ด้วยค่าใช้จ่าย 87 ล้านเหรียญสหรัฐในครึ่งปี งบประมาณเพียงพอสำหรับใช้อีกเพียง 2 ปีเท่านั้น

ต้นฉบับ | Odaily Planet Daily ( @โอเดลี่ไชน่า )

ผู้แต่ง : อาซึมะ ( @azuma.eth )

On June 29, Polkadot community members Alice und Bob and Jeeper released the Polkadot Treasury operation report for the first half of 2024 on the official governance forum. Some of the numbers mentioned in the report are surprising enough, which has aroused the communitys doubts about the current operation status of the Polkadot Treasury and concerns about its future sustainability.

Astronomical expenditure

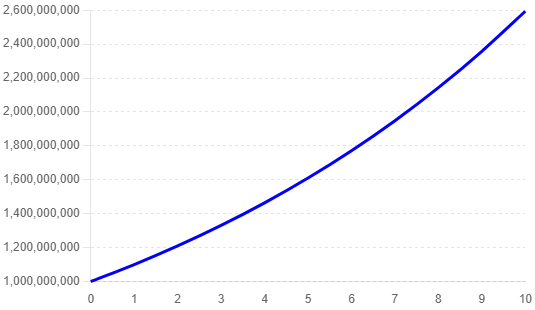

The key points of the report are: In the first half of 2024, the Polkadot Treasury spent a total of US$87 million (11 million DOTs). Considering that the current reserve balance of the treasury is 245 million (38.2 million DOTs), if calculated at the current spending rate, these reserves will only be enough for the Polkadot Treasury to support it for another 2 years…

This set of unexpected numbers obviously shocked the entire industry. Kain Warwick, founder of Synthetix, commented sharply: Polkados treasury is burning money faster than hackers stealing money.

After the shock came confusion, many community members expressed on social media that it was hard to imagine how Polkadot burned $87 million in just half a year.

Where did the expenditure go?

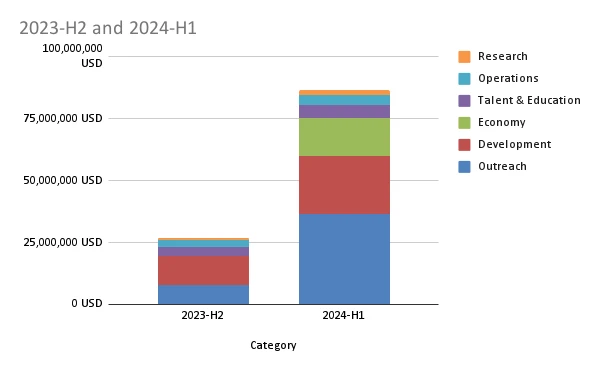

According to the detailed explanation in the “Payment” section of the report, the Polkadot Treasury’s DOT (coin-based) expenditures increased 2.4 times in the first half of 2024 compared to the second half of 2023, but due to the increase in the price of DOT itself, the Treasury’s U-based expenditures increased 3.2 times.

From the perspective of expenditure categories, Polkadots treasury expenditures mainly fall into six directions: research, operations, talent education, economy, development, and marketing . From the comparison in the figure below, although the expenditure structure has changed slightly, the absolute value of expenditures in these six directions has increased compared to the second half of 2023.

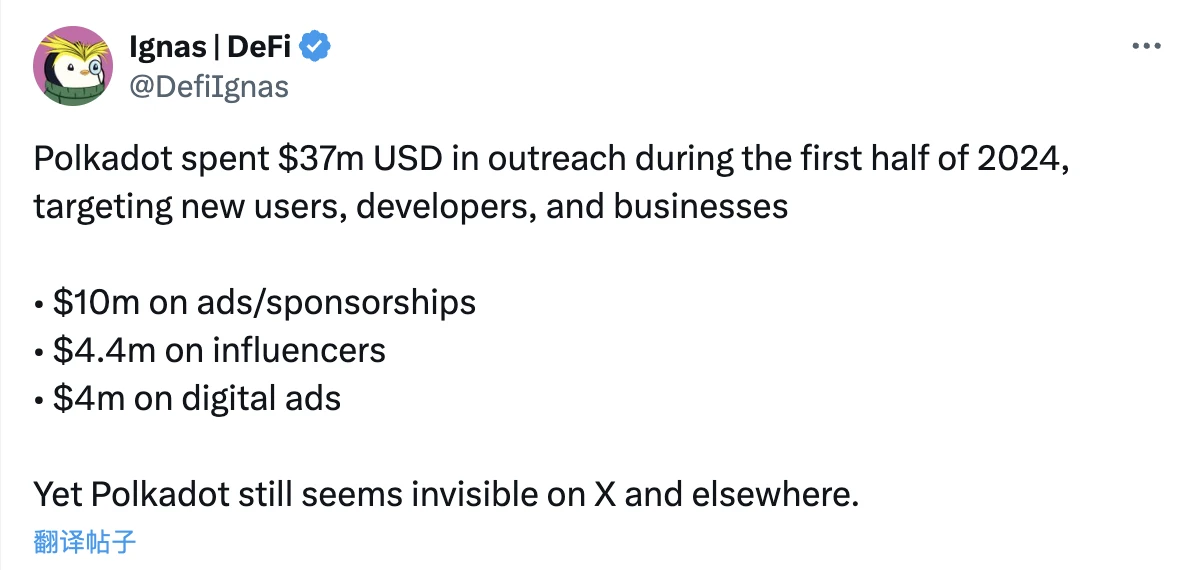

The largest expenditure was on outreach, with a total expenditure of $37 million . Marketing expenditure includes advertising and media expenses, online and offline community activities, and sponsorship of large conferences and business development activities. Among them, advertising expenses accounted for the largest share, with a total expenditure of $21 million, including $6.8 million sponsorship for a football club, $1.9 million sponsorship for racing driver Conor Daly, and $1.3 million sponsorship with e-sports organization HEROIC.

The second-largest spending direction is Development, with a total expenditure of US$23 million, of which US$5.1 million is used for the functional development of the Polkadot protocol and SDK, US$4.1 million is used to develop data services and indexing functions, and US$3.9 million is used to support the development of wallets such as SubWallet, Talisman, and Nova.

Following closely behind is the expenditure in the Economy direction. As the main expenditure item for many other public chain ecosystems to attract traffic, Polkadots expenditure in this regard seems to be much less, spending only US$15 million on liquidity incentives.

In the direction of talent and education, Polkadot invested a total of US$5.5 million in the first half of the year. Ecosystem training and hackathons accounted for the vast majority of the total, of which US$3.1 million was spent on the Polkadot Blockchain Academy series of activities and multiple hackathons, with an average cost of between US$60,000 and US$600,000 per event.

In terms of operation, Polkadot spent a total of $3.8 million in the first half of the year. Among them, the largest expenditure came from governance, with a total expenditure of $2.5 million, including OpenGov funding a foundation in the Cayman Islands for $640,000 as a legal package.

Research is the area where Polkadot spends the least, with a total expenditure of US$2.1 million in the first half of the year.

How much reserves are left ? Can income grow?

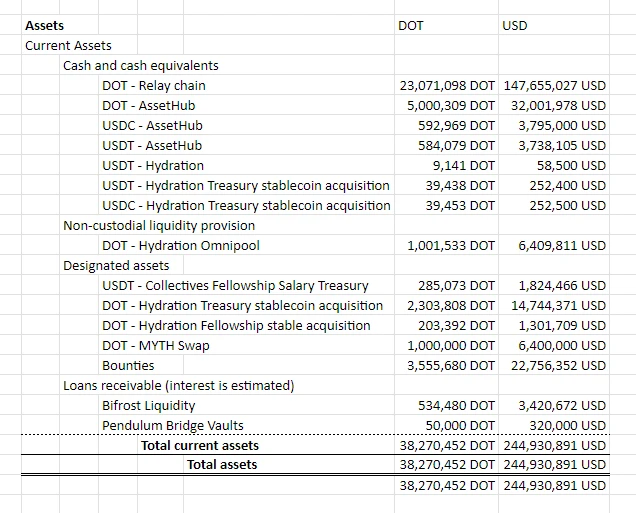

As mentioned earlier, the total value of the remaining reserves in the Polkadot Treasury is currently US$245 million, equivalent to 38.2 million DOTs, but the composition of these remaining reserves needs to be further clarified.

In short, the remaining reserves of the Polkadot Treasury are composed of:

-

Cash and cash equivalents: 29 million DOT (about 188 million US dollars) , mainly including DOT, USDT, and USDC held by Polkadot in the relay chain, AssetHub, and Hydration, which can be used by the treasury immediately;

-

Non-custodial liquidity supply: 1 million DOT (about 6.4 million US dollars) , mainly refers to the 1 million DOT unilateral liquidity provided by Polkadot on Hydration Omnipool;

-

Designated assets: 7.3 million DOT (approximately 47 million U.S. dollars) , which refers to treasury reserves that can only be used for specific purposes such as salaries and grants;

-

Accounts receivable: 5.8 million DOT (approximately US$3.7 million) , referring to the short-term loans provided by Polkadot to ecological projects such as Bifrost and Pendulum.

Overall, although facing spending pressure, the Polkadot Treasury still has a relatively ideal signal in terms of reserve structure – the overall liquidity situation is very good, and most of the reserves are in a state of immediate use.

As for whether the Polkadot Treasury can generate further revenue, the report also clearly mentioned that direct income from network fees is still negligible. In addition to earning nearly 300,000 DOTs due to a short-term inscription boom in the second half of 2023, regular-time fee income is quite stable – about 20,000 DOTs per quarter.

The report also specifically mentioned passive income from DOT inflation (staking rewards), but the two authors of the report, Alice und Bob and Jeeper, both believe that although the treasury can profit from the current 10% income, the current high inflation rate is destructive and is not conducive to the long-term development of the Polkadot protocol and the stability of the DOT coin price.

The community’s doubts are not without reason

Combining the above income and expenditure and remaining reserve analysis, it can be found that the Polkadot Treasury is currently facing certain sustainability pressures. Although the reserves of more than 200 million US dollars are sufficient, the excessive amount of expenditure and almost negligible income pose a real challenge.

Looking around the community, the focus of doubts is generally on Polkadots astronomical expenditure and its composition, especially the marketing expenditure that accounts for nearly half of it – it is understandable that development requires money, and operations, research, and education combined do not cost much, and the economic incentives are even a little less. Only the marketing expenditure of US$37 million is not only questionable in terms of the scale of investment itself, but the results seem to be only minimal.

In this regard, the well-known overseas KOL @Ignas questioned: Polkado spent $37 million on marketing, but they have almost no presence on X and other social media platforms.

@Ignas’ description is a bit exaggerated, but it is not without reason. Looking back at the past two years, Layer 2, modularization, chain abstraction, Restaking and other concepts have captured the attention of the market. As a once-popular project, Polkadot’s voice on social media seems to be getting smaller and smaller… Whether it is Jam or Coretime, if you are not a user who actively pays attention to the development of the Polkadot ecosystem, how many people know what this means?

It is even ironic that today’s controversy about Polkadot’s “too high marketing expenses” has become the biggest exposure of Polkadot, a cryptocurrency with huge marketing investments, on social media in recent times.

A few months ago, a community member who has been working on the Polkadot ecosystem for a long time mentioned to us: “For community participants, the greatest value of Polkadot lies in the treasury. ”

If the treasury continues to be consumed in the current questionable manner, the next thing that may be in doubt is the future of Polkadot.

This article is sourced from the internet: With an expenditure of 87 million US dollars in half a year, the budget is only enough to last for another two years. How does Polkadot plan to survive after that?

Related: The ecological project party ran away before the airdrop, and zkSync became a rug chain?

The long-awaited star project Ethereum L2 ZKsync is finally going to issue tokens. Today, the community is full of users sharing the amount of ZKsync airdrop tokens. As of the time of writing, the pre-market trading market ZK on Whales is temporarily reported at $0.9. It is reported that the airdrop share of early users is 3.675 billion ZK tokens, accounting for 17.5% of the total. In order to obtain airdrops, users have to interact diligently with the ZKsync ecological project. However, just a few days before the coin issuance, a project owner took advantage of the main network upgrade to abscond with the funds, adding another rug army to ZKsync. User fundraising was locked, and the project owner untied and ran away This time, the rugged project is GemSwap,…