Coinbase Q3 financial report interpretation: Election market drives stock price surge, Base continues to lead L2

Оригинальный автор: insights 4.vc

Оригинальный перевод: TechFlow

Between November 5 and 6, Coinbase Global (NASDAQ: COIN) shares rose 31% from $193.96 to $254.31 in response to the election results. This report provides an in-depth analysis of Coinbase’s current financials and the performance metrics of its Layer 2 blockchain, Base.

Coinbase (COIN) Closing price: $254.31 | Volume: 35.46 million – November 6, 2024

Coinbase Competitors: Key Metrics at a Glance

Revenue Analysis

Revenue breakdown (Q3 2020 – Q3 2024)

income

-

Total revenue for the third quarter of 2024: $1,205.2 million, down from $1,449.6 million in the second quarter of 2024, but up from $772.5 million in the third quarter of 2023.

-

Revenue Trends: After reaching a peak in the fourth quarter of 2021, total revenue has stabilized but remained at a lower level since the second quarter of 2022.

Revenue by Segment

-

Consumer Transactions: $483.3 million in the third quarter of 2024, down from $664.8 million in the second quarter, showing sensitivity to market fluctuations, but still a major source of revenue.

-

Institutional Trading: decreased slightly from $63.6 million in the second quarter of 2024 to $55.3 million, with less volatility but contributing a lower proportion of revenue.

-

Blockchain Rewards: $154.8 million in the third quarter of 2024, which is lower than $185.1 million in the second quarter, but an increase year-on-year, providing stable income related to blockchain development.

-

Stablecoin revenue: $246.9 million, which remained stable across quarters, showing the important role of Coinbase in the digital currency field.

-

Interest and finance charges: $64 million in the third quarter, providing a steady stream of income despite market changes.

-

Subscriptions and Services: $556.1 million in the third quarter, down from $599 million in the second quarter, indicating growth in services but impacted by current market pressures.

Cost Analysis

-

Transaction fees: $171.8 million (15% of net revenues), down 10.3% from the second quarter of 2024.

-

Technology and development: $377.4 million, up 3.6% from the previous quarter.

-

Sales and Рынокing: $164.8 million, down slightly by 0.3%.

-

General and administrative: $330.4 million, up 3.2 percent.

-

Other operating net income: – $8.6 million represents net income for this category.

-

Total operating expenses: $1,035.7 million, down 6.4% from the second quarter of 2024.

Trading volume and asset income contribution

-

Total transaction volume in Q3 2024: $185 billion, down from $226 billion in Q2 2024 and down from $92 billion in Q3 2023.

-

Consumer transactions: $34 billion, down from $37 billion in the second quarter of 2024.

-

Institutional trading: $151 billion, down from $189 billion in the second quarter of 2024.

Asset income details

-

Биткойн: 37% of total transaction volume, up from 35% in the second quarter of 2024.

-

Ethereum: Volume remained stable at around 15%, indicating steady market interest.

-

Note: Solana has been highlighted as the third-largest asset in the past two quarters, increasing its share of total trading revenue from 10% to 11%.

-

Other assets: Falling to 33% in Q3 2024, reflecting diversification efforts, but the focus remains on Bitcoin and Ethereum for now.

Resource allocation and investment analysis

Liquidity Overview

-

USDC holdings: $508 million in Q3 2024, slightly lower than $589 million in Q2 2024. This suggests that USDC remains a stable source of liquidity and a reduction could indicate strategic asset redeployment.

-

Company cash held with third-party institutions: $92 million, slightly lower than the previous $97 million, indicating the minimization of third-party risk.

-

Money Market Funds and Government Bonds: Increased to $6.088 billion, up from $4.068 billion in the third quarter of 2023, indicating a conservative shift toward low-risk, liquid financial instruments amid market volatility.

-

Company Cash: Decreased to $1.544 billion from a peak of $3.549 billion in the second quarter of 2022, likely due to a decrease in strategic investments or operational needs.

-

Total Liquidity Resources: Increased to $8.232 billion in the third quarter of 2024, demonstrating a solid financial foundation and readiness to respond to strategic opportunities or market downturns.

Investing and financing activities

-

Operating Cash Flow: $687 million in the third quarter of 2024, demonstrating the companys strong ability and resilience to generate cash in its core operations.

-

Capital expenditures: only $19 million, reflecting a conservative approach to fixed costs to support financial flexibility.

-

Strategic investments: Smaller outflows included $14 million in venture capital (details of Coinbase Ventures’ activity are available in Google Sheets) , $18 million in криптовалюта investments, and $173 million in fiat loans and collateral, emphasizing prudent risk management.

-

Financing Activities: No new long-term debt was issued in the third quarter of 2024, reflecting the strategic focus on organic growth and internal use of liquidity.

Workforce indicators and other data

-

Total headcount in Q3 2024: 3, 672, up from 3, 486 in Q2 2024.

-

Monthly active users (MTUs): 7.8 million, down 4.9% from the second quarter of 2024 and down 16.4% year-over-year.

-

Website traffic: Decreased to 37.8 million in the second quarter of 2024 from 40.7 million in the second quarter, possibly reflecting waning interest or seasonal changes.

-

Google Trends: Peaked at 74 in September, showing fluctuations in public interest.

-

App downloads: dropped from 14,189 in August to 8,928 in September, indicating a slowdown in new user acquisition.

-

Job postings: fell to 818 in October, possibly indicating stabilization of hiring or ongoing restructuring.

Financial Ratios

Note: The following explanations provide insights based on current data and are not final. Independent review of the data is recommended and detailed data can be found in Google Sheets .

Financial ratios (2020 – 2023; Q3 2023 – Q3 2024)

Liquidity Analysis

-

Current Ratio (Q3 2024: 1.03): Remains stable, indicating limited coverage of liabilities by current assets.

-

Operating cash flow to current liabilities ratio (Q3 2024: 0.0025): increased slightly, indicating a partial recovery in cash flow generation ability.

-

Cash Ratio (Q3 2024: 0.03): Remains at a low level, highlighting the strict requirements for cash management.

Leverage Ratio

-

Debt-to-Equity Ratio (Q3 2024: 32.29): High leverage indicates increased financial risk.

-

Debt Ratio (Q3 2024: 0.97): Liabilities are almost equal to assets, indicating a high reliance on debt.

-

Interest Coverage Ratio (Q3 2024: 8.09): A positive value indicates that operating income is sufficient to cover interest expenses, reflecting good debt repayment ability.

Profitability and efficiency ratios

-

Net Profit Margin (Q3 2024: 6.26%): Improved from a loss in Q3 2023, showing improved net income generation capabilities.

-

Return on Assets (ROA) (Q3 2024: 0.03%): Asset utilization is low, indicating possible operational efficiency issues.

-

Return on Equity (ROE) (Q3 2024: 0.86%): Although it has increased slightly, it is still low, indicating that the return on shareholders equity is not ideal.

-

Gross profit margin (Q3 2024: 71.00%): Improved, demonstrating effective cost control.

-

Operating profit margin (Q3 2024: 13.78%): Significant improvement, indicating more effective control of operating expenses.

Market performance ratio

-

Earnings per Share (EPS) (Q3 2024: $0.28): Recovered from negative earnings, showing strengthening profitability.

-

Price-to-Earnings (P/E) Ratio (TTM Net EPS) (Q3 2024: 31.93): The moderate P/E ratio suggests that investors are cautiously optimistic about the future.

База

For more information on the origins and development of Base, please see our June newsletter . Led by Джесси Поллак , Base officially launched on July 13, 2023.

Обзор

-

Platform Mission : Base is Coinbases Layer 2 solution on Ethereum, aiming to create a global on-chain economy that prioritizes innovation, creativity, and economic freedom, and provides a secure, low-cost environment for the development of decentralized applications (dApps).

-

Infrastructure and Governance: Base is built on the OP Stack for scalability and cost-efficiency. Base has confirmed that it will not issue native tokens (as stated by CEO Brian Armstrong on December 1, 2023). Base is working with OP Labs to actively carry out decentralized governance and research projects, including EIP-4844 and the op-geth client, in line with Coinbases vision of gradual decentralization.

-

Ecosystem Development: Base is widely welcomed in the developer community and focuses on substantive product innovation rather than relying on token incentives. Coinbases internal team uses Base to deploy smart contracts, improves the product experience for consumers and institutions, and promotes the popularization of on-chain applications through easy onboarding and intuitive interfaces.

-

Core products: Base is positioned as a decentralized app store that provides an open platform for developers, including the Base name to simplify on-chain identity management, and a smart wallet to provide users with a secure and programmable asset management solution.

-

Strategic Positioning: Base is not only competitive in the Layer 2 ecosystem, but also competes with traditional online platforms by providing an on-chain experience comparable to traditional Web applications.

Key Metrics

In Base’s application activity, the DeFi category stood out, with address activity growing significantly from 143,600 in Q2 to 405,700 in Q3. However, revenue fell to $7.3 million in Q3, down from $24.2 million in Q2. Stablecoin transfer volume grew significantly, from $97.8 billion in Q2 to over $415 billion in Q3, showing an uptick in trading demand. The ratio of new to returning users also changed: 107,000 to 278,000 in Q2, 420,000 to 450,000 in Q3, and 509,000 to 827,000 in Q4. Sybil addresses decreased to 178,000 in Q4, while non-Sybil addresses reached 1.2 million, compared to 550,000 Sybil addresses and 320,000 non-Sybil addresses in Q3.

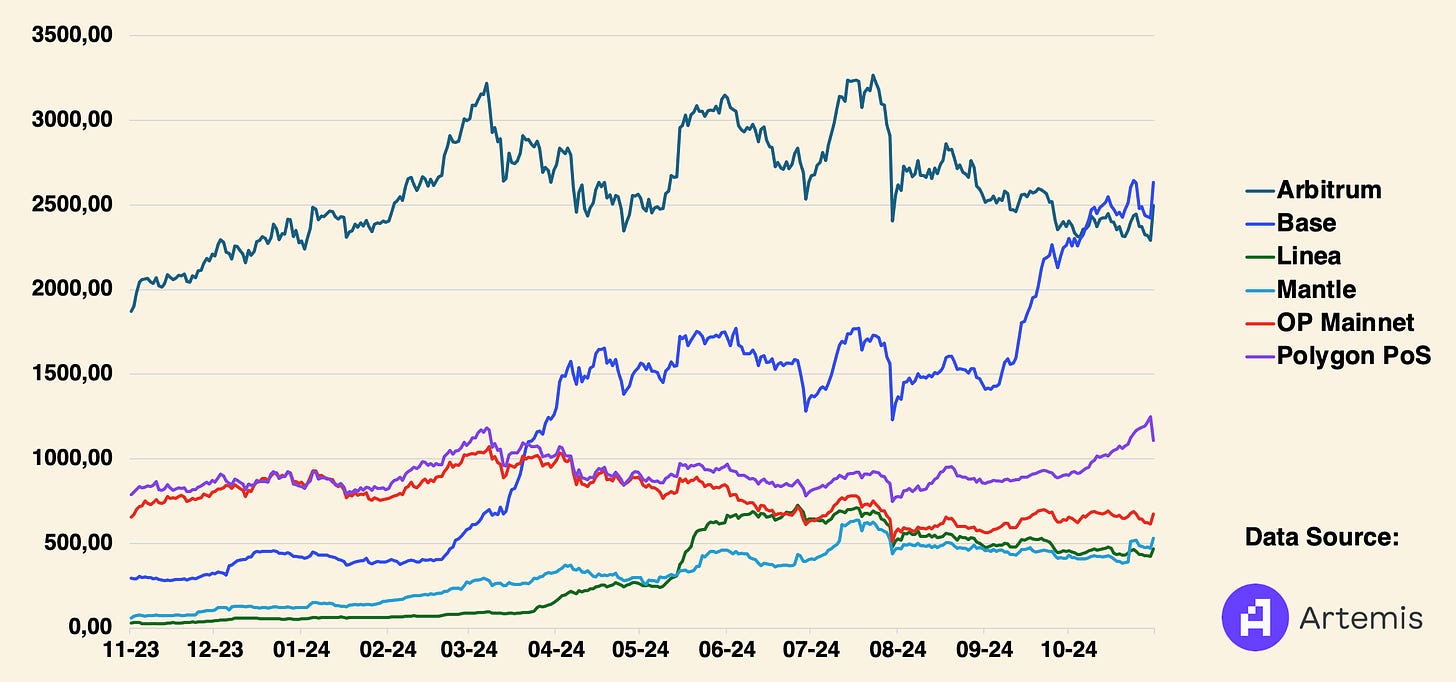

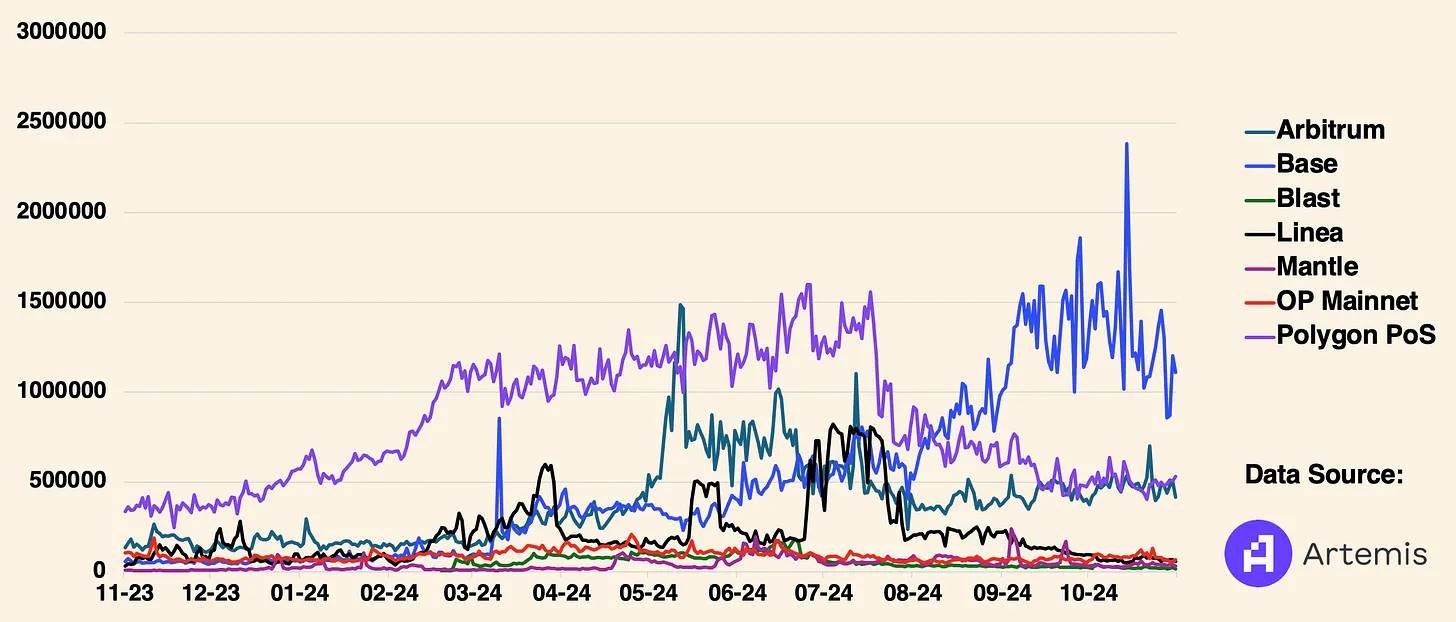

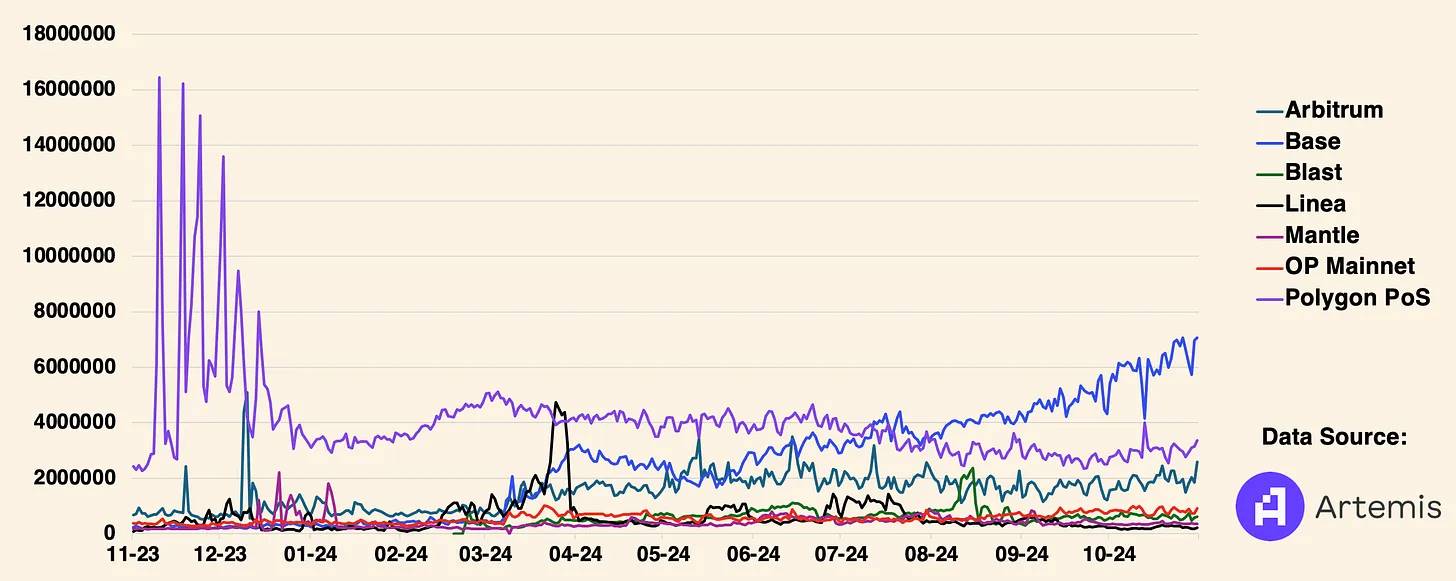

As we can see in the chart, Base is the leading Layer 2 blockchain as of November 7. A few weeks ago, it surpassed Arbitrum in total value locked (TVL) and has maintained its position as the number one Layer 2 in the daily active addresses and daily transactions categories for several months in a row.

Total value locked in smart contracts (in millions of USD)

Daily active addresses (number of unique on-chain wallets interacting with the protocol per day)

Transactions per day (number of unique on-chain interactions with the protocol)

This article is sourced from the internet: Coinbase Q3 financial report interpretation: Election market drives stock price surge, Base continues to lead L2

Related: OP Stack鈥檚 Advanced Path: OP Succinct Unlocks the Potential of ZK Rollup

Original author: YBB Capital Researcher Ac-Core TL;DR The main functionality provided by OP Succinct is to integrate ZKP into the modular architecture of OP Stack to complete the transformation of OP Stack Rollup into a fully verified ZK Rollup; If the ultimate goal of Ethereums future expansion is to convert every Rollup into a ZK Rollup, OP Succinct aims to combine Rust and SP 1 to implement the deployment of OP Stacks Type-1 zkEVM (completely Ethereum equivalent); OP Succinct Proposer mainly completes the parallel generation of proofs and proof aggregation and verification; OP Stacks existing system relies on a 7-day anti-fraud window. If a dispute arises, the transaction verification will be delayed for a week. OP Succinct uses ZK proofs to shorten the time required for transaction completion, eliminating the…