ความกังวลที่ซ่อนอยู่เบื้องหลังความเจริญรุ่งเรือง: โซลานาอาจจะเป็นบ้านไพ่ได้หรือไม่?

Original author: Flip Research

ต้นฉบับแปล: ลูฟี่, Foresight News

Lately, my Twitter feed has been flooded with Solana bullish talk, mostly with Memecoin alibis. I started to believe that Memecoin really was in a supercycle, and that Solana would replace Ethereum as the most important L1. But then I started digging into the data, and the results were worrying. In this post I’ll describe my findings, and why Solana might be a house of cards.

First let’s look at the current bull run, as @alphawifhat succinctly puts it below:

https://x.com/alphawifhat/status/1816136696758735266

In Q2, Solana:

-

The number of users is 50% of Ethereum + L2s;

-

Transaction fees are 27% of Ethereum + L2s;

-

DEX trading volume accounts for 36%;

-

Stablecoin transaction volume is 190% of Ethereum+L2s.

User Group Comparison

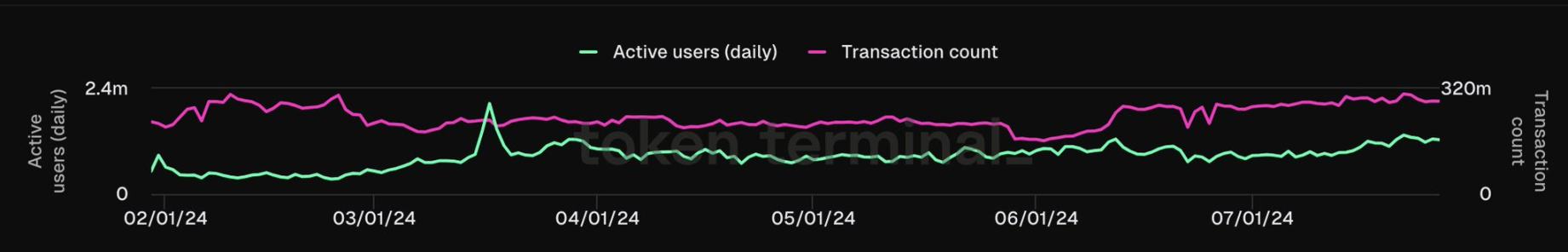

The following is a comparison of the user base of the Ethereum mainnet and the Solana network (only the mainnet is compared, because most of the fees after the Dencun upgrade come from the mainnet, source: @tokenterminal):

Ethereum active users and transactions

Solana Active Users and Transactions

On the surface, Solana’s numbers look good, with over 1.3 million daily active users (DAU) compared to 376,300 for Ethereum. However, when we look at the number of transactions together, we see something odd. For example, on July 26, Ethereum had 1.1 million transactions and 376,300 DAUs, with an average of about 2.92 transactions per user. Solana had 282.2 million transactions on the same day, with 1.3 million DAUs, and an average of 217 transactions per user. I think this may be due to Solana’s low fees, more and more frequent transactions, and increased arbitrage bot activity. So I compared it to another popular cheap chain, Arbitrum. However, Arbitrum only had an average of 4.46 transactions per user on the same day. Similar results can be obtained if you look at the data for other chains:

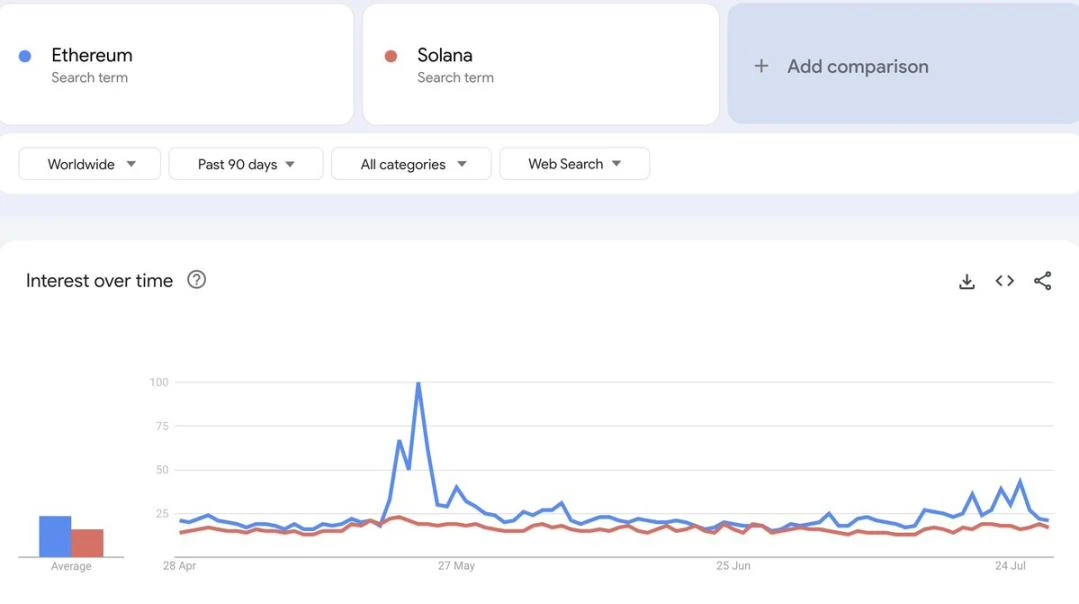

Given that Solana has more users than Ethereum, I compared the Google Trends data for the two:

The result is that Ethereum is either on par with Solana or ahead of Solana. Considering the DAU difference, coupled with the hype around the Solana Memecoin, this result is far beyond my expectation. So what happened?

DEX Trading Volume Analysis

To understand the difference in transaction numbers, it helps to look at Raydium’s liquidity pool data. Even at a glance, you can see some obvious problems:

At first I thought it was just fake trades with low liquidity used to attract memecoin degen, but looking at the chart its much worse:

Behind every low liquidity pool is a project that has rugged in the past 24 hours. Take MBGA as an example. In the past 24 hours, 46,000 transactions occurred on Raydium, with a transaction volume of $10.8 million, 2,845 unique wallets buying and selling, and more than $28,000 in transaction fees. (Note that a reasonable liquidity pool of similar size, such as MEW, only generated 11.2K transactions)

Judging from the participating wallets, the vast majority appear to be bots in the same network, contributing tens of thousands of transactions. These bots independently generate fake volume, with random amounts of SOL and transactions until a project ends, and then they move on to the next project. In the past 24 hours, more than 50 liquidity pools with more than $2.5 million in volume on Raydium have run away (rug), generating a total of more than $200 million in volume and $500,000 in fees. There seem to be far fewer rug pools on Orca and Meteora, and there are few similar rugs on Uniswap on Ethereum.

Solana’s rug problem is already quite serious, and its impact is reflected in many aspects:

-

Given the unusually high tx/user ratio, and the number of fake/scam transactions on-chain, it can be concluded that the vast majority of transactions on Solana are inorganic. The highest daily tx/user ratio on Ethereum L2 is on Blast (15), which also has low fees and users farming the Season 2 airdrop. As a rough comparison, if we assume that the real Solana tx/user ratio is similar to Blast, that means that over 93% of transactions (and fees) on Solana are inorganic.

-

The only reason these scams exist is to make money, so users are losing money at least equal to the fees + transaction costs incurred, which can amount to millions of dollars per day.

-

Once deploying these scams becomes unprofitable (when actual users get tired of losing money), it is foreseeable that both transaction counts and fee revenue on Solana will decline.

-

Therefore, actual users, organic fee income, and DEX trading volume on Solana are greatly exaggerated.

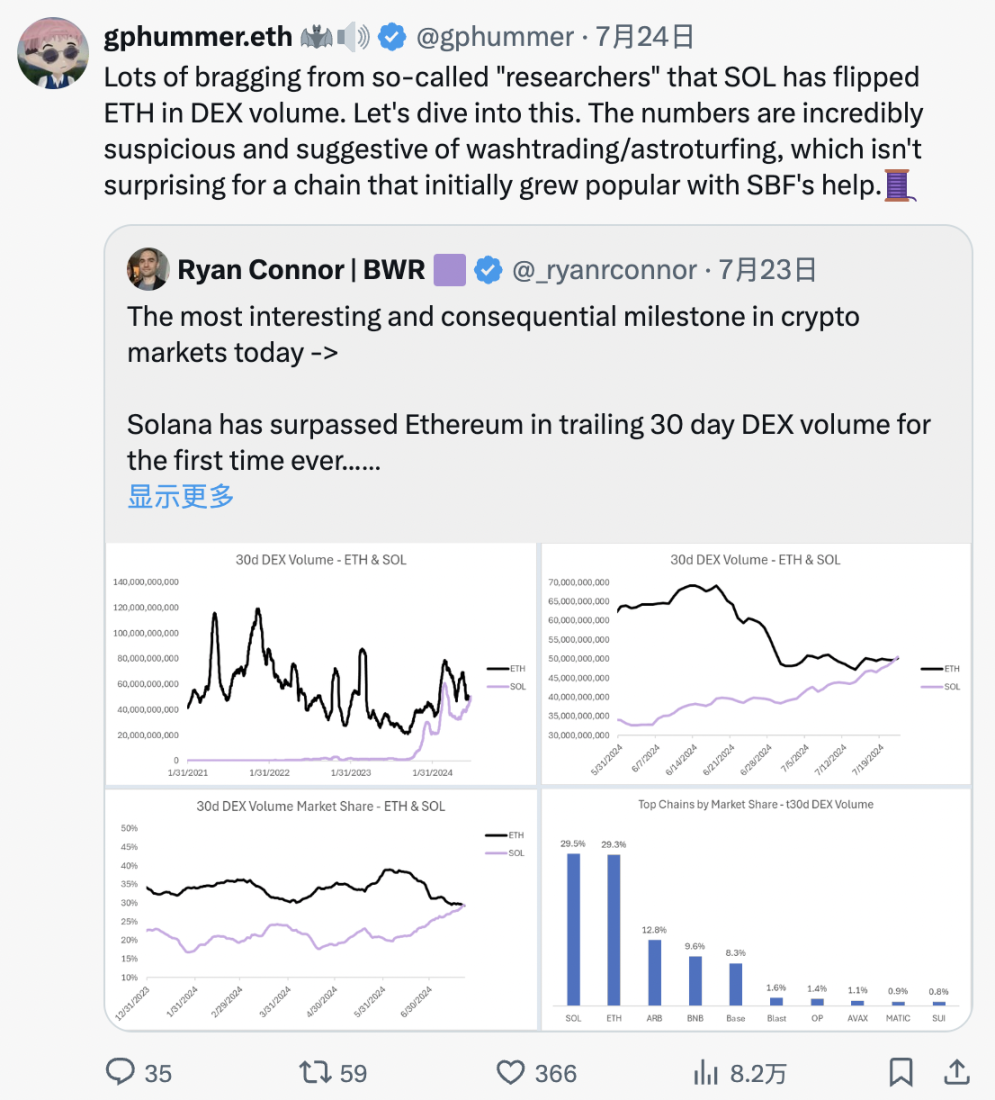

I’m not the only one to come to these conclusions, @gphummer recently posted something similar:

https://x.com/gphummer/status/1816122702564131095

MEV on Solana

MEV on Solana is in a unique situation. Unlike Ethereum, it does not have a built-in mempool; instead, projects like Jito created (now deprecated) extra-protocol infrastructure to simulate mempool functionality, making MEV transactions like front-running, sandwich attacks, etc. possible. Helius Labs put together an in-depth article detailing MEV.

The problem with Solana is that the vast majority of tokens traded are Memecoins, which are extremely volatile and have low liquidity, and traders often set trade slippage to >10% to ensure successful execution of trades. This provides an opportunity for MEV to flourish:

If we look at blockspace profitability, it’s clear that most of the value is now coming from MEV extraction:

While this is technically “real” value, MEV will only be implemented as long as it is profitable, which is as long as retail investors continue to chase Memecoin. Once Memecoin starts to cool, MEV fee income will decline accordingly.

I see a lot of discussion about how Solana’s buzz will eventually switch to infrastructure like JUP, JTO, etc. It is very likely that this will happen, but it is important to note that these tokens have lower volatility and higher liquidity and will not offer the same MEV opportunities as Memecoin.

Experienced players are working hard to build the best infrastructure to take advantage of this opportunity. As I dug deeper, I heard some news that these players are investing in and trying to control the mempool space and then sell access to third parties. I cannot confirm this information. However, there are some obvious perverse motivations: by directing as much Memecoin activity as possible to Solana, savvy individuals will continue to profit from MEV, insider trading, and SOL price appreciation.

Stablecoins

Speaking of stablecoin trading volume and TVL, there is another strange phenomenon on Solana. The stablecoin trading volume on Solana is significantly higher than Ethereum, but data from DefiLlama shows that Ethereum has $80 billion in stablecoin TVL, while Solana only has $3.2 billion.

I believe that stablecoin TVL is a more difficult metric to manipulate than trading volume and fee income on low-fee platforms. Stablecoin volume dynamics confirm this: @WazzCrypto noticed a sudden drop in stablecoin trading volume on Solana after the CFTC announced its investigation into Jump:

https://x.com/WazzCrypto/status/1817560196073292033

Retail investors suffered losses

Apart from rug and MEV, the outlook for retail trading remains bleak. Celebrities chose Solana as their preferred chain for issuing Memecoin, but the results were not optimistic:

Andrew Tate’s DADDY is the best performing celebrity token, but it has a return of -73%.

A quick search on Twitter also reveals evidence of rampant insider trading and developers dumping tokens on retail investors:

You might be asking, “My feed is full of people making millions of dollars trading memes on Solana. What does that have to do with what you’re saying?”

I simply don’t believe that KOLs’ Twitter posts are representative of the broader user base. It’s easy for them to take advantage of the current frenzy, promote their tokens, profit from their followers, and repeat the process. There is definitely a survivor bias here: the voices of the winners are far louder than the losers, creating a distorted view of reality. Objectively speaking, retail investors seem to be losing millions of dollars every day, including scammers, developers, insiders, MEV, KOLs, and this is not considering that most of what they trade on Solana is just Memecoin with no real value backing it. It’s hard to deny that most Memecoins will eventually go to zero.

ข้อควรพิจารณาอื่น ๆ

Markets change rapidly, and when sentiment changes, factors that were once blind to traders become clear:

-

Poor network stability and frequent interruptions

-

High transaction failure rate

-

Unable to read browser

-

The development threshold is high, and Rust is far less user-friendly than Solidity

-

Poor interoperability compared to the EVM. I believe that having multiple interoperable blockchains competing for our attention is much healthier than being tied to a single chain.

-

The likelihood of an ETF passing is low from both a regulatory perspective and a demand perspective. This post explains why institutional demand will be low in Solana’s current state.

-

Issuance volume is up to 67,000 SOL/day ($12.4 million)

-

There are still 41 million SOL ($7.6 billion) locked in FTX’s assets. 7.5 million ($1.4 billion) of these will be unlocked in March 2025, and an additional 609,000 ($113 million) will be unlocked each month until 2028. These SOL tokens can be purchased for approximately $64 each.

สรุปแล้ว

As always, shovel sellers will profit from the Solana Memecoin craze, while speculators are being ripped off, often without their knowledge. I believe that the usual Solana metrics are grossly overstated. Additionally, the vast majority of organic users are losing money to bad actors at a rapid clip. Fortunately, we are currently in the mania phase, and retail inflows are still outpacing these old players’ outflows; once users become exhausted by continued losses, many metrics will quickly collapse. As mentioned above, Solana also faces some fundamental headwinds that will become prominent once market sentiment shifts. Any price increase will increase inflation and unlocking pressure. Ultimately, I believe that SOL is overvalued from a fundamental perspective, and while existing sentiment and momentum may continue to drive SOL prices higher in the short term, the long-term outlook is more uncertain.

Disclaimer: The author has held SOL at various times in the past, but does not currently hold a substantial position in SOL. Many of the points made above are speculations by the author and are not facts. The authors assumptions and conclusions may be wrong, so please always exercise caution.

This article is sourced from the internet: The hidden worries behind the prosperity: Could Solana be a house of cards?

Related: FHE vs ZK vs MPC: What are the differences between the three encryption technologies?

Original author: 0x Todd Last time we analyzed how Fully Homomorphic Encryption (FHE) technology works. However, many people still confuse FHE with ZK and MPC encryption technologies, so the second thread plans to compare these three technologies in detail: FHE vs ZK vs MPC First, let’s start with the most basic questions: – What are these three technologies? – How do they work? – How do they work for blockchain applications? 1. Zero-knowledge proof (ZK): Emphasis on proof without disclosure The proposition explored by zero-knowledge proof (ZK) technology is: how to verify the authenticity of information without revealing any specific content. ZK is built on a solid foundation in cryptography. Through zero-knowledge proof, Alice can prove to the other party, Bob, that she knows a secret without revealing any information…