Weekly Editors Picks — функциональная колонка Odaily Planet Daily. Помимо освещения большого объема информации в режиме реального времени каждую неделю, Planet Daily также публикует много высококачественного глубокого аналитического контента, но он может быть скрыт в информационном потоке и горячих новостях и пройти мимо вас.

Поэтому каждую субботу наш редакционный отдел будет выбирать из контента, опубликованного за последние 7 дней, несколько высококачественных статей, на чтение и сбор которых стоит потратить время, и которые принесут вам новое вдохновение в криптовалюта мир с точки зрения анализа данных, отраслевых суждений и мнений.

А теперь приходите и читайте вместе с нами:

invest

Looking at the long-term trend, the entire industry is in a loss-making state. From 2015 to 2022, the $49 billion invested in token projects created less than $40 billion in value, with a return rate of -19% (before deducting fees and expenses).

Obviously, not all crypto venture capital flows into token projects. Assume that venture investors collectively hold 15% of the FDV of these tokens. Based on the current market value, the venture capital industry theoretically holds $66 billion worth of tokens. If we exclude SOL, a major special project, this value is $51 billion. Therefore, the entire industrys investment (before deducting fees and expenses) before 2022 has increased by 34% as a whole, including SOL. If SOL is excluded, it is basically flat. These data are based on the assumption that the FDV of the locked tokens can be sold at the current price.

When comparing venture capital to liquid assets, the vast majority of funds have underperformed Bitcoin, especially since the trough. Crypto adoption is now similar to the Mag 7 of the early 2010s (and possibly earlier), so there is still a lot of market to be tapped. There is currently 20x more money in crypto venture than in established institutional liquid crypto funds (over $88 billion vs. ~$4 billion). So if things go as I expect, liquid crypto AUM will exceed crypto venture capital AUM.

Какова главная тема этого раунда бычьего рынка криптовалют?

PayFi connects the real world; AI Agent enhances the on-chain world; Meme = on-chain casino.

When selecting funds and GPs, Mason focuses on three core factors: performance (must be supported by reliable data), team (integrity, hands-on approach, global perspective and continuous evolution) and strategy (needs to meet current market demands and industry development trends).

The industry is constantly changing, and the participants at each stage are different, so there is no fixed investment strategy. There are three types of strategies that are better in this cycle: currency-based enhancement strategies (TVL games, quantitative), buying BTC at a discount or mining, and strategies that outperform BTC in stages, such as CTA.

Диалог с трейдером Шоном: Деньги обойдут стороной тех, кто много работает

Sean has a complete set of Meme trading processes: mainly relying on the smart address system and the Alpha community. The basic process is: understand the project background, observe the chip structure, formulate a trading plan, set stop loss and trading pattern, take profit in batches (upward pin, event Price in, expected valuation according to your own trading plan), set up a large-screen Dashboard, and track hot coins in real time.

Entrepreneurship

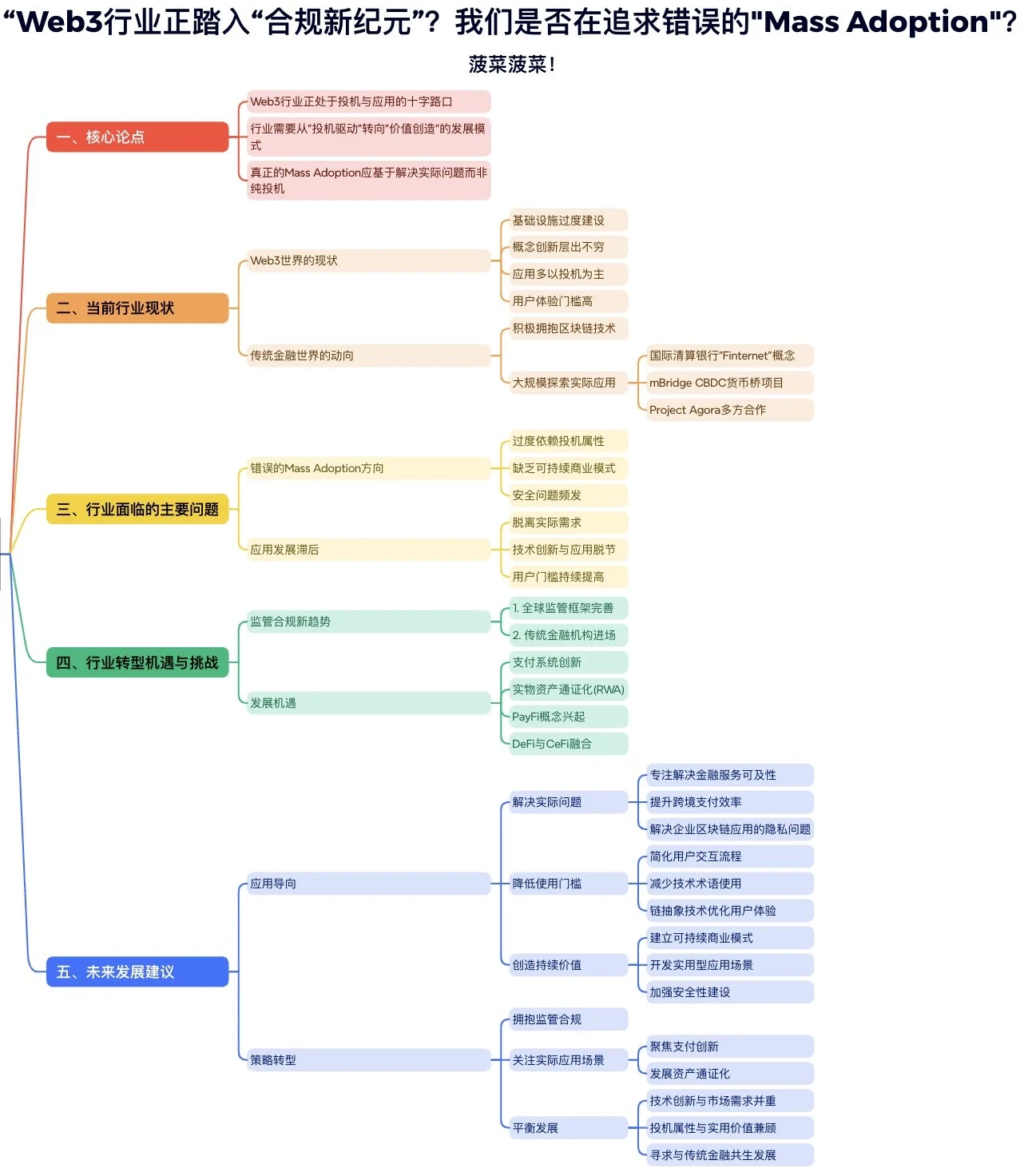

The industry’s truly healthy and sustainable path to Mass Adoption is to solve practical problems, lower the threshold for use, and create sustainable value.

Devcon приближается. Как основатели проекта могут наращивать социальное влияние?

Focus on one platform; schedule dedicated time for creation; leverage prompts and daily themes; seek support from your team; and empower your employees.

Основатель Monad своим коллегам: не стоит легко раздавать акции консультанта

Entrepreneurs can actually get a lot of advice for free; try to solve problems on your own; dont overestimate the value of a consultants endorsement; know that a consultants input is very limited compared to a full-time employee; control expectations and dont be too optimistic; the people most likely to provide you with valuable advice often wont become your consultants; its difficult for consultants to help solve core problems.

Интерпретация данных: является ли OP Super Chain хорошим бизнесом для зарабатывания денег?

Judging from the data dimension, the current development status of OP SuperChain is still in its early stages overall; only the Base chain has come out, and other chains are still in their infancy.

Аирдроп Руководство по возможностям и взаимодействию

Web3 версия MapleStory MapleStory Universe Руководство по тестированию второго пионера

Мем

Meme craze, a new battlefield for VCs, an opportunity or a trap?

The average daily turnover rate of Meme is about 11%, compared with 5% for DeFi, 7% for Layer 2, and 4% for Layer 1. This ratio not only highlights the high liquidity of Meme, but also shows that users are interested in Meme and have a high transaction frequency.

As of the end of the third quarter of 2024, Memes market value in the entire crypto market has increased from 0.87% two years ago to 2.58% today, and is still on the rise.

Meme is a leveraged Layer 1, which means that when the market conditions improve, Layer 1 will increase by about 5 to 10 times.

Animal memes and cult culture memes are suitable for long-term attention. In contrast, other types of memes are often related to short-term hot spots, and their attention and popularity may rise quickly and then fall back.

Some Meme data indicators

Meme Lifecycle Reference Table

Big picture: Global money supply expansion and investment behavior.

Micro-environment: Retail investors seek new ways to grow their wealth.

Trend: Financialization of Internet culture.

Risk considerations: A life-or-death struggle, but control remains unabated; the market is saturated, and innovation is stagnant.

Lesson: Take the best of both worlds (key features like fair launch and low-volume token economics).

Outlook: Токенized software business vs. tokenized concept.

Wintermute, GSR Рынокs, Auros Global, B2C 2 Group and Cumberland DRW hold a total of more than $120 million worth of MEME coins. Among them, Wintermute is the institution with the largest holdings and the most popular projects, and many of its MEME coins have been successfully listed on Binance.

Diamond hands, high profit-loss ratio? What are the winning factors in Solana Meme trading?

The most obvious feature that distinguishes the top addresses from other addresses is that the holding period is much longer than that of regular addresses, showing a clear positive correlation, about 6-8 days, which is similar to the fermentation period of top tokens on Solana. Another factor with an obvious positive correlation is the stop loss rate. As profits increase, the stop loss is also relaxed, but the difference between each interval is not obvious.

Surprisingly, the profit rate has no direct relationship with the profitability of the address, which means that the overall profitability of the address is related to the “win rate”, that is, accurate prediction and long-term holding are the root causes of the profitability differentiation of the address.

Diamond Hand is the core and key to achieving top-level profits. However, for readers with limited funds, it may be difficult to imitate such strategies.

Учебное пособие по мемам: Возрождение: Я хочу быть алмазной рукой (часть 4) | Продюсер: Наньчжи

The in-depth evaluation system has undergone a new upgrade.

Meme battlefield under the US election: no surge, most of them suffered a sharp drop

When good news is exhausted, bad news will come. Big funds will be more cautious when the market is more uncertain. The biggest beneficiaries of the US election may be mainstream crypto assets such as Bitcoin. Too many new MEMEs have been generated, distracting the market. There is serious homogeneous competition and a lack of real narrative ability.

Экосистема биткойнов

Отчет о рынке биткоинов: основные тенденции, аналитика и прогнозы роста цен

Анализ сети биткоинов: балансы бирж биткоинов достигли исторического минимума, что свидетельствует о том, что держатели становятся все более уверенными и все чаще выбирают самостоятельное хранение.

Рост биткоин-ETF: приток ETF превысил $5.4 млрд в октябре, при этом BlackRocks IBIT лидирует на рынке. Это отражает растущее признание биткоина на основных финансовых рынках.

Динамика добычи полезных ископаемых: Россия и Китай расширяют свое влияние в сфере добычи полезных ископаемых, в то время как США по-прежнему сохраняют за собой наибольшую долю вычислительной мощности.

Ethereum

С точки зрения долгосрочной перспективы, важность EigenLayer для будущего развития Ethereum

Eigenlayer has built a programmable security market that allows Ethereums core security resources to be allocated on demand, thereby enhancing the market position of Ethereums security settlement layer under the new trend of chain unification ideas such as modularization and chain abstraction. To some extent, Eigenlayer has strengthened Ethereums external investment promotion and influence system.

Ethereums deflation logic no longer works, and it can only continue to follow the logic of stacking leverage.

Eigenlayer is critical to Ethereums Rollup-Centric strategys ability to maintain the consensus principle of technology first.

DeFi

Opportunities and challenges under Uniswap innovation: Where is the future of DEX?

The three main directions that Uniswap has been promoting recently are Uniswap X, Uniswap V4 and Unichain.

With the development of DEX RFQ networks such as Uniswap X and Arrakis, and modular DEX architectures such as Uniswap V4 and Valantis, the DEX landscape will enter a new stage. First, many problems in the business links of AMM itself will be solved, and the business scope will be greatly expanded. Secondly, under the current intentional landscape, there are still many RFQ-related issues that need to be solved. Finally, AMM will focus on the long-tail market in the future, optimizing the landscape where PMM gradually dominates.

Revisiting Ethena: After a 80% plunge and rebound, is ENA still in the undervalued strike zone?

Ethenas business positioning is a synthetic dollar project with native income, that is, its track belongs to the same track as MakerDAO (now SKY), Frax, crvUSD (Curves stablecoin), and GHO (Aaves stablecoin) – stablecoin. The business model of stablecoin projects is basically similar: raise funds, issue debt (stablecoins), expand the balance sheet of the project; use the raised funds for financial operations and obtain financial benefits. When the income obtained from the projects operating funds is higher than the combined cost of raising funds and running the project, the project is profitable.

In the past two months, ENA has achieved a rebound of nearly 100% from its low point, and this was when ENA opened the rewards for Season 2 in early October. These two months are also two months of intensive Ethena news and positive news. Ethena has stories worth looking forward to in the next few months to a year: with the expected warming of Trumps coming to power and the Republican victory (the results will be seen in a few days), the warming of the crypto market will benefit the perpetual arbitrage yield and scale of BTC and ETH, and increase Ethenas protocol income; more projects will appear in the Ethena ecosystem after Ethereal, increasing ENAs airdrop income; Ethenas self-operated public chain will also bring attention and nominal scenarios such as staking to ENA, but the author expects this to be launched after more projects have accumulated in the second line.

Однако самым важным для Ethena является то, что USDE может быть принят в качестве залога и торгового актива большинством ведущих центральных бирж.

Будучи продуктом стейблкоина с очевидным эффектом Линди (чем дольше он существует, тем сильнее его жизнеспособность), Ethena и ее USDE все еще нужно больше времени, чтобы проверить стабильность архитектуры своего продукта и его способность выживать после сокращения субсидий.

Горячие темы недели

За последнюю неделю, Trump won the election as the new president of the United States (election-related topics ); Bitcoin hit a new record high of $76,400; crypto-related stocks soared ; the Federal Reserve cut interest rates by 25 basis points , and no one voted against it; Elon Musks net worth increased by $20.9 billion in a single day, firmly occupying the throne of the worlds richest man;

In addition, in terms of policies and macro markets, the US media: The 2024 US election has cost $14.7 billion , which may be the most expensive in history; Elon Musk: A thorough reform of the US government is coming; US Senator Warren defeated John Deaton, a supporter of the crypto industry, and won a seat in the Massachusetts Senate ; the Trump team considered nominating Robinhood Chief Legal Officer Dan Gallagher as SEC Chairman ; the Monetary Authority of Singapore announced plans to promote the tokenization of financial services; Russia introduced a regulatory framework for crypto mining , defining it as a legal activity and stipulating requirements for miners to operate;

In terms of opinions and opinions, Cathie Wood talked about the US election and Trumps economic policies: the market likes tax cuts ; analysts: US inflation may rise rapidly after Trump takes office, and the Federal Reserve will change its interest rate cut plan ; Arthur Hayes: Solana will be a high-beta Bitcoin during the US election; CryptoQuant CEO: In the current cycle, stablecoins are mainly used for non-trading purposes, and their supply growth is not enough to boost BTC; Matrixport Investment Research: The new SEC Chairman and the US Strategic Reserve may push BTC to break through $100,000 ; Murad: The road to the Meme coin super cycle is now paved; Andre Cronje: Coinbase has repeatedly asked for listing fees and is willing to publish all evidence for public identification; Jupiter founder : Never sold a JUP, and major news is about to be announced; Sothebys Vice President : BAN tokens were deployed by me, never earned $1 million, and destroyed 3.7% of tokens;

In terms of institutions, large companies and top projects, the Ethereum Foundation released a 2024 report : financial reserves of US$970 million; two Ethereum researchers resigned from EigenLayer advisory positions due to conflicts of interest to focus on Ethereum; on November 8, SOLs market value once again surpassed BNB to become the fourth largest cryptocurrency by market value; Telegram will launch 10 new mini-program features , including sending gifts, advertising monetization, etc.; MakerDAO decided to retain the reshaped Sky brand and planned to launch new stablecoins and expansion projects; Открытое море CEO talked about the new version: We built a new platform from scratch; Lumoz airdropped 15 million esMOZ to ZKFair users;

In terms of security, the founder of Truth Terminal said: There is a problem with the registered domain name , please do not access it; ZachXBT: The crypto gambling platform Metawin was suspected of being attacked and lost more than 4 million US dollars… Well, its another week to witness history.

Прикрепил это портал в серию «Выбор редактора недели».

Увидимся в следующий раз~

This article is sourced from the internet: Weekly Editors Picks (1102-1108)

Related: Uncovering the New “Meme Leader” Murad: From Bitcoin Supremacy to Cult Meme Godfather

Meme coins seem to have ushered in a new round of hype in this cycle. At the end of last year, memes such as MYRO, SILLY, and WIF set off the first wave of Solana meme fever in this cycle; the second wave of meme fever originated from the meme pre-sale wave launched by BOME and SLERF in March this year. Since then, the voices condemning VC coins have gradually spread, and more and more meme coins have been listed on CEX, gradually gaining greater acceptance; with the bull market turning into a bear market, altcoins generally performed poorly, and meme trading tools led by Pump.Fun further promoted the meme fever by upgrading infrastructure, prompting the third wave of meme boom. After the so-called September curse, the crypto market ushered…