ความเสี่ยงเริ่มเพิ่มขึ้น ตลาดรอคำแนะนำจากเฟดเรื่องการปรับลดอัตราดอกเบี้ย

Original title: The market continues to consolidate, waiting for the Feds interest rate cut guidance

ผู้เขียนต้นฉบับ: Mary Liu, BitpushNews

Crypto markets opened the week lower as investors await the Federal Reserve and its upcoming interest rate decision and the Consumer Price Index (CPI) for May.

According to Bitpush data, Bitcoin once broke through the $70,000 mark in the early trading, reaching a high of $70,195, but turned down in the afternoon and returned to the support level near $69,600.

Altcoins fell more than they rose. Among the top 200 tokens by market value, Polymesh (POLYX) led the gains, up 9.7%, followed by Gnosis (GNO), up 8.6%, and Livepeer (LPT), up 5.5%. Wormhole (W) fell the most, up 18%, Biconomy (BICO) fell 17.1%, and Echelon Prime (PRIME) fell 10%.

The current overall market value of cryptocurrencies is $2.53 trillion, with Bitcoin accounting for 54.1%.

As of Mondays close, the SP, Dow and Nasdaq were all up, rising 0.26%, 0.18% and 0.35%, respectively.

The Chicago Mercantile Exchanges FedWatch tool shows that traders expectations for the probability of a September rate cut by the Federal Reserve have dropped to 49% from 60% a week ago.

ETF inflows continue

Inflow data for spot bitcoin exchange-traded funds (ETFs) was more optimistic, with $131 million flowing into ETF products on Friday, the 19th consecutive day of inflows.

CoinShares report showed that a total of $1.83 billion flowed into US-listed spot BTC ETFs last week, while net inflows into digital asset investment products listed globally reached $2 billion, bringing the total inflow in the past five weeks to $4.3 billion.

James Butterfill, head of research at CoinShares, said: We believe that this sentiment shift is a direct response to weaker-than-expected US macro data, which brought expectations of monetary policy rate cuts. The positive price action has caused total assets under management (AuM) to exceed the $100 billion mark for the first time since March.

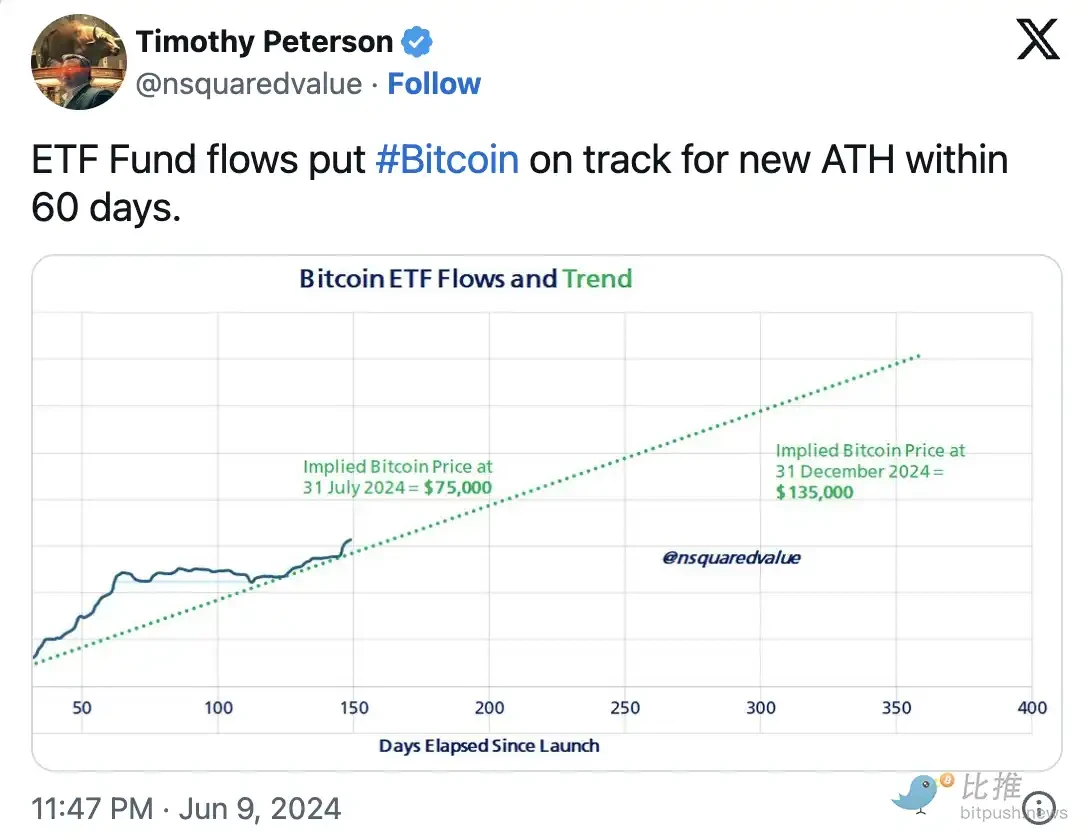

Crypto analyst Timothy Peterson said on the X platform that if the current pace continues, the inflow rate of funds into the spot BTC ETF will put BTC on track to hit a new all-time high on July 31. In addition, if liquidity continues at the current rate, the price of BTC will reach $135,000 by the end of the year.

Short-term leverage surge

Bitfinex analysts hold the opposite view and say: “The massive inflows into ETFs over the past 20 trading days have helped offset the pressure on BTC, but the fact that this has been unable to drive prices further or push BTC above the range highs is unfavorable in the short term. The opposing view is that traders are executing base carry trades where they hold long spot positions and short perpetual futures for hedging.”

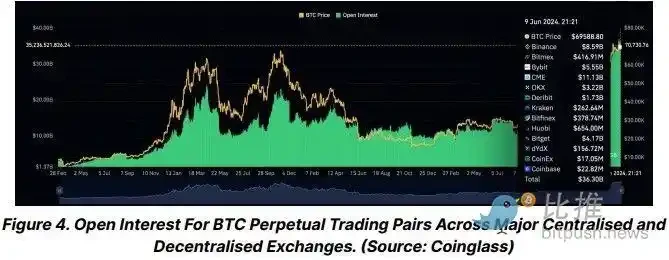

As shown in the above chart, open interest (OI) for BTC and altcoins has been high. Data from Coinglass shows that BTC OI across major exchanges hit an all-time high of $36.8 billion on June 6. Despite the price correction on Friday, OI currently remains above $36 billion.

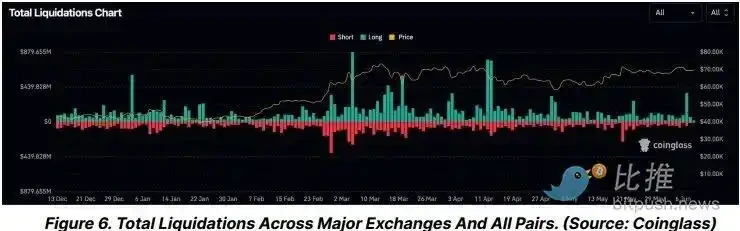

“We view Friday’s drop as more of a ‘leverage flush’, where leveraged longs in a large number of altcoins (and to some extent major currencies) were wiped out and funding rates were neutralized,” the analysts said. “However, while the leverage purge/liquidation in altcoins was quite severe, we do not expect a significant immediate decline.”

On June 7, the long liquidation amount in the crypto market exceeded $360 million, and the total liquidation amount exceeded $410 million, which was the highest level since April 14, exceeding the level when BTC fell below $57,000, but this time only $50 million of long liquidations came from BTC.

The analyst explained: Most of them are altcoins, which explains the sharp drop in altcoins relative to mainstream currencies last week. Such liquidation events usually do not trigger further serious declines, so this week will be a key week as the upcoming Consumer Price Index inflation report on June 12 is expected to be a major market catalyst. With derivatives positions increasing again, prices are expected to continue to fluctuate in a tense environment.

Bitfinex believes that in the current environment, it is crucial for BTC to maintain the local lows around $68,000-68,500 for bulls, and failure to break through the range highs will further put pressure on bulls.

Regarding the Federal Reserve’s monetary policy, Bitfinex analysts said that maintaining high interest rates for a long time is a double-edged sword and needs to be handled skillfully:

On the one hand, the strength and adaptability of the U.S. economy allow it to thrive even in a high-interest rate environment, thanks to strong labor demand and rising wages. This situation will support continued economic growth, solid consumer spending, and overall economic resilience.

On the other hand, there are significant risks in keeping interest rates high for too long, which could depress economic activity, lead to reduced investment, slower job growth, and possibly an economic downturn.

Analysts also said recent rate cuts by the European Central Bank and the Bank of Canada were intended to shift to easier monetary policy to boost growth, suggesting that the Fed may need to reassess its own monetary policy, and the actions of its global peers could influence its decisions in the coming months, especially if inflation trends and economic conditions warrant a shift.

This article is sourced from the internet: Risk aversion heats up, market awaits guidance from the Fed on rate cuts

ที่เกี่ยวข้อง: ArkStream Capital: การลงทุนและการอัปเดตไตรมาส 1 ปี 2024

สรุปโครงการลงทุน ArkStream Capital ลงทุนในโครงการทั้งหมด 6 โครงการในไตรมาสแรกของปี 2567 เราจะเผยแพร่รายละเอียดโครงการและอธิบายว่าเหตุใดเราจึงลงทุนในโครงการเหล่านี้ การแนะนำโครงการ XION เป็นเลเยอร์นามธรรมสากลแบบโมดูลาร์แรก สร้างขึ้นโดยมีจุดประสงค์เพื่อให้ผู้ใช้ทั่วไปได้รับประสบการณ์ที่ราบรื่น เพื่อส่งเสริมการยอมรับของผู้บริโภค เลเยอร์นามธรรมสากลของ XION ประกอบด้วยนามธรรมระดับโปรโตคอลหลายรายการ เช่น บัญชี ลายเซ็น แก๊ส ความสามารถในการทำงานร่วมกัน ราคา อุปกรณ์ การชำระเงิน ฯลฯ ด้วยการสรุปความซับซ้อนของการเข้ารหัสทั้งหมด XION จะขจัดอุปสรรคหลักในการเข้าสู่ผู้ใช้ใหม่ ในขณะเดียวกันก็หลีกเลี่ยงความท้าทายของการแตกแฟรกเมนต์ สำหรับนักพัฒนา โครงสร้างพื้นฐานที่ไม่เชื่อเรื่องพระเจ้าเฉพาะตัวรองรับเส้นโค้งการเข้ารหัสลับที่มีอยู่มากมาย และสามารถปรับให้เข้ากับการพัฒนาในอนาคตได้อย่างง่ายดาย ซึ่งไม่เพียงแต่ขยายความครอบคลุมตลาดเท่านั้น แต่ยังรับประกันความมีชีวิตในระยะยาว...