a16z: To understand the development of the crypto industry, you need to pay attention to these 5 indicators

Original author: Daren Matsuoka, a16z криптовалюта партнер

Оригинальный перевод: Луффи, Foresight News

2024 is an exciting year in the history of crypto. Cryptocurrency activity and usage have reached all-time highs, blockchain infrastructure has been greatly improved, transaction fees have been reduced, stablecoins have found product-market fit, the intersection of crypto and artificial intelligence has become clearer, Bitcoin and Ethereum ETFs have been approved, and the legislative and regulatory environment has now opened up a positive path forward for the crypto industry. All of this has paved the way for another exciting year.

As we think about what’s next for cryptocurrencies, here are five metrics we’ll be watching closely to track the industry’s continued progress.

Monthly mobile wallet users

To unlock the next wave of cryptocurrency user growth, we need to make the user experience closer to Web2 applications. Mobile wallets will play a key role: there are hundreds of millions of passive cryptocurrency holders (people who own cryptocurrency but do not frequently transact on-chain) who could potentially be converted into active users. For this to happen, developers need to continue to build new consumer applications, and consumers need wallets to participate.

Last month, the number of mobile wallet users hit a new all-time high, surpassing 35 million for the first time. This growth was driven by the growth of well-known wallets such as Coinbase Wallet, MetaMask and Trust Wallet, as well as some new players such as Phantom and World App.

For developers, consumer wallets present some of the toughest challenges in the industry, and finding the right balance between security, privacy, and ease of use is no easy feat. But now that blockchain infrastructure is capable of supporting hundreds of millions or even billions of people on-chain, now is the perfect time to build the next generation of mobile wallets. We’ll be watching these developments closely in 2025.

You can track the monthly number of mobile wallet users здесь .

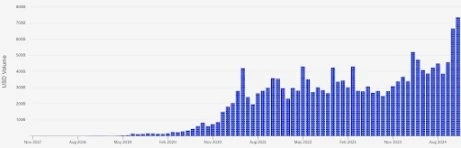

Adjusted stablecoin trading volume

Stablecoin activity increases in 2024 as infrastructure developments significantly reduce transaction fees. Notably, stablecoins are used not only for cryptocurrency transactions, but also for cross-border payments and remittances, purchases of goods and services, and as a store of value in countries with high inflation. Stablecoins are already the cheapest way to transfer USD payments, and we expect more and more businesses to accept stablecoin payments.

Driven by these favorable factors, blockchain-based value settlement should continue to grow in 2025. While we can easily measure this volume using on-chain data, it is difficult to isolate the true use of stablecoins. Transactions can be initiated manually by end users or automatically by program bots, and some of these on-chain transactions do not resemble traditional settlement methods.

Fortunately, Visa has created a clear and simple way to show stablecoin usage while stripping out the impact of unnatural activity caused by bots and other artificial inflationary behavior.

If stablecoin adoption — one of the clearest use cases for cryptocurrency — takes off in 2025, this metric will be in the spotlight.

You can track stablecoin trading volume здесь .

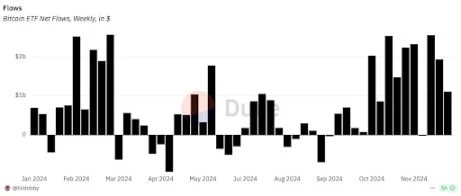

ETF net inflows

Last year, the SEC approved Bitcoin and Ethereum ETFs. This was a major milestone in making cryptocurrencies more accessible to individual and institutional investors. However, it will take time to activate distributors such as Goldman Sachs, JPMorgan Chase and Merrill Lynch to include these products in retail investors portfolios.

One way to measure ETF activity is “net inflows,” which represent the amount of Bitcoin or Ethereum that has flowed into or out of an ETF. (Previously existing products like the Grayscale Bitcoin Trust and Ethereum Trust that were ultimately converted into ETFs are not included.) So far, the Bitcoin ETF has had 515,000 net inflows, and the Ethereum ETF has had 611,000 net inflows.

As more institutional investors seek to get involved in crypto assets, ETF net inflows should increase. By tracking on-chain deposits and withdrawals to addresses identified as ETF custodians, we can monitor this data in real time.

You can track ETF net inflows здесь и здесь .

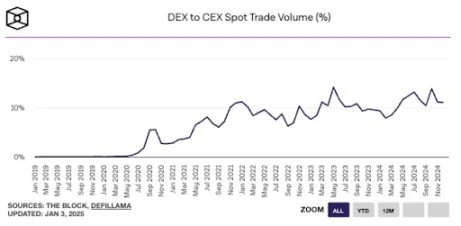

Comparison of spot trading volume between decentralized exchanges and centralized exchanges

As users flock to the blockchain space, we expect to see an increase in the use of decentralized exchanges (DEX) relative to centralized exchanges (CEX) for cryptocurrency trading. After all, the core premise of cryptocurrency is decentralized finance (DeFi). As the DeFi ecosystem develops, the share of spot trading on decentralized exchanges has steadily increased to approximately 11% over the past few years, and we expect this trend to continue in 2025.

Recently, high-throughput chains such as Coinbase’s Base Chain and Solana have seen a surge in transaction volume as new users enter the space, driving decentralized exchange volumes to all-time highs.

As more new consumer applications come online, decentralized exchange trading volumes are likely to grow further.

This will be an important metric to watch as we monitor the changing balance between decentralized crypto-native activity and centralized cryptocurrency exchanges.

You can track the spot trading volume comparison between DEX and CEX здесь .

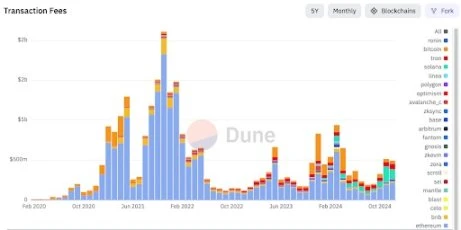

Total blockchain transaction fees

Total transaction fees (in USD) show the total demand for block space on a particular blockchain, i.e. the real economic value.

However, there are many subtleties to this metric, as most projects are explicitly working to keep fees low for their users. That’s why it’s also important to consider unit transaction costs (i.e., the cost of a specific amount of blockchain resources). Ideally, overall demand (total transaction fees) grows, but gas fees (cost per unit of resource usage) remain low.

In November 2024, Solana’s fees surpassed Ethereum’s for the first time ever (see chart below). Notably, this milestone occurred even though Solana’s unit transaction costs were much lower; sending USDC on Ethereum costs about $5 in fees, while sending it on Solana costs less than a cent. This is a significant milestone, and one we’ll continue to watch.

Many ecosystems and their associated fee markets are maturing, and this is a good time to start measuring the economic value facilitated by various blockchains. In the long run, demand for block space (measured by the total dollar value of fees paid) may be the most important single metric for tracking progress in the crypto industry. Why? It reflects participation in valuable economic activity and the willingness of users to pay for it.

You can track the demand for block space via transaction fees здесь .

Подведем итог

We track multiple metrics for the crypto industry, but we’ll be keeping a close eye on these five this year. With investor access expanding, maturing infrastructure paving the way for new applications, and more hot products like stablecoins emerging, the crypto industry is well positioned to attract more users and developers. Let’s see what else will happen this year that will ultimately drive changes in these metrics.

This article is sourced from the internet: a16z: To understand the development of the crypto industry, you need to pay attention to these 5 indicators

Related: Looking Ahead to 2025: 20 Predictions from Scaling to Privacy

Original author: Equilibrium Research Original translation: Yuliya, PANews Predicting the future is a challenging, if not impossible, task. Yet everyone is involved in some form of forecasting and making decisions based on their understanding of the future. Equilibrium has released its first annual forecast report, looking ahead to what is likely to happen and where the industry is headed by the end of next year. The report was produced jointly by Equilibriums lab and venture capital arm. Before we get into the details, here is the methodology used to develop these forecasts: These predictions focus on being relevant (technical oriented), specific, and falsifiable. Therefore, there will be no price predictions or sweeping statements (e.g. ZK will become faster and cheaper) in the report. The scope of the forecasts is strictly…