Оригинальный автор: 0xЛуиТ

Оригинальный перевод: TechFlow

The main reason investors often cite for Bitcoins rise is the digital gold scenario, where BTC will serve as a hedge against inflation. In traditional finance, gold is used as an inflation hedge because its value generally rises with inflation. Gold does not generate income; its returns come only from price appreciation. In fact, gold can even generate negative returns due to storage and insurance costs. Investors buy gold to preserve purchasing power, not to earn income. There is no such thing as a free lunch: you cant have it both ways.

Coming back to Bitcoin, the main theory shared by most BTCfi (BTC L2s etc) investors is that even if only 5% of circulating BTC enters yield-generating protocols, it could expand the space 100x. Therefore, most investors are betting on top-down growth: this space will grow faster relative to other sectors.

While the BTCfi story is compelling, I see BTC as more like gold than a yield-generating asset: at least that鈥檚 the theory held by many investors who see BTC as a macro asset and inflation hedge. Even if only 5% of BTC enters the BTCfi ecosystem, this expectation may be too optimistic.

The first conclusion is: if this is the base case, some valuations may already be high.

The second conclusion is: if you have accepted BTC as a tool to fight inflation, you may need to re-examine your BTCfi theory. You may be optimistic about two contradictory views at the same time. From a philosophical perspective, there is little overlap between BTC holders and yield seekers.

Counterpoint

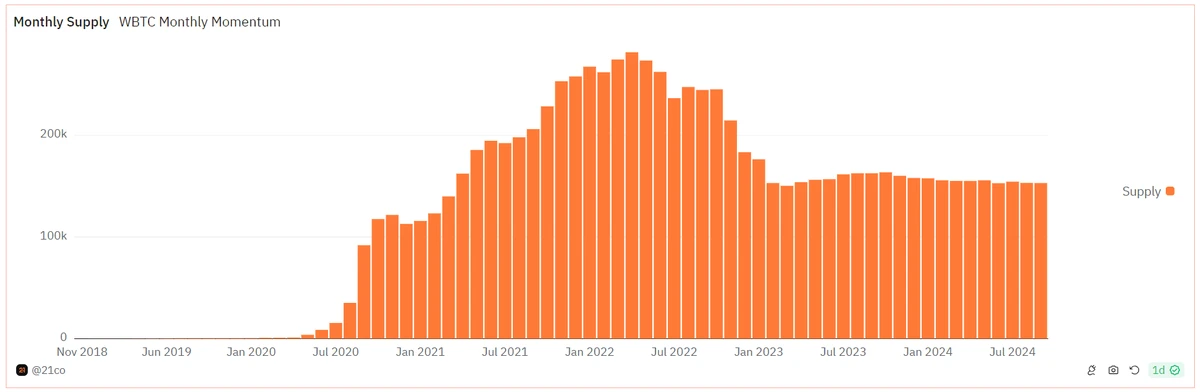

While I鈥檓 skeptical of the BTCfi theory, it鈥檚 also worth considering the opposite. The supply of wBTC over the last cycle and the BTC holdings of Celsius, BlockFi, and Voyager provide a good snapshot of the overlap between BTC holders and yield seekers. Currently, wBTC represents ~0.7% of BTC supply, while Celsius, BlockFi, and Voyager collectively hold ~$5 billion in BTC, or ~1.1% of total supply. Neither the decline of these platforms nor the stagnation of wBTC supply (see below) show any positive shift in demand for BTC yields in these metrics.

(Источник: @tomwanhh )

Finally, one could argue that since BTC is easier to store and trade than gold, there could be a higher demand for yield-generating opportunities due to its higher liquidity. However, the active supply of BTC has been declining since 2012.

In summary, I remain skeptical of the BTCfi thesis at current valuations, as philosophically and economically, there is little overlap between BTC holders and yield seekers.

Thanks to @f_s_y_y for help and data.

This article is sourced from the internet: Opinion: Why I am skeptical about BTCFi?

По теме: IOSG Ventures: Каков выход для однородной инфраструктуры ИИ?

Первоначальный автор: IOSG Ventures Благодарим Zhenyang@Upshot, Fran@Giza, Ashely@Neuronets, Matt@Valence, Dylan@Pond за отзывы. Цель этого исследования — изучить, какие области ИИ наиболее важны для разработчиков и какие могут стать следующими возможностями для взрыва в областях Web3 и ИИ. Прежде чем поделиться новыми исследовательскими идеями, я хотел бы сказать, что мы очень рады и взволнованы тем, что приняли участие в первом раунде финансирования RedPill на общую сумму $5 миллионов долларов США. Мы с нетерпением ждем совместного роста с RedPill в будущем! TL;DR Поскольку сочетание Web3 и ИИ стало горячей темой в мире криптовалют, создание инфраструктуры ИИ в мире криптовалют процветает, но не так много приложений, которые действительно используют ИИ или созданы для ИИ, и однородность ИИ…