Специальный выпуск SignalPlus Macro Analysis: время пришло

Some readers may remember former ECB President Draghi’s famous “whatever it takes” declaration during the Euro crisis, which marked an important historical turning point when the central bank effectively provided a floor for the market and pushed investors into a years-long “risk-on” mode.

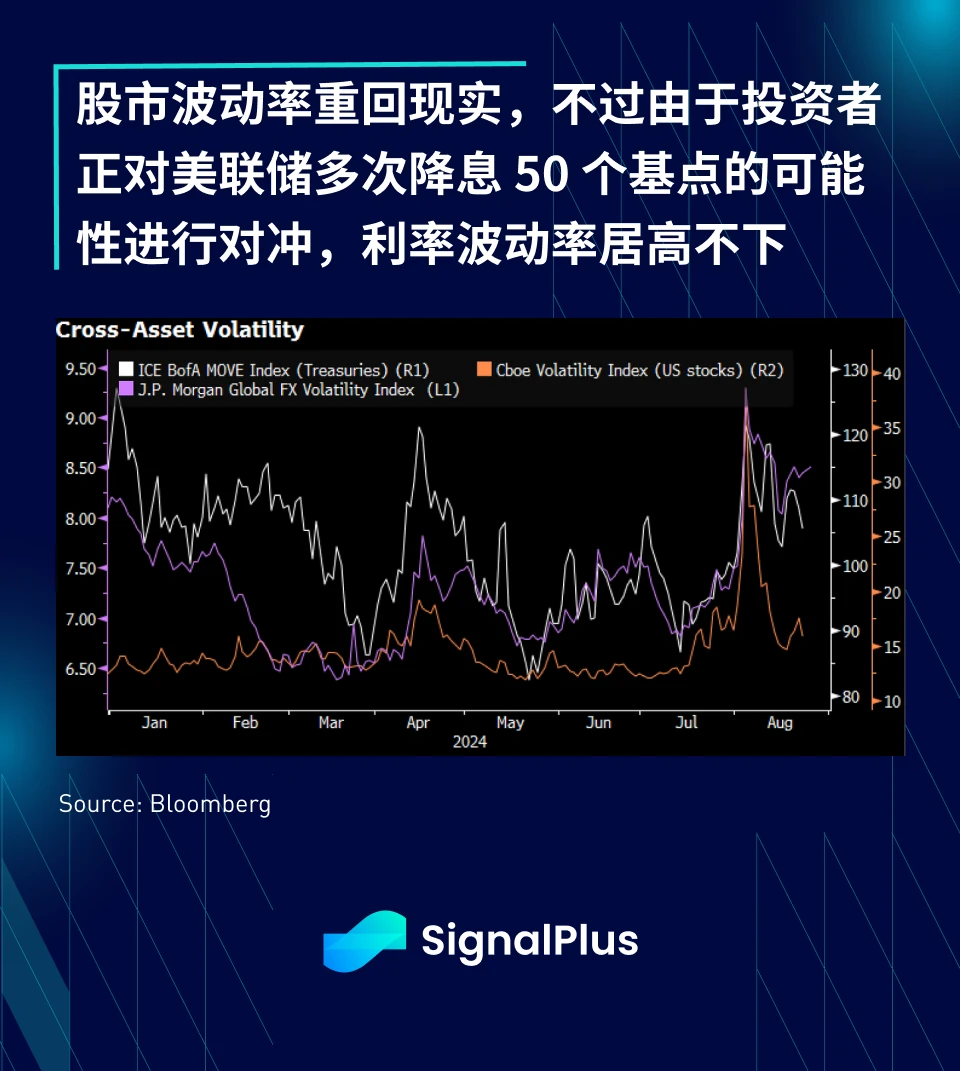

Expectations are high for this years Jackson Hole meeting, a platform the Fed has historically used to announce major policy shifts or strongly reaffirm policy preferences. 24 months ago, in August 2022, the market fell sharply due to Powells extremely hawkish remarks. The stock market plunged 3.4% that day and fell 12% in the following month. The meeting took place just as the market had just escaped the historic one-day crash in early August and recovered most of its losses, thanks to the markets early expectations of a dovish Fed, with pricing reflecting about 4 rate cuts by the end of the year, compared to less than 2 rate cuts a month ago. The market is very curious whether the chairman will meet our expectations this time, or will he throw a bucket of cold water on us?

We think the results are clear enough that the phrase “it’s time” will likely become one of Powell’s most memorable lines during his successful tenure as Fed Chairman.

Here’s a heartfelt interpretation of some of the statements in Powell’s keynote:

The balance of risk for our two missions has changed.

— Its time to focus more on the job market rather than inflation, i.e., its time to shift to easing policy.

The cooling of the job market is undeniable.

— The economy needs help from lower interest rates.

The time is ripe for policy adjustment.

— We will cut interest rates in September.

The direction is clear, and the timing and pace of rate cuts will depend on incoming data, the changing outlook and the balance of risks.

— Interest rates will definitely be lowered. I cannot guarantee a 50 basis point cut in September, but if the economy requires it, it will be cut by 50 basis points. The tail risk now is that the Fed cuts interest rates more significantly at each meeting, at your own risk.

Our current policy rate level gives us ample room to address any risks we may face, including a further deterioration in labor market conditions.

— The U.S. benchmark interest rate is very high, and we can cut it significantly if necessary.

“We do not seek or welcome a further cooling of labor market conditions,” Powell said, adding that a slowdown in the job market was “undoubtedly on the horizon.”

— We didnt want the market to weaken before the end of the year (U.S. election), and it is already weakening now.

“All in all, the recovery from the pandemic, our efforts to curb aggregate demand, and measures to anchor expectations have combined to make it increasingly likely that inflation will reach our 2 percent objective.”

— Inflation is over, the Fed has done its job, and Im doing a great job.

Let me conclude by emphasizing that the pandemic economy is unlike any previous economic situation, and there is still much to learn from this unique period… The limitations of our knowledge have been so apparent during the pandemic that we need to remain humble and questioning, focusing on learning lessons from the past and applying them flexibly to our current challenges.

— We have been very successful in recovering the U.S. economy from the pandemic and dealing with an unprecedented surge in inflation without any surprises, and history should study our outstanding performance during this period. Inflation is behind us, and now let us focus on lowering interest rates.

Basically, the Jackson Hole speech was a celebration of the Fed’s ability to control inflation, raise interest rates from 0% to 5%, and recover from the pandemic without any surprises. Even the Fed’s long-time critics must give them a fair assessment, the US economy has indeed performed significantly better than almost all other developed and major emerging market economies, and the SPX index has continued to hit record highs. Now that the Fed believes that the inflation chapter is “over”, it is time to provide support to the US economy if necessary, and they have plenty of ammunition.

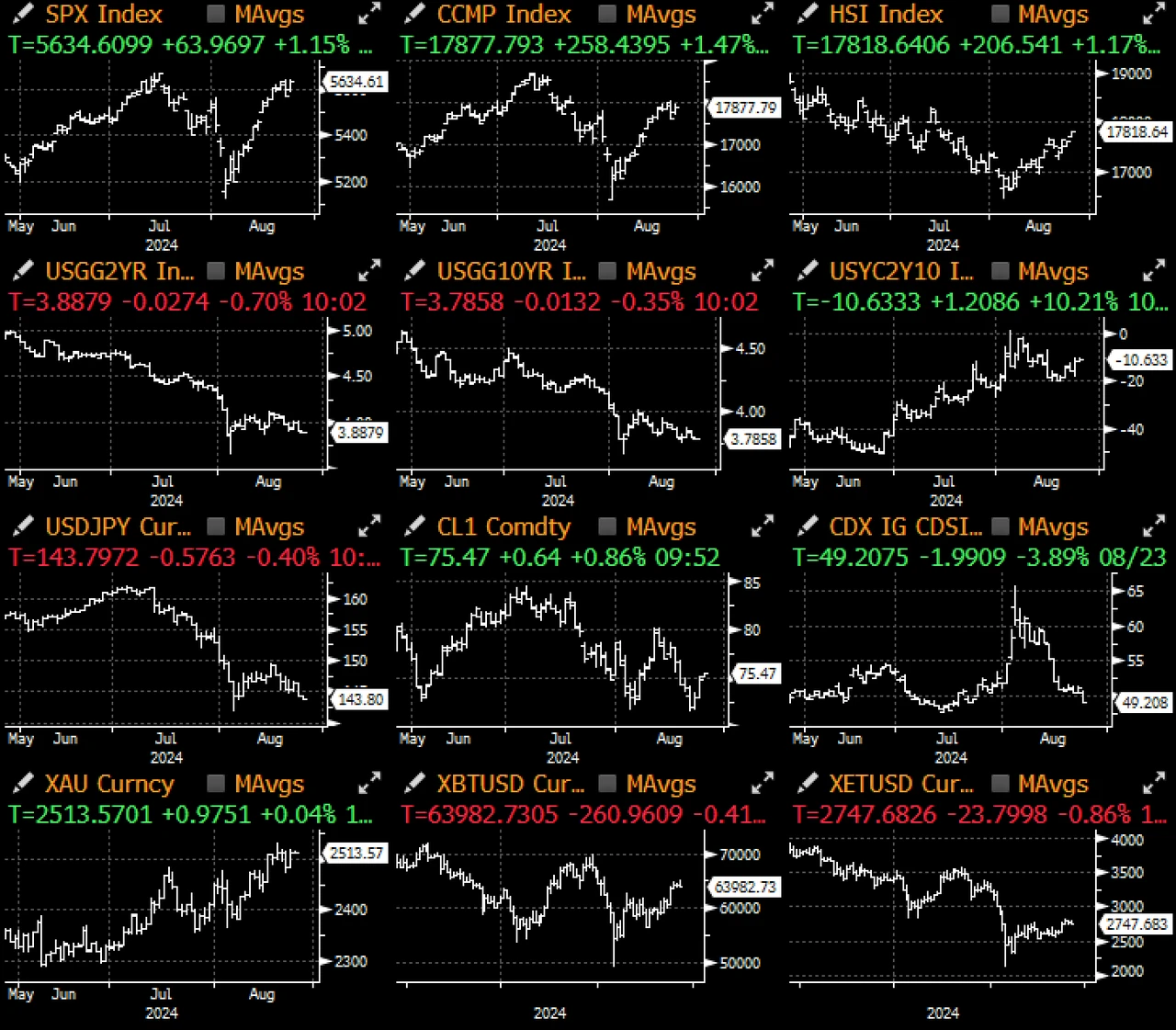

Needless to say, the market reaction was very clear. Stocks rose, yields fell, the dollar weakened, the yen rose, volatility fell, and credit markets strengthened. The 2-year and 5-year Treasury yields closed near their monthly lows at 3.9% and 3.6%, respectively. The Nasdaq index returned to its 50-day moving average and above important technical indicators. The USD/JPY fell back below 145, the market turned to yen bulls and completely flipped the carry trade. BTC also rebounded to above $64,000, and gold stabilized above $2,500.

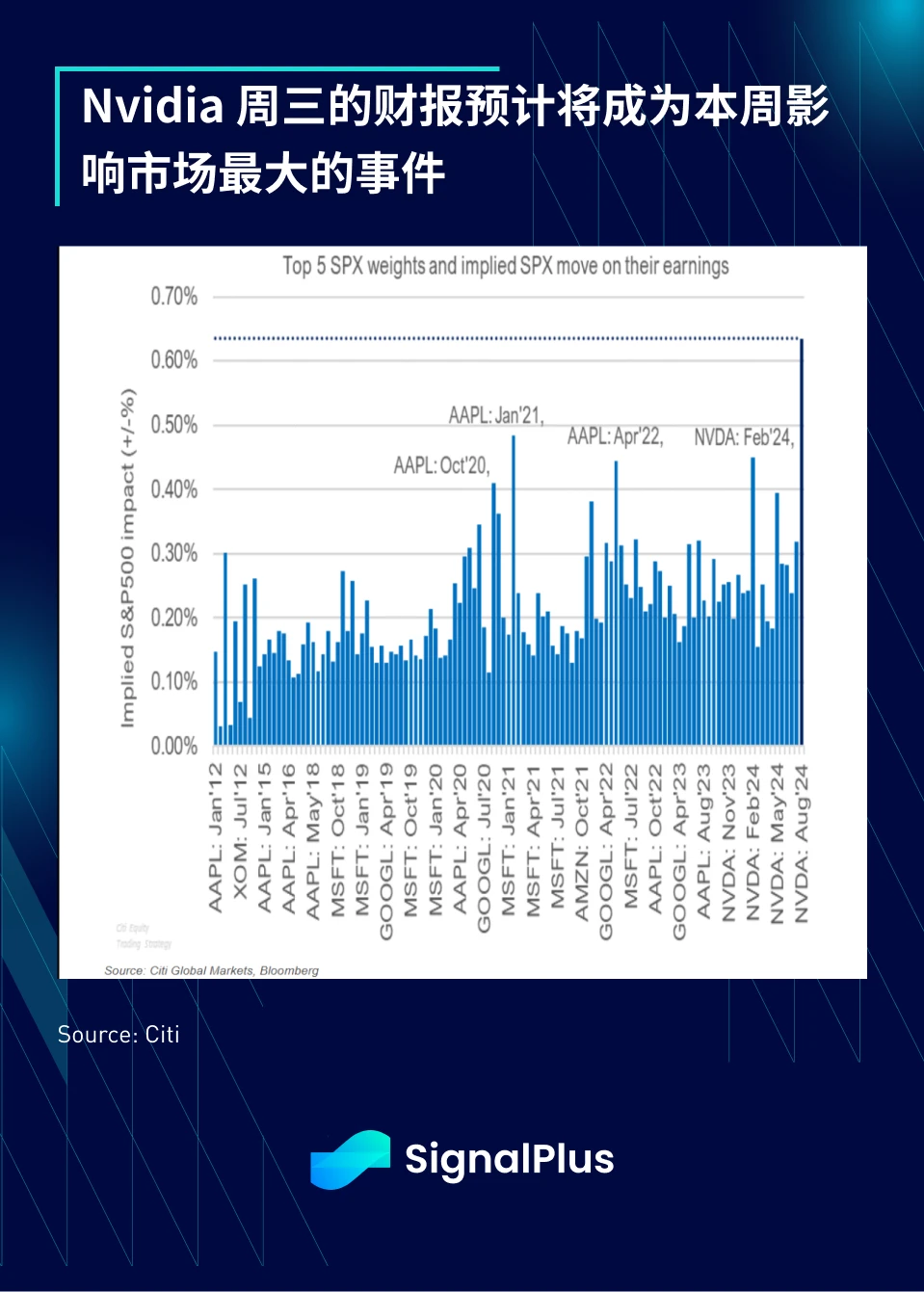

With this expectation already set, the market will now refocus on weekly unemployment claims data as well as monthly non-farm payrolls, with inflation taking a back seat unless it rises sharply for several months in a row. As a result, trading activity this week is likely to be relatively quiet, with Nvidias earnings release after the close on Wednesday likely to be the biggest event moving the market, while the market is likely to downplay the importance of Fridays PCE data, while the University of Michigans consumer confidence index is likely to still receive some attention to assess consumer spending.

Markets may take a break in the last week of summer before heading into a busy fall season, with the first U.S. nonfarm payrolls report after Labor Day having a significant impact on risk sentiment in the fourth quarter.

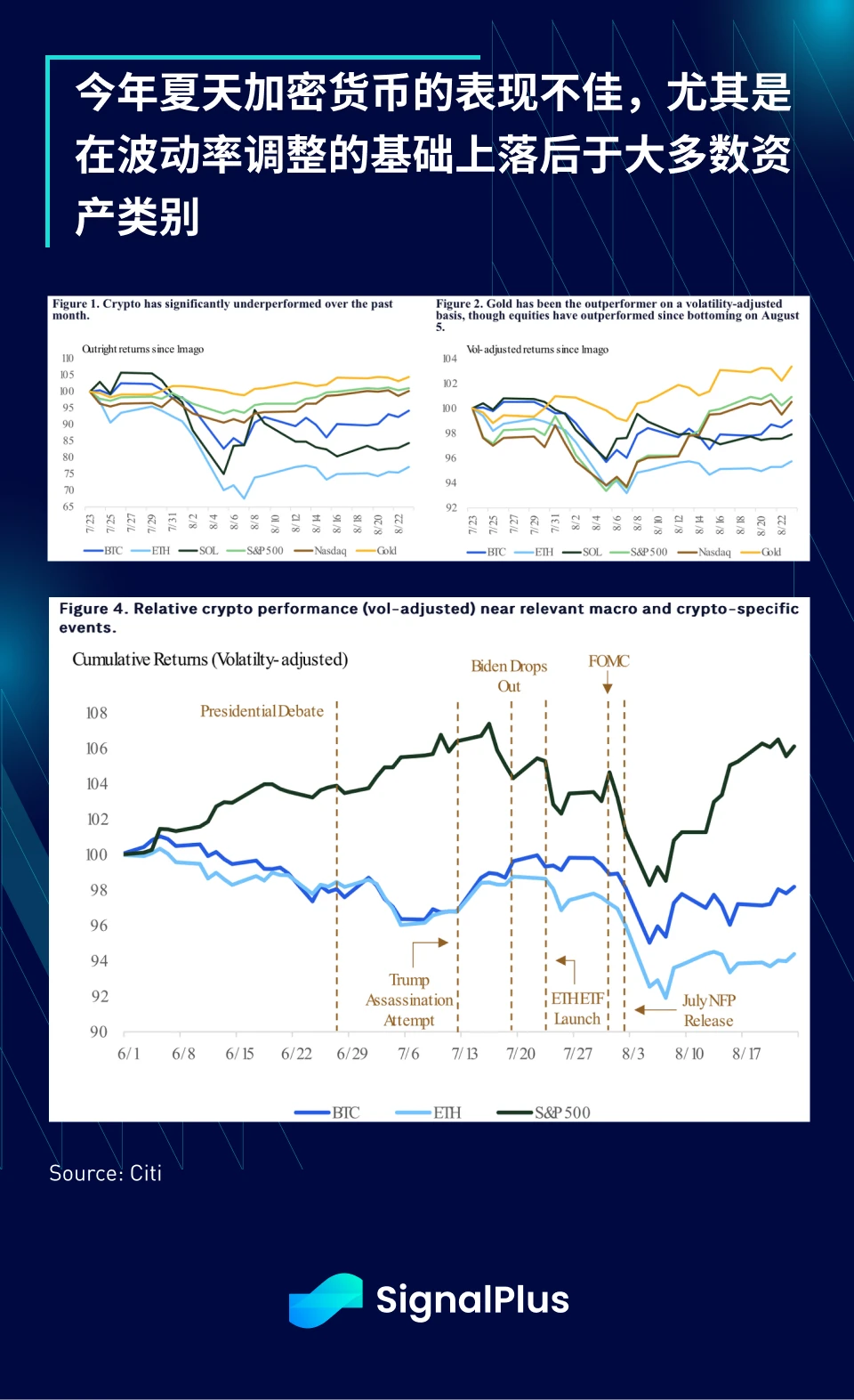

In cryptocurrencies, despite a rebound in prices following Powell’s speech in Jackson Hole, near-term fundamental challenges remain, with cryptocurrencies having underperformed significantly since July compared to other major asset classes.

ETF inflows have been thin since launch, especially into ETH, impacted by poor timing (August risk sell-off) and weak on-chain activity on ETH, with L1 fees having fallen to multi-year lows as revenues concentrate on L2s.

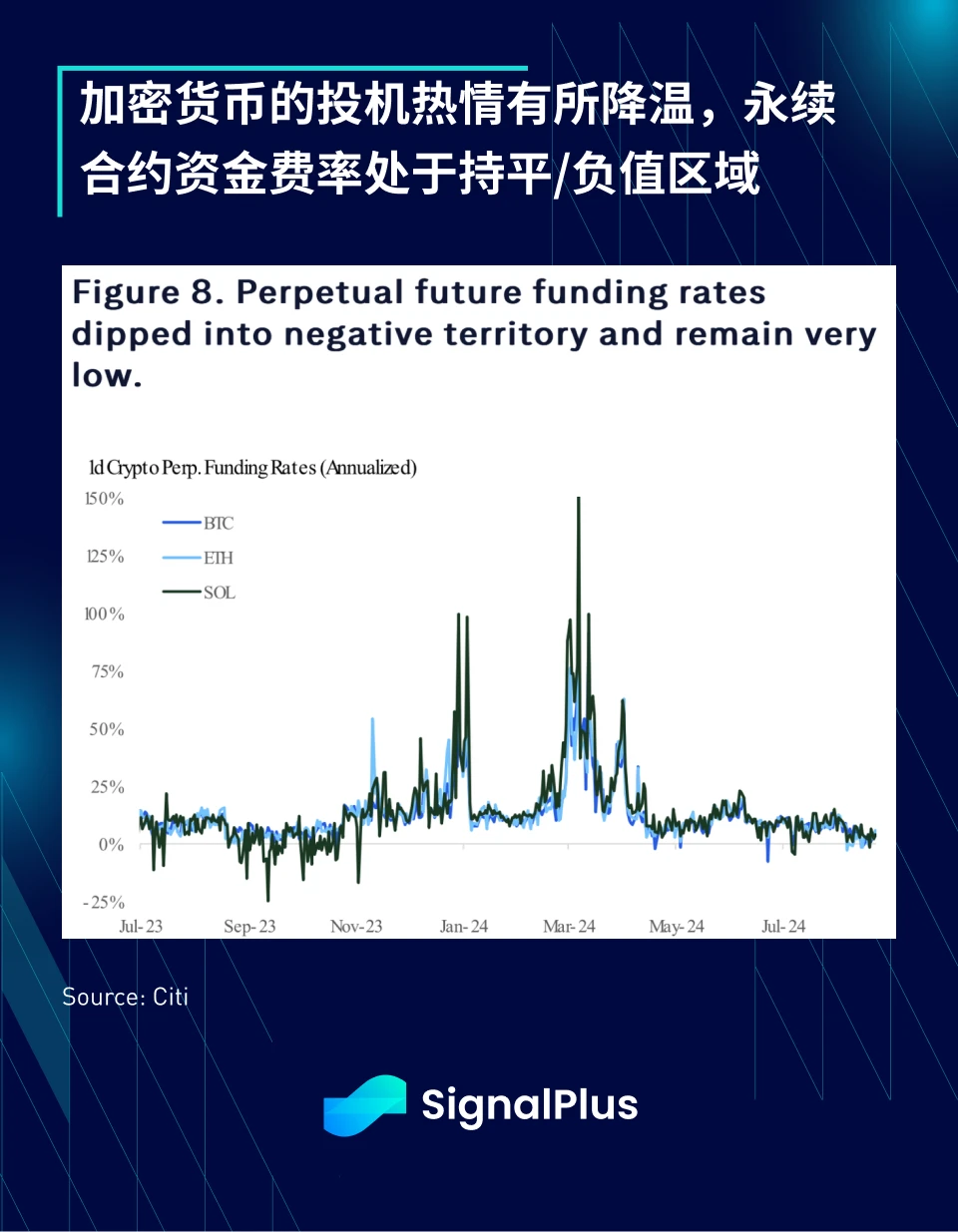

In addition, overall speculative enthusiasm has also declined, and the funding rate of perpetual contracts has entered the flat/negative zone, especially after the market sell-off in early August, when many long traders were forced to exit due to profit and loss control.

This has resulted in BTC’s dominance continuing to rise in a one-way direction, with cryptocurrencies increasingly viewed as an alternative asset class (like oil), while general mainstream investors prefer to only participate in the benchmark token (BTC) because of its simple and clear value proposition of “store of value” for non-technical investors.

As expected, focusing solely on BTC as an alternative asset class rather than focusing on crypto as a “sector” means that crypto prices are becoming increasingly correlated with overall macro risk sentiment, with BTC and ETH’s rolling correlations with the SP reaching 1-year highs.

On the positive side, Axios reported that cryptocurrency has become the dominant force in corporate donations to this years election, contributing about $120 million so far, accounting for nearly half of the total corporate donations. Although the donations mainly come from a few major donors, the entire industry still hopes to gain more favorable political support in this election.

Regardless, both parties have made their views on cryptocurrencies clear, and we expect prices to be increasingly influenced by shifting election odds and expectations of rate cuts. Doesn’t this sound just like other traditional macro assets?

I wish you all good trading in the remaining summer!

You can use the SignalPlus trading indicator function at t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

Официальный сайт SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: The Time Has Come

Original | Odaily Planet Daily ( @OdailyChina ) Author锝淣an Zhi ( @Assassin_Malvo ) Yesterday, Binance Labs announced the first batch of projects selected for the seventh season of incubation , including Astherus, CYCLE NETWORK, DILL and EigenExplorer. Their concepts and businesses are relatively cutting-edge, and the former two have launched early interactive activities, which are linked to future airdrops. Odaily will analyze the business, characteristics and interactive activities of each protocol in this article. Astherus: Liquidity Center for LRT Assets Agreement business The re-staking market space for BTC and ETH is as high as $20 billion and is still growing rapidly. Re-staking allows blockchain validators to deposit ETH or Liquid Staking Tokens (LST) into the platform, receive APR rewards and protect the network. But Astherus believes that most re-staking protocols…