Автор оригинала: Фрэнк, PANews

Facebooks public chain Sui has attracted much attention recently. The most discussed Sui-related topic on social media is SUI token seems to be replicating SOL2s trend in 2021. Many people believe that SUIs recent rise is very similar to the startup stage before SOLs last round of surge, so it is inferred that Sui may become the next Solana.

Suis mainnet will be launched in May 2023, while Solanas mainnet was launched in March 2020. There is a big gap between the current data of the two. However, from the perspective of growth potential, it is necessary to compare the performance of both parties during the same period. PANews compared the performance of Sui and Solana in July 2021, more than a year after they were launched. Although this method is a bit carving a boat to find a sword, it can also provide an objective reference and comparison.

On-chain data: Sui is better than Solana in 2021

In order to make a clearer comparison of the data, we took Solanas data from around July 12, 2021. Suis data was taken on September 24.

Judging from the on-chain data, Suis current data is generally better than Solanas performance in 2021. In fact, although Solanas token SOL has seen a huge increase in 2021, the data of the ecosystem is obviously not bright enough. Especially for the daily active users on the chain, Solanas daily active users in 2021 were basically in the range of tens of thousands of addresses, and it was not until 2022 that this data broke through to more than 100,000. And this data of Sui has changed dramatically recently. Before April of this year, the daily active addresses on Suis chain were similar to Solana in 2021, averaging tens of thousands of daily active users. After experiencing the blessing of SPAM spam in April, Suis number of daily active addresses on the chain began to surge to more than one million, and even in the cold market stage in August, it remained above 400,000. Recently, it has ushered in a substantial increase again, and the number of daily active addresses has exceeded one million again.

Sui daily active address data

Solana Daily Active Address Data

In the argument of Sui bulls, one indicator that has been mentioned many times is that Suis TPS peak can reach 297,000 transactions, while Solanas maximum peak is 65,000 transactions. However, judging from the current daily TPS, Suis TPS data is still lower than Solanas data level in July 2021.

Looking at the chain as a whole, Sui鈥檚 activity is significantly better than Solana in July 2021, which does provide an argument for Sui to become the next Solana.

Social media influence: Sui lacks a celebrity spokesperson

Ecological development is one aspect. In the crypto space, social media hype sometimes seems to have a greater impact on the price of a token. One of the important reasons for Solanas sharp rise in 2021 is the public support of FTX founder SBF. Dylan and Ian Macalinao, co-founders of Saber (the fastest growing DeFi project on Solana in 2021), talked about why they chose Solana and said: I have been paying attention to SBF for a while and was using FTX at the time. From there, we saw that Solana is a good public chain.

In addition to the influence of SBF, the investment in Solana by A16z, an investment institution that was in the limelight in the crypto field at the time, also triggered the markets optimism about Solana. However, this is partly due to the views of capital. More details will be given later. In addition, in 2021, Solana also won the cooperation and support of many celebrities such as Mike Tyson, Mike Jordan, and Melania Trump. Therefore, in 2021, Solana became an out-and-out Internet celebrity public chain, and the argument that Solana will become the Ethereum killer was hotly hyped on social media, which is exactly the same as the current hype that Sui is the next Solana. Andrew Kang, co-founder and partner of Mechanism Capital, said in response to the comments, I dont think SUIs market value will reach the level of SOL. Its current market value is only 3.5% of SOL. This sounds like the arguments given by the .eth community before or during SOLs outperformance.

In contrast, there are also many KOLs supporting Sui on social media today. In September, K 33 Research analyst David Zimmerman said that the Sui network could become a strong competitor to Solana with its technological advantages and upcoming native game consoles.

However, Sui does not seem to have a celebrity spokesperson like SBF, but there are a large number of industry KOLs who post topics about watching Sui on social media.

Seizing the opportunity: Solana still occupies the main market of MEME

Seizing the trend is also the key to the success of a project. The trends in 2021 are NFT and DeFi, and Solana has received a lot of attention in the NFT trend. In this cycle, MEME is the biggest trend, which has made a huge contribution to the performance of on-chain data. Obviously, this trend has been occupied by Solana before. However, judging from recent data, the MEME market on Sui seems to have finally made progress. Recently, the number of new tokens added daily on Sui has finally exceeded 300, which has grown by leaps and bounds. Before September 10, the value of this data was only between 30 and 50. However, this data level is still far behind Solana (Solana chain still maintains 10,000 new tokens generated every day). Since it is impossible to find the new token generation data of Solana in 2021, it cannot be compared with Solana at that time.

In terms of trading volume, on September 24, the 24-hour token trading volume on Sui Chain was $95 million, while Solana鈥檚 was $1.1 billion. Solana currently still occupies the important outlet of MEME. Sui also has to face multiple opponents such as Base, Ethereum L2, and TON.

Capital boost: Both come from the same school

Ultimately, capital support is also an important factor in the growth of token market value. Recently, capital support for Sui mainly comes from Grayscale. On September 13, the management scale of Grayscale Sui Trust, the SUI Trust Fund, exceeded 1 million US dollars. In addition, on September 17, Circle co-founder and CEO Jeremy Allaire said that USDCCCTP was launched on Sui Network.

Looking back at Solana in 2021, in addition to providing influence on social media, FTX also gave Solana strong financial support. It is estimated that FTX and its related investment arm Alameda Research have invested more than $100 million in various companies and projects in the Solana ecosystem. And a16z injected $314 million in financing into Solana in June 2021. The strong binding with FTX has enabled Solana to have a large amount of funds to promote and boost prices.

Sui has not raised any funds recently (there are reports that OTC financing has been carried out, but it has not been confirmed). The last large amount of financing came from the $300 million financing in 2022. Interestingly, this financing was led by FTX Ventures, and the participating investors included a16z Crypto, Jump Crypto, Apollo, Binance Labs, Franklin Templeton, Coinbase Ventures, Circle Ventures, Lightspeed Venture Partners, Bixin Ventures, and AT Capital. Many of these investors were also previous investors in Solana. However, in 2023, Suis development company Mysten Labs paid $96 million to repurchase shares from FTX.

Рынок performance: The market trend does have similar experiences

Returning to the core area of the current bullish sentiment, the token market, Suis token has seen a sharp rise recently, from August 5 to September 23, up 256% in 49 days, a performance far better than other public chains.

Solana Market Trends in July 2021

Back to SOL in 2021, from July 20 to August 18, it rose by 264% in 29 days. The concentrated rise of the two at a certain stage does seem to have many similarities.

SUI market trend chart from August to September 2024

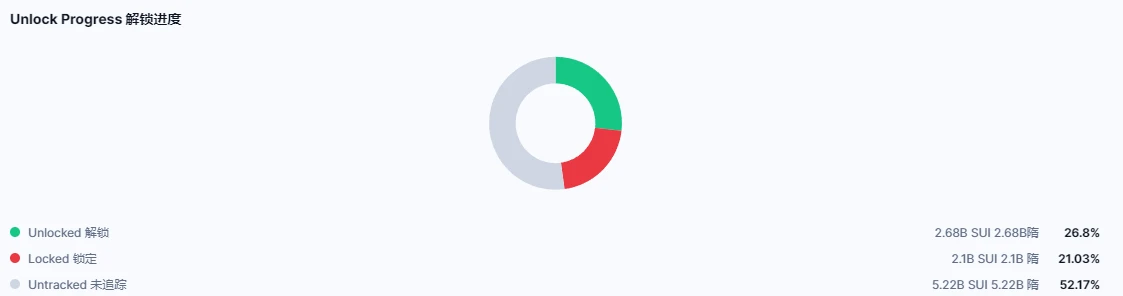

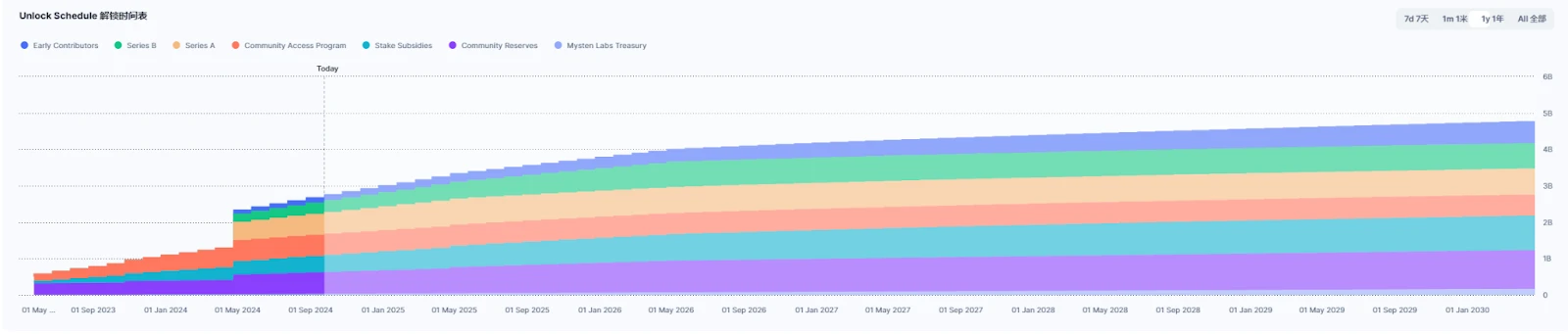

Currently, the circulating market value of SUI is about 4.1 billion US dollars, while the market value of SOL after the first round of increase has reached 18.7 billion US dollars. However, the supply of SUI is currently 26.8%, and SUI tokens will continue to be unlocked every month. SUI currently still has 21% of its tokens unlocked. Even if the circulating market value of these tokens is added, it is still less than the 18.7 billion US dollars after the first round of SOL increase in 2021.

Judging from the popularity of transactions, the current round of SUIs rise may be inseparable from the enthusiasm of the Korean market. Upbit, the largest exchange in South Korea, currently accounts for about 7.21% of SUIs trading volume, becoming the exchange with the largest trading volume of SUI besides Binance, Coinbase, and OKX.

Overall, Sui does have many similarities with Solana in 2021. Similar social media rhetoric, similar performance advantages, similar investment institutions, and so on. Perhaps, Sui may become the next high-performance public chain sought after by the market, but there are still several questions that everyone needs to think about. First, Sui has not achieved the effect of Solanas unique performance in 2021. The current L1 and L2 tracks are surrounded by strong competitors. Can performance really still be a killer? Second, Suis data growth often shows explosive growth, and then experiences a sharp decline. Can this kind of ups and downs on-chain data really represent the activeness of the ecosystem? Third, there are no ecological DAPPs in the ecological project that have wealth effects and break the circle like Solana in the last round of bull market, such as Raydium and MagicEden. Fourth, the token unlocking that cannot be ignored. Of course, no one can predict the market, and the above analysis cannot be used as investment advice. Please be cautious.

This article is sourced from the internet: Sui is in the limelight. Will it become the next Solana?

Trade in a bull market and watch in a bear market. What the crypto industry lacks the least is various interest disputes, and when the market is at a low point, such disputes are often more likely to be brought to the table. In the early hours of this morning, a fierce battle broke out in the BTC ecosystem: Casey, the founder of Ordinals, published an article on his Twitter and blog, pointing out that rocktoshi (@rocktoshi21), who claimed to be the co-founder of Ordinals a few days ago, was not actually a co-founder, and revealed more details about the two people from the founding of the company to their parting ways. Subsequently, a group of bigwigs in the BTC ecosystem, such as Erin, Leo, Charlie, Ninja (friends who play…