Анализ еженедельных данных Ethereum ETF: продажа Grayscales была проведена эффективно

Оригинал|Odaily Planet Daily

Автор: jk

With the launch of the US spot Ethereum ETF, the cryptocurrency investment market has once again ushered in new changes. Over the past week, the performance of US spot Ethereum ETFs has varied. This batch of new ETFs had a net inflow of more than $1 billion in the first week, while Grayscales ETHE had a net outflow of $1.5 billion.

In this article, Odaily Planet Daily will analyze the performance of these new ETFs in detail, explore the key factors that influence market trends, and look forward to possible future development trends.

Spot Ethereum ETF

After receiving approval from the U.S. Securities and Exchange Commission in May, eight issuers’ spot Ethereum ETFs were officially launched last Tuesday. As of July 29, local time in the United States, the total trading volume of spot Ethereum reached $4.83 billion.

A full week after the launch of spot Ethereum, BlackRocks ETHA has been the top trading volume among the eight new ETFs, with a trading volume of $1.104 billion, a net inflow of $500 million, and a market share of around 21%. Fidelitys FETH had a net inflow of $244.2 million, but its market share has fallen from around 12% when it was launched last Tuesday to 5% today. Because of the lowest management fee, Grayscales Mini Trust (ETH) has increased its market share from 5% to 13.6%.

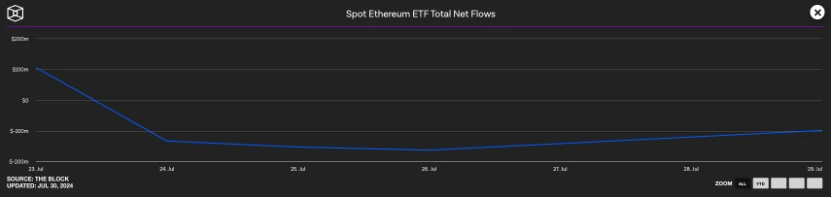

In contrast, Grayscale’s ETHE saw net outflows of over $1.5 billion for the same reasons as GBTC (it had previously been trading at a discount and had excessive management fees), resulting in an overall net outflow of $341.8 million for U.S. spot Ethereum ETFs.

The overall net inflow and outflow of spot Ethereum, source: The Block

Comparison with Bitcoin ETFs

In terms of trading volume, the spot ETFs of Bitcoin and Ethereum are obviously incomparable (once the spot Bitcoin ETF was launched, the trading volume on the first day reached $4.5 billion, which is almost the trading volume of the spot Ethereum ETF in a week). However, according to The Blocks analysis, after deducting ETHE, the net inflow of the Ethereum ETF is about 40% of the net inflow of the Bitcoin ETF after its launch in January (also excluding GBTC), that is, $117 million vs. $289 million.

The spot Ethereum ETF has also quickly surpassed the trading volume of existing Ethereum futures ETF products, accounting for 99.3% of the market share as of last Friday, according to data from The Block.

In comparison, spot Bitcoin ETFs account for 92.75% of the Bitcoin futures ETF trading volume market share.

Similar to GBTC: Will Grayscale Crash the Market? ?

Grayscale Ethereum Trust was originally launched in 2017 and began trading in mid-2019 under the ticker ETHE. This continued until July 23, when ETHE became one of the newly approved spot Ethereum ETFs. The fees for ETHE after conversion are much higher, charging 2.5%, which is basically the same as Grayscales GBTC Trust to Bitcoin spot ETF. Some investors who bought trust shares at a very low discount during the bear market (trust shares are not redeemable) want to sell and cash in after converting to ETFs; another part of investors choose other new ETFs because of high management fees.

Fees for spot Ethereum ETFs from other issuers range from 0.19% to 0.25% after the reduction. However, Grayscales other dual ETF strategy, Grayscale Mini Trust Ethereum ETF product (ETH), has the lowest fee at only 0.15%. This product also saw net inflows last week, totaling $164 million, and its market share has been increasing from 5% to 13.6%. However, due to the huge net outflow of ETHE and the decline in Ethereum prices since the launch of the ETF, its assets under management have decreased to about $7.5 billion (2.28 million ETH).

“The main difference for me is the huge net outflows from ETHE,” said James Seyffart, an ETF analyst at Bloomberg, according to The Block. “I don’t think GBTC had that on day one because it was still trading at a significant discount when it launched.”

“The ‘new eight’ Ethereum ETFs haven’t been as strong as the ‘new nine’ Bitcoin ETFs in offsetting Grayscale net outflows, but the good news is their net inflows/volumes are still very healthy, with ETHE unlocking much faster than GBTC = good outlook, but likely tough days ahead,” added Eric Balchunas, ETF analyst at Bloomberg.

ETH price. Source: Coinmarketcap

The price of Ethereum has not changed dramatically in the past week, falling from over $3,400 to around $3,100, and then rising to around $3,300 today. This also shows that the so-called dumping is not a real sale of ETH, or that the selling has been effectively taken over.

This article is sourced from the internet: Ethereum ETF Weekly Data Analysis: Grayscales Selling Was Effectively Undertaken

Original | Odaily Planet Daily Author | Asher Yesterday, due to the impact of the Mt.Gox incident, the market showed a clear selling sentiment, causing the BTC price to continue to fall, even falling below $58,500 in the short term. The price has rebounded. However, in this environment of BTC selling and mainstream currencies falling, the price of TON remained strong, vaguely showing that there was capital support. In the TON ecosystem, those who missed out on Notcoin should not miss Catizen, which currently has nearly 20 million registered users and plans to issue tokens in the second quarter. Next, Odaily Planet Daily will take you step by step to participate in the interaction of Catizen, a popular game in the TON ecosystem, and lock in potential token rewards. Catizen:…