เนื่องจากมีผู้ใช้งานรายวันมากกว่า Solana, Arbitrum จึงกลายเป็นผู้ได้รับประโยชน์สูงสุดจากการอัปเกรด Dencun ใช่หรือไม่

Original article by Ryan Celaj, DLNews

ต้นฉบับแปล: ลูซี่, BlockBeats

Editors note: After the Dencun upgrade, the transaction cost on Ethereums second-layer blockchain has been reduced by up to 99%. Among them, Arbitrums daily active users and total transaction volume reached a new high on Monday, surpassing Solana. However, the total value of crypto assets, transaction volume and coin prices on Arbitrum are all falling. DLNews reporter Ryan Celaj conducted a data analysis on this. The original text is translated as follows:

- On Monday, Arbitrum reached new highs for daily active users and total transaction volume.

- However, Arbitrum governance token is down 58% since its all-time high at the beginning of the year.

- Arbitrum remains the leader in total crypto asset value, daily transaction volume, and number of daily active users among Ethereum second-layer blockchains.

As Ethereum transaction fees drop to their lowest levels in years, activity on Arbitrum, a second-layer network built on top of Ethereum, has reached an all-time high.

On Monday, Arbitrum daily active addresses surged to a new all-time high of 856,000, up 150% from the 341,000 recorded in early May. The surge puts Arbitrum daily active users ahead of Solana 833,000, despite Solana recent popularity boosted by the memecoin trading frenzy.

This happened on March 15 with Ethereum Dencun upgrade, which reduced transaction costs on Ethereum second-layer blockchain by up to 99%.

Arbitrum Daily Active Addresses and Transactions (Growthepie)

In the week before the upgrade, the number of transactions on Arbitrum was just 747,000, a number that jumped to 1.5 million in the week after the upgrade, before peaking on Monday.

Arbitrum DAO also recently unveiled its plans to invest 35 million ARB tokens in stable, liquid assets. This has led to more than two dozen companies launching potential products, including heavyweights Franklin Templeton, a trillion-dollar asset manager, and Securitize, a company that helps BlackRock tokenize assets.

Despite these significant developments, the total value of crypto assets on Arbitrum has fallen 22% to $15.7 billion from its all-time high of $20 billion on April 1. Trading volume on Arbitrum decentralized exchange has fallen 82% to $404 million from its high of $2.2 billion on March 4. The price of Arbitrum governance token, ARB, has also performed poorly.

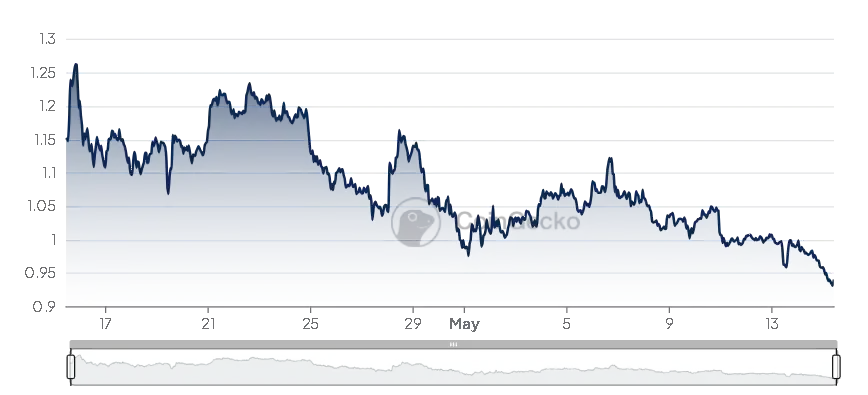

ARB Daily Token Price

ARB hit an all-time high on January 11, reaching $2.26, and came close again on March 7, reaching $2.17. However, the token has fallen 58% since January and currently trades at $0.94. Meanwhile, Ethereum has risen by about 10% in the same period.

One reason for the lag in ARB prices could be the massive token unlocking by Offchain Labs, the development team behind Arbitrum, and its investors. On March 15, about $1.2 billion worth of ARB tokens were unlocked and distributed to these groups, with the tokens being locked up for a year.

Still, Arbitrum remains the preferred second-layer blockchain for bridging to Ethereum overall. According to data as of April 28, just over 1.7 million ether has been transferred to Arbitrum, while Arbitrum 14 largest second-layer competitors have only seen around 1.5 million ether bridged to their blockchains.

This article is sourced from the internet: With more daily active users than Solana, Arbitrum becomes the biggest beneficiary of Dencun upgrade?

Original author: Duncan Original translation: TechFlow While Rune is stealing the show, Bitcoin developers are hard at work introducing a Frankenstein-like monster on top of the world’s most trusted blockchain. Because Bitcoin can take so many different forms, you might think of Bitcoin’s second layer as more of a venture capital gimmick than a cutting-edge development in finance. But, dear reader, please note that Bitcoin is much more than people think. Example? Okay. Bitcoin is like an onion with many layers. In the current case of Bitcoin, there is L2, an emerging narrative that promises to bring Bitcoin into decentralized finance, providing people with lucrative returns. But, like an onion, there are different kinds, and how they are prepared is important. Will the high-end technology attract new users, or just…