SignalPlus Macro Analysis (20240527): ETH ETF is about to be approved, BTC ETF has seen net inflows for three consecutiv

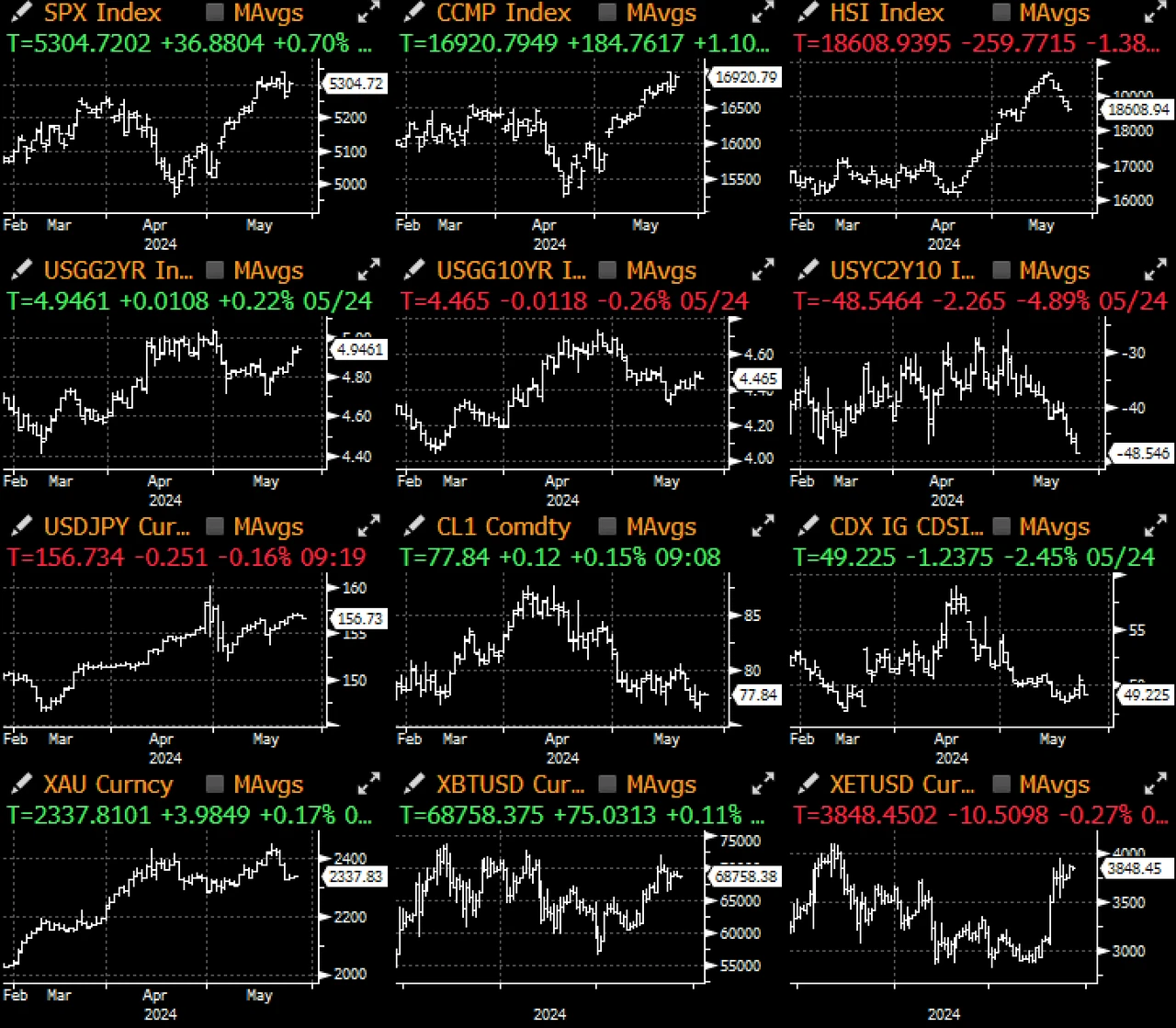

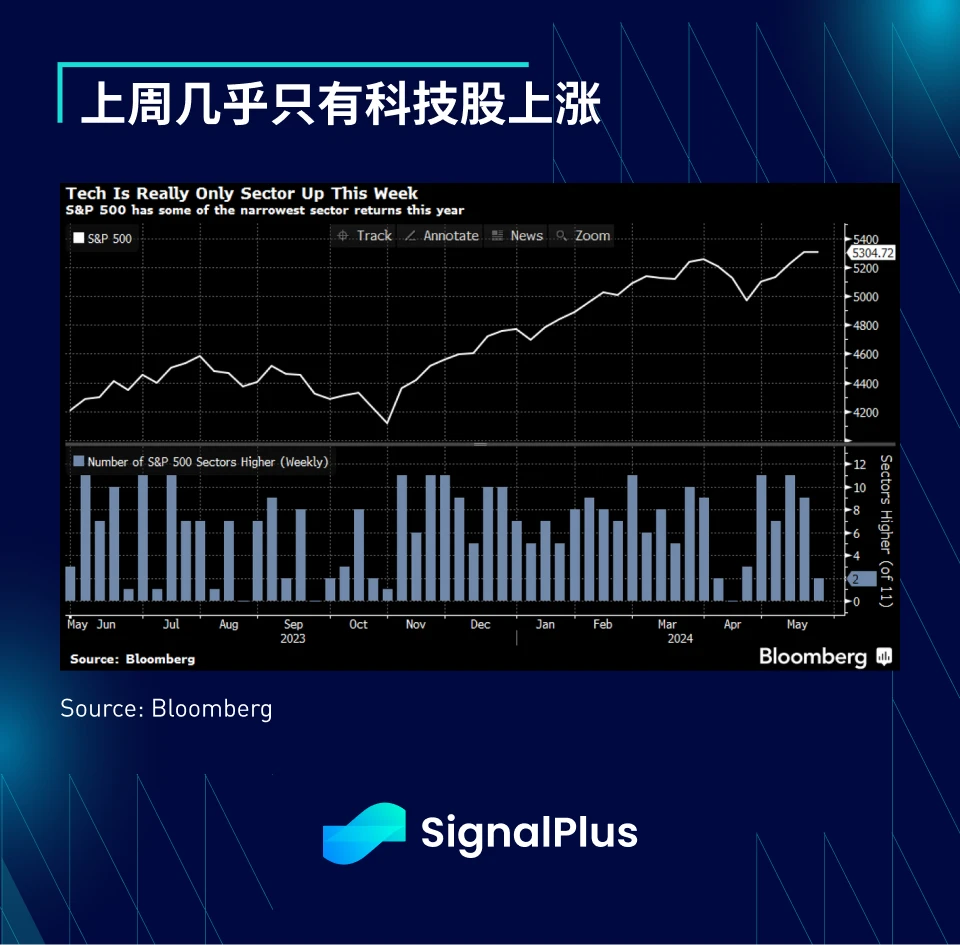

Last week, what many people call a single-pillar market continued, with Nvidia almost single-handedly supporting the market, while high PMIs and inflation expectations and significantly more hawkish Fed rhetoric posed new challenges to the narrative of ideal prosperity. According to Wall Streets observation, last week was the week with the fewest sectors rising since October last year, showing that the markets leading momentum is becoming increasingly concentrated, among which Nvidia is undoubtedly the biggest contributor to last weeks gains.

As we head into the long weekend, the US Treasury yield curve is bullish and flat, with the 2-year yield approaching 5% again. Next, the interest rate market will focus on PCE data this Friday, with the market expecting core PCE to increase by 2.8% year-on-year. At the same time, the stock market has risen amid declining trading volume and weakening market conviction. Rising valuations are accompanied by a seemingly slowing economy, and the Fed, which has a mediocre influence, makes it more difficult to form a strong view.

Over the past 1.5 months, the divergence between economic data and inflation surprises seems to have become more entrenched, with US economic data undeniably trending weaker, yet inflation data moving in the wrong direction, and Bloomberg’s new NLP model showing that Fed officials’ language has become significantly more hawkish, yet asset markets have ignored this, with FX, equities, interest rate volatility and credit spreads all hitting medium-term lows. However, this is bound to change, and our view is that the macro market is a bit short-sighted at the moment, with almost no equity short positions being maintained over the past 6 months.

The cryptocurrency market is still boosted by the rapid development of ETH ETF approval, and issuers have quickly submitted updated S-1 documents. ETH is expected to challenge $4,000, while the ETH/BTC ratio rebounded to the 6-month average, and BTC ETFs also benefited from inflows, with cumulative inflows in the past 3 weeks showing strong performance. Finally, the US election is approaching, and both sides of the competition seem to have decided to see cryptocurrency as a platform to win over young voters such as libertarians and swing votes. Former President Trump has made a series of radical pro-cryptocurrency remarks (including accepting cryptocurrency donations, etc.).

คุณสามารถค้นหา SignalPlus ได้ใน Plugin Store ของ ChatGPT 4.0 เพื่อรับข้อมูลการเข้ารหัสแบบเรียลไทม์ หากคุณต้องการรับข้อมูลอัปเดตของเราทันที โปรดติดตามบัญชี Twitter ของเรา @SignalPlus_Web3 หรือเข้าร่วมกลุ่ม WeChat ของเรา (เพิ่มผู้ช่วย WeChat: SignalPlus 123) กลุ่ม Telegram และชุมชน Discord เพื่อสื่อสารและโต้ตอบกับเพื่อน ๆ มากขึ้น เว็บไซต์อย่างเป็นทางการของ SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240527): ETH ETF is about to be approved, BTC ETF has seen net inflows for three consecutive weeks

Related: Ripple (XRP) Price Correction: How Long Will the Downtrend Last?

In Brief XRP price undergoes a corrective phase, raising concerns about when it will rebound. Recent rejection at $0.632 Fibonacci resistance suggests a revisit to $0.52 support. While daily chart indicates bullish potential, 4-hour and weekly charts show bearish signals. The XRP price continues to undergo a corrective phase. Investors are eager to know if Ripple’s price will soon rebound to resume its upward trajectory. Over the past day, Ripple’s price has once again experienced a decline. This raises questions about when the corrective phase for Ripple will come to an end. XRP Price Hurdle: Rejected Bearishly at $0.632 Fib Resistance In the past seven days, the XRP price has partially recovered from its correction. However, as of yesterday, Ripple’s price trajectory has again turned downward. The recent downturn occurred…