รายงาน VanEck: ETH จะถึง $22,000 ในปี 2030

Original author: Matthew Sigel, Patrick Bush, Denis Zinoviev, VanEck

ต้นฉบับแปล: 1912212.eth, Foresight News

We expect that ETH spot ETFs will soon be approved for trading on U.S. exchanges. Progress towards this milestone will enable financial advisors and institutional investors to hold this asset under the guarantee of a qualified custodian and benefit from the pricing and liquidity advantages unique to ETFs. In response, we updated our financial model and re-evaluated the fundamental investment case for ETH. We also conducted a series of quantitative analyses on how ETH interacts with BTC in a traditional 60/40 portfolio, focusing on the trade-offs between risk and return.

The main content of this article:

-

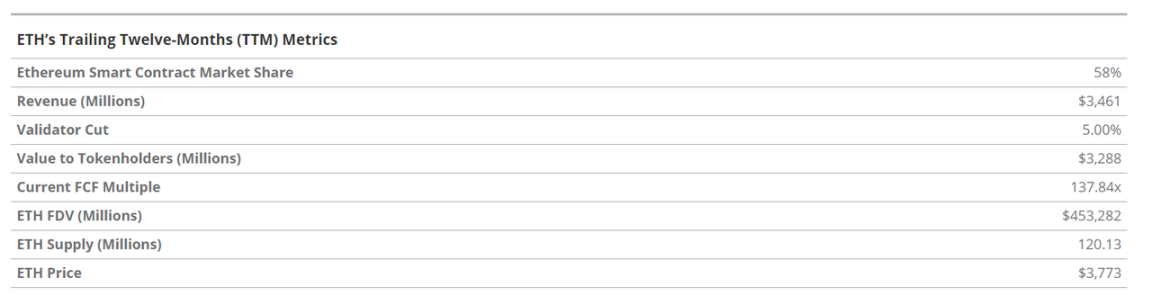

The Ethereum network is likely to continue to rapidly grow its market share from traditional financial market participants and a growing number of large technology companies. If Ethereum can maintain its dominance among smart contract platforms and achieve the above growth expectations, we have reason to believe that by 2030 its free cash flow (CFC, the net amount of ETH available for network operations after considering all network costs such as gas fees for transactions and smart contracts) will reach $66 billion, the market value will reach $2.2 trillion, and the price per ETH will reach $22,000.

-

Adding a modest cryptocurrency allocation (up to 6%) to a traditional 60/40 portfolio can significantly improve the portfolio’s Sharpe ratio with relatively little impact on drawdowns. An allocation of a pure cryptocurrency portfolio close to 70/30 between Bitcoin and Ethereum provides the best risk-adjusted returns.

Evaluating Ethereum Investments

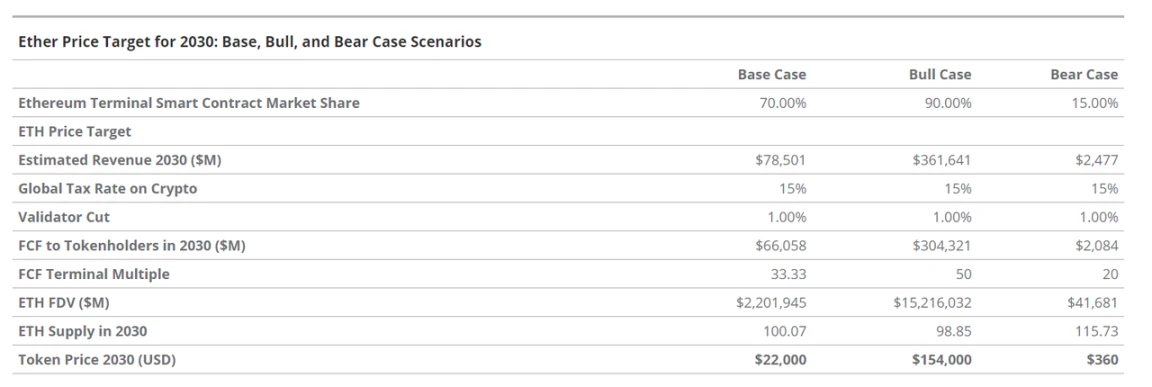

ETH is the native token of Ethereum, a new type of asset that gives investors exposure to a high-growth, internet-native business system that has the potential to disrupt existing financial businesses and large technology platforms such as Google and Apple. Ethereum has attracted about 20 million monthly active users in the past 12 months, while settling $4 trillion in value and facilitating $5.5 trillion in stablecoin transfers. There are over $91.2 billion in stablecoins, $6.7 billion in tokenized off-chain assets, and $308 billion in digital assets on Ethereum. The core asset of this financial system is the ETH token, and in our updated fundamentals, we believe that ETH will reach $22,000 by 2030, a total return of 487% over todays ETH price and a compound annual growth rate (CAGR) of 37.8%.

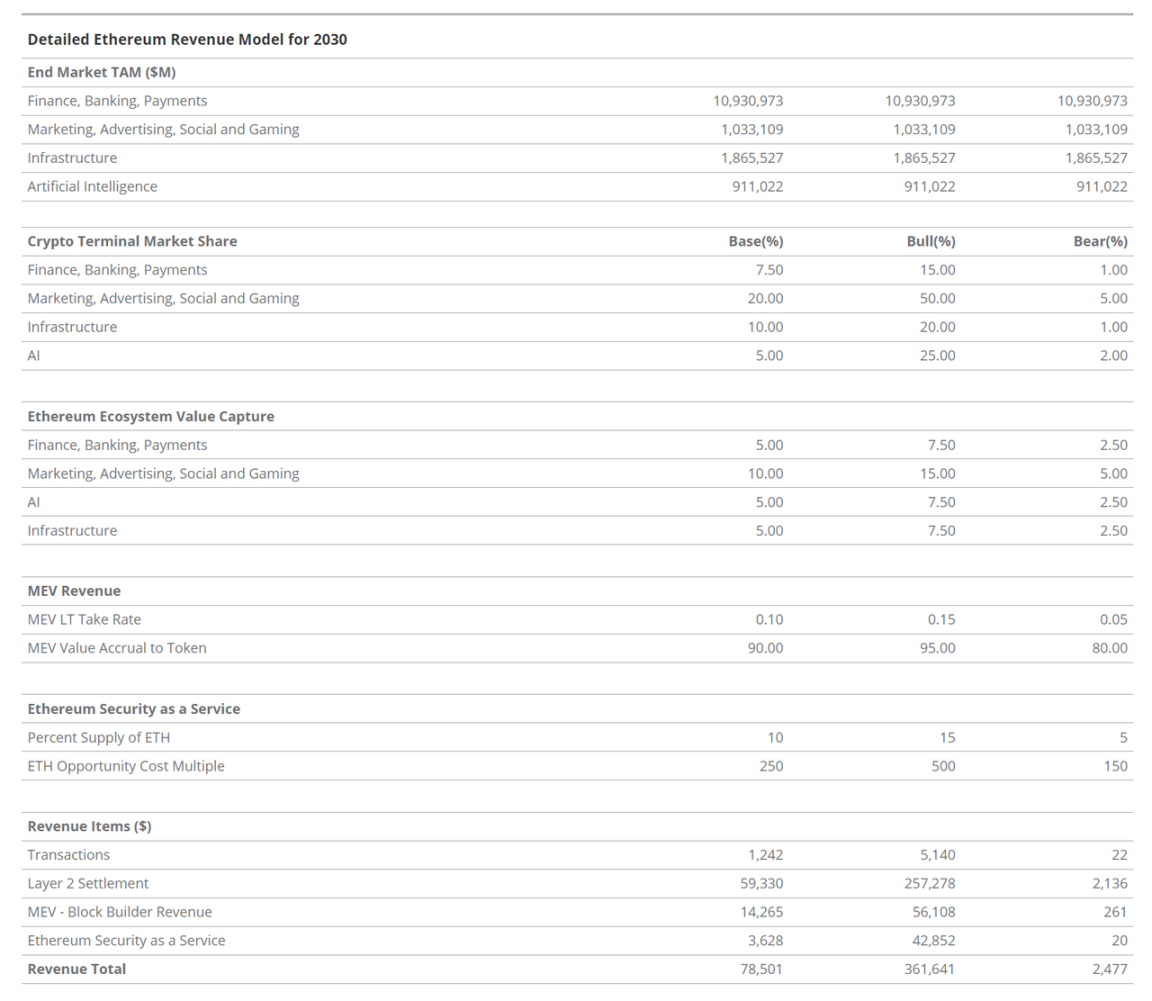

We project ETHs valuation in 2030 based on the $66 billion in free cash flow that Ethereum is expected to generate and attribute to the ETH token. We estimate these cash flows to trade at a 33x P/E multiple. Since Ethereum is an application platform, we begin our valuation by estimating the market size of the business sectors that blockchain applications will disrupt. We estimate the total market size (TAM) of annual revenue for these industry verticals to be $15 trillion.

-

Finance, Banking and Payments (FBP) – $10.9 trillion

-

Marketing, Advertising, Social and Gaming (MASG) – $1.1 trillion

-

Infrastructure (I) – $1.8 trillion

-

Artificial Intelligence (AI) – $1.4 trillion

We use blockchains such as Ethereum to make market capture estimates for these revenues based on TAM data. The penetration rates for FBP, MASG, I, and AI are 7.5%, 20%, 10%, and 5%, respectively. We forecast the share of crypto applications built on Ethereum instead of other blockchains, and our base case is 70%. We estimate the fees that Ethereum will charge application users, which is effectively a “take rate” on the revenues of these applications, and it works out to be 5-10%. We recently updated our ETH model for Spring 2023, adding the AI end market to reflect Ethereum’s huge potential in this area. Other influential adjustments to the previous model are increased consumption of ETH supply, greater end market capture, and higher acceptance of underlying economic activities. We believe these changes are justified by the latest innovations that make Ethereum more accessible to fundamentals and the changing politics in the United States.

We believe ETH is a revolutionary asset with little to no comparison in the non-crypto financial world. ETH can be thought of as “digital oil” because it is consumed by participating in activities on Ethereum. ETH can also be thought of as “programmable money” because the financialization of ETH and other Ethereum assets can occur automatically on Ethereum without any intermediaries or censorship. In addition, we believe ETH is a “yield commodity” because it can be staked in a non-custodial manner to validators who manage the Ethereum network to earn ETH yield. Finally, we believe ETH can also be thought of as an “internet reserve currency” because it is the underlying asset for pricing all activities and most digital assets, involving the over $1 trillion Ethereum ecosystem and its 50+ connected blockchains.

Regardless of its classification, ETH has benefited from the growing use of Ethereum. Ethereum, a vibrant economic platform that can be thought of as a digital mall, has seen a 1500% increase in users and revenues have soared at a compound annual growth rate of 161% since 2019. Over the past year, Ethereum has generated $3.4 billion in revenue. Since ETH must be purchased in order to use Ethereum, all ETH holders benefit from demand-driven inflows of the currency. In addition, 80% of these ETH revenues are used to repurchase and destroy circulating ETH to permanently remove it from circulation. This is similar to an irreversible stock buyback.

Over the past six months, 541,000 ETH (0.4% of total supply) worth $1.58 billion has been destroyed. Therefore, ETH holders benefit doubly from Ethereum activity, both from user-driven ETH purchases and from the destruction of supply. ETH users can also earn an annual yield of approximately 3.5% by staking ETH. This is done by staking ETH to Ethereum network entities called validators, providing them with the collateral needed to run the Ethereum network.

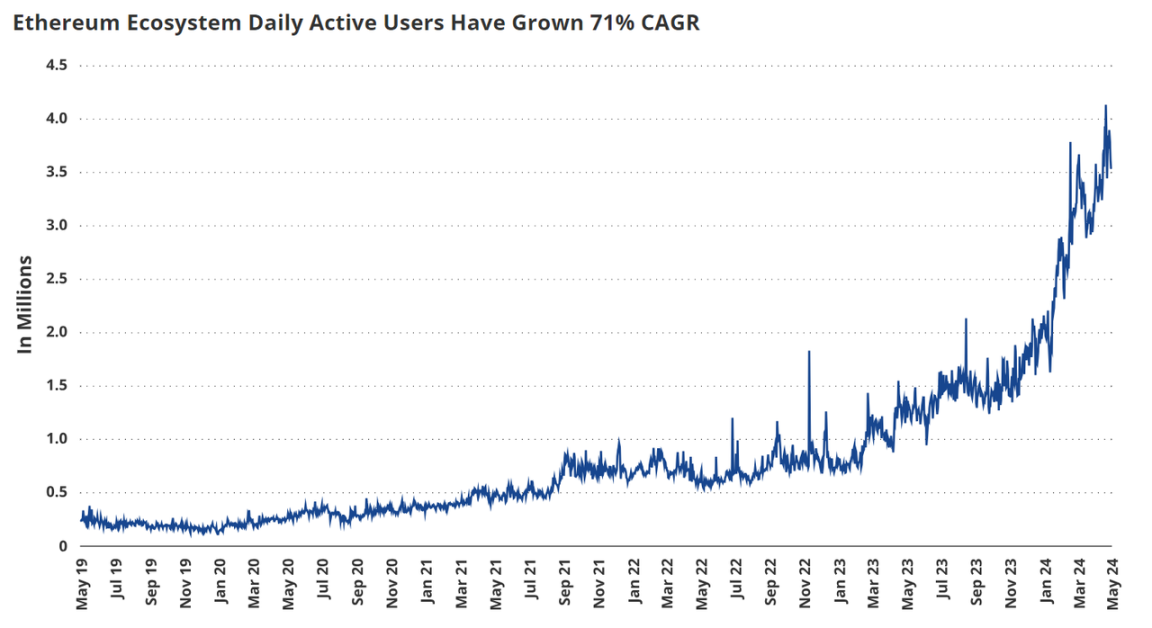

Compared to Web2 applications, Ethereum ($3.4 billion) generates more revenue than Etsy ($2.7 billion), Twitch ($2.6 billion), and Roblox ($2.7 billion). Ethereum (20 million) has more monthly active users than Instacart (14 million), Robinhood (10.6 million), and Vrbo (17.5 million). Furthermore, the average annual revenue per Ethereum monthly active user is $172, which is comparable to Apple Music’s $100. Netflix is $142, and Instagram is $25. We classify Ethereum as a platform business similar to the Apple App Store or Google Play. However, Ethereum has a big advantage over Web2 platforms because it offers users and application business owners a unique value proposition that is not available outside of cryptocurrencies.

The most attractive aspect of using Ethereum is the potential cost savings it offers businesses and users. Apple and Google take around 30% of the revenue for hosted applications, while Ethereum currently takes around 24% (14% for non-DeFi applications). In addition, we believe Ethereum’s acceptance rate will drop to 5-10% over the next 18 months as activity shifts to cheaper Ethereum L2 (current acquisition rates are 0.25%-3%). From a payment perspective, credit card processors and other payment applications like PayPal charge 1.94% on all payments (2.9% for commercial transactions), while Visa charges 1.79-2.43% or more.

Compared to data-centric social networking platforms like Facebook, we think Ethereum has the potential to offer entrepreneurs more powerful and profitable applications. Ethereum allows applications to freely connect and innovate in a permissionless deployment environment and open source data. As a result, anyone can create applications and leverage important data, including data on all user activity on the chain – just like Visa provides customer payment data for free. For example, social media app Farcaster currently generates $75.5 in revenue per monthly active user, while Facebook generates approximately $44. Even more attractive, the open source incentive structure has led to a more attractive application, with Farcaster users averaging 350 minutes of daily usage compared to Facebooks 31 minutes.

As a result of Ethereums properties, some of the profits earned by Big Finance, Big Tech, and Big Data can be transferred to users in the form of consumer benefits. As more data is generated in public, and more commerce moves away from expensive, closed financial tracks, business moats will erode. The result will be a potential business formed around the low-margin economics of open source. Consumers and application builders will migrate to Ethereum. We believe that over the next 5-10 years, 7% to 20% of Web2/Big Finance business revenues, or trillions of dollars, could be squeezed out of systems like Ethereum and primarily fed back to users and application builders. In addition, Ethereums unique ownership properties allow for uncensorable digital presence on social media and gaming applications. These features will become increasingly valuable if government censorship of information continues to intensify.

There is also good reason to believe that public chains like Ethereum will become important backend infrastructure for AI applications. The proliferation of AI agents and their economies will require unrestricted value transfer, explicit proof of humanity, and well-defined data/model provenance. These unique properties are available on blockchains but circumvent existing technical infrastructure. We estimate that the global TAM for AI productivity gains could be as high as $8.5 trillion by 2030. Based on assumptions of 66% business adoption, 25% AI software value capture, and 72% non-hardware value capture, we believe the potential revenue TAM for crypto and AI is $911 billion by 2030, including $45.5 billion in revenue from open source AI applications and infrastructure, of which $1.2 billion in revenue could flow directly back to ETH holders.

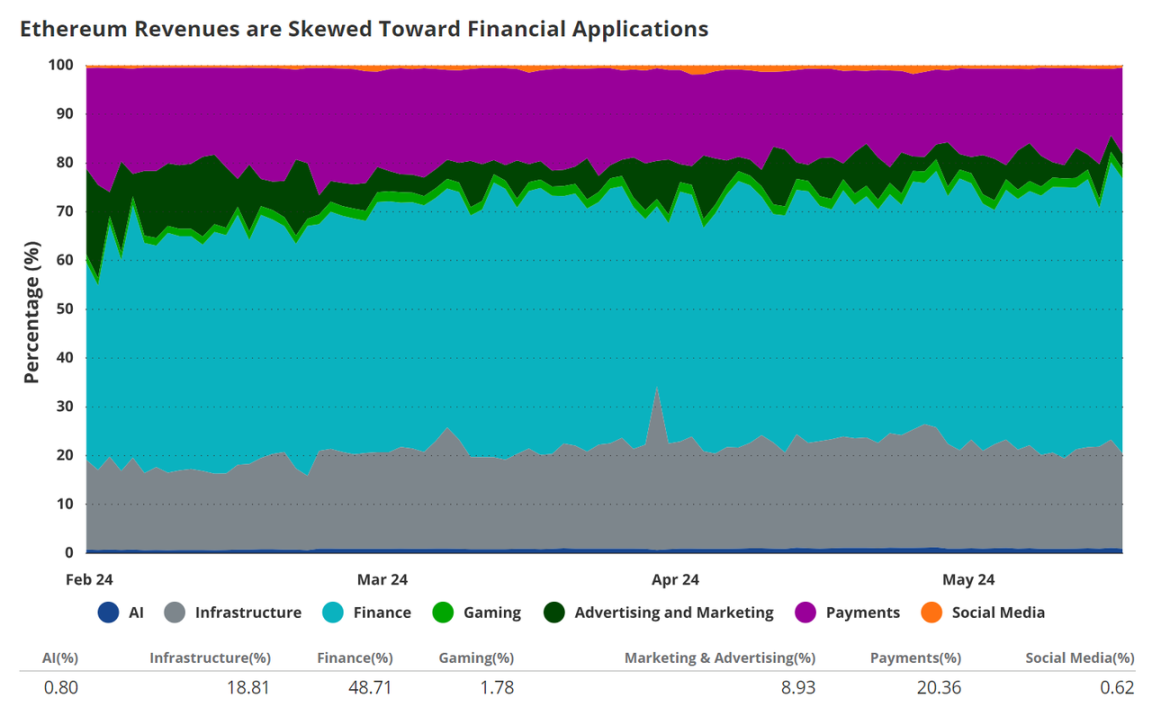

Currently, most of the activity on Ethereum is financial. Decentralized exchanges and banking protocols account for 49% of Ethereums revenue, while 20% is distributed by simple value transfer. These revenues are categorized by Finance, Banking, and Payments (FGP). Meanwhile, Infrastructure (I) accounts for the second largest share, about 19%, which is related to decentralized businesses and creating software to serve decentralized applications. Finally, we classify activities related to social media and NFTs into the Marketing, Advertising, Social Media, and Games (MASG) category. MASG contributes 11% of these revenues. Currently, AI plays a very small role in generating revenue for Ethereum.

Ethereums revenue comes from the above-mentioned end markets, and these activities constitute Ethereums revenue items, including transaction fees, second-layer settlement, block space sorting (MEV), and security as a service. Transaction fees are fees paid by users (and future automated agents) for using applications or transferring value on Ethereum. Second-layer settlement refers to the revenue paid by Ethereum L2 to Ethereum for settling transactions. MEV is the revenue generated by fees paid by users for the right to sort a set of transactions. Security as a service refers to the use of ETH as collateral to support permissionless applications that need this value to perform their business functions. In the past year, about 72% of Ethereums revenue came from transaction fees, MEV accounted for about 19%, second-layer settlement accounted for about 9%, and security as a service has not yet been officially launched.

We believe Ethereum’s strongest value proposition lies in the financial sector, so we expect 71% of Ethereum’s revenue to come from financial services (FGP) by 2030. Due to the advantages of experimentation and Ethereum’s open source financial and data systems, we expect MASG to grow to 17%, which will slightly replace infrastructure to provide 8% of revenue. Overall, AI will account for 2% of Ethereum’s revenue. However, if decentralized AI software demonstrates its huge potential, AI’s revenue contribution may increase exponentially or more.

From a revenue line item perspective, we estimate that a single mainnet transaction will account for only 1.5% of revenue. Layer 2 settlement, which bundles transaction data packages onto the mainnet, will increase significantly to approximately 76% of revenue. This is because we expect most activity to occur on Ethereum’s layer 2 blockchain, but the majority of the value of these transactions will be attributed to Ethereum. At the same time, MEV will maintain its importance, accounting for 18% of revenue, while security as a service will become 4.5% of Ethereum revenue.

Bitcoin and Ethereum: Best Portfolio Allocations

Analysis Overview

We conducted a study to evaluate the impact of including BTC and ETH in a traditional 60/40 portfolio, covering the period from September 1, 2015 to April 30, 2024. The analysis was conducted in five main sections:

-

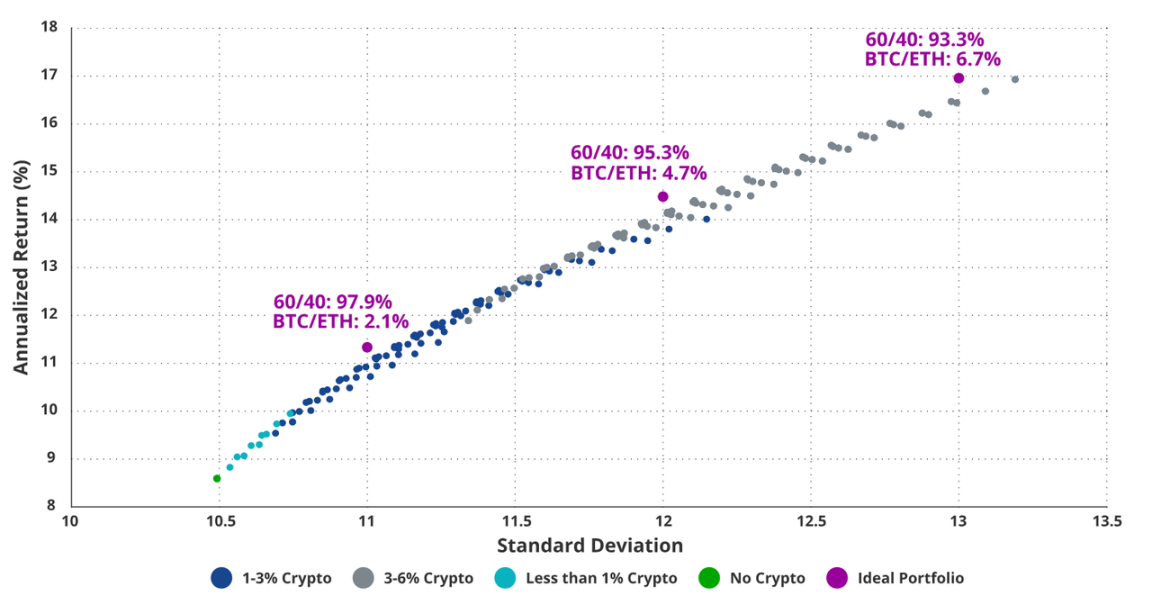

Optimal Constrained Allocation in a Traditional 60/40 Portfolio: We evaluated the ideal weights of BTC and ETH in a 60% stock and 40% bond portfolio, constraining the maximum combined allocation to 6%. We completed and added cryptocurrency exposure using 169 sample portfolios.

-

Drawdown and Sharpe Ratio Analysis: We examine drawdowns and Sharpe ratios for a subset of 16 representative portfolios to understand risk-return tradeoffs. Adding a modest crypto allocation (up to 6%) to a traditional 60/40 portfolio can significantly improve the portfolios Sharpe ratio with relatively little impact on drawdowns. For investors with high risk tolerance (up to ~20% annualized volatility), allocations of up to 20% can continue to improve the risk/return of the entire portfolio. Between BTC and ETH, we believe a weighting of approximately 70/30 provides the best risk-adjusted returns.

-

Optimal BTC and ETH Allocation in a Crypto-Only Portfolio: We analyzed every permutation of BTC and ETH weights in a portfolio consisting of only these two cryptocurrencies, aiming to maximize the Sharpe ratio and derive the ideal BTC/ETH weight.

-

Calculating the efficient frontier using optimal cryptocurrency portfolios: We study the optimal weights of an ideal BTC/ETH portfolio to maximize returns given different volatility levels to illustrate a portion of the efficient frontier when adding cryptocurrencies to 60/40 (with reasonable volatility levels).

-

Time dependence of efficient frontier results: We consider the impact of different starting points on our results, showing that a larger cryptocurrency allocation helps to achieve the portfolio risk-adjusted return in each available time period.

1. Optimized allocation in the traditional 60/40 portfolio

The main objective of this section is to determine the optimal allocation of BTC and ETH in a traditional 60/40 portfolio with a total weight of up to 6% in cryptocurrencies. The analysis involves creating 169 model portfolios with incremental crypto exposure (up to 3% each in BTC and ETH).

The results show that a portfolio with 3% Bitcoin and 3% Ethereum (along with 57% SP 500 and 37% U.S. bonds) provides the highest return per unit of risk (standard deviation). In other words, allowing a maximum allocation to cryptocurrencies while maintaining a conservative overall allocation of 6% achieves the highest risk-adjusted returns.

Optimizing BTC/ETH Allocation in a Traditional 60/40 Portfolio for Risk-Adjusted Returns (September 1, 2015 – April 30, 2024)

2. Drawdown and Sharpe ratio analysis

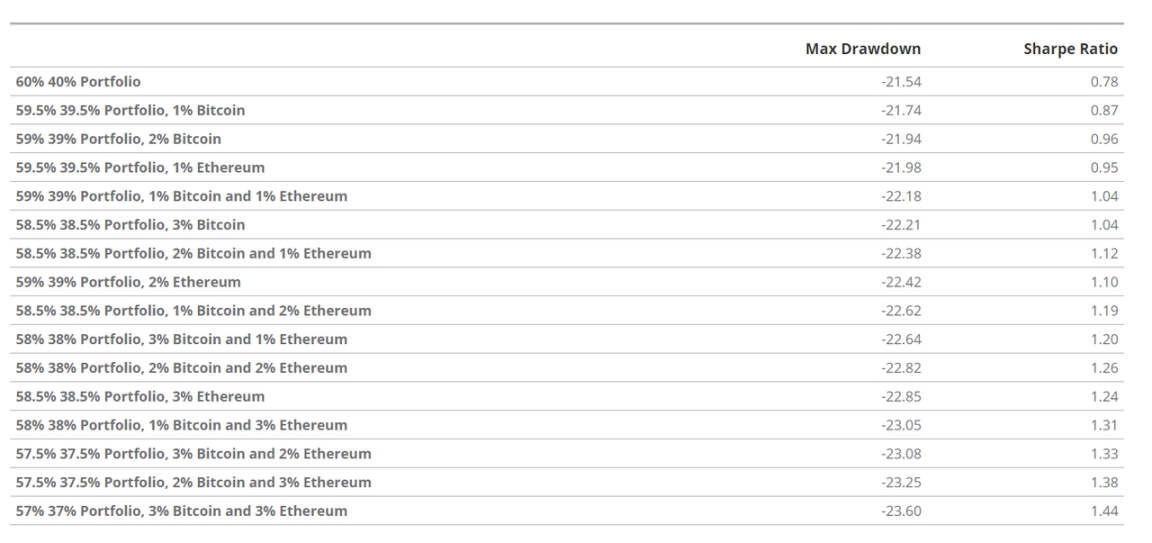

To assess the risk-return tradeoff, we analyzed 16 representative 60/40 portfolios with gradually increasing cryptocurrency allocations up to 6%. The main findings are:

Sharpe Ratio Improvement: The portfolio Sharpe Ratio improves significantly with the increase in cryptocurrency allocation.

Minimal impact on drawdowns: Maximum drawdowns are only slightly increased, making a higher cryptocurrency allocation an attractive trade-off for many investors.

Data on maximum drawdown and Sharpe ratio show that a 6% cryptocurrency allocation results in a Sharpe ratio that is almost double that of a 60/40 portfolio, with only a slight increase in drawdown. This highlights a very favorable risk-reward tradeoff when adding BTC and ETH to a traditional portfolio.

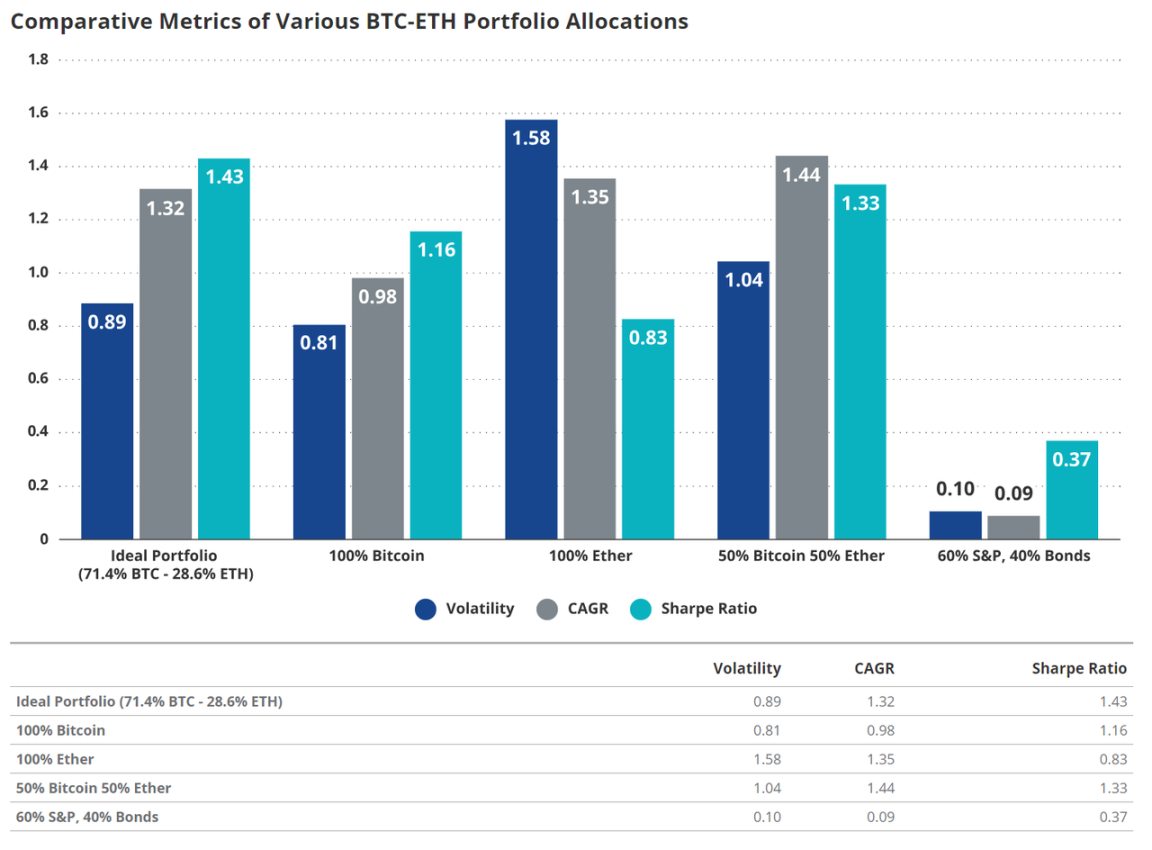

3. Optimal BTC and ETH allocation in a cryptocurrency portfolio

Focusing only on the BTC and ETH portfolios, we tested every possible weight combination to determine the best combination that maximizes the Sharpe Ratio. The analysis shows that the ideal allocation is 71.4% Bitcoin and 28.6% Ethereum. This configuration produces the highest Sharpe Ratio, indicating the best risk-adjusted return for a pure cryptocurrency portfolio. The findings highlight that investors need to hold both cryptocurrencies to maximize their benefits. A simple configuration of 50% BTC and 50% ETH also shows great upside, reinforcing the value of diversification within the crypto asset class.

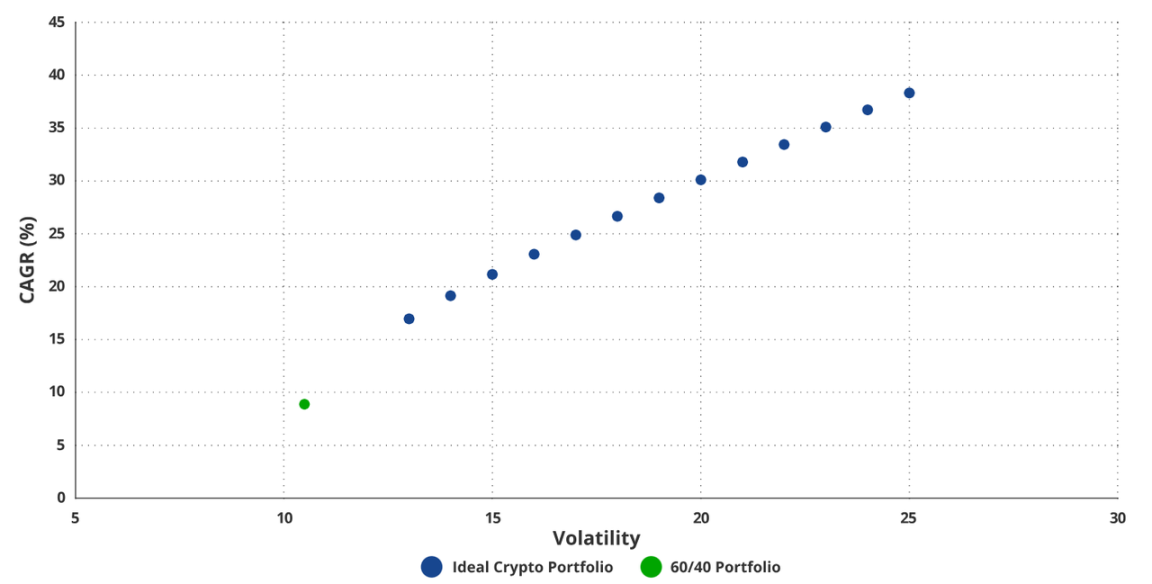

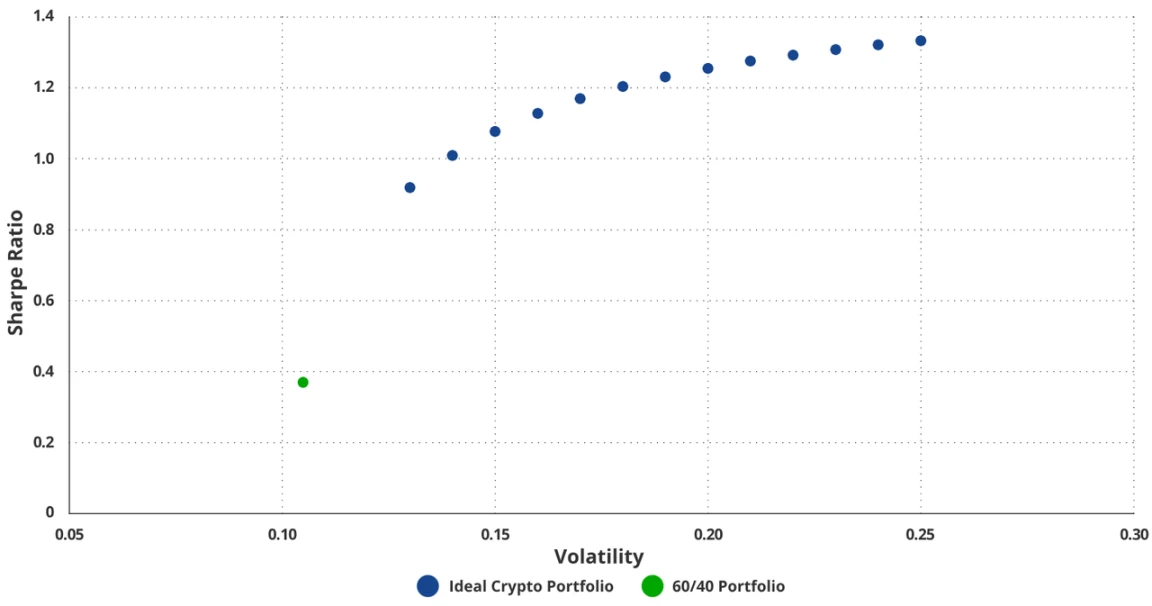

4. The Efficient Frontier When Including Cryptocurrencies

To achieve an optimal allocation to cryptocurrencies without constraints while maintaining reasonable volatility, we examine the optimal weights of an ideal cryptocurrency portfolio (28.6% ETH and 71.4% BTC) to add to a traditional 60/40 portfolio. The goal is to maximize returns while maintaining a given volatility level (13%-25%), thereby generating an efficient frontier portfolio using these assets, with volatility levels typically associated with a broad range of investor portfolios. The resulting scatter plot shows that incorporating the optimal crypto portfolio into a traditional 60/40 portfolio can significantly improve returns with varying degrees of risk.

Additional volatility in digital assets helps overall returns

The Sharpe ratio of the mixed portfolio remained flat at 22% Volatility

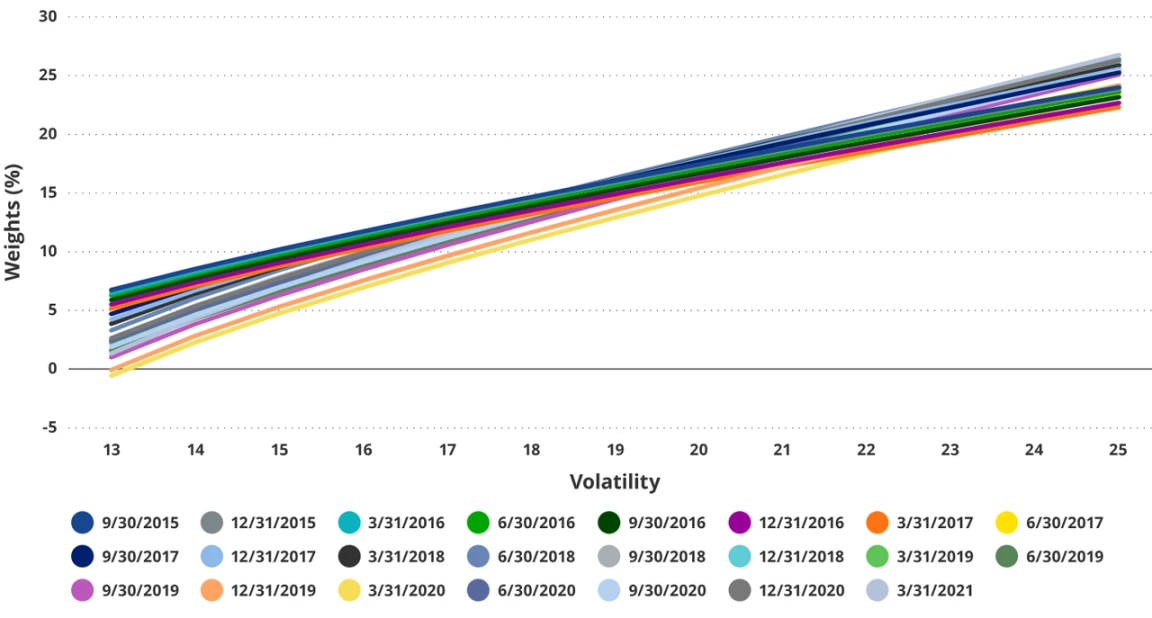

5. Time dependence of efficient frontier results

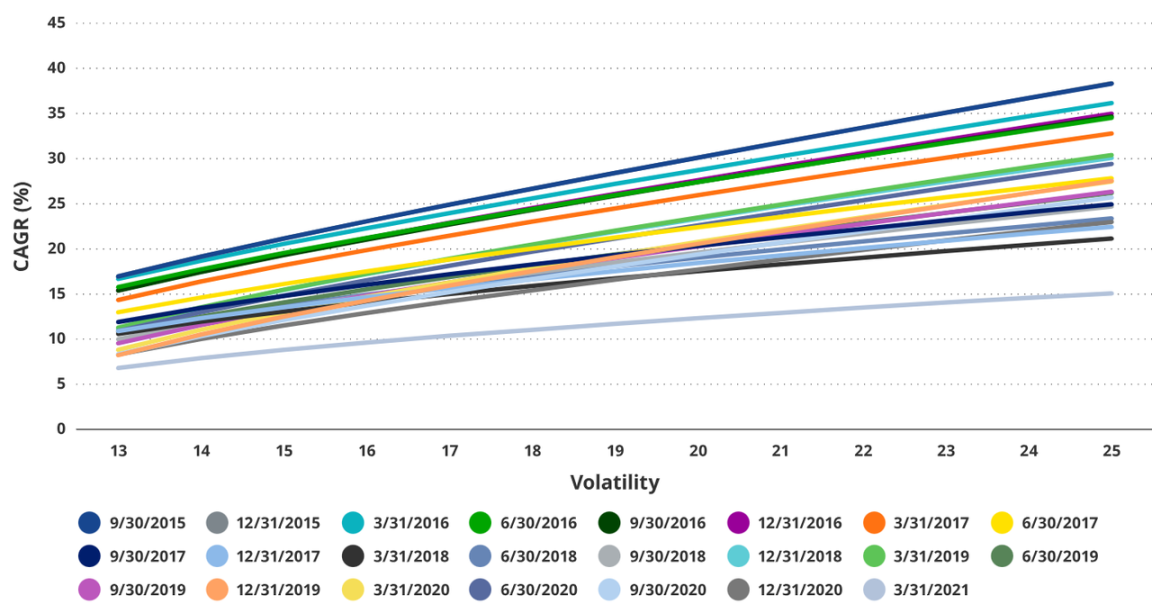

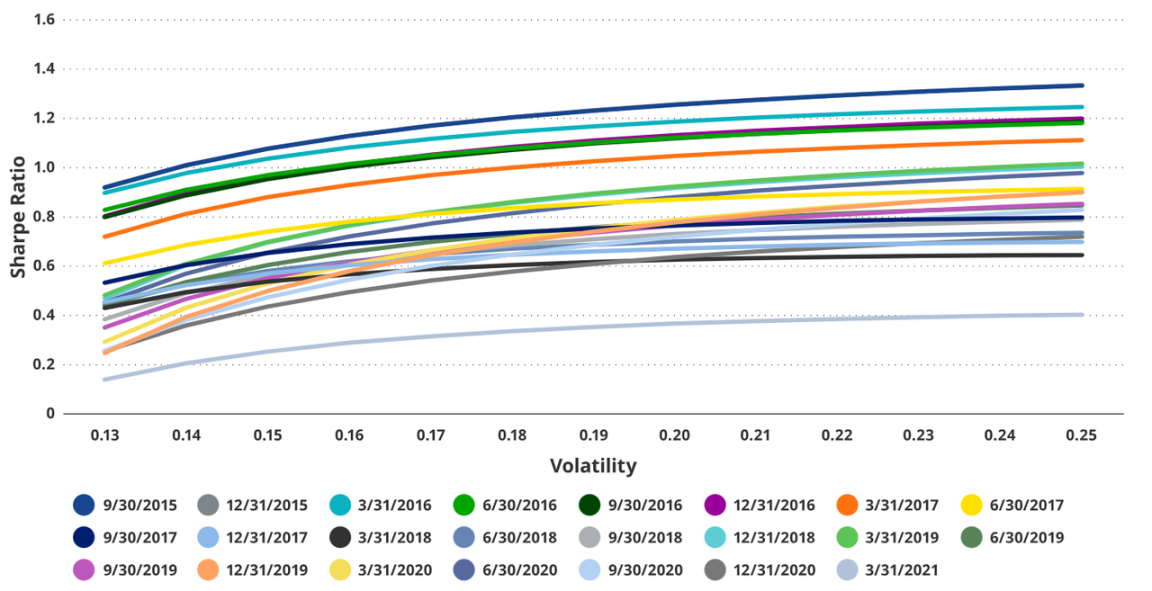

To determine whether different starting points have an impact on the risk/return profile of the combined ideal cryptocurrency and 60/40 portfolio, we repeated the analysis in Part 4 while repeatedly moving the starting point forward by 1 quarter. Our only restriction was to include at least 3 years of returns. Thus, we were able to generate 23 sets of results and remove time dependence as a variable from the analysis.

Our findings are:

-

The optimal weighting of an ideal cryptocurrency portfolio increases as risk increases across all time periods.

Volatility Weights for Time-Separate Portfolios

-

Higher cryptocurrency allocations allow for higher CAGRs across all time periods.

Compound annual growth rate of the time-independent portfolio in volatility

-

The Sharpe ratio generally increases with volatility and cryptocurrency allocation.

Sharpe ratio for volatility of time-separated portfolios

In other words, the results of Study 4 are independent of the starting point, thus supporting the inclusion of a balanced mix of Ethereum (ETH) and Bitcoin (BTC) in the portfolio, up to a weight of 6% in our study.

Ethereum Investment Risks

While ETH has a market cap of over $400 billion and is considered a mature smart contract platform, it is important to note that investing in ETH carries significant risks.

1. Reliance on speculation

At this stage, the Ethereum ecosystem is heavily dependent on speculation to generate revenue. If overall risk appetite declines, ETH could exhibit a significant downside beta coefficient to the SP 500 or Nasdaq Composite.

2. Regulatory risks

Depending on the regulations, ETH or many assets in its ecosystem may be classified as securities. This may result in many Ethereums having to register with the SEC or face serious legal consequences.

The largest financial firms have large lobbyists in governments around the world and many former employees appointed to top positions who could create regulatory barriers that disadvantage disruptors like Ethereum.

3. Interest rate risk

As a high-risk asset, interest rate hikes or other restrictive global liquidity could have a huge impact on ETH’s valuation compared to other asset classes.

4. Competition

Competition in the emerging smart contract platform space is fierce. Although Ethereum has a large lead, high-performance blockchains such as Solana and Sui have technical advantages and focus on business development and user experience. In the long run, this may enable them to challenge Ethereums dominance.

5. Financial companies continue to grow

One of Ethereum’s biggest advantages is that it makes the financial system cheaper because it eliminates many of the high-cost aspects of the current financial system. If financial companies turn to implementing cost-saving measures, they can retain their user base.

Existing financial firms could also create rival blockchain smart contract platforms, undercutting Ethereum’s long-term potential.

6. Geopolitics

Control of money is the most important area of government power. Geopolitical events, such as a major regional war or even increased geopolitical tensions, could prompt governments around the world to clamp down on non-sovereign financial systems and forms of currency.

สรุปแล้ว

In summary, adding a small amount of cryptocurrencies (up to 6%) to a traditional 60/40 portfolio can significantly improve the portfolios Sharpe ratio with relatively little impact on the maximum drawdown. In a portfolio consisting only of cryptocurrencies, Bitcoin and Ethereum have an allocation ratio close to 70/30, providing the best risk-adjusted returns.

Investors should consider their individual risk tolerance, but the data suggests that adding BTC and ETH in a balanced manner can provide significant return enhancement relative to the incremental risk introduced. These findings highlight the potential of cryptocurrencies to improve portfolio performance in a controlled and measurable manner.

This article is sourced from the internet: VanEck Report: ETH will reach $22,000 in 2030

Related: Restarting ICOs: Distributed Token Launch (DTL)

Original author: Anagram Original translation: Block unicorn VCs never innovated in funding structures, they just found a way to invest in companies earlier than ever before. There is no doubt that VC money infusing early-stage tech companies has accelerated innovation, but it has also meant minimizing the communities these products were designed to serve. Cryptocurrency itself is a novel technology with novel properties — permissionless, composable, decentralized — that bring new capabilities to bear on self-sufficient technology. With the advent of new technologies and new requirements, people are starting to think creatively about capital formation for the first time since the IPO. In 2017, ICOs received a lot of attention and quickly attracted investors across the field. However, in 2018, the bear market arrived and many projects and their accompanying…