10K Ventures Annual Report (Part 1): Looking Back at 2024

Оригинальный автор: 10K Ventures

The annual report is divided into two parts

This article shares our thoughts on 2024 and does not constitute investment advice.

This article mainly covers the 2024 part, including:

(1) Impact of ETFs

(2) DEX vs CEX

(3) Application chain

(4) Stable calculation vs. on-chain asset management

(5) Has the industry entered the PE moment?

01. ETFs and giants dominate the market

1.1 BTC ETF has a large net inflow in one year, and the pricing power has shifted to North American institutional investors

After the BTC ETF was approved this year, the North American BTC ETF began to increase its holdings on a large scale. As of December 25, the North American ETF held a total of about 1.19 million BTC, accounting for 5.66% of all BTC. When it was first launched, there were less than 670,000 BTC, and it increased its holdings by 525,600 BTC in one year.

By observing the net inflows and outflows of BTC ETFs, we can find that this year’s BTC volatility and the net inflows and outflows of ETFs have been highly positively correlated, and pricing power has gradually shifted to North America.

This trend is further reinforced by the following factors: large CEXs are becoming more selective about listing VC-backed teams (while charging teams high listing fees), and on-chain liquidity is growing with the development of better tools (such as CLOBs, launch platforms, front-end tools such as Moonshot).

1.2 The progress of ETH ETF is relatively slow and it is currently in the stage of turnover from insiders to outsiders.

In general, the net inflow of ETH ETF is slower than that of BTC ETF. November 29th of this year was the dividing point, when ETH ETF began to receive a large net inflow, with a net inflow of 300 million US dollars on that day, which was twice the cumulative net inflow of the previous four months. For a period of time thereafter, ETH ETF began to receive a continuous net inflow, but we also observed that криптовалюта native OGs such as Justin Sun began to sell Ethereum. The current trend is that the insiders are selling and the outsiders are increasing their holdings. As of December 26th, ETFs hold 3% of ETH in total.

We believe that ETH will also gradually change hands, and pricing power will shift from crypto natives to North America, but this change process may be longer than BTC. If ETH can still have a new narrative from institutions next year, then it may be that ETH ETFs can earn interest by staking and are not considered securities.

02. DEX Flip CEX?

2.1 The on-chain spot ceiling may be gradually approaching its limit

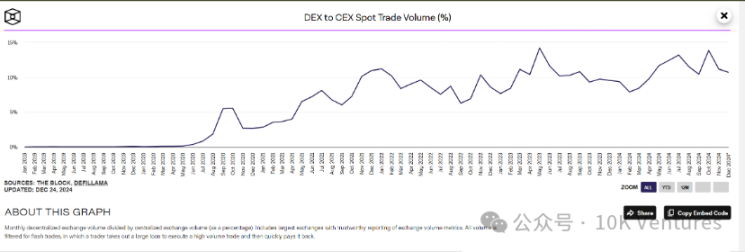

Starting from the new 4-year cycle in 2024, we can clearly see that the market share of on-chain spot/derivatives is constantly expanding.

But dex/cex trading volume may have a certain ceiling. This is because the large transaction volume in the blockchain world still comes from mainstream coins such as BTC/ETH/SOL/XRP, and the transaction volume and best transaction depth of mainstream coins are still in CEX. But as the answer to why crypto is – the biggest role of Crypto is to use tokens to incentivize mid- and long-tail users/project parties. The recent large transaction volume on the chain is all memes, which are mid- and long-tail project parties relative to mainstream coins.

If mainstream coins such as BTC/ETH remain hot in the market in the future (which is highly likely), and Meme does not occupy a majority of trading volume, then the ceiling of on-chain spot trading may soon be seen. In other words, Meme is cannibalizing the trading volume of the middle and tail VC coins in CEX.

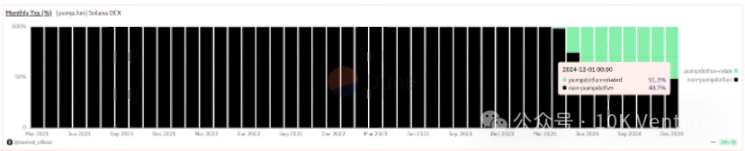

From the perspective of the market share of on-chain DEX, thanks to the emergence of Pumpfun, Raydiums market share has greatly increased, and once occupied 28% of the full-chain DEX market share. Due to the relatively sluggish performance of the Ethereum ecosystem this year, Unis market share has dropped from 42% at the beginning of the year to 33%. The biggest dark horse this year is Aerodrome. Thanks to the active Base ecosystem, Aeros market share has increased from 0 at the beginning of the year to 10% now, becoming the leader on Base (Long Aero=Long Base).

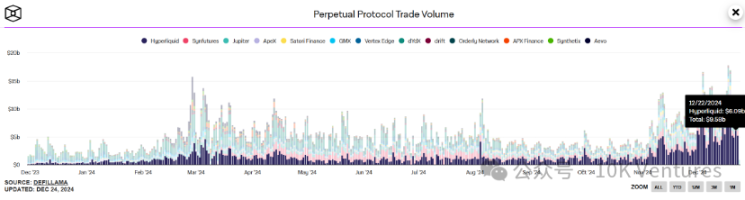

2.2 Hyperliquid stands out

Limited by the relatively small market size of the original on-chain derivatives track, thanks to the rapid development of Hyperliquid in November, the dex/cex futures trading volume increased significantly in November, and its market share increased from 4% to 8% on its own.

We often say that the competitive characteristics of perp dex are:

1. Institutions prefer Orderbook, while retail investors/whales prefer Pool mode

2. Рынок makers/takers have a larger trading volume than retail investors

3. In the orderbook mode, MM/Taker brings 0-1 trading volume and liquidity, and brings 1-10 retail investors by means of gameplay (airdrop + pull-up). 4. Although Pool has a low threshold, MMs gross profit is also low; Orderbook has a high threshold, and MMs gross profit is also high.

The LP Pool model represented by GMX/Jupiter represents the dydx derivatives 1.0 model. GMX/Jupiter allows retail investors to add pools to bet against traders, which can earn commissions and liquidation fees. It brings the original CEX MM business model to retail investors in a decentralized manner, creating a new paradigm for perp dex on the chain. GMX and Jupiter have performed very well in the bear market, and GMXs market value has even doubled against the trend in the bear market.

However, after the bear-bull transition, institutions rushed into the market again, and liquidity began to become abundant again. The trading depth and profit margin represented by Pool can no longer meet the needs of institutions, and the derivatives trading track has returned to the 3.0 model of orderbook. You may think that it is easy to build a high-performance derivatives exchange, but it is not. Buying a garbage trading engine from Chainup is completely unable to meet the needs of high-performance trading. Hyperliquid took two years to build the product online. It not only built its own trading engine and told the L1 story, but also used the Orderbook model to match transactions and used HLP to attract retail investors to add liquidity. Hyper is currently the perfect integrator of perp dex.

But at the same time, we feel that there is still room for improvement in perp dex, and the improvement may lie in the license – the top market makers still tend to MM in compliant/secured perp dex.

3.Solana/Base/Ton are competing for the top spot

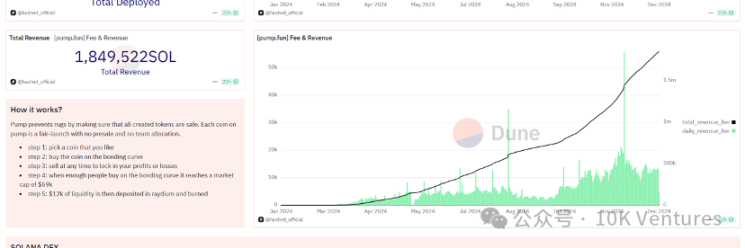

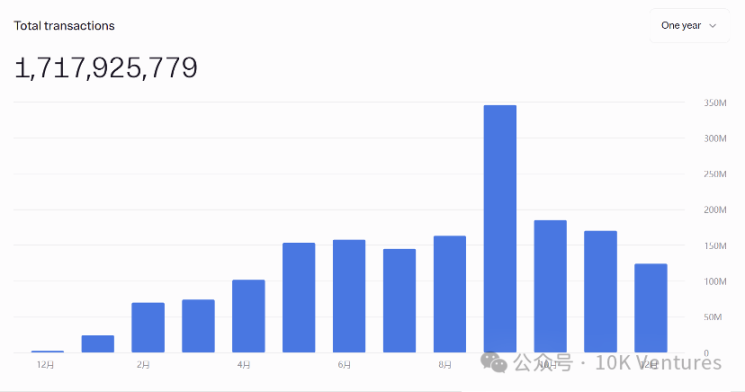

3.1 Pump.fun alone contributes half of Solana’s transaction volume

Every time we ask the leading Infra/public chain companies, what kind of ecosytem do you want to create? We have always adhered to the principle that if a real Infra/public chain company wants to stand out, it must have a unique project/track in the ecosystem.

DeFi/Ethereum, Stepn/Solana+BSC, GameFi/BSC, DePIN/Solana, Payment/Tron. This time, Pump, as the leading dapp, once again turned the tide for the Solana ecosystem, with revenue of 300 million US dollars this year. Solanas Payfi and DePIN tell stories to traditional investors, and everyone is willing to pay. However, retail investors may not recognize Payfi and DePIN. After all, Yuebao with a few percent APY, supply chain finance, wifi base stations, and map data collection are still too far away from pure gambling retail investors. In the carnival of the bull market, retail investors like excitement. A big positive line/negative line stimulates the brain to secrete dopamine. Secondly, Pumpfuns website design is also very magical. The high-frequency flashing and pop-up windows can magnify the greed in the users heart by 200%. Pure gambling, the ultimate enjoyment.

Solana’s path forward is now clear.

On the 2B side, Foundation tells stories about being able to serve the web2 enterprise side, such as Payfi. After all, cross-border payments/payfi are currently happening gradually from the bottom up on the enterprise side. DePIN’s service to the enterprise side is no longer that sexy, and it is found that the promotion speed of DePIN is not satisfactory. After all, in such an efficient chain world, it requires a real industrial chain + supply chain + transportation to all parts of the world, and only after a certain scale is formed can it serve the 2B side, and the speed will not be too fast.

On the 2C side, there is no better money-making story than the extremely low-threshold casino + lottery.

In addition, let me add a little about the auxiliary trading tools of GMGN-type broker products. As the leading product in the track, it has earned more than 20 million US dollars in less than 3 months. This provides new entrepreneurial ideas for web2 product managers to enter the cryptocurrency circle. Compared with products such as Dune and Токенterminal seen in the last cycle, the commercialization ability is at least 2 orders of magnitude stronger, thanks to this round of auxiliary trading products directly entering the transaction.

We will also continue to observe equity investment in similar products and opportunities for revenue sharing. The financing model for such products is mostly equity financing + revenue sharing opportunities, but from current observations, this type of investment model is not very cost-effective for investors (it is actually very good to do it yourself). Usually the first round of valuation is 10-20 million, and investors hold about 20% of the shares, which means that if the company relies on dividends to recover its investment, it must at least achieve 10-20 million in revenue during its life cycle, which is very challenging. The leading effect of blockchain is too significant, and the life cycle is usually very short.

3.2 Solana Memecoin: One man’s success is the result of many sacrifices

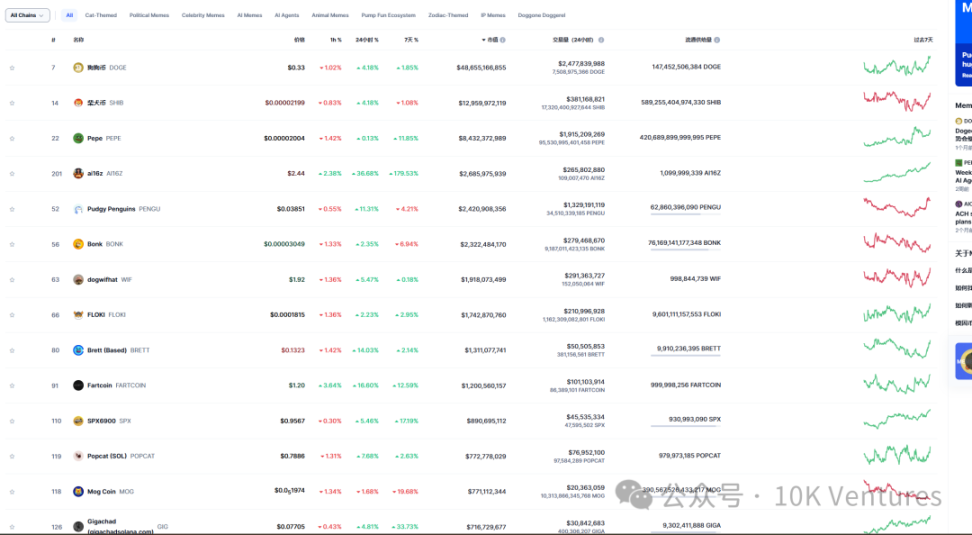

The most successful theme this year is Meme coin. A large part of the trading volume of Meme has siphoned off the trading volume of mid- and low-end VC coins. Pump.fun in October and November pushed the meme craze to its peak, with dozens of plates issued on pumpfun every 10 seconds. This year, memes such as ai16z, bonk, bome, spx 6900, etc. have reached a circulation market value of more than 1 billion US dollars.

The meme market offers huge ups and downs, with intraday fluctuations up to a thousand times, but extremely high returns are accompanied by extremely high risks, and many memes will return to zero in an instant.

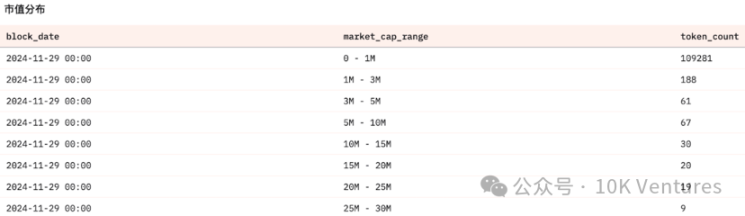

From the following data, we can see that 99% of memes cannot break through the 1 M market value. The meme that can break through the siege of hundreds of thousands of memes is also the result of the sacrifice of thousands of people.

3.3 AI Agent Leads Base to Prominence

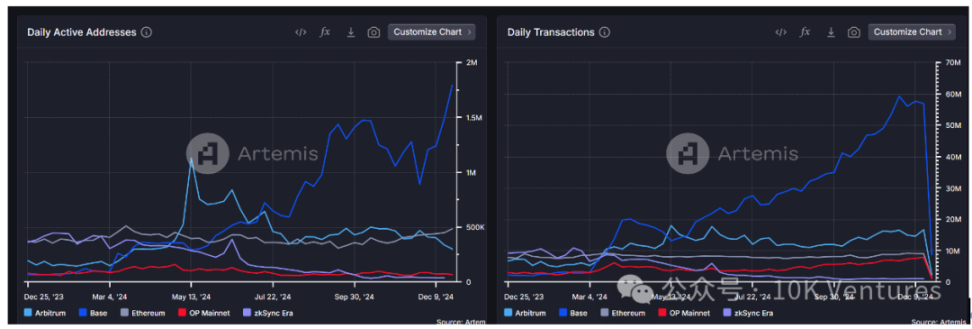

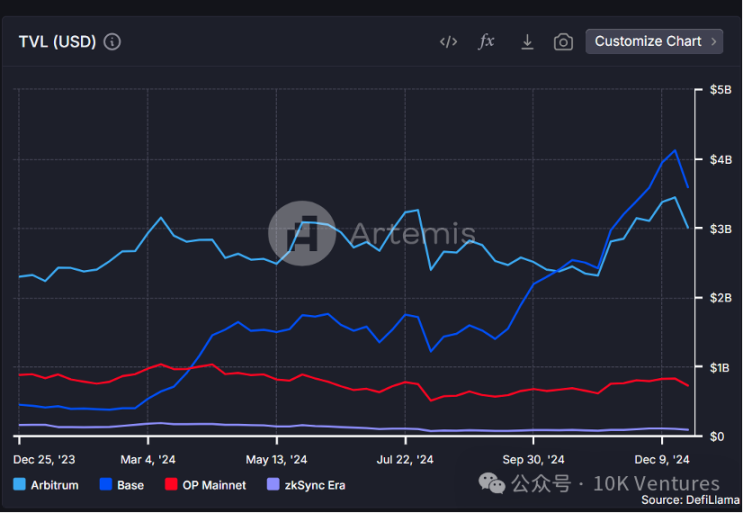

In our October monthly report, we highlighted the rise of the Base ecosystem. Two months later, Base is now far ahead of other Ethereum ecosystems in terms of both DAU and TVL.

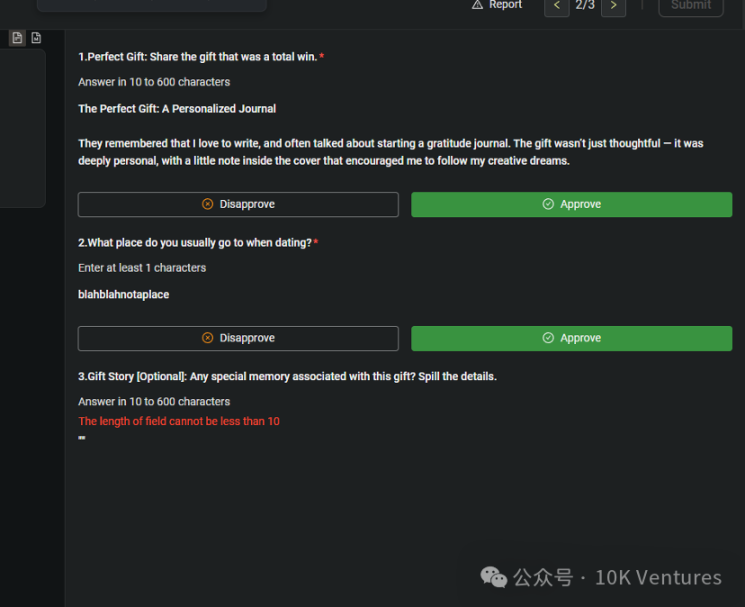

In the current Base ecosystem, Virtual and Clanker are the most likely representative projects of Base besides Aerodrome. Virtual is product-driven, emphasizing the connection between AI and Web2 users, and gradually building a set of usable tool systems. Former Google CEO Eric Schmidt and Marc Andreessen pointed out the unique advantages of the Virtual team in high-frequency trial and error. From PathDAO to Virtual Protocol, the team took three years to cross GameFi, AI+DApp, and completed the miracle of market value growing from 10 million US dollars to 3 billion US dollars. In addition to the practicality of the AI Agent itself (for example, Luna can interact with users), since Virtual has released its Token, the gameplay will be more diverse than pumpfun. As the only platform that uses tokens, Virtual uses new IPOs and other gameplay to replicate the gameplay of Pumpfun/sol.

Interestingly, many projects this year have made more or less innovations in Tokenomics, truly realizing the flywheel effect of business + token.

3.4 Apart from Tap2Earn, where is Tons breakthrough point?

We published a research report on Ton in the middle of this year, in which we mentioned that we don’t have a particularly bullish Ton ecosystem. The main reason is that we are not optimistic about the new user acquisition system under the Tap2Earn system. Tap2Earn is different from the payment system of DePIN and GameFi. The story told by the DePIN project is that when there are more long-tail suppliers, the demand side will pay for the entire long-tail supplier and ecosystem, such as Render rendering and Mobile mobile communications. GameFi talks about how fun the game is, and users will pay for the platform and gold farmers because of entertainment needs.

But the story of Tap2E arn is that when I have enough users, there will be advertising commercial value. But the problem is that these Tap2E arn users are pure wool parties, and the commercial value is very low, or the commercial value that exists is sold to the exchange at one time. After half a year, we think that the business model of Tap2E arn attracting new users + advertising is difficult to exist in the long run. Rather than saying that Tap2E arn is a business innovation, it is better to say that the hamster/catizen/DOGE half a year ago has completed a new wave of blockchain missions.

So where will Tons next breakthrough be? For example, we have recently seen Saharas current alpha test data annotation product, which is mainly for long texts. If a company can get actual orders, distribute them through TG, and let users do annotations, it may be a very sexy веб3 data Foxconn. However, such companies need to seriously consider the quality issues after crowdsourcing distribution.

In addition, after detailed communication with friends from the Ton Foundation, we also deeply realized the problem of the Ton ecosytem – ecological projects usually regard the issuance of coins as a short-term opportunity. The conspiracy group will end after issuing a wave of coins and start the next project, such as DOGE/Hamster, etc. The exchange has gained new users from these projects and has nothing else to ask for. The following six months proved that these users will not bring too much value to the exchange, and will not bring higher TX to Ton (after all, they will withdraw after the wool is finished, and the penetration rate of the chain is too low). The TG team basically does not care about the price of the coin and is in a Buddhist state. Therefore, we are cautious about the subsequent Ton opportunities.

4. Stable ❌On-chain asset management ☑️

Stablecoin company revenue = AUM*Interest Rate.

The underlying interest rate of the stablecoin industry is usually anchored to government bonds. The new on-chain stablecoins that emerged in this cycle are mainly USDE and USD 0. There are two ways to play, one is to increase AUM, and the other is to increase Interest Rate. Ethena and USUAL have adopted two completely different approaches.

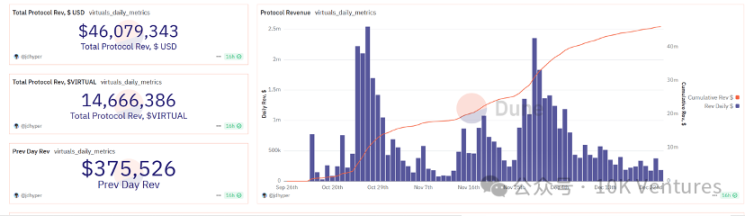

4.1 Ethena——Ultimately Maximizing Yield

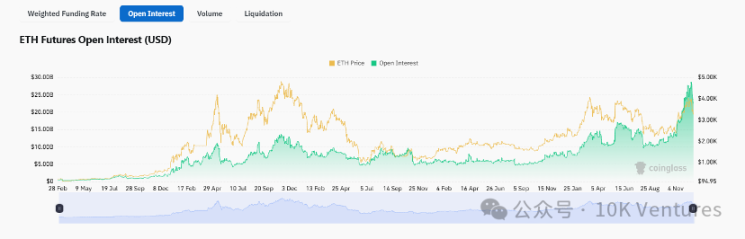

Ethena maximizes risk-return through extreme delta neutral + eth native staking + governance currency standard subsidies, thereby attracting TVL. We have analyzed Ethenas business model too much, so we will not add too much here. But it is worth mentioning that ETH OI has started to grow significantly recently. Compared with September, OI has increased by 2.5 times, and the ceiling of ENA has gradually opened. ENA is probably the token with the most violent rise and fall in the trend market.

Things that may open the ceiling of ENA in the future may include: 1. Changes in ENA Token utility, such as revenue sharing, repurchase, etc., but this may be strongly related to macro policies; 2. Start doing BTC (already cooperating with solv)/Solana/aptos/sui/ton short operations.

4.2 Usual——Decentralized Fiat Currency Collateral

Usual can be seen as a веб3 version of a dividend-paying fiat-collateralized stablecoin. The stablecoin yield is guaranteed by distributing part of the treasury bond income to the community + token subsidies. The teams approach is very much in the style of the old-fashioned DeFi. TVL is subsidized by extremely exaggerated yields similar to the DeFi summer period.

First, lets take a look at the difference between APY and APR. Simply put, APR is the return for the next year without considering the impact of compound interest. APY takes into account the impact of compound interest, which results in APY usually being much greater than APR. The formula is as follows – APY = (1+APR/n)^n-1.

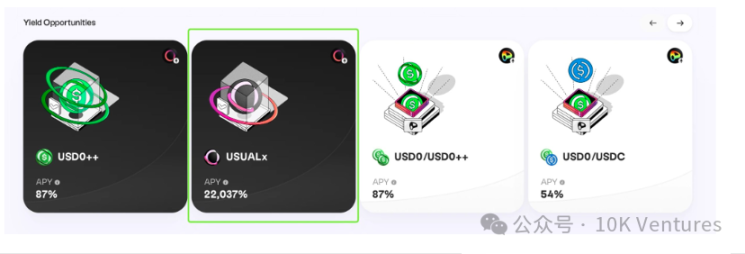

On December 19, Usuals coin-based APY reached an astonishing 22037%. In the context of daily compounding, the APR formula is equal to 543.65%, and the daily interest rate is less than 1.5%. Considering that Usuals emissions are negatively correlated with protocol growth, the problem of excessive token dilution should be avoided. At the current time when USD 0 has grown to 1.7 billion TVL, the protocol has an annualized revenue of 68.94 million US dollars, 500 million US dollars in circulation, and FDV of 4.5 billion US dollars. While FDV/Revenue (65, usually DeFis PF is around 5-20) is ridiculously high, there are also a large number of Usual tokens subsidized to Usualx staking, USD 0++ staking and USD 0/USD 0++ pools, so we believe that at this price, Usual is relatively overvalued. This model is very similar to the model of using governance tokens to subsidize TVL in the DeFi summer of 20-21. But Usual’s token utility is better than ENA’s, at least there is revenue sharing.

The team is raising the price of tokens, and currently selling Usual tokens at 20% off.

5. Has the industry entered the PE moment?

In 2023, a large-scale OTC model began to appear. The project party will give OTC team/consultant/ecosystem tokens to investors, and the OTC money will be used to pull the market or build the ecosystem. After all, without pulling the market, there will be no ecosystem:). The medium- and long-term stable pull is the best marketing cost, which not only attracts retail investors, but also developers. In addition, as the public chain currency is rising, TVL is rising. This will lead to the growth of retail investors/developers/TVL, and the most important three-ring spiral of the public chain will rise.

The most successful OTC deals that are starting to exit may be Pendle/Ton/Solana. Solana is an exception, after all, it is to clean up the mess for FTX. Looking back now, OTC deals are usually profitable (of course there are also money-losing deals). But at the moment of making a decision, it is usually very, very painful. Because the fundamentals were relatively poor at the time, the business was not good, the valuation was high, and the unlocking might not be friendly, the decision would be relatively difficult. Our good performance this year is Solana OTC (very optimistic about the fundamentals + the accounts can be calculated), and the regretful thing is mainly ENA OTC (not optimistic about ENAs utility as a mining coin).

This article is sourced from the internet: 10K Ventures Annual Report (Part 1): Looking Back at 2024

Related: A review of the top ten most influential Web3 attacks in 2024

Original source: Beosin In 2024, the blockchain industry is facing increasingly severe security challenges while innovating technology and expanding its ecosystem. According to the Alert platform of security audit company Beosin, as of press time, the total losses in the Web3 field in 2024 due to hacker attacks, phishing scams and project party Rug Pulls reached US$2.491 billion. These incidents not only exposed technical defects such as private key management and smart contract vulnerabilities, but also highlighted the potential risks of social engineering and internal management. This article will review the top ten Web3 security incidents in 2024 to help the industry learn lessons from them and better deal with future security threats. No.1 DMM Bitcoin Amount of loss: $304 million Attack method: private key leakage On May 31, 2024,…