Краткий обзор финансового отчета Coinbase за второй квартал: впервые показаны комиссии за транзакции SOL, а бизнес Base

At the beginning of August, the crypto market performed sluggishly. However, during the second quarter earnings week, the performance of many crypto companies is worthy of attention.

Coinbase released its second quarter 2024 financial results after the market closed on Thursday and held a financial conference call. After the financial report was released, Coinbases stock price rose by about 2%, trading at about $212.5, and has risen by about 48% since the beginning of this year. Coinbase CEO Brian Armstrong said that Coinbases main goal at present is to increase liquidity, increase users, and grow market share.

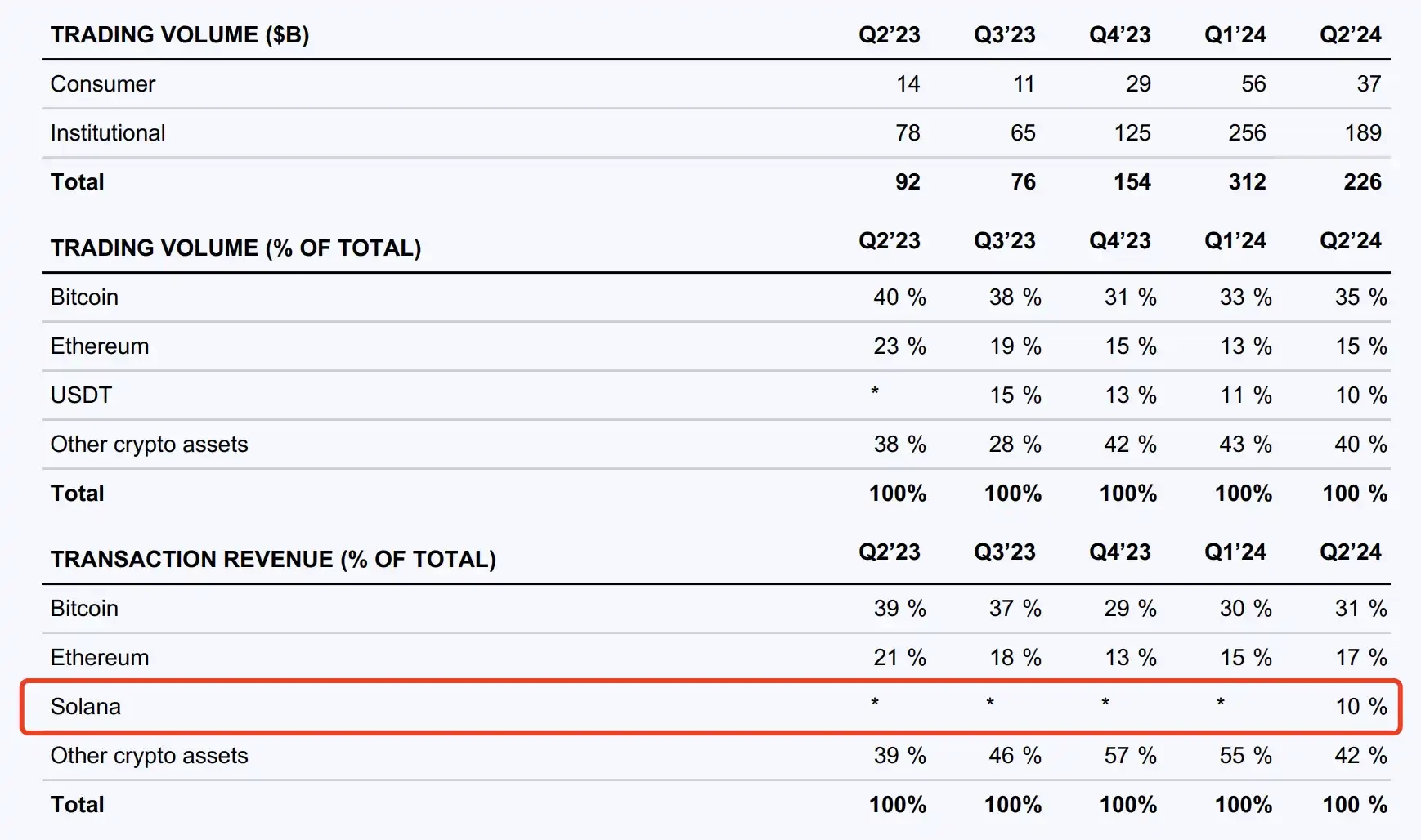

Despite the decline in overall market trading volume, Coinbase has successfully maintained its steady revenue growth by enhancing service subscription revenue and expanding new revenue channels. It is worth noting that Coinbase also announced the revenue from SOL transactions for the first time, marking a new step in its diversified asset management.

Revenue has been positive for four consecutive quarters, and SOL transaction revenue has been displayed for the first time

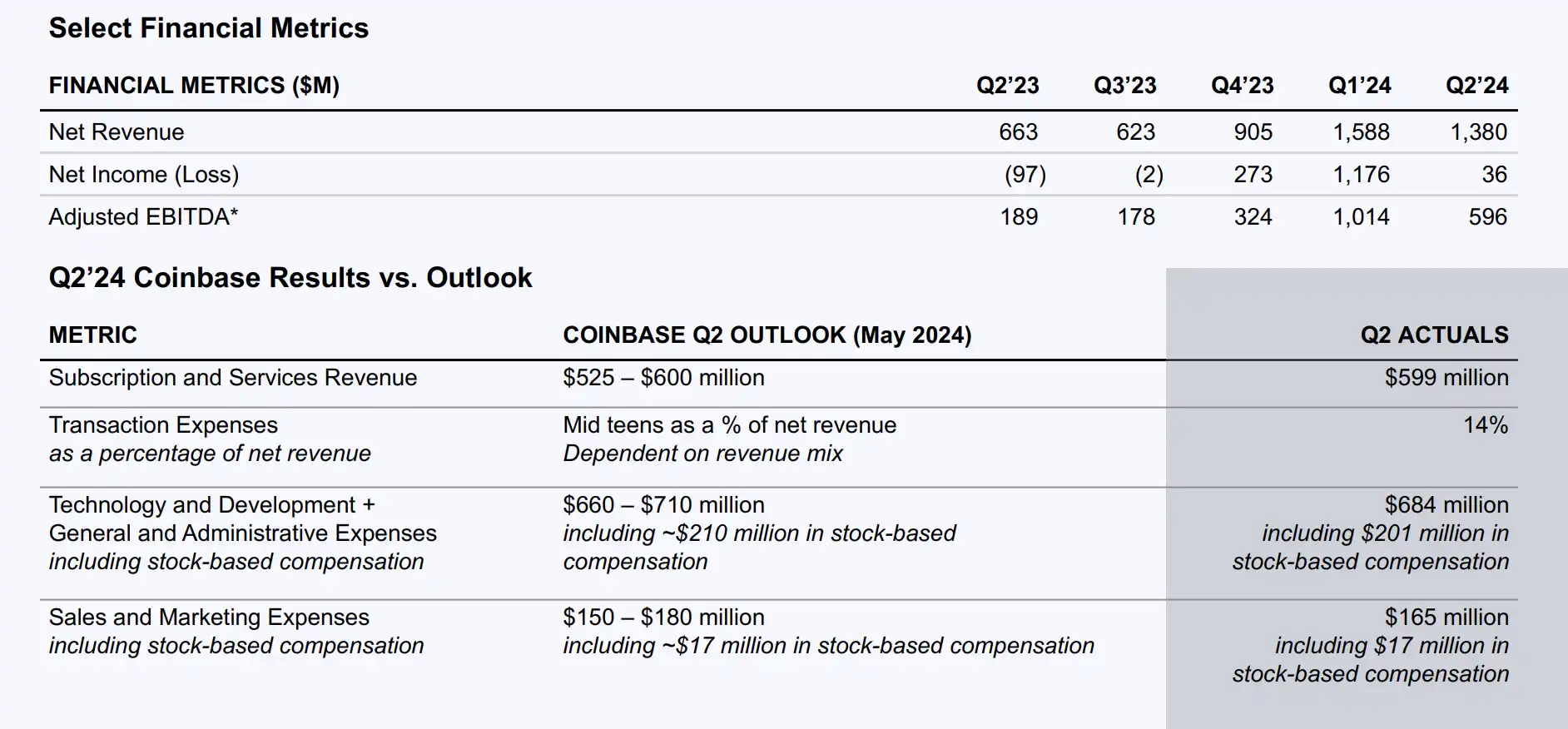

Coinbases second-quarter revenue was $1.4 billion, down 11% year-on-year, almost the same as analysts expectations of $1.37 billion. Net profit fell from nearly $1.2 billion in the first quarter to $36 million, and adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) was $596 million. Coinbase has achieved positive revenue growth for four consecutive quarters.

Coinbases total trading volume in the second quarter was $226 billion, down 28% year-on-year, and trading revenue was $781 million, down 27% from the previous quarter. Subscription and service revenue increased 17% from the previous quarter to $599 million. Total operating expenses were $1.1 billion, up 26% from the previous quarter, while technology and development, general and administrative, and sales and marketing expenses totaled $850 million, up 14% from the previous quarter.

It is worth mentioning that Coinbases custody fee income in the second quarter was US$35 million, a year-on-year increase of 7%. The main driving force was that the average price of crypto assets in the second quarter was higher than that in the first quarter, and it also benefited from the inflow of funds related to its role as the custodian of BTC ETF products. In addition, Coinbase generated US$240 million in USDC stablecoin interest income in the second quarter, a year-on-year increase of 22%.

In terms of trading volume, Coinbase also showed Solana’s trading revenue for the first time.

Transaction volume dropped significantly, but revenue stickiness increased

Compared with the end of the first quarter, the total market value of cryptocurrencies decreased by 11% month-on-month at the end of the second quarter. With the launch of BTC ETF products, the price of crypto assets rose at the end of the first quarter, and the average market value of cryptocurrencies increased by 20% month-on-month during the same period. However, when comparing the second quarter average with the first quarter average, the main driver of revenue, namely the volatility of crypto assets, decreased by about 13%, resulting in weaker cryptocurrency spot market trading conditions in the second quarter of Coinbase than in the first quarter.

Trading revenue benefited from growth in derivatives trading and Coinbase Wallet transaction fees, which Coinbase enabled in the second quarter following a favorable court ruling on its motion to dismiss.

In addition, it is worth noting that Bases sorter revenue (other transaction revenue) revenue was $53 million, a 6% decrease from the previous quarter, but this was due to a decrease in Base sorter fee revenue. In the second quarter, due to the Ethereum Cancun upgrade, Base fees were significantly reduced, but this helped boost Bases transaction volume by 300% month-on-month.

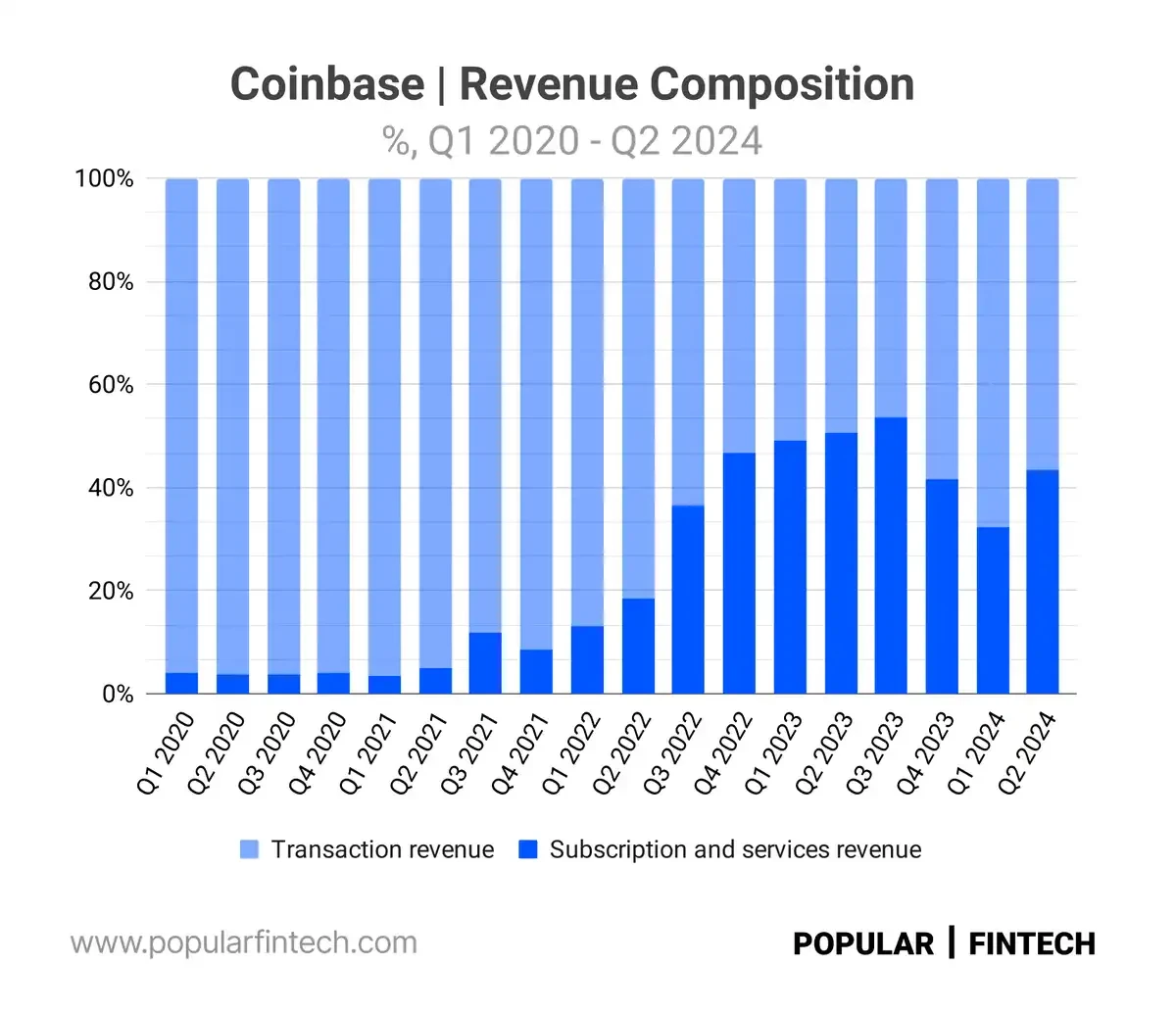

While Coinbase’s trading revenue fell 27% month-over-month, it “made good progress” in diversifying its revenue sources, with subscription and service revenue reaching nearly $600 million, up 17% month-over-month, a stickier revenue source that Coinbase has been eager to grow.

Transactional revenue vs subscription and services revenue

This is reflected in the 300% month-over-month growth in the number of transactions on Base, the expansion of USDC through partnerships and compliance with the likes of Stripe, the launch of Smart Wallets, improvements to simple and advanced trading, and derivatives products on Coinbase Financial Markets.

Blockworks analyst Mippo said, “From the perspective of someone who once doubted whether he could transition from trading income, USDC, staking, and Base are huge businesses in themselves, and they are just getting started.”

This reminds us of the second quarter of 2023, when Coinbases trading revenue was surpassed by subscription and service revenue for the first time. BlockBeats once analyzed that this means that the revenue structure of crypto exchanges is changing, which may redefine the current cryptocurrency landscape. After nearly a year of development, the crypto market has come a lot closer to the mainstream financial market, and Coinbase has also made many efforts in the crypto trading product level.

Armstrong said in the earnings call that “Coinbase will continue to try to work with every fintech company, every bank, and even more traditional companies to try to integrate cryptocurrency into every part of the global financial system.”

This is not just empty talk. On June 28, Coinbase announced a partnership with payment giant Stripe to increase on-chain adoption and provide faster and cheaper financial infrastructure.

Stripe will add support for Base to its suite of crypto products, offering users faster and cheaper remittances, while Coinbase will add Stripe’s fiat-to-crypto on-ramp to Coinbase Wallet to allow users to instantly buy cryptocurrencies with credit cards and Apple Pay.

At the end of July, sources said that Coinbase Asset Management was preparing to create a tokenized money market fund to enter the RWA field. In addition, Coinbase has partnered with financial services provider Apex Group to help promote the development of its tokenized fund.

Последние мысли

During the shareholder conference call, an analyst asked, Can you update Coinbases asset management strategy and potential product roadmap, and given the improved political environment in the upcoming election, how does this affect the timing and type of products Coinbase decides to launch?

However, Coinbase CEO Brian Armstrong did not directly state what kind of updates Coinbase will make in the future at the product level when answering this question, but only explained that its improvement of the regulatory environment will inject new vitality into the industry. He gave an example that institutional clients hold 1%, 2% or 3% of their investment portfolios in cryptocurrencies, and when there is regulatory clarity, this proportion will reach 10%, 20% or 30%.

On July 26, Coinbase announced the addition of three new board members, including OpenAI executive Chris Lehane, former U.S. Deputy Attorney General Paul Clement, and Aon Chief Financial Officer Christa Davies. The addition of new members is intended to help Coinbase exert its strength in U.S. encryption policy and enhance its global financial and operational capabilities. Coinbase said that the three new members have different political philosophies and that ensuring the success of the cryptocurrency industry requires bipartisan cooperation.

On July 28, the Financial Times cited sources as saying that advisers to U.S. Vice President Kamala Harris’ campaign team have been contacting key figures in the crypto industry to build relationships that could ultimately inform the development of a regulatory framework.

According to reports, they have been communicating with Coinbase, Circle and Ripple Labs in recent days. Through the statements made by Coinbase executives in this conference call, perhaps we can expect crypto regulation to make breakthrough progress in this cycle.

At the same time, Armstrong expressed his hope to see a Coinbase 500 product like the SP 500 in a conference call. Although it is difficult to find 500 trustworthy cryptocurrency products in the current market situation, it is a blessing for the entire industry to have such a vision.

This article is sourced from the internet: A quick look at Coinbase’s Q2 financial report: SOL transaction fees are shown for the first time, and Base business is accelerating

Related: VC and EigenLayer founder debate: Is Web3 data ownership a false proposition?

Original translation: Alex Liu, Foresight News Kyle Samani, Partner at Multicoin: I used to believe in owning your data, but not anymore. So-called “ownership” is really about “exclusivity.” This is most clearly seen when it comes to assets: a) I have a $5 bill and you dont. Therefore I can spend the $5 and you cant. b) I own a $1 million piece of art. Rather than loaning it to a museum for others to see, I hang it on my wall for my own enjoyment. Ownership — and therefore exclusivity — is why cryptocurrencies are so closely tied to finance. Now let’s think about what it means to own our data. To be honest, I don’t know what it means. Advocates of the concept of data ownership often accuse…