USDT попал под железный кулак регулятора? Отслеживание расследования Tethers правительством США

Оригинал | Odaily Planet Daily ( @OdailyChina )

Автор: Вензер ( @венсер 2010 )

No one expected that FUD USDT, a staple in the криптовалюта world, would reappear when Tethers market value continued to hit new highs.

On October 26, Fox Business reporter Eleanor Terrett published an article stating that Tether CEO Paolo Ardoino expressed the current plan to go public; and then the Wall Street Journal раскрыто that the US Treasury Department is considering imposing sanctions on Tether. Although Paolo later published an article stating that there is no indication that Tether is being investigated. WSJ is just repeating old news, it still gives people a heavy feeling of impending storm as the influence of regulatory power on the cryptocurrency industry becomes more and more prominent.

Odaily Planet Daily will briefly review the follow-up of the investigation into USDT and its stablecoin issuer Tether in this article for readers reference.

The rapid growth of Tether: a cash behemoth that attracts tens of billions of dollars a year

В предыдущей статье The market value of the first stablecoin USDT hits a new high, revealing the 100 billion business empire behind Tether , we have conducted an in-depth analysis and multi-perspective interpretation of Tether and its USDT stablecoin business. It mentioned:

In July, Tether released its second quarter 2024 financial report . Data showed that its profits in the first half of 2024 hit a record high of US$5.2 billion, and its net operating profit reached US$1.3 billion, its best performance ever.

В соответствии с previous reports from the Wall Street Journal , the amount of funds flowing through the Tether network in 2023 was almost as much as that flowing through the global payment giant Visa card, and its full-year net profit reached US$6.2 billion, even exceeding the net profit of common shareholders of asset management giant BlackRock last year (which was only US$5.5 billion).

CEO Paolo once сказал : Due to rising interest rates, Tether has made extremely high profits in the past two years and can currently earn 5.5% profit from its reserves. In the past 24 months, Tether has accumulated profits of approximately US$11.9 billion.

Thanks to the cyclical bull market in the first half of the year, the business performance of Tether and USDT has been extremely impressive, and they are unrivaled in the stablecoin market. Their ability to attract money has also been verified time and time again in one business report after another.

Согласно details of its reserve assets , combined with the information disclosed by Tether officials at the Plan ₿ forum held in Lugano, Switzerland , its current reserves include US$5.58 billion in BTC and US$3.87 billion in gold (calculated based on the price on October 27), totaling US$9.45 billion; in addition, it also owns approximately US$100 billion in US Treasury bonds.

There is no doubt that what supports Tethers hundred-billion business empire is not only the demand for cryptocurrency transactions and exchanges, but also the boost from cross-border trade and even gray and black money laundering transactions. This may be the main reason for the foreshadowing of the regulatory investigation reported by the media this time.

Is USDT under attack? No conclusion yet

Ранее, the Wall Street Journal disclosed the news that the federal government is investigating the cryptocurrency company Tether for possible violations of sanctions and anti-money laundering regulations, according to people familiar with the matter. Prosecutors in the Manhattan U.S. Attorneys Office have launched a criminal investigation into whether Tethers cryptocurrency is used by third parties to finance illegal activities such as drug trafficking, terrorism and hacker attacks, or involves the laundering of proceeds generated by these activities.

After the report was released, Tether responded extremely quickly.

CEO Paolo clarified the matter immediately and later said in a statement : “In Tether’s daily operations, we often deal directly with law enforcement officials to help prevent rogue states, terrorists, and criminals from abusing USDT. If we were investigated as the Wall Street Journal article falsely claims, we would know. Based on this, we can confirm that the allegations in the article are absolutely false.”

Tether officials also released an announcement titled Tether slams the Wall Street Journals irresponsible reporting and goes hand in hand with strong law enforcement and regulatory tracking , which stated: It is extremely irresponsible for the Wall Street Journal to write articles with reckless accusations so confidently without any authoritative agency confirming these rumors or revealing the source of the news. After Tether confirmed that it had not been subject to such an investigation, it can be confirmed that these reports were written entirely based on speculation. The article also carelessly concealed Tethers well-documented and extensive cooperation with law enforcement agencies, a move aimed at cracking down on bad actors who attempt to abuse Tether and other cryptocurrencies.

After Tether responded, the Wall Street Journal, as the earliest media to disclose the information, remained silent, as if it had stopped reporting the news, or was waiting for more news to be confirmed and spread.

It is worth mentioning that this is not the first time that Tether, the “first crypto stablecoin issuer”, has clashed with regulatory forces:

Tether has been the subject of multiple investigations before, including one by the New York Attorney Generals Office, which fined Tether and its parent company BitFinex $18.5 million in 2021 для operating illegally in the state; the U.S. Commodity Futures Trading Commission required Tether to pay a $41 million fine in 2021 for engaging in illegal trading.

The latest investigation is understood to be an expansion of the Justice Departments investigation into whether the backers behind Tether committed bank fraud. A spokesman for the U.S. Attorney for the Southern District of New York did not immediately respond.

В соответствии с Fortune , the potential charges could mirror those brought against Binance by the U.S. Department of Justice and Treasury over alleged money laundering and sanctions violations stemming from terrorist and drug trafficking network activities. Tether has been linked to groups such as Hamas, and Russian arms dealers have also been involved.

Tether’s hidden worries: Facing the dilemma between regulatory power and illegal transactions

В соответствии с the Illegal Crypto Economy Report released by TRM Labs earlier this year, on the one hand, in 2023, 45% of illegal transactions occurred on the TRON network, which is mainly engaged in stablecoin transactions (this figure is slightly higher than 41% in 2022), and the number of Tron independent addresses related to USDT related to terrorist funding activities increased by 125% last year; on the other hand, more than half of the market value of USDT currently issued by Tether is hosted on the TRON network (over US$60 billion).

In addition, TRM Labs said that drug sales on darknet markets rose from $1.3 billion in 2022 to $1.6 billion in 2023, while drug sales using TRON increased by four times. At the same time, cybercriminals prefer blockchain transactions because of its relatively low gas fee costs, minimal price volatility, and the belief that on-chain transactions are more difficult to track (although this view is long outdated).

In other words, Tether has invisibly provided a corresponding “payment method” for illegal transactions and a “hotbed environment” for breeding illegal activities. In view of this, Tether has also made its own efforts in facing regulation.

In September this year, Tether and TRON объявил, что they had established a new partnership with TRM Labs, called T 3 Financial Crime Unit (T 3 FCU). TRM Labs, as a leading blockchain intelligence company, has professional capabilities in combating financial crimes; TRON, as a major global blockchain and DAO (decentralized autonomous organization), has strong technical capabilities; and Tether, as a giant in the digital asset industry, provides support for the external investigation team.

Under this cooperation arrangement, TRM will continue to provide support to TRON and Tether to identify transactions related to suspected illegal activities such as terrorism, sanctions evasion, theft, hacking, cybercrime and fraud. TRM will use its proprietary technology and global network of investigative experts to generate relevant intelligence, assist TRON and Tether in combating criminal activities, and provide support for law enforcement actions around the world. This cooperation has also received unanimous praise from the industry and has been reported by well-known media at home and abroad, including Forbes, CoinDesk, Cointelegraph, Benzinga, TheBlock, Odaily Planet Daily, etc.

Additionally, Tether has announced initiatives to combat criminal use and freeze addresses associated with illegal activity.

At the end of September , Tether announced that it had assisted the U.S. Department of Justice in seizing more than $6 million in assets related to a Southeast Asian crypto fraud scheme. The fraud team deceived users by imitating legitimate platforms. Tether froze the relevant assets and helped the U.S. Department of Justice to quickly recover the funds. The U.S. Attorneys Office in Washington, DC publicly acknowledged that Tether provided assistance in transferring assets. As of then, Tether had assisted more than 180 law enforcement agencies in 45 jurisdictions, frozen more than $1.8 billion, reallocated more than $128 million in funds to its legitimate owners and law enforcement agencies, and voluntarily froze more than 1,850 wallets related to illegal activities to assist global law enforcement.

Ранее, по данным the monitoring of the on-chain detective ZachXBT, four stablecoin issuers including Tether (the other three are Paxful, Techteryx, and Circle) blacklisted two addresses including the notorious hacker group Lazarus Group, freezing a total of $6.98 million in funds. ZachXBT later said that compared with other major stablecoin issuers, it took Circle four and a half months longer to blacklist the address of the hacker group Lazarus Group, and criticized Circle and its CEO Jeremy Allaire for not caring about the ecosystem at all, but just squeezing value out of it.

The latest on-chain USDT freeze can be traced back to around 6:01 am Beijing time this morning , when an address containing 16,152,303 USDT on the TRON chain was frozen.

It has to be said that Tether’s understanding and response to existing concerns are still extremely clear and direct, but how to further prevent the use of USDT stablecoin in illegal activities such as money laundering and drug trafficking may be a direction that requires long-term efforts.

Conclusion: Tether will not fall, and it is not the next FTX

On the day when the news of Tether being investigated by the US government departments came out, coupled with negative news such as the escalation of the war conflict between Israel and Iran, the prices of cryptocurrencies including the Bitcoin market plunged together, triggering a small-scale panic in the market. Some people exclaimed, If USDT and Tether have problems, then the FTX crash will be repeated in the cryptocurrency industry. Whats more, some people shouted out sensational slogans such as Tether may be the next FTX. It has to be said that until the words are shocking, they will die.

But we have reason to believe that Tether will not fall, let alone become the “next FTX”. The main basis to support this view is the objective data of the number of USDT users.

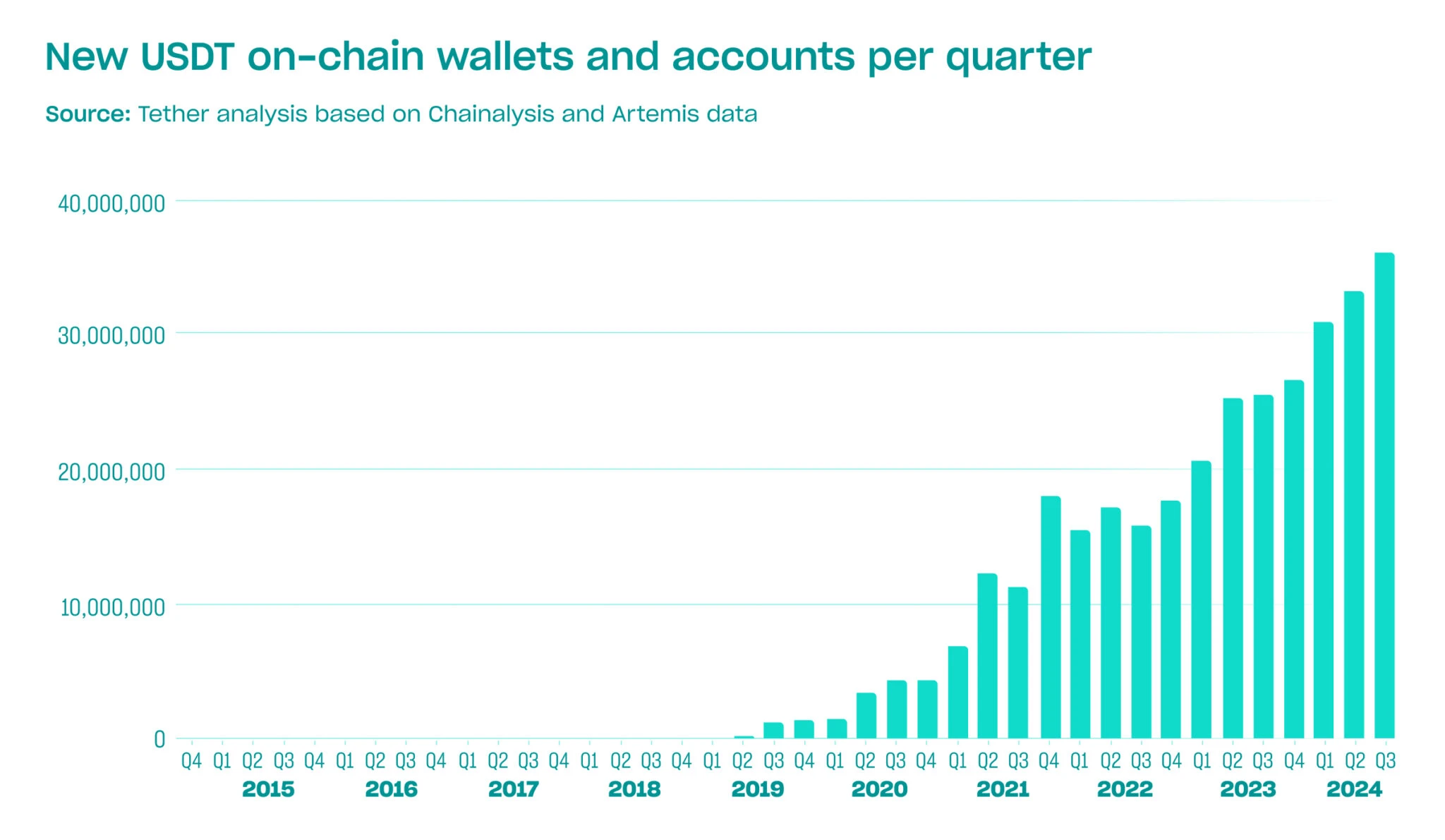

According to Tether s previous announcement , as of the end of the third quarter of 2024, 330 million on-chain wallets and accounts (representing users) have received USDT stablecoins (this number is equivalent to the total population of the United States), and this does not include people who only use USDT on centralized platforms (such as CEX). According to its partners, the number of centralized platform users is as high as tens of millions. In addition, the number of USDT users has increased by an average of 9% in the past four quarters; the third quarter of 2024 is the best quarter for USDT user growth so far, with Tether welcoming 36.25 million users.

There is no doubt that USDT and its issuer Tether have long become part of the world economic system. As Paolo сказал before, USDT may have been just a cryptocurrency at first, but now it is the most widely used digital dollar in the world. USDT, which plays multiple values such as payment, trading, and investment, will inevitably play an increasingly important role in the future as the results of the US election are released and the crypto regulatory environment becomes more relaxed and friendly.

And don’t forget that Tether’s investment portfolio is also gradually expanding. Its latest preview of the privacy-focused Tether Local AI development kit is an attempt in the field of AI. The “seeds” previously sown in areas such as green energy, Bitcoin mining, artificial intelligence, and education programs may also bear fruitful results in the future. Let us wait and see.

USDT new wallet/account quarterly statistics

This article is sourced from the internet: USDT hit by regulatory iron fist? Tracking Tethers investigation by the US government