Колонка волатильности SignalPlus (20240724): молчаливые ETF

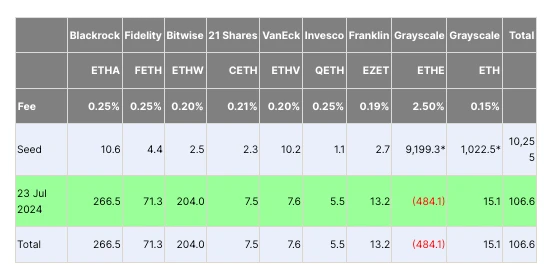

Yesterday (23 JUL), the crypto community focused on the launch of the ETH Spot ETF in the evening. Prior to this, the options market had already priced in a considerable amount of uncertainty at the front end, causing the volatility term structure of ETH to be severely inverted and reaching an intraday high before the previous days settlement. We observed that the price of the currency fluctuated before and after the launch of the ETF, and the market expressed their views fiercely, but from the data collected by Farside Investors, we can see that Grayscales products did suffer a large number of redemptions, similar to the situation of BTC ETF. Investors may want to take profits or simply transfer their positions to products with lower fees. But at the same time, represented by the products launched by Blackrock, Bitwise and Fidelity, more investors in the market chose to buy at the first time, completely offsetting the outflow of funds from the Grayscale ETF and dispelling some negative emotions. ETH finally closed only slightly lower.

Источник: Farside Investors.

Источник: ТрейдингВью

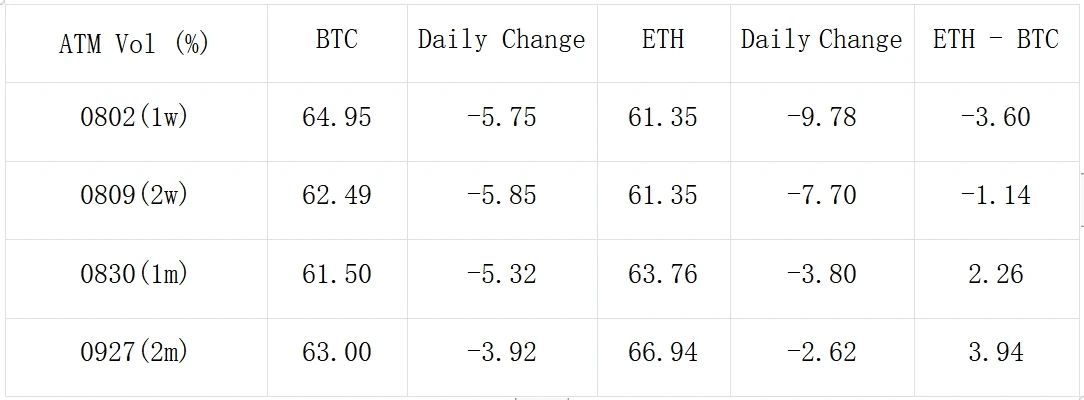

Source: Deribit (as of 24 JUL 16: 00 UTC+ 8)

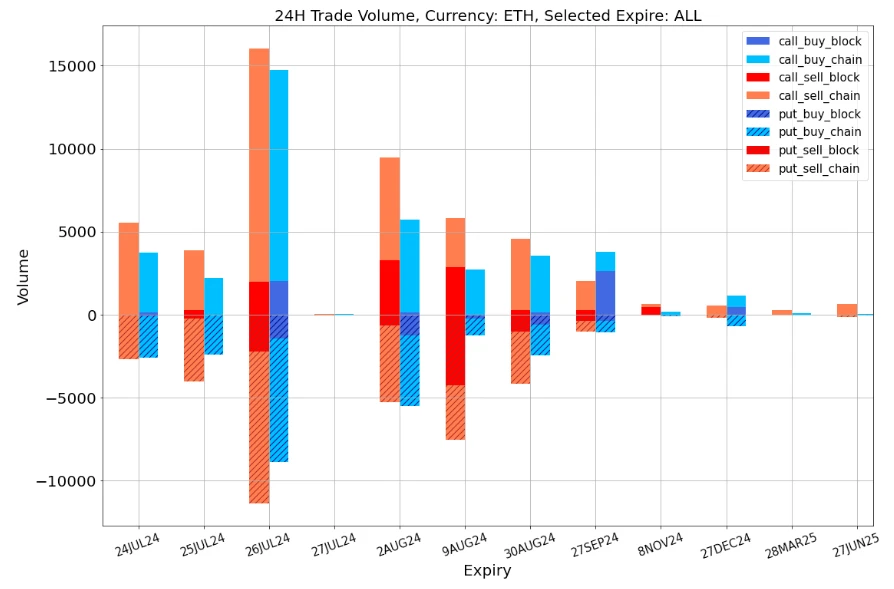

Looking back at yesterdays entire trend, ETHs Realized Vol was far from supporting the markets IV of up to 80% Vol. After ten oclock, ETHs volatility began to decline steeply, returning to a level of around 60+%. The past 24 hours trading was mainly based on Sell Vol, and was mainly distributed on expiration dates within one month.

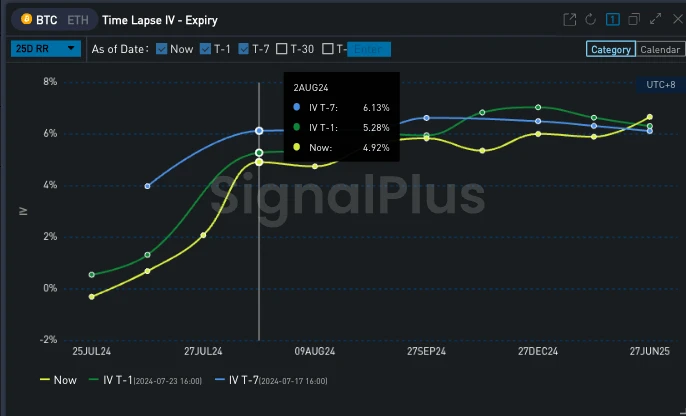

Source: SignalPlus, ETF IV has been declining since its launch

Data Source: Deribit ETH transaction overall distribution

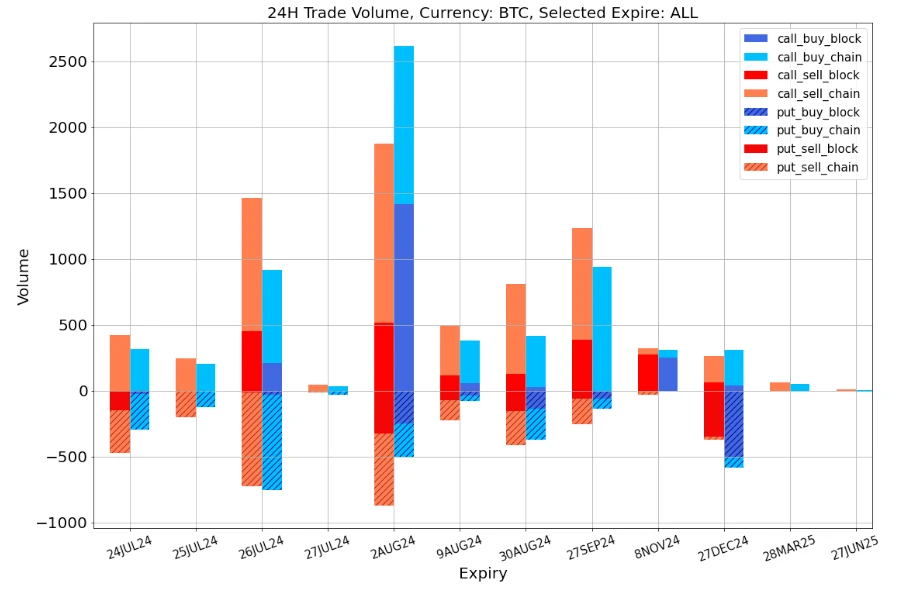

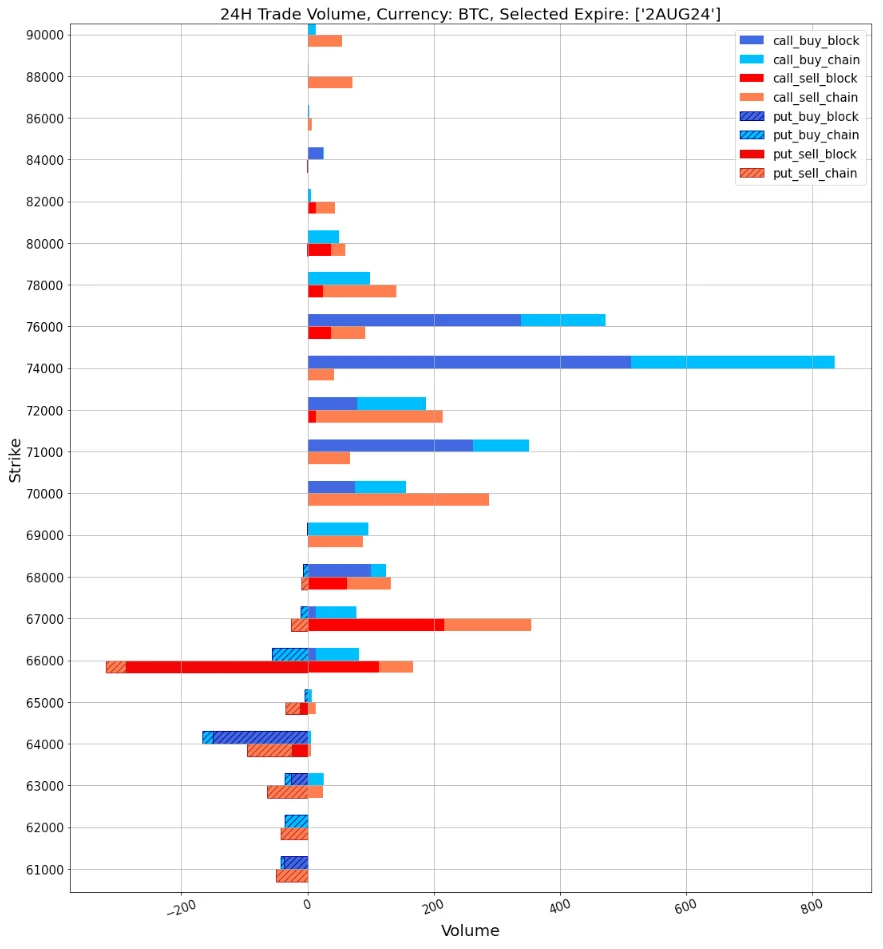

In terms of BTC, the IV term structure also shows the same trend as the uncertainty of ETH ETF dissipates, but the extremely high Vol Premium contained in 2 AUG is further highlighted after the front-end IV plummets. As we mentioned before, the market is still looking forward to the 2024 Bitcoin Summit. If presidential candidate Trump really makes a speech at the meeting about increasing Bitcoin as a reserve for the US economy, it will inevitably lead to a bullish carnival. In fact, we can also see that the Risky Flow of 2 AUG 24 in the past 24 hours is extremely obvious (refer to the figure below, BTC transaction distribution), 74000/76000 Calls are bought, and 66000 Puts are sold, which makes the Vol Skew of BTC in the middle and back ends also maintain a high point of about 5%.

Source: SignalPlus, BTCs Vol Skew has clearly tilted towards call options since 2 AUG

Data Source: Deribit, BTC transaction overall distribution; 2 AUG 24 transaction distribution

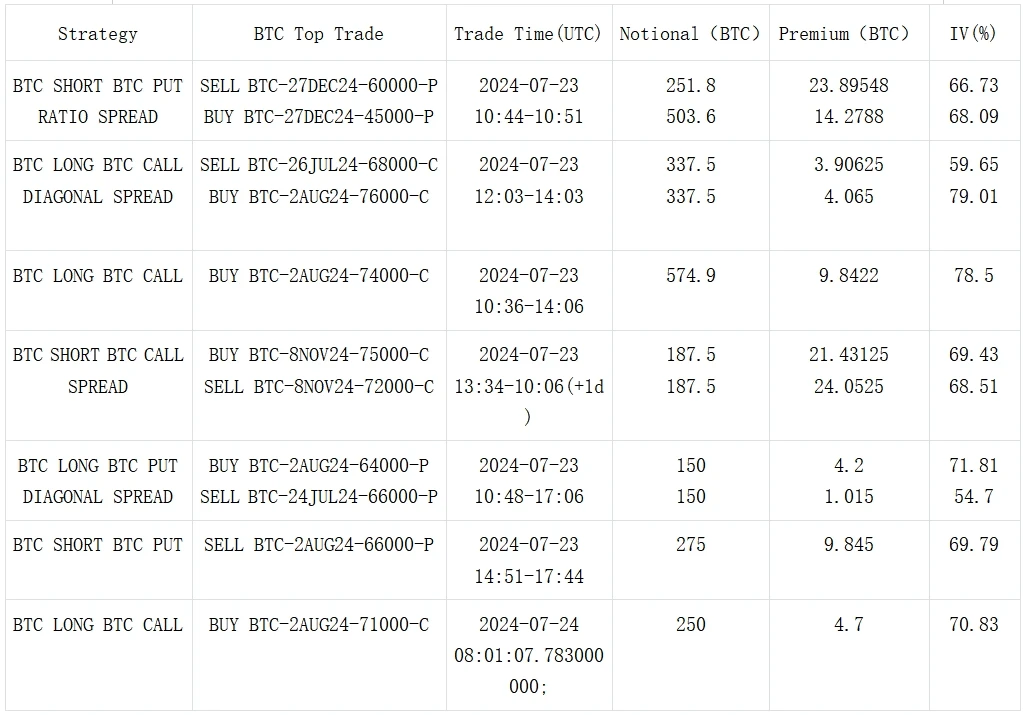

Источник: Deribit Block Trade.

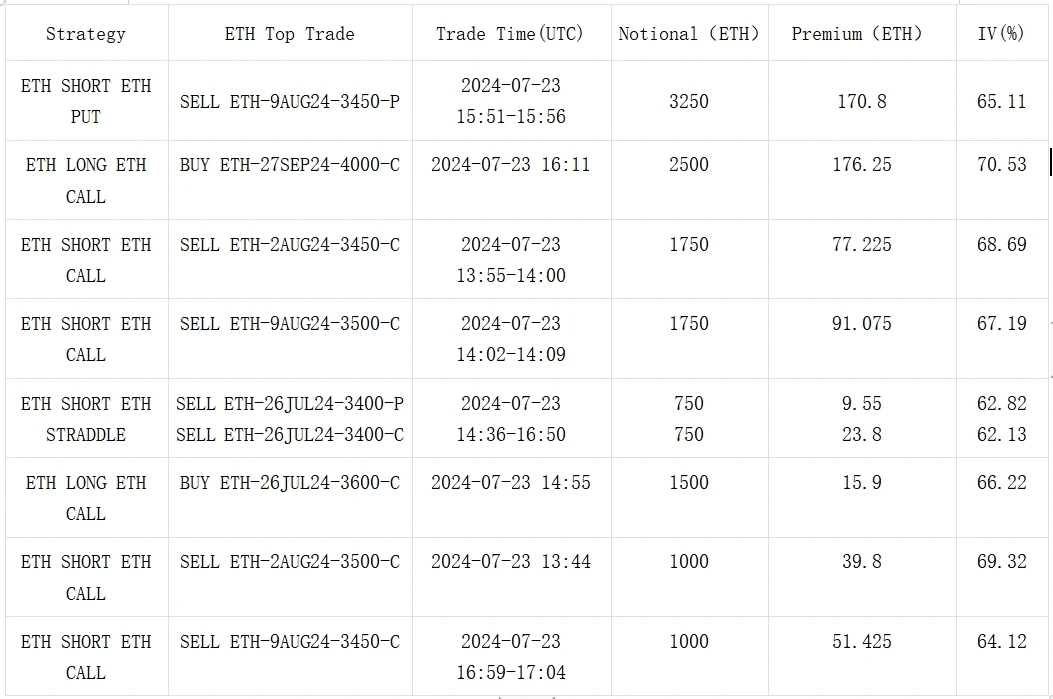

Источник: Deribit Block Trade.

Вы можете использовать функцию трейдинга SignalPlus на t.signalplus.com, чтобы получить больше информации о криптовалютах в режиме реального времени. Если вы хотите получать наши обновления немедленно, подпишитесь на наш аккаунт в Twitter @SignalPlusCN или присоединитесь к нашей группе WeChat (добавьте помощника WeChat: SignalPlus 123), группе Telegram и сообществу Discord, чтобы общаться и взаимодействовать с большим количеством друзей. Официальный сайт SignalPlus: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240724): Silent ETFs

Related: Solanas second-layer network Sonic: Raising tens of millions of dollars, Odyssey airdrop

Original | Odaily Planet Daily Author | Nanzhi Yesterday, Solanas second-layer network Sonic announced the completion of a $12 million Series A financing. Compared with most EVM networks, Solana is known for its high performance. Why is a second-layer network needed? In what ways will Sonic create value for Solana? Odaily will explain Sonics vision, features, and recent opportunities for participation in this article. Interpretation Project Why do we need Sonic? Solana is known for its high performance, but with the gradual increase in users, applications, and network activities, it is not stretched to the limit. For example, individual network fees will soar to tens or even hundreds of dollars. However, during the ORE mining period and the Meme coin boom, the user-perceivable delay and failure rate increase still highlight…