Понимание Puffer UniFi AVS: от предварительных соглашений до следующего десятилетия Ethereum?

Original author: Puffer

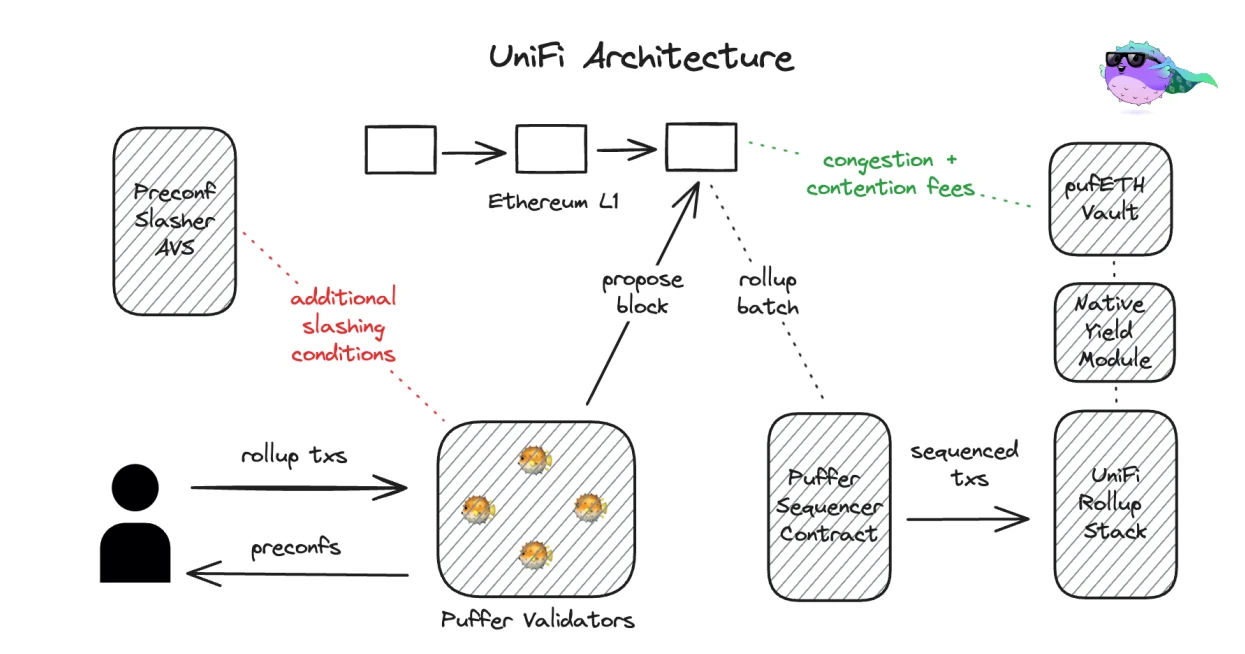

On September 16, Puffer officially announced the Ethereum security infrastructure product UniFi AVS. As an active verification service (AVS) based on EigenLayer, it is designed for the pre-confirmation (Preconfs) challenges in the Ethereum ecosystem, especially in the Based Rollup field, and aims to unleash the full potential of Based Rollup.

Perhaps many users first impression of Puffer is still that it is a single native liquidity re-staking platform. In fact, as early as August, we have been upgraded to an Ethereum decentralized infrastructure provider. The product architecture can be summarized as the three horses: Based Rollup solution Puffer UniFi, pre-confirmation (Preconf) technology solution UniFi AVS and re-staking product Puffer LRT.

This article will share with you in depth the functional services of the UniFi AVS product. However, before that, it is necessary to briefly sort out the relevant concepts of Based Rollup. As long as you understand Based Rollup, you can also touch the important significance and value of UniFi AVS to the future direction of Ethereum.

Based Rollup: The new optimal solution for Ethereum Rollup ?

As a concept officially proposed by Justin Drake, a researcher at the Ethereum Foundation in March 2023, Based Rollup aims to solve a series of problems in the existing Rollup ecosystem.

As we all know, after Vitalik Buterin released the Rollup-centric Ethereum Roadmap in 2020, the Ethereum ecosystem entered the era of multiple Rollups. According to incomplete statistics from L2 BEAT, as of the time of writing, there were as many as 39 Rollup L2s. Both Optimistic Rollup and ZK Rollup have alleviated old problems such as Ethereum expansion to a certain extent, but have also brought about a new dilemma of increasingly fragmented liquidity.

At the same time, the sequencer, as the core component of the L2-L1 architecture, is responsible for the transaction sorting and packaging from L2 to L1, and plays an important role in improving transaction processing efficiency and reducing costs. However, since the running L2 generally adopts a centralized sequencer controlled by a single or a few entities, it also faces the potential risk of sequencer failure or malicious behavior:

Once there is a problem with the sorter, it may cause transaction delays, data loss, and even threats to asset security. This is undoubtedly a huge hidden danger for users who rely on L2 for transactions.

What about the decentralized sorter or shared sorter that is highly sought after in the market?

In theory, they can indeed eliminate the single point of failure and malicious risks brought by centralized sorters, but their coordination and consensus mechanisms are relatively complex, and there may be compatibility issues between different decentralized sorters, making it difficult to achieve seamless docking. Moreover, to be realistic, the decentralized sorter network has not yet had successful large-scale practical verification and may still face various potential attacks and vulnerabilities.

Therefore, Based Rollup directly follows the Occams razor principle in one step and removes the design of a separate sorter network mechanism: the responsibility for transaction sorting is transferred from the original L2 to L1, and the Ethereum L1 verification node acts as a block proposer (proposer) to be responsible for transaction sorting.

This not only avoids the risks brought by centralized sorters, but also makes full use of Ethereum鈥檚 existing node network and decentralized characteristics, directly upgrading security to the same level as the Ethereum mainnet.

However, gaining something in one place may lead to losing something in another, which also brings about another challenge – the native Based Rollup network cannot achieve fast confirmation of transactions.

The reason is very simple. The common L2 based centralized sorters can quickly sort and package, and achieve nearly instant transaction confirmation; while the transaction sorting of Based Rollup is the responsibility of L1 verification nodes, which means that the confirmation time is completely dependent on the block interval of the main network (about 12 seconds), and the user experience is much inferior to the centralized sorter.

Based Rollup, inseparable from Preconfs

To put it bluntly, Based Rollup is aligned with L1 in terms of security and decentralization, but has to sacrifice transaction confirmation speed. For most on-chain scenarios with financial attributes, market conditions change rapidly. Not to mention a difference of 12 seconds, even a difference of only 1 second can cause huge risks and uncertainties.

In view of this, we need to add a patch to Based Rollup, namely Preconfirmations (Preconfs for short). Its logic is also very simple, just as the name implies. Imagine:

When we buy train tickets on 12306, once we select the itinerary and place the order (signature transaction), the booking system will first give you a pre-confirmation message, telling you that the ticket purchase behavior (corresponding to each transaction) has been accepted and is entering the subsequent confirmation process. At this time, we can start planning the itinerary, preparing luggage, etc. Only when the ticket finally confirms the carriage and seat (the transaction is released to L1), we have officially completed the ticket purchase and reservation transaction.

In short, in Based Rollup, pre-confirmation means promising to include a transaction in a block before the transaction is formally submitted to L1 for confirmation. This is equivalent to giving the user a preliminary confirmation signal to let the user know that the transaction has been accepted and is being processed.

This ensures that on-chain transaction scenarios that require timeliness do not need to wait for 12 seconds, and can directly achieve millisecond-level (about 100 milliseconds) transaction response speeds.

This move not only greatly improves transaction speed and user experience, but also does not require changes to Ethereums core protocol. In a sense, Based Rollup and preconfirmation (Preconfs) are like two sides of the same coin – if the potential of Based Rollup is to be fully realized, a permissionless, neutral and flexible preconfirmation service must be implemented.

What needs to be considered is that, in the specific implementation mechanism, who is responsible for sorting and pre-confirming transactions and ensuring that the pre-confirmation commitments are followed?

-

For the first question, the Ethereum Foundation is developing a neutral registration contract that will not be affiliated with any specific protocol. It aims to provide a common basis for pre-confirmation discovery and verification, similar to the registration system model in the stock market, allowing any L1 proposer to voluntarily register as a pre-confirmation verification node;

-

For the second question, the penalty mechanism based on economic rewards and penalties can undoubtedly ensure that the verification node will not violate the pre-confirmation commitment, but it faces a seesaw choice – if a part of the ETH of the verification node is confiscated, the smart contract logic of Restaking needs to be re-implemented, which is capital efficient but also complex; if additional collateral is required, the complexity is low, but the capital efficiency is lower;

So, is it possible to solve the slashing problem directly based on the economic security of the Ethereum mainnet with the help of EigenLayers AVS service?

Puffer UniFi AVS is based on this idea. It uses the Restaking function of EigenLayer and can combine the neutral registration contract mechanism of the Ethereum Foundation in the future to achieve a nearly ideal scenario:

Establish a permissionless pre-confirmation service participation mechanism, allowing any L1 proposer to voluntarily register as a pre-confirmation validator node, thereby achieving economic security directly based on the Ethereum mainnet without additional penalties.

Puffer UniFi AVS: Preconf Solution for Based Rollup

Puffer UniFi AVS specifically includes three key components: EigenLayer integration, on-chain registration, and slashing mechanism . EigenLayer integration gives Puffer UniFi AVS pre-confirmation service an exclusive competitive advantage that is difficult to replicate:

Based on Puffers re-staking verification node set, the re-staking ETH can be directly used as pre-confirmation collateral without the need for additional deposits. In this way, one organization, two brands, the re-staking verification node = pre-confirmation service node, not only improves capital efficiency, but also can quickly pull up a pre-confirmation verification node set with a large number of participants and sufficient decentralization.

We can briefly sort out the specific pre-confirmation implementation process of Puffer UniFi AVS.

First of all, because the Puffer verification node has been registered as a Native Restaking node on Ethereum, when a user submits a transaction that requires pre-confirmation, the Puffer verification node will directly act as a pre-confirmation verification node, providing the user with a pre-confirmation commitment within about 100 milliseconds, allowing the user to quickly know that their transaction has been received and will be included in a future block.

After providing pre-confirmation service, the Puffer verification node will package these transactions with other transactions and submit blocks to Ethereum L1. Finally, the Puffer UniFi smart contract Puffer Sequencer Contract accepts batch transactions to ensure that the transaction status has been confirmed and cannot be rolled back.

Throughout the entire process, UniFi AVSs on-chain registration and slashing mechanism plays an important role – if the validator fails to abide by its pre-confirmed commitment, it will be punished, thereby ensuring the reliability and security of the entire system.

As of the time of posting, the requirements for participating in Puffer UniFi AVS are:

-

EigenPod ownership. EigenPods are a tool for Ethereum validators to interact with EigenLayer, ensuring that the UniFi AVS service can slash validators that violate pre-confirmation commitments;

-

32 ETH. Since the pre-confirmation verification node and the Ethereum verification node are one organization, two brands, the pre-confirmation node requires at least 32 ETH to participate. However, the operators participation is more flexible, whether it is running a native verification node by itself or being part of a re-staking product (LRT);

-

Run Commit-Boost. Operators must run Commit-Boost software alongside their validator clients to ensure that pre-confirmation services are performed and that communication between the validator and the pre-confirmation supply chain is handled smoothly;

It is worth noting that Puffer UniFi AVS, by integrating Commit-Boost, aims to focus on core functions such as registration mechanism and slashing mechanism, providing more efficient, standardized and community-centric pre-confirmation services while adhering to Ethereums basic principles of decentralization and openness.

Who needs Puffers UniFi AVS service?

We should take a long-term view of things. As the Based Rollup narrative continues to expand, numerous Based Rollup projects are bound to emerge like mushrooms after a rain, and their demand for pre-confirmation services is extremely urgent, especially in the face of complex market environments and technical challenges. They need a reliable pre-confirmation technology service provider to protect them.

The market is in urgent need of a secure pre-confirmation technology service provider, so Puffer UniFi AVS is essentially a universal solution that can effectively meet the needs of all parties:

-

On the supply side, link up re-staking verification nodes (not only Puffer, but also native re-staking LRT protocol players such as Etherfi and Renzo in the future) , support them to participate in UniFi AVS to kill two birds with one stone, and obtain additional income by selling their own verification services;

-

On the demand side, the other end is directly facing all project parties that need to build Based Rollup, supporting them to obtain pre-confirmation services conveniently through the UniFi AVS resource pipeline, thereby accelerating transaction processing;

In a nutshell, the service model of Puffer UniFi AVS is similar to that of EigenLayers matching platform, which aims to promote the optimal allocation and utilization of resources. Just like Uber and Didi, it connects to the re-staking verification node as the supplier, and provides Based Rollup pre-confirmation services to the demand side through matching.

This will not only greatly accelerate the innovation process in the Based Rollup field and the Ethereum ecosystem, but also create new sources of income for the Ethereum verification node group, bringing new vitality to the entire ecosystem.

краткое содержание

In general, Based Rollup, as a new type of Rollup concept that Vitalik Buterin has repeatedly mentioned recently, is bound to play a more critical role in the evolution of Ethereum.

Therefore, the pre-confirmation service that is indispensable to Based Rollup is destined to become a key infrastructure for the future direction of the Ethereum ecosystem. Puffer UniFi AVS, as a pre-confirmation technology solution with innovative mechanism design, is currently the most critical step of Based Rollup+Preconfs:

-

For users, Puffer UniFi AVS brings a near-instant transaction confirmation experience, greatly improving the user experience and laying a solid foundation for the popularization and widespread adoption of Based Rollup;

-

For pre-confirmation service providers, it strengthens the reward and punishment mechanism through on-chain registration and penalty mechanisms, improving efficiency and credibility within the ecosystem;

-

For L1 validator nodes, it opens up additional revenue channels, increases the attractiveness of participating in node validation, and further strengthens the economic incentives and legitimacy of the Ethereum mainnet.

From a more macro perspective, Puffer UniFi AVS started with Based Rollup, but is more than Based Rollup – it is closely linked to Ethereums long-term vision, and achieves fast pre-confirmation without changing the core protocol. The impact is not limited to the EigenLayer ecosystem, but also provides a new paradigm for Ethereum innovation, bringing tangible benefits to users, validators and the entire Ethereum community. It is expected to trigger a series of chain reactions for Ethereums continued growth and inject new and greater possibilities.

About Puffer Finance

Puffer Finance is a leading innovator in the Ethereum infrastructure space, focusing on the next generation Rollup – Puffer UniFi, powered by Liquid Restaking (LRT) and pre-confirmation as AVS. With products such as the native restaking protocol, Puffer UniFi and UniFi AVS, Puffer has been committed to enhancing the decentralization of Ethereum. puffer.fi

This article is sourced from the internet: Understanding Puffer UniFi AVS: From Preconfs to the next decade of Ethereum?

Related: Coinbase Research Report: Stablecoins and the New Payment Landscape

introduction Currently, the global payment infrastructure is being modernized and improved, which will provide users with faster and cheaper payment methods. Stablecoins are increasingly being used to build robust crypto payment systems, facilitate remittance payments and simplify cross-border transactions. In 2023, the total transaction volume settled in the stablecoin market exceeded $10.8 trillion – $2.3 trillion if unnatural transactions, such as robots or automated transactions, are excluded. On an adjusted basis, transaction volume increased by 17% year-on-year, which means that stablecoins are quickly catching up with todays largest existing payment networks. Although existing payment networks enjoy some important advantages in terms of liquidity and network effects, as competition has increased, the average cost of remittance payments has fallen by more than a third over the past 15 years, according to…