Отчет о наблюдении за рынком XEX: обзор последних крупных событий в сфере криптовалют

French President Emmanuel Macron denied rumors that the arrest of Telegram founder Pavel Durov was politically motivated, while cryptocurrency inflows rose for five consecutive weeks amid rumors of a September rate cut in the U.S. Meanwhile, Polygon, Avalanche, and ZKsync were all hit by Discord scam attacks within 48 hours.

Macron says Durovs arrest is not politically motivated

President Macron confirmed Durov’s arrest in a post on the X social media platform on August 26.

In his post, Macron responded to false information circulating on social media claiming that Durovs arrest was politically motivated. Macron said it was in no way a political decision.

On August 24, Durov was arrested at an airport outside Paris, sparking rumors of possible charges against him and law enforcement action against Telegram.

On August 25, Telegram released a statement expressing support for its founder, adding that Durov had nothing to hide in his frequent trips to Europe.

On August 26, Cointelegraph reported that French authorities can legally detain Durov until August 28. French prosecutors said in a notice on August 26 that Durov’s detention is part of an investigation into “unnamed persons.”

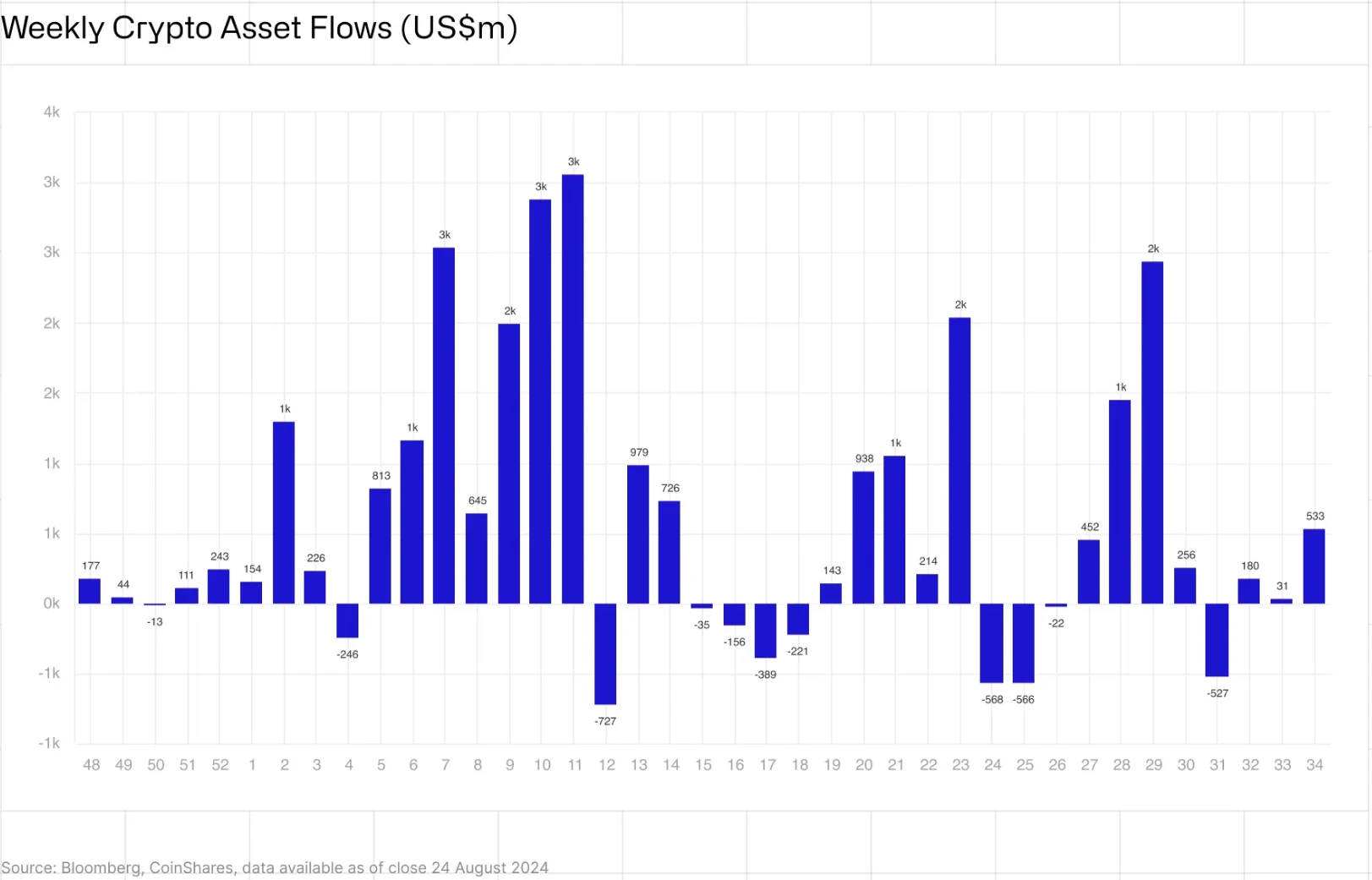

Crypto investment products see largest inflows in five weeks

Cryptocurrency investment company CoinShares reported on August 26 that digital asset investment products saw weekly inflows of $533 million from August 18 to 24.

The pace of buying in crypto-related ETPs last week saw the largest inflows in the past five weeks, driven by expectations of a rate cut in the United States. On August 21, Federal Reserve Chairman Jerome Powell hinted that the first rate cut could occur in September 2024.

Of the various crypto investment products analyzed by CoinShares, Bitcoin-related ETPs saw the largest inflows last week, totaling $543 million.

The most significant buying came from BlackRock’s iShares Bitcoin Trust, which saw inflows of $318 million.

Ethereum ETF loses funds

BlackRock’s ETHA and other Ethereum funds have attracted billions of dollars worth of inflows. However, this has been overshadowed by large outflows from the Grayscale Ethereum Trust (ETHE).

Nate Geraci, president of ETF Store, said BlackRock’s iShares Ethereum Trust (ETHA) had just over $1 billion in net inflows, making it the seventh most successful ETF this year. Fidelity’s Advantage Ether ETF and Bitwise Ethereum ETF saw inflows of $390 million and $312 million, respectively, according to Farside Investors.

But back to the question of overall outflows, which stem from billions of dollars in outflows from the Grayscale Ethereum Trust (ETHE). The product was first sold to investors in 2017 and began trading publicly in 2019 — albeit in a less-than-sexy trust format. It was converted into an ETF in July as new funds from firms like BlackRock emerged.

Grayscale products charge investors much higher fees, meaning many may want to switch to cheaper funds. Excluding Grayscale’s large outflows, investors have allocated more than $2 billion to other funds in the first five weeks.

“The fact that over $2 billion has been specifically allocated to other spot ether ETFs is a good sign because it shows that investors want to invest in ether,” Geraci said. “While not as flashy as the spot bitcoin ETF, I think the spot ether ETF has clearly been successful in its first month and I expect that to continue.”

Regarding Grayscale, Geraci believes that the outflows complicate the situation and make it difficult to clearly understand how much demand there is for these funds. “We simply don’t know all the potential motivations of ETHE sellers, which is why I think it’s important to look beyond the product.”

Demand is likely to continue to grow in the coming months, said Sui Chung, chief executive of index provider CF Benchmarks, who expects more wealth managers to offer such products to clients.

“We expect inflows into ETH ETFs to continue to increase once wealth managers and financial advisors complete the education process on what ETH is, its utility, and why they should hold ETH alongside a BTC ETF,” he said. “The education process will educate investors on the Ethereum economy and highlight its key differences from Bitcoin, clearly demonstrating that the allocation drivers are different and both belong in a balanced portfolio.”

The spot bitcoin ETF, which began trading in January, has seen nearly $18 billion in inflows. Investors have put about $20 billion into BlackRock’s products, and that has been largely offset by $17 billion in outflows from the Grayscale Bitcoin Trust (GBTC), another fund that existed as a trust for years before converting to an ETF.

О X-обмене

X Exchange — первая в мире интеллектуальная платформа для торговли цифровыми активами Web2.5. В X Exchange мы стремимся предоставить пользователям более безопасный, эффективный и удобный опыт торговли цифровыми активами с помощью интеллектуальных технологий и Web2.5.

X Academy охватывает основные операции и меры предосторожности перед торговлей блокчейн-проектами. Мы удовлетворяем потребности новичков в блокчейне, энтузиастов, практиков, инвесторов и любых читателей. Типы контента включают в себя введение в блокчейн и цифровую валюту, обучающие статьи начального уровня, процедуры операций по покупке, как отличить хорошие и плохие проекты, базовые знания о спотовых контрактах, смарт-трейдинге и т. д.

This article is sourced from the internet: XEX Market Observation Report: A review of recent major events in the cryptocurrency space

Related: Blast: The beginning of a revenue-oriented narrative

Blast has airdropped $Blast tokens to the community at 10pm on June 26th, which also announced the end of a huge airdrop feast. There is no doubt that in terms of investment institutions, community enthusiasm and TVL, Blast is the only king-level project that can be compared with ZKsync this year. Layer 2 has entered the next stage. After the large-scale and controversial airdrop event, how will Blast itself and the Layer 2 ecosystem develop in the future? Background of the project Environment drives innovation For a long time, in the conventional Layer 2 ecosystem, users have obtained Layer 2 ecosystem tokens as income by staking ecosystem tokens, stablecoins and other tokens. At the same time, Layer 2 project parties use the staked tokens to complete transaction verification and other…