Bitget Research Institute: Рынок полон негативных эмоций, а ускоренное падение прокладывает путь к ма

За последние 24 часа на рынке появилось много новых популярных валют и тем, которые могут стать следующей возможностью заработать деньги. . Среди них:

-

The sectors with strong wealth creation effects are: U-standard financial management pool with high annualized and low risk, and RWA sector (ONDO, Pendle)

-

The most searched tokens and topics by users are: Penpie, Flux, AAVE

-

Potential airdrop opportunities include: Major, Soneium

Data statistics time: September 4, 2024 4: 00 (UTC + 0)

1. Рыночная среда

In the past 24 hours, the cryptocurrency market suddenly plummeted, and the fear index fell to the lowest level since the market panic in early August. Bitcoin fell to $55,600, and the US spot Bitcoin ETF had a net outflow of more than $287 million yesterday. The main reason was the news that the Governor of the Bank of Japan reiterated yesterday that if the economic and price performance meets expectations, interest rates will continue to rise. In the near future, you can pay attention to the primary market projects that have not yet issued coins, such as the Ethereum L2 network Scroll released a 12-second animated video on the social platform, ending with the text Scroll.Soon., which may imply that major news will be announced soon.

On the macro front, the U.S. ISM manufacturing PMI report for August showed that the U.S. economy continued to shrink. According to the Feds usual data from the Chicago Mercantile Exchange (CME), affected by the weak data, traders raised the probability of the Feds 50 basis point rate cut in September from 30% a day ago to 39%. The main event of U.S. macro news is still Fridays August employment report, which may also be the final factor in whether the Fed will raise interest rates by 25 or 50%.

2. Сектор создания богатства

1) Recommended: U-standard financial management pool with high annualized return and low risk

основная причина:

-

The market sentiment is in panic and it is difficult to see a big rebound in the short term. Before the main uptrend comes, it is recommended to save a large amount of stablecoins and wait and see, waiting for the market to stabilize before making right-side transactions.

Recommended Projects:

-

Kamino: Currently the lending protocol with the highest TVL on Solana. The APY of Supply USDC on the platform is 13%, and the APY of Supply PYSUD is 19%;

-

Aries Markets: Currently the protocol with the highest TVL on Aptos. Currently, the APY of Supply USDC on the platform is 10%, and the APY of Supply USDT is 10.5%. Both borrowing and lending have APT as subsidy rewards, and the yield rate is relatively stable.

2) Sectors that need to be focused on in the future: RWA sector (ONDO, Pendle)

основная причина:

-

The RWA sector is still the most popular sector in the current cryptocurrency industry, and is considered to have a large market size. ONDO and Pendle occupy the RWA treasury tokenization track and the crypto asset interest rate swap market track respectively. The asset volume ceiling of these two tracks is extremely high, and the protocol income that the protocol can generate increases with the growth of asset volume. Investors should pay special attention to each round of market rebound.

Факторы, влияющие на перспективы рынка:

-

Total asset size of the protocol: The cash flow output of this type of protocol mainly depends on the asset size of the protocol. As the asset size accommodated by the protocol gradually increases, the income that the protocol can generate will also gradually increase, and the corresponding currency price will also have a strong performance.

-

Policy impact: As the cryptocurrency industry gradually passes various legislations and social recognition gradually increases, policies that are favorable to this track will also be one of the main factors for the rise of tokens in this track. As more asset management giants enter this field, I believe that the subsequent development of this field will steadily improve.

3. Горячие поисковые запросы пользователей

1) Популярные децентрализованные приложения

Penpie:

Penpie is an interest-bearing asset income aggregator built on Pendle. Due to an attack on its reward protocol, it lost about $27 million. The project has now announced that all deposit and withdrawal operations have been suspended due to a security vulnerability. The Penpie team is doing its best to solve this problem. According to market data, Penpie (PNP) fell below $1 and is now quoted at $0.96, a 24-hour drop of 35.4%.

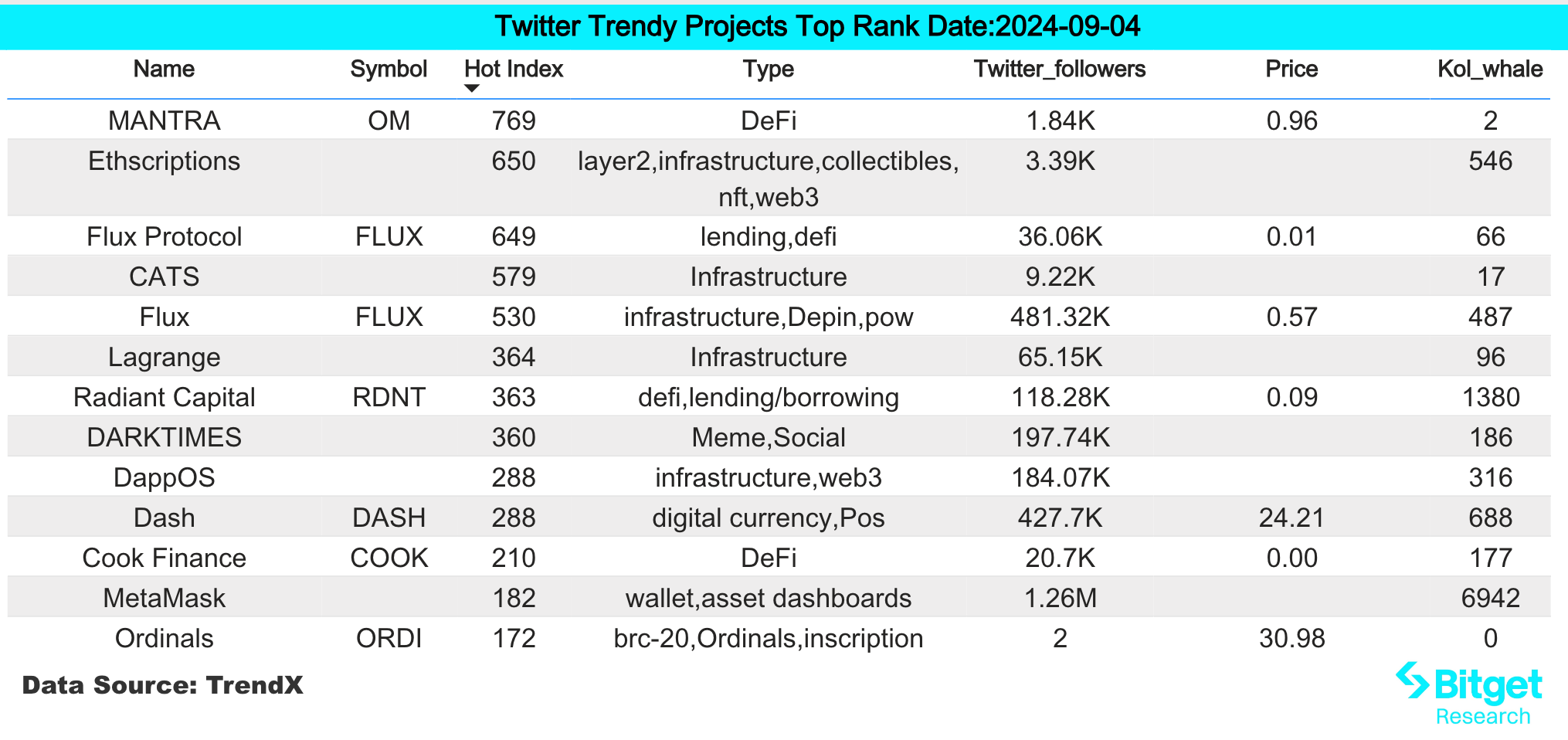

2) Твиттер

Flux:

Flux is a set of decentralized cloud computing services and Web3 solutions, providing Dapps with a fast, easy-to-manage, decentralized AWS and Google cloud service. Binance Contract Platform launched the FLUXUSDT perpetual contract at 15:00 (Eastern Time Zone 8) on September 3, 2024. Affected by the launch of the contract on Binance, the price of FLUX once rose by more than 40%. The token price has fallen back at present, so it is recommended to participate with caution.

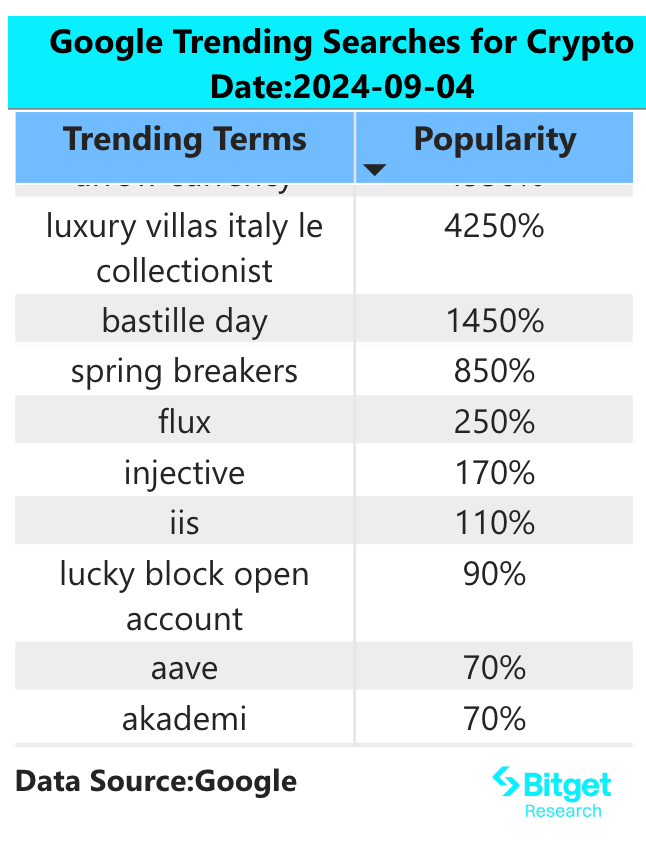

3) Регион поиска Google

С глобальной точки зрения:

AAVE:

Aave Labs announced the introduction of Sky Aave Force, an initiative launched by MakerDAO co-founder Rune and Aave founder Stani to promote mass adoption and narrow the gap between DeFi and TradFi. Sky Aave Force will propose to integrate USDS and savings USDS (sUSDS) on Aave V3 and provide native token rewards. Create a new Spark/Aave market for seamless interaction and exclusive rewards. AAVEs recent business volume and data have steadily increased, and the price of the currency has a good upward trend, so you can participate appropriately.

Из горячих запросов в каждом регионе:

(1) The enthusiasm for TON mini APP in Europe, America and English-speaking regions has increased significantly: TON public chain appeared in the hot words in Canada, Australia, the Netherlands and Poland, and hamster kombat appeared in the hot search words in the UK;

(2) There are no obvious hot spots in Asia, Latin America and other regions, and the hot search terms are scattered. Only a few countries mentioned the TRON public chain.

Потенциал Аирдроп Возможности

Главный

Major is a minimalist game based on Telegram. The only goal of the player is to get more stars. The more stars you have, the higher your ranking and the more generous the rewards you can get. Players can get stars through standard modes such as daily tasks, recruiting people, and completing information. Bitget has launched a pre-market market, where you can place some pre-market sell orders according to the situation and directly lock in profits.

In the game, the only goal of Major players is to get more stars. The more stars you have, the higher your ranking and the more generous the rewards you can get. Currently, Major provides TON token rewards to the top 100 users in the weekly ranking: 150 for the first place; 100 for the second place; 70 for the third place; 50 for each of the 4th to 4th place; 20 for each of the 6th to 10th place; and 5 for each of the 11th to 100th place.

Specific operation method: 1) You can get initial stars after entering the game; 2) You can further get more stars through daily tasks in the task bar, recruiting people, completing information, etc.;

Soneium

Soneium is an Ethereum Layer 2 launched by Sony that will connect blockchain technology (Web3) with everyday Internet services (Web2). It will utilize Optimism Rollup technology and be built using the OP Stack of the Optimism blockchain ecosystem.

Specific participation method: Soneium will launch the testnet on August 28, 2024, and testnet interaction will be available at that time. Currently, all you can do is learn about the project information and obtain a Discord role first;

Исходная ссылка: https://www.bitget.fit/zh-CN/research/articles/12560603815195

«Отказ от ответственности» Рынок рискованный, поэтому будьте осторожны при инвестировании. Эта статья не представляет собой инвестиционный совет, и пользователям следует подумать, подходят ли какие-либо мнения, взгляды или выводы в этой статье к их конкретным обстоятельствам. Инвестирование на основе этой информации осуществляется на ваш страх и риск.

This article is sourced from the internet: Bitget Research Institute: The market is full of negative emotions, and the accelerated decline paves the way for the main uptrend

Related: Metrics Ventures Market Observation: New Momentum Will Be Born in the Fluctuation

Inventory and comments on the overall market situation and market trends: The past months market has been a torment for most holders. The repeated convergence of volatility and the resonant downward trend of asset prices have exploded in early July under the stimulation of various external selling pressures. The decline in contract positions on a single day is close to that of FTX on the same day. As of the time of writing this months report, the market has stabilized on the basis of Fridays macro data and formed an inertial rebound on Saturday. The following phenomena have occurred in this round of leverage liquidation: ① A large number of altcoins stabilized for the first time after a sharp drop; ② Bitcoin is supported near the middle track of the…