ทุนหมุนเวียน: การวิเคราะห์แรงกดดันการขายการชำระหนี้ใน Mentougou

Original author: Cycle capital, duoduo

Mentougou bankruptcy case

MtGox was founded in July 2010. It is a Japanese exchange, the earliest and largest exchange in the cryptocurrency circle, and its trading volume once accounted for more than 80%. In 2013, 850,000 bitcoins were stolen from Mentougou, and the exchange went bankrupt. Subsequently, about 200,000 tokens were recovered. Since 2014, investors and the court-appointed trustee have launched a lengthy compensation lawsuit for these 200,000 coins. About 60,000 BTC were used to pay various fees, and about 140,000 BTC remained.

Debt Transaction

After the incident, during the long period of waiting for the results, institutions have been purchasing Mentougous debts, and debt transactions between individuals are also common. For example, in 2019, Fortress Investment Group sent extensive inquiry emails to creditors, purchasing BTC at a price of $900, which is twice the price of Bitcoin when Mentougou went bankrupt. The price of debt transactions will fluctuate with market conditions. If the original creditors are worried about not being repaid, they can get back part of the principal by selling their debts.

Compensation Plan

In 2021, Mentougou passed a compensation plan, and creditors can get back the remaining value of the exchange.

According to the compensation plan, since the stolen assets can no longer be recovered, the Mentougou Exchange can only compensate the creditors with approximately 23.6% of their original claims. If the creditors choose to accept the early lump-sum compensation, there will be a discount, and the compensation rate will be only 21%; if they do not accept it, the creditors may have to wait for a long time, and the final compensation may be more or less. At present, the proportion of creditors who have not been compensated in advance has not been found.

The composition of the compensation assets is divided into two parts, one is cash, which comes from the BTC sold by the Japanese government during the peak of 2017, and the other is BTC. Cash is 5%-10%, and BTC is 95%-90%, and the specific ratio can be selected. It can be seen that more than 90% of the compensation is BTC.

Regarding the claim time (which is also the time for BTC to enter the market), it may take two to three months. A total of 5 exchanges will accept the BTC used by Mentougou for repayment and distribute it to the creditors account. The timetable for each exchange is different. Kraken takes 90 days, Bitstamp takes 60 days, BitGo takes 20 days, SBI VC Trade and Bitbank will complete the payment within 14 days. This time is the longest time, and it may be advanced.

In addition, the deadline for early lump sum compensation is October 31, 2024. This deadline will not be modified unless approved by the court.

Current Progress

In May 2024, the BTC in the Mentougou cold wallet moved for the first time since 2018, causing panic in the market. On July 5, 2024, 47,000 tokens were moved from the Mentougou account address, of which 1,545 BTC were transferred to Bitbank and began to be paid. On the same day, the German government sold BTC, and the largest single-day decline exceeded 8%.

As of July 12, 138,000 BTC are still in the account address of Mentougou. It can be considered that the selling pressure of Mentougou has not actually entered the market. The decline on July 5 is part of the realization of the expected decline in the selling pressure of Mentougou.

Figure: Mentougou account balance

Figure: Recent transfer records of Mentougou accounts

Selling pressure analysis

Mentougou creditors will sell some of their BTC, but probably not all of them.

From the perspective of profitability, according to cost calculation, when Mentougou went bankrupt, the BTC price was $485. If it is the original creditor, according to the current price, the BTC price has increased by 120 times; the amount of BTC paid by Mentougou is about 20% of the original amount held, so the profit is about 24 times. Even if it is a debt acquisition, there is more than 10 times the profit. In addition, the debt acquisition agency may hold more BTC. It is optimistic about BTC in the long term and will not sell all of it.

From the perspective of holders, during the long litigation process, the widespread debt trading market has given paper creditors ample opportunities to exit. Those who are willing to buy debts should be more likely to be long-term BTC holders.

Assuming that the proportion of early lump sum repayment is 75%, the total number of BTC repaid is 105,750, the discount is 11%, and the actual number of BTC used for repayment is 94,117; and assuming a selling ratio of 30%, 50%, and 70%, and a selling time of 1 to 3 months, the number of BTC sold under different circumstances can be calculated. As shown in the following table:

How much impact does such supply have on the market? We can refer to the recent BTC supply caused by the German government and the demand for BTC ETFs during this period for further analysis.

Comparing the market impact of the German government selling BTC

The German government has been selling its 50,000 BTC through centralized exchanges since June 19. As of July 12, there were 6,394 BTC left in its address, which means that about 43,700 BTC were sold in 23 days, which is worth about $2.4 billion at $55,000.

During this period, the maximum drop in the daily line was about 19% (from 66400 to 53500), and the daily line body column dropped by about 14% (from 64800 to 55900). The largest single-day drop occurred on July 5, when Mentougou transferred 47,000 tokens (of which only 1,500 entered the exchange). Under the double pressure, BTC dropped to 53.5K on July 5, with a single-day drop of 8.5%, which was the lowest point of this round of decline. After July 6, BTC rebounded, reaching a high of around 59500.

Combined with the transfer of German government tokens, it can be clearly seen that the markets expectations for the decline in token sales precede the actual sale time of tokens. When the German government began to transfer out BTC in small amounts, the market continued to fall. From June 19 to July 7, a total of 18 days, the German government sold about 10,000 BTC, with an average daily sale of 556 tokens. On July 5, after the German government + Mentougou double pressure pin, the actual selling pressure of the German government increased, but the markets ability to bear was also strengthened. On July 8, the German government sold nearly 13,000 BTC, and the market pin did not break the previous low, and the daily closing rose. From July 8 to July 12, the German government outflowed about 33,700 tokens, and BTC has been fluctuating between 54K and 60K boxes.

Figure: Schematic diagram of BTC outflow held by the German government (as of July 11)

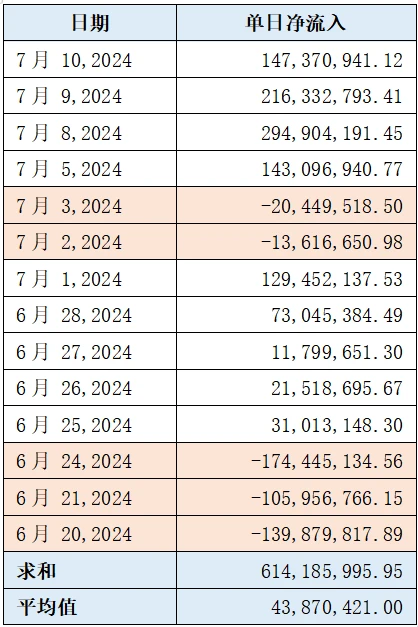

BTC ETF Demand Analysis

BTC ETF is a relatively stable buy in the current market. During the period when the German government sold tokens, there were 15 working days from June 19 to July 10. During the 15 days, the ETF had 6 days of net selling, selling $470 million; there were 9 days of net buying, buying $1.07 billion, with a net inflow of $600 million and a daily average of $43 million. The main purchases occurred after July 5, with a total of more than $800 million in purchases.

As mentioned above, the German government sold a total of 40,000 tokens to the market during this period, about $2.4 billion. Therefore, the demand for BTC ETF was not enough to provide sufficient support, and the market price fell.

Table: BTC ETF daily net inflow (June 20 to July 10)

สรุปแล้ว

If the compensation from Mentougou is sold out within a month, the selling pressure faced by the market will be similar to that of the German government, with similar sales in terms of quantity and timing. According to the current demand for ETFs, there will be no sufficient support, and the price of BTC may fall further.

If the compensation of Mentougou lasts longer (2-3 months), the amount of BTC entering the market every day will not be particularly large, and it will not cause a one-time decline. However, due to the continued expectation of selling pressure, there may be a period of shocks to digest the selling pressure. This also means that it is difficult for the main rising wave to come in the short term.

At present, only 1,545 tokens of Mentougou have been transferred to the exchange, and the rest are still in Mentougous account. It can be considered that the actual selling pressure has not yet entered the market. When the BTC held by Mentougou is distributed to several exchange addresses on a large scale, it may cause a large panic drop, thus forming a plunge. When specific individuals sell, due to dispersion and difficulty in tracking and observation, it may not necessarily cause a significant drop in prices.

This article is sourced from the internet: Cycle capital: Analysis of repayment selling pressure in Mentougou

Related: The current state of VC survival: the hellish primary market and the locked “paper wealth”

Author: Mia, ChainCatcher Original editor: Marco, ChainCatcher Retail investors attributed the reason for losing money to the token issuance strategy of high FDV (future discounted value), low circulation, believing that VCs and project parties conspired to unlock a large number of tokens, which impacted the crypto market. VCs are crying out for injustice, defining the primary market of this cycle as hellish difficulty. Li Xi, partner of LD Capital, said that this years books are profitable, but its all paper value, because the shares belonging to VCs are still unlocked at 0. Except for the VCs who assemble the game, most VCs are big leeks who take over. ChainCatcher interviewed several representatives from the VC industry, trying to understand the current survival status of VC. Many VCs said that there…