A long article reveals the BTCFi TVL scam, and Nubits Proof of TVL report is explained in detail

Original author: Nubit and Nebra

In the Bitcoin ecosystem, the total locked value (TVL) is the core indicator for measuring the scale and security of BTCFi (Bitcoin Finance) projects. However, with the expansion of BTCFi, the controversy surrounding the authenticity of TVL data has continued to intensify. False statistics, duplicate counting, fake locked values, and other phenomena are eroding user trust, and the transparency and credibility of the Bitcoin ecosystem have therefore been severely challenged.

In response to this phenomenon, Nubit and other leading Bitcoin ecosystem projects such as Nebra, Bitcoin Layers and Alpen Labs released the Proof of TVL report on January 5, 2025, directly pointing out the opaque status quo in the BTCFi field, calling for the establishment of a higher standard asset transparency verification mechanism, and proposing an open source TVL verification tool to provide strong support for the transparency of the Bitcoin ecosystem.

The following is the original report:

Special thanks to Bitcoin Layers and Alpen Labs for reviewing this article and providing valuable feedback.

The evolution of BTCFi and Liquid Staking Токенs (LSTs)

Bitcoin has long been the cornerstone of the digital asset ecosystem.

However, for many years, its use was mainly limited to being a store of value and medium of exchange. It wasn’t until 2023 that protocols like Babylon introduced the concept of Bitcoin staking, allowing users to lock up their BTC in a self-custodial manner and participate in the Proof-of-Stake consensus mechanism to earn rewards.

This innovation has ushered in a whole new era for Bitcoin, now commonly referred to as BTCFi. This movement has given Bitcoin unprecedented capabilities. From now on, Bitcoin is no longer just an asset to be held passively, but can actively participate in the decentralized finance (DeFi) ecosystem.

To enhance the usability and liquidity of staked Bitcoin, a wave of Bitcoin Liquid Staking Tokens (LSTs) have emerged. These protocols act as custodians, allowing users to stake their BTC and receive tokenized credentials in return. These LSTs can be freely used in DeFi applications, including lending, trading, yield farming, etc. This model allows Bitcoin stakers to have their cake and eat it too: earn staking rewards while participating in a wide range of DeFi opportunities.

These LSTs protocols have quickly gained user adoption, with the total value locked (TVL) reported by the protocols reaching billions of dollars. TVL is often seen as an important measure of user activity and protocol success.

However, we would like to raise a key question for the industry: How reliable can the TVL data reported by the Bitcoin LST protocol be?

More specifically, for BTC that the protocol cannot actually control or deduct, should these assets be counted in the TVL?

If the TVL data is inflated, this could give users and investors a false sense of security. Inflated TVL data could obscure the true liquidity and risk profile of the protocol, leading all parties involved to make wrong decisions and suffer potential losses.

Why is Bitcoin Liquid Staking Protocol’s TVL so hard to track?

In the context of Bitcoin staking, Bitcoin’s unique UTXO model adds complexity, making TVL (total locked value) data difficult to accurately interpret. This complexity undermines trust in the Bitcoin Liquid Staking Protocol (LST) and also raises concerns about the sustainability of the entire BTCFi ecosystem.

Let’s analyze the reasons in detail.

Bitcoin uses the UTXO model (Unspent Transaction Output), where each transaction creates a separate Bitcoin unit with specific usage conditions. For example:

A UTXO may require a private key signature before it can be used.

More complex UTXOs may include multisig requirements or timelocks.

Unlike Ethereum’s account model, Bitcoin’s UTXO model does not aggregate balances, which makes tracking and locking funds more complicated—though not completely impossible. Therefore, the TVL data of the LST protocol is actually usually reported by the protocol itself. In order to verify these reported data, we need to start with a simple question:

How should TVL of Bitcoin Liquid Staking Protocol be calculated?

The goal of the Bitcoin staking protocol is to provide economic security for application layer protocols such as Rollups, Data Availability Layers (DAs), etc. From this perspective, this economic security is only effective when the staked Bitcoin is escrowed by the staking protocol and can be slashed. Therefore, one thing is clear:

BTC that is not held in custody by a staking protocol or cannot be slashed should not be counted in TVL.

How is the TVL of Bitcoin’s repeated pledge faked?

In pursuit of high TVL (total locked volume), many Bitcoin liquid staking protocols have reached agreements with large holders (whales) at all costs, trying to artificially raise their TVL figures by brushing data.

Here’s how they work:

1. Whale staking: Large Bitcoin holders (i.e. whales) are incentivized to transfer their BTC to an address jointly controlled by the whale and the protocol to participate in the name of staking.

2. Whales’ control remains unchanged: After the pledge is completed, whales still retain ultimate control over UTXO (unspent transaction output). The protocol cannot force redemption or execute penalties (including slashing), which means that these funds are never really at risk.

3. False inclusion in TVL: The protocol includes these UTXOs in its TVL, even though these funds are not truly locked and whales can withdraw or reuse these funds at any time.

The real situation is:

Users (whales) retain full control over their funds: whales can spend these BTC at any time or stake them to other protocols.

Pseudo-staking without slashing penalties: This “staking” process does not have any mandatory slashing conditions and is essentially meaningless.

The core significance of staking is to ensure network security by incentivizing good behavior and punishing bad behavior. Slashing ensures that participants will bear the actual risk of losing funds when they do not follow the rules of the protocol or engage in dishonest behavior. Without this mechanism, staking becomes a farce of staking for the sake of staking with no practical effect.

Please ask yourself: what is the point of staking? It is not to inflate TVL data or symbolically express, but to ensure the security of the protocol through the slashing mechanism.

This reminds me of the painful lesson of FTX. In the FTX crash, the gap between the reported numbers (receipt tokens) and the actual reserves (redeemable assets) ultimately led to a complete collapse of user trust. If a protocol exaggerates its TVL data, can you really trust it not to abuse your reserves behind your back? A protocol that distorts the facts on such a fundamental issue as reserves is likely to have deviated from the trustless principle that Bitcoin represents.

This inflated TVL data raises a bigger question: Are these биткойнs reported as “staked” actually locked up, or is this just a false indicator to attract attention and inflate the numbers?

The Risk of Fake TVL

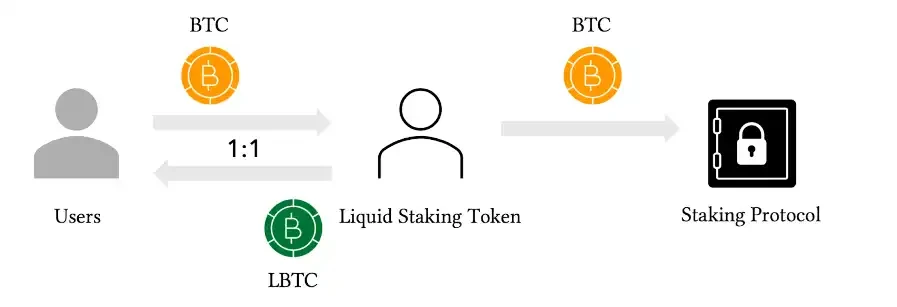

In theory, Liquid Staking Tokens (LSTs) are designed to represent Bitcoin staked to protocols like Babylon, allowing holders to earn staking rewards while maintaining asset liquidity. The premise of this mechanism is that each LST is fully backed by real Bitcoin reserves at a 1:1 ratio.

However, some staking arrangements that pursue high TVL figures could shake these promises. If a portion of the staked BTC remains fully controlled by the original holder, while the protocol simultaneously reports it as fully locked, this would directly threaten the fundamental assumptions on which LSTs rely. The results could be:

The actual collateral locked is lower than the reported amount.

The staking model cannot provide the expected security guarantees.

There is a huge gap between the reported TVL and the actual amount of BTC actually staked.

Ultimately, these actions call into question whether LSTs are truly fully backed by verifiable reserves and raise doubts about the economic security these tokens can provide, such as:

1. Lack of 1:1 support guarantee

Since the protocol counts Bitcoin as “collateralized” that is not actually locked or pledged, there is no guarantee that the assets backing LSTs actually exist or are under the control of the protocol. Users holding these tokens can only rely on the unilateral statement of the protocol. In addition, if these assets do not exist, users will face a real risk of financial loss when redeeming the underlying assets.

2. Unverifiable Staking Rewards

Staking rewards should come from real contributions to network security or Proof of Stake (PoS) consensus. However, where do these rewards come from when the underlying Bitcoin is not actually involved in staking? Are they sustainable?

This is a systemic risk for the entire BTCFi ecosystem. As trust weakens, liquidity may quickly drain away, destabilizing not only a single protocol, but the stability of the entire BTCFi ecosystem based on Bitcoin staking.

What happens when a Bitcoin staking protocol becomes indistinguishable from a centralized entity? In this case, users cannot audit the reserves and can only choose to trust the operator’s statements. This situation seriously threatens BTCFi’s credibility.

The current situation is an existential threat to BTCFi’s credibility. To avoid repeating the mistakes of centralized systems and fake TVL, we must address the root of the problem: the lack of a trustless and verifiable mechanism for proving reserves and staking activity.

This is where Proof of TVL (PoTVL) comes in. Only by establishing a scientific, transparent, and криптовалютаgraphically based reserve verification standard can we rebuild trust in Bitcoin LSTs and ensure the long-term sustainability of the ecosystem.

Basic solution: Transparent calculation of TVL

In the context of Bitcoin staking, Taproot addresses play a key role in implementing staking locking scripts such as Babylon. These locking scripts define clear rules for staking, tracking, and ultimately withdrawing BTC. Babylon is a classic example because it ties staking behavior directly to verifiable protocol-level rules on the Bitcoin UTXO model.

When a staker participates in a staking protocol, they construct special transactions to send BTC to the Taproot address specified by the protocol. These transactions typically include the following:

1. Staking output: A UTXO used to send BTC to the Taproot address for staking.

2. Ownership verification output: The second UTXO contains the public keys of the staker and the protocol. These public keys prove the ownership of the staked BTC.

Брать the specification of Babylon pledge agreement as an example:

The specification requires the staker (or the LST protocol) to construct the following transaction:

-

The first UTXO sends BTC to the Taproot address that is tied to Babylon’s stake locking script.

-

The second UTXO contains the public keys of the staker and Babylon to ensure ownership verification.

This design ensures that staking behavior can be fully tracked on-chain, with clear proof of ownership and transparent rules.

Case Study: Lombard Finance

To demonstrate the approach in practice, we validated it against Lombard Finance using the open source tool Proof of TVL.

The following is the complete verification process:

1. Identify the user’s deposit wallet

It starts with users depositing BTC into Lombard wallets. These wallets represent the initial flow of funds into the system.

2. Track transactions to the staking wallet

Track the flow of BTC from deposit wallets to the staking wallets controlled by Lombard. Identify all staking transactions according to Babylons staking specifications.

3. Verify ownership

Confirm that the required public key is included in the pledge transaction for ownership verification using Babylons protocol rules. Ensure that the transaction complies with the pledge locking script.

4. Calculate the real TVL

Aggregate the BTC outputs from verified staking transactions to calculate on-chain collateral. Compare the collateral to the total supply of LBTC to calculate the collateralization ratio.

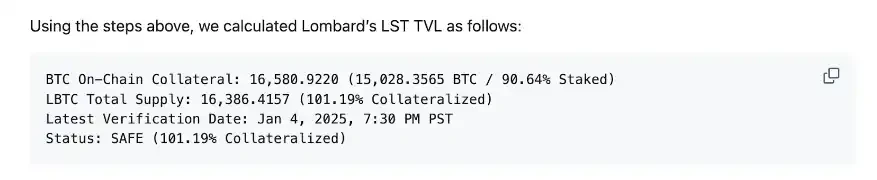

Through the above steps, we calculate Lombards LST TVL as follows:

-

BTC on-chain collateral: 16,580.9220 (15,028.3565 BTC / 90.64% staked)

-

LBTC Total Supply: 16,386.4157 (101.19% overcollateralized)

-

Last verified: January 4, 2025, 7:30 PM Pacific Time

-

Status: Secure (101.19% overcollateralized)

Verification details:

-

90.64% staked

Of the 16,580.9220 BTC on-chain collateral, 15,028.3565 BTC are actively staked per Babylon specifications.

-

101.19% Overcollateralization

The total supply of LBTC is 16,386.41, while the on-chain collateral is 16,599 BTC.

-

Full on-chain transparency

Each staking transaction can be directly traced back to the Lombard protocol deposit address, and ownership verification complies with the staking rules.

The verification process was completed at 7:30 PM Pacific Time on January 4, 2025 (at the time of writing this article), and the data is fully reproducible and requires no human intervention. Through our open source tool Proof of TVL , anyone can independently verify LBTCs TVL data in real time.

This is true transparency.

While this solution provides a high degree of transparency, it has a key flaw: it relies on trusting the protocol to accurately calculate and report TVL.

So, is there a way to remove this dependency and allow anyone to confidently and independently verify the results? Zero-knowledge proofs (ZKPs) offer a potential solution.

TVL verification using zero-knowledge proof

One of the great advantages of zero-knowledge proofs (ZKPs) is that they are cryptographically trusted, and the verification cost is extremely low, so users can verify zero-knowledge proofs directly on client devices such as mobile phones or browsers. This greatly reduces the friction and trust assumptions of TVL verification. Now, users don’t even need to trust the third party running the TVL verification protocol.

The zero-knowledge proof used to verify LST TVL is specifically expressed as follows:

BTC from LST on Babylon + Proof of Reserves of LST Wallet ≥ Total LST Supply

BTC from LST on Babylon

According to Babylons transaction specifications: For a transaction to be considered a valid pledge transaction, the following conditions must be met:

-

The transaction needs to have a Taproot output with the key spending path disabled and submit to a script tree consisting of the following three scripts: timelock script, unbonding script, slashing script. This output is called staking_output and its value is called staking_amount.

-

The transaction needs to contain an OP_RETURN output containing the following: global_parameters.tag, version, staker_pk (staker public key), finality_provider_pk (finality provider public key), staking_time (staking time).

In order to verify the LST BTC on Babylon, we need to first check the validity of the pledge transaction. For example, verify that the Taproot output and OP_RETURN contain the same public key.

Proof of Reserves for LST Wallets

We can adopt a standard proof of reserve protocol, such as the one proposed by Vitalik Buterin: https://vitalik.eth.limo/general/2022/11/19/proof_of_solvency.html.

In addition, a slightly improved version was proposed by Shumo et al.

Дальнейшее чтение: SNARKed Merkle Sum Tree: Vitalik’s proposed solution for the Proof of Reserves protocol .

The only technical detail is that we need to replace the signature algorithm used by Ethereum with the algorithm used by Bitcoin. For example, although both Bitcoin and Ethereum use ECDSA, Bitcoin chose SHA instead of Keccak as the secure hash algorithm.

LST Total Supply

This is a public input provided by the user.

TVL verification through zero-knowledge proof can effectively minimize counterparty risk while lowering the threshold for any user to verify the results.

The future of BTCFi

Bitcoin has always stood for trust, decentralization, and transparency. However, with the proliferation of fake TVL data in the Bitcoin staking space, these core principles are at risk of being eroded.

The solution is clear: TVL verification, enabled by zero-knowledge proofs, provides a clear path to true accountability.

By removing the reliance on trust and making the reserve verifiable by anyone, we are able to rebuild user confidence in Bitcoin LST and ensure BTCFi thrives on a “real” foundation.

Sustained Engagement

We believe in the power of collective progress. Here’s how you can help drive that progress:

-

Provide more TVL verification analysis: Help expand the scope of the tool and contribute transparent analysis to other BTCFi protocols. Transparency is a joint effort of the entire ecosystem.

-

Contribute PRs: Improve the tool or propose new features (e.g., implementation of zk-proofs).

-

Setting Industry Standards: Work with us to create public, verifiable standards for BTCFi transparency.

-

Spread the word: Share this article to raise awareness of the need for trustless TVL verification.

Appendix: Full report and verification tool open source address

This article is sourced from the internet: A long article reveals the BTCFi TVL scam, and Nubits Proof of TVL report is explained in detail

The information, opinions and judgments on markets, projects, currencies, etc. mentioned in this report are for reference only and do not constitute any investment advice. Since the launch of the BTC Spot ETF, the correlation between BTC prices and U.S. stocks has become stronger and stronger. This is vividly reflected in the market since November. On November 5, Trump was elected as the 47th President of the United States, and the U.S. stock market and BTC simultaneously started the Trump market. The confidence of all parties in Trumps economic policies was very strong, which pushed the market to continue to rise until December 18. On that day, the Federal Reserve made hawkish remarks, suggesting that monetary policy may change. The market expected the number of interest rate cuts in 2025…