Financing Express of the Week | โครงการที่ได้รับการลงทุน 21 โครงการ มียอดเงินทุนรวมที่เปิดเผยประมาณ

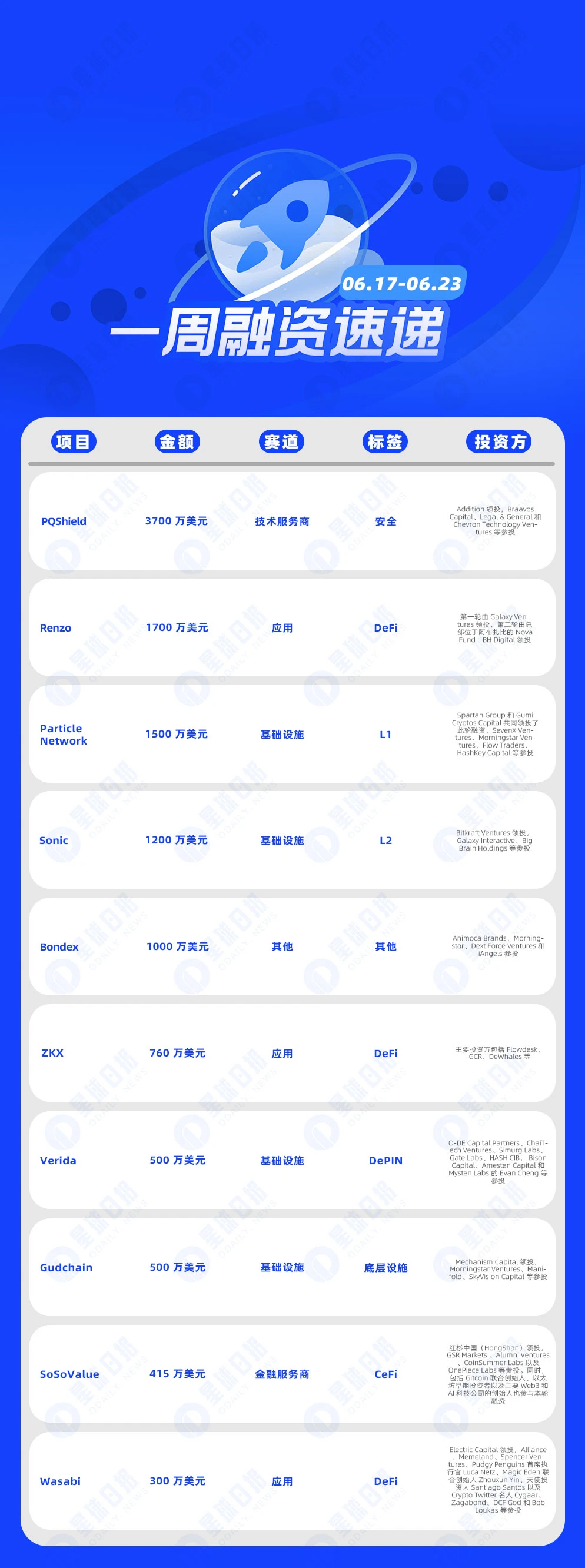

According to incomplete statistics from Odaily Planet Daily, there were 21 blockchain financing events announced at home and abroad from June 17 to June 23, which was a decrease from last weeks data (30). The total amount of financing disclosed was approximately US$128 million, which was an increase from last weeks data (US$125 million).

Last week, the project that received the most investment was security startup PQShield ($37 million); followed by liquidity re-staking protocol Renzo ($17 million).

ต่อไปนี้เป็นกิจกรรมการระดมทุนโดยเฉพาะ (หมายเหตุ: 1. เรียงตามจำนวนเงินที่ประกาศ 2. ไม่รวมการระดมทุนและกิจกรรม MA 3. * หมายถึงบริษัทแบบดั้งเดิมที่มีธุรกิจเกี่ยวข้องกับบล็อคเชน):

On June 23, security startup PQShield announced the completion of a $37 million Series B financing round led by Addition, with participation from Braavos Capital, Legal General and Chevron Technology Ventures. The valuation has not yet been disclosed. The new funds will be used to recruit more employees and promote closer partnerships with partners and customers.

On June 18, Renzo, a liquidity re-pledge protocol, announced the completion of a $17 million financing. As of press time, Renzos re-pledge TVL is close to $4 billion. The financing was divided into two rounds, the first round was led by Galaxy Ventures, and the second round was led by Abu Dhabi-based Nova Fund – BH Digital.

On June 20, modular blockchain Particle Network announced the completion of a $15 million Series A financing round. Spartan Group and Gumi Cryptos Capital jointly led this round of financing, and SevenX Ventures, Morningstar Ventures, Flow Traders, HashKey Capital and others participated in the investment. It is reported that this round of financing was completed through the Simple Protocol for Future Tokens. Particles main product is a universal account that allows users to use funds and transactions from different blockchains.

On June 18, Solanas second-layer network Sonic announced the completion of a $12 million Series A financing round, led by Bitkraft Ventures and participated by Galaxy Interactive, Big Brain Holdings, etc. It is reported that its fully diluted token valuation in this round of financing reached $100 million.

On June 19, Web3 talent ตลาด Bondex announced that it had raised over US$10 million in funding, with participation from Animoca Brands, Morningstar, Dext Force Ventures and iAngels. It is reported that Bondex’s goal is to become a gamified version of the professional social network LinkedIn.

On June 20, ZKX, a derivatives DEX based on Starknet and Ethereum, announced the completion of a new round of strategic financing of US$7.6 million. Major investors include Flowdesk, GCR, DeWhales, etc. Previous investors also include Hashkey, Amber Group, Crypto.com, and StarkWare.

On June 22, DePIN network developer Verida completed a $5 million seed round of financing, with participation from O-DE Capital Partners, ChaiTech Ventures, Simurg Labs, Gate Labs, HASH CIB, Bison Capital, Amesten Capital and Evan Cheng of Mysten Labs. The post-investment valuation reached $50 million. It is reported that the new funds will be used to develop Veridas personal data storage infrastructure and provide decentralized storage and encryption services for users personal information.

Gudchain Completes $5 Million Funding, Led by Mechanism Capital

On June 21, Gudchain completed a $5 million financing round led by Mechanism Capital, with participation from Morningstar Ventures, Manifold, SkyVision Capital and others.

On June 23, according to official news, Singapore crypto financial research startup SoSoValue announced the completion of a $4.15 million seed round of financing, led by Sequoia China (HongShan), with participation from GSR Markets, Alumni Ventures, CoinSummer Labs and OnePiece Labs. At the same time, the co-founder of Gitcoin, early Ethereum investors, and founders of major Web3 and AI technology companies also participated in this round of financing.

Memecoin leveraged trading protocol Wasabi completes $3 million financing, led by Electric Capital

On June 18, Memecoin and NFT leveraged trading protocol Wasabi completed a $3 million financing round, led by Electric Capital, with participation from Alliance, Memeland, Spencer Ventures, Pudgy Penguins CEO Luca Netz, Magic Eden co-founder Zhouxun Yin, angel investor Santiago Santos, and Crypto Twitter celebrities Cygaar, Zagabond, DCF God and Bob Loukas. The team will use the funds to expand the team and plans to expand its current team of 6 to 10 people.

EVM storage L1 network development company Decent Land Labs raises $3 million

On June 23, Decent Land Labs, a sovereign Layer 1 blockchain development company dedicated to solving EVM storage problems, announced the completion of a $3 million financing round, with Foresight Ventures, LD Capital, Big Brain Holdings, Longhash Ventures and Web3.com Ventures partners participating. The new financing will be used to expand the projects EVM expertise, ecological incentives and growth rate.

Elys Network Completes $2.5 Million Seed Round, Cogitent Ventures and Others Participate

On June 17, Elys Network, a crypto trading platform in the Cosmos ecosystem, announced on the X platform that it had completed a $2.5 million seed round of financing, with participation from Comma 3 Ventures, Cogitent Ventures, Persistence One, and Kahuna. Elys Network is a DeFi Layer 1 application chain on the Cosmos Hub, providing native Bitcoin staking, automated market making, and multi-asset index pools.

Web3 gaming platform Farworld Labs completes $1.75 million in financing, led by Variant and others

On June 20, Web3 game platform Farworld Labs completed a $1.75 million financing, led by Lemniscap and Variant, with participation from Base Ecosystem Fund and Coinbase Ventures. This round of financing will be used to release products in the third quarter and launch its decentralized Farcade platform for developers to build Web3 games.

On June 19, blockchain event support project EventCHI announced the completion of a seed round of financing of over 1.6 million euros and plans to expand its artificial intelligence workforce.

EventCHI is committed to reshaping the event planning, finance and logistics markets, using artificial intelligence and blockchain technology to support events in various fields. By seamlessly integrating artificial intelligence and blockchain, EventCHI provides a unified platform for cashless payments, NFT ticketing and intelligence.

4 Arts Protocol Completes $1.3 Million Seed Round, Led by Crypto Alpha SB Fund

On June 22, 4 Arts Protocol, a platform project driven by CulArt-memes, announced the completion of a $1.3 million seed round of financing, led by Crypto Alpha SB Fund, with participation from Crypto Store LB Capital, NOBI Capital, Crypto View and CoinDEX CEO Gupta King, as well as other individual investors from the entertainment and crypto industries.

On June 20, Bring, a white label cryptocurrency cashback provider, announced the completion of a $1.1 million SAFE round of financing, with Starkware participating. It is reported that Bring currently supports cashback for purchases of fashion, electronics, health and beauty, travel services and other goods at 450 retailers. Web3 wallets and exchanges have integrated Brings white label solution to provide cashback services to users.

On June 21, Ordinox announced the completion of a $1 million pre-seed round of financing, with participation from Digital Asset Capital, CMS Holdings, UTXO Management, Sats Ventures, Hidden Street and STS Digital.

NFT art platform Artfi completes new round of financing, DWF Ventures participates in the investment

On June 17, NFT art platform Artfi announced the completion of a new round of financing, with DWF Ventures participating in the investment. The specific amount has not been disclosed yet.

Router Protocol เสร็จสิ้นรอบการระดมทุนใหม่เพื่อสนับสนุน Ethereum และ BNB Chain Bridge

On June 18, the bridge protocol Router Protocol announced the completion of a new round of financing. The specific amount has not been disclosed yet. The new funds will support it in providing Ethereum and BNB Chain bridge services and expanding the bridge to more networks.

Zodia Custody receives investment from National Australia Bank

On June 19, Zodia Custody, a digital asset custody company founded by Standard Chartered Bank, announced that National Australia Bank has become an investor through NAB Ventures.

On June 21, Saltwater Games, a UK-based Web3 and XR game company, announced the completion of a new round of financing, with Animoca Brands participating in the investment. The specific amount has not been disclosed yet. This financing was carried out through a seed SAFT (Simple Agreement for Future Tokens).

This article is sourced from the internet: Financing Express of the Week | 21 projects received investment, with a total disclosed financing amount of approximately US$128 million (June 17-June 23)

Related: Why Solana (SOL) Could Surge 20% Amid Growing Institutional Support

In Brief Solana’s price is currently on the verge of breaking out of a double-bottom pattern, eyeing a 20% rise. Institutional interest has driven the rally for the past few days, with SOL noting higher inflows. Retail investors are also pining for a rise in price, with the funding rate increasing consistently. Solana (SOL) price is observing a potential rally that could validate the bullish pattern the altcoin has been observing for days now. The primary catalyst will most likely be the institutional investors whose interest has noted a sudden surge. Solana Investors Push for a Rise Solana’s price is close to breaking out of the double-bottom pattern it is stuck in. In order to make this happen, though, the cryptocurrency would need support from the market as well as its investors, which seems to be the case at…