การวิเคราะห์มหภาคของ SignalPlus (17/04/2024): ตลาดเริ่มกลับสู่ภาวะปกติอีกครั้ง

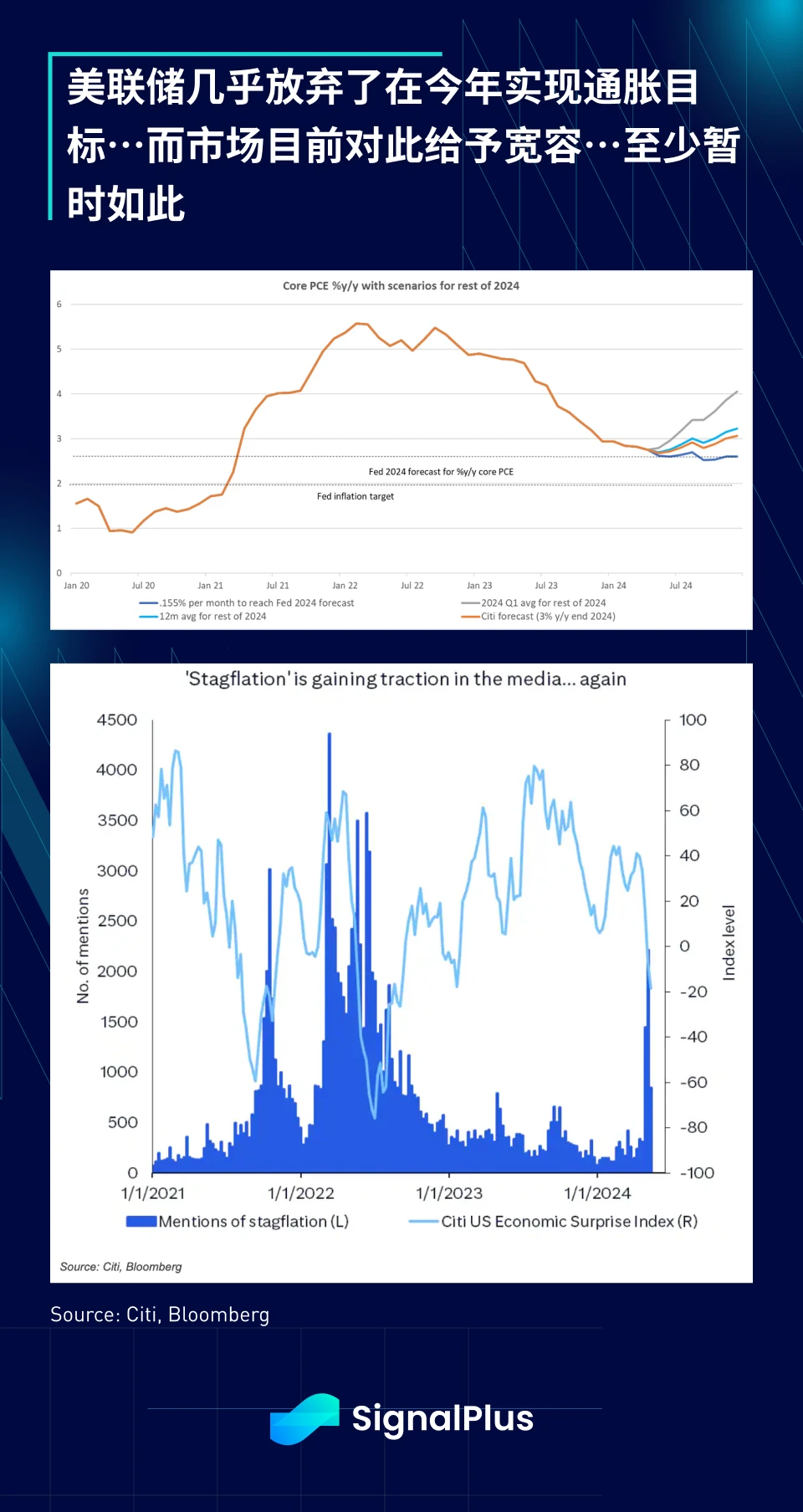

ในช่วงสัปดาห์ที่ผ่านมา การเติบโตทางเศรษฐกิจที่ชะลอตัวและคาดการณ์ว่าอัตราเงินเฟ้อจะลดลงได้กระตุ้นให้เกิดภาวะเศรษฐกิจถดถอยอีกครั้ง ซึ่งนี่ไม่ใช่ครั้งแรกที่เราพบเห็นเหตุการณ์เช่นนี้ ปฏิกิริยาที่เป็นธรรมชาติที่สุดของตลาดในเวลานี้คือความรู้สึกกลัวพลาด (FOMO) ของหุ้น การซื้อตราสารสินเชื่อ การเก็บอัตราดอกเบี้ยคงที่ การขายชอร์ตความผันผวน และรับผลตอบแทนจากการเก็งกำไร ซึ่งถือเป็นพฤติกรรมมาตรฐานตั้งแต่การประชุม FOMC ครั้งล่าสุด และเนื่องจากไม่มีตัวแปรสำคัญใดๆ แนวโน้มนี้จึงไม่มีทีท่าว่าจะชะลอตัวลง

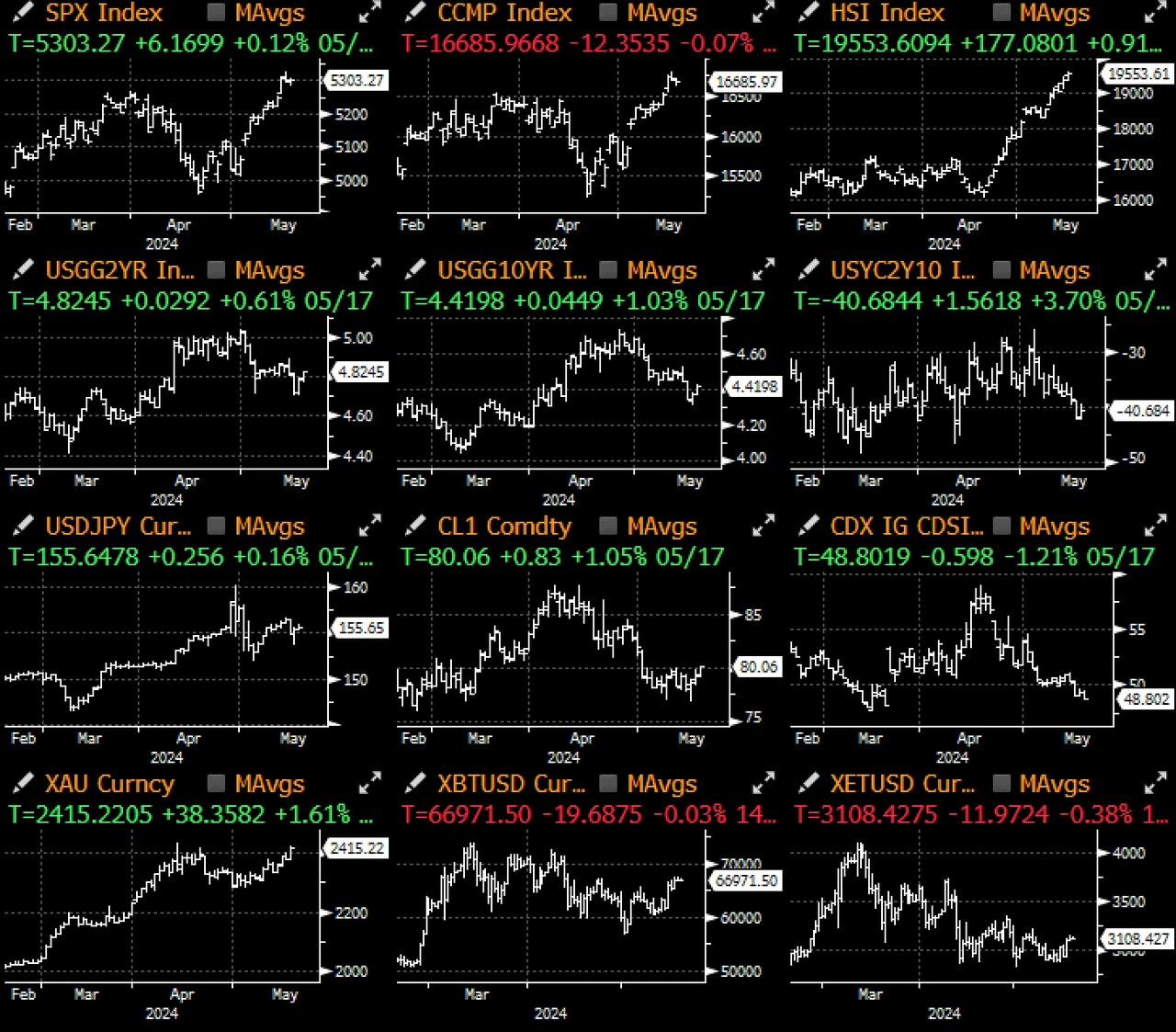

ตลาดหุ้นพุ่งแตะระดับสูงสุดใหม่เมื่อสัปดาห์ที่แล้ว โดยดัชนี SPX พุ่งขึ้น 1.5% ทะลุ 5,300 จุด โดยหุ้นกลุ่มยานยนต์ (+4.4%) กลุ่มเทคโนโลยี (+2.9%) และกลุ่มอสังหาริมทรัพย์ (+2.5%) มีผลงานดีเป็นพิเศษในสภาพแวดล้อมทางการเงินที่เป็นมิตร อัตราผลตอบแทนพันธบัตรอายุ 10 ปีลดลง 8 จุดพื้นฐาน และขณะนี้ลดลง 27 จุดพื้นฐานในเดือนนี้ ขณะที่ราคาน้ำมัน (+2%) ทองคำ (+2%) และทองแดง (+8%) ก็พุ่งขึ้นเช่นกันในเดือนนี้ ตามที่บทความของ Wall Street Journal กล่าวไว้ มีอะไรที่ไม่น่าชอบเกี่ยวกับสภาพแวดล้อมการลงทุนในปัจจุบัน?

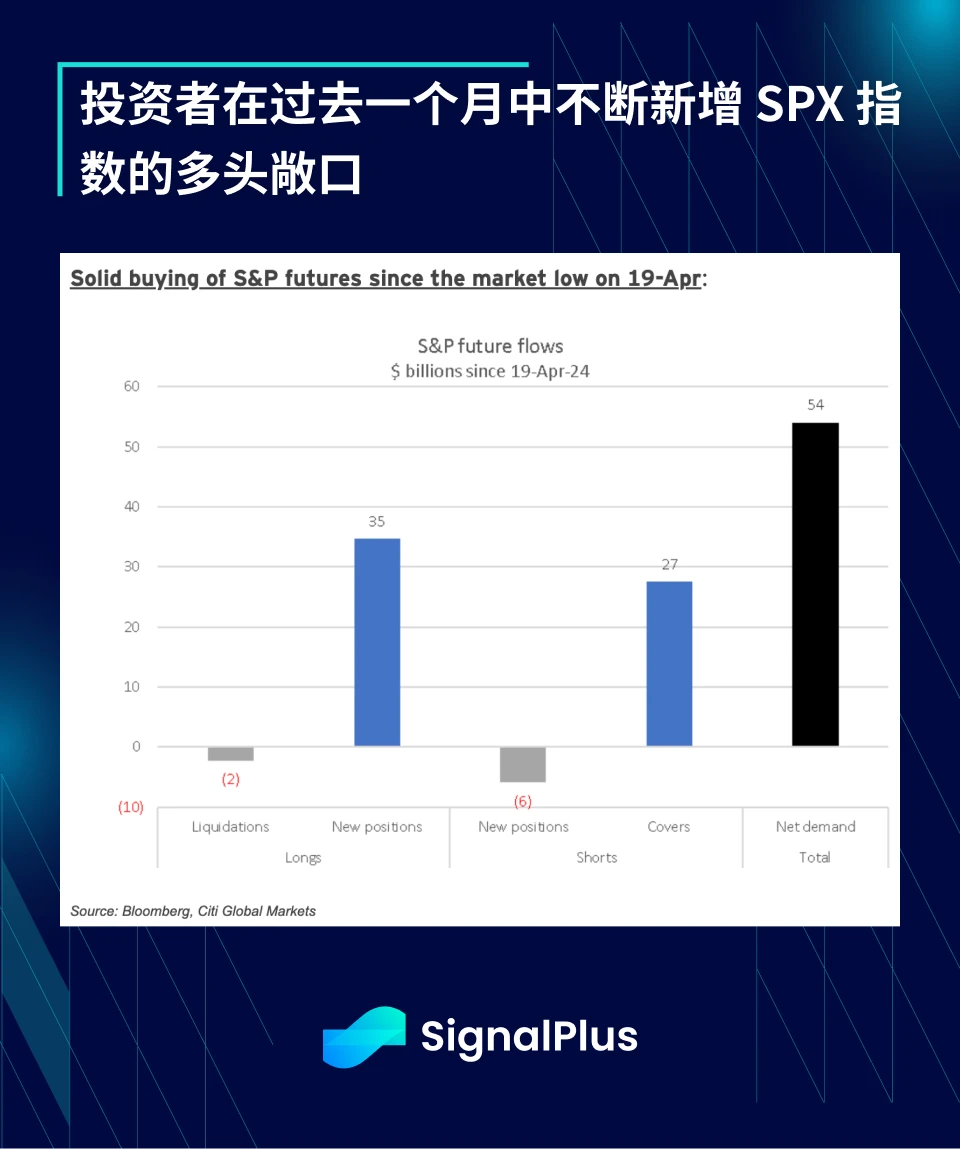

นอกจากนี้ ผู้ซื้อขายบนวอลล์สตรีทเชื่อว่าการขึ้นของตลาดหุ้นเมื่อเร็วๆ นี้ได้เปลี่ยนจากการปิดสถานะระยะสั้นอย่างแท้จริงไปเป็นสถานะซื้อใหม่ โดยที่ Citi ประมาณการว่าจะมีการออก ETF ดัชนี SPX ใหม่มากกว่า $50 พันล้านในช่วงเดือนที่ผ่านมา ขณะที่ ICI รายงานว่ามีการออก ETF หุ้นในประเทศมากกว่า $20 พันล้านนับตั้งแต่ต้นเดือน เนื่องจากนักลงทุนรายย่อยต่างพากันทำกำไรจากการขึ้นของราคาครั้งนี้

กระแสออปชั่นหุ้นก็ชี้ไปในทิศทางเดียวกัน โดยราคาออปชั่นไบนารีสะท้อนให้เห็นโอกาส 25% ที่จะได้กำไรเพิ่มอีก 10% ใน SPX ภายในสิ้นปี นอกจากนี้ อัตราส่วนการซื้อ/ขายของออปชั่น 0 DTE ก็เพิ่มขึ้นอีกครั้งระหว่างการพุ่งขึ้นนี้ โดยมีปริมาณประมาณ 56% ที่ขายออปชั่น

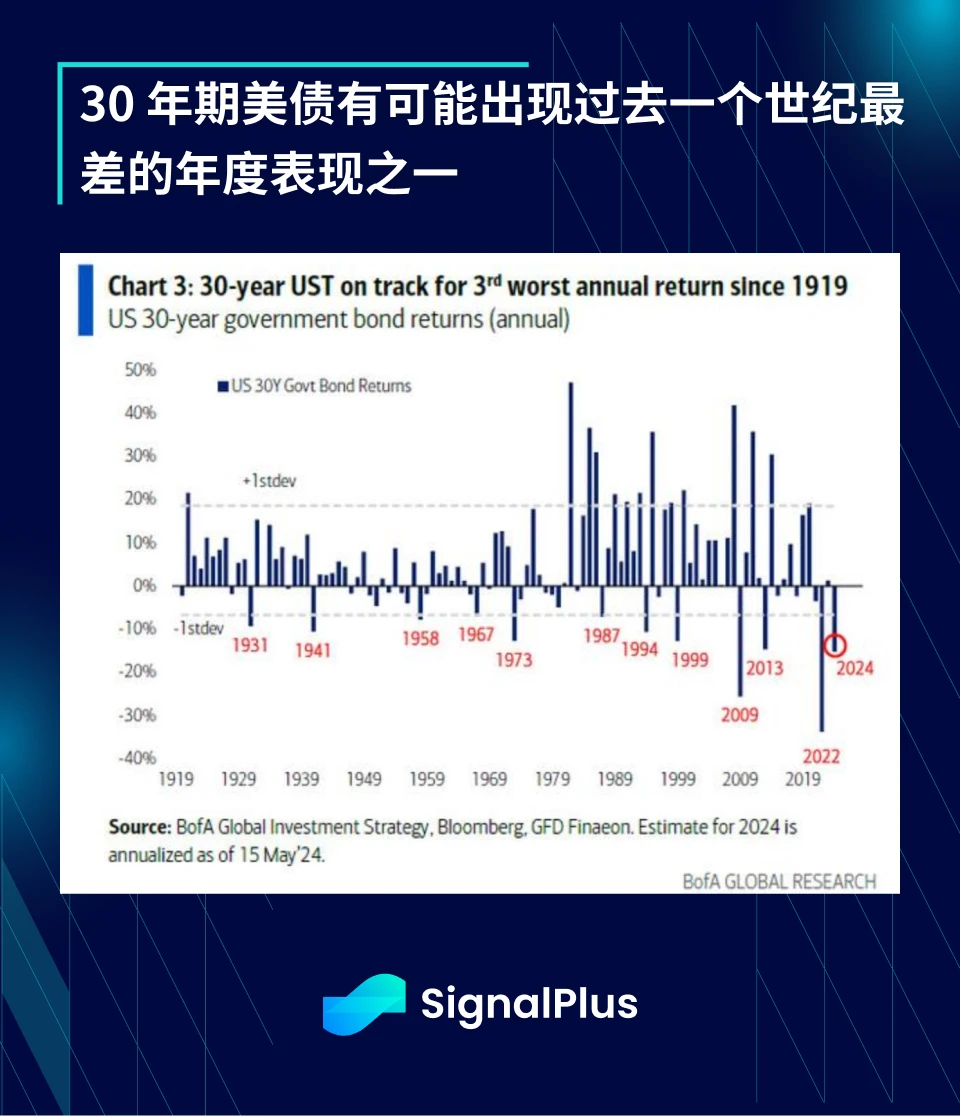

ที่น่าสนใจคือ เบื้องหลังความตื่นตระหนกทั้งหมดนี้ พันธบัตร 30 ปีมีพฤติกรรมที่แตกต่างจากปกติ ตามการประมาณการของ BoA พันธบัตร 30 ปีกำลังมุ่งหน้าสู่ผลตอบแทนรายปีที่แย่เป็นอันดับสามในรอบศตวรรษ การใช้จ่ายภาครัฐที่ผ่อนปรน งบประมาณที่ควบคุมไม่ได้ เงื่อนไขทางการเงินที่ผ่อนปรนเกินไป และธนาคารกลางสหรัฐฯ ที่ทนต่อเงินเฟ้อได้ (เป้าหมายเงินเฟ้ออยู่ที่ไหน) กำลังส่งผลกระทบเชิงลบต่อเครื่องมืออัตราดอกเบี้ยระยะยาว นโยบายการคลังที่เอื้ออำนวยในที่สุดก็จะได้รับผลตอบแทนผ่านอัตราดอกเบี้ยจริงที่สูงขึ้นและ/หรืออัตราแลกเปลี่ยนที่อ่อนค่าลง แต่ยังไม่ถึงเวลานั้น...

ไม่มีข้อมูลที่น่าสนใจมากนักในสัปดาห์นี้จนกว่า Nvidia จะรายงาน และจากนั้นก็กลับสู่โหมดวันหยุดอีกครั้งก่อนการประกาศตัวเลขการจ้างงานนอกภาคเกษตรและ FOMC + CPI ในสองสัปดาห์แรกของเดือนมิถุนายน อิงจากการถ่วงน้ำหนักของ Nvidia ใน SPX และความผันผวนที่นัยโดยอ็อปชั่นของ Nvidia บริษัทมีผลกระทบต่อ SPX ในวันรายงานผลประกอบการ +/- 0.4% และการวางตำแหน่งในหุ้นดูเหมือนจะเข้มข้นเท่ากับเมื่อต้นปี

ไม่มีข่าวอะไรให้ติดตามมากนักในแวดวงคริปโต ราคา BTC กำลังซื้อขายที่ระดับความสัมพันธ์ระยะสั้นสูงสุดกับ Nasdaq นับตั้งแต่ไตรมาสที่ 3 ปี 2024 และการเคลื่อนไหวของราคาเป็นไปในทางบวก โดยนักลงทุนในประเทศกำลังมองหาโอกาสที่จะท้าทายจุดสูงสุดตลอดกาลอีกครั้งในอีกไม่กี่สัปดาห์ข้างหน้า ไม่มีอะไรจะเปลี่ยนความรู้สึกได้มากกว่าราคา และไม่มีอะไรจะส่งผลกระทบต่อราคาคริปโตได้มากกว่าหุ้นในตอนนี้ ทุกคนกลายเป็นผู้ซื้อขายตามอัตราในช่วงครึ่งแรกของปี 2023 และตอนนี้สินทรัพย์มหภาคทุกประเภทก็กลายเป็นเครื่องมือซื้อขายรายวันของ Nasdaq ที่ถูกปกปิดไว้ หวังว่าการหยุดชั่วคราวของตลาดจะทำให้ทุกคนได้มีเวลาหายใจหายคอบ้าง!

คุณสามารถค้นหา SignalPlus ใน Plugin Store ของ ChatGPT 4.0 เพื่อรับข้อมูลการเข้ารหัสแบบเรียลไทม์ หากคุณต้องการรับข้อมูลอัปเดตของเราทันที โปรดติดตามบัญชี Twitter ของเรา @SignalPlus_Web3 หรือเข้าร่วมกลุ่ม WeChat ของเรา (เพิ่มผู้ช่วย WeChat: xdengalin) กลุ่ม Telegram และชุมชน Discord เพื่อสื่อสารและโต้ตอบกับเพื่อนๆ เพิ่มเติม

เว็บไซต์อย่างเป็นทางการของ SignalPlus: https://www.signalplus.com

บทความนี้มีที่มาจากอินเทอร์เน็ต: การวิเคราะห์มหภาคของ SignalPlus (17/04/2024): ตลาดเริ่มกลับสู่ภาวะปกติอีกครั้ง

ที่เกี่ยวข้อง: คอลัมน์ความผันผวน SignalPlus (13/05/2024): จุดเริ่มต้นที่แข็งแกร่ง

เมื่อวันศุกร์ที่ผ่านมา ข้อมูลเศรษฐกิจมหภาคของสหรัฐฯ มีผลงานไม่ดี โดยคาดการณ์อัตราเงินเฟ้อ 1 ปีในเดือนพฤษภาคมเพิ่มขึ้นจาก 3.2% เป็น 3.5% ดัชนีความเชื่อมั่นผู้บริโภคของมหาวิทยาลัยมิชิแกนแสดงให้เห็นถึงความอ่อนแอ โดยลดลงเหลือ 67.4 ซึ่งชดเชยผลกระทบเชิงบวกจากข้อมูลการจ้างงานที่อ่อนแอล่าสุดต่อความรู้สึกเสี่ยงของตลาด อัตราผลตอบแทนพันธบัตรสหรัฐอายุ 10 ปี กลับมาอยู่เหนือระดับ 4.5% ครั้งหนึ่ง และอัตราผลตอบแทนพันธบัตรอายุ 2 ปี ซึ่งไวต่อนโยบายอัตราดอกเบี้ยมากกว่า เพิ่มขึ้นแตะระดับ 4.853% สินทรัพย์เสี่ยงมีผลงานค่อนข้างสม่ำเสมอ และดัชนีหุ้นหลัก 3 ตัวของสหรัฐฯ ปรับตัวเพิ่มขึ้นและลดลง โดยดัชนีดาวโจนส์และดัชนีหุ้นเอกชนปิดตลาดเพิ่มขึ้นเล็กน้อยที่ 0.32%/0.16% ตามลำดับ และดัชนีแนสแด็กปิดตลาดลดลง 0.03% สัปดาห์นี้ ตลาดจะให้ความสนใจกับข้อมูล CPI ที่เผยแพร่ในวันพุธ ซึ่งอาจกลายเป็นปัจจัยสำคัญที่ขับเคลื่อนแนวโน้มราคาในระยะกลาง ที่มา: Investing…