TGE is coming soon, let’s talk about StakeStone Berachain Vault’s BERA “Gold Rush Guide”

Original author: Web3 farmer Frank

The mainnet is about to be launched. How can we capture the most BGT/BERA on Berachain easily and hassle-free?

With the successive issuance of Movement, Fuel and other tokens, Berachain has become one of the few emerging public chains that still attracts much attention, relying on the on-chain liquidity flywheel designed based on the PoL (Proof of Liquidity) mechanism. However, for ordinary users, this has also built a high wall of participation:

From how to participate in Boyco pre-deposit to choosing DAPP, calculating income strategy, to dynamic participation in governance voting, each step places high demands on on-chain experience and operational capabilities, hindering the vast majority of users from maximizing their chances of capturing BERA, and there are currently almost no simplified tools available.

It is worth noting that StakeStone has just launched the market’s first one-stop Berachain liquidity provider product “Berachain Vault”, which is designed to simplify the process from Berachain pre-deposit activities to liquidity mining (Yield Farming) under the POL mechanism. It aims to help ordinary users easily participate in the Berachain ecosystem and seize early dividends through one-stop nanny services.

Can this Vault product become a through train for retail investors to participate in Berachain? This article will start from the emerging ecological needs represented by Berachain, combined with the core design of StakeStone Berachain Vault, to explore the potential and value of this product in lowering the threshold and optimizing revenue management.

Berachain: The “flywheel” and “high wall” of the POL mechanism

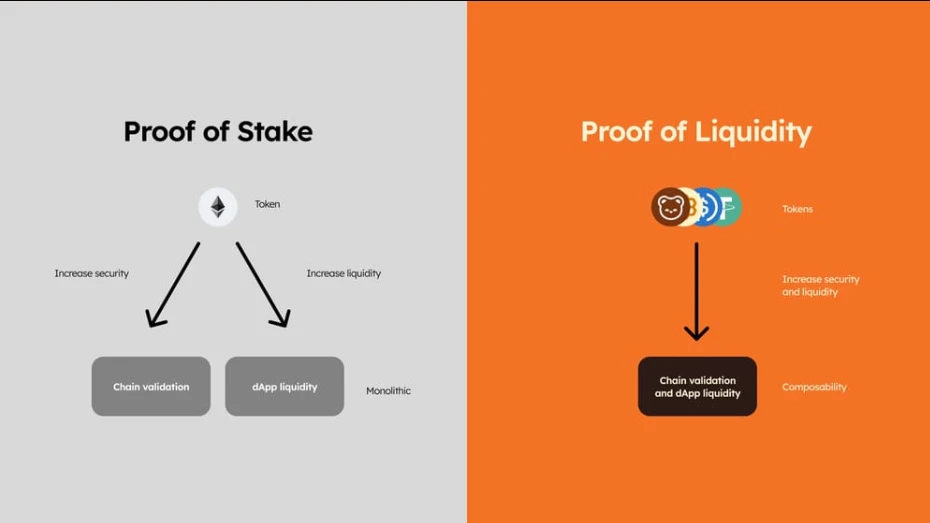

When talking about Berachain, we naturally cannot leave out its core innovation, the Proof-of-Liquidity (POL) mechanism, which means that users must provide liquidity to a specific liquidity pool in order to obtain the corresponding BGT (a governance token that can be converted into BERA) rewards. Which liquidity pools can obtain more BGT emissions is decided by voting by the verification nodes entrusted by BGT holders.

Does it look familiar? If we replace Berachain with Curve, the POL mechanism with the ve model, and BGT with CRV, the operating logic of the two is surprisingly similar – on Curve, CRV holders obtain veCRV with voting weights through different lock-up periods. The veCRV with voting weights obtained can also be used to decide which trading pools can get the subsequent emission of CRV tokens through voting. In other words, Berachain can actually be simply understood as a public chain version of Curve, or a public chain that operates based on the ve model:

Under the POL mechanism, the votes of the verification nodes directly affect the emission and distribution of BGT, which will undoubtedly greatly stimulate ecological projects to actively create various liquidity incentive plans to actively strive for more BGT emissions and form a bribery ecology similar to Curve.

Однако, Berachain has integrated this logic into the underlying architecture of the chain, allowing users, verification nodes, and DApps to form a highly collaborative community of interests:

Ideally, the interests of the verification nodes and DApps are aligned in their success. The former is motivated to emit more BGT to DApps with high transaction volumes and high activity. DApps will attract more users to participate in the liquidity pool by increasing the incentive returns to LP users, allowing these high-volume pools to generate more substantial returns.

As more users flock to the liquidity pool due to high returns, the governance support and liquidity scale of DApp will be further improved, thereby gaining more BGT emission rights. This continuously expanding liquidity and governance weight will not only expand the scale of the protocol, but also in turn attract more users and funds into the ecosystem, gradually forming a strong positive flywheel.

But new problems also arise. Once the Berachain mainnet is launched, how can ordinary users judge and choose where to provide liquidity to maximize their profits?

Whether it is the selection of verification nodes, ecological projects or liquidity pools, each layer of selection requires in-depth research on more than a dozen options. This undoubtedly constitutes a high wall for participants.

Compared with Curve, the Berachain ecosystem undoubtedly also needs an entire ecosystem project to support users. Among them, the voting delegation platform Convex and the one-stop income platform Yearn.finance will also be indispensable components on Berachain to solve the core pain points of ordinary users.

Typical user dilemmas include:

-

Асимметрия информации: The returns and governance weight distribution of different DApps/liquidity pools are in dynamic change. Retail investors need to invest energy and time to track and study the dynamics of each project in order to make the best choice;

-

Disadvantages of scale effect: Individual retail investors contribute little liquidity and are unable to compete with large-scale project owners or professional players in the process of competing for emission rights. It is difficult to achieve scale effect through individual participation;

-

Operational complexity: managing liquidity, participating in voting governance, and optimizing returns at the same time is a high barrier for ordinary users. If you are not careful, you may miss the best opportunities. For example, failure to adjust voting direction or reallocate liquidity in time may directly affect overall returns.

In response to this demand, the full-chain liquidity asset protocol StakeStone launched Berachain Vault, an innovative product designed specifically for the Berachain ecosystem, which became the earliest one-stop Berachain mining service platform officially launched by Berachain in the market.

StakeStone Berachain Vault: One deposit, two networks, multiple benefits

In the context of DeFi, Vault is an automated investment strategy designed to simplify the user experience. Users only need to deposit assets, and the protocol can automatically execute a series of financial transactions to maximize returns through a combination of various strategies. However, although traditional Vault products provide convenient asset management, they have obvious limitations in terms of revenue appreciation and liquidity release.

On the one hand, what users deposit are usually non-interest-bearing underlying native assets such as ETH, which, despite having high market recognition, cannot directly generate returns; on the other hand, after depositing in the Vault, liquidity is often locked and difficult to further utilize, limiting users’ investment flexibility.

As interest-bearing assets such as stETH, pufETH, and rzETH gradually become mainstream, Vault products have also evolved and begun to support these assets with embedded income logic, enabling them to not only capture basic income such as PoS staking, but also further stack income through combined strategies such as liquidity mining and lending, thereby maximizing users return on investment.

Then, if we extend our thinking, on this basis, the liquidity locked in the Vault is also released in the form of Valut LP Токен, and it is allowed to participate in various DeFi income scenarios, wouldn’t it be possible to maximize the multi-layered income?

Take the newly launched Berachain StakeStone Vault as an example. It is such an innovative product that not only continues the asset management function of Vault, but also completely opens up all dimensions of multiple benefits for users through the innovation of Vault+Vault LP Token:

-

Encapsulate Berachain Vaults LP assets into interest-bearing assets: Allow users who want to participate in the Berachain ecosystem to deposit LP assets such as ETH and STONE (interest-bearing or non-interest-bearing). After receiving the assets, Vault uses the liquidity mining and governance income strategy under the POL mechanism to maximize the returns of LP assets for specific liquidity scenarios, and based on this, encapsulate them into Vault LP Tokens with interest-bearing capabilities (such as beraSTONE).

-

Then, based on the packaged interest-bearing assets, DeFi income combination is carried out: Subsequently, Vault LP Token can be used for various mature DeFi infrastructures on Ethereum to realize a new and unique parallel universe structure, that is, the source of interest is on other chains such as Berachain, and the allocation of funds for interest-bearing activities occurs on the Ethereum mainnet. This structure takes into account the respective advantages of high returns on new chains and large funds on the Ethereum mainnet and mature DeFi infrastructure, thus having the opportunity to become a new paradigm in the DeFi market.

In Stakestones design mechanism, the encapsulated Vault LP Token has top-level composability like ETH – it can participate in Uniswap liquidity mining, Aave/Morpho mortgage lending, and even be split into PT and YT in Pendle, etc., further amplifying returns.

So if you look closely, the real innovation of StakeStone Berachain Vault is that it links the emerging Berachain ecosystem and the mature Ethereum (or other EVM chain) network through secondary utilization and deep release of an asset, forming a flywheel effect of multi-level benefits:

-

The first layer of income, the PoS income of the underlying interest-bearing assets: users can deposit ETH to obtain full-chain liquidity assets such as STONE, covering the underlying PoS income of ETH;

-

The second layer of income, the POL income of the Berachain ecosystem: STONE is deposited into the StakeStone Berachain Vault, and the liquidity mining income under the POL mechanism is obtained in the Berachain ecosystem, and this layer of income is further encapsulated into Vault LP Token (such as beraSTONE);

-

The third layer of income is the income from diversified DeFi strategies on Ethereum: Vault LP Token in the form of beraSTONE can be used to increase income on Ethereum through leverage, liquidity mining and other strategies;

In this way, by combining the ecological characteristics of Berachain and the diversified on-chain revenue scenarios of Ethereum, StakeStone Berachain Vault realizes the multiple reuse of an asset from emerging markets to mature ecosystems, maximizing profits while also completely releasing liquidity potential, greatly improving the utilization efficiency of a single asset, and bringing higher capital liquidity and market recognition to the Berachain ecosystem.

Through these two assets, users can not only obtain high BERA income under the Berachain Proof of Liquidity (PoL) mechanism, but also realize income superposition in mature ecosystems such as the Ethereum mainnet. More importantly, users can also lock in future governance tokens STO in advance by participating in the StakeStone Vault:

During the event, users can participate in a total of 15 million STO reward pools by holding or using beraSTONE and beraSBTC, including 8.25 million Bera-Wave points rewards (issued in the form of points, settled by TGE) and 4 million STO additional rewards during the Boyco event; in addition, the first 10,000 early bird users (depositing ≥ 0.042 ETH or ≥ 0.0015 BTC) will also receive an additional incentive of 150 STO each.

So how do you earn Bera-Wave points? It is mainly divided into two parts: basic points rules + DeFi acceleration rewards (the recommended reward mechanism can be found in the specific process below):

1. Basic points rules:

-

Holding 1 beraSTONE earns 1 point per hour;

-

Holding 1 beraSBTC, you can earn 25 points per hour (points are accumulated hourly, no additional operations are required);

2. DeFi Acceleration Rewards – Investing beraSTONE or beraSBTC in the following DeFi protocols can significantly increase the speed of point accumulation:

-

Uniswap provides liquidity: 5 times the reward of basic points.

-

Precise liquidity range (± 0.1%): When the liquidity range remains within ± 0.1% of the current price, you can get 6 times the basic points (continuous activity required).

-

More protocol support: In the future, protocols such as Pendle and Morpho will be launched to provide more reward opportunities and further increase points benefits.

In general, these rewards cover Berachain PoL, Boyco protocol and future ecosystem benefits, as well as StakeStones future token airdrops. It can be said to be killing two birds with one stone, providing users with a full range of Berachain StakeStone participation opportunities. The specific operation process is also very simple:

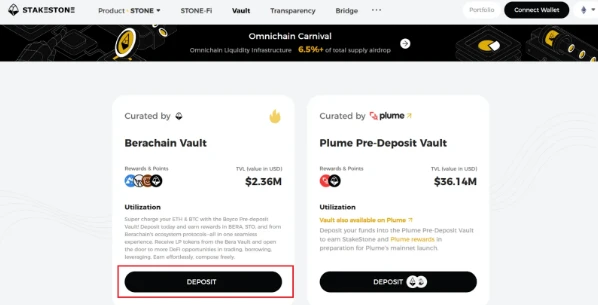

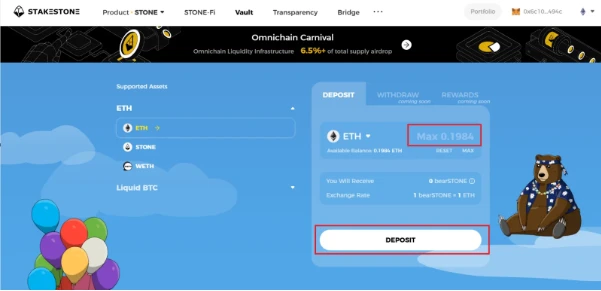

1. Enter the StakeStone Vault interface and click Deposit to enter the StakeStone Berachain Vault interface.

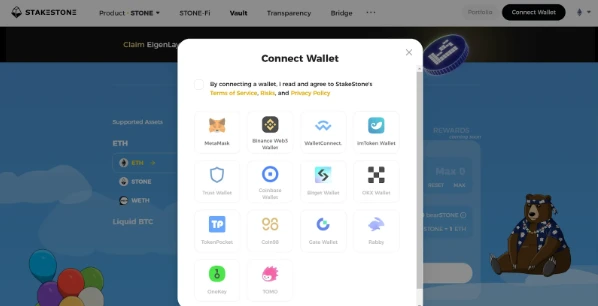

2. Connect your wallet in the upper right corner.

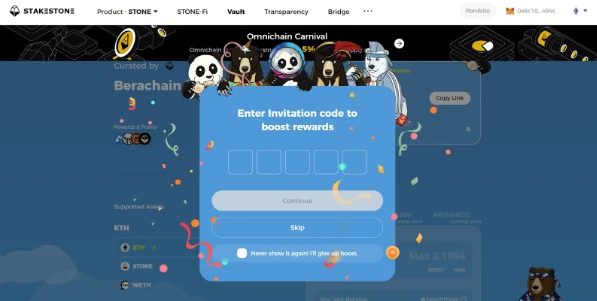

3. Enter the invitation code to get a 10% points boost reward (you can fill in 91852), share your personal invitation code on Twitter to get more rebate rewards (20%)

4. Deposit ETH/STONE/WETH to get beraSTONE; deposit SBTC/WBTC/cbBTC/BTCB to get beraSBTC (not yet enabled). Hold beraSTONE or beraSBTC to get points.

-

Only Ethereum mainnet assets are available. If not, please click Switch Network to switch to the Ethereum mainnet;

-

Select the asset you want to deposit on the left, enter the amount, then click the Deposit button and Confirm in the wallet;

5. Participate in DeFi protocols to get more rewards.

It is worth noting that Berachain has not yet launched its mainnet, so the initial operation of StakeStone Berachain Vault will mainly focus on Berachains pre-deposit protocol Boyco. In addition to receiving direct BERA token rewards during the pre-deposit period, the pre-deposit funds deployed in Boyco will also be mapped 1:1 to the mainnet, laying the foundation for full access to the Berachain mainnet in the future.

Once the Berachain mainnet is launched, Vault’s core functions will be switched to the POL system of the Berachain mainnet, providing users with one-stop Berachain liquidity mining services.

This progressive deployment path not only reduces technical and operational risks, but also provides early users with the opportunity to participate in the construction of Berachain ecosystem liquidity, allowing users to seize liquidity opportunities before the Berachain mainnet is launched and capture early liquidity mining benefits in the Boyco protocol.

Will StakeStone Vault be a new solution for the emerging on-chain ecosystem?

From the perspective of Berachain alone, Berachain StakeStone Vault provides the earliest Berachain pre-deposit channel in the entire market and is the preferred tool for seizing dividends and maximizing profits.

Especially in the critical window period when the Berachain mainnet is about to be launched and the mining mechanism is about to start, it can help ordinary users to lock in the early dividends of the new ecology without facing complicated technical operations, so that retail investors can also participate fairly in the ecological benefits of Berachain.

However, from the perspective of the broader emerging blockchain market, the significance of this product goes far beyond this. It not only provides Berachain with an innovative liquidity management solution, but also provides a new development idea for the entire emerging ecosystem – encapsulating the income of the emerging ecosystem as interest-bearing assets and connecting it with more mature mainnet infrastructure, thus becoming an important channel for cross-ecological liquidity and income management.

This mechanism is particularly suitable for emerging markets such as Berachain and Movement, as they often face challenges such as insufficient liquidity and imperfect infrastructure during cold start or early stages of ecological development. The Vault product previously launched by StakeStone in cooperation with Plume and others has preliminarily verified the feasibility of this model. The StakeStone Berachain Vault is a further deepening of this model.

Its core value lies in allowing users assets to be reused in multiple ecosystems, maximizing returns while releasing liquidity potential:

-

Lower the threshold for participation in emerging ecosystems: Users can seize ecosystem dividends through Vault without complicated operations, allowing more people to efficiently participate in local revenue capture of ecosystems such as Berachain, thereby achieving wider user coverage;

-

Enhance the attractiveness of emerging ecological assets: Through the packaging mechanism of Vault LP Token, traditionally locked assets are converted into interest-bearing assets on the Ethereum mainnet with liquidity and profitability, which not only improves the efficiency of asset utilization, but also enhances the attractiveness of emerging ecological assets;

-

Connect to mature networks to realize value flow: Vault-encapsulated interest-bearing assets (beraSTONE) can be seamlessly connected to mature financial infrastructure such as the Ethereum mainnet, further amplifying asset returns. At the same time, the Berachain ecosystem can also establish a deeper synergy with the global DeFi market;

This means that the Stakestone Vault product can not only capture the local returns of the emerging ecosystem, but also encapsulate assets such as LPs as interest-bearing assets to give them higher-dimensional financial attributes, and access more abundant and mature liquidity markets such as Ethereum in the form of structured products, thereby improving capital efficiency.

The complexity of Berachain’s POL mechanism and the asset management needs of the initial launch make it the best test field for testing the StakeStone Vault model. The Vault mechanism not only effectively solves Berachain’s liquidity bottleneck in the cold start phase, but also injects more application scenarios and revenue paths into its ecological assets:

On the one hand, the automated strategies within the Vault help users efficiently capture local revenue such as liquidity mining and governance rewards. On the other hand, the encapsulated interest-bearing assets can participate in multi-level revenue scenarios in more mature ecosystems, such as Uniswap’s liquidity mining, Aave’s mortgage lending, and even Pendle’s revenue splitting.

This mechanism not only improves the compounding ability of asset returns, but also promotes the acceptance and recognition of emerging ecosystems such as Berachain. As more and more emerging ecosystems emerge in the future, users demands for asset returns and capital efficiency of emerging ecosystems will undoubtedly become more complex. This means that StakeStone Vaults innovative mechanism actually provides a dynamically adaptive asset management method, enabling it to develop income superposition and secondary utilization of different asset types based on any emerging ecosystem, further improving investment returns.

Under such a framework, StakeStone Vault is not only an efficient asset management tool, but also an important bridge connecting the emerging ecosystem with the mainstream blockchain ecosystem.

Заключение

Whether in traditional finance or the DeFi world, improving capital efficiency is always the ultimate pursuit of all players.

For on-chain revenue products, how to simply and safely maximize revenue and maximize the effectiveness of every dollar can also be regarded as the eternal muse of the market. From this perspective, StakeStone Berachain Vault and the Stakestone Vault product structure behind it actually provide a very interesting new paradigm for emerging public chains:

By using Vault with embedded multi-layered income paths as a bridge, the threshold for user participation is simplified and the attractiveness to foreign funds is increased. At the same time, the income within the ecosystem is packaged into a liquid interest-bearing asset, thereby achieving seamless connection between local income opportunities and the mainstream chain DeFi market, exploring a more ideal startup and long-term growth path for the entire emerging ecosystem.

In the future, whether this model can become a universal solution for the emerging ecosystem, or even grow into a tens-billion-dollar on-chain financial narrative, still needs time to test. However, the vision and practice of StakeStone Berachain Vault may be one of the best ways for us to get closer to the answer.

This article is sourced from the internet: TGE is coming soon, let’s talk about StakeStone Berachain Vault’s BERA “Gold Rush Guide”

Related: IOSG Ventures: AgentFi, the AI x Crypto Future Driven by PMF

Original author: IOSG Ventures In the past two months, AI Agents x Crypto has sparked a wave of enthusiasm. Memecoins, interactive agents, and the openness of social media to bot accounts have combined to drive a wave of agent-driven agent hype, creating significant heat on Twitter and Farcaster. This proves the PMF of AI Agents x Crypto. The market cap of Agent-related assets has reached $10 billion. Since the birth of goat in October, Agent has created numerous new projects and assets driven by the market. Combined with the outlook for the future, this article roughly summarizes the following framework: Source: IOSG Ventures 1. Sentient Memecoins Cult memecoin, which has rapidly risen under Murads call, is an asset with community and spread as the core narrative. Memecoin represented by Agent…

“If you’ve lost money fraudulently to any company, broker, or account manager and want to retrieve it, contact www.Bsbforensic.com They helped me recover my funds!”