9 древних китов пробуждаются, намекая на последний крипто-буллер?

Original锝淥daily Planet Daily ( @OdailyChina )

Автор: Вензер ( @венсер 2010 )

With the news of the Federal Reserves 50 basis point interest rate cut, the crypto market began to end the long period of volatility and began to rise slowly after a long absence: Bitcoin once broke through $64,750, and Ethereum once approached $2,700. At the same time, many ancient crypto whales that had disappeared have also slowly surfaced recently. Even the miner wallets that started mining Bitcoin as early as 2009 have begun their own on-chain asset transfer operations, which makes people more nervous about the future market trend. Some people even exclaimed: This cycle may be the last bull market for retail investors.

Of course, it may be too early to make a judgment now. Odaily Planet Daily will briefly review the crypto whales that have recently ended their slumber and are slowly waking up in this article for readers to follow and refer to.

Ethereum Ancient Whale No. 1: IC0 received 1 million ETH, with an average price of $0.31

Although the price increase of Ethereum has been relatively limited compared to Bitcoin since the beginning of this year, its ecological status and market influence are still second only to Bitcoin.

And since 3 months ago, an Ethereum IC0 whale also started his personal performance:

-

On June 8, 0x7d6149aD9A573A6E2Ca6eBf7D4897c1B766841B4 made its first small transfer to the multi-signature wallet 0x7d6149aD9A573A6E2Ca6eBf7D4897c1B766841B4, and then transferred 5 million USDC and deposited it into the OKX address (0x6Eb6ae5f1027E190AdcC7B66D3aa8f14a7677FAF);

-

On July 12, 0x7d6149aD9A573A6E2Ca6eBf7D4897c1B766841B4 transferred 4,500 ETH to the multi-signature wallet 0x7d6149aD9A573A6E2Ca6eBf7D4897c1B766841B4 in batches, and then deposited it into OKX again for shipment. Since then, he began his ETH selling journey. Later, he transferred 6,600 ETH, 20,000 ETH, and 33,000 ETH in batches, and continued to ship out.

-

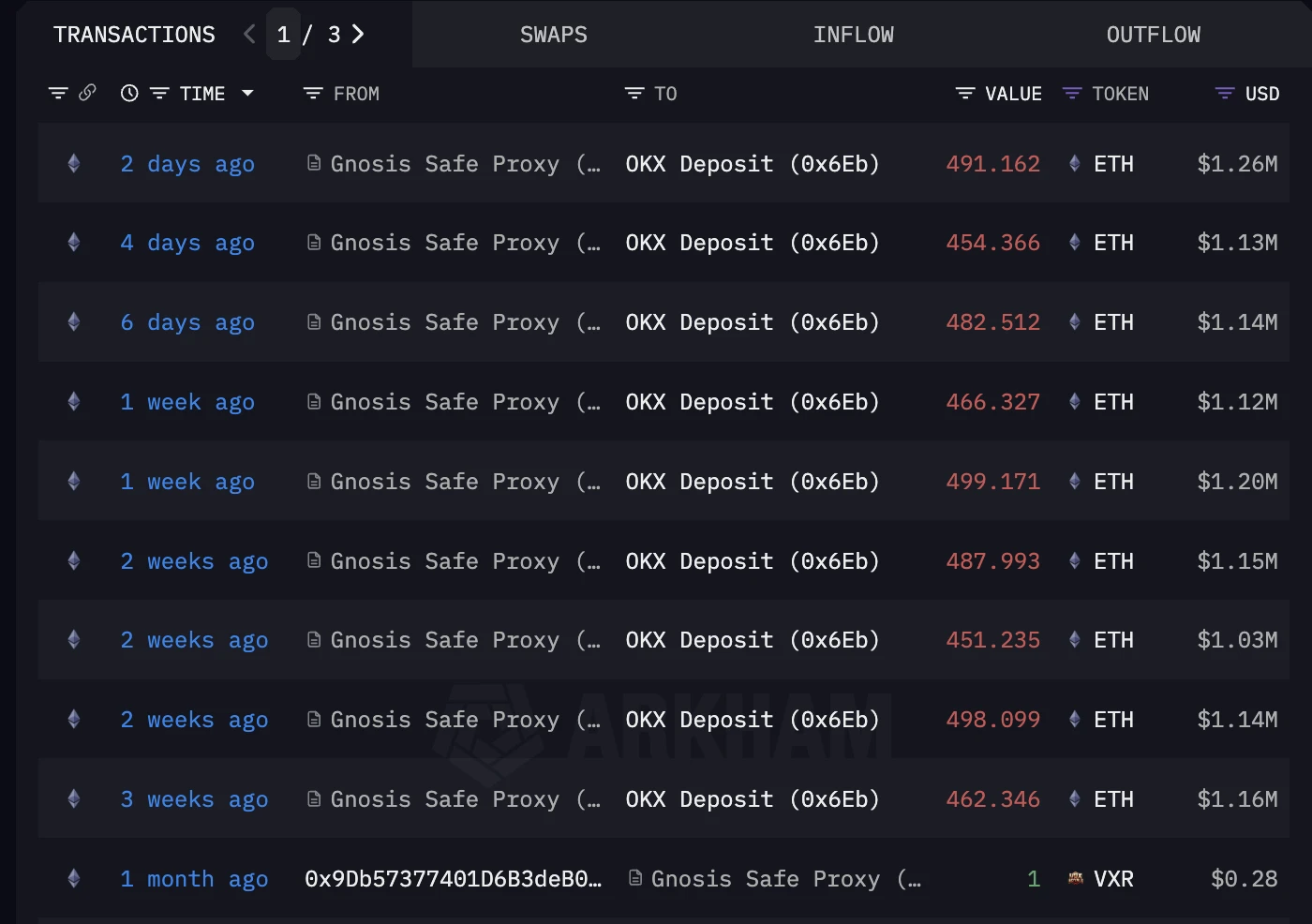

On September 3, the whale deposited another 462 ETH (worth $1.16 million) into OKX. According to мониторинг , since July, the whale has sold a total of 48,963 ETH, with a total value of $155 million, and an average selling price of $3,169; at that time, its three pledged addresses still held 697,000 ETH, equivalent to more than $1.7 billion;

-

From September 5th to 22nd, the whale was still dispersing its shipments. The most recent sale deposited 491 ETH into OKX. Since July 8th, it has sold a total of 52,794 ETH (about US$164 million), with an average deposit price of US$3,112.

I have to say, the ancient giant whale is so terrifying.

Recent dumping records

Primary Tracking Address:

https://platform.arkhamintelligence.com/explorer/address/0xe17E2774c8B2453172Fb3b44E9F822c718fa0Ab7

IC0 address: 0x1937C5c515057553cCBd46D5866455cE66290284 (currently cleared);

Dumping address: 0xe17E2774c8B2453172Fb3b44E9F822c718fa0Ab7 (balance of $28.71 million in assets, mainly more than 10,800 ETH);

Other Addresses:

1) 0x7d6149aD9A573A6E2Ca6eBf7D4897c1B766841B4 (balance of 188 million USD, including 52,870 ETH);

2) 0xd656374CEB16e2dF41e8C66Eb71b8f30a63b422d (balance of $5.733 million, including 2,169 ETH);

3) 0xb0555C4C2f8aD5a562A69F217598EEE0585CC8d3 (balance of more than 20,000 US dollars, only 7.8 ETH).

The number one giant whale is wealthy and powerful, and has three burrows.

Ethereum Ancient Whale II: IC0 received 150,000 ETH at an average price of $0.31

On July 30, 2015, the whale obtained 150,000 ETH at an average price of $0.31, and then distributed it to multiple addresses.

On June 18 , after two years of dormancy, the whale quickly sold 10,000 ETH in three days, worth $35.39 million. At that time, it still had five addresses holding 75,000 ETH, with a floating profit of $257 million;

On September 23 , today, the whale sold another 3,510 ETH (worth $9.12 million). He currently still holds 71,490 ETH scattered in 5 currency holding addresses (about $187 million).

IC0 address: 0xb8cc0f060aad92d4eb8b36b3b95ce9e90eb383d7 (currently cleared);

5 current holding addresses:

1) https://platform.arkhamintelligence.com/explorer/address/0xBF4E47672B9418865bB27147d1B09fCB00573C06 (balance of 52.764 million USD, including 20,000 ETH);

2) https://platform.arkhamintelligence.com/explorer/address/0xA60C073eaA1bdC3F56aF8a9292B9A1E6d3c7E5b7 (balance of 39.573 million USD, including 15,000 ETH);

3) https://platform.arkhamintelligence.com/explorer/address/0x35c9BBD1e0dDEadca4118A2378E9B0D1959B79F1 (balance of 39.573 million USD, including 15,000 ETH);

4) https://platform.arkhamintelligence.com/explorer/address/0xB1E52e319B83dd3bEdBaE9878B63F67B535dE2be (balance of 30.312 million USD, including 11,490 ETH);

5) https://platform.arkhamintelligence.com/explorer/address/0x5406217655c8DEbE51774C08A0A7cB516bA2F122 (balance of US$26.382 million, including 10,000 ETH).

Giant Whale No. 2 is the type that is fine if it doesn鈥檛 move, but shocking when it moves.

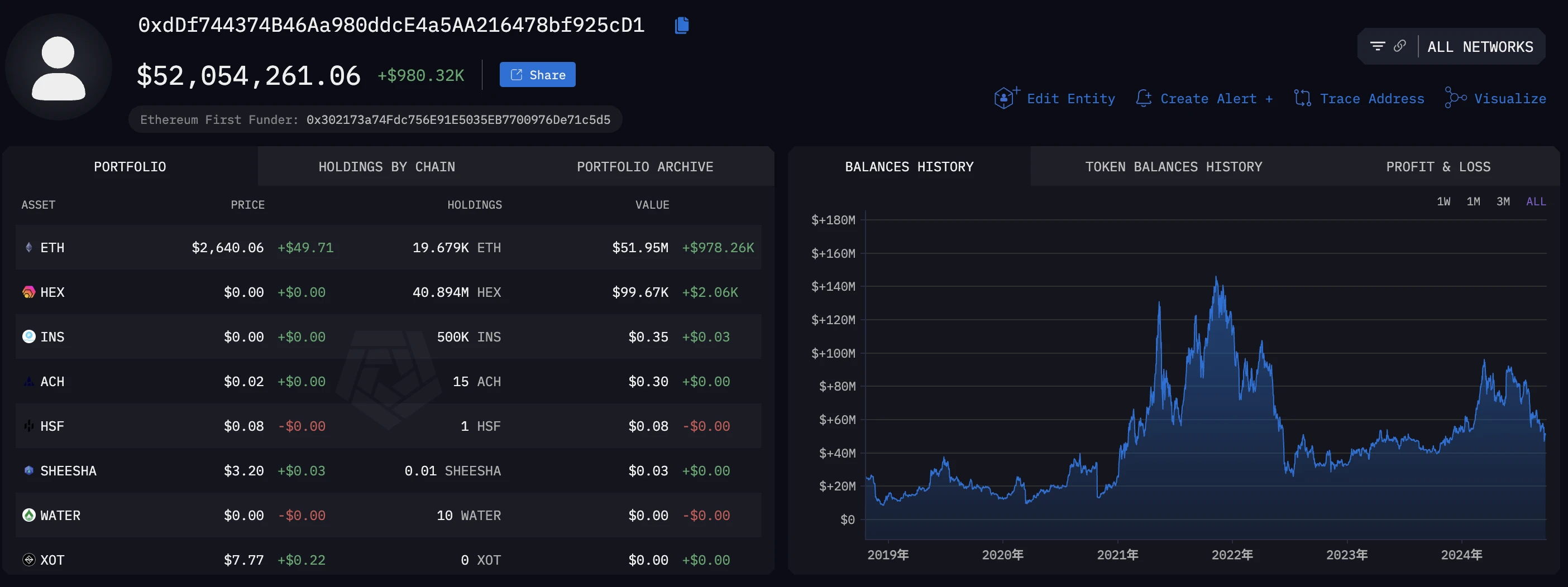

Ethereum Ancient Whale No. 3: From IC0 310,000 ETH to TheDAO refund 100,000 ETH

On September 18, an ancient Ethereum whale deposited 4,000 ETH (worth $9.33 million) into the Kraken exchange, suspected of selling.

It is understood that this whale not only participated in the Ethereum IC0 and obtained 310,000 ETH; it also received 100,000 ETH distributed by the refund contract of The DAO incident on July 24, 2016 (worth only 1.28 million US dollars at the time).

IC0 address: 0x512b91bbfAa9E581ef683fc90d9DB22a8F49f48B (cleared);

Main tracking address: https://platform.arkhamintelligence.com/explorer/address/0xdDf744374B46Aa980ddcE4a5AA216478bf925cD1 (balance of US$52.054 million, including 19,679 ETH and 40.894 million HEX).

Position information

Ethereum Ancient Whale No. 4: Opened a position of 16,636 ETH at an average price of $5.23

Compared with the previous ancient whales who participated in IC0, this whale belongs to the relatively ancient category, and the average holding price has also risen sharply to US$5.23 compared to IC0s US$0.31, but it still enjoys a hundreds-fold increase so far.

In February 2016, the whale bought a token from @ShapeShift at a price of $5.23 per token. 聽 Received 16,636 ETH.

Eight and a half years later, on September 16 this year, the whale began his own sell-off – he first transferred 16,636 ETH (worth US$39.62 million on that day) to the 0xe3e…566 address, and then sold 350 ETH at US$2,340.

It is understood that the 16,636 ETH he received at that time were worth only US$87,000, and now they are worth as much as US$44.015 million. If he could hold on until today before selling them, it would be equivalent to a 505-fold increase in assets.

ETH address received in 2016: 0x996A4A7E6ec3DeEdbe47522216112bdBae8aC2e2 (currently liquidated);

ETH selling address: 0xE3E5540B029d4662F6E99a5Af3E8b431Cff59566 (currently all have been converted into USDT stablecoins, with a balance of US$39.745 million).

Tracking address: https://etherscan.io/address/0xE3E5540B029d4662F6E99a5Af3E8b431Cff59566

Bitcoin Genesis Mining Whales: Sudden Dumping of 5 Mining Addresses from 2009

Not only have Ethereums ancient whales awakened one after another, but even the Bitcoin mining whales that originated in the wild age of cryptocurrency have recently awakened from their slumber.

On September 20, it was monitored that Bitcoin miner wallets that had been dormant for more than 15.6 years were transferring Bitcoin assets. Among them, 5 miner wallets quickly transferred 250 Bitcoins in one hour, with a total value of 15.9 million US dollars. It is understood that as early as 2009, these wallets received 50 Bitcoins per block as mining rewards; and now, the price of 50 Bitcoins is about 3.18 million US dollars.

The following are 5 mining address wallets:

-

1C4rE41Kox3jZbdJT9yatyh4H2fMxP8qmD

-

18E5d2wQdAfutcXgziHZR71izLRyjSzGSX

-

13J8FkimCLQ2EnP1xRm7yHhpaZQa9H4p8E

-

1MBBJBFEaYKHFZAeV7hQ7DWdu3aZktjzFH

-

1CGT3Ywaa2upJfWtUtbXonDPNTfZPWqzmA

Whale Alert monitoring records for the day

Summary: After the Fed cuts interest rates, the crypto whale sell-off may continue

After the news of the Federal Reserves interest rate cut came out, the crypto market was very receptive in the short term, but on the other hand, it also exacerbated the concerns of some market participants about economic recession. Perhaps for this reason, there have been many crypto whales making frequent moves recently. Even Shenyu, which has always been calm and low-key, recently deposited 85.6 WBTC (worth US$5.37 million) into Binance . It is not clear whether this is exchanging for pocket money or a regular asset movement.

However, from now until the results of the US election are released, as the market trends rise, the selling spree of crypto whales may continue further with the help of the upward trend.

This article is sourced from the internet: 9 ancient whales awaken, hinting at the last crypto bull run?

Original | Odaily Planet Daily ( @OdailyChina ) Author | Fu Howe ( @vincent 31515173 ) As the integration of mainstream finance and the crypto industry accelerates, the advantages of Web3 are increasingly being accepted by global companies and countries. However, Web3 is also affected by its own limitations in terms of global popularity, especially the complex on-chain processes. The complex transaction steps protect the right to use personal property, but also limit its large-scale popularization. While Web3 gives users freedom, it also makes itself a gathering place for risky activities, resulting in a high threat to the security of on-chain assets. This is also the reason why in this bull market, new external funds are still staying at the doorstep of Web2 and Web3 (that is, spot ETFs), but…