Отчет об исследовании настроений на рынке криптовалют (2024.08.09-08.16): умеренные данные об инфляции, колебания ценового диапазона

Mild inflation data, price range fluctuations

Источник изображения: https://www.cnbc.com/2024/08/13/wednesdays-cpi-report-could-mark-a-change-in-thinking-for-the-fed.html?qsearchterm=CPI

Источник изображения: https://hk.investing.com/

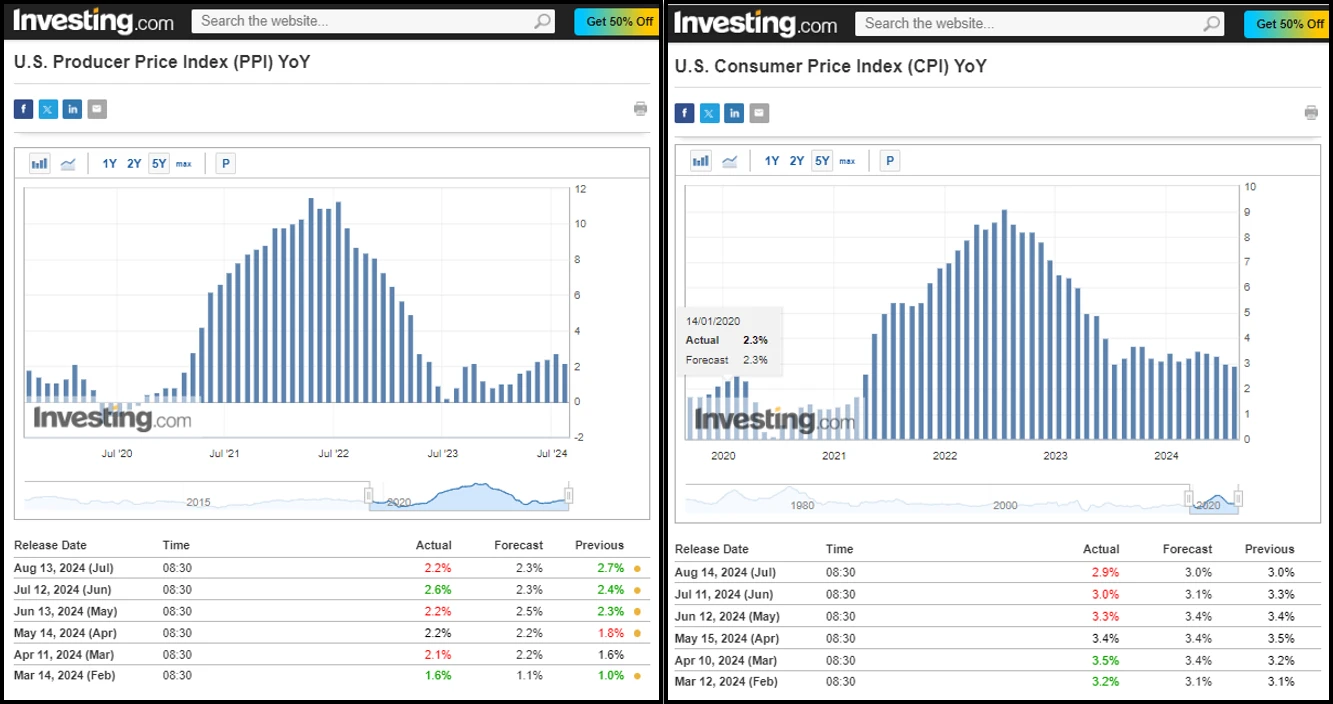

This week, two important inflation data, PPI and CPI, were released. CNBC said the data showed that the United States has passed the environment of ultra-high inflation. Moderate inflation data may mean that the Federal Reserve can turn its attention to other economic challenges, such as employment rate.

Data: PPI data, an indicator of producer inflation, showed that prices rose by only 0.2% in July and were up about 2.2% year-on-year. This figure is now very close to the Feds 2% target, indicating that market expectations for the central bank to start cutting interest rates are basically on target.

CPI data, an indicator of consumer inflation, showed a year-on-year growth rate of 2.9% over the past 12 months, a figure that, while much lower than the high point in mid-2022, is still far from the Feds 2% target.

In terms of market conditions: After the release of the PPI data at 20:30 on the evening of the 13th, Hong Kong time, the market began to rise, and Bitcoin rose from 59,000 to around 61,500. It was not until the release of the CPI data at 20:30 on the 14th that the market began to fall, and Bitcoin fell from 61,500 to around 58,000.

Future events: The latest employment rate data will be released on September 6, the latest CPI and PPI data will be released on September 11 and 12, and the Federal Reserve will hold its interest rate decision at 02:00 Hong Kong time on September 19. September will be a critical node. If the Federal Reserve decides to cut interest rates, the market may bring a new round of surprises.

There are about 33 days until the next Federal Reserve interest rate meeting (September 19, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

Технический анализ рынка и аналитика настроений

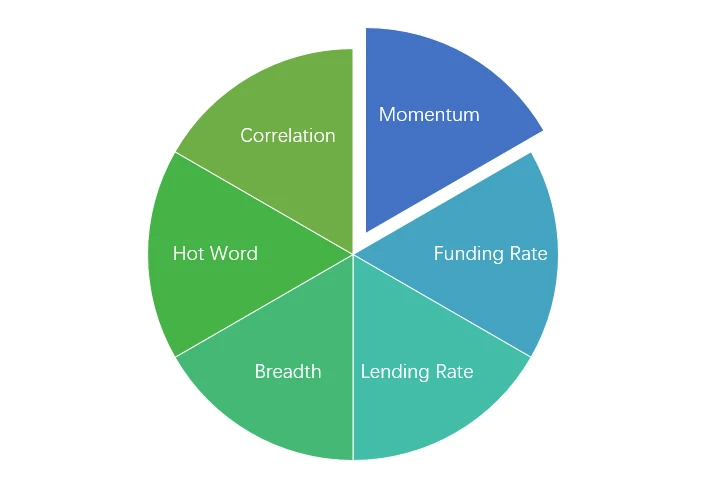

Компоненты анализа настроений

Технические индикаторы

Price Trends

BTC price fell -6.72% and ETH price fell -4.2% in the past week.

На изображении выше показан график цены BTC за последнюю неделю.

На изображении выше показан график цены ETH за последнюю неделю.

В таблице представлена скорость изменения цен за прошедшую неделю.

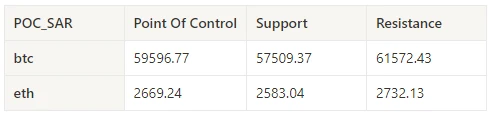

График распределения цены и объема (поддержка и сопротивление)

In the past week, both BTC and ETH have been fluctuating downward in a range of dense trading areas.

На рисунке выше показано распределение зон с плотной торговлей BTC на прошлой неделе.

На рисунке выше показано распределение зон с плотной торговлей ETH за последнюю неделю.

В таблице показан недельный интенсивный торговый диапазон BTC и ETH за прошедшую неделю.

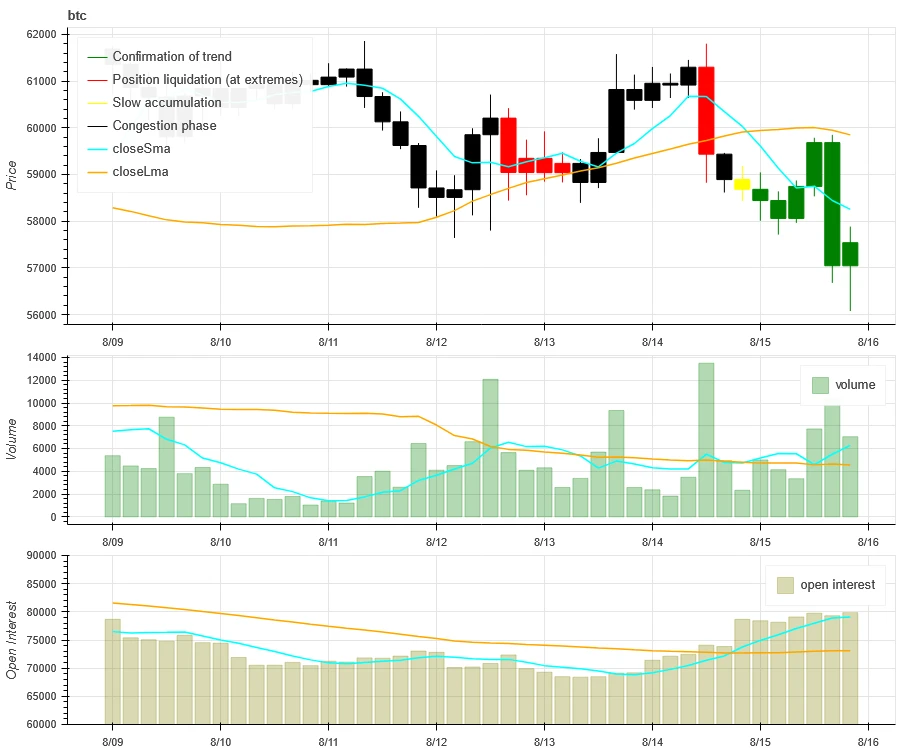

Объем и открытый интерес

In the past week, both BTC and ETH had the largest trading volume when they rebounded sharply on August 12; the open interest of BTC increased while that of ETH decreased.

Верхняя часть изображения выше показывает ценовой тренд BTC, середина показывает объем торгов, нижняя часть показывает открытый интерес, голубой цвет — среднее значение за 1 день, а оранжевый — среднее значение за 7 дней. Цвет K-линии представляет текущее состояние, зеленый означает, что рост цены поддерживается объемом торгов, красный означает закрытие позиций, желтый означает медленное накопление позиций, а черный означает состояние переполненности.

Верхняя часть изображения выше показывает ценовой тренд ETH, середина — объем торгов, нижняя часть — открытый интерес, голубой цвет — среднее значение за 1 день, а оранжевый — среднее значение за 7 дней. Цвет К-линии представляет текущее состояние, зеленый означает, что рост цены поддерживается объемом торгов, красный — закрытие позиций, желтый — медленное накопление позиций, черный — переполненность.

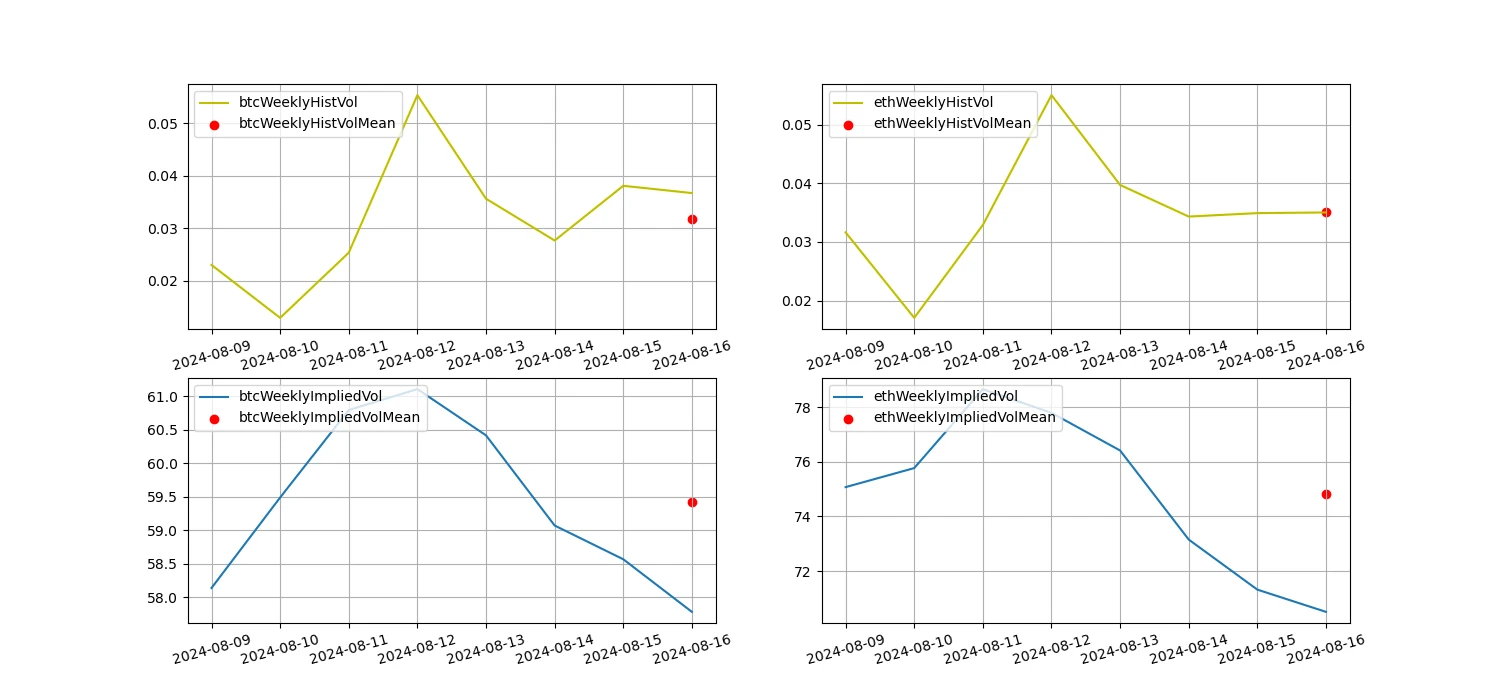

Историческая волатильность против подразумеваемой волатильности

In the past week, the historical volatility of BTC and ETH was the highest when they rebounded sharply on August 12; the implied volatility of BTC and ETH both decreased.

Желтая линия — это историческая волатильность, синяя линия — подразумеваемая волатильность, а красная точка — ее среднее значение за 7 дней.

Управляемый событиями

The PPI and CPI inflation data were released this past week. After the PPI data was released at 20:30 on the evening of the 13th Hong Kong time, the market began to rise, and Bitcoin rose from 59,000 to around 61,500. It was not until 20:30 on the 14th when the CPI data was released that the market began to fall, and Bitcoin fell from 61,500 to around 58,000.

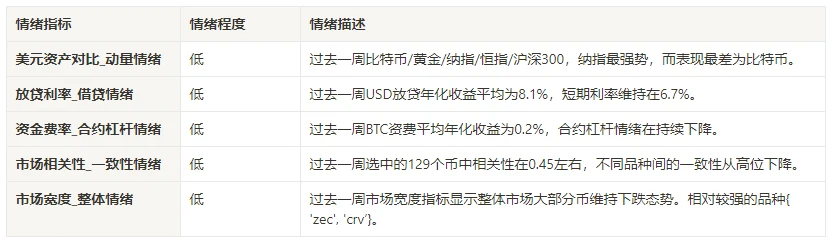

Индикаторы настроений

Импульс Настроения

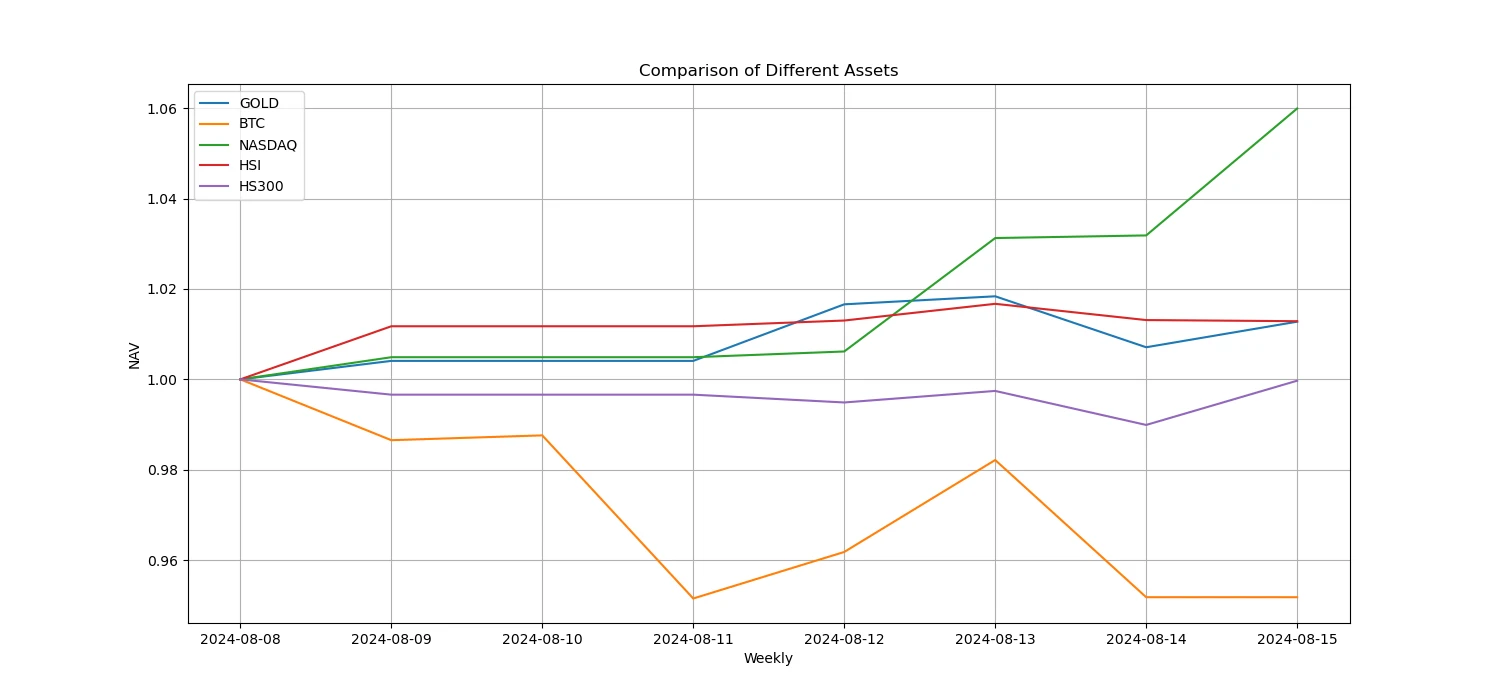

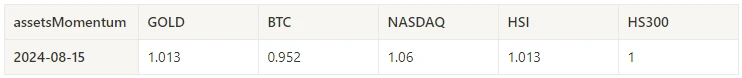

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/SSE 300, Nasdaq was the strongest, while Bitcoin performed the worst.

На картинке выше показана динамика различных активов за последнюю неделю.

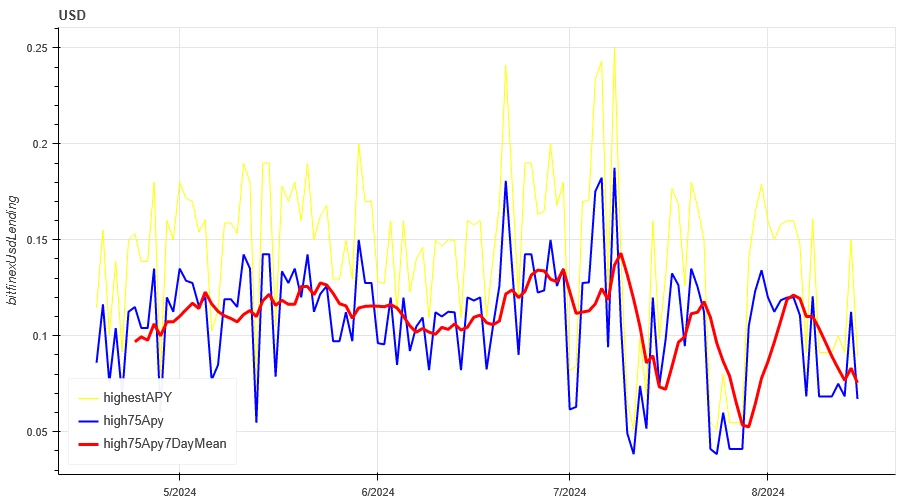

Кредитная ставка_Настроение по кредитованию

The average annualized return on USD lending over the past week was 8.1%, and short-term interest rates remained at 6.7%.

Желтая линия — это самая высокая цена процентной ставки в долларах США, синяя линия — 75% самой высокой цены, а красная линия — 7-дневное среднее значение 75% самой высокой цены.

В таблице показана средняя доходность процентных ставок в долларах США в разные дни владения в прошлом.

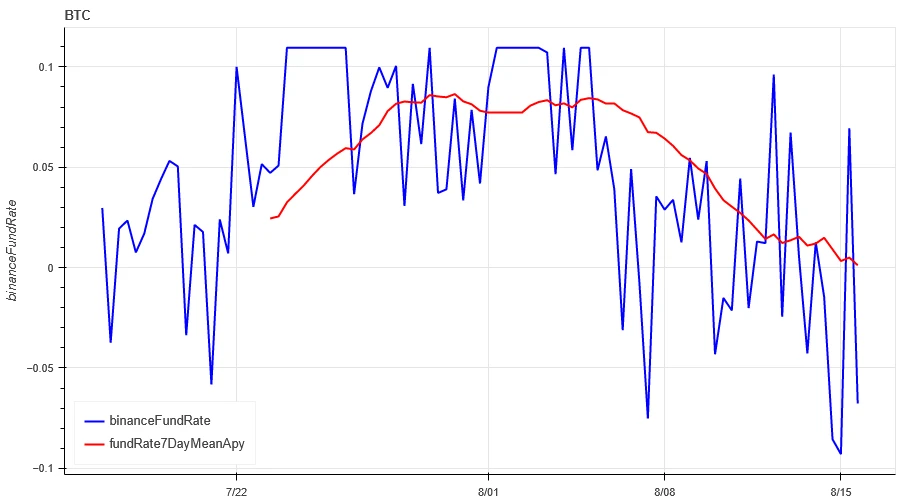

Ставка финансирования_Настроение по кредитному плечу по контракту

The average annualized return on BTC fees in the past week was 0.2%, and contract leverage sentiment continued to decline.

Синяя линия — это ставка финансирования BTC на Binance, а красная линия — ее среднее значение за 7 дней.

В таблице показана средняя доходность комиссий BTC за разные дни владения в прошлом.

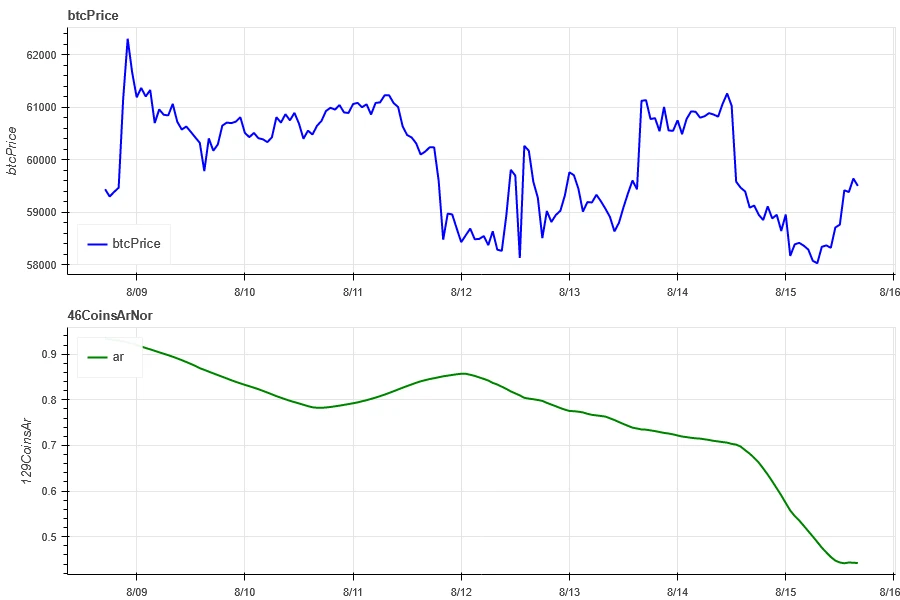

Рыночная корреляция_консенсус-настроение

The correlation among the 129 coins selected in the past week was around 0.45, and the consistency between different varieties has dropped from a high level.

На картинке выше синяя линия — это цена биткоина, а зеленая линия — [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos и т. д., eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx , imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, магия, мана, matic, мем, мина, mkr, рядом, нео, океан, один, ont, op, pendle, qnt, qtum, rndr, роза, руна, rvn, песок, sei, sfp, snx , sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] общая корреляция

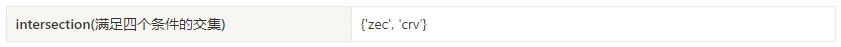

Широта рынка_Общее настроение

Among the 129 coins selected in the past week, 4% of them were priced above the 30-day moving average, 24% of them were priced above the 30-day moving average relative to BTC, 6% of them were more than 20% away from the lowest price in the past 30 days, and 7% of them were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market maintained a downward trend.

Картинка выше [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos и т. д., fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, Idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, ссылка, ткацкий станок, lpt, lqty, lrc, ltc, luna 2, магия, мана, манта, маска, matic, мем, мина, mkr, рядом, нео, nfp, океан, один, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, Robin, Rose, Rune, RVN, Sand, Sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-дневная пропорция каждого индикатора ширины

Подведем итог

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) showed a volatile downward trend, especially when the historical volatility and trading volume reached a peak during the sharp drop and rebound on August 12. The open interest of BTC increased, while that of ETH decreased. The implied volatility decreased. Bitcoin performed the worst in comparison with gold, Nasdaq, Hang Seng Index and CSI 300, while Nasdaq performed the strongest. Bitcoins funding rate continued to decline, reflecting the continued decline in market participants interest in its leveraged trading. The correlation between the selected 129 currencies remained at around 0.45, showing that the consistency between different varieties has declined from a high level. The market breadth indicator shows that most cryptocurrencies in the overall market are still in a downward trend. The market began to rise after the PPI data was released on the 13th, and then the market began to fall after the CPI data was released on the 14th.

Твиттер: @ https://x.com/CTA_ChannelCmt

Веб-сайт: channelcmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.08.09-08.16): Mild Inflation Data Price Range Fluctuation

Related: When live streaming happens in Web3: Will Pump.fun create a “live streaming magic”?

Pump.fun is the most special product in this cycle. Since its launch more than 4 months ago, more than 1.17 million tokens have been issued on Pump.fun, and the cumulative revenue has exceeded 50 million US dollars. How to understand this number? Compared with Uniswap, the top traffic product in the previous bull market, it is estimated that Uniswap Labs annual revenue is about 25 million to 30 million US dollars. It can be said that Pump.fun is not a typical Web3 project. It does not have a complex token economics model or a DAO governance mechanism. However, with its precise market positioning, Pump.fun has created a business market that is sure to make money. Under the dominance of the attention economy, many people will interpret the continued prosperity of…