Bitget Research Institute: ETH ETF อาจได้รับการอนุมัติในวันที่ 23 กรกฎาคม ระบบนิเวศ Ethereum ฟื้นตัวอย่างมีนัยสำคัญ

ในช่วง 24 ชั่วโมงที่ผ่านมา สกุลเงินและหัวข้อยอดนิยมใหม่ๆ มากมายปรากฏขึ้นในตลาด ซึ่งอาจเป็นโอกาสต่อไปในการสร้างรายได้ รวมทั้ง:

-

The sectors with relatively strong wealth-creating effects are: Meme sector, AI sector, and ETH ecological projects

-

Hot searched tokens and topics by users: UXLINK, ETH, JD Vance

-

Potential airdrop opportunities include: Sonic, Solayer

Data statistics time: July 16, 2024 4: 00 (UTC + 0)

1. สภาพแวดล้อมของตลาด

In the past 24 hours, BTC has been on a unilateral rise, with the price of BTC rising continuously from $62,000 to the current level of $64,500. BTC spot ETF has had net inflows for the seventh consecutive trading day, with a net inflow of $300 million yesterday, becoming the main driving force for BTCs rise. Balchunas, a well-known ETF analyst at Bloomberg, said on social media that the SEC requires ETF issuers to submit the final version of the S-1 document before Wednesday this week, which means that the SEC will announce the approval results next Monday, and the relevant ETF may be launched next Tuesday.

On the news level, BlackRock CEO Larry Fink said on CNBC that I was wrong about Bitcoin five years ago, and reiterated that Bitcoin is digital gold and a legitimate financial instrument. Dell CEO forwarded the interview video of BlackRock CEO and said that BTC is fascinating. Trump appointed crypto-friendly JD Vance as his vice presidential candidate. The most influential KOLs in technology, finance, and politics stand for BTC, and market sentiment has turned optimistic.

2. Wealth-creating sector

1) Sector changes: Meme sector (PEPE, WIF, FLOKI)

เหตุผลหลัก:

-

Blue-chip tokens such as ETH and SOL began to rebound;

-

The market is paying more attention to the Meme coin sector, and there are good gaming opportunities in the technical indicators of the Meme sector;

Rising situation: PEPE, WIF, and FLOKI rose by 26.4%, 23.2%, and 23.1% respectively within 24 hours;

ปัจจัยที่ส่งผลต่อแนวโน้มตลาด:

-

Price token trend: For PEPE, the trend of ETH tokens will affect the price of PEPE, because BONK on DEX is denominated in SOL. Continue to pay attention to the price trend of ETH and SOL. If ETH and SOL maintain an upward trend, you can continue to hold Meme assets in the relevant ecosystem.

-

Increase or decrease in open interest: The contract data on the tv.coinglass website can be used to understand the movement of major funds. In the past 24 hours, the open interest of PEPE has surged by 30%, mainly due to the increase in net long positions. The account long-short ratio has fallen below 1, indicating that major funds have opened long positions in PEPE through contracts. In the future, we can continue to pay attention to changes in contract data.

2) Sector changes: AI sector (ARKM, TAO, NEAR)

เหตุผลหลัก:

-

As the overall crypto market rebounded, the AI sector took the lead in rebounding, mainstream AI tokens all rose steadily, and sector funds were active.

-

Dell is an active stock in the AI sector of the US stock market this round. The CEO pays attention to and retweets related to cryptocurrency, which makes the market continue to pay attention to the AI crypto asset sector.

Rising situation: ARKM, TAO, and NEAR rose by 10.5%, 5.5%, and 8.6% respectively within 24 hours;

ปัจจัยที่ส่งผลต่อแนวโน้มตลาด:

-

Large financing information in the primary market: ETHCC was held in Brussels as scheduled, and participating institutions paid attention to the primary trends of the AI sector. Sentient, an AI Model-related research project, completed a financing of US$85 million, and the market once again paid attention to the effective combination of AI ecology and blockchain.

-

Actions of traditional technology companies: OPENAI鈥檚 launch of new products often drives the rise of the AI sector. Currently, this track is still in its early stages and requires stimulus from news to continuously raise valuations in the secondary market.

3) Sectors that need to be focused on in the future: ETH ecosystem projects (UNI, LDO, PEPE)

The main reason is that the S-1 document of the ETH spot ETF may be officially launched in the US capital market on July 23, and ETH ecological assets may have room for speculation. Recently, the track has experienced a large correction and has fallen out of layout space;

รายการสกุลเงินเฉพาะ:

-

UNI: The first DeFi Swap project on blockchain applications. Uniswap鈥檚 average daily revenue in the past was around $1 million, which is a considerable income.

-

LDO: The leading LSD project in the ETH ecosystem, with a TVL of 29.6 billion US dollars and a valuation of less than 1.8 billion US dollars, is relatively undervalued;

-

PEPE: Currently, it is the most hyped meme coin in the ETH ecosystem. It has a very strong community foundation and is likely to continue to rise along with the ETH price.

3. การค้นหายอดนิยมของผู้ใช้

1) DApps ยอดนิยม

UXLINK:

Web3 social platform and infrastructure UXLINK announced that it will be listed on 8 exchanges including Bitget, OKX, Bybit, Gate, KuCoin, etc. at 4 pm Singapore time on July 18. According to information disclosed by UXLINK officials, the project currently has more than 15 million registered users, covering 110,000 Telegram groups, and 8 million users on the chain. The project has made a profit and will continue to invest profits in the community and ecosystem.

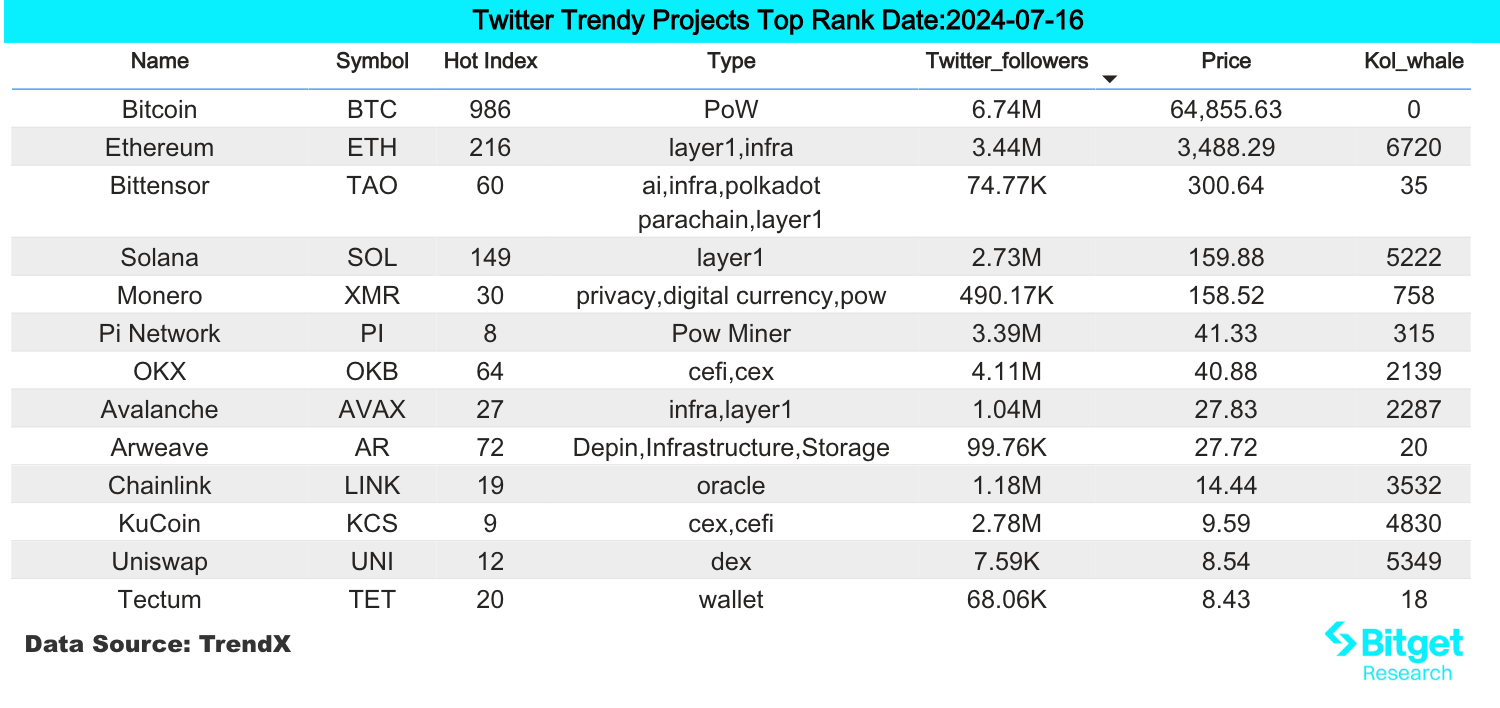

2) ทวิตเตอร์

ETH:

Three sources said that the US SEC has given preliminary approval to at least three of the eight asset management companies to launch ETH ETF transactions. Final approval depends on whether the applicant can submit final issuance documents to the regulator before the end of this week. Affected by the good news, ETH and ETH ecological tokens have risen significantly.

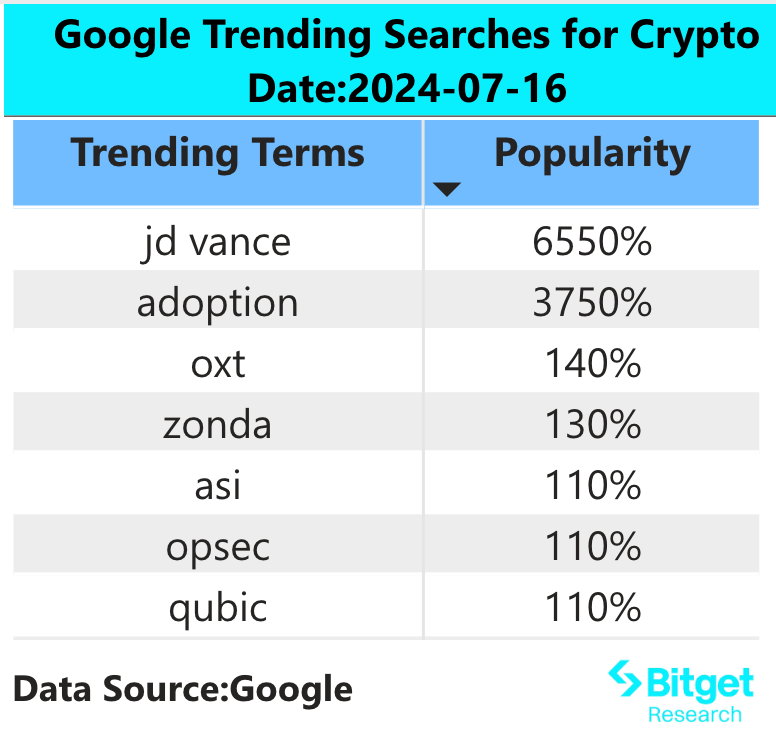

3) ภูมิภาคการค้นหาของ Google

จากมุมมองระดับโลก:

JD Vance:

According to a recently exposed video, JD Vance, the Republican vice presidential candidate, once fiercely criticized the crypto regulatory policy of Gary Gensler, chairman of the U.S. Securities and Exchange Commission, and said that his approach to regulating the cryptocurrency market is completely contrary to ideal policy. The market expects that if JD Vance is elected, it will be conducive to the introduction of crypto-friendly policies.

จากคำค้นหาที่มาแรงในแต่ละภูมิภาค:

(1) There was no obvious commonality in the hot searches in various regions of Asia yesterday. It is worth noting that the Philippines began to pay special attention to Tesla, Nvidia and other top market capitalization stocks in the US stock market.

(2) JD Vance appeared on the hot searches in many countries in Europe and the United States. JD Vance is the vice presidential candidate of the Republican Party in the United States. Some media have revealed that he holds BTC, and he has criticized the crypto regulatory policies of Gary Gensler, Chairman of the US SEC.

ศักยภาพ แอร์ดรอป โอกาส

Sonic (zero-cost interactive testnet)

Sonic is a game chain based on Solana, which proposes the first expansion architecture HyperGrid, which can help game developers efficiently process and manage game status, logic and events. Sonic is 100% compatible with all EVM smart contracts and has a native game engine, providing game developers with comprehensive On-Chain game development components.

On June 18, 2024, Sonic completed a $12 million Series A financing round with a valuation of $100 million. Bitkraft led the investment, with participation from Galaxy Interactive, Big Brain Holdings and others.

How to participate: (1) Open the developer mode in the Backpack wallet preferences and add the Sonic Devnet test network; (2) Go to https://faucet.sonic.game/ to claim SOL test coins; (3) Enter the Sonic Odyssey mission page and follow the prompts to complete the social media account binding, daily check-in, game trial and other interactive steps.

โซลาเยอร์

Solayer กำลังสร้างเครือข่ายการยึดครองใหม่บน Solana โดย Solayer ใช้ประโยชน์จากความปลอดภัยทางเศรษฐกิจและการดำเนินการที่มีคุณภาพในฐานะโครงสร้างพื้นฐานคลาวด์แบบกระจายอำนาจเพื่อให้เกิดฉันทามติในระดับที่สูงขึ้นและการปรับแต่งพื้นที่บล็อกสำหรับนักพัฒนาแอปพลิเคชัน

In July 2024, Solayer announced the completion of the Builder Round of financing, and the specific investment amount was not disclosed. Investors include Solana Labs co-founder Anatoly Yakovenko, Solend founder Rooter, Tensor co-founder Richard Wu, etc.

Specific participation method: You can stake SOL and SOL LST (jitoSOL, mSOL, bSOL, INF) supported by some projects to obtain points for each episode. At the same time, please note: If the pledged assets are cancelled before expiration, the reward will be reduced.

ลิงค์ต้นฉบับ: https://www.bitget.com/zh-CN/research/articles/12560603812802

銆怐isclaimer銆慣ตลาดมีความเสี่ยง ดังนั้นควรระมัดระวังในการลงทุน บทความนี้ไม่ถือเป็นคำแนะนำในการลงทุน และผู้ใช้ควรพิจารณาว่าความคิดเห็น ความเห็น หรือข้อสรุปในบทความนี้เหมาะสมกับสถานการณ์เฉพาะของตนหรือไม่ การลงทุนตามข้อมูลนี้เป็นความเสี่ยงของคุณเอง

This article is sourced from the internet: Bitget Research Institute: ETH ETF may be approved on July 23, Ethereum ecosystem rebounds significantly

Related: A look at seven emerging trends in the crypto market

Original author: Ignas, DeFi researcher Original translation: Shan Ouba, Golden Finance I feel like something big is about to happen in the cryptocurrency market, and I am very bullish. While I am not sure exactly what it will happen, the market is going through significant changes. Interest rates began to fall, ETH ETF was approved, BTC ETF capital inflows increased, Stripe launched stablecoin payments… Like armies positioning themselves before a decisive battle, major crypto companies and traditional financial institutions are preparing for the coming bull run. More on this “feeling” below: Meanwhile, the crypto machine hasn’t stopped turning. Yes, prices are falling… but markets are always changing, and new narratives and trends are emerging and influencing markets as they grow in influence. Just like MakerDAO was launched before the term…