พันธมิตรตัวแปร: โปรเจ็กต์ Web3 ใช้แรงจูงใจโทเค็นเพื่อกำหนดทิศทางการจัดหาตลาดอย่างไร

Original author: Mason Nystrom, Variant Fund Venture Partner

ต้นฉบับแปล: ลูฟี่, Foresight News

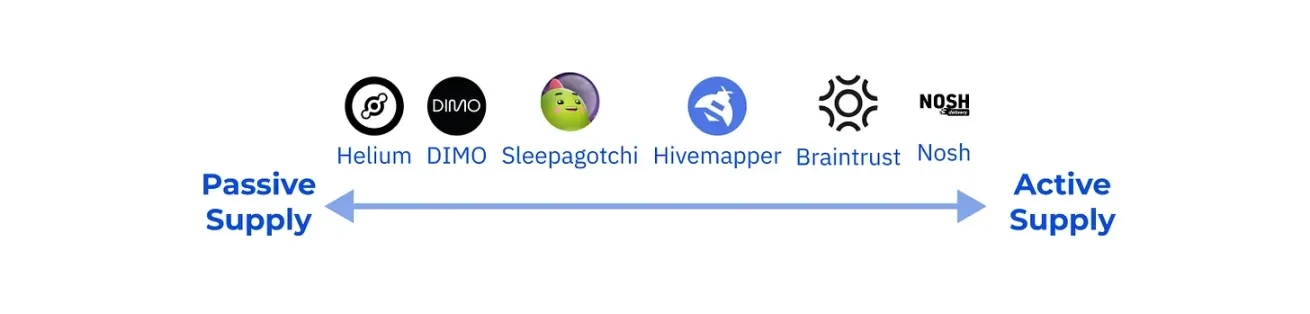

Token incentives can overcome the cold start problem by attracting supply-side participants to the market. But not all supply is created equal.

Active provisioning requires ongoing participation in market activities; passive provisioning requires initial onboarding but very little subsequent maintenance.

Tokenized markets with active supply are stickier and tend to be more defensible once they reach scale because the compounding nature of demand provides better economics for suppliers. Whoever reaches the most demand liquidity first wins.

In contrast, passive supply markets are able to quickly expand supply without equivalent market demand, but their stickiness is difficult to guarantee. Builders can leverage these properties while bootstrapping tokenized markets, but only if they know how to make the tradeoffs.

Active and passive markets

To understand that active supply markets tend to be defensive while passive markets are more easily scaled, one must first understand their general characteristics, each of which has certain scope limitations.

Human Resources

Active supply is like human labor. Until now, people have not been able to passively rent out their brainpower like they can rent out storage space. For example, Braintrust is a decentralized career network that needs a constant supply of talent to meet employers real-time needs.

Corresponding to human labor are resources, such as hardware, NFTs, and capital. These are typical representatives of passive supply. For example, the car data sharing network DIMO requires users to purchase and connect to the DIMO hardware device. After paying a one-time fee, the device will continuously transmit vehicle data to the DIMO network, with almost no need for user input again.

Opportunity Cost vs. Sunk Cost

In active markets, supply-side participants choose markets with the best potential for revenue/yield and token appreciation. Axie Infinity popularizes the earn-while-playing model, which competes with other markets where users can earn income through their labor. Without strong organic demand, active markets must constantly compete with all the other ways users can earn tokens by spending their time.

However, in passive markets, suppliers need to invest assets in the early stage, which has certain sunk costs. Therefore, as long as it is profitable, supply-side operators will passively provide physical assets to the market. For example, GPU owners have an incentive to provide their computing power to the GPU market. Even in the case of an imbalance between supply and demand, passive markets can use token incentives to support a large supply.

Quality-dependent supply vs. quality-independent supply

When you have a clear understanding of the quality of supply, it is much easier to scale the market. Passive supply markets, with physical supply, are better suited to this than active supply markets. This is because their supply is usually quantitatively qualified, making it easier to improve quality. For example, GPUs have different quantitative classifications (such as A100 vs. RTX 4090s), which are closely related to the quality of supply.

This is rare in active supply markets, which have to deal with highly variable skills. Gig platforms like Braintrust or Nosh are only as good as their workers, but the demand side has different standards for the quality of those workers.

Implications of Token Design

So how should builders guide and scale tokenized markets? And how do the supply characteristics of a market affect token design?

Active supply market

For active supply markets, there are several key points in token design:

-

Scaling token incentives as demand grows

-

Incentivize supplier loyalty, quality or reliability

-

Establish a dynamic incentive mechanism

In passive markets, supply can wait for demand to catch up (e.g. Filecoin). This is not the case in active markets, where people face high opportunity costs. Therefore, builders must prioritize demand-side growth to remain competitive. However, tokens can help guide initial demand to induce demand-side participants to join the market.

One strategy for scaling active markets is to dynamically scale supply-side incentives so that token distribution is tightly tied to growth. A related mechanism is to introduce supply in a permissioned manner, which provides a consistent and stable yield to supply-side participants, thereby keeping the supply-side workforce engaged and reliable.

Regardless, the constraints of such active supply markets actually make them stickier as they grow: they are able to provide more stable returns as demand increases. From an incentive design perspective, such tokenized markets should focus on providing ongoing rewards to keep users active on the platform. Furthermore, they should dynamically adjust these rewards to incentivize users who provide a steady supply, rather than those who are likely to churn.

However, while token incentives are valuable for guiding supply and demand, some innovation may be required at the service, verification, and reputation levels to scale the quality of supply, an important feature of active supply markets.

In this regard, tokenized markets must learn lessons from traditional custodial markets. For example, The RealReal and StockX provide verification services to ensure that physical supplies are legitimate. Similarly, Braintrust acts as a middleman and provides a quality assurance layer in its ตลาด products while leveraging tokens to help bring in supply.

Active supply markets that can leverage the scaling effect of tokens can do even better. By using a network of stake-based intermediaries or token-incentivized validation and management layers, quality assurance processes can be enhanced and more efficient markets can be produced.

What about tokenized marketplaces where supply and demand come from the same user, like NFT marketplaces or play-and-earn games like Axie or Stepn?

These role-switchable markets need to be more flexible when aligning token incentives, as they are most likely to uncover speculative flywheels for tokens and obfuscate organic demand. Such markets can help mitigate the reflexivity of growth by incentivizing long-term participation by including lockups in token rewards. Active supply markets should incentivize supply-side diversity to bring in more prosumers and professional supply, rather than retail supply, which can be more volatile.

Passive supply market

There are also important implications for token design for builders of passive supply markets:

-

Proactively expand the number of suppliers to achieve commercially viable scale

-

Build stronger defenses through demand-side products (e.g., SDKs, APIs) or supply-side lock-in through proprietary hardware

-

Incentivize supplier loyalty, quality or reliability

Passively supplied markets typically need to reach a certain supply threshold before the market becomes commercially viable (i.e. generates strong demand), so builders should initially focus on growing the supply side. Furthermore, this supply is typically measured in quantity rather than quality. For example, data collection networks like DIMO, Hivemapper, and Wynd require large amounts of data before the aggregated data or services built on them become valuable.

Since all passively supplied markets are easier to scale, new entrants do not secure demand simply by aggregating enough liquidity. Instead, it often requires competing on products by building SaaS components, such as SDKs and APIs, to help the demand side access the market. GPU marketplaces like IO.net provide aggregation services to make GPUs more accessible to end computing users. Similarly, DIMO has built a marketplace that enables DIMO token owners to purchase services for their cars.

Another way to make a passive supply market more defensible is to move from commodity supply to proprietary supply. Wireless network markets such as Helium and XNET are using proprietary supply to build their telecommunications infrastructure.

Finally, given the high sunk costs of passive supply markets, suppliers will generally continue to provide services to the network as long as the rewards exceed the operating costs. When sunk costs are high and opportunity costs are low (e.g. Blackbird restaurant accepts FLY tokens), suppliers are more likely to stay because they have an inherent incentive to provide services to the market. Conversely, when high sunk costs coexist with high opportunity costs (e.g. GPU owners providing services to the compute market), demand or token rewards may be the determining factor in suppliers choices to allocate resources.

This article is sourced from the internet: Variant Partner: How do Web3 projects use token incentives to guide market supply?

ที่เกี่ยวข้อง: นักวิเคราะห์อ้างว่า Bitcoin พุ่งถึงจุดสูงสุดและอาจร่วงลงมาที่ $42,000

Bitcoin ทดสอบช่วงราคา $63,000-$61,000 เสี่ยงที่จะพังทลาย นักวิเคราะห์คาดการณ์ว่าราคาอาจปรับตัวลงที่ $42,000 ความสนใจของสถาบันที่เพิ่มขึ้นอาจทำให้ราคาคงที่ การวิเคราะห์ล่าสุดจากผู้เชี่ยวชาญด้านสกุลเงินดิจิทัลชั้นนำชี้ให้เห็นว่า Bitcoin ซึ่งขณะนี้แกว่งตัวอยู่ระหว่าง $63,000 ถึง $61,000 อาจมีแนวโน้มปรับตัวลงอย่างมีนัยสำคัญ นักวิเคราะห์เหล่านี้เตือนเกี่ยวกับจุดสูงสุดของตลาดที่อาจส่งผลให้ราคาปรับตัวลงอย่างรุนแรง เหตุใด Bitcoin อาจร่วงลงสู่ระดับ $42,000 นักวิเคราะห์ทางเทคนิค DonAlt แสดงความกังวลเกี่ยวกับการทดสอบซ้ำๆ ของช่วงราคาแนวรับ $63,000 – $61,000 ซึ่งอาจทำให้ราคาอ่อนตัวลง “Bitcoin กลับมาอยู่ที่ระดับเดิมระหว่าง $63,000 ถึง $61,000 ยิ่งทดสอบบ่อยเท่าไหร่ ก็ยิ่งมีแนวโน้มที่จะพังทลายมากขึ้นเท่านั้น ผมคิดว่าแม้แต่ฝ่ายกระทิงก็อยากจะให้ราคาตกต่ำกว่าราคานั้นในจุดนี้" DonAlt อธิบาย เขาทำนายว่าแม้จะเป็นฝ่ายกระทิง...