Каково происхождение FLUX, первого протокола токенов Fractal?

Оригинал | Odaily Planet Daily ( @OdailyChina )

Yesterday, the Fractal mainnet was officially launched.

While everyone was still immersed in discussing and calculating the profit and loss of FB token mining during the day (recommended reading How is the first days profit of Fractals first mine, can leasing computing power make money? ) , FLUX, known as Fractals first token protocol, suddenly came out in the evening. Moreover, the FLUX protocols eponymous token was minted within half an hour, with a total of 21 million, and the casting cost of one (1,000) was 0.05 FB. (Odaily Note: The FB OTC price is 15 USDT, and the casting cost of a single FLUX is about 0.75 USDT)

Although the token has no index or market yet, the over-the-counter price once reached 50 USDT/piece; calculated based on the minting cost, the increase was more than 60 times. Such high returns have also made the Bitcoin community lively again:

-

“Using the airdropped FB zero-cost mint, it has turned around”

-

Its over, youve reached the next ORDI

-

This moment is just like that moment, the familiar feeling of the inscription craze is back

In fact, the BRC-20 token officially supported by Fractal will not be activated until the mainnet block height reaches 21,000 – the current block height is 5,490, and it will take about 5 days to reach the set height. Logically, no related tokens will appear before then. What is the origin of the FLUX token protocol, and can it reproduce the inscription craze? Odaily Planet Daily will briefly interpret the FLUX protocol in this article.

Introduction to FLUX Protocol

The FLUX protocol claims to be the first UTXO-based Fractal native token protocol, developed by Inscrib 3. Like BRC 20, the FLUX inscription consists of 3 simple functions: deployment, minting, and transfer, and there are no other technologies and functions. Therefore, FLUX can be simply understood as an asset issuance protocol that replicates BRC-20 on Fractal.

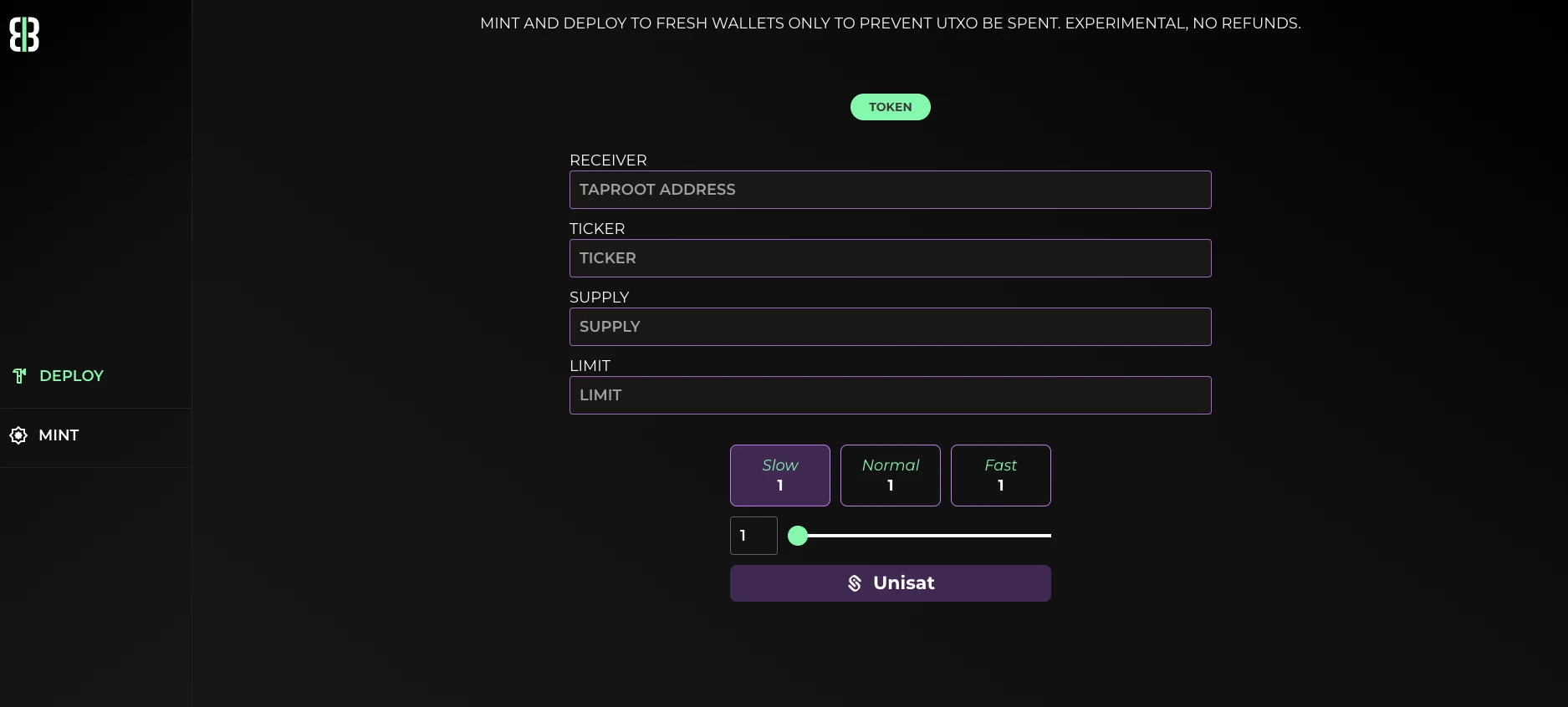

Currently, the FLUX protocol has no index, trading market or official wallet. However, in order to facilitate users to deploy and mint assets, the official first created a minting website, which users can use to deploy (DEPLOY) or mint (MINT) FLUX assets.

Odaily Planet Daily has personally tested that no matter it is deploying or minting assets, each operation costs 0.05 FB. However, because the payment address for each operation is a new address, it is not possible to determine whether this 0.05 FB is used for the network fee of protocol asset deployment and minting or directly attributed to official income.

Overall, the minting website is relatively simple and players are in a passive situation. For example, it is impossible to view the assets currently deployed for minting and the minting progress; if you do not fill in any content, directly clicking the Unisat button below will directly pop up the wallet payment window and cause incorrect payment; there is also a reminder at the top of the website that experimental, no refunds, so players who participate must pay attention to the risks.

In addition to FLUX, the first token deployed by the FLUX team itself, it has also forwarded tokens named HAWK and WGBA on the X platform (the possibility of team members participating is not ruled out). Other FLUX assets are still unknown.

Serial Entrepreneur

The introduction of the FLUX protocol development team Inscrib 3 on social media is providing open source and non-custodial solutions for the BTC protocol. Before developing the FLUX protocol, the team had developed a number of Bitcoin ecosystem-related projects.

The team used to focus on building the Pipe protocol, and developed a casting platform, indexer, exclusive wallet, trading market, and hybrid token standard PRC-404 for the Pipe protocol. However, due to the decrease in the popularity of the PIPE protocol market and the number of players, these infrastructures are rarely used. (Odaily Note: Pipe is a Bitcoin mainnet asset issuance protocol launched in October 2023. Its leading asset PIPE is currently priced at 200 USDT per piece, and its historical high is around 3,000 USDT)

In addition to the Pipe protocol, the team has also started a business in the rune field and developed a launch platform called Runescription. On this platform, users can deploy the non-fungible inscriptions generated by the Rune protocol when etching each token as NFTs. The concept of rune NFTs was also popular for a while, but as the popularity declined, the platform never picked up again.

Inscrib 3 also co-developed the Bloki protocol in the Rune protocol. The supply of the protocol token in each block is determined by the block height and the number of runes etched in each block. At the same time, a decentralized large language model (LLM) built on the Blok protocol, Bloki AI, was recently launched to help users train a censorship-resistant dataset on the Bitcoin blockchain.

In summary, Inscrib 3 can be regarded as a serial entrepreneur in the Bitcoin ecosystem, and it also grasps the hot spots in the ecosystem in a timely manner. From choosing to stand on the Pipe protocol in the early Bitcoin asset issuance protocol war, to choosing to build in the rune field again after the results of the protocol competition were settled, and finally coming to the current hottest Fractal ecosystem to issue assets. Although the teams previous entrepreneurial ventures did not cause much splash, this times entrepreneurship in the Fractal ecosystem has achieved a certain degree of success in terms of popularity, but it is still unknown how long it can last.

A long drought finally ends in rain?

Searching for the keyword FLUX on the X platform and adding the language region restriction, you will find that although the FLUX protocol is an overseas project, various discussions in the Chinese area are relatively active, from protocol introductions, minting discussions to OTC trading groups. In comparison, there are fewer discussions in other language areas.

The FLUX protocol has attracted so much attention not only because the team has a rich history of entrepreneurship in the Bitcoin ecosystem (which is often a demerit), but also because it has met the markets demand for homogeneous tokens in the Fractal ecosystem ahead of the official plan. Therefore, even if the protocol is imperfect and only supports simple minting and deployment, driven by the narrative of the first Fractal token protocol and first is first, the market is like a long-awaited rain, celebrating the early opening of the casino.

The FLUX protocol may just be a beginning, and it may mark that the Fractal ecosystem will enter the barbaric era of competition in asset issuance protocols, just like the early Bitcoin network, even in the case of asset protocols that are already officially supported.

In short, the traffic and attention generated by Fractal are certainly valuable, but if the same group of people move from one casino to another casino from the Bitcoin mainnet ecosystem to the Fractal ecosystem, playing the same games without any innovation, then it will not only be boring and difficult to attract new blood to join, but the PVP on the field will not produce a large-scale wealth effect.

This article is sourced from the internet: Known as Fractal’s first token protocol, what is the origin of FLUX?

Related: Move Gemini: How Sui and Aptos challenge the blockchain landscape

Original author: YBB Capital Researcher Zeke Preface The market has become increasingly cold recently, and many OGs in the industry have begun to waver in their understanding of the significance of the industry. Let me share my personal thoughts. I always feel that many great visions in the past have been falsified because these visions were not logically self-consistent from the beginning. Dapps outside of non-financial applications always try to cover up the fact that the products themselves are not good enough by emphasizing the value of decentralization. But the fact is that they told me not to trust Google, Twitter, and YouTube, but to believe that their multi-signature wallets and stand-alone servers are safe enough. Many visions are not falsified, but have never been truly verified. I still believe…