Комплексный анализ экономики токенов Solana: высок ли уровень инфляции SOL?

Original title: Is Solana’s Inflation Too High?

Original author: Lostin

Оригинальный перевод: zhouzhou, BlockBeats

Editors Note: Solanas inflation issue has sparked widespread discussion in recent years. Currently, the inflation rate of the Solana network is about 5.07%, and the network staking rate has reached 65%. In the inflation model, users obtain rewards by validating nodes, and the circulation of tokens gradually decreases over time. Although Solanas staking return rate is attractive, there is still uncertainty about the long-term impact of its inflation on token prices. Future adjustments to the inflation plan may further affect the sustainability and economic model of the network by reducing issuance or changing the inflation mechanism.

The following is the original translation:

Sincere thanks to Ichigo from 0x and Michael from Laine | Stakewiz for reviewing earlier versions of this article, and Zantetsu from Shinobi Systems for providing some of the data.

Operational methodology:

All SOL tokens come from two places: the genesis block or protocol inflation (also known as staking rewards). In contrast, transaction fee destruction is the only protocol mechanism that can remove SOL tokens from circulation.

Токен issuance is described by three key parameters of the inflation schedule: initial inflation rate (8%), deflation rate (-15%), and long-term inflation rate (1.5%). Inflation on the Solana mainnet officially started on epoch 150 on February 10, 2021. The current inflation rate is 5.07%.

Proof of Stake inflation causes non-stakers to lose a smaller share of the network relative to stakers, and this dilution effect effectively transfers wealth from non-stakers to stakers.

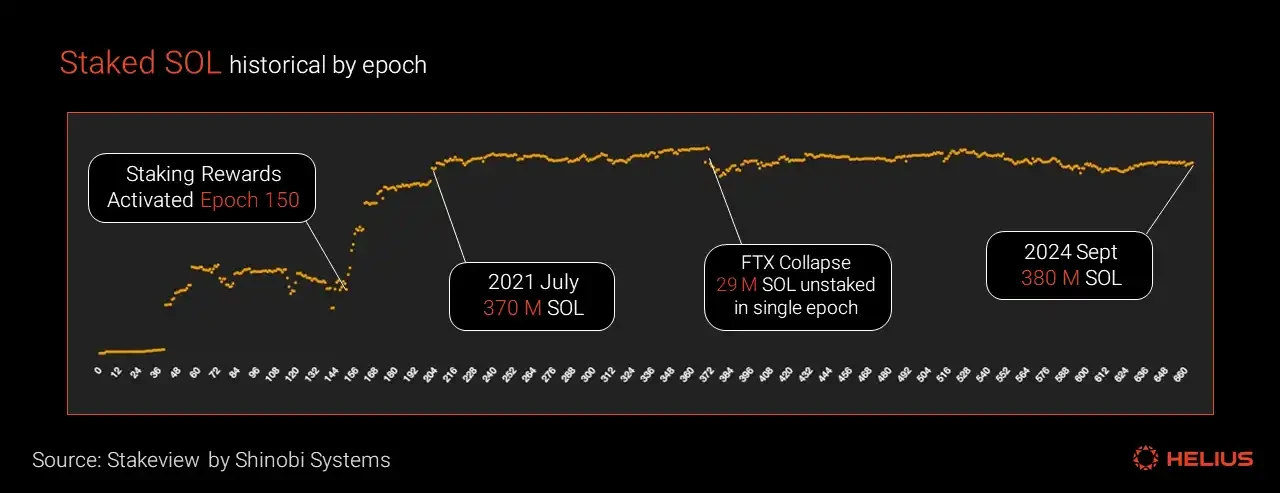

Solana’s staking rate is 65%, which is relatively high compared to other networks in the industry. The total staked amount is currently 380 million SOL, which has remained relatively stable since the 202nd epoch in July 2021. In most epochs, seven-digit SOLs are staked and unstaked.

The key variables when calculating staking yield are the inflation rate and the percentage of SOL staked. The nominal staking yield (NSY) can be calculated by the following formula: NSY = inflation rate * validator uptime * (1 – validator commission) * (1 / SOL staked percentage).

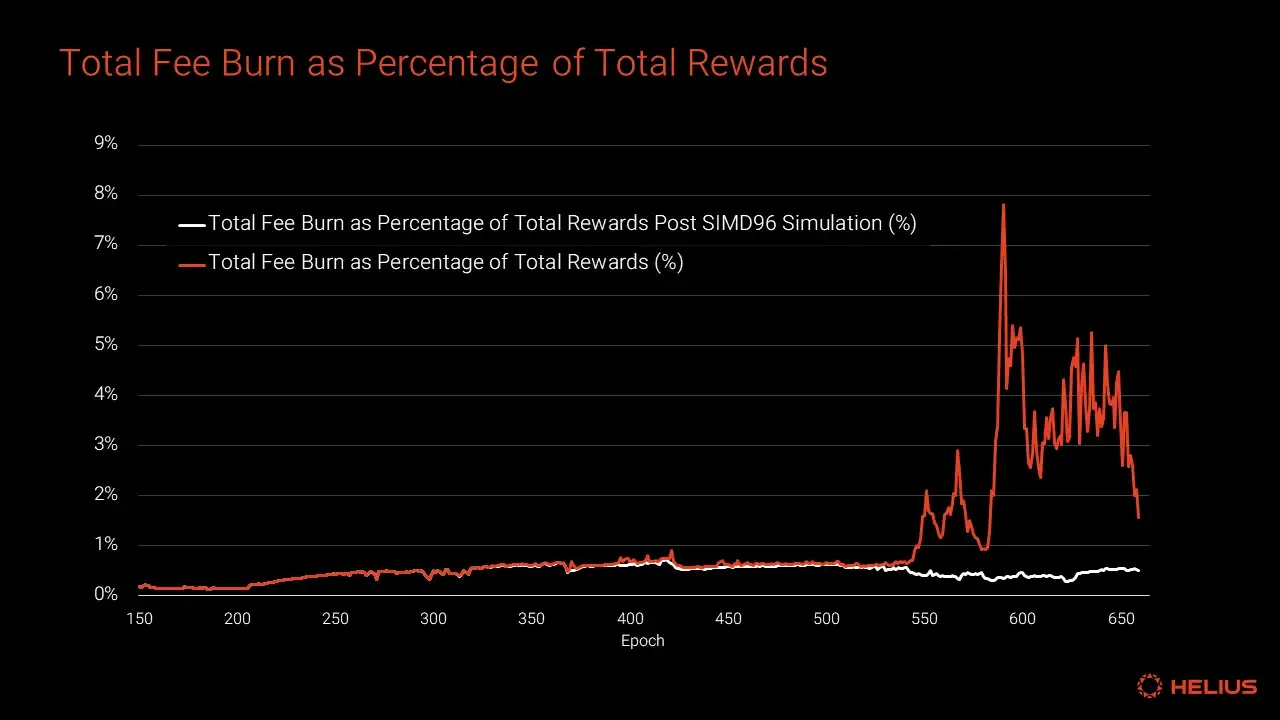

On December 14, 2023, total burned fees as a percentage of staking rewards exceeded 1% for the first time, and peaked at 7.8% in March. Over the last 100 epochs, fee burns averaged 3.2% of total staking rewards. After the implementation of SIMD-96, the deflationary pressure from burning tokens will become negligible.

In many jurisdictions around the world, receiving inflation rewards in the form of additional tokens is considered a taxable event, which can lead to selling pressure due to tax obligations. This impact is difficult to quantify.

Proof-of-Stake (PoS) inflation leads to long-term and sustained downward price pressure, distorting market price signals and hindering fair price comparisons.

Long-tail independent validators and ecosystem team validators tend to exhibit lower staking reward commission rates and rely less on inflation commissions than other validator groups (including exchanges and institutional validators).

Since December 2023, alternative sources of income for validators, including MEV commissions and block rewards, have increased significantly. This growth provides a potential path for a sustainable validator group in the future to become less dependent on inflationary commissions for operating expenses. However, it remains to be seen whether these alternative sources of income can remain elevated in the long term.

Введение

This report provides a comprehensive analysis based on data and facts, aiming to clear up the doubts (FUD) and misinformation surrounding Solanas inflation plan. The analysis is divided into three parts: past, present, and future.

Past: A review of Solana’s token economics before inflation, detailing key events including token sales, unlocks, and early token burns.

Now: Quantitatively evaluate the current inflation schedule and disinflation factors, including transaction fee burning, penalty slashing, user-related losses, and rent. Also discuss the possible impact of the upcoming SIMD-96 protocol update.

Future: Explores arguments for and against Solana’s current Proof-of-Stake (PoS) inflation rate and considers potential adjustments to the existing inflation schedule.

Important Definitions

First, we will formally define several important terms that will be used throughout this report. Readers who are already familiar with these Solana-specific definitions can skip this section.

Total Current Supply: The total number of SOL tokens in existence, including locked and unlocked tokens. More technically, the total current supply is equal to the total number of tokens generated minus the total number of tokens destroyed. At the time of writing, the current total supply is 583 million.

Circulating Supply: The total amount of SOL tokens circulating in exchanges, on-chain protocols, and user wallets, including both staked and unstaked SOL. The circulating supply is 466 million. More formally:

Circulating Supply = Current Total Supply – Non-Circulating Supply

Non-Circulating Supply: Non-Circulating Supply consists of two main forms: SOL tokens locked in staking accounts, and SOL tokens in unlocked staking accounts held by Solana Labs or the Solana Foundation. SOL in staking accounts are usually due to SOL investments or grants provided by the Solana Foundation. Each staking account has an unlock date set according to the vesting arrangement. Secondly, SOL tokens directly owned by Solana Labs or the Solana Foundation, which are held in unlocked staking accounts. The Foundation currently uses a large portion of this (currently 51 million SOL ) for its delegation program. At the time of writing this article, the non-circulating supply is 117 million.

Locked Tokens: Locked tokens are those tokens held in staking accounts that have conditions set so that they cannot be withdrawn before a predetermined date. These locking parameters are based on a specific UNIX timestamp, or epoch, and are set by the designated custodian when the account is created. Locked staking accounts can be undelegated, split into smaller accounts, and re-delegated to other validators. However, these tokens cannot be withdrawn or transferred to other addresses until the lock-up period expires. While any user can create a locked staking account, this practice is primarily used by the Solana Foundation to distribute tokens and grants, and these allocations often come with specific performance requirements or time locks.

The Past: Pre-Inflation and Early Token Economics

On March 16, 2020, 500 million SOL tokens were minted in the genesis block of the Solana Mainnet Beta cluster. During its first year of operation, Solana had no inflationary staking rewards. On March 24, 2020, 8 million SOL tokens were sold to non-US buyers via a Dutch auction on CoinList . The auction raised just $1.76 million , with a final liquidation price of $0.22 per token. The tokens from this public auction, plus a small number of tokens distributed through a series of airdrops on Binance, make up Solana’s initial circulating supply.

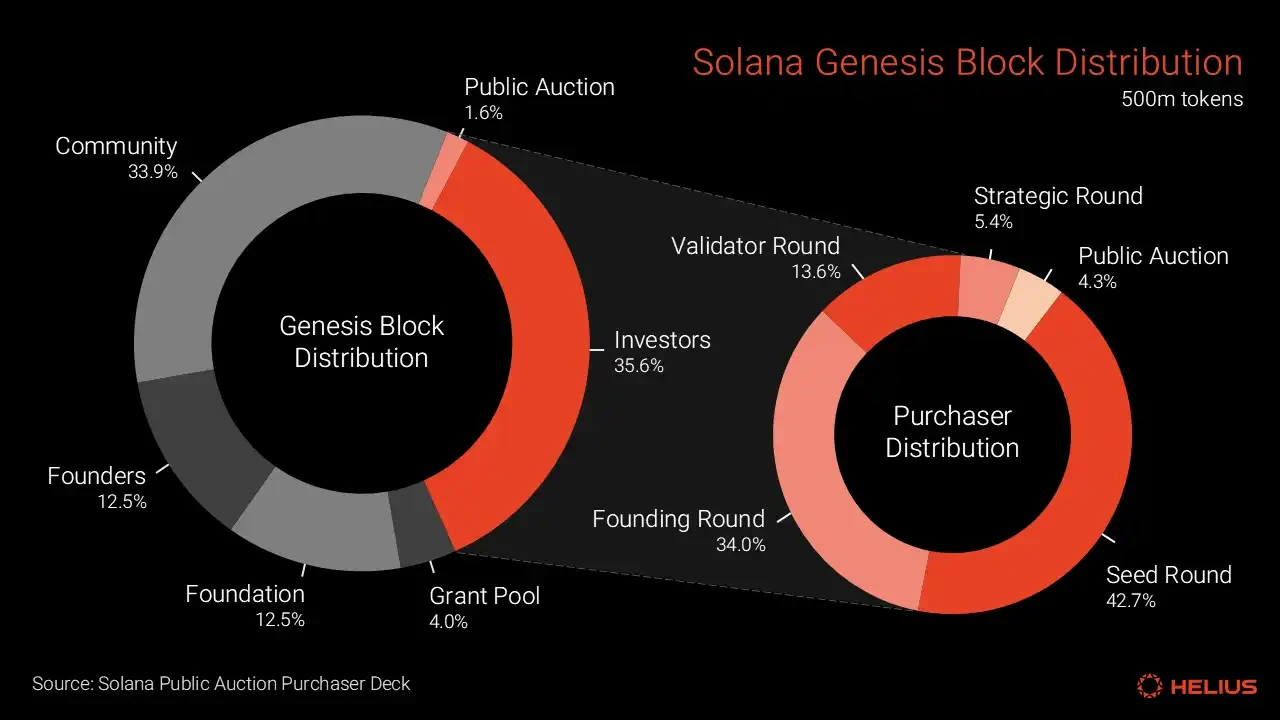

Solana Genesis Block Distribution, extracted from the original public auction purchaser

During this period, Solana has faced significant challenges in raising capital compared to many of its peers in the industry. For example, Algorand successfully raised $60 million through a similar CoinList auction six months ago, while Hedera Hashgraph raised $100 million from institutional and high-net-worth individual investors eighteen months ago.

“We tried to raise more bridge funding before we launched in 2020, but it didn’t work out. We had to lay off a third of the team to extend the time we had to use the funding. We launched in March as quickly as possible, and the pressure was very high… We announced the auction, and two days later, on March 16, 2020, all the markets collapsed. The world was in chaos, and we only had six or seven months of funding left.”

This period of cash shortage shaped many important early decisions.

“It forced me to adopt a specific strategy, which in hindsight was the right one… If we had as much money as our competitors, I probably would have followed their lead and supported the EVM; we had to support the EVM… It turns out that the best decision we could have made was to build a runtime that was purely optimized for performance.”

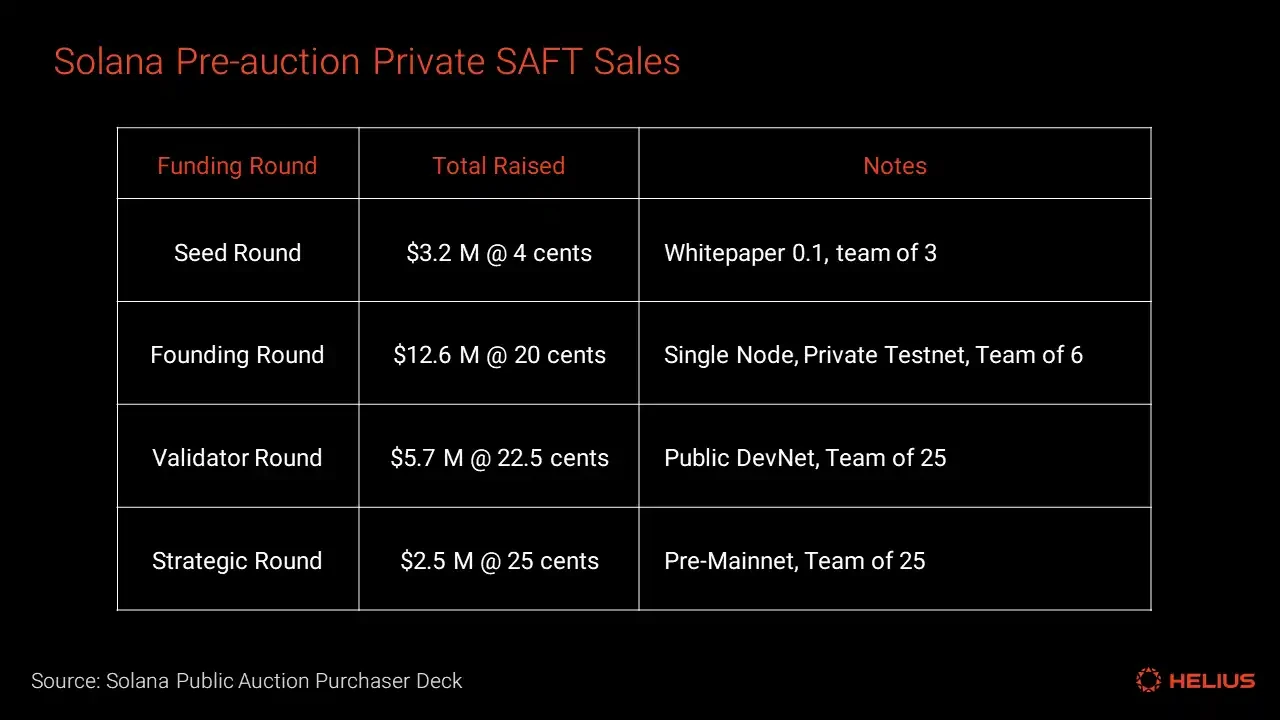

Private SAFT sales prior to auction ( source )

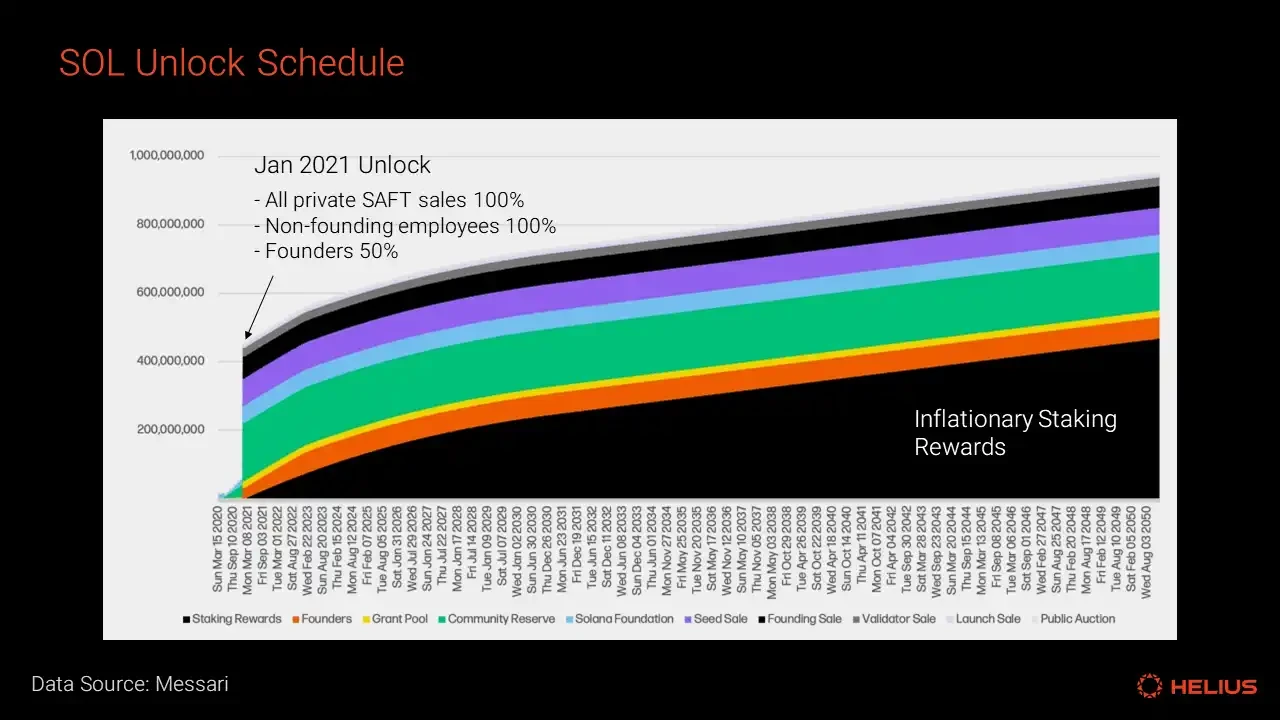

Approximately nine months after the auction, all tokens of early token holders who participated in the pre-auction private SAFT sales (i.e., Seed, Founding, Strategic, and Validator rounds) were unlocked. Founding team members unlocked 50% of their tokens, and the remaining 50% will be unlocked gradually over the next 24 months. Non-founding employee tokens were also fully (100%) unlocked at this time, but there were undisclosed sales restrictions (source).

Solana’s Unlock Plan

In May 2020, in response to early community concerns about lending tokens to market makers, the Solana Foundation permanently removed 11.36 million SOL from its holdings, reducing the total supply to 488.64 million.

Currently: Solana’s Inflation Plan

According to community voting, the inflation of Solana Mainnet Beta was officially запущен on February 10, 2021 at slot 64800004 (epoch 150), with the first payment of 213,841 SOL.

An inflation schedule is a deterministic description of a token issuance schedule that includes three key parameters:

Initial inflation rate (8%): The starting inflation rate when inflation is first started

De-inflation rate (-15%): the rate at which inflation decreases in each epoch year

Long-term inflation rate (1.5%): Stable long-term expected inflation rate

At the time of writing, Solana’s inflation rate is 5.07%. You can view it using the command “solana inflation” or the RPC method “getInflationRate” in the Solana CLI tool suite .

Solana’s inflation plan (source)

An epoch year consists of 182.5 epochs, which is the number of epochs a year would contain if each epoch lasted exactly two days. An epoch has 432,000 slots , and each slot should take at least 400 milliseconds. However, because block times are variable, epochs can often exceed this two-day minimum, extending by several hours (e.g., the most recent epoch 661 was 2 days and 4 hours). In early years, Solana’s mainnet cluster often experienced slower three-day epochs (e.g., epoch 322 was 3 days and 3 hours), which significantly extended the progress of the inflation schedule when calculated in standard years.

For example, as I write this on August 30, 2024, Solana is currently at epoch 663. This is the 513th epoch since inflation started at epoch 150 on February 10, 2021, which is equivalent to 2.81 epoch years, but spans 3.55 standard years.

The following chart models the current total supply based on an inflation schedule starting with an initial 488.6 million SOL in February 2021 (500 million minus 11.3 million burns).

The original community forum discussion about how these specific parameters were chosen is no longer available. However, at the time, Solana co-founder Anatoly Yakovenko revealed some clues in an интервью .

“I don’t think the inflation parameters will be too different from Cosmos because our validator set has a lot of overlap with that network, and it’s pretty much the same people. Also, Cosmos’ inflation schedule seems to work well, so we don’t have to experiment. When things work for other networks, we will definitely borrow those ideas.”

Additionally, an early brief outline of staking rewards in the Solana GitHub repository also mentions the impact of Casper FFG.

Inflation Allocation Mechanism

The Delegated Proof of Stake (DPoS) consensus mechanism is natively integrated in Solana. Users can directly access the staking interface through wallets, ecosystem dApps, and various comparison platforms. Token holders can easily stake SOL to the validator of their choice and unstake at the end of each epoch. In addition, they can also delegate tokens to staking pools or purchase liquid staking tokens , which is actually equivalent to staking. Delegating tokens to a validator implies trust in the validator, but does not give the validator ownership or control over the tokens.

Staking rewards are first divided based on the points earned within the epoch. Each time a validator votes for a block that is subsequently confirmed and becomes final, the validator will receive a point. A validators share of the total points (i.e., their points divided by the sum of all validators points) determines the proportion of rewards they receive. This proportion is also weighted by the amount staked. If a validator has 1% of the total stake and their points are average, then the validator will receive approximately 1% of the total inflation rewards . If the points are above average, the rewards will fluctuate accordingly. Voting points are a quantitative measure of the participation and correctness of an individual validator in the consensus process. Validators being offline (i.e., inactive) or out of sync with the chain will significantly affect their rewards.

Inflation rewards are calculated and distributed to the delegators’ staked accounts at the end of the epoch. Since there are more than one million staked accounts to distribute, the resource consumption is large, which will slow down the network and cause frequent consensus forks at the end of the epoch.

Validators charge a percentage commission for their services as part of the inflation reward for delegators. This commission is usually in the single digits, but can theoretically be anywhere between 0% and 100%. There are currently over 200 private Solana validators whose staked funds may be fully owned and self-delegated by the operating entity. These fully self-staking SOL validators can be identified by their 100% commission rate.

The following formula describes the notional staking yield from inflation rewards:

Nominal staking income = inflation rate * validator online rate * (1 – validator commission) * (1 / SOL staking percentage)

The SOL staking percentage is defined as:

SOL staking percentage = total staked SOL / current total supply

Staking returns will fluctuate with the inflation rate of each epoch, validator performance, and the ongoing changes in total active stake.

For a deeper dive into how Solana’s staking works, check out our Helius Staking blog post.

Proof of Stake Inflation Model

Anatoly Yakovenko pointed out in the Lightspeed podcast : “The biggest criticism is that Solana’s inflation rate is too high, which is a cost to the network. From a mathematical perspective, inflation is actually transferring value between non-staking users and staking users. It is indeed a cost for non-staking users, but at the same time it is a benefit for staking users. The market will strike some kind of balance with this.”

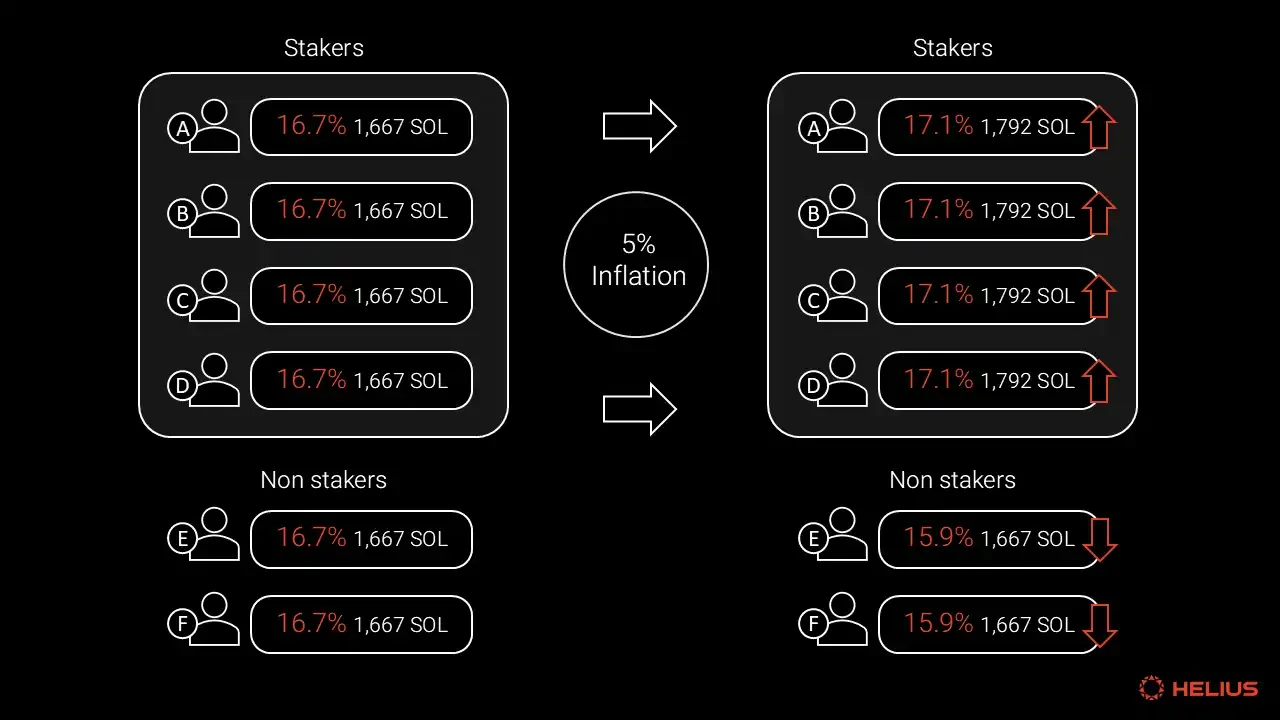

In general, Proof of Stake (PoS) inflation reduces the network share of non-stakers relative to stakers, and this dilution actually transfers wealth from non-stakers to stakers. This phenomenon can be demonstrated by a simplified model with the following parameters:

Total Token Supply: 10,000

Market value: $1 million

Annual inflation reward: 5%

Initial token holders: 6 users, each holding the same number of tokens

Staking rate: 66% (4 staking users, 2 non-staking users)

This model shows that as inflation occurs, the number of tokens of staking users increases relatively, while the shares of non-staking users are diluted, resulting in a redistribution of wealth.

Initially, each user holds 1,667 SOL tokens, representing 16.7% of the network share and a market cap of $166,666. Within a year, 500 new tokens will be distributed to stakers as inflation rewards. After a year, the four stakers will each have 1,792 SOL tokens, a nominal increase of 125 tokens (7.5%), and their network share has increased by 0.4% to 17.1%. Meanwhile, the two non-stakers have the same number of tokens and their network share has decreased by 0.8% to 15.9%. Assuming the total market cap of the network remains unchanged at $1 million, the value of each SOL will decrease from $100 to $95.23. However, the total value of each stakers network share will increase by $3,968 (an increase of 2.4%). Correspondingly, the value of each non-stakers token will decrease by $7,936 (a decrease of 4.8%).

This model shows how Proof of Stake (PoS) staking not only prevents dilution, but actually strengthens holders’ network ownership over time. Additionally, this simplified scenario accurately reflects Solana’s current inflation rewards. With Solana’s current inflation rate of 5.07% and a total supply of 583 million SOL, of which 378 million SOL are staked (a staking rate of 65%), users can expect similar annual value transfers through inflation rewards. Stakers gain approximately 2.4% in network ownership, while non-stakers lose approximately 4.8% in network ownership. Based on this simplified model, stakers should receive a nominal 7.5% SOL staking return per year, which is roughly in line with current actual returns. Of course, the actual situation is more complicated than this model, which we will discuss in detail in the subsequent discussion.

It is important to note that the percentage gain or loss in network ownership is the same regardless of the absolute number of tokens held by the user. The two key variables are the inflation rate and the percentage of SOL staked.

SOL staked by epoch since the genesis block ( source )

Solana has a relatively high staking rate compared to other industry networks, in part due to the ease and user-friendliness of its staking process. However, since reaching 370 million SOL in epoch 202 in July 2021, the amount of SOL staked has remained relatively stable (as shown in the chart above), despite the inflation of the total supply due to staking rewards. This means that Solanas SOL staked percentage is slowly decreasing over time, which is a favorable dynamic for stakers.

Although the total amount of SOL staked remains stable overall, there is still significant fluctuation, with the amount of SOL staked and unstaked in each epoch often reaching seven figures. This fluctuation is mainly driven by the flow of funds within the staking pool.

Weekly staking changes ( source )

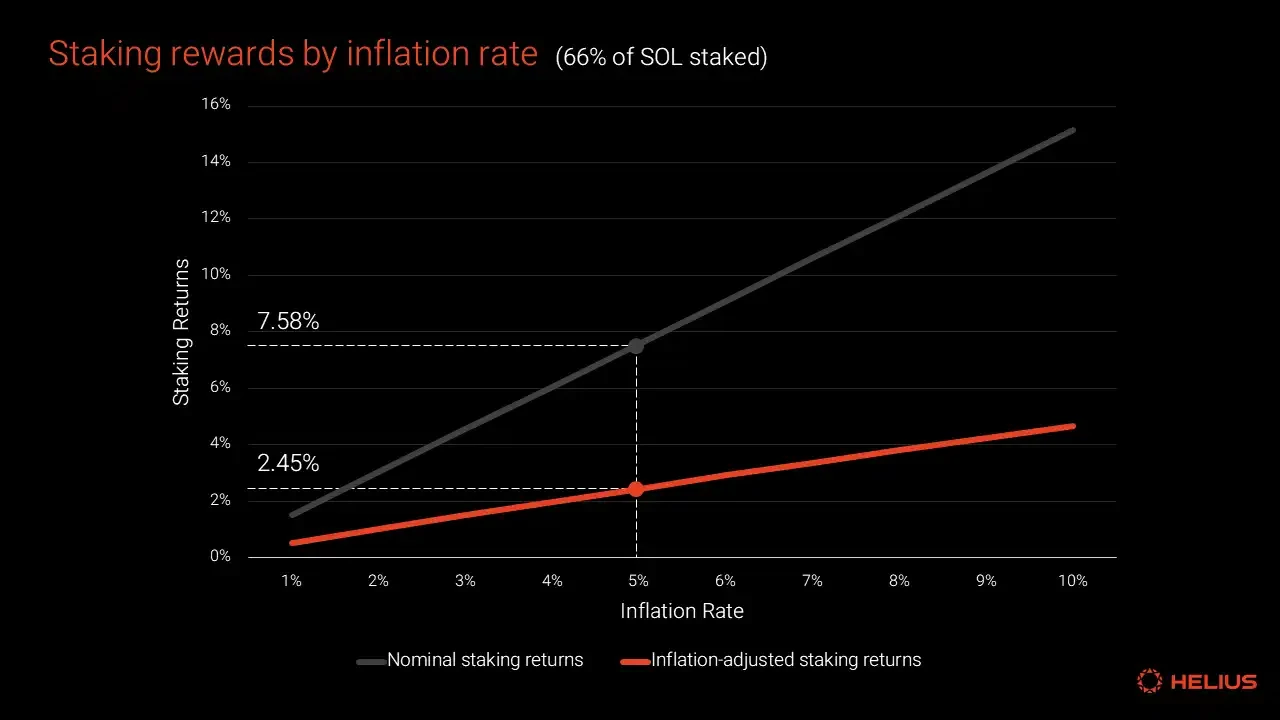

As mentioned earlier, the current SOL staking percentage is 65% and the inflation rate is 5.07%. Assuming the staking rate remains at two-thirds, we can plot the inflation-adjusted and unadjusted charts of staking rewards, showing the nominal return and the return adjusted for inflation, respectively.

Nominal and inflation-adjusted staking rewards assuming a constant SOL staking rate of 66%

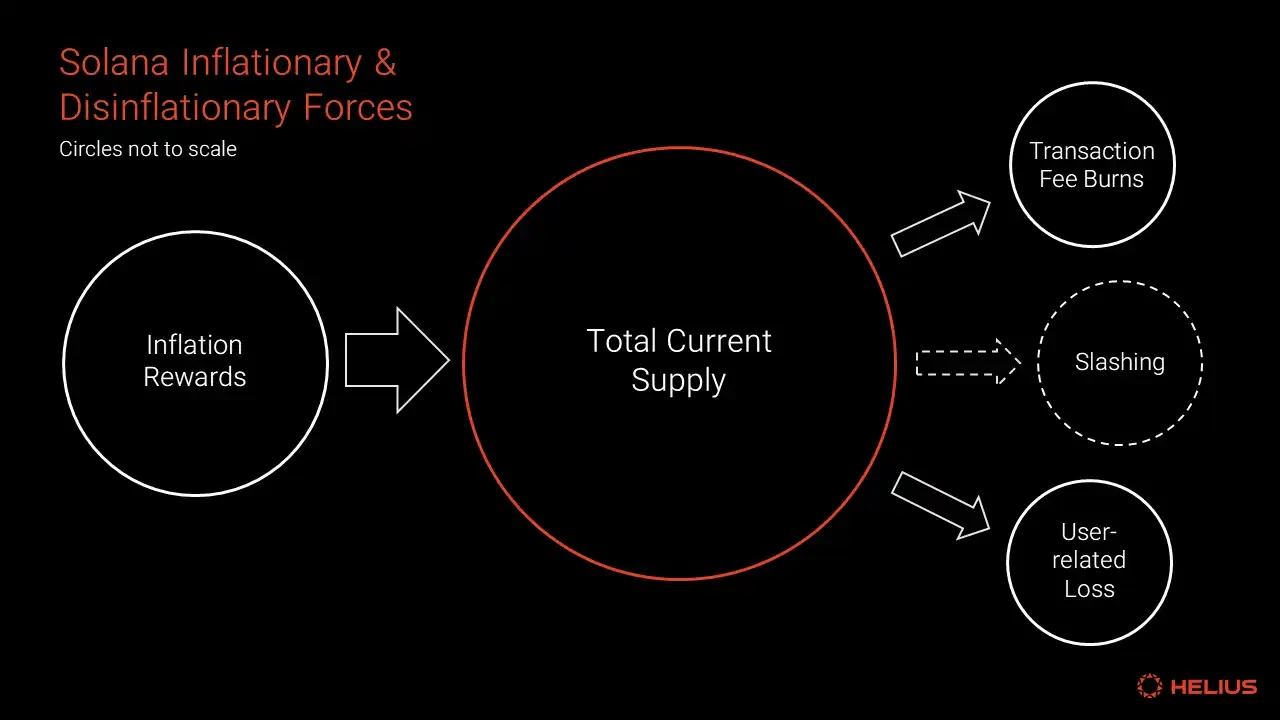

Disinflationary forces

Next, we will analyze Solana’s disinflationary forces, and we identify three types: transaction fee destruction, punitive slashing, and user-related losses. In addition, we will consider the impact of Solana’s leasing mechanism on inflation. This section introduces the term “net inflation”, which is defined as follows:

Net inflation = gross inflation – gross disinflation

Transaction Fee Destruction

All graphs and data in this section are based on a dataset provided by Zan of Shinobi Systems . The raw data is available in a spreadsheet (click to view). Readers are encouraged to perform their own analysis.

Transaction fee burning is the only protocol mechanism that directly removes SOL and reduces the total supply. Previously, the fee burning mechanism consisted of burning 50% of the base fee and 50% of the priority fee of all transactions in each block. The base fee (also known as the signature fee) is fixed at 5,000 lamports per signature, regardless of the complexity of the transaction – usually each transaction contains one signature. The priority fee is technically optional, but is gradually becoming standard practice. These fees are priced in microlamports (one millionth of a lamport) per computational unit.

Priority fee = Compute unit price (microlamports) x Compute unit limit

This structure will change with the passage of SIMD – 96, which will be implemented with Agave 2.0 shortly after Breakpoint 2024 according to the current release plan. In the future, 100% of priority fees will go to block producers, removing their incentive to make deals outside the protocol.

Starting from Epoch 544 on December 10, 2023, there is a clear turning point in priority fees. The highest total fee burn occurred in Epoch 590 (starting on March 18, 2024), with a total of 13,212.31 SOL burned. In the last 100 epochs, the average total fee burn per epoch is 5,372.16 SOL.

Total SOL fee destruction by epoch before SIMD-96 (priority + signature fee)

In Epoch 546, which began on December 14, 2023, fee burns accounted for more than 1% of total staking rewards for the first time, and reached a peak of 7.8% in Epoch 590, which began on March 18, 2024. Over the last 100 epochs, fee burns have averaged 3.2% of total staking rewards. However, if we apply the SIMD-96 rule changes (removing priority fee burns) to simulate fee burns, the total amount burned will never exceed 1% of total staking rewards at any point in Solanas history. If the SIMD-96 changes were implemented over the last 100 epochs, total issuance would increase by 2.81% (for example, an epoch with 5% net inflation would rise to 5.14%). Previously, validator community members estimated that this increase in total issuance could be slightly higher, at 4.6%.

Analysis of net inflation per epoch (defined as total staking rewards minus total fee burns) shows that new SOL token issuance far outweighs the impact of token burns in the protocol. Furthermore, with the implementation of SIMD-96, the already limited impact of token burns will be further reduced to almost negligible.

В the Solana forum discussion about SIMD-96 , a comment from 7 LayerMagik (Overclock validator) summarized the impact of SIMD-96 on inflation:

“This SIMD will make it much harder for transaction fees to create significant deflationary pressure. While transaction fee burns may currently be masked by the issuance of inflationary tokens, it is still possible that fee burns will have a larger impact in the future — however, this SIMD makes them much more insignificant in that regard. Whether deflationary pressures matter is up for debate.”

One final point worth noting is that unlike the inflation plan, which was formally voted on by the community, the initial decision to burn 50% of the priority fees did not go through a formal governance or consensus process.

User-related losses

User-related loss is a broad term that refers to situations where SOL is permanently lost through unfortunate means such as user error, security incidents, program vulnerabilities, or loss of private keys. For example, previous estimates show that about 0.76% of the total supply of Ethereum (912,296.82 ETH), worth about $2.3 billion at the time of writing, has been permanently lost due to similar incidents. More than half of these losses can be attributed to a security incident in 2017, which resulted in the freezing of more than 500,000 ETH.

Lost ETH by type (source)

Bitcoin is another notable example where data is available. There are approximately 1.75 million Bitcoin wallets that have not been used in a decade or more, holding a total of 1,798,681 BTC, valued at approximately $106.3 billion at the time of writing. This figure does not include approximately 30,000 wallets believed to be associated with Bitcoin creator Satoshi Nakamoto. These long-dormant coins represent 8.3% of the total fixed supply of 21 million Bitcoins. While it is impossible to be sure, given the many high-profile cases involving users unable to access their Bitcoins due to lost or forgotten keys, many of these coins may have been lost forever.

As Solana network activity grows, user-related losses will inevitably occur. Storing private keys securely for a long time is challenging, and even professional wallet service providers can make mistakes . Additionally, token holders may not transfer their private keys before death, resulting in the loss of tokens.

Punitive cuts

Although such mechanisms were considered in Solana ’s early economic design , programmatic punitive slashing has not yet been implemented. The official documentation describes a manual social slashing process that has been tested on the testnet:

“…after a security breach, the network will be suspended. We can analyze the data, identify the responsible parties, and recommend slashing their stake after the restart.”

For completeness, we include slashing in our analysis as one of the known ways that proof-of-stake networks reduce token supply. However, because this happens infrequently, the impact of slashing on the overall inflation rate may not be significant. Additionally, some initial proposals for automatic slashing suggest freezing staked tokens for a number of epochs, making them ineligible for rewards, rather than slashing the principal directly. Therefore, these methods may not actually reduce token supply.

Rent mechanism

While rent is not a true de-inflationary force, it is still worth discussing in this context. All Solana accounts are required to hold a minimum “rent-free” SOL balance, which is required to pay for storage and ensure that the account remains active in the validator’s memory. This minimum balance requirement is proportional to the amount of data stored and is fully refundable when the account is closed. Solana’s rental rate is network-wide and is set to the number of lamports per byte per year based on a runtime constant. For example, a standard user token account ( linked token account ) has a rent-free balance of 0.002 SOL. This mechanism helps reduce state bloat and incentivizes users to close unused accounts.

Many programs automatically manage rent refunds for users, and there are несколько приложения that help users get rent back from unused accounts. However, despite these tools, many Solana users still don’t have a good understanding of how rent works. Additionally, some applications fail to provide users with an easy way to recover rent.

А почта on the Jupiter DAO forum points out the problem of high rental costs caused by large-scale on-chain DAO voting

Each rent payment represents a temporary lock of SOL, which constitutes a user-related loss if it is not recovered. While the rent amount for a single account is very small, these small losses can accumulate into a considerable total when all applications and users are considered. In the future, ZK compression technology may partially alleviate these high account costs.

The Future: Is It Time for a Change?

“It’s just some numbers moving around in a black box… The current inflation plan is probably too high. Even if it were reduced tenfold, everything would be fine. I think in the end these costs are not that important.” – Anatoly Yakovenko ( source )

In this final major section, we’ll first briefly quantify the remaining non-circulating supply unlocking schedule. We’ll then discuss arguments for modifying Solana’s token issuance, including the concept of “issuance as a network cost,” the tax inefficiency of inflation, the downward price pressure of inflation, the punitive effect on network usage, and the rise of alternative validator revenue sources. Afterwards, we’ll explore some practical ways to adjust the inflation schedule and reduce inflation.

Unlocking of future non-circulating supply

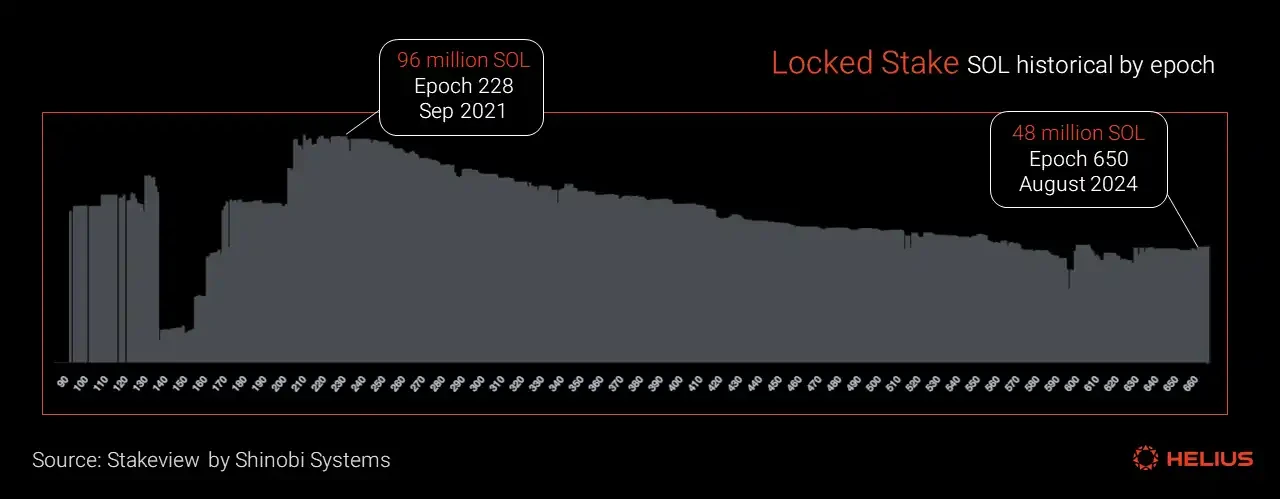

Over the past three years, Solanas locked stake unlocking rate has been relatively stable, falling from a peak of 96 million SOL in September 2021 to 48 million SOL in September 2024, an overall reduction of 50%.

Locked staking historical data (source)

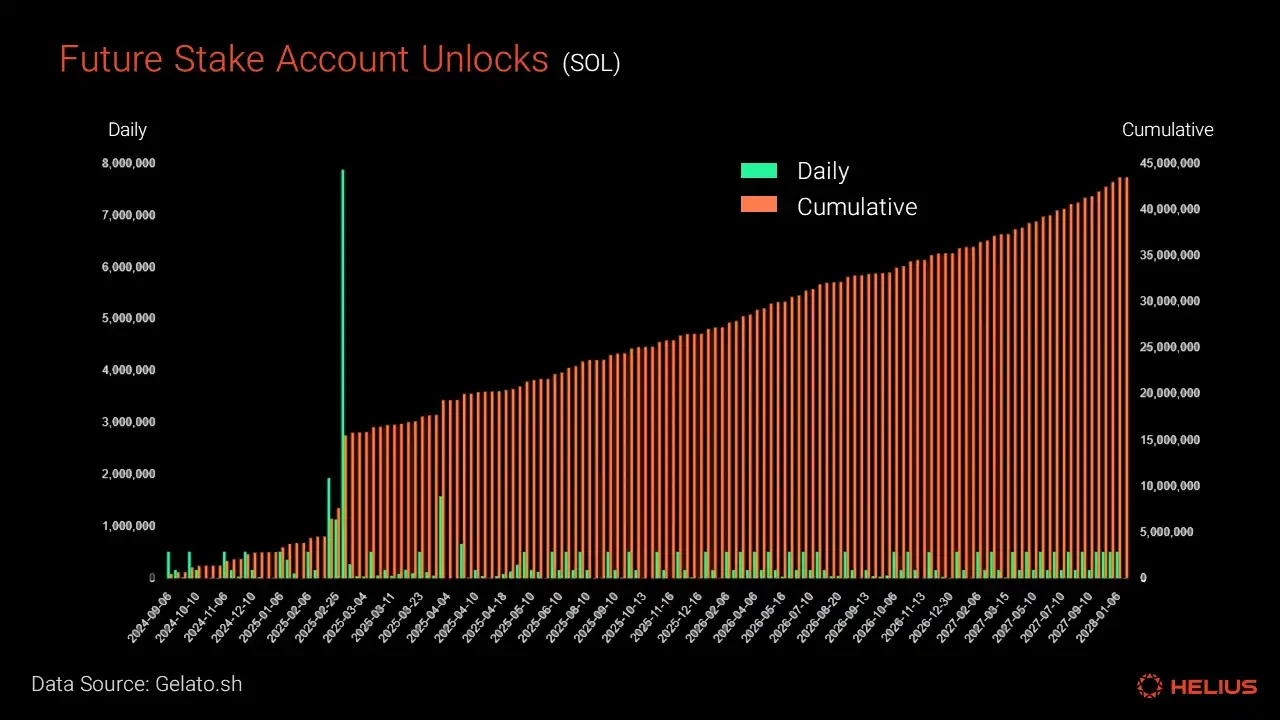

At least 43.5 million SOL tokens remain locked in staking accounts, representing 7.5% of the current supply. This includes 41 million SOL tokens sold to large industry entities such as Galaxy Digital and Pantera during the FTX Asset bankruptcy proceedings earlier this year. Some companies, such as Neptune Digital Assets, have publicly announced the details of their purchases – Neptune purchased 26,964 SOL at $64 per coin. 20% of these tokens will be unlocked in March 2025, and the remainder will be unlocked linearly every month until early 2028. This unlocking schedule is consistent with the on-chain locked staking account data (see chart).

Future unlocking of pledged accounts (data source)

Below, we present several reasons for adjusting Solana’s issuance.

Issuance as a network cost

A common argument against inflation in Proof of Stake (PoS) is that inflation is an explicit cost to the network and that token issuance constitutes part of the blockchains profitability, calculated as follows: Profit = Destruction – Issuance. However, this argument is incorrect . Inflation cannot be understood in this way, it is actually just a redistribution of wealth between all token holders and stakers, and all token holders have equal rights to receive this cash flow.

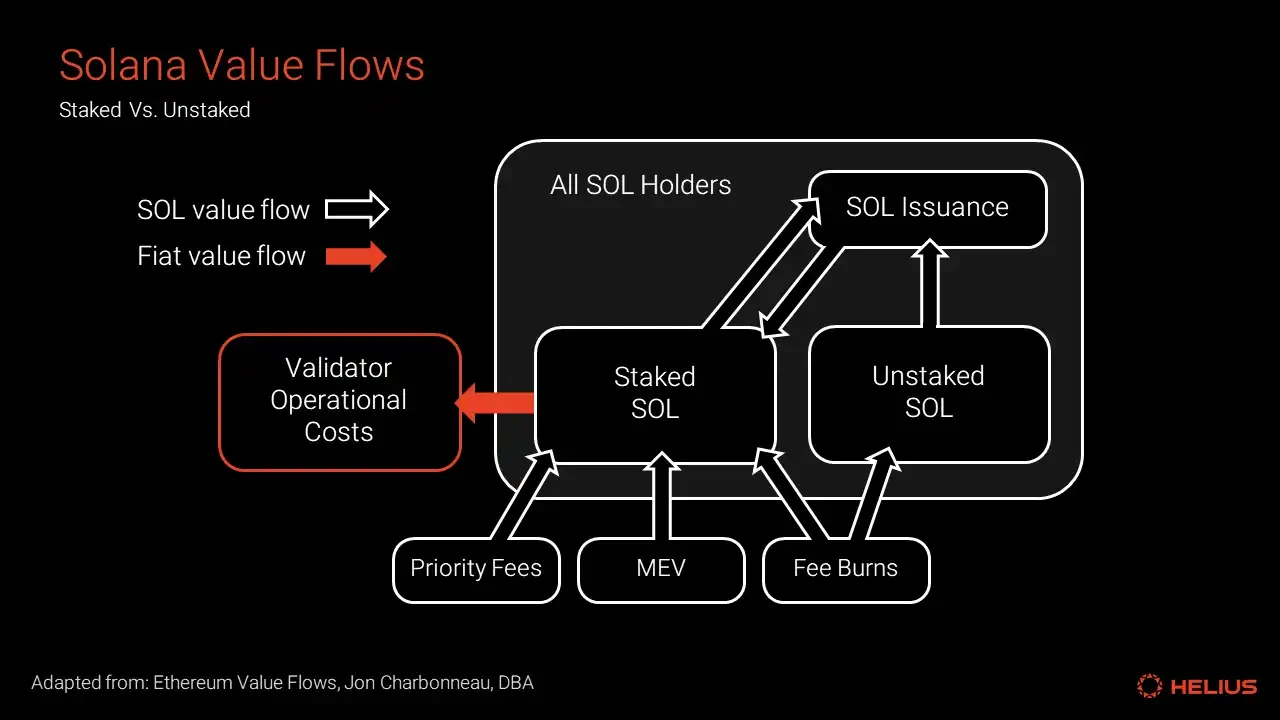

The only network cost associated with inflation is the portion of value that flows from stakers to validators, which is then used to pay operating expenses, as shown in the figure below.

Solana Value Flow, adapted from this source

We can begin to quantify this flow of value by looking at the total staking reward commissions paid to validators, which is currently around 44,000 SOL per epoch. However, this figure is greatly inflated by the presence of private self-staking validators, which receive a 100% commission rate.

Total staking reward commissions paid to validators by epoch

Tax inefficiency

In many jurisdictions around the world, receiving inflation rewards in the form of additional tokens is considered a taxable event, similar to stock dividends. This type of income is generally taxed as income tax when received. This tax burden may cause stakers to have to sell some of their tokens each year to pay taxes, creating constant selling pressure. Quantifying this effect is extremely difficult because tax laws are complex and vary greatly around the world. Even within the same jurisdiction, individuals tax liabilities can vary significantly. In addition, because staking is permissionless, it is difficult to trace token ownership back to an individual.

The Jito Сообщение блога mentions that rebasing Liquid Staking Tokens (LST) could help reduce this tax burden:

“Non-rebased LST on Solana may allow users to claim rewards without triggering a taxable event, as the number of LST tokens in the wallet will not change (please consult a financial professional for advice specific to your situation).”

However, conversions between SOL and staked SOL may also constitute taxable events in themselves. In addition, as we explored in previous SFDP reports , overall adoption of LST on Solana remains low. Currently 94% of staked SOL is natively staked, with only 6% of SOL (24.2 million SOL) being liquid staked, compared to 17 million SOL at the beginning of 2024 and 12.4 million SOL a year ago (95% annual growth).

Downward price pressure

Inflation can cause long-term, sustained downward price pressure, which distorts market price signals and prevents fair price comparisons. An analogy from traditional financial markets can be used to explain: PoS inflation is similar to a public company doing a small stock split every two days. Charts, dashboards, casual observers, and marginal retail investors do not usually consider the impact of inflation in their analysis.

A favorable price chart is the best advertisement for the ecosystem, not only for traders but for all ecosystem participants. In a psychology-driven market like cryptocurrency, price is a coordination point and a signal of the health of the ecosystem. Strong price performance is always the best marketing – price drives the narrative.

Consider two different scenarios. I currently hold 100 SOLs, each worth $100, for a total value of $10,000.

Scenario A: I choose to stake these SOL and wait for a year. Although the price has dropped by 5% during this period, as a staker, I received 12% inflation rewards. I now hold 112 SOL, each worth $95, with a total holding value of $10,650.

Scenario B: I choose not to stake. The price of SOL increases by 5% in one year. I still hold 100 tokens worth $105 each, for a total holding value of $10,500.

In absolute terms, scenario A makes me slightly better. However, scenario B feels more satisfying because of the higher prices, even though this perception is irrational. The psychological impact of prices is often overlooked or underestimated because they are inherently difficult to quantify. People tend to make decisions or policy judgments based on quantitative data, even though qualitative factors may be equally or even more important.

Penalizing Internet Use

Proof-of-Stake (PoS) inflation actually penalizes users who actively use SOL on-chain, such as participating in liquidity pools, NFT trading, or placing orders – the opposite of what a network seeking growth should incentivize. While Solanas mature and robust Liquid Staking Token (LST) infrastructure can partially mitigate these negative effects by allowing SOL to be actively used without dilution, it also introduces additional costs. These costs include friction in the user experience, fragmentation of liquidity between different tokens, potential slippage when converting between LST, and the burden on users to understand the staking mechanism to protect themselves from the indirect costs of dilution.

Some respected industry commentators have noted that a majority of the native token should be productive and that the ideal staking ratio should be close to 10%.

Balancing high state costs

Downward price pressure from inflation could help mitigate Solana’s high state storage costs. These costs were set when the price of SOL was much lower than it is today. The Solana developer community often complains about the high cost of deploying programs on-chain, which often costs hundreds or even thousands of dollars in SOL.

Solana developer community members voice their opinions (X Platform post)

Viable Alternative Sources of Validator Income

As mentioned in our previous SFDP report , validators have three main sources of income: MEV (Maximum Extractable Value) commissions, block rewards, and commissions on staking rewards.

The source of operating income for a validator depends on its staking situation.

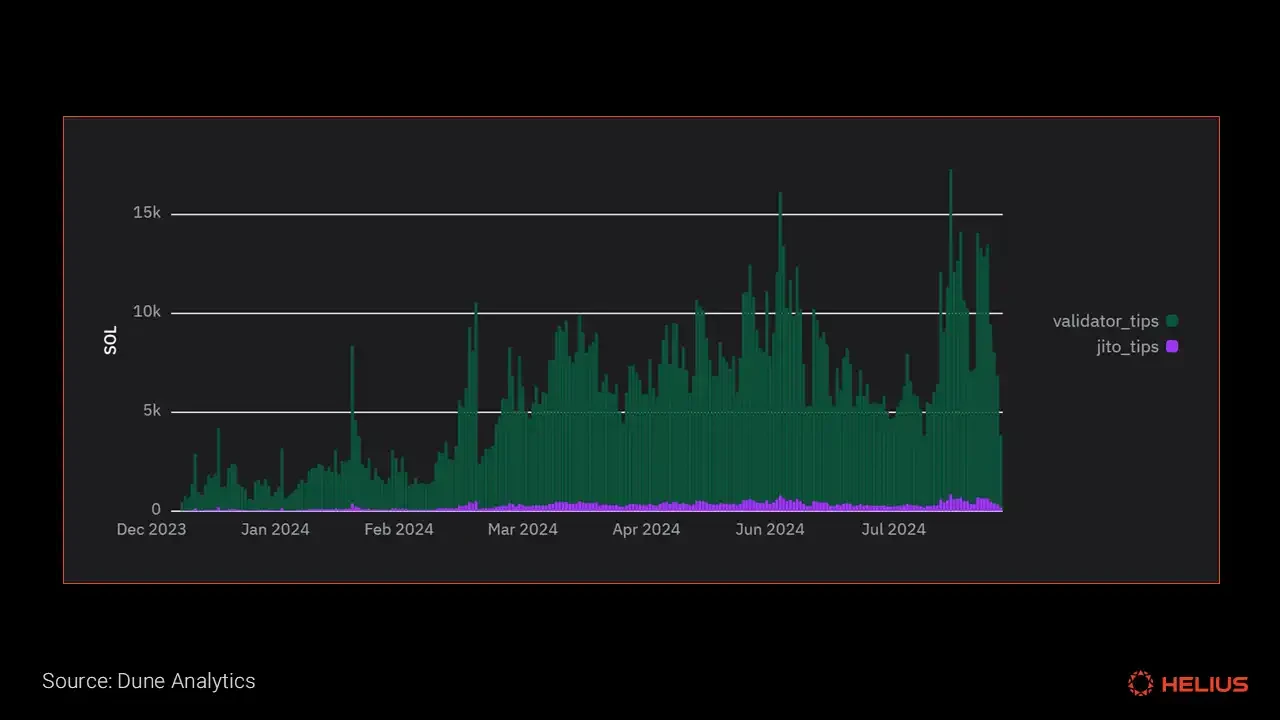

MEV commissions and block rewards have increased significantly since December 2023. In the fee burning section of the report, we discussed the data on priority fees. The following chart shows the growth of MEV.

Jito daily tip growth in 2024 (Dashboard)

The ratio of these three income sources will vary from validator to validator, depending on the validator’s total stake, commission level, percentage of self-delegated stake, commissions paid to projects like staking pools or staking auction markets like Marinade Finance, and overall performance metrics like inactivity rate and voting delays.

However, it is easy to identify the groups of validators that benefit the most from high inflation, including highly staked exchange validators that serve off-chain retail users and some institutional-focused validators. These validators typically have relatively high commission rates, such as Coinbase (8%), Binance Staking (8%), Kraken (100%), and Upbit (100%). Institutional examples include Everstake (7%), Twinstake (10%), Hashkey (7%), and P2P (7%).

On the other hand, ecosystem teams (e.g. Jupiter 0%, Solflare 6%, Mrgn 0%, Helius 0%) and independent validators (e.g. Melea 0%, StakeHaus 0%, Shinobi Systems 3%, Laine 5%, Solana Compass 5%) typically exhibit lower commission rates and benefit less from inflationary commissions. This is because these validators, especially the long-tail independent validators, must compete for market share by targeting active stakers on the chain that respond based on the annualized yield (APY). These stakers are the most price sensitive and seek the highest returns.

Overall, alternative revenue sources outside of inflationary commissions have grown significantly in 2024. However, it remains to be seen whether these alternative revenue sources can remain at such high levels in the long term. At the same time, the validator groups that benefit the most are those exchanges and institutional validators that charge higher fees, which account for a disproportionate share of the networks super-minority and super-majority.

This section uses data from Solana Beach as the source of staking commissions. For further exploration of the validator community, see our previous SFDP report .

Staking Incentives

Anatoly Yakovenko ( source ) once said: Rationally, you need some stakers to choose the quorum. The quorum will not cause security violations such as network outages, but in a well-managed system, the quorum cant actually do much. You need some incentives to get people to stake and thus choose the quorum. You also need some punishment mechanisms, such as slashing, to ensure that people do a good job in choosing the quorum, thats all.

Inflation rewards encourage users to stake their tokens, thereby enhancing the security of the network. Although Solana’s current staking rate is relatively high at 65%, a significant reduction in inflation rewards could change the equilibrium level of staking, potentially leading to some unintended consequences, such as a drop in governance participation.

Modifying the inflation planning model

One of my key principles has always been to either double a value or halve it. Dont waste time adjusting it by 5%, then 5%, then another 5%…just double it and see if it produces the effect you expect. – Sid Meier, creator of the game Civilization. Source: Sid Meiers Memoir

In this section, we will explore several hypothetical scenarios for modifying the inflation rate by adjusting three key parameters of Solana’s inflation schedule. This analysis aims to provide a clearer understanding of the impact of each parameter on the overall inflation rate.

Current parameters:

Initial inflation rate: 8%

Disinflation rate: -15%

Long-term inflation rate: 1.5%

These projection data can be found in this spreadsheet .

We will explore the following scenarios:

Scenario A: Doubling the deflation rate from -15% to -30%

Scenario B: Halving the long-term inflation rate from 1.5% to 0.75%

Scenario C: Immediately halve the current inflation rate from 5% to 2.5%

Scenario D: Halve the current inflation rate, double the deflation rate, and halve the ultimate inflation rate

Each scenario is designed to test the long-term impact of these key adjustments on the overall inflation rate, helping to understand how different strategies could change the inflation dynamics of the SOL.

The current inflation rate is projected to be approximately 5% from September 2024, with a total supply of 584 million SOL, simulating the impact over the next eight years. As shown previously, Solana’s token burn mechanism has minimal impact on supply after SIMD-96 implementation, so this factor is ignored in this analysis. To simplify calculations, inflation is calculated on an annual basis, with epoch years treated as equivalent to standard years. In addition, a baseline is provided where the current inflation schedule remains unchanged.

Halving the long-term inflation rate (Scenario B) would have little impact on inflation over the next eight years. This change would only reduce total supply by 1 million by September 2032. Doubling the deflation rate (Scenario A) would result in a total supply of 678 million after eight years, a 5.3% decrease from the baseline. Halving the current inflation rate (Scenario C) would result in a total supply of 664 million after eight years, a 7.3% decrease from the baseline. Finally (Scenario D), the combination of halving the current inflation rate, doubling the deflation rate, and halving the terminal rate would result in a total supply of 629 million after eight years, a 12.2% decrease from the baseline.

Solana total supply forecasts based on four hypothetical changes to the inflation schedule.

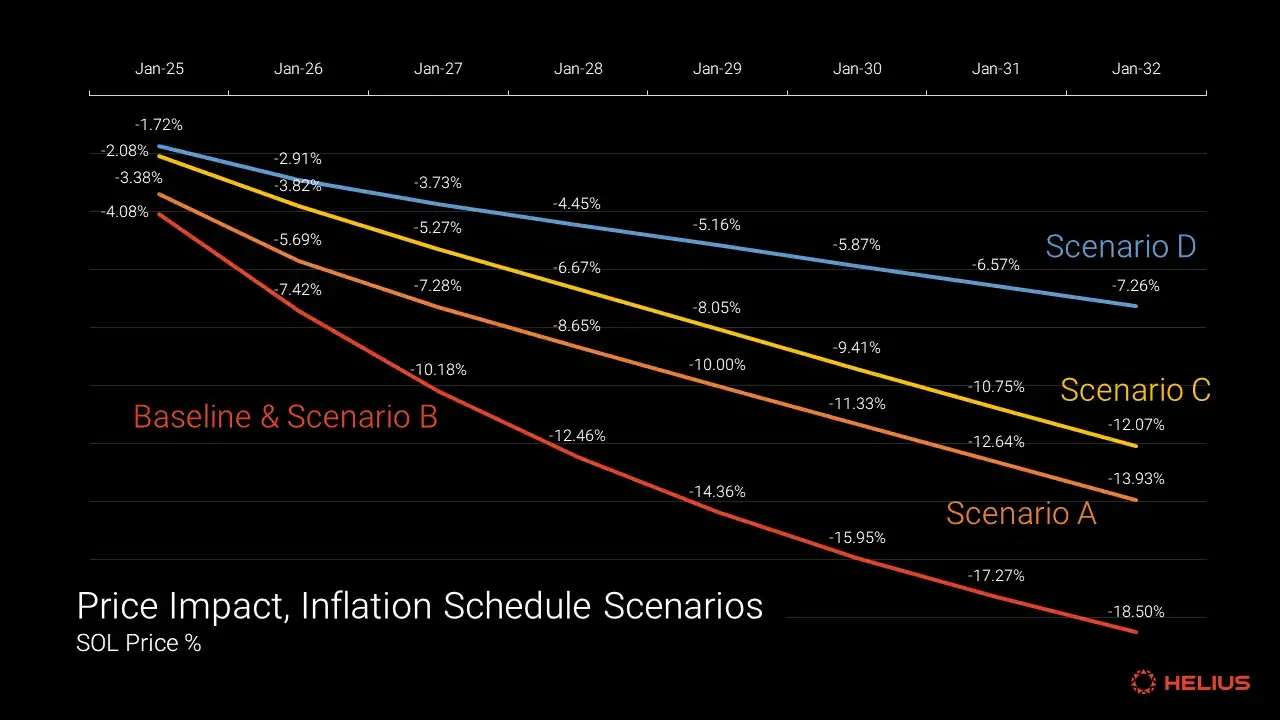

Based on these supply increases, we can simulate their expected impact on the SOL token price by holding Solana’s fully diluted valuation (i.e. token price current total supply) constant, while other variables remain constant (i.e. the “ceteris paribus” assumption). To illustrate, we assume a starting price of $150 for the SOL token.

In our baseline scenario, the current inflation reward schedule causes downward pressure on the price, causing the token price to fall by 18.5% in eight years, to $122.25. By doubling the deflation rate (Scenario A), the token price falls by 13.93% in eight years, to $129.10. Immediately halving the current inflation rate (Scenario C) causes the price to fall by 12.07%, to $131.90. Finally (Scenario D), halving the current inflation rate, doubling the deflation rate, and halving the terminal interest rate causes the price to fall by only 7.26% in eight years, to $139.10.

Solana price impact projections based on four hypothetical changes to the inflation schedule.

One direction for further research in the future is to analyze the impact of these changes on the inflationary commissions collected by long-tail independent validator operations, and the overall impact on the incentive mechanism for users to continue staking.

в заключение

This article explores Solana’s inflation schedule and token issuance mechanism from the perspective of the past, present, and future. We analyze the current mechanisms used to calculate and distribute inflation and identify countervailing forces that could reduce inflation. In addition, we assess the potential impact of SIMD-96, discuss the main arguments for adjusting the inflation rate, and analyze changes to the inflation schedule parameters through modeling assumptions.

Solana’s token launch has been subject to scrutiny with a lot of misunderstanding, and hopefully this report can provide clarity on some of the key questions. Through these analyses, we aim to foster more informed discussions and contribute to constructive dialogue that drives positive change.

This article is sourced from the internet: A comprehensive analysis of Solana’s token economy: Is SOL’s inflation rate high?

Related: VC and EigenLayer founder debate: Is Web3 data ownership a false proposition?

Original translation: Alex Liu, Foresight News Kyle Samani, Partner at Multicoin: I used to believe in owning your data, but not anymore. So-called “ownership” is really about “exclusivity.” This is most clearly seen when it comes to assets: a) I have a $5 bill and you dont. Therefore I can spend the $5 and you cant. b) I own a $1 million piece of art. Rather than loaning it to a museum for others to see, I hang it on my wall for my own enjoyment. Ownership — and therefore exclusivity — is why cryptocurrencies are so closely tied to finance. Now let’s think about what it means to own our data. To be honest, I don’t know what it means. Advocates of the concept of data ownership often accuse…