur Hayes new article: How will the end of the yen carry trade affect the US stock and crypto markets?

Related: The bull market is already halfway through, does the Bitcoin ecosystem still have a chance?

Original author: Biteye core contributor Louis Wang Original translation: Biteye core contributor Crush The Bitcoin network, with its outstanding stability and security, has not only endowed BTC with lasting value, but has also accumulated impressive capital. With the approval of the BTC spot ETF, a massive influx of traditional funds has pushed its market value to over $1.3 trillion. However, the distinction between Bitcoin as a network and BTC as a digital asset is often overlooked. The key to realizing Bitcoin’s full potential is to leverage the network’s capabilities to transform Bitcoin from a mere store of value to the core infrastructure of the Bitcoin economy. In December 2022, the emergence of the Ordinals protocol brought an unexpected innovation to the Bitcoin ecosystem. The popularity of Inscription not only focused…