Bitget Research Institute: กองทุน Bitcoin ETF ยังคงไหลออกสุทธิ การแจกเหรียญ zkSync

ในช่วง 24 ชั่วโมงที่ผ่านมา สกุลเงินและหัวข้อยอดนิยมใหม่ๆ มากมายปรากฏขึ้นในตลาด ซึ่งอาจเป็นโอกาสต่อไปในการสร้างรายได้ รวมทั้ง:

-

Sectors with strong wealth creation effects are: blue chip public chain sector, ETH ecological projects

-

Hot search tokens and topics by users: UXLINK, ZKSYNC, IO.Net

-

Potential airdrop opportunities include: Nile Exchange, Spark

Data statistics time: June 12, 2024 4: 00 (UTC + 0)

1. สภาพแวดล้อมของตลาด

Yesterday morning, Bitcoin fell to 66032 USDT, down more than 5.5% in 24 hours, and rebounded to 67500 USDT in early trading this morning. The daily volatility is high. In the past 24 hours, the entire network has been liquidated for $255 million, of which long orders have been liquidated for $236 million and short orders have been liquidated for $19.5956 million. The main liquidation is long orders. The US stock market is volatile. The overall market is waiting for the FOMC meeting and CPI inflation data in the United States tonight. The market is generally cautious.

Yesterday (June 11, Eastern Time), Bitcoin spot ETFs continued to have net outflows, totaling $200 million, ending 19 consecutive trading days of net inflows. Grayscale ETF GBTC had a net outflow of $121 million in a single day, and the current historical net outflow of GBTC is $18.093 billion. The recent wealth effect is mostly on some new coins, such as NOT, which has a good increase after launching BN, including IO, which was launched yesterday. Subsequent investors can keep an eye on the launch of new coins and the market trends of some blue-chip public chain ecosystems.

2. ภาคการสร้างความมั่งคั่ง

1) Sector changes: blue chip public chain sector (FTM, TON)

Main reason: TON ecosystem and FTM ecosystem are actively operating communities and releasing new project progress updates. The wealth effect will circulate in their ecosystems, constituting a potential buying opportunity for the public chain assets.

Rising situation: FTM rebounded slightly to $0.65 yesterday; TON returned to hover around $7;

ปัจจัยที่ส่งผลต่อแนวโน้มตลาด:

-

Data from all aspects are impressive: TON network activity has gradually increased since February. As of now, the number of daily active addresses of TON has exceeded that of Ethereum, and the TVL of the TON ecosystem has exceeded US$460 million, setting a record high.

-

Ecosystem construction continues to gain momentum: Yesterday, the Fantom Foundation released the second Sonic governance proposal, including airdropping S tokens for Opera and Sonic users, and plans to adopt a destruction mechanism to increase activity and TVL. TON Ecosystem also announced that the fourth season of TON OpenLeague will start at 19:00 today, and will launch enhanced pools on STON.fi and DeDust, and provide more than $1.8 million in rewards in the next two weeks. Users can earn rewards by maintaining on-chain activity and providing liquidity.

2) The sectors that need to be focused on in the future: ETH ecological projects

The main reason is that the ETH spot ETF may release results at the end of June/early July. ETH ecological assets may have room for speculation. Recently, the track has experienced a large correction and has fallen out of layout space.

รายการสกุลเงินเฉพาะ:

-

UNI: The first DeFi Swap project on blockchain applications. Uniswap generated $2.022 million in fees in the past 24 hours, with considerable revenue.

-

LDO: โครงการ LSD ชั้นนำในระบบนิเวศ ETH ซึ่งมีมูลค่า TVL ที่ 34.4 พันล้านเหรียญสหรัฐ และมีมูลค่าต่ำกว่า 2 พันล้านเหรียญสหรัฐ ถือว่าถูกประเมินค่าต่ำเกินไป

-

PENDLE: The TVL of the project has continued to rise. The current TVL has reached 6.6 billion US dollars. The total market value of stablecoins has increased, and the popularity of the Restaking track has increased the demand for PENDLEs business in the bull market.

3. การค้นหายอดนิยมของผู้ใช้

1) DApps ยอดนิยม

UXLINK: UXLINK is a groundbreaking web3 social system designed for mass adoption, allowing users to build social assets and trade cryptocurrencies. It includes a series of highly modular Dapps, from getting started to graph formation, group tools to social transactions, all of which are seamlessly integrated into Telegram. UXLINK recently announced financing, led by SevenX Ventures, Ince Capital, and HashKey Capital, with a total financing of US$15 million. Web3 social infrastructure project UXLINK issued the IN UXLINK WE TRUST series of NFTs as airdrop vouchers. Due to the high financing, users can consider participating in its airdrop activities.

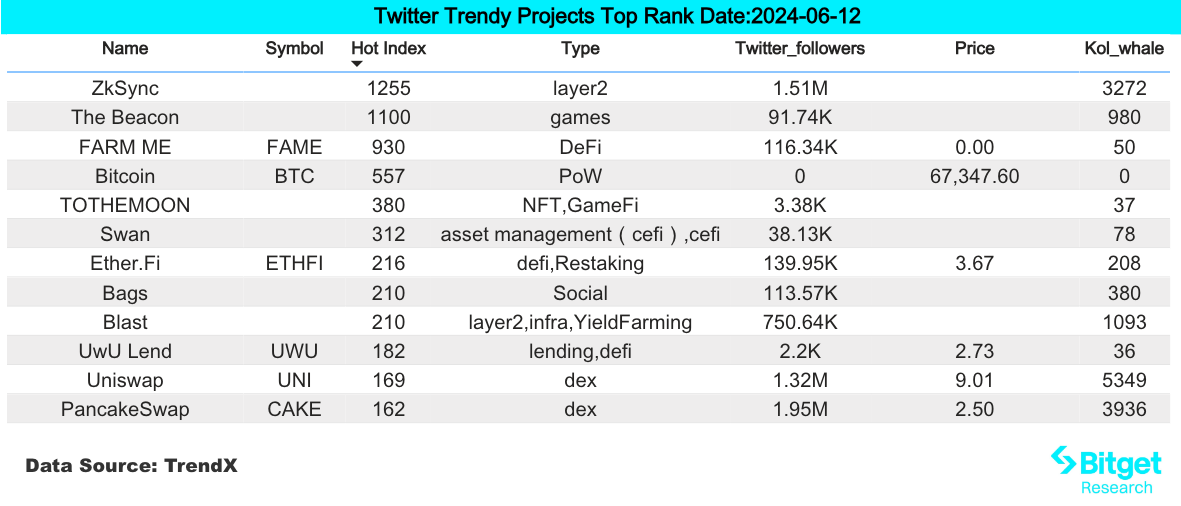

2) ทวิตเตอร์

ZKSYNC: ZKsync opened the airdrop query interface yesterday. Many users on Twitter said that they met the conditions but did not receive the airdrop, and they were very dissatisfied. In response, ZKsync explained that failure to meet one or more airdrop criteria does not mean a legal right or requirement to receive the airdrop. All decisions related to airdrop allocation are made by the ZKsync Association. The over-the-counter price of ZKsync (ZK) is currently around US$0.35, down more than 40% in 24 hours.

3) ภูมิภาคการค้นหาของ Google

จากมุมมองระดับโลก:

IO.Net: The project is a decentralized computing network that supports the development, execution, and expansion of ML applications on the Solana blockchain, combining 1 million GPUs to form the worlds largest GPU cluster and DePIN.io.net to aggregate underutilized resources. In addition, Bitget will be listed on PoolX today, staking IO to obtain local currency income, with a total prize pool of $100,000 worth of IO, and the mining time is from 16:00 on June 12 to 16:00 on June 22 (UTC+ 8).

จากคำค้นหาที่มาแรงในแต่ละภูมิภาค:

(1) There are big differences in the hot searches in English-speaking regions. The United States mainly focuses on meme tokens, and the hot search tokens that appear are pepe, floki, and boden. However, Australia and the United Kingdom pay more attention to public chain projects, such as monad, icp, sui, etc. The number of public chains that appear is relatively high.

(2) Europe focuses on projects with fundamentals, mainly public chains and some mainstream altcoins. Hot search projects include public chains such as Solana and Ethereum, and large-cap altcoins such as Uniswap and RNDR.

(3) The CIS region pays attention to opportunities such as TON ecology and DePIN, and Notcoin and Grass appear more frequently.

4. ศักยภาพ แอร์ดรอป โอกาส

Nile Exchange

Nile is a centralized liquidity DEX on Linea that combines incentives with centralized liquidity to achieve a higher level of capital efficiency. As a sister branch of RAMSES on Arbitrum, NILE inherits the proprietary centralized liquidity ve(3, 3) implementation mechanism. Nile Exchange is one of several Eligible Protocols in Linea The Surge event. Providing liquidity to the Nile protocol can also earn Lineas points LXP-L.

How to do it specifically: On the Linea mainnet, deposit LP positions of weETH/ETH, wrsETH/ETH, ezETH/ETH, and USDC/USDT to Nile to obtain a higher APY and multiple points.

Spark

Spark Protocol is a lending market launched by MakerDAO that integrates direct lending capabilities into MakerDAO. Through Spark, users can use assets such as ETH, stETH, sDAI, etc. to obtain DAI loans.

Spark announced that it will start the second season of SPK token pre-mining, which will be distributed to eligible SparkLend users on Ethereum. The second season of pre-mining will start on May 20th UTC time and end when SPK and Spark SubDAO are launched.

Specific participation method: Refer to the project announcement. Specific conditions include the amount of ETH deposited and the amount of DAI borrowed by the user, as well as the term of the ETH deposit or DAI borrowing position.

ลิงค์ต้นฉบับ: https://www.bitget.com/zh-CN/research/articles/12560603811062

銆怐isclaimer銆慣ตลาดมีความเสี่ยง ดังนั้นควรระมัดระวังในการลงทุน บทความนี้ไม่ถือเป็นคำแนะนำในการลงทุน และผู้ใช้ควรพิจารณาว่าความคิดเห็น ความเห็น หรือข้อสรุปในบทความนี้เหมาะสมกับสถานการณ์เฉพาะของตนหรือไม่ การลงทุนตามข้อมูลนี้เป็นความเสี่ยงของคุณเอง

This article is sourced from the internet: Bitget Research Institute: Bitcoin ETF funds continue to net outflow, zkSync coin airdrop

Original author: Arthur Hayes Original translation: TechFlow Introduction: Arthur deeply analyzes how the global elite use policy tools to maintain the status quo, even though these tools will bring pain now or in the future. His core point is that the exchange rate between the US dollar and the Japanese yen is one of the most important global economic variables, and explores the complex monetary policy interactions between Japan, the United States and China and their far-reaching impact on the global economy. The global elites have a variety of policy tools to maintain the status quo that will cause pain now or in the future. I am skeptical and believe that the only goal of elected and unelected bureaucrats is to stay in power. Therefore, the easy button is always…