HashWhale BTC Mining Weekly Report | The market is waiting for a key trigger point; Trump promises to make the United St

1. Bitcoin Рынок

From March 15 to March 21, 2025, the specific trend of Bitcoin is as follows:

March 15

Bitcoin suddenly rose at the close of the previous day, with the price rising from $82,976 to $85,043. The market then experienced a brief correction, with the price fluctuating in a narrow range of $83,790-$84,640 throughout the day. In the evening, Bitcoin rebounded slightly from $83,792 to $84,453, and remained near this level in the short term.

March 16

Bitcoin continued to fluctuate, with the overall price around $84,400. It briefly dropped to $83,839 before quickly recovering. The market fluctuated violently in the afternoon, with Bitcoin suddenly dropping from $84,271 to $82,490, and then rebounding to $84,358, showing that the markets long and short battles intensified.

March 17

The market was in fierce competition between long and short positions, and the price trend fluctuated violently. Bitcoin formed short-term support at $83,700 and $83,000, but eventually fell to $82,047, and the decline was temporarily halted. It then quickly rebounded to $83,777, but failed to stabilize, and fell back to $82,711 in the short term, then rebounded to $83,714 again, and then fluctuated downward to $82,771, showing an overall trend of narrowing the range.

18 марта

Bitcoin broke through the range of fluctuations and rose to US$84,572, and then showed a step-by-step decline, falling to US$83,976, US$83,062, and US$82,361. After a brief rebound to US$83,343, it weakened again and finally fell below US$82,000, reaching a low of US$81,367.

19 марта

Market sentiment began to turn positive, and Bitcoin started a rebound trend. It started to rise from $81,343, briefly broke through $82,223, and then continued to rise to $83,110, and maintained a volatile upward trend, and finally closed at $86,841.

20 марта

Continuing the previous days upward trend, the price of Bitcoin slightly adjusted from $84,713 to $83,990, and then quickly rose to $85,907, and then further rose to a new stage high of $87,427. However, the market fluctuated violently in the short term, and Bitcoin quickly adjusted back to $85,082, rebounded to $86,303, and then plunged again, reaching a low of $83,727.

March 21

Bitcoin briefly bottomed out and then stabilized, starting a new round of volatile recovery, first rising to $84,285, and then further climbing to $84,681 after a correction. As of writing, Bitcoin is quoted at $84,618, and the market as a whole has entered a consolidation phase.

Подведем итог

This week, the overall trend of Bitcoin fell first and then rose, with multiple confrontations between long and short forces. The market was under pressure in the first half of the week, and prices fluctuated downward. In the second half of the week, there was a strong rebound, and the price broke through the key resistance level and then adjusted. As of now, the price of Bitcoin remains around US$84,600, and market sentiment has stabilized. In the future, we need to pay attention to whether it can further break through the key resistance area.

Bitcoin price trend (2025/03 /15-2025/03/21)

2. Market dynamics and macro background

Fund Flows

Обмен fund flow

-

Bitcoin spot ETF fund outflow: As of March 14, 2025, the US spot Bitcoin ETF has reduced its holdings by 55,348 биткойнs in the past 35 days, a decrease of 4.76%, reflecting a decrease in demand from institutional investors.

-

Comparison of fund flows between gold and Bitcoin ETFs: In the past 30 days, gold ETFs have attracted $10 billion in inflows, while Bitcoin ETFs have suffered $5 billion in outflows. This trend shows that some investors are shifting funds from Bitcoin to traditional safe-haven assets such as gold.

Whale positions and trading dynamics

-

Whale trading activity surges: At the beginning of the week of March 15, large Bitcoin transactions were $32 billion, and then surged 40% to $42.9 billion, indicating that whale demand increased significantly by $13 billion in a short period of time.

-

Changes in whale holdings: According to IntoTheBlock data, the holdings of Bitcoin whales have been on a downward trend over the past year, but data from March suggests a possible trend reversal. The number of Bitcoins currently held by whales has increased by 62,000 from the beginning of the month, indicating that they are reaccumulating chips.

-

Whale short position event: On March 16, 2025, an anonymous trader 0x f 3 f opened a 40x leverage with a margin of $16.2 million on the decentralized derivatives exchange Hyperliquid, establishing a $379 million short position in Bitcoin with a liquidation line set at $86,593. This move attracted widespread attention in the market and exacerbated market volatility.

-

Whale liquidation: On-chain analysts monitor that the Hyperliquid 5 0x whale used the time-weighted average price (TWAP) strategy to gradually close short positions in Bitcoin. In an hour and a half, he closed 108 BTC, leaving 5,500 BTC short positions with a market value of approximately $455 million.

Technical indicator analysis

Moving Average (MA) :

-

Short-term moving average (5 days, 10 days): presents a buy signal, indicating that the short-term price trend is biased upward.

-

Long-term moving averages (50-day, 200-day): also show a buy signal, suggesting that the long-term trend remains bullish.

Relative Strength Index (RSI) :

-

The RSI indicator is in the overbought range, sending a strong buy signal, but we need to be wary of short-term pullback risks.

Stochastic :

-

The stochastic indicator simultaneously showed a strong buy signal, further supporting the short-term uptrend.

Overall, multiple technical indicators point to Bitcoin being in a strong buying zone, with both short-term and long-term trends maintaining an upward trend. However, as the RSI indicator is at a high level, attention should be paid to the risk of overbought corrections in the market. Investors are advised to be cautious in their layout based on their own risk tolerance.

Market sentiment

-

Panic subsides: According to the analysis of on-chain analyst Murphy, market panic has gradually weakened after reaching its peak, and players panic selling at low prices has significantly decreased, and the mood is quietly recovering.

-

Increased willingness to buy at the bottom: During the second wave of correction from March 7 to March 13, the number of active buy orders for Bitcoin spot on the Coinbase platform increased significantly, indicating that American players showed great interest in Bitcoin around $80,000 and had a strong willingness to buy at the bottom when the price fell 7.

-

Market confidence is recovering: Although prices have not yet fully reflected this sentiment shift, the market seems to be waiting for a key trigger point. From a macro perspective, the Federal Reserves interest rate meeting and Powells subsequent speech will become important nodes. As long as the results of the meeting do not exceed the markets pessimistic expectations, combined with current data, Bitcoin has a basis for a rebound in the short term.

Macroeconomic Background

Impact of Fed policy: The Fed kept its benchmark interest rate unchanged and plans to cut interest rates twice in 2025. This policy has increased market demand for Bitcoin, pushing Bitcoin toward $86,000 or higher.

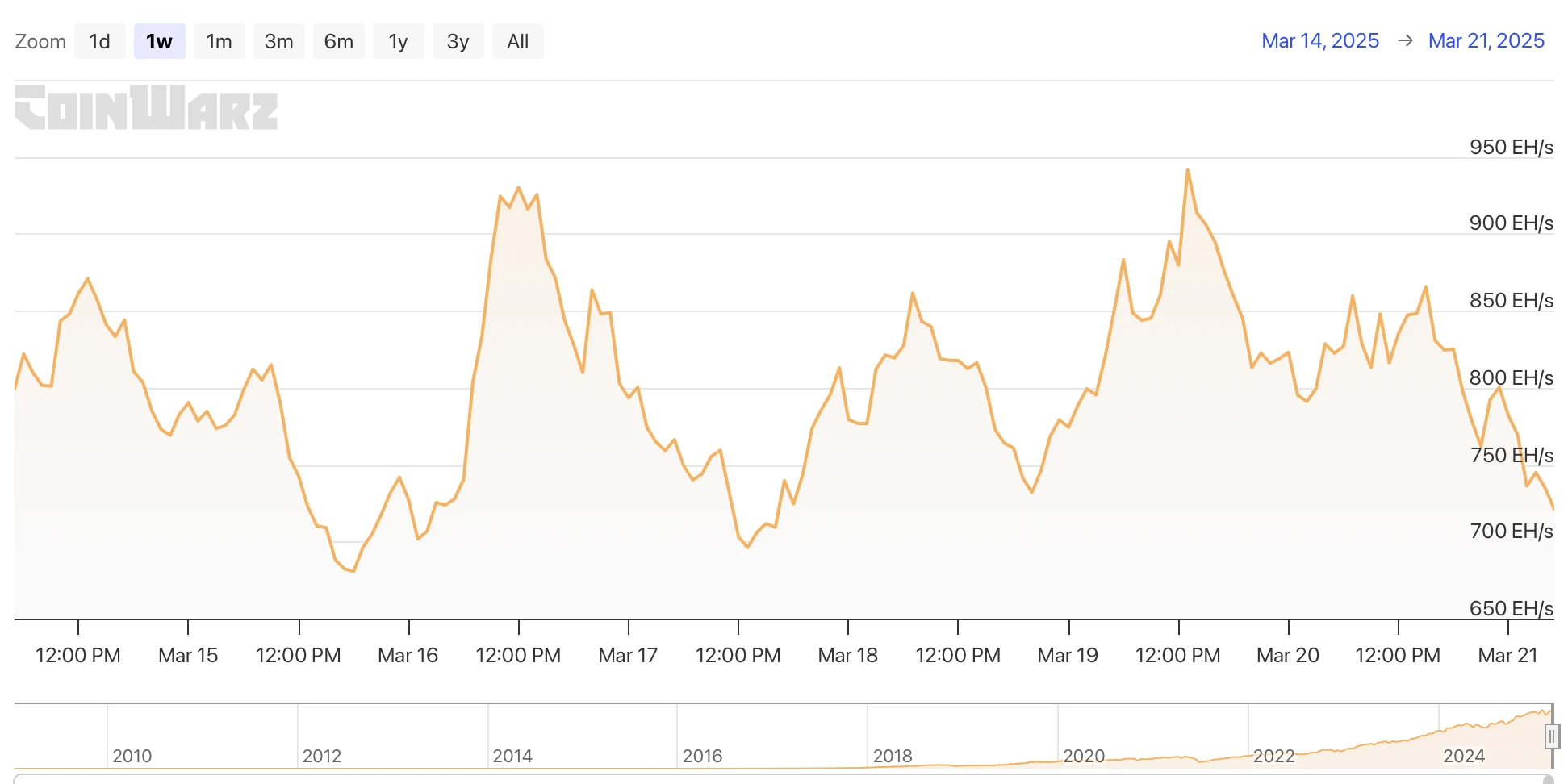

3. Hash rate changes

Between March 15 and March 21, 2025, the Bitcoin network hash rate fluctuated as follows:

On March 15, the hash rate showed an overall downward trend, rising from 790.37 EH/s to 814.94 EH/s, then falling sharply to 680.74 EH/s, and rebounding to 741.72 EH/s in a short period of time. On March 16, the hash rate dropped to 701.74 EH/s, then rebounded strongly to 924.43 EH/s, and maintained at a high level for a short time, and then entered a correction phase, reaching a minimum of 793.49 EH/s. On March 17, the hash rate continued the previous days volatile trend, first falling to 696.23 EH/s, then gradually rising to 812.89 EH/s, and then falling slightly to 779.32 EH/s during the session. On March 18, the hash rate briefly climbed to 861.48 EH/s before entering a correction phase, gradually falling to 731.93 EH/s. On March 19, the hash rate slowly rose, reaching a high of 941.81 EH/s, then fell back to 813.10 EH/s, and remained volatile within this range. On March 20, the hash rate first dropped to 791.07 EH/s, then rebounded to 859.72 EH/s, and after a slight adjustment, it further rose to 865.68 EH/s, but then continued to fall back, reaching a low of 762.04 EH/s, and finally rebounded to 800.32 EH/s. On March 21, as of the time of writing, the hash rate was on a downward trend.

The overall hash rate showed strong volatility this week, especially on March 16 and March 19, when it rose sharply, which may be affected by factors such as miners computing power adjustments, changes in market sentiment, or fluctuations in energy supply. Subsequent trends still need to pay attention to the distribution of computing power across the entire network, mining difficulty adjustments, and changes in the macro market environment.

Bitcoin network hash rate data

4. Mining income

Between March 15 and March 21, 2025, Bitcoin miners’ earnings were affected by multiple factors, including Bitcoin price fluctuations, mining difficulty adjustments, and market sentiment.

On March 17, according to CoinDesk, a research report released by JPMorgan Chase (JPM) on Monday showed that the computing power of the Bitcoin network increased slightly in March and the economic efficiency of mining declined.

The report pointed out that US listed mining companies maintained about 30% of the network computing power share. At the same time, the average price of Bitcoin fell by about 10% during the period, which put pressure on the economics of mining. The price of computing power (a measure of daily mining profitability) remained basically unchanged compared with the end of last month. In the first two weeks of March, miners received about $48,300 per EH/s in daily block rewards, down 11% from February and 52% from the halving event in April last year.

The total market value of 14 US listed mining companies tracked by JPMorgan Chase fell 13% from the previous month, about $3 billion. Among them, Argo Blockchain (ARGO) performed best, up 1%, while Cipher Mining performed the worst, down 25%. The report added that during the same period, only one of the mining companies covered by the bank performed better than Bitcoin.

Overall, although the computing power of the Bitcoin network continues to grow, miners profitability is facing further pressure to shrink due to the price correction of the currency.

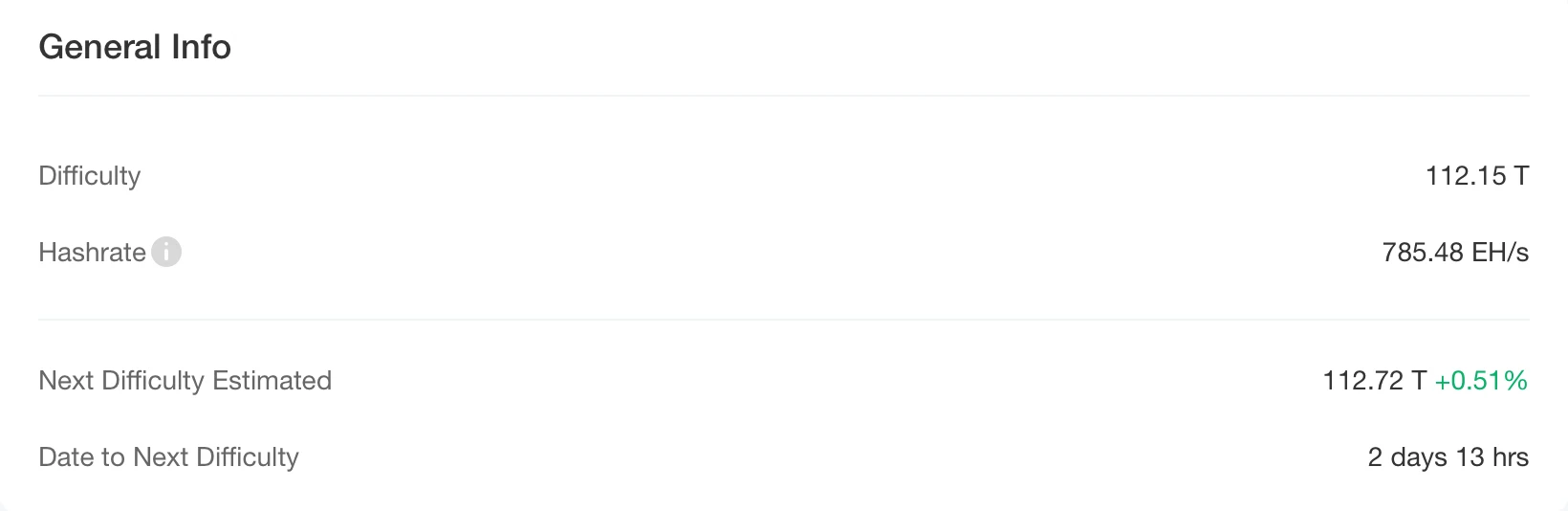

5. Energy costs and mining efficiency

В соответствии с CloverPool data, as of the time of writing, the total Bitcoin network computing power has reached about 785.48 EH/s, and the current mining difficulty is 112.15 T. Based on the current trend, it is expected that the Bitcoin mining difficulty will be further increased by about 0.51% to 112.72 T at the next difficulty adjustment (about 2 days later).

According to the latest data from MacroMicro, the total production cost of Bitcoin on March 19 was approximately $88,101.12, and the mining cost-to-price ratio was 1.01, which means that the cost required for miners to produce each Bitcoin is almost the same as the market price, resulting in relatively small profit margins for miners. This ratio reflects the operating pressure of miners, especially when Bitcoin prices fluctuate greatly, miners profitability becomes more sensitive.

In this context, miners not only need to continuously improve mining efficiency, but also need to optimize energy use to ensure profitability in the fierce competition. In the future, the computing power of the Bitcoin network is expected to continue to grow, and miners may need to rely more on advanced cooling technology, solar energy and other renewable energy sources to reduce their carbon footprint and energy costs, thereby gaining an advantage in the long-term competition.

Bitcoin mining difficulty data

6. Policy and regulatory news

Progress of Bitcoin-related legislation in various U.S. states

-

Kentucky

On March 15, the Kentucky Senate passed the Blockchain Digital Assets Act (HB 701) with a unanimous vote of 37-0. The bill has now been submitted to the Governors Office for final approval. The bill confirms the right of individuals to self-custody digital assets through self-custody wallets and prevents local governments from enforcing discriminatory laws against digital asset mining companies, ensuring that Bitcoin miners can operate freely in the state. -

North Carolina

On March 19, the North Carolina Senate introduced the bill S B3 27, authorizing the state finance department to allocate up to 10% of public funds to Bitcoin. The bill stipulates that the purchased Bitcoin will be escrowed in multi-signature cold storage and audited monthly. The sale of Bitcoin is only allowed under serious financial crises and strict conditions. North Carolina has currently proposed two Bitcoin reserve bills, House HB 92 and Senate S B3 27. The states general fund is about $9.5 billion. -

Missouri

Missouri Bitcoin Reserve Bill HB 1217 was referred to the House Select Committee on Intergovernmental Affairs on March 20. The bill, one of the slower-moving of Missouri’s Strategic Bitcoin Reserve (SBR) bills, has now moved to the committee stage.

Politicians support Bitcoin reserve plan

-

Cynthia Lummis

On March 17, Senator Cynthia Lummiss plan to buy 1 million bitcoins has won the support of 12 U.S. politicians. The plan aims to strengthen the U.S.s bitcoin reserves and promote the legalization of bitcoin as a digital asset. -

Nick Begich

On March 18, U.S. Congressman Nick Begich said that the United States should buy and hold 5% to 15% of the total Bitcoin to cope with the risk of legal currency collapse. He believes that Bitcoin reserves will provide emergency support for the American people. Begich has previously called for the United States to become a Bitcoin superpower and announced that he would submit a Bitcoin bill to the U.S. House of Representatives in 2025.

South Koreas central bank: Never considered adding Bitcoin to foreign exchange reserves

On March 17, the Bank of Korea explicitly stated that it had never considered including Bitcoin in its foreign exchange reserves. In response to a written inquiry from Congressman and member of the Planning and Finance Committee, Che Guigen (transliteration), the Bank of Korea said on the 16th, We believe that we need to be cautious about including Bitcoin in our foreign exchange reserves. This is the first time that the Bank of Korea has expressed its position on the issue of Bitcoin reserves.

The first reason for the Bank of Koreas negative attitude is the high volatility of Bitcoin prices. In this regard, the Bank of Korea pointed out: If the virtual asset market becomes unstable, Bitcoin may face the risk of a sharp increase in transaction costs during the cash-out process. In addition, the Bank of Korea also stated: We believe that Bitcoin does not meet the International Monetary Fund (IMF)s foreign exchange reserve calculation standards. For these reasons, the Bank of Korea replied: As of now, we have never discussed or considered including Bitcoin in foreign exchange reserves. The Bank of Korea also added: It is understood that some countries such as the Czech Republic and Brazil have a positive attitude towards this, but the European Central Bank (ECB), the Swiss National Bank and the Japanese government have all expressed opposition.

A former federal congressman from Sao Paulo, Brazil, has submitted a bill to the Brazilian Congress seeking to legalize Bitcoin salary payments

On March 17, Luiz Phillipe of Orleans-Braganza, a former federal congressman from Sao Paulo, Brazil, submitted a bill to the Brazilian Congress seeking to legalize Bitcoin salary payments. The politician proposed legislation to allow Brazilian workers to receive salaries and labor rights in the form of криптовалютавалюта.

The bill aims to allow workers to receive up to 50% of their wages and benefits in the form of digital assets. It is worth noting that the bill does not require the acceptance of Bitcoin, but provides a legal basis for residents who want to access emerging technologies. With the consent of the employer, employees can choose to obtain labor rights in the form of Bitcoin and can terminate this payment method at any time. The bill also stipulates that 50% of the salary must still be paid in Brazilian reals to ensure the practicality of the currency. However, this provision does not apply to freelancers, foreigners and self-employed persons, and related matters are regulated by the Central Bank of Brazil. The proposal must be passed by the plenary session of the House of Representatives and a majority vote before it can enter the Federal Senate for final review.

Related images

Trump Promises to Make America a Bitcoin Superpower

On March 20, U.S. President Donald Trump delivered a pre-recorded speech at the Blockworks Digital Asset Summit in New York City, emphasizing that the United States will become the undisputed Bitcoin superpower and the global cryptocurrency capital. He announced that he would end the previous governments regulatory restrictions on cryptocurrencies and called on Congress to pass legislation to establish clear rules for stablecoins and market structures to promote innovation and investment. Trump also mentioned recent initiatives, including hosting the White House Digital Asset Summit and establishing a strategic Bitcoin reserve, aimed at consolidating the United States dominance in the cryptocurrency field.

He said the measures will unleash economic growth potential and enhance the United States leading position in global fintech.

7. Mining News

Thailand seizes 63 illegal crypto mining rigs, stealing over $327,000 worth of electricity

On March 17, officials from the Central Bureau of Investigation (CIB) of Thailand seized 63 illegal crypto mining machines last Friday. These illegal crypto mining equipment, worth about 2 million baht (60,000 US dollars), were found in three abandoned houses in Pathum Thani Province. Local residents complained that unidentified people stole electricity from poles and transformers in the area, and then the officials raided. Locals suspected that the stolen electricity was used for cryptocurrency mining operations hidden in abandoned buildings. Investigators estimated that the electricity stolen from the three houses for crypto mining caused losses of more than 11 million baht (327,000 US dollars) to the power bureau.

8. Bitcoin related news

Bitcoin holdings of global companies and countries (statistics for this week)

-

El Salvador

On March 15, El Salvador added one bitcoin to its reserve fund. In the past seven days, El Salvador has added 13 bitcoins, bringing its total holdings to 6,117.18 bitcoins, with a total value of approximately $515.5 million. -

Lazarus Group / North Korea

Lazarus Group now holds 13,562 bitcoins, pushing North Koreas bitcoin reserves past El Salvador and Bhutan to become the worlds third-largest bitcoin holder, after the United States and the United Kingdom. -

Strategy

From March 10 to 16, Strategy increased its holdings by 130 bitcoins, bringing its total holdings to 499,226 bitcoins, with an average purchase price of $82,981. At the same time, the company plans to issue 5 million additional preferred shares to raise funds and continue to implement its bitcoin reserve strategy. -

Metaplanet

Metaplanet issued 2 billion yen (about 13.38 million US dollars) of zero-coupon bonds to purchase more Bitcoin, and announced that it had increased its holdings by 150 Bitcoins, bringing its total holdings to 3,200 Bitcoins.

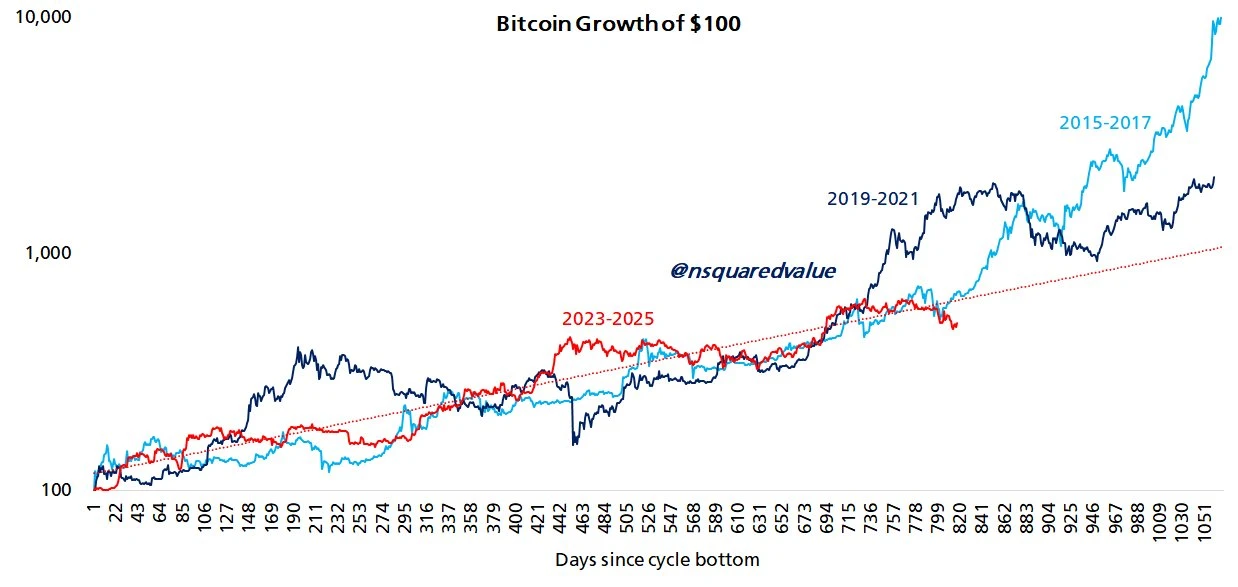

Analyst: Bitcoin is experiencing a shakeout rather than the end of a four-year cycle

On March 16, the current price of Bitcoin fell 22% from the historical high of $109,000 set on January 20, the day Trump was inaugurated. Although investor sentiment has fallen into the extreme fear zone many times, crypto analysts generally believe that the Bitcoin bull market cycle has not yet ended, and this decline may be a shock – a sharp drop caused by the concentrated liquidation of long positions, followed by a rapid rebound.

Bitfinex analysts pointed out that a number of key technical indicators have turned bearish, triggering speculation that the bull market will end early. However, Bitcoins four-year cycle is still a key factor. History shows that corrections in bull market cycles are normal. This is more likely to be a shakeout rather than the beginning of a bear market. The bottom of Bitcoin may be formed in sync with the U.S. stock market (especially the SP 500). $72,000 to $73,000 is still the key support range, but global government bond yields and stock market trends will dominate Bitcoins next move. Trade war risks have been partially priced in, but long-term economic pressures may suppress sentiment.

Nexo analyst Iliya Kalchev said, Although Bitcoins four-year compound annual growth rate (CAGR) has dropped to a historical low of 8%, the halving event is still crucial to long-term price trends. The halving in April 2024 will reduce the block reward to 3.125 BTC. Since then, Bitcoin has accumulated more than 31%. Although ETF buying brought about by institutional adoption has become the main driving force in the past year, the halving effect will continue to affect the market.

Analyst: Bitcoin bull market may return in June, median target price expected to reach $126,000

On March 16, Bitcoin has fallen 30% since it peaked in mid-January, but network economist Timothy Peterson believes that the bull market may make a comeback. He said: The current trading price of Bitcoin is close to the lower end of its historical seasonal range. Bitcoins annual performance almost all occurs in two months: April and October, which means that Bitcoin is entirely likely to hit a record high before June, with an estimated median target price of $126,000.

Related images

Shenyu: Strategy amplifies Bitcoins high volatility by 2.5 times and transmits it to the U.S. stock market. Professional institutions use this high volatility for arbitrage

On March 17, Cobo co-founder and CEO Shen Yu said that Strategy (MSTR) amplifies Bitcoins high volatility by 2.5 times through clever design and passes it on to the U.S. stock market.

Professional institutions use this high volatility to conduct arbitrage and obtain short-term profits; MSTR obtains cash through the issuance of convertible bonds and additional ATM issuances to hoard large amounts of Bitcoin; ordinary shareholders bear the risk of drastic stock price fluctuations and short-term declines, but passively obtain increased Bitcoin income per Bitcoin; Bitcoin holders benefit from the continued inflow of market funds and rising Bitcoin prices.

CZ: Holding Bitcoin has surpassed 99% of market participants, and the last 1% of winners need extraordinary efforts

On March 17, Binance founder CZ responded to EmperorBTC’s views on social media and said that only 5% of people in the market can survive in the crypto field for a long time, including:

• 4% are actively trading or working on projects, but their returns still lag behind Bitcoin.

• Only 1% of people can actually surpass Bitcoin, which requires extraordinary effort.

CZ emphasized that long-term holding of Bitcoin is able to surpass 99% of crypto market participants, while performing better than most traditional assets with almost no active trading operations.

GSR Lianchuang: It is only a matter of time before Bitcoin returns to a stable area, and the bull market is still

On March 18, the co-founder of market maker GSR and the founder of cryptocurrency clearing house Yellow said: The value of Bitcoin remains unchanged, it is still $100,000, and now it is only discounted by 20% due to risks and uncertainties. It is only a matter of time before Bitcoin returns to a stable area. If we eliminate all uncertainties, Bitcoin will appreciate. We are in a bull market.

Despite U.S. President Donald Trump’s sudden turn in support of the crypto industry, his administration’s aggressive tariff policy has caused investors to flee, and Bitcoin has fallen more than 20% from its all-time high set on January 20, the day of Trump’s inauguration.

Meanwhile, as the VIX, an index measuring market volatility expectations, has surged more than 50% this month, investors are flocking to gold, which hit a new record of $3,000 an ounce in March. Sirkia said of Bitcoins investment attributes: Bitcoin is not a long-term asset in the eyes of institutions like gold.

Cathie Wood: Most Memecoins may return to zero, Bitcoin may reach $1 million in 2030

On March 19, Cathie Wood said that most Memecoins may eventually become worthless and warned investors to be cautious.

She pointed out that the combination of blockchain technology and AI is creating millions of Memecoins, but ARKs private equity funds will not invest in these assets. Wood believes that Memecoins may evolve into digital collectibles in the future, and only a few will stand the test of time, including the Memecoin launched by Trump.

In addition, she reiterated her bullish expectations for mainstream crypto assets such as Bitcoin, Ethereum, and Solana, and predicted that Bitcoin could break through $1 million by 2030.

Bitwise CIO: Continue to buy Bitcoin during a crisis, and you will usually get higher returns within a year

On March 19, Bitwise Chief Investment Officer Matt Hougan said that Bitcoins response to moments of crisis – such as the recent pullback driven by President Trumps tariffs – depends on Wall Streets valuation of assets and its trickle-down effect on the markets invisible hand. Although Bitcoin is often called a long-term hedge asset, it tends to pull back sharply during short-term fluctuations, frustrating many investors. The average decline in Bitcoin is 30% higher than the decline in the SP 500, but those who continue to invest or buy more stocks after the pullback have an average return of up to 190% in the following year. This fall first and then rise is one of the common patterns in the cryptocurrency market.

10x Research: Bitcoin is expected to rise above $90,000 as U.S. inflation concerns ease

On March 19, Markus Thielen, CEO of 10x Research, said that despite widespread investor concerns, Bitcoin may be expected to rebound above $90,000 as U.S. inflation concerns ease. He added: Because prices are oversold, we can see some counter-trend rebounds, and the Federal Reserve is likely to take a mildly dovish stance, which is some fine-tuning by policymakers. It will put BTC in a wider consolidation range, but it is entirely possible to return to $90,000.

Nexo analyst Iliya Kalchev said traders and investors will be watching for any news on the end of the Feds quantitative easing (QT) program, a move that could increase liquidity as the Feds upcoming decision could be a major catalyst for further movement, and if Chairman Powell takes a dovish stance, Bitcoin could take off in a new bullish momentum.

Related images

This article is sourced from the internet: HashWhale BTC Mining Weekly Report | The market is waiting for a key trigger point; Trump promises to make the United States a Bitcoin superpower (3.15-3.21)

1. CEX popular currencies CEX top 10 trading volume and 24-hour rise and fall: BNB: -8.42% BTC: -5.39% ETH: -12.25% SOL: -10.24% DOGE: -15.29% XRP: -11.66% RARE: 52.1% MOVE: 2.91% ADA: -10.16% 24 H increase list (data source: OKX): DORA: 5.1% OM: 3.07% UMA: 2.73% IP: 2.23% HMSTR: 1.1% VRA: 1.17% LOOKS: 0.75% LEO: 0.53% ACT: 0.26% ZKJ: 0.01% 2. Top 5 popular memes on the chain (data source: GMGN ): BTRUMP ROGER YODA PIPE WTFO 3. 24-hour hot search currencies GRK: GRK caused a short-term surge in the community due to Grok’s reply, and has not been officially certified by Musk or Grok AI. Headlines UK Treasury: No plans to introduce US-style Bitcoin reserves According to market news, the UK Treasury said it has no plans to introduce US-style…