ขายซอฟต์แวร์เทรด V3 แล้วโดนแฮ็ก dYdX กำลังทำอะไรอยู่

ผู้แต่งต้นฉบับ: Grapefruit, ChainCatcher

ผู้เรียบเรียงต้นฉบับ: Marco, ChainCatcher

According to ChainCatcher on July 24, dYdX, the leading decentralized derivatives trading platform, was revealed to be planning to sell the dYdX V3 trading software.

However, within less than an hour after the news broke, the dYdX V3 website (dydx.exchange) was attacked by hackers. The hackers first took over the website and then implanted links pretending to be phishing websites. Once users authorized their information, they might face the possibility of having their assets or information stolen.

As soon as the planned sale of V3 was revealed, its domain name was hacked, and the community speculated whether this was pure coincidence or a premeditated action.

The sale and security crisis of dYdX triggered a series of chain reactions, with users and investors showing obvious concerns. The price of DYDX token fell rapidly in response to the news, from $1.45 to a low of $1.23, a daily drop of more than 15%. At press time, the price of the currency fluctuated at $1.27.

Why sell V3? Is the dYdX team going to cash out? Why did the hacker choose this time to attack? Can DYDX tokens still be held? A series of questions filled the community chat page.

Intends to sell dYdX V3, not related to dYdX Chain

Bloomberg reported that dYdX is in talks with potential buyers to sell part of its derivatives trading software (dYdX V3). It is reported that Wintermute Trading and Selini Capital are among the potential buyers of dYdX V3 software, and the specific amount has not been disclosed.

As the leading derivatives company in the DeFi field, the rumor that dYdX is selling V3 has attracted widespread attention from the crypto community. Most community users are more concerned about whether the V3 being sold is just the trading software or the entire dYdX brand being sold as a package. Is the dYdX team going to withdraw completely? You should know that the V4 version of dYdX Chain launched last year was managed by the DAO community? What impact will this incident have on the overall ecosystem of dYdX? What impact will it have on the price of DYDX?

In response to the news about the sale of V3, dYdX officials responded on social media that dYdX Trading is exploring strategy alternatives related to V3 technology, which does not include Ethereum smart contracts or other technologies managed by DYDX tokens, and this process has nothing to do with dYdX Chain. dYdX Chain is the focus of future development.

It added that the dYdX V3 exchange is a trading engine supported by the operating entity dYdX Trading. All funding and settlement on V3 occurs on smart contracts governed by DYDX token holders, and V3’s trading fees also belong to dYdX Trading.

With the launch of dYdX Chain in V4, all transactions of dYdX will eventually be migrated to this chain, and all transaction fees paid on this chain will belong to validators and DYDX stakers.

He also emphasized that the dYdX Chain code is open source and fully decentralized, which is more in line with the development concept of DeFi products. In the future, the focus will be on building products around dYdX Chain.

Regarding the official statement made by dYdX, community user Bobo summarized to ChainCatcher that it seems that the rumor about dYdX selling V3 is true, but what is sold is only the V3 trading software, which has little impact on dYdX Chain. In addition, dYdX’s main business focus is now dYdX Chain, and the price of DYDX is also directly related to the transaction fee income of dYdX Chain.

User @atg 1688 also said that dYdX only sells the V3 trading software, which is owned by the organization dYdX Trading, while dYdX Chain is run by the dYdX Foundation, so the impact is not significant.

The long-awaited V3 domain vulnerability was finally hacked

However, less than an hour after dYdX V3 was revealed to be under sale, the V3 domain name was discovered to have been hacked.

On July 24, dYdX officially issued a reminder that the dYdX v3 website domain name (dYdX.exchange) has been hacked. Please do not visit the website or click any links. However, dYdX v4 was not affected.

Hackers successfully exploited the vulnerability and tampered with the DNS record of the domain name, causing users to be redirected to malicious websites when accessing dYdX V3. Users encountered phishing attacks when accessing the malicious website, and the private keys and assets of some users are likely to be stolen.

Fortunately, in this hacker attack, only the network domain name became the target of the attack, and the underlying smart contract was not attacked. The user funds on the dYdX platform were not affected. The dYdX V3 domain name vulnerability has now been fixed and the website has resumed normal operation. dYdX stated that the dYdX Chain, dydx.trade website and V3 protocol were not attacked.

However, community users are not satisfied with the dYdX vulnerability handling.

Because as early as July 11, some users had already reminded that the dYdX domain name had the same vulnerability as protocols such as Compound and Celer. However, after the official dYdX reply that no vulnerabilities or security issues had been found, there was no follow-up, and no relevant countermeasures were deployed in advance.

Therefore, some users viewed this hacker attack as a warning against dYdX’s negligence.

However, the timing of the hacker’s attack on the dYdX V3 domain name coincided perfectly with the time when the news of the V3 sale was revealed, which made community users wonder whether it was a long-planned attack.

Some users said that when dYdX V3 was damaged by hackers during negotiations for the sale of the software, dYdX had to deal with a security crisis and handle a potential business transaction at the same time, which was simply killing two birds with one stone.

Is dYdX selling V3 to “cash out” or for the development of the ecosystem?

Compared with this security attack, users are even more confused about dYdXs plan to sell V3. According to dYdXs original plan, after the V4 version of dYdX Chain was launched last year, all transactions would be fully transitioned to V4, and V3 would be gradually abandoned. However, dYdX is now trying to sell V3.

In the DeFi space, buying and selling of entire projects is rare because most projects use open-source software, which means others can use, modify, and rebuild them without having to buy them.

A DeFi OG player lamented to ChainCatcher that after being in the DeFi industry for so long, he has seen platforms shut down, sell coins and dump stocks, and run away. dYdX is the first to directly sell the trading platform.

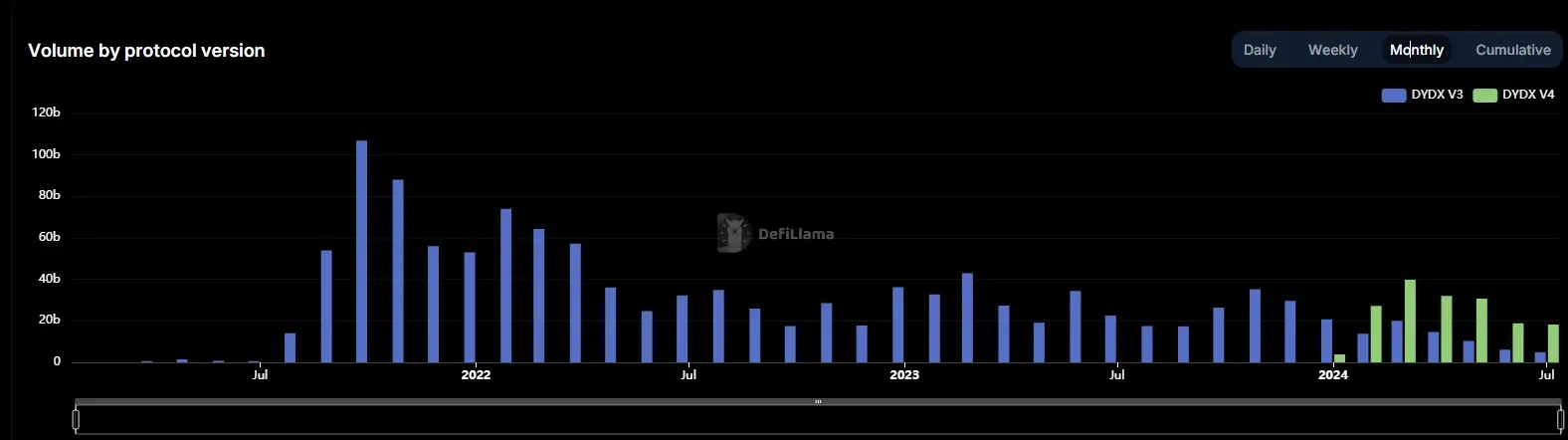

Although dYdX V3 is an old version of the product, the platforms trading data performance is still impressive. According to DeFiLlama statistics, the V3 platform is expected to generate approximately $18.67 million in revenue this year.

VanEck estimated in a report last March that the V3 platform generated $137 million in fees in 2022.

DeFiance Capital also publicly stated last year that although the dYdX V3 product has basically no new trading pairs and functions launched in more than a year, its market share is still over 50%.

According to DeFiLlama data, the average weekly derivatives trading volume on dYdX V3 is still $1.5 billion, and the weekly trading volume on V4 dYdX Chain is approximately $5 billion.

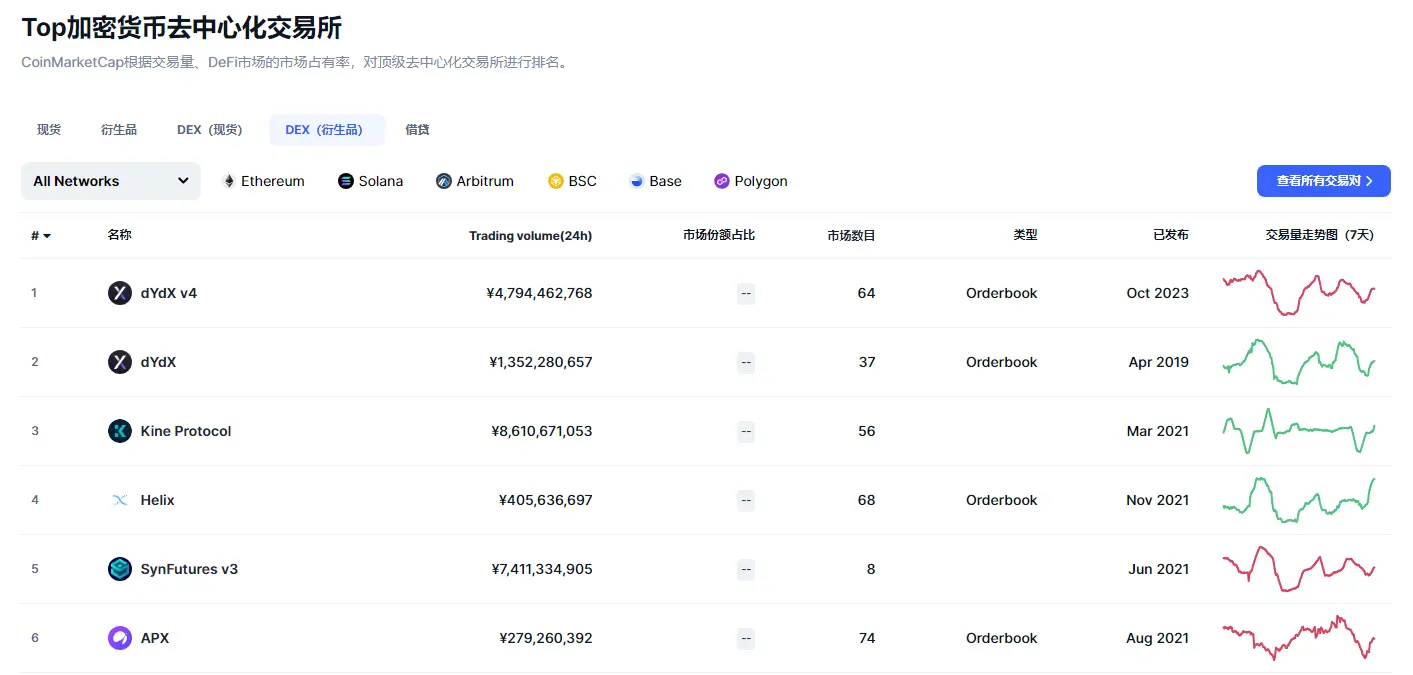

CoinMarketCap data shows that in the current decentralized derivatives sector, dYdX V3s trading volume still ranks in the top two.

According to an analysis by crypto risk firm Gauntlet, the V3 platform remains attractive to traders because some tokens on the platform have higher liquidity and traders face less slippage on large trades.

User Bobo also mentioned to ChainCatcher that he still uses V3 the most and rarely uses V4 because the asset trading volume and liquidity of this version seem to be very low.

From this point of view, dYdX V3 is still a continuous cash cow. It is reported that the business transaction of V3 sale will reach hundreds of millions of dollars.

Since its launch on the Ethereum network in 2017, the business has grown rapidly under the liquidity mining incentive policy during the DeFi Summer period. The dYdX product has also undergone countless major changes. The product has been upgraded from the initial V1 to todays V 5 version. After escaping Ethereum, it launched dYdXChain and became the king of the mountain.

However, the business development of dYdX is quite different from the price trend of DYDX. The price of DYDX has plummeted from its high of US$27 in 2021, and its lowest point has fallen to around US$1.005 many times. It now fluctuates around US$1.25, and the price of the coin has shrunk by 95% compared to the high point.

Although after the launch of V4 dYdX Chain, all on-chain transaction fee income belongs to DYDX token staking users, etc., providing more empowerment, it has no impact on the coin price.

There are two main views on dYdXs sale of V3. One is the negative view that the project party wants to cash out, and the other is the positive view that the funds obtained from the sale will be beneficial to the overall development of dYdX.

Bobo said that it would undoubtedly be a good thing if dYdX invested its sale funds into the dYdX ecosystem.

He explained that as a fast-growing DeFi company, dYdX needs a lot of funds to support its technology research and development and market expansion. The sale of the V3 platform can raise a lot of funds for it, helping it to concentrate its energy and resources and improve its overall competitiveness.

In the long run, the sale of the V3 platform may also have a positive impact on the value of the DYDX token. By obtaining a large amount of funds, dYdX can further improve its technology and services, enhance its market competitiveness, and thus enhance the long-term value of the DYDX token.

He also reminded that for the sale of dYdX V3, the official has not said whether the funds obtained after the sale will be pocketed by the team itself or used for other purposes.

This article is sourced from the internet: Selling V3 trading software and being hacked, what is dYdX doing?

ที่เกี่ยวข้อง: คอลัมน์ความผันผวน SignalPlus (15/07/2024): เมื่อเสียงปืนดังขึ้น

เวลา 18.00 น. ของวันที่ 13 กรกฎาคม ตามเวลาท้องถิ่นในสหรัฐอเมริกา ทรัมป์ได้กล่าวสุนทรพจน์หาเสียงเลือกตั้งประธานาธิบดีรอบใหม่ที่เมืองบัตโลบ รัฐเพนซิลเวเนีย เวลา 18.11 น. มือปืนได้ยิงปืนใส่เขาหลายนัดจากตำแหน่งสูงนอกสถานที่จัดงาน ทำให้หูขวาของทรัมป์ได้รับบาดเจ็บ และยังได้ส่งเสียงสนับสนุนทรัมป์จากประชาชนชาวอเมริกัน ทำให้อัตราชัยชนะในการเลือกตั้งของเขาพุ่งสูงขึ้นถึงมากกว่า 70% เมื่อพิจารณาจากการใช้และการสนับสนุนสกุลเงินดิจิทัลของเขา (อย่างน้อยก็ในช่วงหาเสียงครั้งนี้) การลอบสังหารครั้งนี้ยังสนับสนุนทางอ้อมให้ราคา BTC พุ่งสูงขึ้นอย่างต่อเนื่องและระดับความผันผวนโดยรวมพุ่งสูงขึ้นอย่างรวดเร็วจากจุดต่ำสุดของสุดสัปดาห์อีกด้วย ที่มา: TradingView; SignalPlus แต่ถึงกระนั้น เครดิตสำหรับการฟื้นตัวของ Bitcoin ก็ไม่ใช่ของเขาทั้งหมด ตามข้อมูลที่ Farside Investors จัดทำขึ้น กองทุนแบบดั้งเดิมได้รับการฉีดกลับเข้าไปใน...