BTC Fear and Greed Index hits an 18-month low, is a bottom signal emerging?

Original author: BitPush

On Tuesday, Federal Reserve Chairman Powells positive tone on the improved inflation outlook eased market tensions. After Powells speech, traders bet on the probability of a September rate cut rose to 73% from 68% last week, but remained cautious ahead of the release of this weeks Consumer Price Index (CPI) and Producer Price Index (PPI) reports.

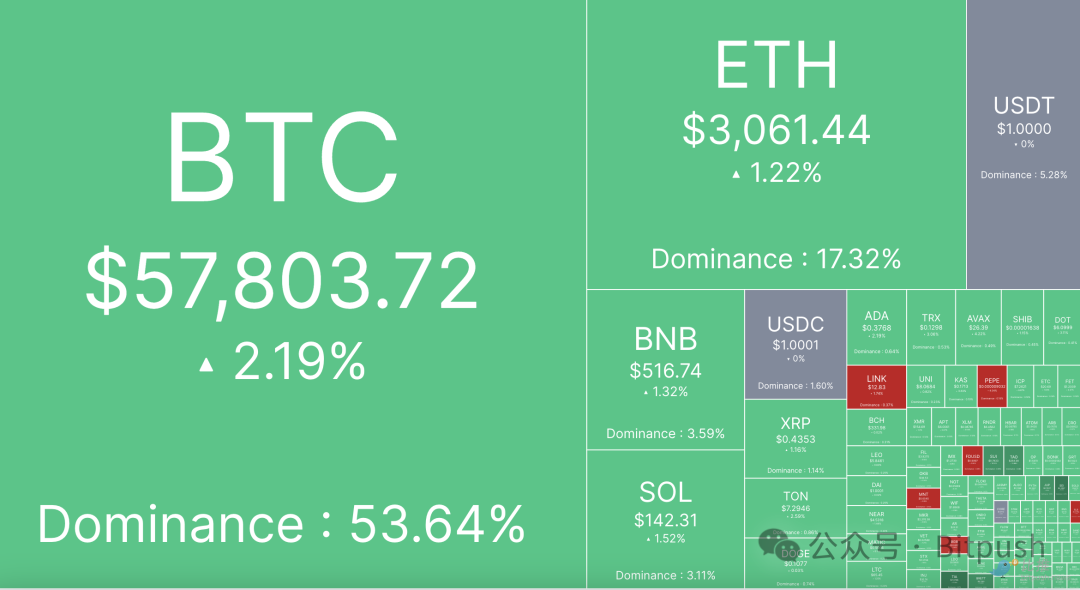

According to Bitpush data, the total market value of cryptocurrencies rose by 2.5%, and the long and short forces of Bitcoin competed. The long force pushed BTC from US$56,700 all the way to an intraday high of US$58,312. As of press time, the trading price of Bitcoin was US$57,804, a 24-hour increase of 2.19%.

The altcoin market has mostly rebounded, with around 90% of the top 200 tokens by market cap posting gains.

Mog Coin (MOG) had the largest increase, about 18.1%, followed by Sei (SEI) with a 17% increase and Celestia (TIA) with a 16.8% increase. aelf (ELF) had the largest decrease, down 6%, Pepe (PEPE) down 4.4% and Axelar (AXL) down 3.5%.

The current overall market value of cryptocurrencies is $2.12 trillion, with Bitcoin accounting for 53.7% of the market share.

At the close of U.S. stocks, the SP 500 and Nasdaq 500 rose 0.07% and 0.14% respectively, while the Dow Jones fell 0.13%.

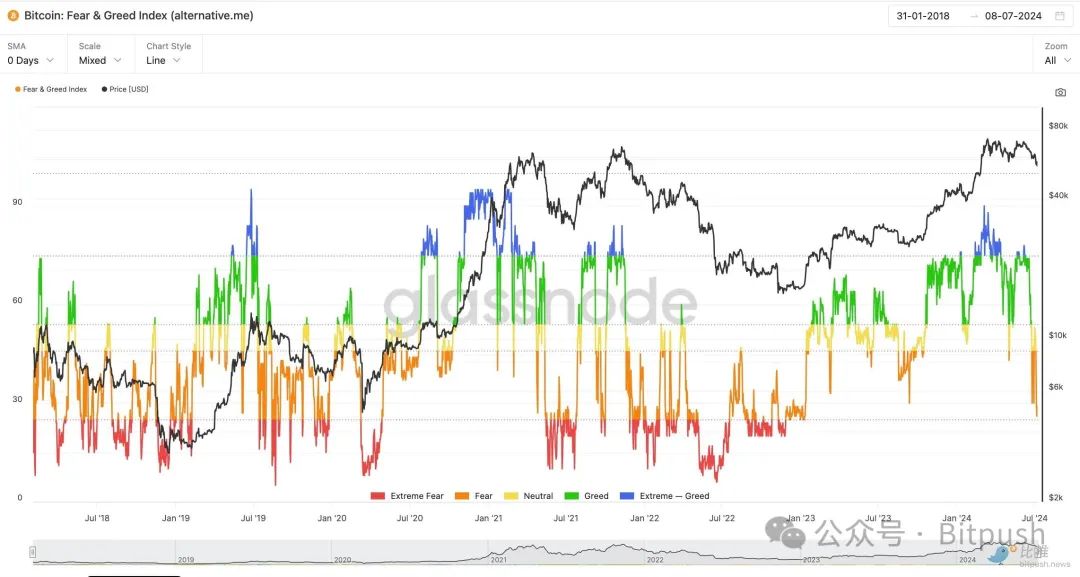

Bitcoin Fear and Greed Index Falls to Lowest Level Since January 2023

According to data from Glassnode, the BTC Fear Greed Index — an indicator that tracks relative market sentiment — has fallen to its lowest level since January 2023, dropping to 27 on July 9.

Lower levels of the index indicate negative investor sentiment, while higher levels indicate a hot market where investors are afraid of missing out on profit opportunities.

January 2023 marks just two months after the collapse of cryptocurrency exchange FTX. At the beginning of the month, the Crypto Fear Greed Index was at 26, and Bitcoin was trading at around $16,500. It then rebounded to around $22,000 by the end of the month.

Some analysts believe that the recent correction may be attributed to the panic caused by the German governments sale of more than $3 billion worth of previously seized Bitcoin and the return of Mt. Gox creditors. Mt. Goxs Bitcoin repayment is close to $8 billion, although the timing is still uncertain and creditors may choose to hold rather than sell on the market. Meanwhile, as of July 9, more than 50% of the 50,000 Bitcoins in the German government wallet had been transferred to exchanges.

10x Research founder Markus Thielen said in a market update on Tuesday that BTC’s upward momentum could continue for a while, possibly reaching $60,000, but that the rise will be short-lived and no tactical bullish counter-trend rally is expected in the short term.

He added: “We expect Bitcoin could recover to nearly $60,000 before falling again to the low $50,000s, creating a mixed trading environment.”

Vetle Lunde, senior analyst at K 33 Research, noted on Tuesday that seasonal trends also don’t help Bitcoin, with the third quarter historically tending to have the lowest returns.

He added that seasonal weakness, combined with the German government’s sale of seized assets and the ongoing distribution of Mt. Gox refunds, weighed on prices. These selling pressures are expected to weigh on the market in the coming months, and market volatility is expected to continue into October, according to estimates by K 33 Research.

Signs of a turnaround

As the market moves lower, technical and fundamental analysts offer some ideas for what might happen next.

According to CryptoQuant analyst Crypto Dan, the Bitcoin Puell Multiple “is often good for finding bottoms in bear markets, but can also predict the end of corrections in bull markets.”

He explained that the area circled in red in the above figure is the situation where miners profitability declined rapidly during the bull market cycle and the Puell multiple indicator plummeted. The indicator fell sharply during the bull market cycles in 2016 and 2020, and then Bitcoin began to rise strongly.

Crypto Dan said: “Currently, similar movements have been detected, and while it is difficult to determine the exact end of the correction period, it can be expected that it will not be too far away. We are likely to see the bull market resume within the third quarter of 2024.”

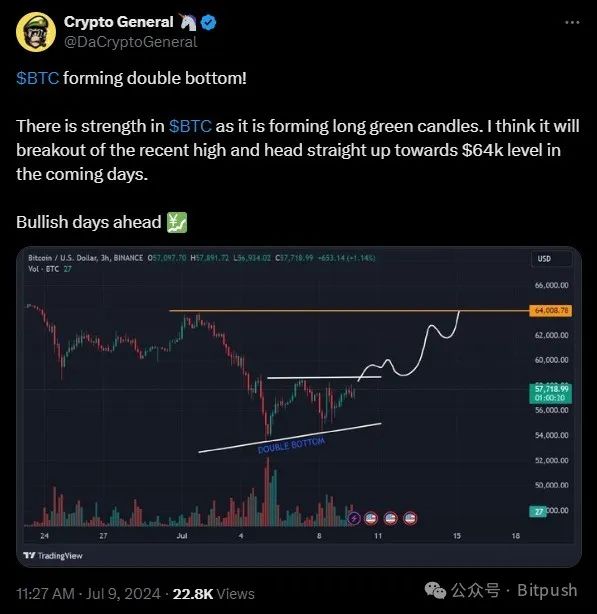

After Bitcoin’s recent drop below $55,000, crypto market analyst Crypto General on the X platform pointed out that a “double bottom” pattern is forming and predicted a rebound to $64,000 in the short term. He believes that for Bitcoin to continue its rally, it needs to hold support at the 4h 50 EMA, which is currently close to $58,000.

This article is sourced from the internet: BTC Fear and Greed Index hits an 18-month low, is a bottom signal emerging?

Related: VC perspective: How to solve the chronic poison of high FDV, low circulation

This article comes from: Hack VC Partner Ro Patel Translator: Odaily Planet Daily Azuma Current status of token lock design In the current market cycle, the high FDV, low circulation token issuance method has gradually become a mainstream trend, which has caused investors to worry about the sustainable investment potential of the market. It is expected that by 2030, a large number of tokens will be gradually unlocked in the cryptocurrency market. Unless demand is significantly increased, the market will inevitably withstand these potential selling pressures. Historically, network/protocol contributors (including teams and early investors) usually receive a certain percentage of tokens as rewards, which are locked up according to a specific time limit structure. As the main development force in the early stages of the network/protocol, contributors should indeed be…