การคาดการณ์แนวโน้มในอนาคตของตลาด Crypto: การครองตลาดของ BTC และ ETH จะเพิ่มขึ้น

ผู้เขียนต้นฉบับ: คริปโต กลั่น

ต้นฉบับแปล: Felix, PANews

What is the next trend of the crypto market? The market is like a battlefield. The gap between the bear market and the bull market will only get bigger. Crypto analyst Benjamin Cowen made a prediction about the future of the crypto market, believing that the dominance of BTC and ETH will increase, and the trend of altcoins against Bitcoin (ALT/BTC) will be similar to that in the summer of 2019.

ประเด็นสำคัญ:

-

BTC dominance is on an overall upward trend

-

The dominance of blue-chip stocks will further increase

-

ETH/BNB/TON rose against the trend

-

The impact of ETH spot ETF may be exaggerated

-

Once market attention hits the bottom, altcoins hit the bottom

The impact of ETF on Bitcoin:

Many investors are confused by the surge in ETF holdings but the poor performance of Bitcoin. Ben believes that the size of the crypto market is much larger than the flow of ETFs. There are also many overlooked sources of liquidity, such as whale old players.

Why the obsession with ETFs?

The enthusiasm for ETFs is largely based on personal bias. Ironically, the proponents of no key means no coin, coin and key are one are also pushing for ETFs. This inconsistency reveals a key force at work: the greater fool theory (note: the greater fool theory refers to the price of an asset is determined by peoples expectations).

Altcoin Outlook: What are the future trends?

The altcoin market is at a critical support level. A breakout is expected which could trigger a further pullback.

Bens point stems from the fact that most ALT/BTC tend to be volatile.

Why are you bearish on altcoins?

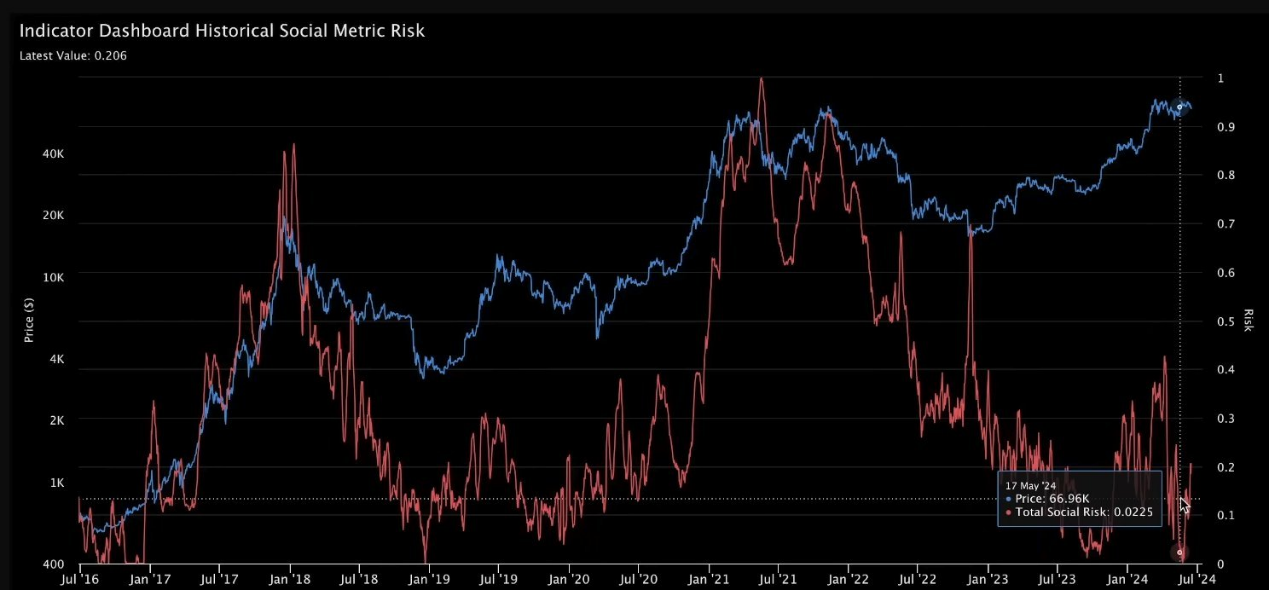

Ben’s bearish view focuses on market attention. Altcoins thrive on the attention they receive, which shapes their narrative and price action. The current Total Social Risk indicator is unusually low at 0.02/1, indicating minimal retail interest.

When will ALT/BTC bottom?

Once the social risk indicator reaches a lower low, ALT/BTC may bottom. The current market situation is similar to the situation in the summer of 2019 before the Fed cut interest rates. Both 2019 and 2024 social interest rebounded before the halving, but then fell again.

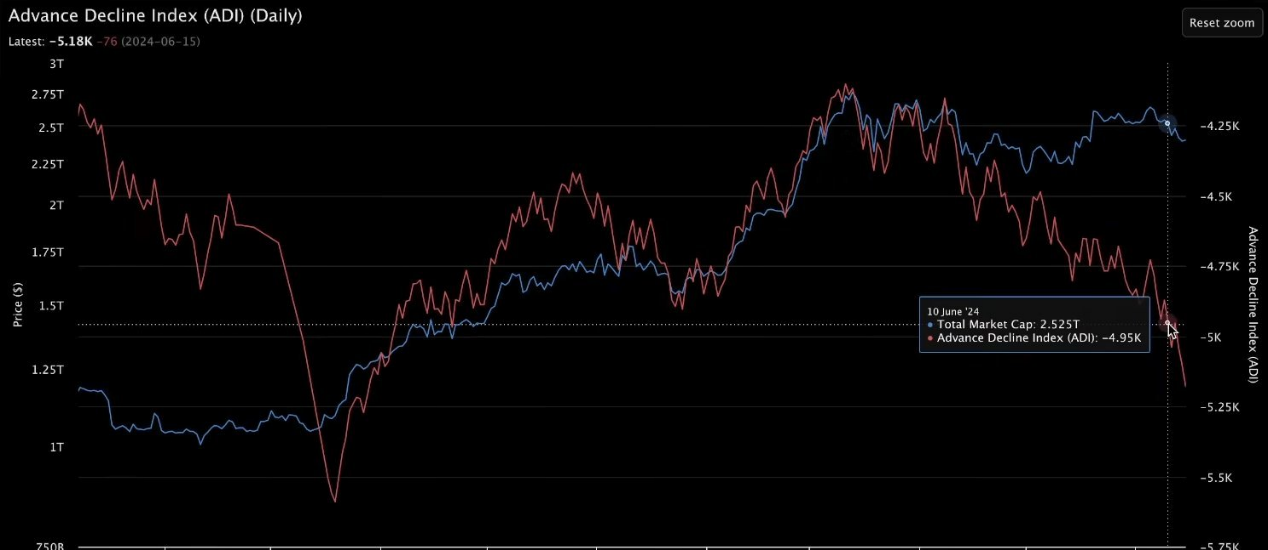

Advance Decline Index (ADI):

One way to visualize altcoin capitalization is to use the ADI. The ADI is an indicator compiled based on the ratio of the number of coins that rise to the number of coins that fall each day, reflecting the overall trend of the market. Recent market trends show that more altcoins are falling than rising. Dont fight the trend.

BTC — The Calm in the Storm

Although Ben is bearish on most altcoins, BTC has some resilience. In addition, Ben also emphasized the relative strength of ETH, BNB and UNI.

Ben did not elaborate on why ETH and UNI are holding up. One plausible reason could be the resilience of DeFi. There are some signs of strength amidst the general weakness in the market.

Weak Total 3

The Total3 indicator (the total market capitalization of all cryptocurrencies except BTC and ETH) remains below its 20 W moving average.

This doesn’t mean altcoins are dead, but selective investing is crucial.

Small market capitalization vs. large market capitalization:

Another interesting perspective is OTHER – Total3/OTHERs. This is a comparison of low market cap altcoins vs high market cap altcoins.

Recently, higher market cap altcoins have significantly outperformed other tokens in terms of returns. Ben expects that lower market cap altcoins may see further declines similar to mid-2022.

Will Bitcoin’s dominance peak soon?

BTC’s dominance has not peaked yet. This is because Bitcoin has not fallen below its 20W moving average. Bitcoin remains stable between $60,000 and $70,000 while other coins are seeing a decline.

BTC dominance is on an upward trend overall:

The notable feature of this cycle is that there is no general rise in altcoins. As a result, BTC dominance is on an upward trend overall.

Blue-chip coins dominate:

This trend also extends to the dominance of blue-chip tokens: BTC and ETH’s dominance is rising.

It is expected that this figure will be close to 73%, and may even reach the upper limit of 80%. The recent market data is about 73%, which has entered the upper limit of the range.

BTC dominance (excluding ETH):

The recent drop in BTC dominance is entirely due to the hype of the ETH spot ETF. Apart from ETH, BTC dominance remains strong.

ETH/BTC Outlook:

The hype of spot ETFs may boost ETH temporarily. However, ETH/BTC is expected to trend downward in the long term. This is because the US monetary policy has not changed, although Bitcoin has performed well in difficult times.

When will ETH/BTC bottom out?

ETH/BTC could bottom out after the Fed cuts rates or the end of quantitative tightening, but those events have yet to happen.

In the context of restrictive monetary policy, BTC could outperform ETH.

What are the conditions under which prediction fails?

Ben is open to the possibility of ETH outperforming. Especially if ETH/BTC remains above the bullish range in July. It is worth mentioning that Ben did not predict the ETH price surge in late May. Therefore, this prediction may be wrong again.

It is worth noting that in the crypto space, pessimistic views are often easier to rationalize than optimistic ones. However, it is important not to forget the irrational nature of the market. Strong reflexivity can cause huge price fluctuations in an instant.

PANews Note: Reflexivity means that rising prices attract buyers, who chase higher prices and push prices up further until the process becomes unsustainable. The same process can be reversed, causing prices to fall to a catastrophic collapse.

This article is sourced from the internet: Crypto market future trend prediction: BTC and ETH dominance will increase

Original title: Have listed Bitcoin mining companies become high-quality investment targets? The top 10 have mined more than 20,000 BTC this year, and transformation and integration after halving have brought new changes Original author: Nancy, PANews Spending huge sums of money to acquire chip developers to develop new products, spending huge sums of money to purchase mining machines/mines to expand computing power, renting out data centers to increase revenue sources, deploying AI to try to diversify and transform businesses, selling a large number of company shares or Bitcoin to raise funds, and massively increasing holdings to swallow competitors… After the halving event, the news that followed is showing the various aspects of mining companies facing the test of survival. In fact, since 2024, the movements of listed mining companies have…