The opening ceremony of the Trump Market has officially ended: How the market prices the debt crisis from the rise in te

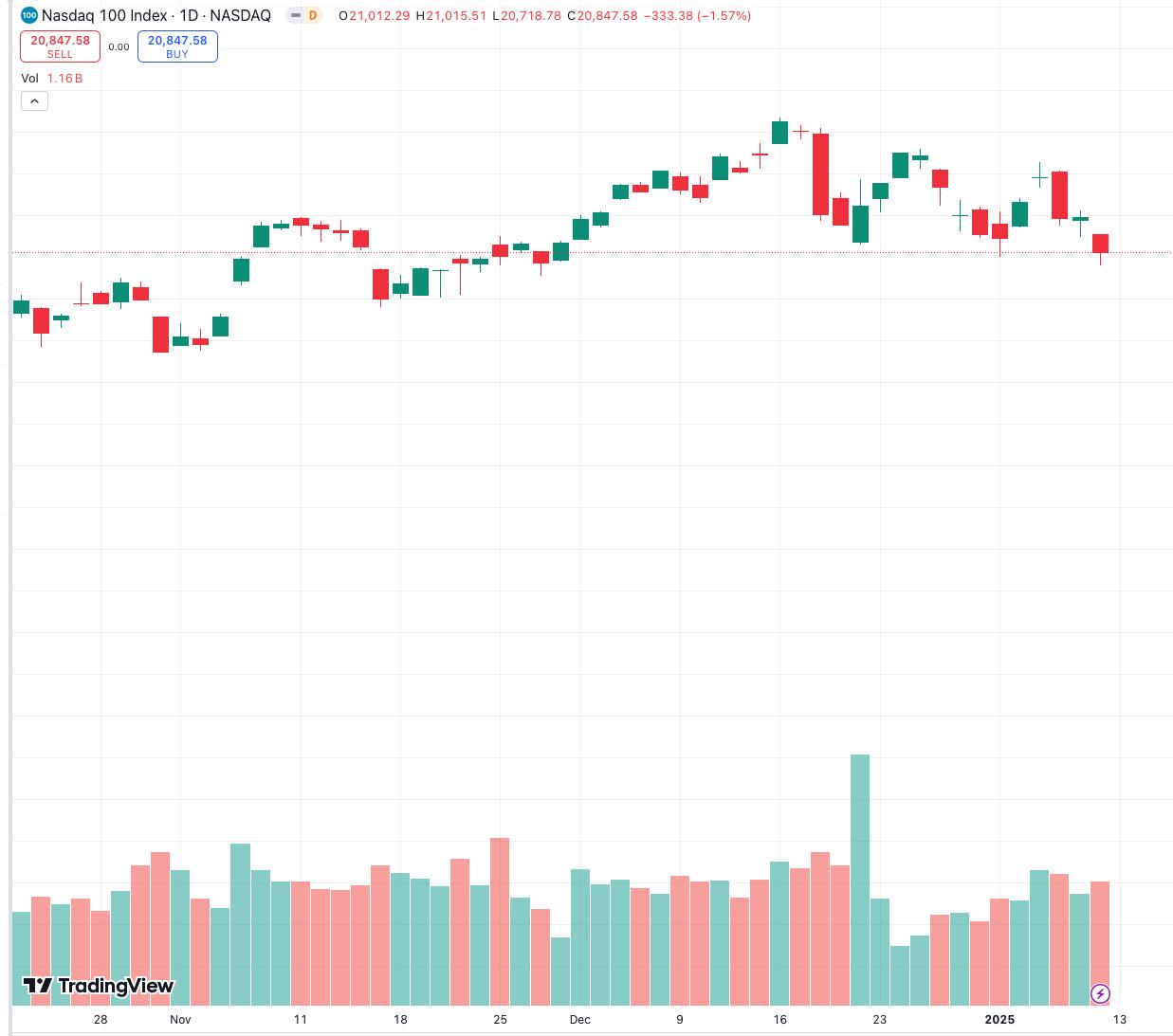

This week, the криптовалютаcurrency market has experienced a relatively large shock, and the price trend has also gone out of the M head pattern. All of these indicate that as Trumps official inauguration on January 20 is getting closer, the capital market has quietly begun to price in the opportunities and risks after his election, which means that the opening ceremony of the Trump market driven by emotions, which has lasted for 3 months, has officially ended. So what we need to do now is to extract the focus of the markets short-term game from a lot of messy information, so that it is conducive to making rational judgments on market changes. Therefore, in this article, the author still talks about his own observation logic from the perspective of a non-financial enthusiast, hoping to help everyone. In general, the author believes that the prices of many high-growth risky assets, including the crypto market, will continue to be suppressed in the short term. The reason is that the U.S. Treasury market has been adversely affected by the amplification of the term premium and the rise of medium and long-term interest rates. The reason for this situation is that the market is pricing the U.S. debt crisis.

Macroeconomic indicators remain strong and inflation expectations have not increased significantly, so they have little impact on current price trends.

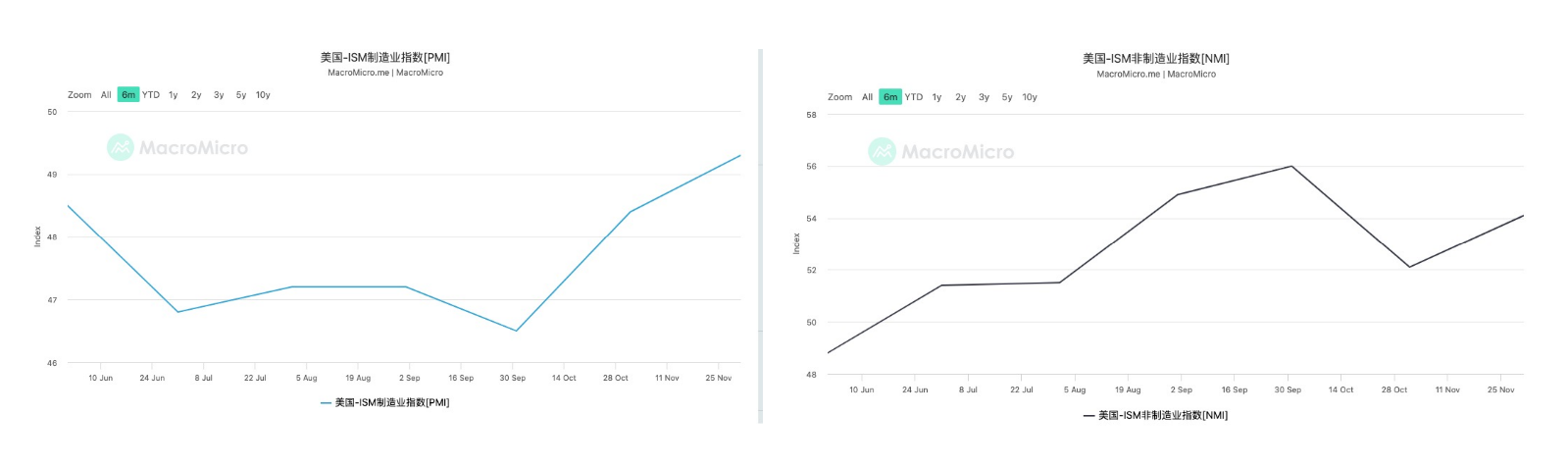

So first lets look at what factors are causing price weakness in the short term. Last week, many important macroeconomic indicators were released. Lets look at them one by one. First, lets look at the data related to US economic growth. The ISM manufacturing and non-manufacturing purchasing managers indexes continued to rise. Since the purchasing managers index is usually a leading indicator of economic growth, this indicates that the US economic outlook is relatively positive in the short term.

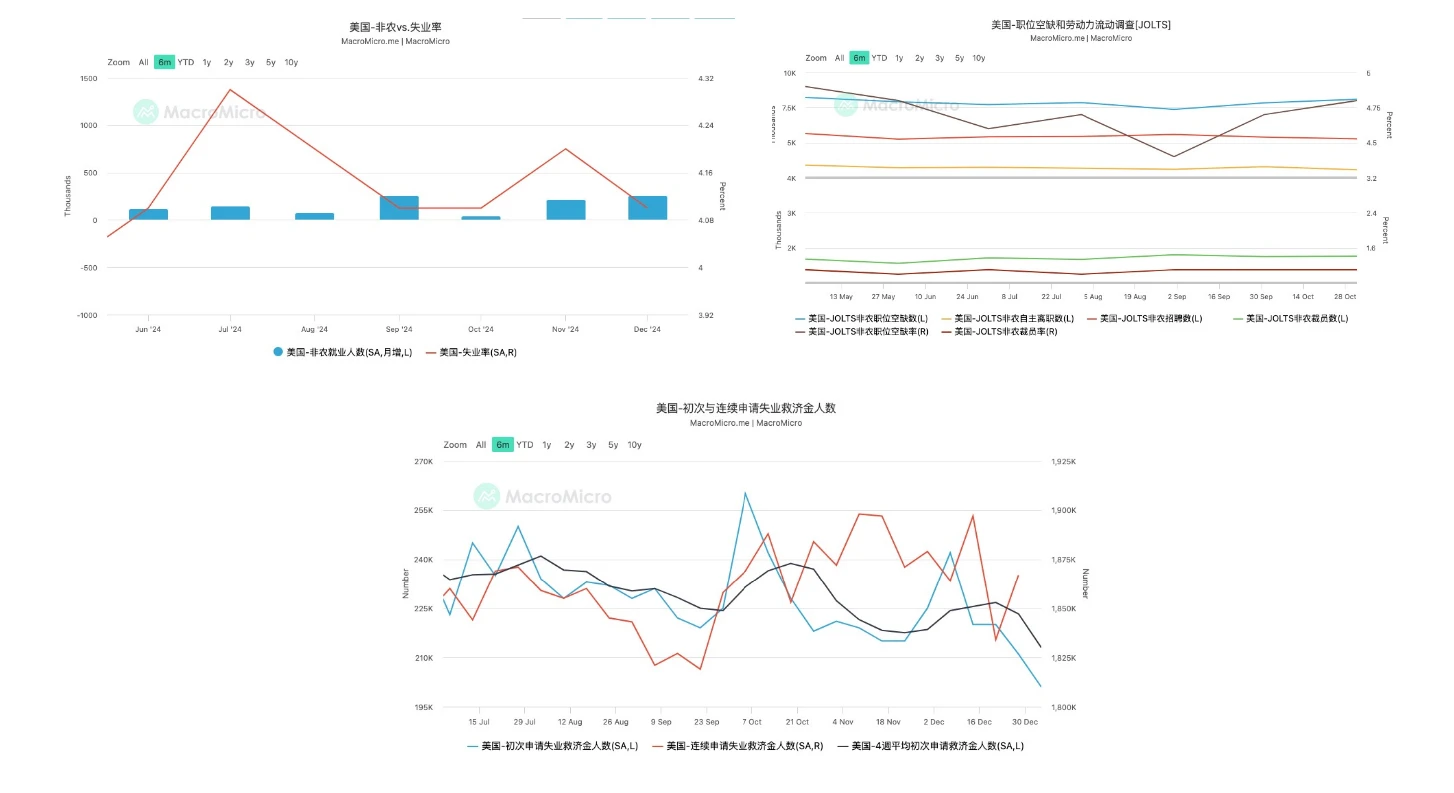

Next, lets look at the situation of the job market. We have selected four data for observation: non-farm payrolls, job openings, unemployment rate, and initial unemployment claims. First, non-farm payrolls increased from 212,000 last month to 256,000, far exceeding expectations. At the same time, the unemployment rate also fell from 4.2% to 4.1%. At the same time, JOLTS job vacancies also increased significantly, reaching 809,000. From the perspective of the more differentiated initial unemployment claims, it has also continued to decline, which shows that the outlook for the performance of the job market in January is also relatively optimistic. All of these show that the current US job market remains strong, and a soft landing should be a foregone conclusion.

Finally, lets look at the performance of inflation. Since the December CPI needs to be announced next week, we will observe its performance in advance from the University of Michigans 1-year inflation expectations. Compared with November, the indicator has rebounded to 2.8%, but it is lower than expected, and this value seems to be within the reasonable range of 2-3% set by Powell. Of course, the specific development is still worth paying attention to. However, we can see from the changes in the yield of inflation-resistant bonds TIPS that the market does not seem to be overly panicked about inflation furniture.

To sum up, the author believes that there are no obvious problems with the US economy from a macro perspective. Next, let us identify the core reasons for the current decline in the market value of high-growth companies.

The medium- and long-term interest rates of US Treasury bonds continue to rise. Under the bearish and steep market situation, the term premium continues to rise, and the market prices the US debt crisis.

Lets take a look at the changes in the U.S. Treasury yields. From the yield curve, we can see that in the past week, the long-term interest rates of U.S. Treasury bonds continued to rise. Taking the 10-year Treasury bond as an example, it rose by 20 BP in one go. It can be said that the bearish pattern of U.S. Treasury bonds has further intensified. We know that the rise in Treasury bond interest rates has a greater depressing effect on the prices of high-growth stocks than blue-chip stocks or value stocks. The core reason is:

1. Impact on high-growth companies (usually technology companies, emerging industries):

Rising financing costs: High-growth companies rely on external financing (equity or debt) to support business expansion. Rising long-term interest rates increase the cost of debt financing and make equity financing more difficult because investors increase the discount rate for future cash flows.

Valuation pressure: The valuation of growth companies is highly dependent on future cash flow (FCF). Rising long-term interest rates mean higher discount rates, which leads to a decrease in the present value of future cash flows, thereby lowering corporate valuations.

Shift in market preferences: Investors may shift from riskier growth stocks to more stable value stocks with stable dividends, which puts pressure on the share prices of growth companies.

Limited capital expenditure: High financing costs may force companies to reduce RD and expansion spending, affecting long-term growth potential.

2. Impact on stable enterprises (consumption, utilities, medicine, etc.):

The impact is relatively mild: Stable companies are usually profitable, have stable cash flow and are less dependent on external financing, so rising interest rates will have less impact on their operations.

Increased pressure to repay debt: If there is a high debt ratio, rising financing costs may increase financial expenses, but generally stable companies have stronger debt management capabilities.

Dividend attractiveness declines: Dividend yields of stable companies may compete with bond yields. When Treasury yields rise, investors may turn to bonds with higher risk-free returns, putting pressure on the stock prices of stable companies.

Inflation transmission effect: If rising interest rates are accompanied by rising inflation, companies may face pressure from rising costs, but stable companies usually have a stronger ability to pass on costs.

Therefore, we can see that the rise in the long-term interest rate of treasury bonds has a very obvious impact on the market value of technology companies such as cryptocurrencies. Then the key to the next question is to locate the core reason for the rise in the long-term interest rate of treasury bonds in the context of this interest rate cut.

First, we need to introduce the calculation model of the nominal interest rate of government bonds as follows:

I = r + 蟺 + RP

I represents the nominal interest rate of government bonds, r is the real interest rate, 蟺 is the inflation expectation, and RP is the term premium. This needs to be explained in detail. The so-called real interest rate is the interest rate that reflects the real return of bonds. It is not affected by market risk preferences and risk compensation. It directly reflects the time value of money and economic growth potential. 蟺 refers to the average social inflation expectation, which is usually observed through CPI or the yield of inflation-resistant bonds TIPS. Finally, RP is the term premium, which reflects investors compensation for interest rate risks. When investors believe that future economic development is uncertain, they need higher risk compensation.

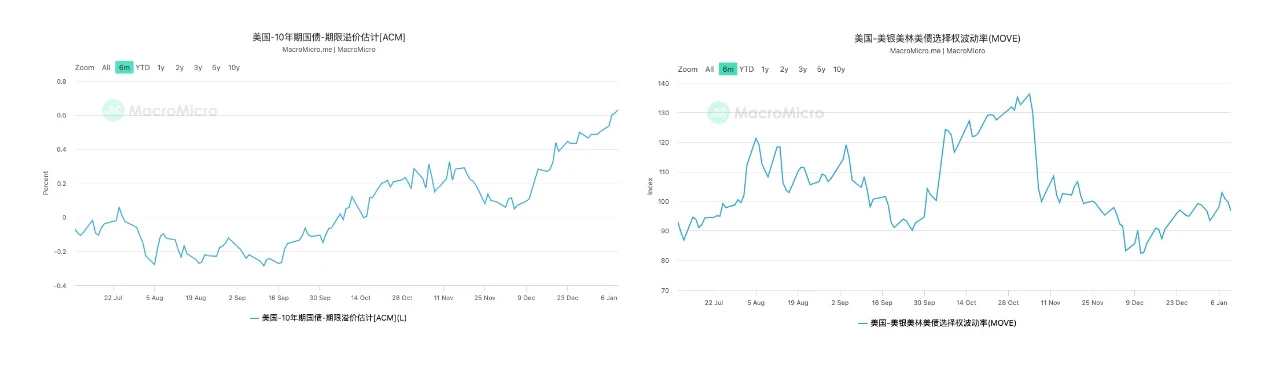

In the first part of the analysis, we have made it clear that the current US economic development remains stable in the short term. At the same time, it can be observed from the TIPS yield that inflation expectations have not risen significantly. Therefore, real interest rates and inflation expectations are not the main factors pushing up nominal interest rates in the short term. The problem then lies in the factor of term premium.

For the observation of term premium, we choose two indicators. The first one is the ACM model to estimate the term premium level in US Treasury bonds. It can be seen that in the past period of time, the term premium of the US 10-year Treasury bond has risen significantly. From a numerical point of view, this factor is the main factor in raising the yield of US Treasury bonds. The second is the Merrill Lynch US Treasury option volatility, that is, the MOVE indicator. It can be seen that in the recent period of time, the volatility has not changed dramatically. Usually, MOVE is more sensitive to the implied volatility of short-term interest rates because it has a larger weight. From this set of data, we can draw a conclusion that the market is not sensitive to the risk of short-term interest rate fluctuations. We know that short-term interest rates are mainly affected by the decisions of the Federal Reserve. Therefore, it can be said that the market has not made obvious risk pricing for potential policy changes of the Federal Reserve. Therefore, the recent panic caused by the change in the direction of the Federal Reserves interest rate decision in 2025 is not a direct factor. However, the continuous rise in the term premium shows that the market is concerned about the medium- and long-term development of the US economy. According to the current economic hotspots, this is obviously focused on concerns about the US fiscal deficit.

So it is clear that the market is currently pricing in the potential debt crisis risk of the United States after Trump takes office. Therefore, in the next period of time, it is still necessary to observe political information and the views of stakeholders to think about whether their impact on debt risk is positive or negative, which will make it easier to judge the trend of the risk asset market. Take the news last week that Trump announced that he was considering entering a national economic emergency in the United States. Due to the state of emergency, the International Economic Emergency Powers Act (IEEPA) can be used to formulate a new tariff plan. The bill unilaterally authorizes the president to manage imports during a national emergency. Therefore, the constraints and resistance to tariff adjustments will be further reduced, which undoubtedly amplifies the concerns about the potential impact of the trade war that have been alleviated. However, from the most direct impact, the increase in tariff revenue is undoubtedly a positive impact on US fiscal revenue, so I don鈥檛 think the impact will be very drastic. On the contrary, the progress of its tax cut bill and how to cut government spending are the most worthy of attention in the entire game, and I will continue to follow up.

This article is sourced from the internet: The opening ceremony of the Trump Рынок has officially ended: How the market prices the debt crisis from the rise in term premium

Trumps victory not only brought a new high for BTC, but also some US-related crypto projects also performed well. The following will focus on analyzing several representative US concept-related projects, which are worth following up. With the announcement of the results of the US election on November 5, 2024, the cryptocurrency market has surged, with Bitcoin breaking through $75,000 to a record high, and then breaking through the important milestone of $100,000. Trump made a series of pro-cryptocurrency remarks during the campaign, promising to make the United States the world capital of Bitcoin and cryptocurrency, firing Gensler, etc. In addition, the Trump family also launched the DeFi project World Liberty Financial. Trump once made ten new cryptocurrency policy promises. His victory not only brought BTC to a new high, but…