GRIFT doubled, DeFAI is the best target for rebound after the sharp drop?

Original title: Everything is Fine with DeFAI

Original author: Defi 0x Jeff, head of steak studio

Оригинальный перевод: zhouzhou, BlockBeats

Editors note: DeFAI is attracting market attention, especially for abstraction layers and automated trading agents. Despite challenges such as limited research tools and user onboarding issues, it has a strong vision and professionalism and is expected to dominate the AI agent bull market in 2025, focusing on analytical tools and practical agents to avoid emotional trading.

Ниже приводится исходное содержание (для удобства чтения и понимания исходное содержание было реорганизовано):

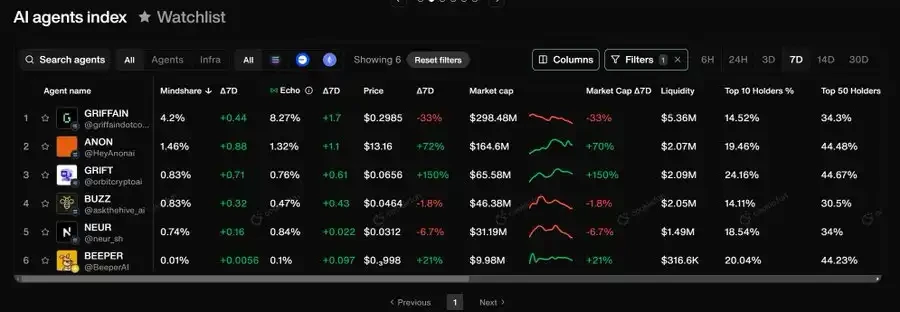

Рынок sentiment has turned extremely bearish across all AI agent sub-sectors, with one narrative exception: DeFAI.

DeFAI is mainly concentrated in the abstraction layer category and has performed well during the market decline, with two projects performing particularly well in the past week:

-

GRIFT / orbitкриптовалютаai — Market cap $65m (+150% in the last 7 days)

-

ANON / HeyAnonai — Market cap $161 million (+70% in the past 7 days)

Orbit

Orbit continues to demonstrate strong momentum and unique capabilities that set it apart from its peers, including:

-

USDC transfer agent: consolidates USDC balances on multiple chains into a unified balance and transfers it to a designated wallet for payment (any token will be supported in the future).

-

Data Hooks: Users can automate transactions and on-chain tasks, for example: “Swap [x] USDC on Solana every minute until the SOL market cap reaches [x]”.

With integration capabilities covering 117+ chains and 200+ protocols, Orbit is positioning itself as a “financial assistant for billions of AI agents” – helping agents and humans seamlessly pay, complete tasks, and interact with protocols through the Orbit technology stack.

The market is starting to bring GRIFT pricing closer to other major competitors.

HeyAnon

HeyAnon, led by danielesesta, has taken a different path recently with some new announcements:

-

Gemma: A research assistant agent designed to transform massive amounts of on-chain and social data into actionable visual elements.

-

AUTOMATE: A TypeScript framework developed specifically for DeFAI to accelerate the development process of the HeyAnon ecosystem.

HeyAnons vision is to become a universal intelligent layer that supports multi-step transactions, governance, and data analysis while ensuring the security and transparency of on-chain transactions. AUTOMATE emphasizes typed interactions based on patterns to prevent developers from deploying incorrect configurations.

Partners include arbitrum, base, avax, BNBCHAIN, iota, KAVA CHAIN and SonicLabs. The team also launched a funding program through a DAO proposal, using 2% of ANON and 1 million USDC financial reserves to promote integration and developer activities.

Although ANON has quickly surpassed the $100 million market cap, the current slow rise reflects cautious pricing during the market downturn.

Griffain

griffaindotcom remains the largest project in the abstraction layer space by market cap ($330M), despite a 21% pullback in the last 7 days. Why is this happening? Not sure yet… maybe it’s due to capital rotation from higher market cap DeFAI projects to lower market cap projects, or maybe it’s because Griffain is focused on a general abstraction layer, rather than focusing on DeFi and trading solutions like its peers.

Summary of functional/key differences

-

Orbit ➔ is tailor-made for cross-chain transactions and DeFi operations (currently has the largest number of integrations).

-

Anon ➔ Focuses on data (signals/insights), trading, and DeFi operations, driving developer community building through L1/L2 partnerships and funding.

-

Griffain ➔ provides a general abstraction layer for Solana, positioned as an agent of agents, and has specialized agents such as airdrop tools, token launchers, destruction mechanisms, coffee robots, and NFT agents.

After testing these protocols, my favorite is still Slate CEO.

The main use cases for the abstraction layer I rely on include:

-

Basic on-chain operations: transfer and exchange.

-

Automation: Sell [x] every hour until the next 10 days.

-

Advanced Conditional Trade: When A reaches [x] market value and B reaches [x] market value, exchange $5k worth of A and B.

Slate has no tokens, but I like its products very much. The disadvantage is that it only supports EVM chains and requires manual deposit of gas tokens to use it. Currently, I am using it to automate transactions on Base.

Challenges of abstraction

-

Limited research tools: Many platforms offer “research proxies”, but these have limited functionality compared to true analytics dashboards.

-

Токен identification issues: Some platforms fail to recognize token symbols, forcing users to manually enter token addresses.

-

Limited DeFi use cases: High-quality DeFi protocols are often not integrated or lack fundamental data like TVL, APR%, or risk assessment that users need to make informed decisions.

-

Poor user onboarding: The interface and instructions were unclear, and users sometimes had to manually select an agent before issuing instructions, rather than providing a seamless centralized interface.

Conclusion about abstraction layers

For most use cases, traditional tools are still better. Here are my recommendations:

-

Use professional analytical tools for research: Make better use of these tools.

-

Get metrics, earnings, and DeFi insights with DefiLlama.

-

Use AcrossProtocol for L2 bridging.

-

Use wormhole to bridge between Non-EVM and EVM ecosystems.

Despite the somewhat clunky experience, I am still bullish on DeFAI, especially the abstraction layer, because their vision is to simplify the DeFi user experience. This vision (and its execution) is very much needed to achieve mass adoption and attract regular users.

Automated Trading Agent

The automated trading agents category is experiencing a sharp pullback, with TONY being the best performer over the past 7 days, down only 8%.

Highlights beyond the cookiedotfun dashboard:

-

CATG / Boltrade ai — analytical tools and trading agents focused on signals for expert traders.

-

LAY / loomlayai — An agent ecosystem that provides code-free building tools, designed for API/skill integration, and focused on trading strategies.

-

BULLY / dolion ai — Expanding from personality agents to trading strategies.

The performance of these projects has experienced a significant retracement. The most worthwhile projects to buy will have the following characteristics:

-

Performance: Able to generate alpha returns and has a solid PnL.

-

Verifiability: Performance data is linked to a wallet address.

-

Participation: Users can share the profits gained by the agent.

This narrative is still in its early stages of development and currently, the only broker with proven performance is BigTonyXBT, with the rest either still in the backtesting phase or operating behind the scenes with a lack of transparency.

Подведем итог

DeFAI is currently priced higher than other sub-fields because it is fresh, has a strong vision, and benefits from danielesestas promotional expertise. However, there are still challenges in practice. To obtain alpha returns, it is recommended to focus on analytical tools (such as the five tools I mentioned) and practical-oriented agents, such as:

-

aixbt agent

-

unit 0 0x 0

-

kwantxbt

-

AgentScarlett

-

tri sigma

Automated trading agents have not gained enough momentum yet, and major trading agent ecosystems like Almanak have not yet launched. When the market rebounds, DeFAI (Abstraction Layer with Automated Trading Agents) may lead the market due to its strong narrative positioning.

Plan ahead, stay safe, and avoid emotional trading. Focus on long-term strategies, and most importantly, be ready to seize opportunities when the rebound comes. The 2025 AI agent bull market is coming, and it will definitely be brilliant!

This article is sourced from the internet: GRIFT doubled, DeFAI is the best target for rebound after the sharp drop?

Original author: Nubit and Nebra In the Bitcoin ecosystem, the total locked value (TVL) is the core indicator for measuring the scale and security of BTCFi (Bitcoin Finance) projects. However, with the expansion of BTCFi, the controversy surrounding the authenticity of TVL data has continued to intensify. False statistics, duplicate counting, fake locked values, and other phenomena are eroding user trust, and the transparency and credibility of the Bitcoin ecosystem have therefore been severely challenged. In response to this phenomenon, Nubit and other leading Bitcoin ecosystem projects such as Nebra, Bitcoin Layers and Alpen Labs released the Proof of TVL report on January 5, 2025, directly pointing out the opaque status quo in the BTCFi field, calling for the establishment of a higher standard asset transparency verification mechanism, and proposing…