รายงานการวิจัย Coinbase: ตลาด Crypto ยังขาดการบรรยายที่น่าเชื่อถือ ไตรมาสที่ 3 จะผันผวนเป็นหลัก

แหล่งที่มา: Coinbase

Original translation: BitpushNews Mary Liu

Summary:

-

According to Arkham data, the German government’s Federal Criminal Police Office (BKA) may have completed its sell-off, reducing its holdings from approximately 50,000 BTC ($3.55 billion) in mid-June to 0 BTC as of July 12 (data as of 14:38 EST on that day).

-

There is concern that a rate cut could be bad for markets if the economic slowdown is deeper amid fears that the U.S. could fall into recession later this year or early 2025.

-

Panel discussions and speeches at the seventh Ethereum Community Conference (EthCC), including a keynote by Ethereum co-founder Vitalik Buterin, reiterated Ethereum’s roadmap to provide the most decentralized and secure settlement layer 1 (L1) for various L2s.

มุมมองตลาด

The third quarter started off badly with excess supply as price-insensitive holders sold Bitcoin. This included the German government’s Federal Criminal Investigation Bureau (BKA), which began selling its seized Bitcoin on June 19. Although the scale of their Bitcoin sales ($85 million per day on average) was not particularly large relative to the $10.6 billion in daily BTC spot trading volume (since June 1, on centralized exchanges around the world), the BKA’s mindless selling unnerved the market, putting pressure on Bitcoin prices.

On the bright side, BKA may have almost completed its sale as its holdings have dropped to zero as of July 12 according to Arkham Intelligence (not sure if some of it will be returned by CEX). But we think this indicates that some of this market panic should dissipate soon.

Meanwhile, repayments from the Mt. Gox Rehabilitation Trust that began on July 5 also had an impact on the market, but it is unclear how much of the repaid BTC was actually sold.

Exchanges approved to process repayments include Bitbank, BitGo, Bistamp, Kraken and SBI VC Trade, according to the exchange. However, repayment processing times may vary depending on the exchange and its internal verification procedures — from immediate (Bitstamp) to 90 days (Kraken).

We believe the uncertainty will be more damaging to the market than any actual sell-off because the largest creditors (i.e., third parties who purchase the claims of others) are likely to be hedged. Furthermore, we expect any sell-off that does occur to be gradual and orderly, with only a modest impact on the market.

But looking at the long term, how will the market develop for the rest of this quarter?

Lately, we’ve seen an increasing number of reports expressing concerns that the U.S. could fall into a recession later this year or early 2025.

We hold the opposite view, arguing that productivity gains from accelerated post-pandemic technology adoption (including but not limited to generative AI models) will kick off a new multi-year economic cycle, possibly as early as the fourth quarter of 2024. (The timing is difficult to predict) However, typically the difference in economic views is not this large, and parsing increasingly complex signals is a challenge.

That being said, the macro data has given plenty of evidence that the US economy has slowed (ISM manufacturing, unemployment, domestic demand, etc.), and we acknowledge that.

In fact, we think the US economy is likely to peak in the second quarter of 2024 – one reason why we think the Fed will start cutting rates on September 18th (too early this month and there is no August meeting). In fact, the June CPI data released this week (-0.1% mom or -3.0% y/y) was below the median forecast of +0.1% and 3.1%, which may support a more dovish Fed stance.

The worry is that a rate cut could be bad for markets if the economic slowdown that people are worried about deepens.

That said, if the U.S. economy were to fall into a recession, retail investors might be reluctant to enter new stock or cryptocurrency positions.

On the other hand, if the economy is still performing relatively well and the Fed cuts interest rates, this could release more liquidity and attract more retail investors.

Furthermore, the US election is coming up in November, and fiscal expansion seems likely regardless of who wins. In our view, this is a strong incentive to buy Bitcoin as an alternative to the traditional financial system.

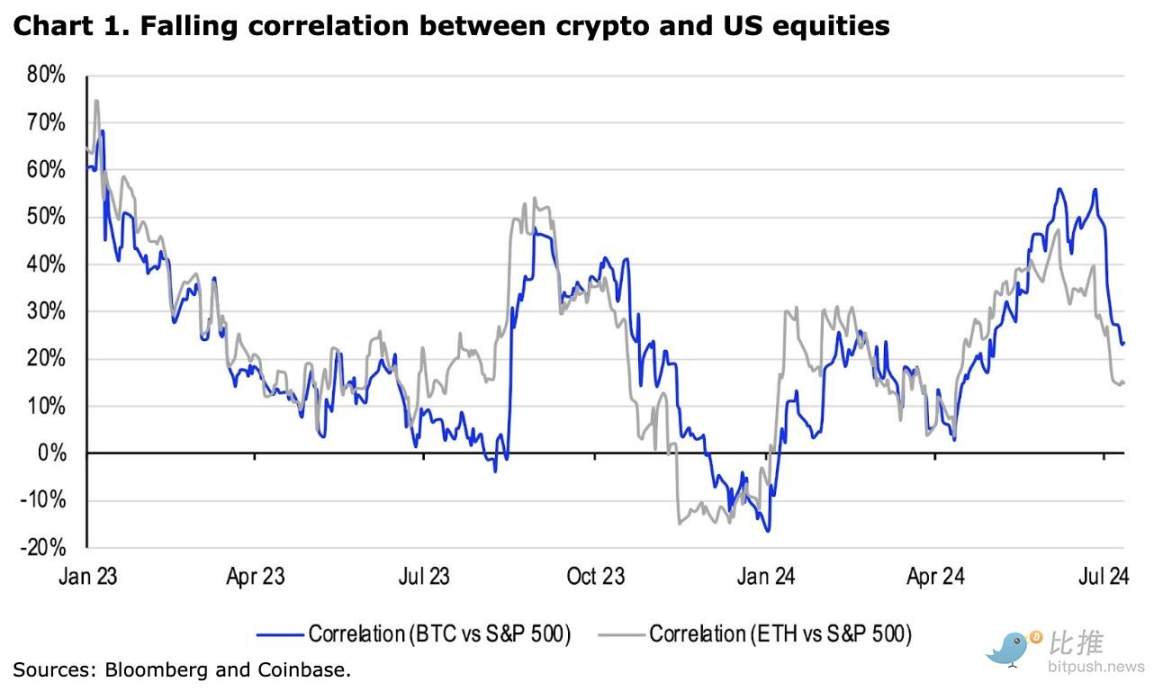

Currently, we expect price action to remain volatile in Q3 2024 as the cryptocurrency market continues to lack a strong narrative.

For example, the market cannot decide whether potential spot ETH ETF flows (experts expect to launch soon) are bullish or bearish, although we believe this is not necessarily a bad thing from a positioning perspective. Even if flows take time to materialize, this could leave room for surprise performance and provide more support for ETH. But overall, we think the next two months are likely to produce more volatility until the situation starts to improve more clearly in late September.

EthCC Essentials

The 7th Ethereum Community Conference focused on key technical topics including Layer 2 (L2) scaling and differentiation, ETH staking issuance, cross-chain interoperability, and more. Conference panels and discussions (including a keynote from Ethereum co-founder Vitalik Buterin) reiterated Ethereum’s roadmap to provide the most decentralized and secure settlement Layer 1 (L1) for various L2s.

Ethereum continues to focus on becoming the settlement layer L1, which suggests that its execution layer is unlikely to scale significantly in the short term (measured in gas per second). Instead, it is more focused on increasing the data availability bandwidth of L2 storage. However, this does not mean that ETHs utility is stagnant.

On the contrary, the diversity of L2 enables different technical approaches to compete quickly. L2 platforms such as Optimism, Base, Arbitrum, and Starknet have demonstrated their unique technical and ecosystem advantages on EthCC. The ability of L2 to quickly iterate on competing technologies is a unique advantage of the modular approach and one of the advantages of Ethereum that we have previously highlighted.

That being said, general interoperability between L2s remains a contentious issue. While many solutions appear technically feasible (with varying tradeoffs), there is no single top winner that spans all chains. Communications standards tend to be a winner takes all market due to network effects, but crypto interoperability faces the additional challenge of resolving conflicts of interest. Namely, the ability of interoperability protocols to monetize the adoption of their standards makes this space a near zero-sum game. In our view, full interoperability remains an open challenge that may take months or even years to coalesce into a clear standard.

However, we do not believe that barriers to interoperability mean that crypto user experience (UX) will hinder user onboarding.

Account abstraction and smart account adoption are gaining momentum. Beyond the core infrastructure layer, it seems more decentralized application (dApp) developers are looking to leverage gas abstraction and bundled transactions to simplify the dApp experience. Additionally, session key technology (which enables automatic transaction approval under certain conditions) is expected to be a means to further reduce dApp UX friction, especially in DeFi (swap) and games.

Pledging and re-pledging are also related issues.

Rising staking rates (currently 28% of total ETH supply) and the resulting reduction in net staked APY could pose long-term challenges to the economic viability of independent stakers. Similarly, concerns have been expressed about the growth and centralization of Liquid Staking Tokens (LSTs). While no firm conclusions have been reached, suggestions include lowering the base issuance curve (which should theoretically moderate staking growth) and establishing LST standards to enable more LST diversity and competition. Meanwhile, restaking faces challenges with implementation timelines. Payout and slashing functionality is not yet enabled for any shared security layer. Additionally, uncertainty has been expressed about the importance of Active Validation Service (AVS)-based returns relative to the size of ETH being re-staked in the short to medium term (a risk we highlighted earlier this year).

For the most part, the discussion at the main EthCC event focused on the infrastructure layer, though there were many consumer-facing applications demonstrated at many of the side events. Applications ranged from AI-parsed blockchain data, perpetual on-chain games, novel prediction markets, and more. That being said, in our opinion, the infrastructure to application ratio still seems to be more heavily skewed toward infrastructure projects than one might expect.

Overview of Cryptocurrencies and Traditional Currencies (data as of 4pm EST on July 11)

ที่มา: บลูมเบิร์ก

การแลกเปลี่ยน Coinbase และข้อมูลเชิงลึกของ CES

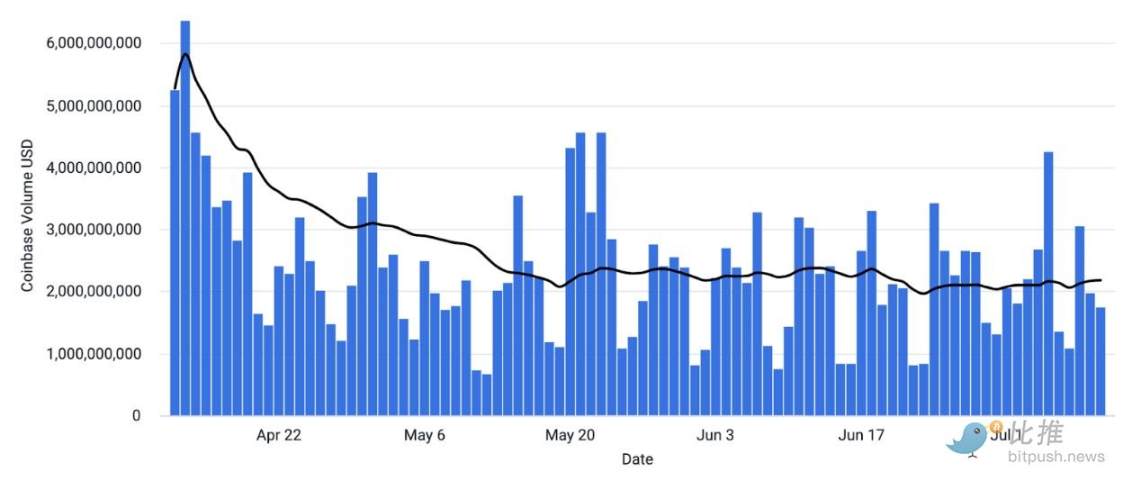

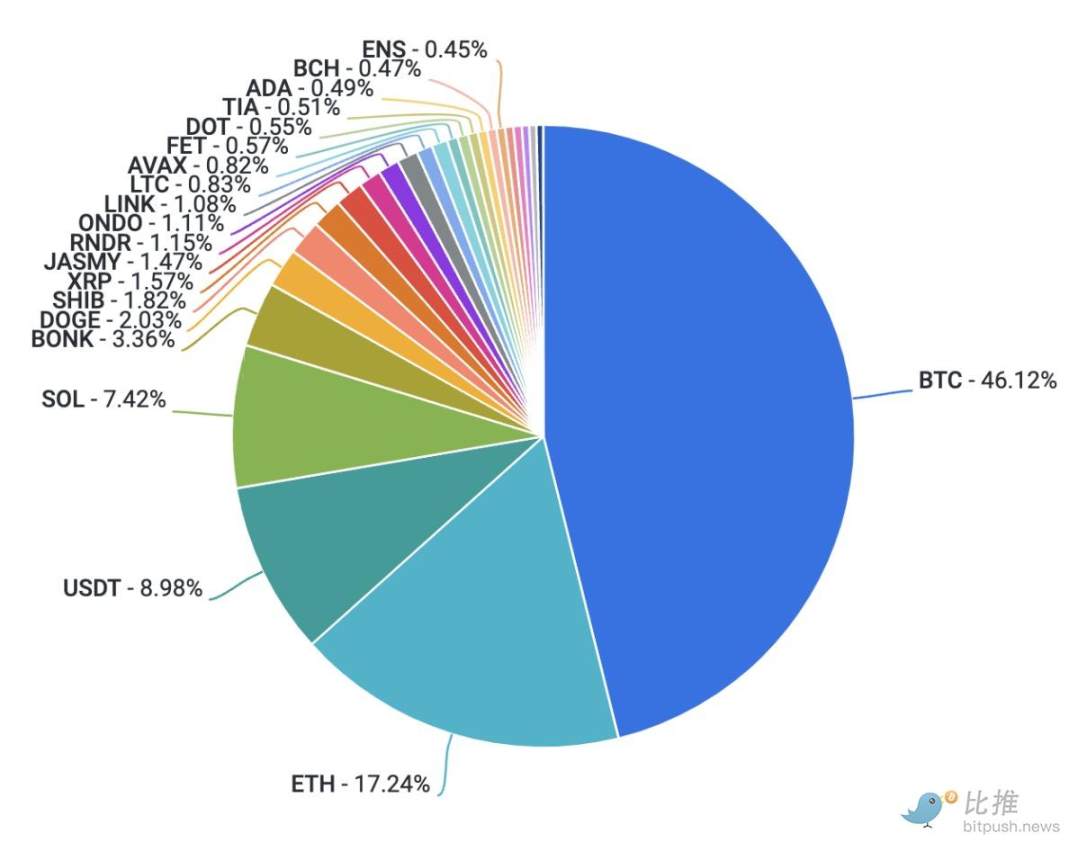

This week, Bitcoin has been consolidating below its 200-day moving average. Lower-than-expected CPI data failed to drive the coin higher as supply concerns continue to weigh on the market. Ethereum is also trading in a tight range around $3,000 as traders await the launch of a spot ETF in the U.S. Positioning on the coin is sparse, but we have begun to see a rotation from altcoins into ETH. Elsewhere in the market, SOL has held up relatively well during this month’s sell-off, suggesting to some traders that it could outperform if the broader crypto market rebounds.

Coinbase trading volume (USD)

Coinbase trading volume by asset

This article is sourced from the internet: Coinbase Research Report: Crypto Market Still Lacks Strong Narrative, Q3 Will Be Mainly Volatile

ข่าวเด่น ETH พุ่งแตะ 3700 USDT อย่างรวดเร็ว เพิ่มขึ้น 19.95% ใน 24 ชั่วโมง ข้อมูลตลาด OKX แสดงให้เห็นว่า ETH พุ่งแตะ 3700 USDT อย่างรวดเร็ว และปัจจุบันซื้อขายอยู่ที่ 3675.81 USDT โดยเพิ่มขึ้น 19.95% ในช่วง 24 ชั่วโมง สภาคองเกรสของสหรัฐฯ อาจผ่านร่างกฎหมายต่อต้าน CBDC ในสัปดาห์นี้ ตามรายงานของ Bitcoin Magazine ส.ส. ของสหรัฐฯ Emmer เปิดเผยว่าสภาคองเกรสของสหรัฐฯ ตั้งใจที่จะผ่านร่างกฎหมายต่อต้าน CBDC ในสัปดาห์นี้ Emmer กล่าวว่าแนวคิดของ CBDC ไม่เพียงน่าตกใจเท่านั้น แต่ยังไม่ใช่แนวคิดแบบอเมริกันอีกด้วย พันธมิตรของ Dragonfly: ประสิทธิภาพโดยทั่วไปที่ย่ำแย่ของโทเค็นที่มีการหมุนเวียนต่ำ/FDV สูงเป็นกระบวนการของการแก้ไขตัวเองของตลาด Haseeb Qureshi ผู้จัดการหุ้นส่วนของ Dragonfly เผยแพร่บทความบนแพลตฟอร์ม X ที่มีหัวข้อว่า ทำไมเหรียญที่มีอัตราลอยตัวต่ำ/FDV สูงทั้งหมดจึงแย่ลง? ซึ่งเป็นเรื่องเกี่ยวกับประสิทธิภาพโดยทั่วไปที่ย่ำแย่ของเหรียญที่มีอัตราลอยตัวต่ำ...