การตีความอดีตและปัจจุบันของ RWA จากมุมมองของ EIP

คำนำ

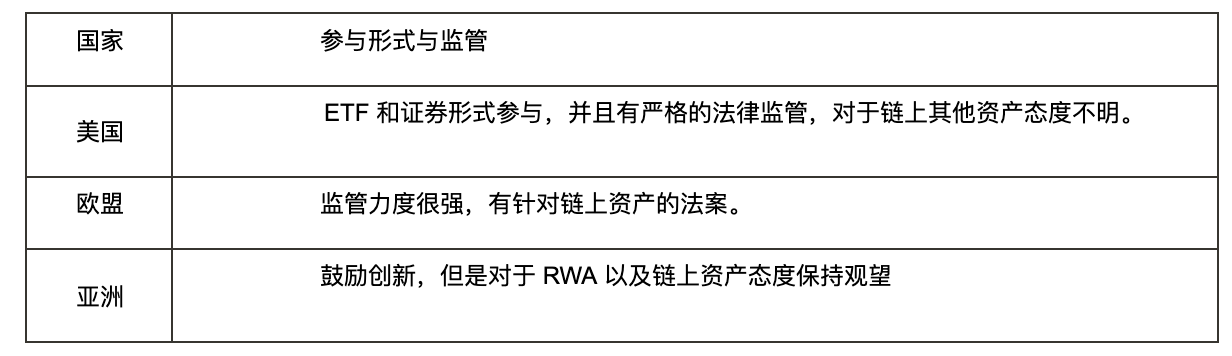

With the continuous evolution of the global financial market, especially with the approval of Bitcoin and Ethereum ETFs in the United States, real world assets (RWA) are increasingly becoming an important and indispensable part of the digital economy.

RWA refers to assets with actual physical existence or legal effect, such as real estate, precious metals, stocks, bonds and other financial instruments. These assets can be digitized and tokenized through the application of blockchain technology, bringing unprecedented opportunities and challenges.

In this context, the practical significance of RWA cannot be ignored. It not only injects new vitality into the traditional financial market, but also finds a broader application space for blockchain technology. With the continuous advancement of technology and the continuous maturity of the market, RWA is expected to become an important driving force for the future financial market and promote the further integration and development of the global economy.

Let me first introduce what the EIP protocol and ERC standard are. EIP (Ethereum Improvement Proposal) and ERC (Ethereum Request for Comment) are the two main mechanisms used to improve and standardize different parts of the Ethereum ecosystem.

EIP (Ethereum Improvement Proposal) is the abbreviation of Ethereum Improvement Proposal, which is a technical specification and standard proposed for the Ethereum network. The purpose of EIP is to improve the Ethereum protocol, core protocol specifications, APIs, and smart contract standards. The EIP process includes proposal, discussion, review, and improvement.

ERC (Ethereum Request for Comment) is the abbreviation of Ethereum Request for Comment, which is a standard proposal for the Ethereum application layer. ERC proposals usually involve application layer protocols and smart contract standards, especially token standards.

Early days – EIP 884

As early as in the Delaware Senate Bill No. 69, 149th Assembly, Compatible Tokens: An Act to Amend Title 8 of the Delaware Code Relating to General Corporation Law, it aims to combine assets on the blockchain with real-world assets.

EIP-884 provides a framework for issuing and managing shares of Delaware corporations in a compliant manner. It leverages the widely used ERC-20 token standard, which allows shares to be represented as tokens on the Ethereum blockchain. The standard ensures that each token represents a certain number of company shares, allowing these shares to be traded transparently, efficiently, and securely on the blockchain. In short, this proposal simply integrates traditional finance onto the chain, but lacks many mechanisms.

Basic Mechanics

– Token holders must verify their identity.

– The contract must provide the following functions:

It must enable the company to prepare a list of shareholders;

There are partly paid shares;

Total amount paid;

the total amount payable;

It must record transfers of shares.

– Each token must correspond to one share, all fully paid, so there is no need to record information about partially paid shares, and there are no fractional tokens.

– There must be a mechanism to allow shareholders who have lost their private keys or otherwise lost access to their tokens to reallocate their addresses and tokens to new addresses.

However, this proposal is just an innovative attempt, and many things inside it have not been perfected, which has led to the fact that this proposal has not been promoted and used for a long time, but it still provides a huge development direction for the legalization of on-chain assets. This proposal was put forward before FTX went bankrupt, and there was no large-scale chaotic ICO phenomenon and on-chain asset fraud at that time, so its feasibility has certain problems.

Problems with EIP-884

– This proposal does not provide a solution for how implementers can verify a persons identity.

– In terms of permissions management, no one can add, remove, update, or replace verified addresses. How access to these features is controlled is beyond the scope of this proposal.

– The SEC has additional requirements for crowdfunding, but this standard supports them. For example, the SEC requires crowdfunding sites to display the amount of funds raised in USD. The crowdfunding contract must maintain a conversion rate for USD to ETH and record the conversion rate.

The development of the token model

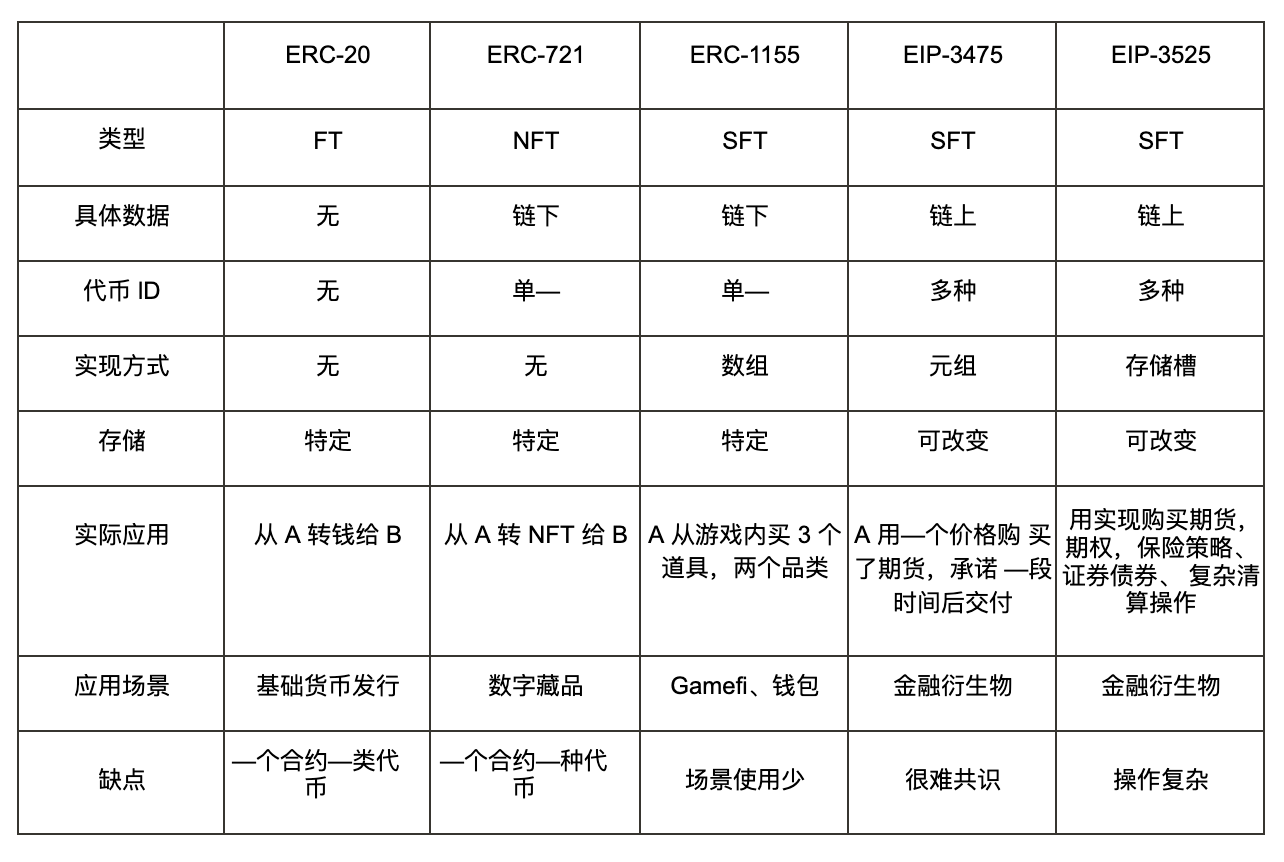

No matter what on-chain assets are concerned, a suitable token type is always an unavoidable topic. On-chain assets are completely different from the cash model and Web2 centralized assets in real life, so ERC 20 and ERC 721 came into being, but they still have some problems such as the inability to transfer different tokens in batches, limited standard flexibility, and difficulty in upgrading. Therefore, in order to cope with various complex development scenarios and realize the development of hundreds of tokens at a time (such as blockchain games), ERC 1155 appeared.

For some traditional finance, these existing models are not enough, such as futures, options, securities ETFs, etc. Since the implementation method of DEX (decentralized exchange) on the chain is to use the product market maker method to realize transactions, which is very different from the order form of the actual centralized exchange, it is difficult to realize futures, options, etc. In other words, it is precisely because of the model of the exchange on the chain that the traditional financial model cannot be directly copied, which makes it difficult for the actual financial industry to directly realize the leap from Web2 to Web3.

For example, take the so-called risk-free arbitrage of the most basic DEX (decentralized exchange) internal liquidity pledge. This process still has the problem of impermanent loss risk. Therefore, before the birth of EIP-3475, most traditional finance wanted to enter the Web3 industry to obtain opportunities and handed it over to third parties to operate, such as the previous FTX exchange, etc. Of course, the bankruptcy of FTX later also led to an industry crisis, so there were later proposals that imitated real financial logic. EIP 3475 and EIP 3525 will be introduced below.

EIP-3475 Mechanism

– This EIP allows the creation of tokenized obligations using abstracted on-chain metadata storage. Issuing bonds with multiple redemption data is not possible with existing token standards.

– This EIP enables each bond class ID to represent a new configurable token type, and for each class, the corresponding bond nonce represents the issuance conditions or any other form of data in integer. Each nonce of a bond class can have its metadata, supply and other redemption conditions.

– Bonds created by this EIP can also be batched based on issuance/redemption conditions to improve efficiency in terms of gas costs and user experience. Finally, bonds created under this standard can be split and exchanged on the secondary market.

In EIP-3475, each debt contract is called Class 0, and a contract can contain multiple contracts, similar to the ID of NFT. Each Class manages a lot of data, including text information such as contract name, abbreviation, description, etc. The information can be further subdivided into types and values, such as contract amount, time, deliverer, deliverable, notary agency, and business license number. It mainly saves gas fees when storing highly customized contracts on the chain, and optimizes functions such as batch transfer.

Bonds occupy an important position in the overall debt securities market in the traditional financial market. They are mainly used as fixed-income instruments and are usually issued by governments. The stability of their returns is considered a key factor in the stability of money and monetary policy. In the field of decentralized finance (DeFi), similarly, some large projects such as Olympus DAO issue specific types of fixed-rate bonds for liquidity provision (LP) tokens. In addition, there are institutions such as Societe Generale that issue bonds as collateral for loans to MakerDAO. After trading and staking, bonds are expected to become the next important asset class in the DeFi field.

In simple terms, this EIP can implement a futures shorting mechanism on the chain. Suppose a futures exchange issues a futures product, corn, and requires delivery after a certain number of blocks. A, as a trader, can buy and sell within this period of time to realize arbitrage, but delivery must be made in the end. Different from on-chain lending, this model does not require over-collateralization, as long as it is redeemed at the end. In addition, this EIP also uses a multi-layer pool model to manage different bonds and realize the debt transfer function.

EIP-3525 Mechanism

– Added some storage model innovations based on ERC-1155 to implement the management of different types of tokens on Slots.

– Include an ERC-721 equivalent ID property to identify itself as a universally unique entity so that tokens can be transferred between addresses and approved to operate in an ERC-721 compatible manner.

– Also contains an attribute value, which represents the quantitative nature of the token. The meaning of the value attribute is very similar to the meaning of the balance attribute of ERC-20 tokens. Each token has a slot attribute, which ensures that the value of two tokens with the same slot is considered fungible, thus adding fungibility to the tokens value attribute.

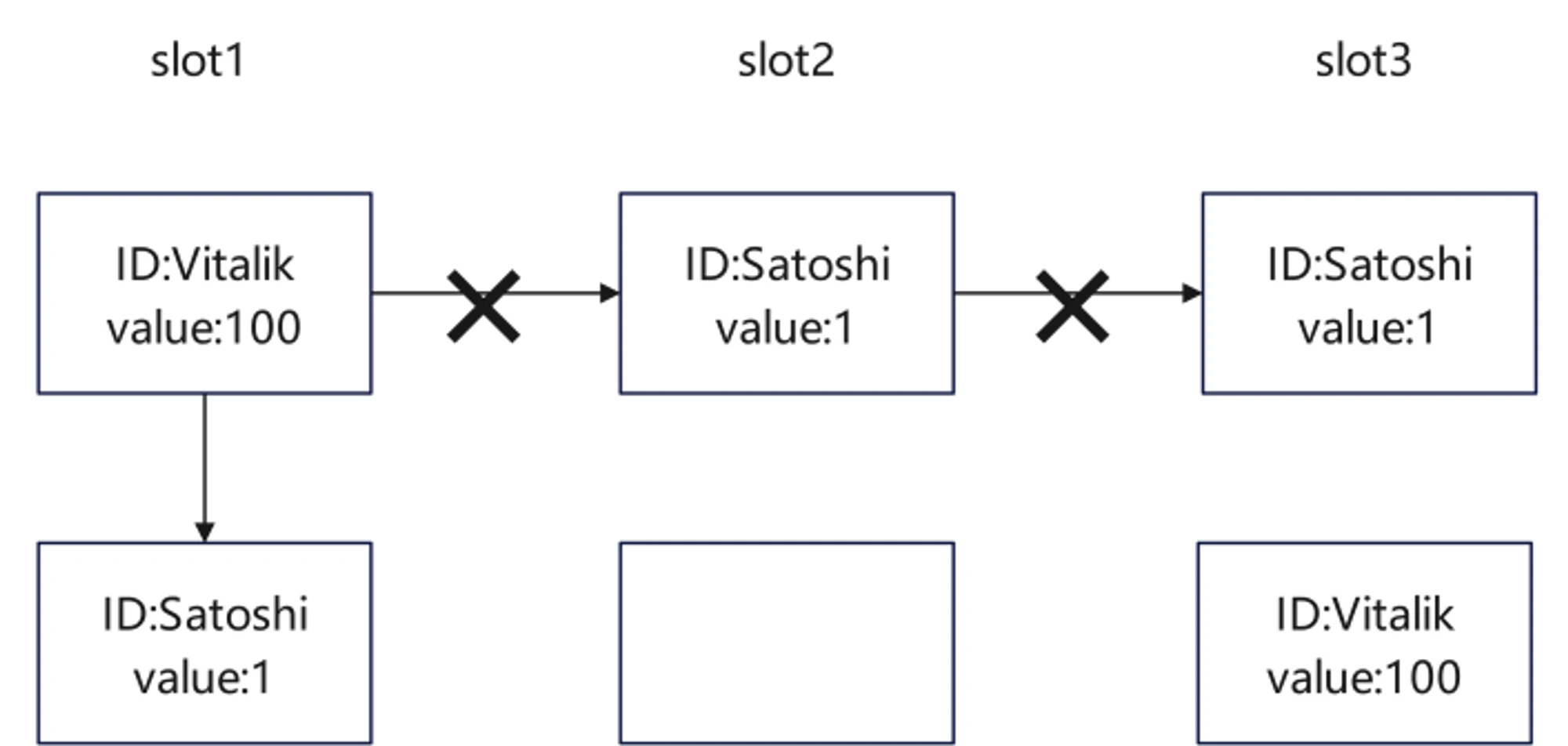

Each slot in the contract corresponds to a token, which has an ID and value. Owners of the same slot can perform transactions and transfers with each other, and the arrows below only represent internal elements.

It is like Vitalik and Satoshi each have a bank card in Slot 1, so they can transfer money, but cross-bank transfers cannot be directly executed in this contract. Although each ID has its own value, different IDs in the same slot can be considered the same and can be exchanged, combined, and split. The arrows in the figure below represent transfers.

NFT splits and imitation of real stocks:

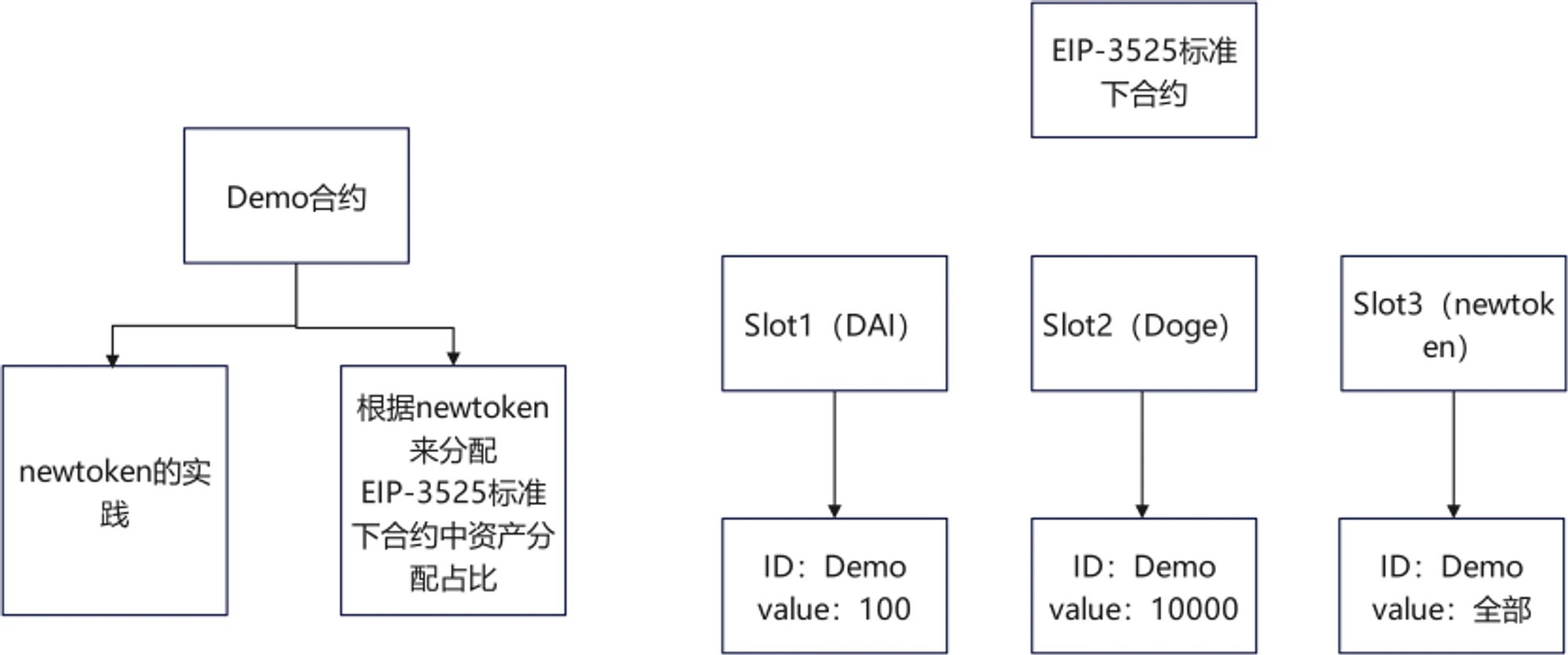

Of course, this is only a small part of the advantages brought by EIP 3525. By abstracting the account into a contract and not limiting the value of the ID to 1 in a slot of the contract, the NFT splitting solution can be realized, and a diverse on-chain lending solution for NFT can be realized during the lending process. In addition, this abstract method can be used to imitate many traditional financial stocks, making it easier for traditional financial institutions to enter the market. Stocks and dividends can be divided by the proportion of a slot.

The realization of anchored stablecoin is based on:

As mentioned earlier, in some DEXs, simply adding liquidity to obtain fees may cause some impermanent loss problems. For example, when someone provides liquidity to a DEX liquidity pool, the ratio of the two tokens provided is determined by the ratio of the two parties in the liquidity pool at that time. When this person withdraws the lp, he withdraws it according to the ratio added to the entire liquidity pool and obtains the fees provided by the trader. However, over time, this ratio will change with price fluctuations, which results in the value withdrawn ultimately not being able to ensure legal currency profitability.

For example, in the context of EIP-3525, a contract is abstracted into an ID and entered into the Slot, and this contract is recorded as Demo. Since an ID can correspond to assets in multiple slots, when the Demo contract deposits 100 DAI and 10,000 Doge into the contract under the EIP-3525 standard, the assets of Demo can be abstracted into ten parts, each of which corresponds to 10 DAI and 1,000 Doge. If the Demo contract issues a token, the proportion of the Demo contract assets can be decentralized managed based on this new token. If one of the ten parts is obtained, DAI and Doge can be relatively stable.

Development of on-chain RWA – EIP-7092

With the development of blockchain, multi-chain assets and how to implement reasonable trading rules have become a commonplace issue. Here we share EIP-7092 (currently ERC).

– Allows investors to lend money to an issuer at a given interest rate for a predetermined period of time. In return, the issuer promises to pay interest (coupon) and repay the principal at maturity.

– The standard defines all the basic properties required to model a financial bond, such as issue date, maturity date, coupon rate, principal, and currency.

– Provides cross-chain capabilities for bond operations and management across multiple blockchains.

In traditional finance, bonds are managed by intermediaries, with orders routed and settled through brokers or over-the-counter (OTC). Therefore, these transactions are usually handled by intermediaries that are approved to manage bonds on behalf of bondholders. The ERC-7092 standard can remove these intermediaries, allowing bonds to be traded directly between investors, or using the traditional model but with intermediaries replaced by smart contracts. Therefore, the holder of a bond can be an individual investor, or a smart contract authorized by the bondholder to manage its bonds.

If a traditional institution wishes to issue a bond on behalf of its clients via the ERC-7092 standard, they can take the following steps:

1. Create a debt contract that complies with the ERC-7092 standard interface.

2. Create a bank contract as the core contract for all transactions. This contract is responsible for the work of brokers and investment banks. It defines a set of managers responsible for triggering certain actions, such as using the issued bonds in the contract when the total issuance volume is reached, or redeeming the bonds when they mature. Investors approve the bank contract to manage their bonds for trading in the secondary market. In this case, the actual bond holders are still investors, but bond transfers can only be completed by approved bank contracts.

3. If a bond needs to be listed on a bond platform, the holder or smart contract may need to transfer the bond to the platform, and the platform will be responsible for selling the bond on behalf of the bond holder.

4. Bonds can also be traded between investors without an intermediary. In this case, the bond holder is always an investor or a smart contract.

Other RWA-related EIPs

ความเป็นส่วนตัว

EIP-7540: Aims to improve the tokenized treasury standard for RWA, introducing asynchronous deposit and redemption processes

– EIP 7540 is a new proposal to improve the privacy and security of cryptocurrency transactions. It introduces zero-knowledge proof technology to protect the sender, receiver, and transaction amount of transactions from being made public. This will make transactions on the Ethereum network more difficult to track and monitor, and enhance user privacy protection. At the same time, the proposal also includes a new set of smart contract standards to support the implementation and application of this private transaction mechanism.

specification

EIP-4626: Aims to introduce RWA specifications as an existing tokenized treasury standard

– The lack of standardization of tokenized vaults leads to a variety of implementation details, which is particularly evident in examples such as lending markets, aggregators, and intrinsic interest-bearing tokens. Since each tokenized vault has its own unique design and implementation, it makes it complex and difficult to integrate protocols that need to comply with multiple standards at the aggregator or plugin level, forcing each protocol to develop and maintain its own adapter, which is not only error-prone, but also wastes a lot of development resources.

– The standardization of tokenized vaults will significantly reduce the integration workload of profitable vaults. By introducing unified standards, developers can follow a consistent implementation model and create a more reliable and robust system. Standardization not only simplifies the development process and improves interoperability between different protocols, but also promotes innovation, saves resources, enhances security, and ultimately promotes the healthy development of the entire financial ecosystem.

ความปลอดภัย

EIP-4788: Improved security and functionality, with important implications for processing RWA transactions and assets

– Introducing protocol-level oracles reduces reliance on external oracles, reduces security and failure risks, optimizes the structure of the RWA cross-chain bridge and staking pool, and improves the efficiency of the liquidity pledge protocol. It provides a more flexible mechanism for the RWA bridge and re-staking solution based on smart contracts, which is conducive to lowering the entry threshold for node operators and making decentralized protocols more competitive.

Infrastructure

EIP-1153: Reduce on-chain data storage fees, which helps reduce RWA-related data storage costs. In addition, it significantly reduces the risk of flash loan hacker attacks

– Introducing temporary storage opcodes for processing temporarily stored data during smart contract execution, which can save network gas fees because the data will be discarded after each transaction and will not be permanently saved on the blockchain. This provides application developers with more flexible storage options, especially for applications that need to frequently store temporary data, such as Uniswap. This improvement improves the efficiency and performance of the Ethereum network and makes it more convenient and economical to process temporary data.

สรุป

Through this article, we have explored in depth the development history, technical mechanisms, and related EIP and ERC standards of real-world assets (RWA). From the initial EIP-884 to the recent EIP-3475 and EIP-3525, these proposals demonstrate the application potential of blockchain technology in asset digitization and tokenization. Especially in the fields of financial derivatives, debt securities, and privacy protection, RWA has demonstrated a wide range of application prospects and great potential.

However, with technological advancement come many challenges, including regulatory compliance, security, and standardization. Through further research and innovation, RWA is expected to become an important force in promoting the integration and development of financial markets and the global economy, and help achieve a more efficient, transparent, and secure digital financial ecosystem.

This article is sourced from the internet: Interpreting the past and present of RWA from the perspective of EIP

Original title: “Solana Need L2s And Appchains?” Original article by Yash Agarwal Original translation: Ladyfinger, BlockBeats Editor’s Note: As a high-performance public blockchain platform, Solana is facing unprecedented development opportunities and challenges. In this article, Yash Agarwal takes a panoramic and in-depth look at the key issues in the Solana ecosystem – modularity, application chains, and Rollups, and how they work together to drive Solana towards a broader future. Introduction A month ago, Vibhu, the founder of DRiP, the top free NFT distribution application on Solana, made a statement that sparked widespread discussion: Solana will and needs to have Layer 2 and Rollup. He expressed this view because DRiP loses about $20,000 in value per week as SOL prices and network congestion rise. The increase in Solana network activity has…