เมื่อการสตรีมสดเกิดขึ้นใน Web3: Pump.fun จะสร้าง “ความมหัศจรรย์ของการสตรีมสด” หรือไม่

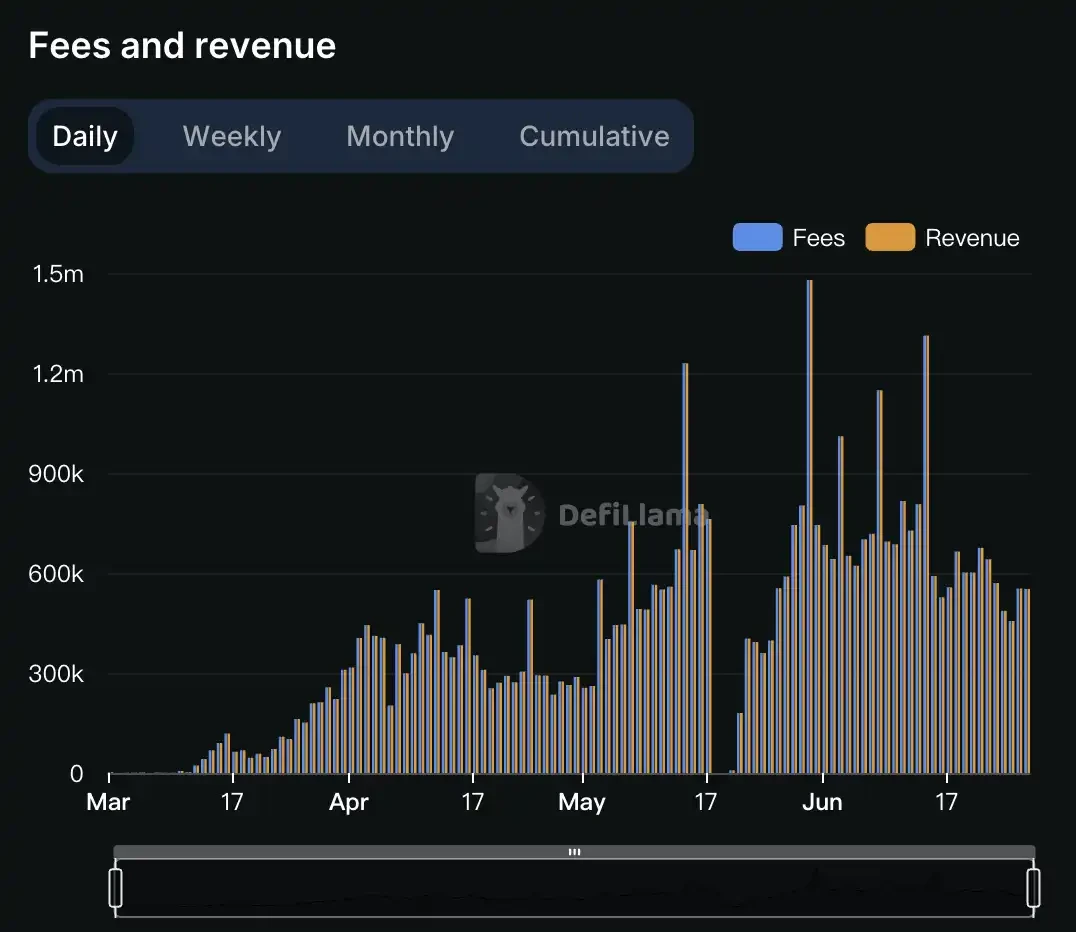

Pump.fun is the most special product in this cycle. Since its launch more than 4 months ago, more than 1.17 million tokens have been issued on Pump.fun, and the cumulative revenue has exceeded 50 million US dollars. How to understand this number? Compared with Uniswap, the top traffic product in the previous bull market, it is estimated that Uniswap Labs annual revenue is about 25 million to 30 million US dollars.

It can be said that Pump.fun is not a typical Web3 project. It does not have a complex token economics model or a DAO governance mechanism. However, with its precise market positioning, Pump.fun has created a business market that is sure to make money. Under the dominance of the attention economy, many people will interpret the continued prosperity of the meme coin track as the advantage of short videos over long videos. So in the era of everyone issuing coins, can latecomers still get a share of the pie? With the attention economy and extreme pvp, what new tricks will the meme coin have?

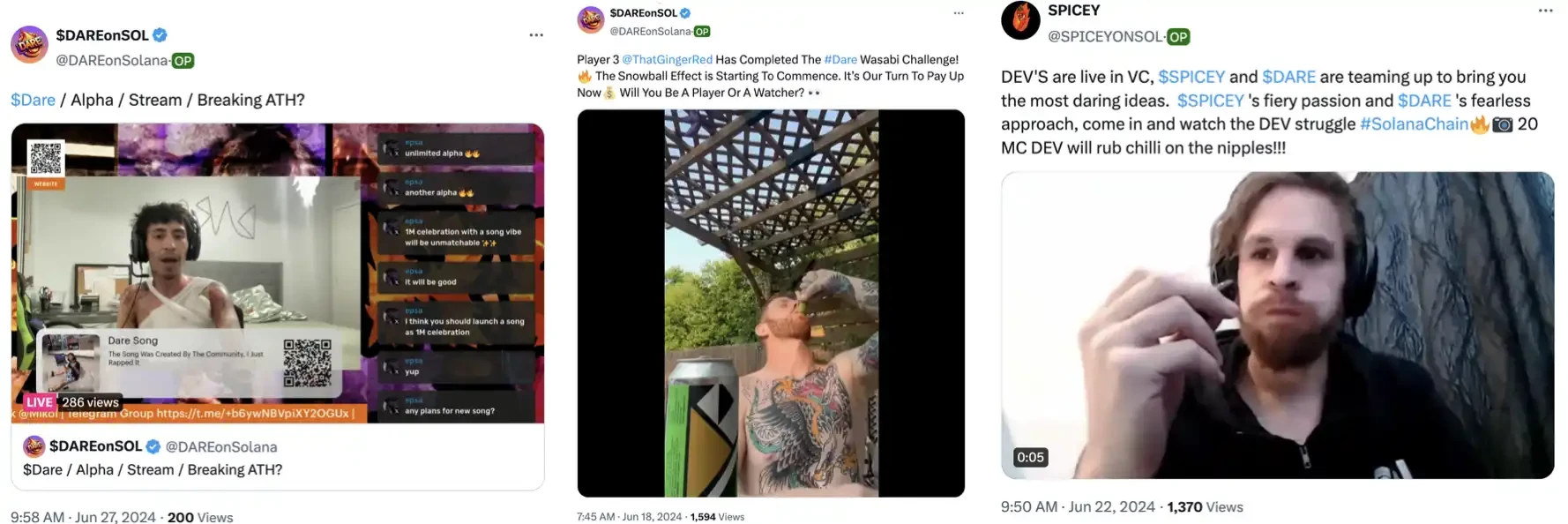

The guy who burned himself to promote meme coins is still live streaming

Remember the developer who burned himself a month ago for promoting his own meme coin? Last Thursday, June 27, he was live on Twitter.

The developer is named Mikol. On May 17, he launched a meme coin called TruthOrDare (DARE) on Pump.fun. At that time, Pump.fun did not have a live broadcast function, and pictures could only be posted in the comment area. Mikol showed the community the highlights of the first season in person. He poured isopropyl alcohol on himself live on Twitch and asked his friends to launch fireworks in his direction. Amid the exclamations of fans and the rise of DARE, his body was ignited and he was sent to the hospital with third-degree burns all over his body.

The token DARE gained 12 times on the day Mikol was burned, and then quickly returned to zero the next day. Mikols story was reported by the crypto community media Decrypt, which attracted a lot of attention. Facing such popularity, Mikol, who was lying in the ICU, specially recorded a video to express to the community that he would not give up the operation, You will see a better me.

Mikol is not the only one who posts a meme coin and then uses extreme behavior to attract attention in the hope of rising prices. The Solana meme craze has brought in a large number of crypto newcomers and also spawned many meme coins that watch the line in seconds. In addition to Mikols Burn Coin, there are also meme coins named LIVEWITHMOM and seeking to buy by live broadcasting naked private parts of the body.

Although the life cycle of these meme coins is extremely short and very few have a market value exceeding 1 million US dollars, the combination of live streaming and coin issuance has allowed many people with low incomes to find the code to wealth.

A week after this incident, Pump.fun launched a live broadcast function, and the community’s first reaction was to advise the coin issuer “please don’t burn yourself to make money.”

When Mikols deeds attracted the attention of the community, there were many people who thought that such behavior was too morbid and contrary to the original intention of encryption. Some people also advised Mikol to find a good job after he recovered. But after his condition stabilized, Mikol, who was still in the hospital, started live streaming on Twich and live streaming on Pump.fun. As he wished, his comeback to live streaming pushed DARE up 15 times again.

The comeback only lasted for one day, and the price of DARE continued to fall, and it seemed difficult to have the momentum to rise again. But since then, Mikol often broadcast live with a bandage on, performing eating raw eggs, swallowing cinnamon powder, and his daily recovery. There are also new members joining his TruthOrDare family, showing unique skills such as eating mustard and eating dried peppers.

Except in rare cases, Mikol and his DARE may not get the same attention as before. There are many more Mikol on the Internet, hoping to gain the attention of the community and make their memes soar by being abstract and impactful enough.

Those with high traffic have already started to issue coins, from Jenner to Mother, Father, etc. The wave of celebrity coins has made the issuing teams and early followers rich. Although people like Vitalik have expressed their opinions against this phenomenon, it is difficult to stop the trend of entertainment to death in the crypto community.

Perhaps it can be said that the newcomers to the crypto community this time come from the downstream market. The market for meme coins is still huge, but unlike the meme coins such as DOGE and PEPE that had some connection with the crypto community, the current meme coin craze points to a new direction, the downstream market outside the crypto community.

The crypto market is undergoing a transition from PGC to UGA

There are many practical reasons for the emergence of the meme craze. Admittedly, the crypto narrative in this bull market is not as attractive as before. Compared with the value coins with opaque chip distribution and grand narratives, newcomers are more willing to use memes as their first stop to experience the circle.

Behind this, more and more users have seen through the ultimate PVP logic. No matter how varied the narrative is, it is just to create a ponzi-like plate and wait for the next person to take over. The market is not short of people who issue coins, but people who can tell a good story about issuing coins. Since the consensus of the community has become the essence of value coins is also a kind of air coin, it is better to do it in one step and issue coins yourself. The birth of Pump.fun is just in time.

The emergence of Pump.fun allows users to publish their own meme coins with one click at a very low cost (0.02 SOL). Rounds of memes take off and crash in a few hours. More than 10,000 tokens are released on Pump.fun every day, accounting for more than 80% of the total Solana ecosystem tokens. Recently, Pump.funs daily revenue has been between 450,000 and 1 million US dollars, and the total revenue has exceeded 50 million US dollars since its launch a few months ago.

As Youbi Capital pointed out in an analysis report released in May, the popularity of low-liquidity assets is an inherent reaction to the lack of liquidity in the market in the current cycle. It also has a potential metaphor that the sharp increase in the number of coins issued after the transition from PGA (Professional Generated Asset) to UGA (User Generated Asset) has led to an increasingly decentralized consensus.

However, new opportunities still exist.

Three days ago, DEX Screener launched the token issuance platform Moonshot. More than 7,000 tokens were issued on the first day of its launch. During the same period, Solana was also recognized by the community for launching blinks, a feature that allows tokens to be traded on Twitter. Combining these two hot topics, the meme coin SC has increased more than 100 times in two days, indicating that the market wants to grab the cake of the token issuance platform, and users are also looking forward to the new story after Pump.fun.

After all, crypto technology has unprecedentedly and greatly lowered the speed and threshold of asset issuance and trading, and its potential application market is still very large. As long as the communitys demand for attention monetization remains, the crypto market will still have a narrative to tell.

What if live streaming happens on Web3?

In the traditional Internet, the attention economy industry has been developing for about 20 years, going through the transition from the forum post bar era to the picture and text microblog era, and then to the short video live broadcast era. And this trajectory is also happening in the encryption field.

On May 29, pump.fun announced that it had launched a live broadcast function on its platform. For a website that makes money by playing games, users do not really need to watch live broadcasts. However, live broadcasts are the form of communication with the largest amount of information, the most scene-based and appealing content, and the asset issuance function, which is worth imagining from the perspective of attention economy.

Make commercialization as simple as possible

The commercialization path of Web3 is completely different from that of the traditional Internet, but in terms of attention economy, the typical cases of Web2 can provide some inspiration to the crypto industry.

Take Kuaishou as an example. In 2013, less than two years after its launch, Kuaishou decided to transform from a GIF production tool to an Internet community. Users can create content on Kuaishou, record and share their lives and creativity through short videos, and interact with fans. Unlike new platforms such as Douyin, Kuaishous user positioning is average people in society, and its users are mainly young people in second- and third-tier cities.

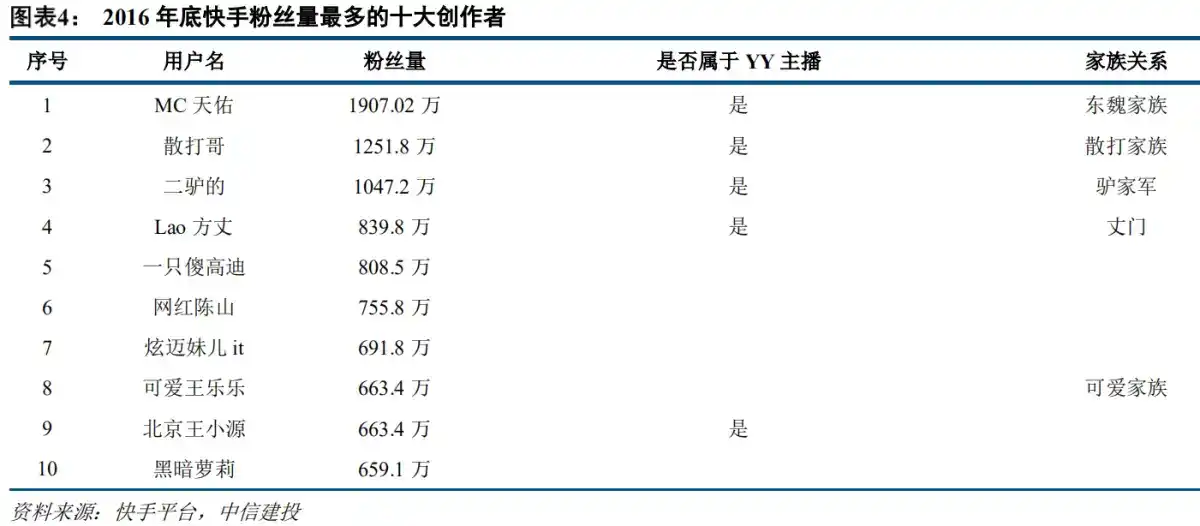

In 2014, YY anchors with a group of loyal fans in the sinking market joined Kuaishou, and Kuaishous monthly active users were 1 million at that time. At the end of 2016, Kuaishous monthly active users exceeded 64 million. In the two years when Kuaishou was growing rapidly, YY anchors occupied the top four places on the list of Kuaishous top anchors during the same period.

Kuaishou has maintained the characteristics of the sinking market community. It does not sign internet celebrities, does not provide traffic support, and its fair algorithm mechanism encourages the vigorous development of UGC content. Compared with products of the same period, Kuaishou ultimately stood out with its unique decentralized community model.

In 2017, Kuaishou took the lead in seizing the dividends of live broadcasting and became the worlds largest single live broadcasting platform. According to Kuaishous prospectus, from 2017 to 2019, the companys revenue was 8.3 billion, 20.3 billion, and 39.1 billion yuan, respectively, of which the live broadcasting revenue was 7.9 billion, 18.6 billion, 31.4 billion, and 17.3 billion yuan, accounting for 95.18%, 91.63%, 80.31%, and 68.38%, respectively. It can be seen that live broadcasting was Kuaishous core business at the time and also the background of Kuaishou.

After its booming development, Kuaishou had to adjust its content ecology. After all, traditional Web2 companies all needed to undergo commercial transformation. In this process, only those content producers with high audience consumption levels, who met traditional social values and survived the fierce competition could survive to the end.

Looking back, it is better to say that Kuaishou has targeted the novice market in the attention economy rather than the sinking market. The coin issuance platform, which is also aimed at crypto novices, does not need to consider commercial transformation.

In traditional Internet giants, whether they are content platforms or shopping platforms, they all hope to show users that there are good things worth watching/buying here, because only content that is recognized and loved by more users has commercial value and then brings profits to the platform. But Pump.fun does not need commercialization, and its profit model is extremely simple and pure. It only needs to show there are enough coins and traders here, and as long as there are people trading, Pump.fun can make money.

At present, although Pump.fun has opened a comment area and live broadcast function, users log on to Pump.fun only to complete the buying or selling process. Discussions about meme coins mainly take place on Twitter, and meme coin developers who have the idea of live broadcasting will also choose platforms such as Twitch and Kick for live broadcast promotion.

In the Pump.fun interface, users can only make choices based on the number of comments and token market value. If there is a live broadcast column, will there be a live broadcast god on Pump.fun?

The game of human nature and regulatory challenges

At present, some meme display platforms have emerged, such as Game.com, whose Twitter followers have just exceeded 7,000. It provides paid list token services. By paying 0.8 SOL, you can publish your own meme coins on this platform to gain more attention.

The Pump.fun team seems to have no intention of exploring more on existing services. After all, a small team with a revenue of over 40 million US dollars in half a year and a stable daily income of 600,000 US dollars has no motivation to break the product and innovate the narrative. It is enough to position it as a tool.

As more newcomers enter the crypto space, perhaps live streaming can become a label for other coin issuance platforms such as Moonshot to differentiate themselves.

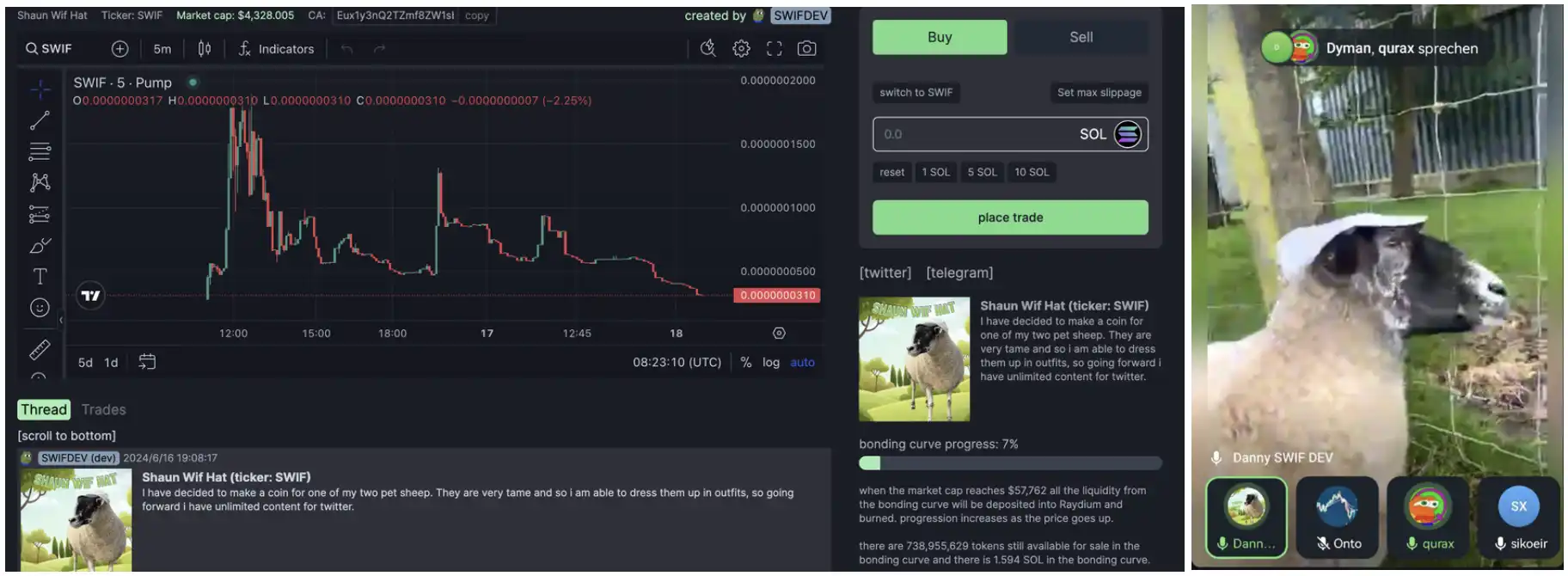

However, the failure of several x to earn projects in Web3 in the past has shown that no matter how sophisticated the design is, it cannot challenge human nature. On June 13, a user launched a meme coin with the theme of a sheep wearing a hat on Pump.fun and broadcast it live at the same time. But just a moment after the live broadcast started, the comments section was still discussing the sheeps actions, and the snipers who bought the tokens at the time of the token release quickly sold most of the tokens at a high price, causing the token price to plummet.

After the token crash, the meme coin issuer explained in the comment section, “My token balance always remains the same and can be verified through solscan. If I just want to make a quick buck, why would I live stream my sheep but not sell my tokens?”

The reason for not selling may be that the token has not been listed on Raydium yet, and until the end, the token has not reached a market value of $60,000. And the issuer has never broadcast his sheep live again.

In addition, regulatory issues are also something that such platforms need to pay attention to. If the live broadcast format is combined with asset issuance, there will inevitably be various extreme and vulgar behaviors to attract attention. When Pump.fun announced the launch of the live broadcast function, the community was most concerned about how the platform would review extreme content. When the issuer posted some pornographic or more extreme inappropriate behavior, should Pump.fun intervene to prevent possible criminal behavior?

บทสรุป

Going back to the meme coin issuers mentioned at the beginning of this article, we can feel the content ecology of the traditional Internet short video platforms in the early years. After several years of development, these platforms have explored a business model with great money-making ability.

As a form of content that provides an immersive experience, live streaming has made people realize in a way that breaks imagination how simple it is to gather traffic. Traffic monetization channels such as rewards and product promotion have also enabled content producers to compete with platform capital to a certain extent.

In the field of encryption, the control of the platform disappears in an instant. However, attention is still the core driving force of the entire market. What will happen if live broadcasting takes place in Web3? Can the extreme utilization of traffic find new forms of expression in a decentralized environment?

Looking back over the years, the crypto industry has seen countless projects that have gone from “innovation” to collapse amid the constant breakdown and reconstruction of consensus. The emergence of Pump.fun is just the beginning.

This article is sourced from the internet: When live streaming happens in Web3: Will Pump.fun create a “live streaming magic”?

Original author: shaqima, crypto KOL (X: @Daji_ 357 ) Where did the funds go? Why don鈥檛 exchanges like your coins? Arrogance is not unsolvable. We can find a way out by learning from past experience. There have been many different opinions on this topic recently. I have conducted a comprehensive reflection from the perspective of the flow of the entire capital market, as well as exchanges and VC business models. I will share it here using easy-to-understand logic and examples. History tells us that the current situation is not unsolvable. The content is divided into several categories: 1. Current market capital distribution and population distribution 2. VC model coins and the operating logic of exchanges 3. Why do exchanges dislike your coin? 4. How to break through in the future?…