Bitcoin, Ethereum และ 7 หุ้นยักษ์ใหญ่ของสหรัฐฯ หุ้นตัวไหนมีผลงานดีกว่ากัน?

Original article by Shane Neagle, Coingecko

Original translation: Tao Zhu, Golden Finance

The Big Seven stock phenomenon is the result of consolidation. When a company monopolizes a particular market space, it gains enough momentum to continue growing and gobble up startups that might threaten it later. In addition, these companies tend to scale their products more efficiently, further consolidating their market position.

This process happened to Apple (AAPL), Microsoft (MSFT), Alphabet (GOOGL), Meta Platforms (META), Amazon (AMZN), Nvidia (NVDA), and Tesla (TSLA). Bank of America analyst Michael Hartnett called them the Big Seven in April 2023. In that time, these stocks contributed 88% of the returns to shareholders.

Even as Tesla is losing ground, the Magnificent Seven is still outperforming the broader market. The Roundhill Magnificent Seven ETF (MAGS) has returned 35.8% so far this year, while the broader benchmark SP 500 (SPX) has returned 15.1% over the same period.

The Big Seven stocks (comprising about 30% of the SP 500) represent the concentrated market for U.S. tech stocks by virtue of their outsized market performance. So how do they compare to that other technology with no revenue: blockchain networks?

Specifically, how do the Big Seven stocks compare to Bitcoin (BTC), which represents proof-of-work, and Ethereum (ETH), which represents proof-of-stake?

Are cryptocurrencies outperforming the Big Seven?

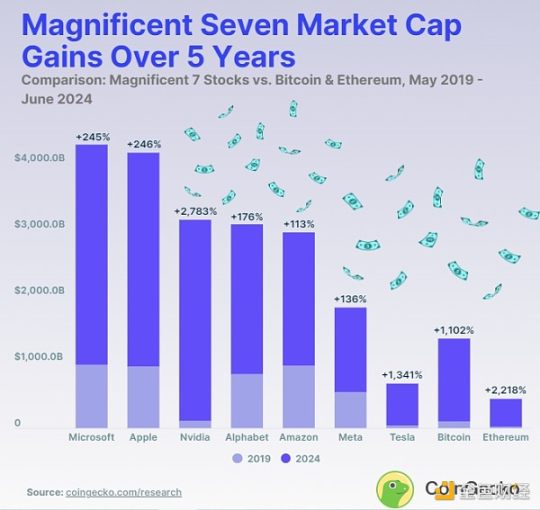

Cryptocurrencies have outperformed most of the Big Seven stocks, but they also have a significantly lower market cap compared to stocks in 2019. How have the Big Seven, Bitcoin, and Ethereum performed?

Sorted by market capitalization weight, the ranking within five years (from May 7, 2019 to June 28, 2024) is as follows:

In terms of valuation growth rate, Nvidia and Tesla are clear winners, growing by 2,782.8% and 1,102.2% respectively. Amazon and Meta are the slowest growing companies.

The two companies have a combined market capitalization of $15.770 trillion, up 262.5% from $4.35 trillion five years ago.

Nvidia has outperformed Bitcoin and Ethereum over the past five years

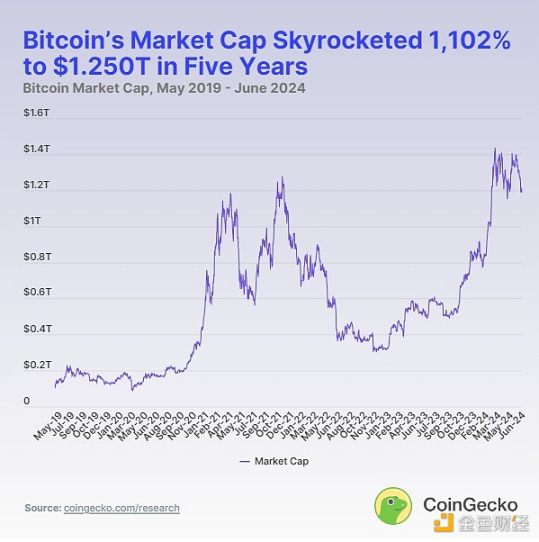

Nvidia is the only stock among the Big Seven that has outperformed Ethereum and Bitcoin over the five-year period. Its market cap has grown from $105.42 billion to $3.039 trillion, an increase of 2,782.8% during this period. As of June 28, 2024, Bitcoin and Ethereum account for 66.9% of the total cryptocurrency market cap of $2.46 trillion, at $1,250 billion (49.9%) and $421 billion (17.0%), respectively.

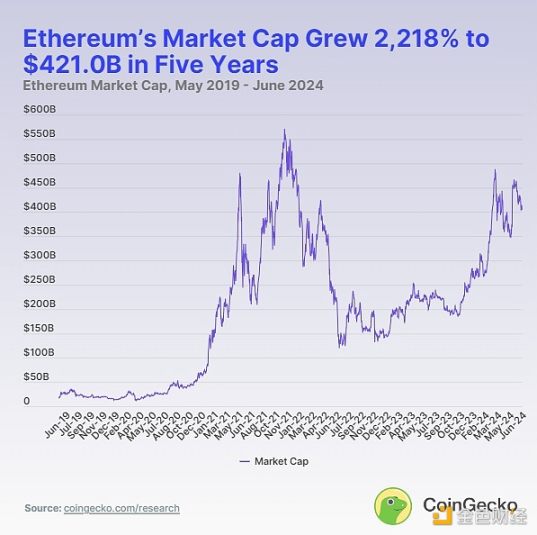

Over the past five years, from May 8, 2019 to June 28, 2024, Ethereum鈥檚 (ETH) market cap has increased from $18.16 billion to $368.3 billion, a 1,880% increase in market cap.

Over the past five years, from May 8, 2019 to June 28, 2024, the market capitalization of Bitcoin (BTC) has increased nearly sixfold from $103.98 billion to $1,257.16 billion, a 1,109% increase in market capitalization.

In other words, considering Ethereum was launched six and a half years after Bitcoin, Ethereum has outperformed Bitcoin by 1.7 times. Therefore, Ethereum鈥檚 growth benchmark is a lower market cap. Compared to the Big Seven stocks:

-

Ethereum鈥檚 market cap performance was consistent with Nvidia鈥檚 at 2,218.3% and 2,782.8%, respectively.

-

Bitcoins market capitalization performance is consistent with Teslas, at 1,102.2% and 1,340.8% respectively.

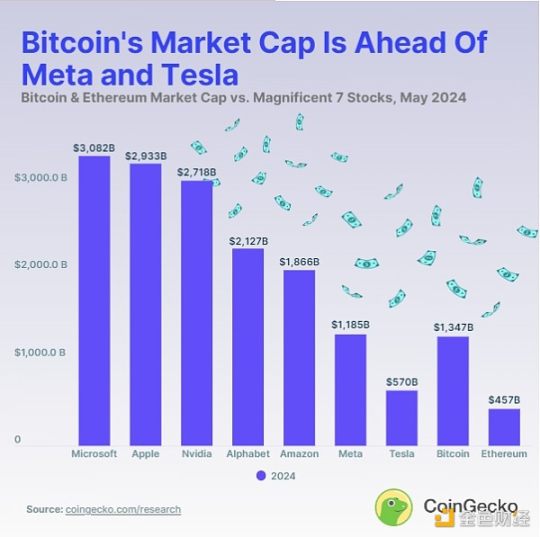

How do the market caps of the Big Seven compare to Bitcoin and Ethereum?

To the surprise of many, the U.S. Securities and Exchange Commission (SEC) changed its stance on Ethereum ETFs. As of May 23, 2024, the market regulator approved three exchanges to list and spot trade Ethereum funds. There are a total of eight Ethereum ETFs listed on NYSE Arca, Nasdaq, and CBOE BZA.

Taking this new development into account, the comparative market capitalization of all the Big Seven, excluding Bitcoin and Ethereum, as of June 28, 2024, is shown below.

Taking into account growth over the past five years, Nvidia and Ethereum have achieved the highest comparable market capitalization growth since May 2019, at 2,782.8% and 2,218.3%, respectively.

Together they hold $17.44 trillion in value, with Bitcoin and Ethereum accounting for 9.6%.

Difference in market capitalization between Bitcoin and Ethereum

As can be seen in the above chart, the ups and downs of Bitcoin and Ethereum are consistent with bullish and suppressive events.

-

PayPal announced the integration of cryptocurrencies in October 2020.

-

Elon Musk abandoning BTC payments in favor of Tesla is a major dampening event.

-

The Terra (LUNC) crash in May 2022 ended the bull run.

-

The Federal Reserve began raising interest rates in March 2022, maintaining the suppressive momentum.

-

After several bankruptcies including BlockFi and Celsius, 2022 ended with the collapse of FTX, the third-largest cryptocurrency exchange by trading volume in November.

-

Since the banking crisis in the United States in March 2023, BTC and ETH have begun to recover.

However, Bitcoin and Ethereum鈥檚 growth diverged more after the SEC approved 11 Bitcoin ETFs on January 11, 2024. Since this milestone of institutional adoption, Bitcoin鈥檚 market cap has increased by 50% from $838.38 billion to $1.25 trillion.

During the same period, Ethereum鈥檚 market cap increased from $281.14 billion to $421 billion, also up 50%. This is not surprising, as Ethereum is about to launch its own ETF lineup. However, Ethereum鈥檚 market is much smaller than Bitcoin鈥檚, so one might expect it to perform better.

This article is sourced from the internet: Bitcoin, Ethereum and the seven giants of US stocks, which one performs better?

Related: SignalPlus Macro Analysis Special Edition: Half Way Through

An unusually quiet first half of the year has come to an end, and a quick review of the first half of the year shows that the SPX, Nasdaq, Nikkei and gold prices have outperformed, while on the other hand, the Japanese yen, Japanese government bonds, the euro and most recently French government bonds (OATs) have lagged due to the continued zero interest rate policy of the Bank of Japan and Macrons political adventure of early elections. Not to be outdone, the US dollar has also remained near its highest level in the past 30 years as AI continues to drive capital inflows, strong economic conditions and high benchmark interest rates. This year, the outstanding performance of the US capital market continues to exceed the expectations of most skeptics. As…