เปิดเผยความลับของวิธีการจัดการราคาของผู้สร้างตลาด: นักลงทุนรายย่อยจะหลีกเลี่ยงการถูกตัดราคาได้อย่างไร

Original author: OwenJin 12 (X: @OwenJin12 )

This article is not targeting $P****. I just picked a project with obviously abnormal data in the secondary market, which makes it easier to prove.

This article discusses a common strategy for manipulating spot and contract coin prices. It may be the projects own market value management team, professional market makers, or large hot money investors with large amounts of funds. Therefore, the following text uses the term Zhuang that everyone prefers.

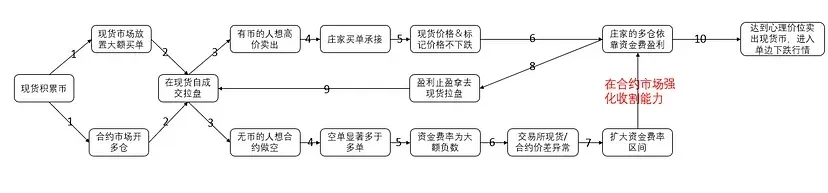

1. Write the simple process first

2. Phenomenon

Do you often see the following unreasonable situations in exchanges?

Phenomenon 1: Low on-chain and spot trading volume, but high contract trading volume

Taking Gate as an example, the contract trading volume is about 60 times the spot trading volume.

Phenomenon 2: Prices are rising but trading volume is gradually decreasing?

The price keeps rising, but the trading volume is getting smaller and smaller, and MACD is also showing a clear top divergence.

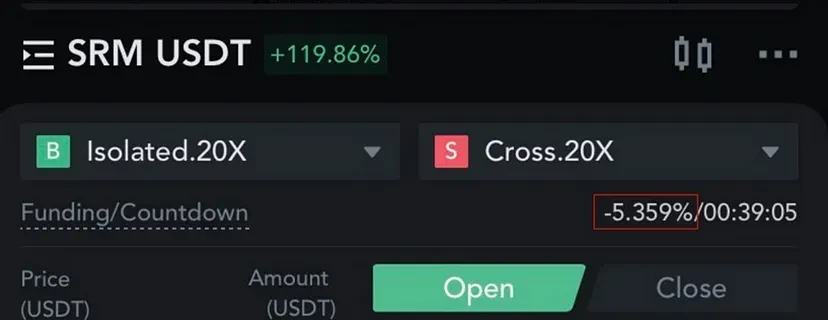

Phenomenon 3: The long-short ratio of spot and futures trading orders is completely opposite, resulting in negative funding rates

The high price caused users to collectively be bearish, but they did not have the coins in hand, so they could only open short orders in the contract. Therefore, the spot and contract markets had completely opposite market sentiments.

Completely opposite market sentiment resulted in a funding rate of -0.66%, with settlement every 8 hours, so -1.98% for 24 hours.

For example, trading derivatives (contracts) is like buying and selling houses. I am a real estate developer, and my houses are mainly for rich person A. A bought all my houses at once. The pricing power only exists between me and A, and we are the supply and demand sides that affect the housing prices.

Although B is not the owner of the house, he believes that the house price will fall. Therefore, B took out 1 million to make a bet with A, thinking that A will definitely lose money on this investment. Then it is difficult for B to succeed, because the circulation price of the house is controlled by me and A , and the transaction between me and A will really affect the circulation price. I and A only need to agree on the transaction price, so B will definitely lose money. The bet between B and A is similar to derivative trading, which will not affect the circulation price of the spot.

Even if B believes that the housing price is inflated and is actually only worth 1 yuan per square meter, that is impossible to achieve, because his transaction is not a spot transaction, but a derivative transaction. Derivative transactions bet on spot prices, so those who control the spot price (me and A) can largely determine derivative transactions.

In the above example, the real estate developer is the project party, A is the banker who controls the spot circulation (possibly controlling the spot price), and B is the contract user.

This is why it is often said that naked short selling in the derivatives market is a very dangerous behavior.

3. Some basic knowledge of contracts that you must know

Knowledge point 1: What is the mark price and the latest transaction price of a contract?

A contract has two prices: the latest transaction price and the mark price. When users buy and sell, the latest transaction price is generally used by default. However, the mark price is used for liquidation. In order to objectively reflect the price situation, the mark price is calculated by using the latest transaction price of the foreign exchange through an algorithm.

Gate’s contract mark price description:

https://www.gate.io/help/futures/futures_logic/22067/instructions-of-dual-price-mechanism-mark-price-last-price

In other words, as long as the spot price is controlled, the mark price can be controlled, and then whether the contract market will be liquidated can be controlled.

Knowledge point 2: What is the funding rate of a contract?

In order to ensure that the latest transaction price of the contract does not deviate from the latest transaction price of the spot market, the long-position user will pay the price to the short-position user, or vice versa, in the form of funding fees every 8 hours, and the gap between the latest transaction price of the spot market and the latest transaction price of the contract will be narrowed.

Knowledge point 3: What is the circulating market value of a project?

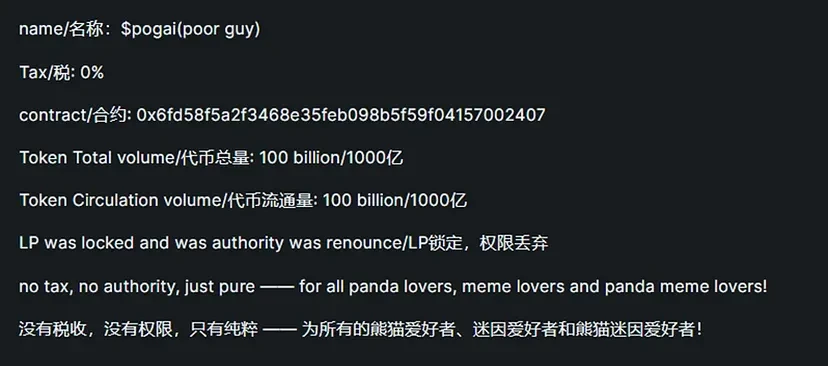

The economic mechanism of a project depends on the white paper. It is generally divided into project parties, early investors, community airdrops, project treasury, etc. If a projects white paper is not transparent enough, it is more likely to be manipulated. For example, although the white paper gives the community enough freedom, it also gives market makers/institutional investors enough freedom – they can get low-priced chips at will, and once they are obtained, they cannot be diluted because there is no additional issuance or linear unlocking mechanism.

4. Small market value contract control process

Step 1: Find a project with a relatively small market capitalization and open a contract on CEX

Generally, small projects with a circulating market value of 1 ~ 10 M USDT are selected, and the contract leverage ratio is generally 20 ~ 30 times.

Step 2: Raise funds, funds > external circulation market value

Million-level hot money investors prefer to be the market maker in small-cap contracts. Take $P**** as an example, with a circulating market value of 5M. During a long decline, if the market maker obtains 60% of the circulating volume at a low price, he only needs to prepare 2M USDT and 3M coins in his hands, and he can fully control the spot and contract prices of this coin.

Step 3: Control the spot price

As long as 3M of coins are not sold, the spot market will have a maximum of 2M sell orders. So as a banker who wants to manipulate the coin price, he will need to prepare 2M USDT as funds to maintain the spot price.

Obviously, even if all $P**** other than those in the hands of the dealer were sold at the same time, the price would not fall.

Step 4: Control the contract mark price

As mentioned earlier, the mark price of a contract is the spot price of each exchange, which means that the mark price of the contract remains unchanged.

Step 5: Open a long contract

After ensuring that the mark price is under control, use your own funds to open any leverage position in the contract. You can open it lower if you are more cautious, or higher if you are more aggressive. It doesn’t matter. Anyway, the mark price has been controlled, and the long position of the banker will never be liquidated.

Step 6: Pull funds or use small counterparties to trade

For coins with poor depth and small market value, it does not take much money to increase the spot price by 100% in one day. If it cannot be increased, then open a small account and place a high-level sell order at a price of + 100%. After the transaction is completed, it will naturally be displayed as the coins recent 24-hour increase or decrease + 100%.

After seeing this news, retail investors will flock in and begin to generate a large amount of short-selling demand.

Step 7: Use funding rates to make stable profits

There are very few sell orders in the spot order book at this time, but there are many short sellers in the contract, which causes the spot price to be higher than the contract price, resulting in a negative funding rate. The larger the gap, the more negative the funding rate, which means that even if the mark price remains unchanged, the short sellers have to pay a high funding rate to the long sellers every 8 hours just for holding the position.

Under this game mechanism, the dealer continues to make money by relying on the funding rate. To give an extreme example, SRM can earn 16% profit every 24 hours as long as the position is not moved.

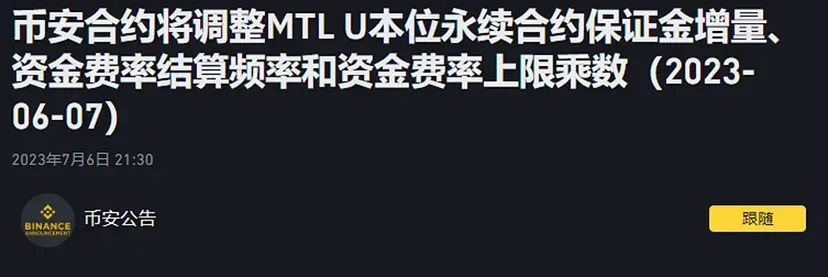

Coincidentally, exchanges have also frequently modified funding rates recently in an attempt to help narrow the price gap between the spot market and the contract market. However, they have not found the root cause of the abnormal funding rate. Expanding the rate range cannot solve this problem, but will help project parties/market makers/institutional investors to harvest retail investors with funding rates.

Adjust LINA funding rate

Adjust MTL funding rate

You will also find that LINA and MTL were the hype coins some time ago, and their contract funding rates are large negative numbers.

5. How do bookmakers make money?

The first profit point: buy low and sell high in spot market.

Please remember that being a banker is not charity, the coins you buy are not gold or BTC, and you must sell them to make a profit in the end. The so-called pump is for the subsequent dump.

The second profit point: contract funding rate.

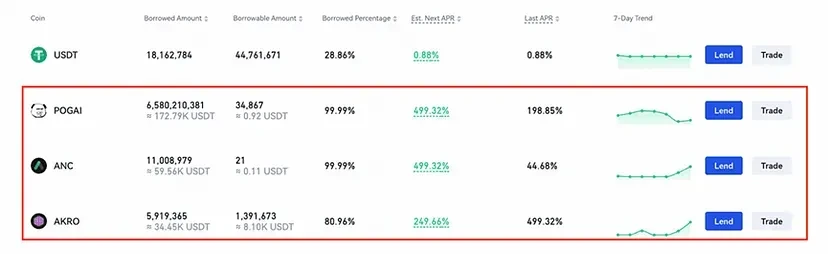

The third profit point: the coins that are not sold can be directly lent out in the leveraged lending market. For example, Gate can be put into Yubibao to obtain an annualized rate of return of 499%+.

After reading the process, you can also find that the premise is to control the circulation of the current currency. If it is a large number of coins with a linear unlocking mechanism, it cannot be manipulated for a long time. Each unlocking will change the circulation.

6. What’s the problem?

Question 1: Can the contract Open Interest (opening position) exceed the spot circulating market value?

Contracts only require USDT to open a position, while spot requires coins to sell. The difficulty of obtaining coins to create selling pressure in the spot market and shorting in the contract market is different.

Back to the third step of the third part, the banker has already collected the coins in his own hands. Even if some users think that the coin is seriously overvalued, they cannot form selling pressure in the spot market. At this time, the user will turn to shorting the contract. In other words, the users trading tendency cannot be released in the spot market due to the problem of low circulation, and can only go to the contract market to short.

Let’s go back to the mark price in the second part. The mark price of the contract is the latest spot transaction price, which has been controlled by the project party/market maker/institutional investor. Therefore, how the contract will be liquidated has also been controlled.

Therefore, when the contract OI is greater than the spot market value, it means that due to the scarcity of the currency, the users trading demand cannot be reflected in the spot price. The extra contract OI will aggravate the phenomenon of price deviation between futures and spot.

Question 2: When the funding rate is abnormal, can expanding the upper and lower limits of the funding rate really promote fairness?

The current solution of the exchange is to increase the funding rate, which ostensibly solves the problem of price difference between the spot and contract markets, but in fact expands the ability of project parties/market makers/institutional investors to harvest retail investors. Generally, the funding rate range of the exchange is now [-2%, + 2%]. Further expansion will actually increase the income of the banker.

Therefore, although the existing funding rate mechanism helps the derivatives market prices anchor the spot market prices, it does not help the trading market become fair. Instead, it may make the trading market more unfair.

7. How to hedge risks as a retail investor

Note 1: Be wary of projects with small market capitalization but high leverage contracts. This gives large investors a very unequal competitive advantage over retail investors.

When users choose to buy spot and open long contracts, enough buyers will be accumulated for the project party/market maker/institutional investor, and they can start to harvest retail investors again by shipping in batches.

Note 2: Projects with higher absolute funding rates

Note 3: The banker does not do charity. The final cost of pulling the market is to make a profit by smashing the market.

If you flee early, be careful not to become the banker’s buyer. When you think “this coin is a valuable coin, I want to hold it for a long time until the next bull market”, it is not far from the banker’s dumping. His purpose of pulling the market is to cultivate this user mentality and take over for himself.

Trading against the dealer in the small-cap contract market is like playing Texas Holdem with him with your cards exposed, where he is both the player and the dealer.

This article is sourced from the internet: The secrets of market makers’ price manipulation methods revealed: How can retail investors avoid being cut?

Related: WSJ exposes DWF Labs for suspected market manipulation, Binance denies the allegation

Original article: Binance denies reports of DWF Labs market manipulation By Zoltan Vardai Compiled by: Odaily Planet Daily Husband On May 9, the Wall Street Journal reported that an anonymous source claiming to be a former Binance insider said that Binance investigators discovered that DWF Labs had conducted $30 billion worth of fake transactions during 2023. When asked about instances of market manipulation, Binance denied the reports. A Binance spokesperson told Cointelegraph: “Binance strongly denies any suggestion that its market surveillance procedures allow for market manipulation on our platform. We have a robust market surveillance framework that identifies and takes action against market abuse. Any user who violates our Terms of Use will be removed; we do not tolerate market abuse.” According to the Wall Street Journal, DWF Labs manipulated…