Task

Ranking

已登录

Bee登录

Twitter 授权

TG 授权

Discord 授权

去签到

下一页

关闭

获取登录状态

My XP

0

Original author: 100y

Оригинальный перевод: Луффи, Foresight News

If you live to see tomorrow, it could mean: a) youre more likely to be immortal, or b) youre closer to death.

鈥擭assim Nicholas Taleb鈥檚 The Black Swan

It has been two years since FTX filed for bankruptcy in November 2022. The market seemed to have forgotten the collapse of FTX and Terra, and quickly recovered, with Bitcoin reaching the $100,000 mark.

While the steady rise of the market is exciting, as an investor who entered the криптовалюта market in 2020, I have witnessed so many crashes that I can鈥檛 help but worry about what the next black swan event will be.

The collapse of FTX and Terra had different causes, processes, and outcomes, but they share a clear similarity: virtuous and vicious cycles. Both were structured to achieve explosive growth in favorable market conditions, but also to fall into an endless death spiral when things get bad.

Currently, similar characteristics are being exhibited by another entity, MicroStrategy. I personally believe that MicroStrategy is less risky than FTX and Terra, but its use of debt to purchase Bitcoin is not without danger. I want to discuss this briefly.

MicroStrategy was originally founded by Michael Saylor as a business intelligence company in 1989. In its early days, the company focused on analytical software, eventually expanding into mobile applications and cloud services as technology advanced.

Source: companiesmarketcap.com

The company went public in 1998 with an initial valuation of around $1 billion. Aside from a brief spike during the dot-com bubble, MicroStrategys market cap has hovered around $1 billion, and until 2020, it remained a relatively unremarkable stock. However, everything changed on August 11, 2020, when MicroStrategy announced its first purchase of Bitcoin as a public company. Since then, it has continued to accumulate BTC, driving its market cap exponentially to around $90 billion.

Source: SaylorCharts

MicroStrategy purchased a total of 402,100 BTC at an average price of $58,263, which is about 1.9% of the total supply of 21 million Bitcoins, a staggering figure. The company financed its Bitcoin purchases in three main ways:

1.2.1 Cash Reserves

Source: SEC

As a software company, MicroStrategy generates revenue through product licensing, subscription services, and product support. According to its 10-K filing, the companys core business generated approximately $499 million in revenue in 2022 and approximately $496 million in revenue in 2023.

After deducting costs and operating expenses (excluding cryptocurrency price fluctuations), MicroStrategy will have a surplus of $10.5 million in 2022 and $800,000 in 2023. These funds can be used to purchase BTC or pay interest on existing debt.

1.2.2 Convertible Senior Notes and Stock Issuance

Source: MicroStrategy Q3 2024 Report

MicroStrategys primary method of raising capital is through the issuance of convertible senior notes. As of the third quarter of 2024 financial results, the company had accumulated approximately $4.26 billion in debt through such notes, with an average annual interest rate of 0.811% and annual interest expense of $34.6 million.

Most recently, on November 21, 2024, MicroStrategy issued another $3 billion worth of convertible senior notes. This brings its total debt to over $7 billion. It is worth noting that the newly issued $3 billion notes have a coupon rate of 0%, which means that no interest expenses will be incurred. In return, investors can convert these notes into shares in the future at a 55% premium.

In addition to convertible notes, MicroStrategy also conducts equity offerings. In the third quarter of 2024, the company issued $1.1 billion worth of Class A common stock.

MicroStrategy announced plans to raise a total of $42 billion in the next three years (2025-2027). Of this, $21 billion will come from equity offerings and the remaining $21 billion will be raised through fixed income offerings. The specific timeline is: $5 billion from each funding source in 2025, $7 billion in 2026, and $9 billion in 2027.

Here are some interesting statistics and facts about MicroStrategy:

Source: SaylorCharts

MicroStrategy purchased Bitcoin at an average price of $58,263, and the total market value of its Bitcoin holdings was $38.5 billion, with a book value of $23.4 billion, resulting in unrealized gains of approximately $15 billion.

Source: MSTR-tracker

MicroStrategy鈥檚 market valuation is about 2.2 times its Bitcoin holdings. This valuation discrepancy is why funds such as Citron are shorting MicroStrategy鈥檚 stock.

Source: MSTR-tracker

Despite the increase in the number of shares due to the stock issuance, the BTC price per underlying share actually increased. This is because MicroStrategy is buying Bitcoin at a rate that outpaces the dilution effect of the additional stock issuance.

While structural issues played a role in the collapse of FTX and Terra, the moral hazard of their founders was also an important reason. Black swan events are inherently unpredictable by definition, so it is impossible to assess whether there is moral hazard within MicroStrategy based on public information. Therefore, the focus here will be on analyzing structural risks.

While the topic sounds grand, the structural risk involved for MicroStrategy is actually simple: investing in Bitcoin through leverage. If the company only invested its own equity in Bitcoin, the impact of the price crash would be relatively small.

Source: MicroStrategy

However, as highlighted in the Q3 2024 report, MicroStrategys goal is to use prudent leverage to acquire as much BTC as possible, increase shareholder value, and outperform Bitcoin itself.

As we all know, leverage is a double-edged sword. Leverage itself is accompanied by debt interest costs. If the value of BTC purchased with leverage falls, the company may be forced to sell its holdings to repay its debts.

Michael Saylor has repeatedly stated in the media that he has no intention of selling BTC, which means that any forced liquidation could seriously affect the companys value. This could lead to a drop in MSTRs stock price and difficulty in future financing. The collapse of the leveraged strategy could also have a major chain reaction on the market.

To assess whether MicroStrategys leverage strategy is sustainable, I will examine two key aspects:

Interest costs

Sustainable volatility

First, lets consider interest costs. With the recent issuance of $3 billion in convertible senior notes at a 0% coupon rate, MicroStrategys total debt is approximately $7.3 billion, with an average interest rate of 0.476%, and annual interest expenses of $34.6 million. The key question is: Can MicroStrategy continue to make these interest payments?

Source: SEC

In addition to digital assets, MicroStrategy holds about $1.13 billion in other assets, according to the companys 2023 10-K filing. This is significantly higher than its $34.6 million in annual interest expenses, suggesting that MicroStrategy has no problem paying interest anytime soon.

In addition, MicroStrategy generates significant revenue from its core business, business intelligence software. However, what is worrying is that after deducting revenue and operating expenses, the remaining profit is relatively small and has been declining.

The size of future debt cannot be ignored either. As mentioned earlier, MicroStrategy plans to issue an additional $21 billion in convertible senior notes over the next three years. This will increase its total debt to $28.3 billion. At the current average interest rate of 0.476%, annual interest expenses could rise to $134.7 million, which may be an unaffordable amount in the long run.

While MicroStrategy recently reduced its interest burden by issuing 0% coupon bonds, it remains uncertain whether the company will be able to continue to have access to this low-interest debt. The next section explores this question further.

2.2.1 Will investors continue to provide funding?

Source: MicroStrategy

The primary issue is the sustainability of financing. While the current positive sentiment in the cryptocurrency market makes it easy to obtain financing, historical data shows that MicroStrategy did not issue any convertible senior notes between February 2021 and March 2024. This period happens to be the period from the 2021 Bitcoin crash to the recent market recovery.

Source: Bitbo

While there is no hard evidence, Bitcoins price cycles have historically been consistent with its 4-year halving cycle. This suggests a high probability of a bear market around 2026-2027, with the BTC long-term power law model suggesting a potential price floor of $53,000-70,000 during this period. Considering MicroStrategys average Bitcoin purchase price is $58,000, a bear market could make financing difficult.

2.2.2 Volatility is crucial

Source: MicroStrategy

In addition to the price of Bitcoin, volatility also plays an important role in the sustainability of convertible senior note financing.

Some readers may be asking: Why is MSTR stock trading at more than 2x its net asset value (NAV)? Why would investors participate in the recent offering of $3 billion in 0% convertible senior notes?

Source: MicroStrategy

The key to these issues is volatility. Compared to other assets, Bitcoin and MSTR exhibit significantly higher volatility, which is attractive to investors. MicroStrategy even highlighted the volatility of its stock in its third quarter 2024 IR report.

High volatility enables various trading strategies such as delta hedging, gamma trading and volatility arbitrage.

Delta measures the sensitivity of an options price to changes in the price of the underlying asset.

Gamma measures the amount that delta changes as the price of the underlying asset changes.

Gamma trading exploits these changes to profit from market fluctuations, making higher volatility profitable.

Source: MSTR-tracker

Because биткойн is more volatile than traditional stocks, and MSTR amplifies that volatility through leveraged bitcoin purchases, MSTR stock and its convertible senior notes have attracted significant interest from hedge funds. These notes are not only a debt instrument but also a call option that allows holders to convert them into stock at a specific price, further increasing their appeal.

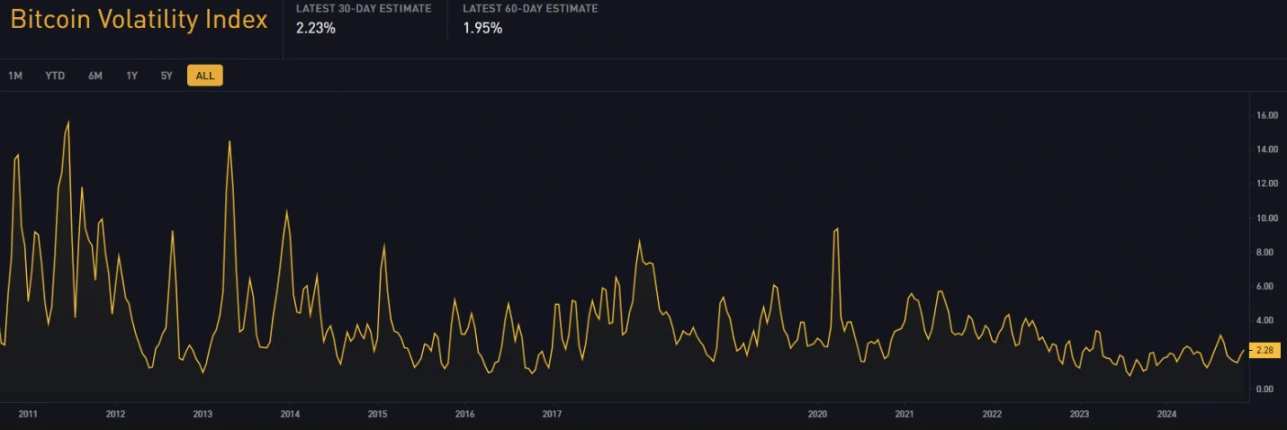

Source: Bitbo

In order for MicroStrategy to maintain smooth financing, the volatility of BTC and MSTR must continue to exist. However, with the approval of Bitcoin ETFs and the continued entry of institutional investors, the market is becoming more stable and volatility is gradually decreasing. If Bitcoin volatility decreases, MSTRs NAV premium may shrink, affecting its stock price and reducing the financing attractiveness of its convertible senior notes.

Ultimately, the most critical factor is the price of Bitcoin. If the cryptocurrency market had not experienced a downturn, FTX could have become a large exchange comparable to Binance. Similarly, if Curve Finances UST pool had not been attacked, Terra could have become the third largest network after Bitcoin and Ethereum.

If the price of BTC continues to rise steadily, MicroStrategys current strategy could form a positive flywheel, driving explosive growth for the company and the cryptocurrency market. However, if the price of BTC plummets, the worst-case scenario is that MicroStrategy sells its Bitcoin holdings to repay debts, triggering a vicious death spiral.

Thankfully, MicroStrategy鈥檚 debt is unsecured. The company previously issued bonds backed by Bitcoin, but they were not fully repaid until the third quarter of 2024. If Bitcoin were still used as collateral, being forced to liquidate in the event of difficulty in repaying the debt could have disastrous consequences.

Personally, I think MicroStrategy does not appear to face significant immediate risks. Its interest costs remain manageable and financing has gone well so far. However, the size of the planned financing is unprecedented, and the volatility of the underlying asset, Bitcoin, is expected to decline. Therefore, I expect the risk level to be high during the period 2025-2027.

Bitcoin鈥檚 value is growing rapidly, becoming a challenger to gold鈥檚 status. But the question remains: Will MicroStrategy continue to buy BTC in a sustainable manner, becoming one of the most powerful companies in the world? Or will it become another cautionary tale, caught up in the narrative of the tulip bubble? Only time will tell.

This article is sourced from the internet: Will MicroStrategy be the next FTX?